Amerisafe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amerisafe Bundle

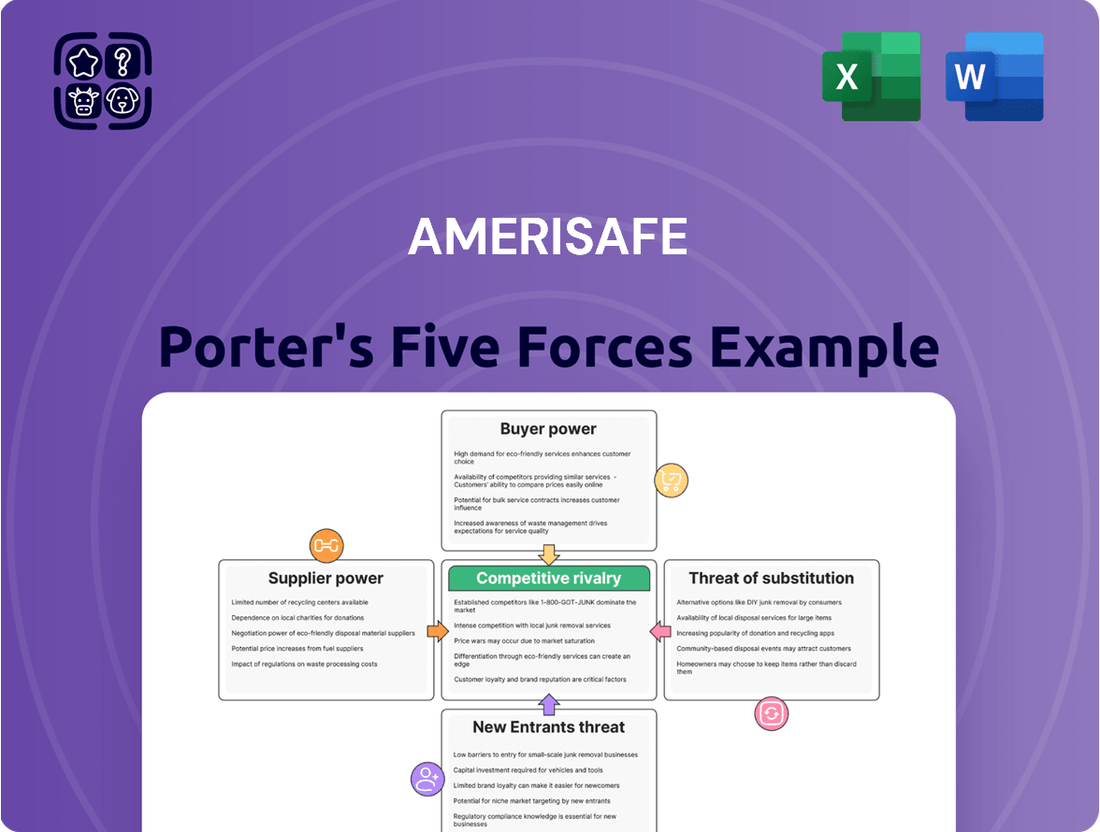

Amerisafe operates in a specialized insurance market, and understanding the forces shaping its industry is crucial. Porter's Five Forces analysis reveals key pressures like the threat of new entrants and the bargaining power of buyers. It also sheds light on the intensity of rivalry and the impact of substitute products. Evaluating the bargaining power of suppliers further clarifies Amerisafe's competitive landscape.

The complete report reveals the real forces shaping Amerisafe’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AmeriSafe's reliance on a specialized network of medical providers for workplace injury treatment, particularly in high-risk sectors, exposes it to supplier bargaining power. When there are shortages of key specialists like orthopedic surgeons, these providers gain leverage, potentially leading to increased medical claim costs. For instance, in 2024, the American Association of Orthopaedic Surgeons reported ongoing challenges in recruiting and retaining specialists in certain geographic areas, a trend that could impact AmeriSafe's cost control efforts.

Reinsurance providers hold significant sway over specialty insurers like AmeriSafe, as they absorb the potentially crippling, high-severity risks inherent in industries like mining and construction. The cost and availability of this coverage directly influence AmeriSafe's operational capacity and bottom line.

