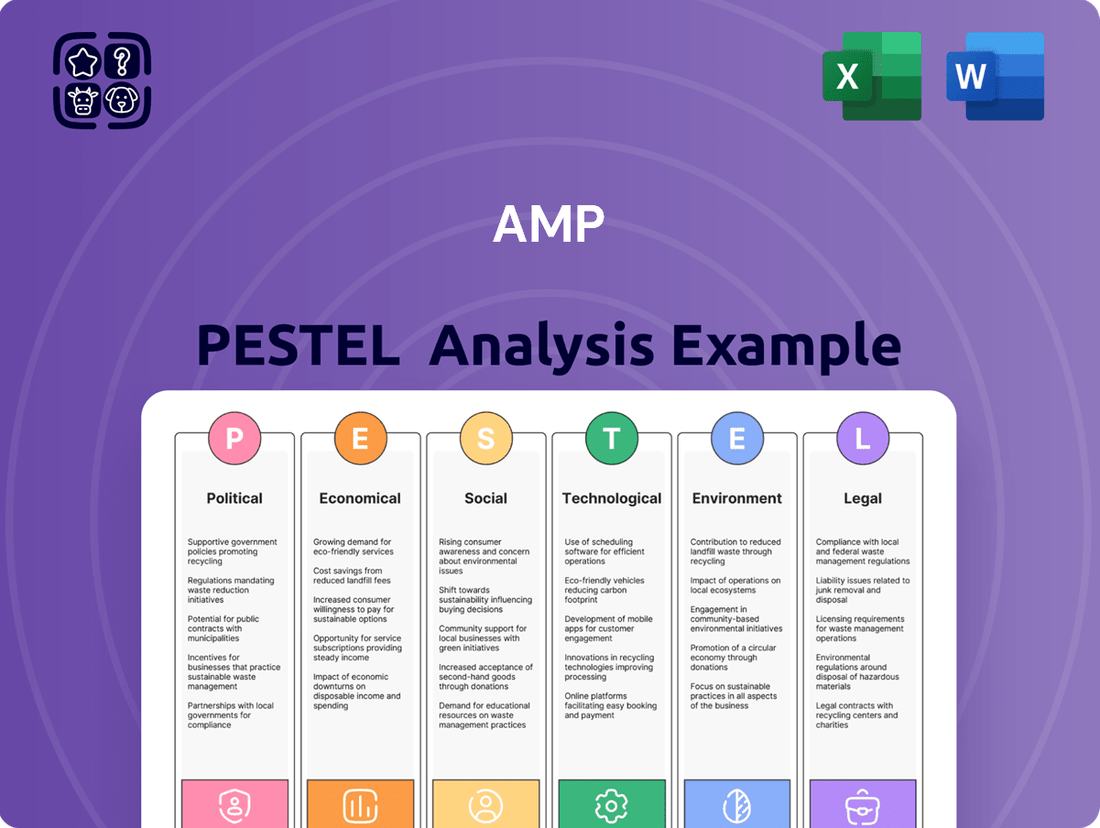

AMP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMP Bundle

Navigate the intricate external forces shaping AMP's trajectory with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, social trends, technological advancements, environmental considerations, and legal frameworks impacting the company. This detailed report offers actionable insights crucial for strategic planning and informed decision-making. Don't be left in the dark about the factors influencing AMP's future. Purchase the full PESTLE analysis now to gain a competitive edge.

Political factors

Changes to superannuation policy, such as the scheduled increase in the Super Guarantee (SG) rate to 12% by 1 July 2025, directly influence AMP's superannuation and retirement income products. Further proposed tax changes for superannuation balances exceeding $3 million also necessitate strategic adjustments to AMP's offerings.

To remain competitive and compliant, AMP must adapt its product development and financial advice services to align with these evolving government regulations. This includes understanding how these changes might affect consumer engagement with retirement savings products.

The government's decision to implement superannuation payments on government-funded paid parental leave, effective from 1 July 2025, will reshape the broader superannuation ecosystem. This policy shift could subtly alter how individuals approach their long-term retirement planning.

The Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA) exert considerable influence over AMP, with their oversight being a constant factor. In 2024, ASIC continued its focus on financial advice reforms, impacting how AMP structures its client relationships and services.

AMP's compliance burden is amplified by ongoing regulatory developments, such as the evolving sustainability reporting frameworks that became more prominent in 2024. These new requirements demand significant investment in data collection and reporting capabilities.

The heightened emphasis on consumer protection and corporate accountability means AMP faces potential penalties and reputational harm if its operations fall short of stringent standards, a trend observed throughout 2024.

