Amerisafe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amerisafe Bundle

Amerisafe's unique position in the specialty insurance market highlights significant strengths, particularly its niche focus and strong customer relationships. However, understanding the subtle threats and untapped opportunities is crucial for any forward-thinking investor or strategist. Our comprehensive SWOT analysis delves into these areas, providing a clear roadmap for navigating the competitive landscape.

Want the full story behind Amerisafe's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amerisafe's niche market specialization in high-hazard industries, particularly for small to mid-sized businesses, is a significant strength. This focused approach allows them to cultivate deep expertise in underwriting and risk assessment, which is crucial for profitably insuring these challenging sectors.

Their ability to navigate and excel within these high-risk segments, even when broader markets face difficulties, highlights their tailored capabilities. This specialization translates into a strong market position, as evidenced by their consistent performance and ability to identify profitable opportunities that others might overlook.

Amerisafe’s unwavering commitment to strong underwriting discipline and proactive claims management is a significant strength, consistently leading to operating results that outshine industry benchmarks. This rigorous approach is evident in their favorable prior year loss reserve development, a key contributor to their robust financial performance.

The company's specialized claims personnel are adept at cost control while simultaneously delivering exceptional service to injured workers. This dual focus ensures efficient claims resolution, minimizing financial strain and fostering positive outcomes for all parties involved.

AmeriSafe demonstrates remarkable financial resilience and consistent profitability. In 2024, the company posted an impressive net combined ratio of 88.7%, a clear indicator of operational efficiency in its core business. Furthermore, a return on average equity of 20.2% underscores its ability to generate strong profits for shareholders.

This financial strength is further validated by AM Best's assessment of AmeriSafe's balance sheet as 'very strong'. This rating is underpinned by robust risk-adjusted capitalization, ensuring the company is well-equipped to handle potential claims, and a prudent, conservative investment strategy that protects its assets.

High Policy Retention Rates

AmeriSafe’s ability to retain its customers is a significant strength, reflecting the trust and value clients derive from its specialized offerings. This loyalty is a key driver of stable revenue and predictable growth.

In 2024, AmeriSafe achieved an impressive policy renewal rate of 94.2% for its voluntary business. This metric highlights exceptional customer satisfaction and the effectiveness of the company's client relationship management strategies.

Such a high retention rate directly contributes to consistent premium growth, providing a solid foundation for financial planning and operational stability. It indicates that clients perceive AmeriSafe’s safety programs and specialized services as highly valuable and essential.

- Customer Loyalty AmeriSafe fosters strong relationships with both agents and policyholders, leading to high retention.

- 2024 Voluntary Renewal Rate Achieved a 94.2% policy renewal rate, showcasing client satisfaction.

- Consistent Premium Growth High retention directly supports predictable and stable premium income.

- Value Proposition Clients clearly recognize and value AmeriSafe's specialized services and safety focus.

Emphasis on Safety Programs and Risk Reduction

AmeriSafe's dedication to robust safety programs and risk reduction stands as a significant strength. Their proactive approach, centered on minimizing workplace injuries for clients, directly translates to better insurance cost control and improved safety metrics. This focus on prevention is key to their business model, as it directly impacts their ability to minimize claims and losses.

The company deploys Field Safety Professionals (FSPs) who possess specialized, in-depth knowledge of high-hazard industries. This expertise allows them to provide tailored safety guidance and support, further enhancing the effectiveness of AmeriSafe's risk management services.

- Proactive Risk Mitigation: AmeriSafe's core strength lies in its comprehensive safety programs designed to prevent workplace injuries.

- Cost Control for Clients: By reducing injuries, clients benefit from lower insurance costs and improved safety records.

- Specialized Expertise: Field Safety Professionals (FSPs) bring industry-specific knowledge to high-hazard sectors.

- Alignment with Business Goals: The emphasis on safety directly supports AmeriSafe's objective of minimizing claims and losses.