In 2024, the global reinsurance market experienced a tightening, with property catastrophe rates increasing by an average of 10-20% in some segments. This trend suggests that reinsurers are gaining leverage, potentially driving up costs for insurers like AmeriSafe.

A concentrated reinsurance sector, where a few major players dominate, amplifies their bargaining power. This concentration can lead to less competitive pricing and more stringent terms for primary insurers seeking to transfer risk.

For AmeriSafe, a workers' compensation insurer operating in high-hazard industries, the bargaining power of suppliers providing actuarial and data analytics services is a significant factor. Accurate risk assessment and precise pricing are paramount, especially when serving specialized, high-risk sectors.

Suppliers offering sophisticated actuarial models, cutting-edge data analytics platforms, and artificial intelligence solutions are gaining leverage. As these technologies become indispensable for efficient underwriting and effective claims management, their importance to insurers like AmeriSafe grows.

The need for continuous investment in these advanced analytical capabilities is critical for AmeriSafe to maintain competitive pricing and ensure sustained profitability in its market.

Claims Management Technology and Legal Services

AmeriSafe's operational efficiency hinges on its claims management technology and legal services. Suppliers of specialized claims management software and legal expertise for intricate cases hold significant sway. Any scarcity of experienced claims professionals or an escalation in legal fees directly boosts their bargaining power, potentially increasing AmeriSafe's operational outlays.

The bargaining power of suppliers in claims management technology and legal services is a critical consideration for AmeriSafe. These suppliers provide essential tools and expertise that directly influence the company's ability to manage costs and achieve efficient claims handling, a stated core strength.

- Key Suppliers: Providers of claims management software, specialized legal firms handling complex claims, and vendors offering return-to-work program support.

- Impact of Shortages: A shortage of skilled claims professionals or an increase in the cost of legal services can empower these suppliers, driving up AmeriSafe's expenses.

- Industry Trends: As of early 2024, the insurance technology sector continues to see investment, but specialized legal talent in areas like workers' compensation can be highly sought after, particularly in regions with robust regulatory oversight.

Human Capital (Skilled Employees)

AmeriSafe's commitment to specialized underwriting, robust safety programs, and efficient claims management hinges on its skilled workforce. The company's success is directly tied to the expertise of its underwriters, risk managers, and claims adjusters.

A tight labor market for these specialized roles, especially in 2024, can significantly amplify the bargaining power of human capital. This can translate into increased wage demands and benefits, impacting AmeriSafe's operational costs.

- Talent Scarcity: Shortages in experienced underwriters and risk management professionals can give these individuals greater leverage in salary negotiations.

- Increased Labor Costs: In 2024, average salaries for experienced insurance underwriters saw an upward trend, potentially increasing AmeriSafe's personnel expenses.

- Service Quality Impact: Difficulty in attracting and retaining top talent could compromise the quality of AmeriSafe's specialized services, affecting customer satisfaction and retention.

AmeriSafe's reliance on specialized medical providers, particularly for niche treatments in high-risk industries, grants these suppliers considerable bargaining power. When demand for specific medical expertise, such as that of occupational health physicians, outstrips supply, these providers can command higher fees, directly impacting AmeriSafe's claims costs.

Reinsurance partners are critical for AmeriSafe to manage the significant risks associated with its high-hazard client base. The terms and pricing of reinsurance contracts are heavily influenced by the bargaining power of reinsurers, especially in a hardening market where capacity may be constrained.

Suppliers of advanced actuarial and data analytics services are becoming increasingly influential. As AmeriSafe prioritizes data-driven underwriting and claims management, the leverage of providers offering sophisticated modeling and AI solutions grows, potentially leading to higher service costs.

Key suppliers for AmeriSafe include specialized medical networks, reinsurers, and providers of actuarial and claims management technology. The bargaining power of these entities can be amplified by talent shortages or market concentrations.

| Supplier Category | Key Leverage Factors | Potential Impact on AmeriSafe |

|---|---|---|

| Medical Providers | Shortage of specialists (e.g., occupational physicians) | Increased medical claim costs |

| Reinsurers | Market hardening, limited capacity | Higher reinsurance premiums, stricter terms |

| Actuarial/Data Analytics | Demand for advanced technology, data scarcity | Increased costs for essential analytical tools |

What is included in the product

This analysis examines the five competitive forces impacting Amerisafe, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Easily visualize competitive pressures with a pre-built, customizable Porter's Five Forces template, saving hours of manual setup.