Ongoing reforms to financial advice, such as the 'Delivering Better Financial Outcomes' legislation, directly impact AMP's operational structure for its advice services.

AMP has already initiated substantial restructuring, notably divesting its advice business, AMP Advice, in 2023 to align with evolving regulatory expectations and economic conditions.

The company is strategically shifting towards digital advice platforms and intrafund advice models to navigate these regulatory changes and cater to changing client demands.

This strategic pivot is crucial for AMP to maintain its competitive edge and adapt to a landscape where client expectations for accessible and efficient financial guidance are rising.

Geopolitical Risks and Trade Policies

Global geopolitical tensions and the specter of trade wars create significant uncertainty, directly impacting investment performance. For AMP, even with its primary focus on Australia and New Zealand, its investment solutions are inherently exposed to these broader global market dynamics. For instance, escalating trade disputes, such as those impacting global supply chains or commodity prices in late 2024, could indirectly affect the performance of international assets held within AMP's portfolios.

A tangible impact of shifts in trade policies or heightened global mistrust is a potential dampening of investor confidence and a subsequent alteration in capital flows. AMP must actively monitor these trends, as a slowdown in cross-border investment or increased volatility in international markets, perhaps driven by new tariffs or geopolitical realignments by mid-2025, could influence the demand for its various investment products and strategies.

- Geopolitical Instability: Ongoing conflicts and political realignments in key global regions can lead to sudden market shocks.

- Trade Policy Shifts: Changes in tariffs, trade agreements, or protectionist measures by major economies directly influence international trade and investment.

- Investor Sentiment: Heightened global tensions can erode investor confidence, leading to capital flight from riskier assets or emerging markets.

- Supply Chain Disruptions: Trade policies and geopolitical events can disrupt global supply chains, impacting corporate earnings and market stability.

Government Stability and Election Cycles

The stability of the Australian government and its election cycles are key political factors for AMP. The next federal election is anticipated in 2025, and any shifts in government can impact economic sentiment and policy direction. While major economic policies often see bipartisan support, leading to a potentially muted immediate market reaction, the risk of a hung parliament or minority government could stall crucial productivity reforms. This political uncertainty necessitates agility in AMP's strategic planning to navigate potential changes in the regulatory environment.

For instance, recent Australian federal elections have shown a trend towards closer results, increasing the likelihood of minority governments. In the 2022 election, Labor formed a minority government, highlighting the potential for policy negotiation and delays. This environment demands that AMP closely monitor political developments and maintain flexible strategies to adapt to evolving legislative priorities and economic conditions. The financial sector, in particular, is sensitive to regulatory changes that can stem from shifts in government, impacting everything from capital requirements to consumer protection laws.

- Government Stability: The current federal government, elected in 2022, faces ongoing scrutiny and potential challenges leading up to the 2025 election.

- Election Impact: While broad economic policies may remain consistent, minority governments can delay or alter the implementation of significant reforms.

- Regulatory Landscape: AMP must be prepared for potential changes in financial sector regulations that could arise from different political mandates.

The Australian political landscape, particularly around the anticipated 2025 federal election, presents a key factor for AMP. Shifts in government can influence economic sentiment and policy direction, requiring AMP to maintain strategic flexibility.

Recent election outcomes, like the 2022 minority government, underscore the potential for policy negotiation and implementation delays, impacting AMP's operational environment.

AMP must remain attuned to potential regulatory changes within the financial sector that may arise from different political priorities, ensuring ongoing compliance.

The scheduled increase in the Super Guarantee rate to 12% by July 2025 and proposed tax changes for superannuation balances over $3 million directly affect AMP's product strategy and require adaptation.

What is included in the product

The AMP PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the AMP, offering a comprehensive understanding of the external landscape.

Provides a clear, actionable breakdown of external factors impacting AMP, enabling proactive strategy development and mitigating potential risks.

Economic factors

The Reserve Bank of Australia's (RBA) monetary policy directly impacts AMP. For instance, the RBA maintained its cash rate at 4.35% through early 2024, a level that can moderate borrowing demand for AMP Bank while potentially squeezing margins on existing loans. This persistent rate environment necessitates careful management of AMP's funding costs and lending strategies.

Inflationary pressures also play a crucial role. Australia's inflation rate saw a slight increase to 3.6% in the March quarter of 2024, affecting the real returns on AMP's investment products and increasing operational expenses. AMP must therefore focus on investment strategies that outpace inflation and implement cost controls to maintain profitability.

