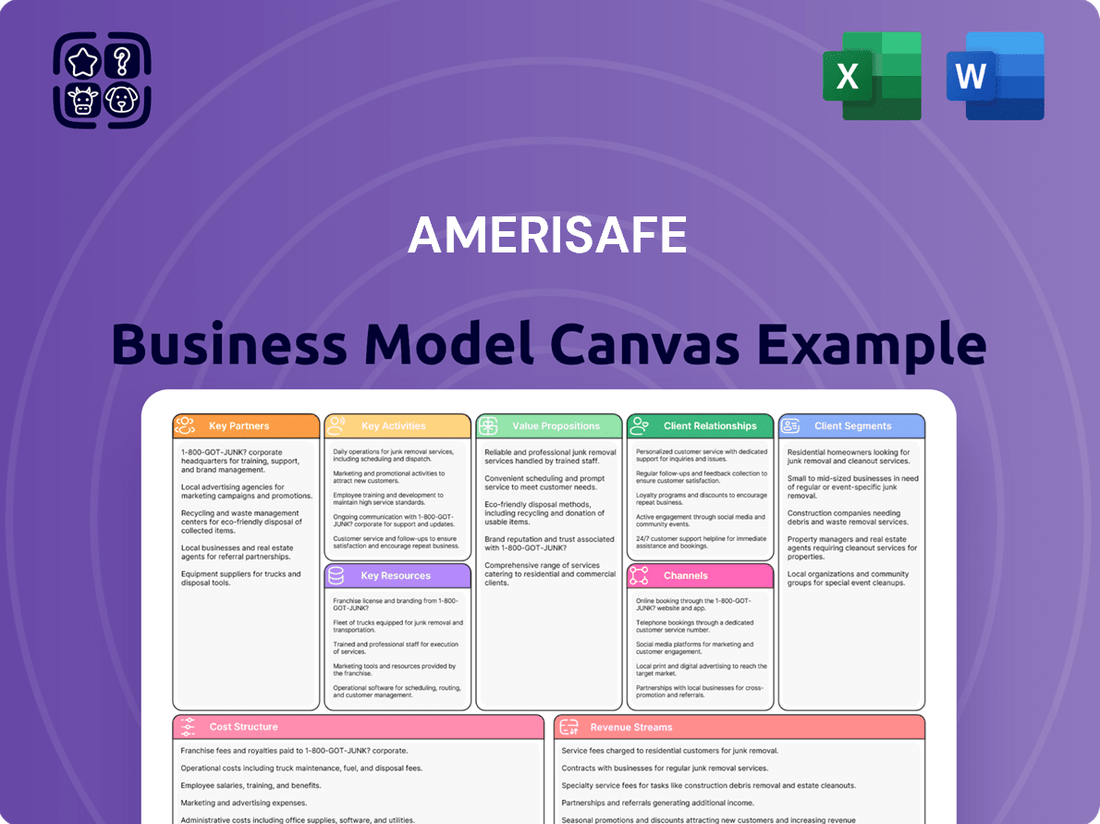

Amerisafe Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amerisafe Bundle

Unlock the full strategic blueprint behind Amerisafe's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into their unique approach to safety and insurance.

Dive deeper into Amerisafe’s real-world strategy with the complete Business Model Canvas. From its specialized value propositions for high-risk industries to its robust cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Want to see exactly how Amerisafe operates and scales its business in niche markets? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking your own strategies, conducting thorough strategic planning, or preparing compelling investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Amerisafe’s success in specialized insurance. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies and adapt them for their own ventures.

See how all the pieces fit together in Amerisafe’s successful business model. This detailed, editable canvas highlights the company’s specific customer segments, key strategic partnerships, unique revenue strategies, and more. Download the full version to accelerate your own business thinking and gain a competitive edge.

Partnerships

Amerisafe's success hinges on its extensive network of independent insurance agents and brokers. These partners act as the primary channel for distributing Amerisafe's specialized workers' compensation insurance. They are instrumental in connecting Amerisafe with its target market of small to mid-sized businesses operating in high-hazard sectors across 27 states.