Customers Bargaining Power

AmeriSafe primarily caters to small to mid-sized businesses. Individually, these businesses often have limited bargaining power because their premium volumes are relatively small. However, when viewed as a group, these businesses can exert some influence by comparing prices and looking for insurers that provide specialized coverage for their high-risk industries. AmeriSafe’s robust customer retention, which stood at approximately 90% in 2023, indicates they are successfully addressing these specific needs.

The workers' compensation insurance market has seen a noticeable trend of declining rates, a clear signal of heightened price sensitivity among customers. This competitive environment means insurers must be very mindful of their pricing strategies to remain attractive.

Small and medium-sized businesses, in particular, are acutely focused on managing their insurance expenditures. With ongoing inflation in medical costs and wages, they are actively seeking ways to control their overall operational expenses, making competitive pricing a critical factor in their decision-making process.

This heightened customer demand for lower premiums directly impacts insurers like AmeriSafe, compelling them to offer competitive rates to secure and retain business. For instance, in 2024, the average workers' compensation rate saw a slight dip in many states, reflecting this market pressure.

Customers today have unprecedented access to information, making it easier than ever to compare insurance quotes and coverage. Online platforms and insurance brokers empower individuals and businesses to quickly assess options, significantly increasing their bargaining power. This transparency means AmeriSafe must continually offer competitive pricing and superior service to retain clients, as switching providers is now a relatively simple process.

Switching Costs

Switching costs for customers in the workers' compensation insurance market are typically low. This means that businesses can change providers with relative ease if they find a better deal or service elsewhere. For instance, while there's some administrative work involved, the direct financial outlay to switch is usually minimal, empowering customers to shop around. This low barrier to exit directly enhances the bargaining power of customers.

AmeriSafe's strong policy renewal rates, exceeding 90% in recent years, demonstrate their success in overcoming this customer leverage. This high retention suggests that AmeriSafe effectively provides value and service that keeps clients from seeking alternatives, despite the low switching costs. They are likely achieving this through competitive pricing, excellent claims handling, and robust safety programs.

- Low Direct Financial Switching Costs: Businesses can change workers' compensation insurers without incurring significant financial penalties or upfront fees.

- Customer Empowerment: This ease of switching gives customers the power to demand better terms and pricing from providers like AmeriSafe.

- AmeriSafe's Retention Success: AmeriSafe maintains a policy renewal rate above 90%, indicating effective strategies to retain clients despite low switching costs.

- Value Proposition: High renewal rates suggest AmeriSafe's pricing, service, and safety solutions are compelling enough to prevent customers from switching.

Focus on Safety and Cost Control

AmeriSafe's customers, particularly those operating in high-risk sectors, place a significant emphasis on minimizing workplace accidents and managing their experience modification factor (mod). This focus on safety directly impacts their operational costs and overall profitability. For instance, a reduction in a company's mod can lead to substantial savings on insurance premiums, making safety a primary driver in their purchasing decisions.

Insurers that provide comprehensive safety programs and efficient claims handling, such as AmeriSafe, offer a distinct advantage. These value-added services address customers' core concerns beyond just the insurance premium itself. By actively helping clients reduce injuries and control their mods, AmeriSafe demonstrates tangible benefits that mitigate the customer's desire to switch based on price alone. This commitment to safety translates into stronger customer loyalty and reduced bargaining power for the customer.

- Focus on Safety: Customers in hazardous industries prioritize reducing workplace injuries to control costs.

- Mod Factor Importance: A lower experience modification factor directly reduces insurance premiums for businesses.

- Value Beyond Premium: AmeriSafe's safety programs and claims management offer significant value, reducing price sensitivity.

- Customer Retention: By addressing safety concerns, AmeriSafe enhances customer loyalty and limits the power of customers to demand lower prices.