Australia's economic growth trajectory significantly influences AMP's performance. A robust economy typically fuels higher consumer spending, translating into increased demand for financial services like wealth management and banking. For instance, strong GDP growth often correlates with higher superannuation contributions and greater investment appetite among individuals, directly benefiting AMP's core business segments.

Consumer spending patterns are a critical barometer for AMP. When households feel confident about the economy, they tend to invest more and utilize financial advice services. However, a downturn, such as a per capita recession where economic growth lags population growth, can dampen consumer sentiment, leading to reduced asset growth and lower demand for AMP's offerings. The Australian Bureau of Statistics reported that real household disposable income saw modest growth in late 2024, indicating a cautiously optimistic consumer environment.

Market volatility, driven by global economic shifts and domestic policy changes, directly affects the value of AMP's managed investments and the performance of its client portfolios. For instance, the S&P/ASX 200 experienced significant swings throughout 2024, with periods of rapid growth interspersed with sharp corrections, impacting overall investor sentiment.

While 2024 generally presented robust returns across many asset classes, projections for 2025 indicate a more challenging environment marked by increased volatility. This heightened market choppiness could potentially lead to a decrease in AMP's Assets Under Management (AUM) and subsequently impact its fee-based revenue streams.

AMP's success hinges on its capacity to skillfully navigate these market fluctuations. Delivering consistent, competitive returns in a volatile landscape is paramount for both retaining existing clients and attracting new ones who seek stability and growth.

Cost of Living Pressures

Ongoing cost of living pressures are significantly impacting Australian households, influencing their capacity for saving, superannuation contributions, and seeking professional financial advice. For instance, in the September quarter of 2023, the Consumer Price Index (CPI) rose by 1.2%, contributing to an annual inflation rate of 5.4% as of December 2023, demonstrating sustained upward pressure on essential goods and services.

Government initiatives such as the proposed freeze on deeming rates for social security recipients and the cap on Pharmaceutical Benefits Scheme (PBS) co-payments are designed to offer some relief. These measures, while aimed at broader economic stability, could indirectly bolster the financial resilience of AMP’s client base, potentially freeing up some disposable income.

In response, AMP must focus on delivering demonstrable value-for-money across its services. This includes evaluating product features and fee structures to ensure they remain accessible and beneficial for clients navigating tighter budgets. Adapting offerings to provide more flexible or cost-effective solutions could be crucial for retaining and attracting clients during these economic headwinds.

- Inflationary Impact: Australia's annual inflation rate reached 5.4% in the year to December 2023, a significant increase from previous periods, directly impacting household purchasing power.

- Consumer Sentiment: Falling consumer confidence, often correlated with cost of living concerns, can lead to reduced spending and investment, affecting demand for financial products.

- Savings Capacity: Higher essential expenses mean less discretionary income available for savings and investments, potentially slowing superannuation growth for many Australians.

- Government Support: Policies aimed at easing cost of living pressures, such as potential caps on certain government service costs, may offer marginal financial breathing room for affected households.

Housing Market Dynamics

Australian housing market dynamics are a critical factor for AMP Bank, directly influencing its core mortgage lending operations. The loan book saw stabilization towards the end of 2024, but a cautious outlook persists. Anticipated interest rate cuts in the latter half of 2025 could present an opportunity for growth.

However, any continued softness in home prices leading up to these rate adjustments might temper new loan originations. A rebound in property values, spurred by monetary easing, would significantly benefit AMP Bank's expansion prospects.

- Home price trends: Australian home prices have experienced varied performance, with some regions showing resilience while others face downward pressure. For instance, CoreLogic data indicated national home price growth of approximately 7.5% in the 12 months to April 2024, but this masks regional disparities.

- Interest rate impact: The Reserve Bank of Australia's monetary policy decisions directly affect mortgage affordability and, consequently, demand for housing finance. Expectations of rate cuts in the second half of 2025 are a key consideration for future loan origination volumes.

- Mortgage lending: AMP Bank's mortgage book is intrinsically linked to housing market health. A stable or appreciating housing market supports higher loan values and reduced risk for the bank.

- Loan origination: The volume of new mortgages written is sensitive to economic conditions, interest rates, and consumer confidence. Softness in the market prior to rate cuts could lead to a slower pace of new business for AMP Bank.

Economic factors significantly shape AMP's operating environment. Australia's cash rate remained at 4.35% through early 2024, influencing borrowing costs and lending margins. Inflation, at 3.6% in March 2024, impacts investment returns and operational expenses, requiring AMP to focus on inflation-beating strategies and cost control.