AmeriSafe's specialized underwriting and claims management in high-hazard industries are key strengths, driving superior operating results. This focus allows for deep expertise, translating into a strong market position and consistent profitability, as demonstrated by a net combined ratio of 88.7% in 2024.

The company's financial health is robust, evidenced by a 20.2% return on average equity in 2024 and an AM Best 'very strong' balance sheet assessment. This financial stability is supported by strong capitalization and a conservative investment strategy.

Customer loyalty is a significant asset, with AmeriSafe achieving a 94.2% voluntary policy renewal rate in 2024. This high retention underscores client satisfaction and provides a foundation for stable premium growth.

AmeriSafe's commitment to safety programs and risk reduction is paramount. Their proactive approach, utilizing specialized Field Safety Professionals, directly contributes to fewer workplace injuries, lower costs for clients, and reduced claims for the company.

| Metric | 2024 Data | Significance |

|---|---|---|

| Net Combined Ratio | 88.7% | Indicates strong operational efficiency and profitability. |

| Return on Average Equity | 20.2% | Demonstrates effective profit generation for shareholders. |

| Voluntary Renewal Rate | 94.2% | Highlights exceptional customer retention and satisfaction. |

| AM Best Rating | Very Strong | Reflects robust financial stability and capitalization. |

What is included in the product

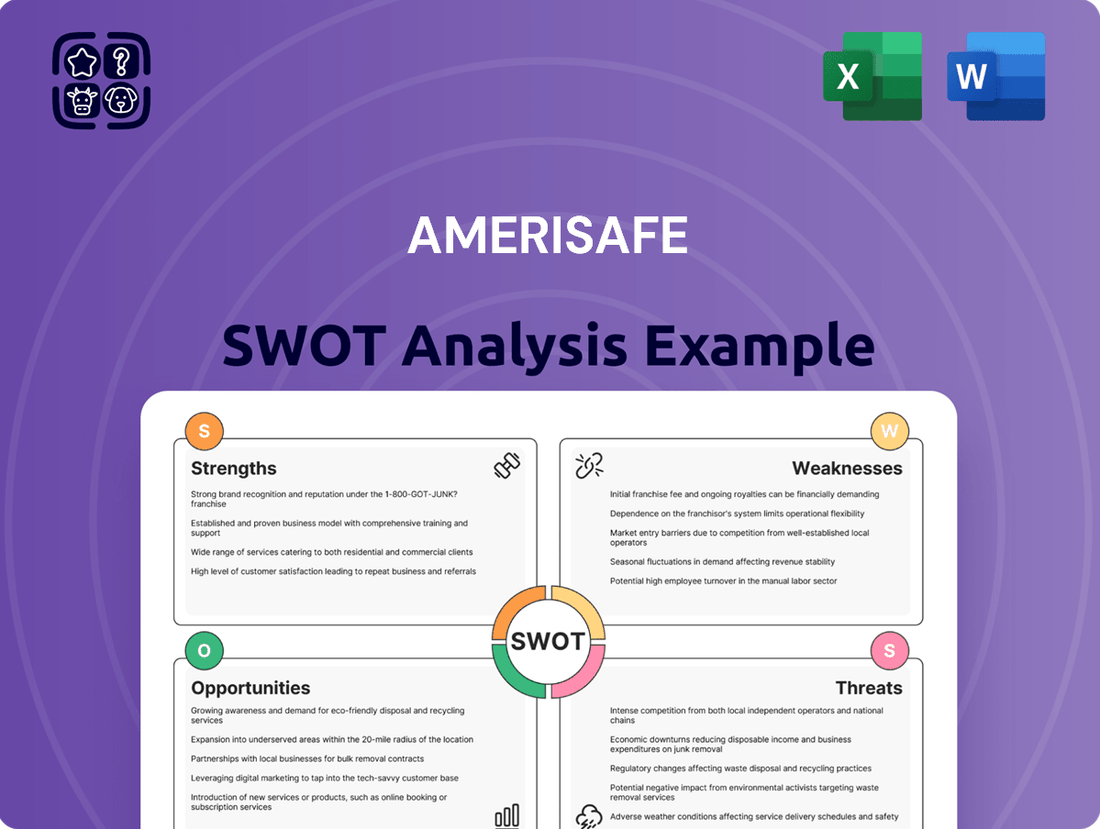

Delivers a strategic overview of Amerisafe’s internal strengths, weaknesses, opportunities, and threats.