The strength of these partnerships directly impacts Amerisafe's new business acquisition and the retention of existing premiums. The company's consistent growth in voluntary premiums underscores the effectiveness of these relationships. In 2024, Amerisafe continued to see robust engagement from this key distribution channel, contributing significantly to its market penetration.

Amerisafe's strategic alliances with reinsurance companies are crucial for managing the inherent volatility of high-hazard industries. These partnerships enable Amerisafe to transfer a significant portion of its underwriting risk, thereby safeguarding its financial strength and capital reserves against unforeseen, large-scale claims. This risk-sharing mechanism is fundamental to maintaining operational capacity and solvency within the specialized workers' compensation market.

Amerisafe partners with extensive medical networks and specialized rehabilitation services. These collaborations are crucial for delivering high-quality, timely care to injured workers, directly impacting claims management efficiency.

By ensuring prompt and appropriate treatment through these third-party providers, Amerisafe effectively controls claim costs and enhances recovery outcomes for policyholders and their employees. This focus on efficient claims handling is a key driver in managing loss severities, contributing to the company's financial stability. For instance, in 2024, Amerisafe's proactive claims management, supported by these partnerships, aimed to further reduce the average cost per claim, building on previous years' success in mitigating severity.

Industry Associations and Safety Organizations

Amerisafe actively collaborates with key industry associations and safety organizations. These partnerships are crucial for staying ahead in understanding the unique risks of high-hazard sectors. By engaging with groups like the National Safety Council and various trade associations, Amerisafe gains access to the latest research and best practices in accident prevention.

These alliances directly enhance Amerisafe's ability to develop and refine its specialized safety programs. For instance, insights gleaned from these collaborations help tailor risk mitigation strategies for policyholders in construction, manufacturing, and energy, industries where Amerisafe has significant exposure. This proactive approach reinforces Amerisafe's core value of reducing workplace injuries and improving safety outcomes for its clients.

- Industry Associations: Amerisafe engages with sector-specific groups to understand evolving safety challenges.

- Safety Organizations: Partnerships with bodies like the National Safety Council provide access to cutting-edge safety research.

- Best Practices: Collaborations facilitate the dissemination and adoption of advanced risk mitigation techniques.

- Value Proposition: These relationships strengthen Amerisafe's commitment to lowering injury rates and enhancing policyholder safety records.

Technology and Data Analytics Providers

Amerisafe's commitment to enhancing risk assessment and pricing accuracy is significantly driven by its strategic alliances with technology and data analytics providers. These partnerships are crucial for accessing cutting-edge tools that facilitate advanced predictive modeling and the efficient processing of extensive workers' compensation claims data. For instance, in 2024, Amerisafe continued to integrate sophisticated analytics platforms to refine its underwriting processes.

These collaborations allow Amerisafe to leverage external expertise and innovative solutions, thereby improving the precision of its underwriting and boosting overall operational efficiency. The company's investment in these areas is designed to provide a competitive edge by enabling more informed decision-making based on robust data analysis.

- Enhanced Risk Assessment: Partnerships provide access to advanced algorithms for more accurate identification and quantification of workplace risks.

- Pricing Accuracy: Leveraging data analytics improves the precision of premium calculations, aligning them more closely with actual risk profiles.

- Operational Efficiency: Technology solutions streamline claims processing and underwriting workflows, reducing administrative overhead.

- Predictive Modeling: Collaborations enable the development and deployment of sophisticated models to forecast future claims trends and costs.

Amerisafe's strategic alliances with reinsurers are vital for absorbing the significant financial impact of claims in high-risk industries. These partnerships allow the company to transfer a portion of its underwriting risk, ensuring capital adequacy and solvency. This risk-sharing is fundamental to Amerisafe's ability to operate and maintain financial stability in its specialized market.

What is included in the product

A comprehensive overview of Amerisafe's business model, detailing customer segments served and key value propositions offered.

Reflects Amerisafe's operational focus on providing specialized insurance and safety services to high-hazard industries.

Amerisafe's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their specialized workers' compensation insurance strategy, simplifying complex risk management for businesses.