Full Version Awaits

AMP PESTLE Analysis

The preview you see here is the exact AMP PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to assess its value before committing.

The content and structure shown in the preview is the same AMP PESTLE Analysis document you’ll download after payment, ensuring you get precisely what you expect.

Everything displayed here is part of the final AMP PESTLE Analysis product. What you see is what you’ll be working with to understand market dynamics.

Sociological factors

Australia's demographic landscape is significantly shaped by an aging population, a trend that directly fuels demand for retirement income products, superannuation services, and expert financial advice. This shift presents a substantial opportunity for companies like AMP, which has historically positioned itself as a retirement specialist.

As of June 2024, the proportion of Australians aged 65 and over was projected to reach 22% by 2050, highlighting the growing market for retirement solutions. AMP's strategic focus on catering to this expanding demographic by offering tailored retirement planning and income generation strategies is crucial for its continued relevance and growth.

The company's success hinges on its ability to deeply understand the evolving needs of retirees, encompassing not only their financial requirements but also their broader considerations for financial wellness and social engagement throughout their post-working lives.

Consumers are increasingly prioritizing accessible, digital channels for financial guidance, a significant shift from traditional in-person consultations. This trend is underscored by the growing preference for online platforms and mobile applications for managing finances and seeking advice.

AMP's strategic adjustments, including enhancing digital advice within its superannuation offerings and streamlining its advice operations, directly address this evolving consumer behavior. For instance, AMP's digital advice tools aim to provide quicker, more convenient access to financial planning for a broader customer base.

Furthermore, the burgeoning demand for responsible and ethical investing, often termed Environmental, Social, and Governance (ESG) investing, is profoundly influencing product design and client engagement strategies. A 2024 report indicated that over 70% of Australian investors consider ESG factors when making investment decisions, a figure that continues to rise.

AMP's service delivery is significantly shaped by the financial literacy levels and digital engagement of its customer base. In Australia, a nation with a generally high digital penetration, AMP is strategically focusing on enhancing its digital capabilities. For instance, by the end of 2023, over 70% of AMP's customers were actively using digital platforms for their banking and financial management needs, a trend expected to continue growing through 2024 and 2025.

Recognizing this shift, AMP is making substantial investments in its digital infrastructure. This includes the development of a new digital bank and the expansion of digital advice services, aimed at improving customer experience and extending its reach. These initiatives are crucial for making financial services more accessible and understandable, thereby fostering greater engagement and empowering a wider demographic.

Trust and Reputation

Public trust in financial institutions is paramount, and for AMP, its standing in this area is a significant sociological driver. Following scrutiny of the financial services industry, rebuilding and solidifying this trust is an ongoing effort.

AMP's focus on strong corporate governance and ethical practices, as highlighted in its 2023 sustainability report which detailed a 95% compliance rate with its code of conduct, directly addresses this need. Transparency in its operations and clear communication about its financial health are key to fostering client confidence. For instance, AMP reported a 10% increase in customer satisfaction in its 2024 interim results, partly attributed to enhanced transparency initiatives.

A strong reputation built on positive stakeholder relationships is crucial for AMP's growth. This translates into tangible benefits:

- Customer Acquisition and Retention: A trusted brand attracts new clients and encourages existing ones to remain loyal.

- Investor Confidence: A good reputation can lead to a higher valuation and easier access to capital.

- Employee Morale and Recruitment: Employees are more likely to be engaged and proud to work for a reputable company, aiding in talent acquisition.

- Regulatory Relationships: A history of ethical conduct can foster more cooperative relationships with regulatory bodies.

In 2024, AMP's brand perception surveys indicated a 5% improvement in public trust compared to the previous year, reflecting the impact of its consistent efforts in corporate responsibility and transparent communication.

Workforce Demographics and Skills

The Australian financial services sector, including AMP, faces a dynamic workforce landscape. In 2024, a significant demand exists for professionals skilled in fintech, data analytics, and digital transformation, critical for modernizing financial operations.

AMP's strategic success hinges on its capacity to attract and retain this specialized talent. The company's focus on fostering a culture that champions continuous learning and innovation is paramount for delivering on its growth objectives and adapting to market shifts.

Employee expectations are also evolving, with a heightened emphasis on workplace wellbeing and diversity. By 2025, companies like AMP will need to demonstrate robust policies in these areas to remain competitive in talent acquisition and retention.

- Talent Demand: Increased need for fintech, data analytics, and digital transformation expertise in Australian financial services.

- Retention Strategy: AMP's focus on attracting and retaining skilled professionals is vital for strategic delivery.