Amerisafe's SWOT analysis offers a clear framework to identify and address operational risks, alleviating concerns about safety compliance and potential liabilities.

Weaknesses

AmeriSafe's specialized focus on high-hazard industries, while a core strength, also introduces a significant weakness due to the inherent volatility and elevated risk associated with these sectors. A severe downturn or a major catastrophic event within industries like construction or oil and gas could disproportionately impact AmeriSafe's financial results.

This concentration means that a single large-scale incident, such as a major workplace accident or a natural disaster affecting a key industry segment, could lead to higher loss severities if not managed with exceptional precision and robust risk mitigation strategies.

AmeriSafe's financial performance is closely tied to economic health, especially within its core construction and industrial markets. Factors like employment levels and wage growth directly influence its premium income. For instance, if wage inflation moderates, as seen in some economic forecasts for 2024-2025, it can slow down the payroll audits that adjust premiums, thus affecting AmeriSafe's top-line revenue growth.

A broader economic slowdown presents a significant risk. During such periods, companies in construction and industry may reduce their workforce or curb wage increases, directly impacting AmeriSafe's ability to grow its premium base through payroll audits. This sensitivity means the company is exposed to the cyclical nature of the economy, making it vulnerable to downturns that affect its policyholders' payrolls and, consequently, its own financial results.

Amerisafe has encountered a dip in its net investment income. This decline is partly attributed to a reduction in the company's investable assets, a consequence of significant special dividend distributions to shareholders. While these dividends are beneficial for investors in the short term, a continued downward trend in investment income could negatively impact overall profitability, especially if underwriting results do not compensate for this shortfall.

Specifically, net investment income saw a notable decrease of 9.7% in the first quarter of 2025 when compared to the same period in 2024. This highlights a challenge for the company in generating returns from its investment portfolio, which could put pressure on its financial performance if underwriting success doesn't fully offset this trend.

Increasing Underwriting Expense Ratio

AmeriSafe's underwriting expense ratio has experienced a slight uptick. This increase is largely attributable to ongoing investments necessary for business expansion and the growth in both premium volume and the number of policies written. For the first quarter of 2025, this ratio stood at 29.9%, a rise from 27.3% recorded in the same period of 2024.

While these investments are crucial for driving growth, a sustained upward trend in the underwriting expense ratio could signal potential challenges in efficiently managing operational costs in relation to the earned premiums. This warrants close monitoring to ensure operational efficiency keeps pace with expansion efforts.

- Underwriting Expense Ratio (Q1 2025): 29.9%

- Underwriting Expense Ratio (Q1 2024): 27.3%

- Trend: Modest Increase

Competitive Market Pressures

Amerisafe faces significant headwinds in the workers' compensation insurance sector due to intense market competition. This environment frequently leads to downward pricing pressure, as insurers vie for policyholders by offering lower rates. Such competition directly impacts Amerisafe's ability to maintain premium rates and underwriting margins, potentially hindering premium growth without sacrificing profitability.

The persistent trend of rate reductions within the workers' compensation market presents a continuous challenge for Amerisafe. This dynamic requires the company to operate with exceptional efficiency and underwriting acumen to remain competitive and profitable.

- Intense Competition: The workers' compensation market is crowded, leading to aggressive pricing strategies.

- Downward Pricing Pressure: Insurers often lower rates to attract or retain customers, squeezing profit margins.

- Challenged Premium Growth: Achieving substantial premium increases without compromising profitability is difficult in this climate.

- Margin Erosion: Competitive pressures can directly reduce the profitability of written premiums.