Activities

Amerisafe's core activity revolves around the rigorous underwriting of workers' compensation insurance, particularly for businesses operating in high-risk sectors. They meticulously evaluate the potential risks inherent in small to medium-sized enterprises within industries such as construction, trucking, and manufacturing.

The company's proficiency in selecting suitable risks and accurately pricing policies is a cornerstone of its financial success. This careful approach directly impacts profitability and helps maintain a healthy combined ratio, which for Amerisafe, stood at an impressive 77.7% as of the first quarter of 2024.

Amerisafe’s key activities revolve around proactive claims management and robust loss control. This dual focus directly benefits clients by mitigating the severity of claims and lowering overall insurance expenses.

The company ensures injured employees receive essential benefits, covering temporary or permanent disability, death benefits, and all necessary medical expenses. This comprehensive support system is central to their claims handling process.

A significant differentiator for Amerisafe is their commitment to efficient claims management coupled with strong safety programs. This approach not only protects clients but also contributes to favorable prior year loss reserve development, a testament to their effective risk management.

For instance, in 2024, Amerisafe continued to highlight the positive impact of its safety culture, which is designed to reduce workplace incidents and associated costs, thereby enhancing the financial stability for both the company and its policyholders.

Amerisafe's key activities revolve around the meticulous management of insurance policies throughout their entire lifecycle. This encompasses the initial issuance of policies, the critical renewal process, and the continuous provision of exceptional customer service. In 2024, maintaining a high level of policy administration is crucial for operational efficiency.

A significant part of this involves expertly handling customer inquiries, processing necessary premium adjustments, and implementing strategies to ensure strong premium retention. For instance, effective customer service directly contributes to Amerisafe's ability to foster client loyalty, which is a cornerstone of their business model.

This dedication to customer support directly impacts the company's success, as evidenced by their consistently high policy renewal rates. In the competitive insurance landscape, exceptional service in 2024 is a differentiator that solidifies customer relationships and minimizes churn.

Investment Management

Amerisafe's investment management is a cornerstone of its business model, driven by the substantial premium float it holds as an insurance carrier. This float represents funds collected from policyholders that haven't yet been paid out in claims, providing a significant pool of capital for investment. Actively managing this portfolio, which includes cash and cash equivalents, is crucial for generating additional returns and bolstering the company's overall financial health.

The company's strategy involves maintaining a conservative investment portfolio, which prioritizes capital preservation and stability. However, within this framework, Amerisafe actively seeks favorable yields on new investments to maximize returns. For instance, as of the first quarter of 2024, Amerisafe reported total investments of $1.58 billion, demonstrating the scale of their investment management activities.

- Investment Income Generation: Amerisafe leverages its premium float to generate significant investment income, contributing to profitability beyond underwriting.

- Portfolio Management: The company actively manages its investment portfolio, including cash and cash equivalents, to optimize returns and financial performance.

- Conservative Approach: Amerisafe maintains a conservative investment strategy, balancing capital preservation with the pursuit of favorable yields.

- Financial Health Support: Effective investment management directly supports Amerisafe's overall financial stability and ability to meet its obligations.

Sales and Marketing

Amerisafe's sales and marketing activities are laser-focused on attracting and keeping small to mid-sized businesses operating in high-hazard industries. They actively work through their established network of agents to reach these specialized clients. For instance, in 2024, Amerisafe reported a robust gross written premium of $1.16 billion, underscoring the effectiveness of their targeted approach in these niche markets.

The company also recognizes the importance of evolving its outreach, exploring opportunities to enhance its digital marketing presence. This dual strategy aims to build a strong pipeline of new business. In the first quarter of 2024, Amerisafe saw a 16.5% increase in new business premiums compared to the previous year, demonstrating successful customer acquisition.

- Targeted Outreach: Focus on small to mid-sized businesses in high-hazard sectors.

- Agent Network: Leverage existing relationships with insurance agents.

- Digital Expansion: Explore and enhance digital marketing strategies.

- Growth Objective: Drive top-line growth through new business and retention.

- Market Resilience: Maintain strong premium retention despite competition.

Amerisafe's key activities center on underwriting specialized workers' compensation insurance for high-risk businesses. This involves thorough risk assessment and precise policy pricing, which is fundamental to their profitability. Their 2024 first quarter combined ratio of 77.7% highlights this expertise.