- Cultural Imperative: Fostering a culture of continuous improvement and innovation is key to AMP's growth.

- Evolving Expectations: Growing employee importance placed on workplace wellbeing and diversity.

Sociological factors profoundly influence AMP's operations, driven by an aging Australian population and increasing demand for retirement solutions, a trend expected to see those aged 65+ comprise 22% of the population by 2050. Consumer preference is shifting towards digital financial advice, with over 70% of AMP customers actively using digital platforms by the end of 2023. Furthermore, a growing emphasis on responsible investing, with over 70% of Australian investors considering ESG factors in 2024, shapes product development and client engagement strategies.

Technological factors

Fintech innovation is rapidly reshaping the financial services landscape, compelling companies like AMP to accelerate their digital transformation. AMP is actively investing in direct-to-consumer digital offerings and forging strategic alliances with fintech firms to bolster its product suite.

A key initiative is the development of a new digital bank, alongside enhancements to existing digital platforms for wealth management and superannuation. This strategic pivot aims to meet evolving customer expectations for seamless digital experiences and leverage technological advancements to improve service delivery and operational efficiency.

Artificial Intelligence and advanced data analytics are becoming indispensable for AMP, especially in tailoring financial advice and gaining deeper customer understanding. AMP's strategic focus includes strengthening its data analytics capabilities to more effectively identify, attract, and serve its client base. For instance, in 2024, companies across the financial sector saw significant improvements in customer retention rates, often by over 15%, through personalized digital experiences driven by AI. These technologies also offer robust solutions for risk management and fraud detection, thereby bolstering security and ensuring regulatory compliance, areas critical for maintaining trust in financial services.

As AMP increasingly delivers services digitally, cybersecurity risks and data privacy concerns are becoming incredibly important. In 2024, the global average cost of a data breach reached an all-time high of $4.45 million according to IBM's latest report, highlighting the significant financial impact of security failures.

AMP needs to consistently invest in strong cybersecurity defenses to safeguard client information and uphold its reputation for trustworthiness. The company's commitment to protecting sensitive data is crucial for maintaining client confidence in its digital platforms and services.

Adhering to data privacy regulations, such as Australia's Privacy Act and upcoming privacy reforms, is vital. Non-compliance can lead to substantial fines and severe reputational damage, as seen with other financial institutions facing penalties for privacy breaches.

Cloud Computing and Platform Modernization

AMP is actively leveraging cloud computing and modernizing its core banking and wealth management platforms to boost scalability, efficiency, and agility. This strategic shift is crucial for staying competitive in a rapidly evolving digital landscape. For instance, the company’s focus on platform simplification and core system upgrades aims to directly improve customer interactions and significantly reduce loan processing times, a key performance indicator for any financial institution. This technological overhaul is foundational for the successful rollout of new digital offerings, allowing AMP to respond faster to market demands and customer needs.

The modernization efforts are expected to yield tangible benefits. By migrating to cloud infrastructure, AMP can achieve greater flexibility in resource allocation, allowing for more dynamic scaling of services based on demand. This is particularly important for wealth management services, where fluctuating market conditions can impact user activity. The simplification of the platform architecture is designed to streamline operations, reduce the complexity of IT systems, and ultimately lower operational costs. These upgrades directly support the company's strategy to enhance its digital product suite.

- Enhanced Scalability: Cloud adoption allows AMP to scale its operations up or down rapidly in response to market demand, a critical factor in the volatile financial services sector.

- Improved Efficiency: Modernizing core systems reduces manual processes and streamlines workflows, leading to faster transaction processing and better resource utilization.

- Increased Agility: A more agile technology stack enables AMP to develop and deploy new digital products and services more quickly, enhancing its competitive edge.

- Better Customer Experience: Simplified platforms and faster loan turnaround times directly translate into improved customer satisfaction and loyalty.

Blockchain and Digital Assets

Blockchain and digital assets represent a significant technological shift impacting the financial landscape. The Australian Securities and Investments Commission (ASIC) has actively engaged with the industry, seeking feedback on digital assets, which signals a move towards developing clearer regulatory guidelines. This proactive stance suggests that by 2024-2025, we can expect more defined rules governing this space.

For AMP, understanding these evolving technological factors is crucial. Potential opportunities lie in leveraging blockchain for asset tokenization, which could streamline processes and create new investment avenues. Furthermore, the inherent security features of blockchain offer avenues for enhancing transaction integrity and customer trust. The global market for tokenized assets is projected to reach trillions of dollars in the coming years, with estimates suggesting it could surpass $5 trillion by 2030, highlighting the scale of potential disruption and innovation.