The bargaining power of customers for AmeriSafe is moderate, driven by increased price transparency and low switching costs in the workers' compensation market. While individual small to mid-sized businesses have limited leverage, their collective ability to compare quotes and seek specialized coverage influences pricing. AmeriSafe's high customer retention, around 90% in 2023, indicates success in mitigating this power through competitive pricing and value-added safety services.

| Factor | Impact on AmeriSafe | Data/Observation |

|---|---|---|

| Customer Price Sensitivity | Moderate to High | Workers' compensation rates saw a slight dip in many states in 2024. |

| Switching Costs | Low | Minimal financial outlay for businesses to change providers. |

| Information Availability | High | Online platforms and brokers facilitate easy quote comparisons. |

| Customer Retention Rate | High | AmeriSafe's policy renewal rate exceeds 90%. |

| Value-Added Services (Safety Programs) | Mitigates Bargaining Power | Focus on reducing workplace accidents and improving mod factors. |

What You See Is What You Get

Amerisafe Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document detailing Amerisafe's Porter's Five Forces Analysis, covering the intensity of rivalry among existing competitors, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products or services. This comprehensive analysis is professionally written and fully formatted, providing actionable insights into Amerisafe's competitive landscape. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The workers' compensation insurance sector has experienced a robust decade, marked by considerable profitability and favorable underwriting results. This sustained success has cemented its appeal, drawing the attention of numerous market players. For instance, in 2023, the industry reported an estimated combined ratio of around 95%, indicating a profitable underwriting environment.

This attractive profitability acts as a magnet, compelling established multi-line insurance companies to dedicate increased resources and strategic focus to their workers' compensation offerings. Simultaneously, it lowers the barrier to entry for new, specialized insurers eager to capitalize on these favorable conditions, thereby fueling market expansion.

The influx of both existing and new participants intensifies the competitive rivalry for market share. Companies are increasingly vying for policyholders, leading to more aggressive pricing strategies and a greater emphasis on service differentiation to capture and retain business in this lucrative segment.

The workers' compensation insurance market, while generally profitable, has experienced a notable trend of declining premium rates over several years. This has intensified competitive rivalry, forcing insurers to compete more fiercely on price. For instance, the average premium rate for workers' compensation in the US has seen a downward trend in the years leading up to 2024, as reported by industry analyses.

This sustained downward pricing pressure creates a softening market environment. Consequently, insurers face the challenge of maintaining healthy profit margins as they engage in more aggressive price competition to secure business. This dynamic directly impacts the profitability of companies operating within this sector.

AmeriSafe has demonstrated resilience in this challenging landscape by prioritizing rigorous risk selection. Their disciplined approach to pricing, ensuring that premiums adequately reflect the assessed risks, has allowed them to navigate the market's softening conditions effectively.

AmeriSafe's strategic focus on high-hazard industries, such as construction and logging, carves out a distinct niche that shields it from direct competition with general workers' compensation insurers. This specialization allows AmeriSafe to develop deep expertise and tailored solutions for its target clientele.

However, this niche is not entirely without competition. Specialist providers also cater to these high-risk sectors, and larger, multi-line insurance carriers often maintain specialized underwriting units dedicated to high-hazard risks. This competitive landscape means rivalry exists both within AmeriSafe's core market and at its periphery.

For instance, in 2023, the workers' compensation market, while diverse, saw continued specialization. While specific data for high-hazard niches is proprietary, industry reports indicate that carriers with specialized underwriting capabilities often achieve better loss ratios in these segments. AmeriSafe's ability to maintain its competitive edge relies on its continued differentiation and underwriting proficiency within these demanding sectors.

Differentiated Service and Claims Management

In the workers' compensation landscape, competition increasingly hinges on service quality and claims management, particularly within high-hazard sectors where claims are intricate and expensive. AmeriSafe distinguishes itself by focusing on robust safety programs and diligent claims handling. This approach is crucial because efficiently managing claims and mitigating costs for policyholders offers a significant competitive edge.

AmeriSafe's strategy directly addresses the complexities of workers' compensation by offering more than just insurance coverage. They provide value-added services aimed at preventing injuries and managing the aftermath of workplace incidents. This focus on proactive safety and responsive claims processing is a key differentiator in a market where policyholders seek comprehensive risk management solutions.

- Service Quality: AmeriSafe's emphasis on safety programs and intensive claims management sets them apart from competitors who may primarily focus on pricing.

- Claims Management Advantage: The ability to effectively manage complex claims and reduce overall costs for clients is a critical factor in retaining business and attracting new policyholders.