AmeriSafe's reliance on high-hazard industries creates vulnerability to economic downturns in sectors like construction and oil and gas. A significant slowdown or a major catastrophic event in these areas could disproportionately affect the company's financial performance due to concentrated risk exposure.

The company's net investment income experienced a notable decrease of 9.7% in Q1 2025 compared to Q1 2024, partly due to reduced investable assets following special dividend distributions. This decline puts pressure on overall profitability if underwriting results don't compensate.

AmeriSafe's underwriting expense ratio rose to 29.9% in Q1 2025 from 27.3% in Q1 2024, driven by investments in expansion. While necessary for growth, this trend requires careful management to ensure operational efficiency keeps pace.

Intense competition in the workers' compensation market leads to downward pricing pressure, making it challenging for AmeriSafe to grow premiums and maintain underwriting margins without sacrificing profitability.

Preview Before You Purchase

Amerisafe SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Amerisafe's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive analysis is designed to provide actionable insights for strategic planning.

Opportunities

AmeriSafe can strategically expand its presence within its established high-hazard market segments, where its specialized knowledge and existing client relationships provide a competitive edge. This involves identifying and exploiting lucrative niches, potentially through geographic expansion or by focusing on specific sub-segments that are currently underserved. The company has indicated that it anticipates continued growth opportunities within its core markets.

Amerisafe can significantly boost its operational efficiency and risk management by embracing advanced technology. Investing in AI-driven analytics for risk assessment can lead to more precise underwriting, identifying potential hazards before they escalate. This translates to better pricing and a reduced likelihood of unforeseen losses.

Streamlining claims processing through technological integration is another key opportunity. Automated systems can expedite claim handling, reducing administrative burdens and improving customer satisfaction. For instance, AI can analyze claim documents for fraud detection or automate payouts for straightforward claims, thereby cutting down processing times and associated costs.

These technological enhancements directly contribute to improved financial metrics. By reducing loss costs through better risk prediction and more efficient claims management, Amerisafe can see a positive impact on its expense ratios and overall profitability. For example, a 2024 industry report indicated that insurers leveraging AI in claims saw an average reduction of 15% in processing costs.

AmeriSafe, currently heavily focused on workers' compensation, has a significant opportunity to expand its product suite by offering complementary insurance lines to its established clientele in hazardous industries. This strategic move could involve introducing general liability, commercial property insurance, or even occupational accident coverage. By leveraging existing client relationships and deep industry expertise, AmeriSafe can tap into these adjacent markets. For instance, expanding into commercial property insurance for manufacturing clients could be a natural fit, building upon their understanding of industrial risks. This diversification would not only broaden revenue streams but also reduce the company's dependence on the potentially volatile workers' compensation market.

Geographic Expansion into New States

Amerisafe currently serves 27 states, but a significant opportunity exists in expanding into new states. Identifying states with favorable workers' compensation regulations and a robust concentration of high-hazard industries, where their specialization is most valued, could drive substantial growth. This strategic move would broaden their market penetration and tap into previously unreached customer segments.

For instance, states with a strong manufacturing, construction, or logging presence, like Idaho or Alaska, could represent attractive expansion targets. Such an expansion requires meticulous attention to varying state-specific regulatory frameworks and thorough market analysis to ensure successful entry and sustained operations. In 2023, AmeriSafe reported gross premiums written of $1.7 billion, indicating a solid foundation for further market capture.

- Expansion into states with favorable workers' compensation laws and high-hazard industries presents a clear growth avenue.

- Targeting states with significant manufacturing, construction, or logging sectors could yield substantial new business.

- Successful geographic expansion necessitates rigorous adherence to diverse state regulations and in-depth market research.

- AmeriSafe's 2023 gross written premiums of $1.7 billion underscore its capacity to absorb and capitalize on new market opportunities.