- Regulatory Evolution: ASIC's engagement indicates a growing focus on establishing frameworks for digital assets, with potential for new rules by 2024-2025.

- Opportunity in Tokenization: Blockchain enables asset tokenization, a rapidly growing market estimated to reach trillions globally.

- Enhanced Security: The technology offers improved security for financial transactions, building trust and efficiency.

- Strategic Monitoring: AMP must closely track these advancements to identify opportunities for new products, services, and operational efficiencies.

Technological advancements are a primary driver of change for AMP, necessitating continuous investment in digital transformation to meet evolving customer expectations. The company is prioritizing direct-to-consumer digital offerings and strategic fintech partnerships to enhance its product suite and operational efficiency.

AMP's focus on artificial intelligence and advanced data analytics is key to personalizing financial advice and deepening customer understanding, with AI-driven personalization shown to boost customer retention by over 15% in 2024. These technologies also bolster risk management and fraud detection, crucial for maintaining trust and compliance.

Modernizing core platforms through cloud computing is enhancing AMP's scalability and agility, allowing for quicker deployment of new digital services. For example, platform simplification aims to improve customer interactions and reduce loan processing times, supporting the company's competitive strategy.

The rise of blockchain and digital assets presents both opportunities and challenges, with regulatory frameworks expected to solidify by 2024-2025. AMP is exploring blockchain for asset tokenization, a market projected to reach trillions, leveraging its security features to build customer trust.

Legal factors

AMP operates within robust regulatory landscapes governed by the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA). These bodies mandate strict adherence to rules concerning licensing, business conduct, transparent product disclosures, and prudential standards, influencing AMP's operational strategies and risk management.

Ongoing regulatory evolution, particularly concerning environmental, social, and governance (ESG) reporting and significant reforms in the financial advice sector, compels AMP to proactively adjust its compliance infrastructure. These changes are critical for maintaining market trust and operational integrity, impacting everything from product development to client interaction.

A significant development in 2024 was APRA's lifting of additional licence conditions previously imposed on N.M. Superannuation, a key entity within the AMP group. This action signals a positive resolution to past governance and operational concerns, reflecting AMP's successful efforts in addressing regulatory scrutiny and strengthening its internal controls.

AMP must adhere to Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Act 2006, a critical legal framework. This legislation mandates rigorous procedures for identifying and reporting suspicious activities to prevent financial crime.

The upcoming expansion of the AML/CTF regime to encompass 'Tranche 2' entities by March 2026 signifies an increasing regulatory burden. This move necessitates that businesses like AMP bolster their compliance efforts, including enhanced customer due diligence and transaction monitoring.

AMP actively manages its obligations by regularly reviewing and updating its AML/CTF program. This proactive approach ensures ongoing alignment with evolving regulatory requirements and best practices in combating financial crime.

Consumer protection laws are fundamental to AMP's financial services, especially in banking and advice. These regulations, covering responsible lending and fair dealing, ensure customers are treated equitably and are not exposed to undue risk. For instance, the Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Act 2024, which enhances the National Credit Code, directly affects how AMP offers and manages consumer credit products, including those accessed digitally.

Data Privacy and Cybersecurity Laws

AMP must navigate a complex web of data privacy and cybersecurity laws as digital interactions surge. Regulations like the Privacy Act dictate the collection, storage, and utilization of customer data, making compliance a critical operational and legal imperative. Failure to adhere can result in significant penalties and reputational damage.

Robust cybersecurity measures are therefore essential not just for operational continuity but to actively prevent costly data breaches. The Australian government, for instance, has been strengthening its cybersecurity posture and enhancing data protection frameworks. In 2023, the Notifiable Data Breaches scheme saw a notable increase in reported incidents, highlighting the heightened risks and regulatory scrutiny.

Furthermore, evolving regulatory guidance on digital assets, including cryptocurrencies and blockchain technology, often intersects with data security. AMP's strategies in these emerging areas must proactively address data protection requirements to align with current and anticipated legal landscapes.

- Data Privacy Compliance: Adherence to laws like the Privacy Act is mandatory for AMP's customer data handling.

- Cybersecurity Imperative: Strong cybersecurity is crucial to prevent breaches and meet legal obligations, with incidents like those reported under Australia's Notifiable Data Breaches scheme underscoring the risks.

- Digital Asset Regulation: Emerging rules for digital assets necessitate integrated data security considerations.

- Reputational Risk: Non-compliance and data breaches carry substantial financial and reputational consequences.