- Industry Focus: For high-hazard industries, where claims can be particularly challenging, AmeriSafe's specialized approach to safety and claims handling is a significant competitive advantage.

Consolidation and Capacity

While Amerisafe operates in a niche, the broader insurance sector sees significant merger and acquisition (M&A) activity. For instance, in 2023, the insurance industry experienced a robust M&A market, with deal volumes remaining strong, indicating a trend towards larger, more integrated players. This consolidation can lead to increased competition from consolidated entities possessing greater financial capacity and a wider array of services, potentially impacting market dynamics.

Despite consolidation trends in the wider insurance landscape, the workers' compensation market, Amerisafe's core focus, continues to exhibit high levels of available capacity. This means there is ample supply of insurance coverage within the workers' comp sector. For Amerisafe, this translates to a competitive environment where capacity itself is not a significant barrier to entry or a primary driver of pricing power.

- Consolidation Impact: M&A activity in the broader insurance market creates larger competitors with enhanced capacity and service portfolios.

- Workers' Comp Capacity: The specific market Amerisafe serves remains characterized by high levels of available insurance capacity.

- Competitive Dynamics: High capacity in workers' comp means that coverage availability is generally not a limiting factor for competitors.

The workers' compensation insurance sector has seen intense rivalry due to sustained profitability, attracting both established insurers expanding their offerings and new specialized entrants. This heightened competition has led to aggressive pricing strategies and a greater emphasis on service differentiation, as evidenced by the reported average premium rate decline in the US leading up to 2024.

AmeriSafe differentiates itself by focusing on high-hazard industries, a niche that, while specialized, still faces competition from other niche providers and specialized units of larger insurers. Their competitive edge is built on rigorous risk selection, disciplined pricing, and superior claims management, which are critical in managing complex claims within these demanding sectors.

The overall insurance market's consolidation, with strong M&A activity in 2023, means larger, more financially capable competitors may emerge. However, AmeriSafe's core workers' compensation market maintains high capacity, ensuring coverage availability is not a primary competitive constraint, allowing AmeriSafe to focus on its specialized service and risk management strengths.

SSubstitutes Threaten

Self-insurance and group self-insurance plans present a significant threat to AmeriSafe. For substantial companies, especially those with predictable operations and robust financial standing, these alternatives offer a way to manage workers' compensation risks without traditional insurance. This directly bypasses the need for AmeriSafe's core services.

While less prevalent among smaller enterprises, the existence of these self-managed risk pools means that AmeriSafe faces competition from businesses choosing to retain their own risk. This approach can be particularly appealing when insurance premiums are perceived as high relative to the actual risk exposure.

In 2024, the economic climate may further encourage larger businesses to explore self-insurance. For example, if interest rates remain elevated, the ability to retain and invest premium dollars could offer a financial advantage, making self-insurance a more attractive substitute for AmeriSafe's policyholders.

Businesses can explore alternative risk transfer (ART) mechanisms like captives or risk retention groups instead of traditional workers' compensation insurance. These alternatives allow companies to self-insure and manage their own risk, potentially leading to cost savings. However, these strategies demand substantial capital investment and advanced risk management expertise, making them a less accessible substitute for many of AmeriSafe's core customers.

Pay-as-you-go workers' compensation insurance, directly tied to payroll, presents a flexible alternative to traditional upfront annual premiums. This model offers small businesses a way to manage cash flow more effectively, making it a potential substitute for the conventional payment approach.

For instance, in 2024, a significant number of small businesses are actively seeking payment solutions that align with their fluctuating revenue streams. The ability to pay for insurance as payroll is processed can be particularly attractive, especially for those with seasonal or project-based workforces, potentially impacting the demand for policies with rigid annual payment schedules.

Enhanced Safety and Risk Mitigation

Enhanced safety and risk mitigation act as a significant threat of substitutes for traditional insurance products. Businesses that invest proactively in comprehensive workplace safety programs, focusing on injury prevention and effective return-to-work strategies, can substantially decrease both the frequency and severity of insurance claims. This proactive approach, which AmeriSafe actively champions, directly reduces the reliance on insurance payouts and can lead to lower premium costs, thereby substituting the need for higher insurance expenditures.