Acquisitions and Strategic Partnerships

AmeriSafe can significantly boost its market position and capabilities through strategic acquisitions and partnerships. For instance, acquiring smaller, specialized insurance carriers could immediately broaden AmeriSafe's client base and tap into niche markets. This approach aligns with their stated focus on acquisitions as a key strategic initiative. By integrating these entities, AmeriSafe could also gain access to unique underwriting expertise or distribution channels that are difficult to build organically.

Forming alliances with technology providers presents another avenue for growth. Such partnerships could enable AmeriSafe to integrate cutting-edge claims processing software, AI-driven risk assessment tools, or enhanced customer service platforms. These technological advancements are crucial for staying competitive in the evolving insurance landscape. For example, a partnership could lead to a more streamlined digital customer onboarding process, a key differentiator in 2024 and beyond.

- Acquisition of specialized carriers: This can provide immediate access to new customer segments and specialized underwriting knowledge.

- Partnerships with Insurtechs: Collaborating with technology firms can accelerate the adoption of AI, data analytics, and digital platforms.

- Enhanced Service Offerings: Mergers or collaborations can lead to the integration of new products or services, such as cyber insurance or specialized risk management solutions.

- Market Share Expansion: Both strategies are direct pathways to increasing AmeriSafe's footprint in the workers' compensation and specialty insurance markets.

Leveraging technology for enhanced risk assessment and claims processing presents a significant opportunity for AmeriSafe. AI-driven analytics can improve underwriting precision, while automation can streamline claims handling, leading to cost reductions and better customer experiences. For instance, a 2024 industry report highlighted that insurers using AI in claims saw an average 15% decrease in processing costs.

Expanding its product offerings beyond workers' compensation into adjacent lines like general liability or commercial property insurance can tap into existing client relationships and diversify revenue. Furthermore, strategic acquisitions and partnerships, particularly with Insurtech companies, can accelerate technological adoption and market share growth. In 2023, AmeriSafe generated $1.7 billion in gross premiums, indicating a strong base for capitalizing on these opportunities.

| Opportunity Area | Key Action | Potential Benefit | Data Point/Example |

|---|---|---|---|

| Technological Advancement | AI for risk assessment, automated claims processing | Improved underwriting, reduced processing costs, enhanced customer satisfaction | 15% average reduction in claims processing costs for AI-using insurers (2024 industry report) |

| Product Diversification | Offer complementary insurance lines (e.g., general liability) | Broader revenue streams, reduced reliance on workers' comp | $1.7 billion in gross premiums written in 2023 |

| Market Expansion | Enter new states with favorable regulations and high-hazard industries | Increased market penetration, access to new customer segments | Currently serves 27 states; potential for growth in states like Idaho or Alaska |

| Strategic Growth | Acquire specialized carriers or partner with Insurtechs | Expanded client base, access to unique expertise, faster tech adoption | Acquisitions identified as a key strategic initiative by AmeriSafe |

Threats

Changes in state-specific workers' compensation insurance regulations or federal workplace safety laws could significantly impact AmeriSafe's business model and compliance costs. For instance, shifts in how medical costs are covered or claims are processed in key states could alter pricing strategies and reserves.

Potential legislative changes, such as enhanced worker protection laws or insurance coverage expansion mandates, could lead to increased operational expenses or lower profitability. For example, a federal mandate for broader coverage could require significant adjustments to underwriting and premium structures.

Regulatory complexity across the 26 states where AmeriSafe operates already presents a challenge, requiring constant monitoring and adaptation. Staying compliant with varying rules on claims handling, reporting, and premium collection demands substantial resources.

Rising medical inflation and escalating home healthcare expenses are significant concerns, directly impacting the cost of workers' compensation claims. AmeriSafe has noted a modest uptick in loss and loss adjustment expenses, a trend that could accelerate with continued medical cost increases.

While AmeriSafe's efficient claims management strategies are in place to mitigate these rising costs, a sharper escalation in medical inflation could put pressure on the company's financial performance and overall profitability.