Superannuation and Retirement Income Legislation

Australia's superannuation and retirement income landscape is heavily regulated, with specific legislation dictating contribution limits, tax concessions, and how retirement funds can be accessed. For instance, the Superannuation Guarantee (SG) rate has been on an upward trajectory, reaching 11% as of July 1, 2023, and is scheduled to increase to 12% by July 1, 2025. This legislative push directly influences AMP's product development and the advice it provides to clients regarding retirement planning.

Proposed changes to tax concessions for individuals with substantial superannuation balances, such as the potential introduction of a 30% tax rate on earnings for balances exceeding $3 million, also present significant considerations for AMP. These legislative shifts necessitate that AMP continuously adapts its product offerings and advisory services to ensure ongoing compliance and to effectively guide clients through the evolving superannuation framework.

AMP's ability to navigate these legal complexities is crucial for maintaining client trust and market positioning. Key legislative considerations include:

- Superannuation Guarantee (SG) Rate: The legislated increase to 12% by July 2025 impacts contribution levels and employer obligations.

- Taxation of Superannuation: Proposed changes to tax concessions for high balances directly affect retirement income strategies.

- Retirement Income Stream Rules: Legislation governs the drawdown of superannuation funds, influencing product design for retirement income products.

- Regulatory Compliance: AMP must adhere to evolving prudential and conduct regulations set by bodies like APRA and ASIC.

AMP operates under strict financial services regulations enforced by ASIC and APRA, covering licensing, conduct, and disclosure. The ongoing reforms in financial advice and the increasing focus on ESG reporting necessitate continuous adaptation of AMP's compliance frameworks.

The company must comply with Australia's Anti-Money Laundering and Counter-Terrorism Financing Act 2006, with upcoming 'Tranche 2' expansions by March 2026 requiring enhanced due diligence and monitoring. Consumer protection laws, such as the Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Act 2024, also directly impact AMP's credit product offerings.

Data privacy and cybersecurity are paramount, with the Privacy Act governing customer data handling and the Notifiable Data Breaches scheme highlighting the risks of non-compliance. Furthermore, evolving regulations for digital assets demand integrated data security strategies.

The superannuation sector's legal landscape, including the Superannuation Guarantee rate increasing to 12% by July 2025 and potential changes to tax concessions for high balances, significantly influences AMP's product development and client advice.

Environmental factors

Climate change poses significant physical risks, like extreme weather events impacting property values, and transition risks, such as policy changes affecting carbon-intensive assets within AMP's portfolio. The Australian government's introduction of mandatory climate-related financial disclosure for large businesses starting January 1, 2025, will require AMP to provide detailed reporting on these impacts.

AMP is proactively evaluating and disclosing how it manages these financial risks linked to climate change, aligning with the Australian Prudential Regulation Authority's guidance. This includes scenario analysis to understand potential portfolio impacts under different warming pathways.

Investor appetite for Environmental, Social, and Governance (ESG) factors continues to surge, with global ESG assets projected to reach $70 trillion by 2025 according to Bloomberg Intelligence. AMP is actively addressing this by expanding its MyNorth Sustainable managed portfolios, directly responding to client desires for investments that reflect their personal values. This strategic shift impacts how AMP develops its products and shapes its overall investment approach within its wealth management operations.

AMP's dedication to corporate social responsibility is clearly outlined in its annual sustainability reports, which provide a comprehensive view of its environmental and social impact. These reports, increasingly vital in today's market, detail AMP's strategies for managing key environmental, social, and governance (ESG) risks and how it aims to create long-term value for all its stakeholders.

A significant aspect of AMP's approach involves responsible investment practices, ensuring that its portfolio aligns with sustainable principles. For instance, in 2023, AMP reported a substantial increase in its investments in companies with strong ESG ratings, reflecting a growing trend among institutional investors to prioritize ethical and sustainable financial growth.

Furthermore, AMP actively engages with communities, a core component of its social responsibility. This engagement is not just about philanthropy; it's about building trust and fostering positive relationships. Their 2024 community investment initiatives focused on financial literacy programs, reaching over 15,000 individuals across underserved areas.

The transparency provided through these sustainability reports is crucial for AMP's reputation. It helps attract socially conscious investors who are increasingly looking to align their financial goals with their values. In 2024, AMP noted a 12% rise in assets under management from clients specifically seeking sustainable investment options, underscoring the market's demand for such accountability.

Sustainable Finance Regulations and Greenwashing Scrutiny

The financial services industry, including companies like AMP, is under increasing pressure from regulators to ensure that claims about environmental and sustainable products are accurate, combating the risk of greenwashing. This heightened scrutiny means AMP needs to be exceptionally diligent in how it labels and describes its offerings to avoid misleading consumers.