Consider the following points regarding this threat:

- Reduced Claim Frequency: Investing in safety training and equipment directly lowers the likelihood of workplace accidents. For instance, a 10% reduction in lost-time injuries could translate to significant savings in workers' compensation premiums.

- Lower Claim Severity: Robust return-to-work programs help injured employees recover and return to their jobs faster, minimizing the duration and cost of claims. Studies indicate that well-managed return-to-work programs can reduce claim costs by up to 30%.

- Premium Negotiation Power: Demonstrable improvements in safety metrics provide businesses with stronger leverage when negotiating insurance premiums. Companies with excellent safety records often secure more favorable rates compared to industry averages.

- Cost Savings: By minimizing accidents and associated costs, businesses effectively substitute the need for higher insurance payouts and premiums, creating direct financial benefits.

Government Programs and State Funds

Government programs and state funds can present a significant threat of substitutes for AmeriSafe. In certain states, these entities function as the sole or primary provider of workers' compensation insurance, or act as a safety net for businesses struggling to obtain coverage in the open market. For instance, some states operate assigned risk pools or monopolistic state funds that offer coverage to employers deemed too high-risk for private insurers. This availability of government-backed coverage can divert potential customers from private carriers like AmeriSafe, especially if these programs offer more competitive pricing or guaranteed coverage options.

The existence of these state-sponsored programs can exert downward pressure on pricing within the voluntary market. Businesses in competitive states where AmeriSafe operates might still compare its offerings against those of state funds or assigned risk pools. If these government programs provide a viable alternative, even as a last resort, they effectively limit AmeriSafe's pricing power and market share. For example, a business in a state with a strong monopolistic fund might find that fund a more attractive option than a private insurer if the cost differential is substantial.

- Monopolistic State Funds: In states like North Dakota, Ohio, Washington, and Wyoming, private insurers cannot offer workers' compensation; only the state fund provides this coverage.

- Assigned Risk Pools: These pools are designed for employers who cannot obtain coverage in the voluntary market and are mandated in most states, acting as a substitute for private coverage.

- Cost Competitiveness: State funds may sometimes offer lower premiums due to their tax-exempt status or operational efficiencies, making them a direct substitute on price.

- Guaranteed Availability: Unlike the voluntary market which can reject risks, state programs often guarantee coverage, serving as a crucial substitute for high-risk employers.

Self-insurance, captives, and risk retention groups offer alternatives for businesses to manage workers' compensation risks internally. These options bypass traditional insurance, appealing to larger, financially stable companies. For example, in 2024, businesses with strong cash flow might find retaining premiums more advantageous due to prevailing interest rates, making self-insurance a viable substitute for AmeriSafe.

Pay-as-you-go insurance models, directly linked to payroll, provide flexibility, especially for small businesses with fluctuating revenues. This approach allows for more manageable cash flow compared to traditional annual premiums. Many small businesses in 2024 are seeking such payment solutions to align insurance costs with their income streams.

Enhanced workplace safety and proactive risk mitigation can reduce the need for insurance coverage by lowering claim frequency and severity. Companies with robust safety programs can achieve significant cost savings, effectively substituting higher insurance expenditures. For instance, a 10% reduction in lost-time injuries can lead to substantial premium savings.

State-sponsored programs, including monopolistic funds and assigned risk pools, act as substitutes by providing guaranteed coverage, particularly for high-risk employers. In states like North Dakota and Washington, where private insurers are excluded, these state funds are the sole option, limiting AmeriSafe's market reach.

Entrants Threaten

Entering the specialty insurance market, particularly in areas like workers' compensation which Amerisafe operates in, demands significant upfront capital. These requirements stem from the need to establish adequate reserves for potential claims, build robust underwriting capabilities, and cover extensive operational expenses. For instance, in 2023, the overall US insurance industry saw premium volumes exceeding $2.7 trillion, illustrating the scale of financial commitment needed even to gain a foothold.

The workers' compensation insurance market is a heavily regulated arena, with each state imposing its own unique set of laws, rates, and compliance demands. For AmeriSafe, which operates across 27 states, this means navigating a patchwork of differing regulations. This complexity creates a significant barrier to entry, as new companies must invest substantial resources to understand and adhere to these varied requirements, including obtaining the necessary licenses in each operational state.