A significant economic downturn presents a considerable threat to AmeriSafe. Reduced economic activity often translates to lower employment in the high-hazard sectors AmeriSafe serves, directly impacting its premium volume. For instance, if construction or manufacturing payrolls shrink significantly, AmeriSafe collects less in premiums.

Furthermore, economic hardship can increase the frequency of workers' compensation claims. Employees facing financial strain may be more prone to accidents, or conversely, employers might cut corners on safety to save costs. This could lead to a rise in claims, putting pressure on AmeriSafe's profitability, especially considering the cyclical nature of the workers' compensation market which is closely linked to overall economic health.

Intensified Competition and Pricing Pressure

The workers' compensation insurance sector is inherently competitive, and AmeriSafe faces persistent downward pressure on pricing. This environment is further complicated by the emergence of new participants in the market.

Increased competition from both specialized and more general insurance providers can directly impact AmeriSafe's ability to command premium rates. This could potentially squeeze underwriting profit margins and challenge its existing market share.

For instance, the overall workers' compensation market experienced a combined ratio of approximately 92% in 2023, indicating a degree of profitability but also highlighting the sensitivity to pricing and claims management in a competitive landscape. This necessitates constant strategic adjustments to remain viable.

- Persistent Pricing Pressure: Downward trends in premiums across the industry threaten revenue streams.

- New Entrants: The influx of new competitors can dilute market share and intensify price wars.

- Margin Squeeze: Maintaining underwriting profitability becomes more challenging as competition heats up.

- Strategic Adaptation: Continuous innovation and efficient operations are crucial to navigate this dynamic threat.

Investment Portfolio Volatility and Interest Rate Fluctuations

AmeriSafe faces a significant threat from investment portfolio volatility and interest rate fluctuations. These market dynamics can directly impact the value of its holdings, influencing net investment income and, consequently, overall financial performance. For instance, in early 2025, net unrealized losses on equity securities, driven by market volatility, already contributed to a reduction in quarterly returns on average equity.

A substantial downturn in investment returns could place considerable pressure on AmeriSafe's profitability. Such a scenario would necessitate careful management of its investment strategy to mitigate potential losses and maintain financial stability.

- Market Volatility Impact: Fluctuations in equity markets in early 2025 led to net unrealized losses on AmeriSafe's securities.

- Interest Rate Sensitivity: Changes in interest rates can affect the income generated from AmeriSafe's fixed-income investments.

- Profitability Pressure: A sustained decline in investment returns could directly reduce the company's net income.

- Portfolio Revaluation: The value of AmeriSafe's investment portfolio is subject to ongoing revaluation based on prevailing market conditions.

AmeriSafe faces ongoing pressure from regulatory changes and the increasing cost of claims due to medical inflation. Economic downturns also pose a risk by reducing premium volume and potentially increasing claim frequency.

Intense competition within the workers' compensation market, coupled with market volatility impacting investment returns, presents significant challenges to profitability and financial stability. For example, the workers' compensation market had a combined ratio of approximately 92% in 2023, indicating a competitive environment.

| Threat Category | Specific Threat | Impact on AmeriSafe | Relevant Data/Example |

|---|---|---|---|

| Regulatory & Legal | Changes in state workers' compensation laws | Increased compliance costs, altered pricing strategies | Navigating regulations across 26 states requires constant adaptation. |

| Economic Conditions | Economic downturns | Reduced premium volume, potential increase in claim frequency | Lower employment in high-hazard sectors directly impacts payroll-based premiums. |

| Market Competition | Persistent pricing pressure and new entrants | Squeezed underwriting margins, potential loss of market share | Industry combined ratio of ~92% in 2023 highlights competitive pricing. |

| Financial Markets | Investment portfolio volatility and interest rate changes | Impact on net investment income and overall profitability | Net unrealized losses on equity securities in early 2025 affected quarterly returns. |

SWOT Analysis Data Sources

This Amerisafe SWOT analysis is built upon a comprehensive review of financial statements, industry-specific market research, and expert commentary. These reliable sources provide a robust foundation for understanding the company's internal capabilities and external market dynamics.