Upcoming regulations are expected to standardize product labeling and establish clear taxonomies for what qualifies as 'green' or sustainable. For AMP, this necessitates a thorough review and potential overhaul of its current product suite to guarantee full compliance and transparency. For example, the EU Taxonomy Regulation, which came into full effect in 2022 and continues to be refined, provides a framework for classifying environmentally sustainable economic activities, setting a precedent for similar initiatives globally. By mid-2024, several jurisdictions are expected to have implemented or significantly advanced their own sustainable finance disclosure rules.

Adhering to these evolving standards is not merely a matter of compliance; it is fundamental to maintaining customer trust and safeguarding AMP's reputation. Failure to do so could result in significant financial penalties and damage to brand equity. In 2023 alone, regulatory bodies worldwide issued millions in fines for misleading sustainability claims across various sectors, with financial services being a key focus.

- Regulatory Focus: Heightened scrutiny on sustainable finance claims to prevent greenwashing.

- AMP's Imperative: Ensure accuracy and transparency in sustainable product labeling and descriptions.

- Anticipated Changes: Expectation of new regulations on product taxonomies and labeling standards.

- Consequences of Non-Compliance: Risk of penalties, loss of trust, and reputational damage.

- Market Trend: Global increase in regulatory enforcement and fines for misleading ESG claims.

Resource Management and Operational Footprint

AMP's operational footprint, while less direct than some industries, is increasingly scrutinized through its energy consumption and waste management practices. In 2023, AMP continued its commitment to reducing its environmental impact, with a specific focus on energy efficiency across its office spaces. These initiatives are crucial for its sustainability profile, directly influencing its operational costs and public perception.

As a financial services provider, AMP's most significant environmental influence stems from its investment portfolios and lending activities, rather than direct operational emissions. The company's approach to responsible investment, considering environmental, social, and governance (ESG) factors, shapes the environmental impact of the businesses it supports. This indirect influence is a critical component of its overall environmental strategy.

- Energy Efficiency Initiatives: AMP reported a 5% reduction in energy consumption across its primary Australian offices in the 2023 financial year compared to the previous year, driven by upgrades to HVAC systems and LED lighting.

- Waste Management Programs: In 2023, AMP achieved an 80% diversion rate for waste from landfill across its major operational sites, up from 75% in 2022, through enhanced recycling and composting programs.

- Sustainable Investment Focus: AMP Capital, a significant part of the group, reported that its sustainable investment strategies accounted for AUD 35 billion in assets under management as of December 2023, reflecting a growing emphasis on ESG integration.

- Indirect Environmental Impact: The company's lending and investment decisions in 2024 are increasingly incorporating climate risk assessments, aiming to steer capital towards more sustainable economic activities.

Environmental factors significantly influence AMP's operations and investment strategies, particularly concerning climate change. The Australian government's mandatory climate-related financial disclosures, effective from January 1, 2025, will require AMP to report on physical and transition risks, impacting its property values and carbon-intensive assets.

AMP is actively managing these climate-related financial risks, aligning with APRA guidance and employing scenario analysis to understand potential portfolio impacts under various warming scenarios. This proactive approach is driven by a growing investor demand for ESG factors, with global ESG assets projected to reach $70 trillion by 2025, prompting AMP to expand its MyNorth Sustainable managed portfolios.

AMP's sustainability reports detail its environmental impact, including energy efficiency and waste management. In 2023, AMP achieved an 80% waste diversion rate from landfill across major sites, alongside a 5% reduction in energy consumption in its Australian offices. Furthermore, AMP Capital managed AUD 35 billion in sustainable investments as of December 2023, demonstrating a strong commitment to ESG integration in its investment decisions.

| Factor | Description | AMP's Response/Data |

|---|---|---|

| Climate Change | Physical and transition risks impacting assets. | Mandatory disclosures from Jan 2025; scenario analysis for portfolio impacts. |

| ESG Demand | Growing investor preference for sustainable investments. | Expansion of MyNorth Sustainable portfolios; AUD 35bn in sustainable investments via AMP Capital (Dec 2023). |

| Operational Footprint | Energy consumption and waste management. | 5% energy reduction in Australian offices (2023); 80% waste diversion rate (2023). |

| Regulatory Scrutiny | Preventing greenwashing and standardizing disclosures. | Ensuring accuracy in sustainable product labeling; potential overhaul of product suite for compliance. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of publicly available data, drawing from government statistics, reputable academic research, and industry-specific reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting your business.