AmeriSafe's focus on high-hazard industries presents a significant barrier to new entrants due to the critical need for specialized expertise and underwriting capabilities. These sectors, such as construction and manufacturing, involve complex risk profiles that require deep industry knowledge to accurately assess and price. This specialized skill set is not easily replicated by generalist insurers, making entry into AmeriSafe's core market exceptionally challenging.

Developing the intricate underwriting acumen and experienced teams necessary to navigate these high-risk environments is a substantial investment in both time and capital. For instance, a new entrant would need to invest heavily in training and data acquisition to match AmeriSafe's proven ability to manage workers' compensation for these demanding industries. This steep learning curve and the associated financial outlay effectively deter many potential competitors.

Established Relationships and Distribution Channels

Established players like AmeriSafe have cultivated deep, long-standing relationships with insurance agents and their policyholder base, especially in specialized high-hazard sectors. These existing connections create a significant barrier for newcomers attempting to penetrate the market.

Developing a robust distribution network and a solid brand reputation requires substantial, sustained investment over many years. AmeriSafe's commitment to effective claims handling, a critical factor in customer retention, further solidifies its market position and deters new entrants who would struggle to replicate this trust.

- Established Agent Networks: AmeriSafe's long-term partnerships with independent agents provide a ready-made sales force, a channel that new entrants would need considerable time and resources to replicate.

- Policyholder Loyalty: Decades of service and reliable claims processing foster significant policyholder loyalty, making it difficult for new companies to attract business away from established relationships.

- Brand Trust in Niche Markets: In high-hazard industries, where safety and reliability are paramount, AmeriSafe's established brand trust is a powerful deterrent to new competitors.

Claims Management Infrastructure

The threat of new entrants to Amerisafe's claims management infrastructure is low due to the significant capital investment required. Establishing a robust claims handling system, complete with specialized adjusters experienced in complex, high-risk industrial injuries, along with curated medical provider networks and specialized legal counsel, represents a substantial upfront cost. For instance, building out such capabilities from scratch could easily run into tens of millions of dollars, a prohibitive barrier for most potential competitors.

New entrants would face considerable challenges in replicating Amerisafe's established expertise and operational efficiency.

- High Setup Costs: Developing a specialized claims infrastructure involves significant expenditure on personnel, technology, and legal/medical partnerships.

- Expertise Gap: Acquiring or training claims adjusters with deep knowledge of niche, hazardous industries takes considerable time and resources.

- Network Development: Building reliable networks of medical providers and legal experts experienced in specific high-risk claims is a complex, lengthy process.

- Regulatory Hurdles: Navigating the regulatory landscape for insurance claims management in various jurisdictions adds another layer of complexity and cost for new players.

The threat of new entrants into Amerisafe's specialized insurance market is considerably low. High capital requirements, extensive regulatory compliance across multiple states, and the need for specialized underwriting expertise in high-hazard industries act as significant deterrents. For example, the insurance industry's robust financial health, with total assets of over $30 trillion globally in 2023, underscores the capital intensity involved.

New entrants would struggle to match Amerisafe's established agent networks, policyholder loyalty, and brand trust built over decades, particularly within niche sectors where reliability is paramount. Replicating Amerisafe's sophisticated claims management infrastructure, which demands substantial investment in expert personnel and curated provider networks, presents another formidable barrier.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Need for significant reserves, underwriting capabilities, and operational expenses. | High; discourages undercapitalized entrants. |

| Regulatory Complexity | Navigating state-specific laws, rates, and licensing for workers' compensation. | High; requires substantial legal and compliance investment. |

| Specialized Expertise | Deep knowledge of high-hazard industries for accurate risk assessment and pricing. | High; difficult to replicate complex underwriting acumen. |

| Distribution & Brand Loyalty | Established agent relationships and policyholder trust in niche markets. | High; takes years and significant investment to build. |

| Claims Management Infrastructure | Investment in specialized adjusters, medical networks, and legal counsel. | Very High; prohibitive cost and time to develop from scratch. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Amerisafe is built upon a foundation of robust data, including industry-specific market research reports, detailed financial statements from public filings (SEC), and expert commentary from financial analysts covering the insurance sector.