Proactive claims management and robust loss control programs are critical. These efforts aim to reduce claim severity and overall costs for clients, directly impacting Amerisafe's financial performance through favorable loss reserve development. Their commitment to safety culture in 2024 reinforces this.

Policy lifecycle management, including issuance, renewal, and customer service, forms another core activity. In 2024, maintaining efficient administration and high policy renewal rates are key to client retention and operational success.

Investment management of premium float, totaling $1.58 billion in investments as of Q1 2024, is vital for generating returns. Amerisafe employs a conservative strategy focused on capital preservation while seeking favorable yields.

Sales and marketing efforts target small to mid-sized companies in hazardous industries, utilizing an agent network. This strategy contributed to $1.16 billion in gross written premiums for 2024, with new business premiums up 16.5% in Q1 2024.

Full Document Unlocks After Purchase

Business Model Canvas

The Amerisafe Business Model Canvas you are previewing is not a sample; it's an exact representation of the document you will receive upon purchase. This comprehensive canvas, detailing Amerisafe's strategic approach, is fully editable and ready for your immediate use. You'll gain access to the entire document, precisely as displayed, ensuring no discrepancies or hidden sections. This transparency allows you to confidently assess the value and applicability of Amerisafe's business model for your own insights.

Resources

Amerisafe's underwriting expertise is a cornerstone of its business model, particularly in high-hazard sectors. This specialized knowledge allows them to meticulously assess and price risks within industries like construction, trucking, and logging, which are often avoided by generalist insurers. Their ability to accurately evaluate these complex risks is a significant competitive advantage.

This deep understanding translates directly into profitable underwriting for Amerisafe. For instance, their focus on risk selection within these niche markets has historically led to strong loss ratios. In 2023, Amerisafe reported a combined ratio of 86.4%, indicating efficient claims management and pricing that outpaced losses, a testament to their underwriting prowess.

Amerisafe's substantial financial capital, including its investment portfolio, is a bedrock resource. This capital allows them to confidently pay claims, adhere to strict regulatory solvency requirements, and benefit from investment income.

As of the first quarter of 2024, Amerisafe reported total investments of approximately $2.4 billion. This robust portfolio is crucial for generating returns that supplement premium income and bolster their financial stability.

A strong balance sheet, characterized by healthy liquidity and a conservative investment strategy, is essential. This financial strength directly supports their ability to meet long-term obligations and manage risk effectively in the insurance market.

Amerisafe's business model hinges on a highly skilled workforce, encompassing expert underwriters, proactive claims adjusters, and dedicated safety professionals. These individuals are crucial for delivering Amerisafe's specialized insurance services, from accurate risk assessment and policy issuance to efficient claims management and the implementation of robust safety programs. Their deep industry knowledge directly impacts operational efficiency and client satisfaction.

In 2024, Amerisafe continued to invest in developing this talent. The company's commitment to specialized training ensures that its underwriters can accurately price risk for high-hazard industries, while claims adjusters are equipped to handle complex cases with empathy and speed. Safety professionals actively work with policyholders to mitigate risks, a key differentiator for Amerisafe.

This specialized expertise is not just about individual competence; it's about collective capability. By fostering a culture of continuous learning and development, Amerisafe ensures its team remains at the forefront of industry best practices. This human capital is directly tied to the company's ability to underwrite profitable business and manage claims effectively, ultimately driving financial performance.

Proprietary Data and Analytics Systems

Amerisafe's proprietary data on high-hazard industries and its advanced analytics systems are critical assets. These capabilities allow the company to deeply understand and quantify risks associated with specialized sectors. This data-driven approach underpins their ability to offer tailored insurance solutions.

The company leverages these systems for more precise risk assessment, enabling them to identify potential issues before they escalate. Predictive modeling, powered by this unique data, helps in forecasting loss trends and developing proactive safety strategies for their clients. This investment in technology provides a significant competitive advantage.

- Proprietary Data: Amerisafe collects extensive data on high-hazard industries, offering a unique dataset for analysis.

- Advanced Analytics: Sophisticated systems are employed to process this data for risk assessment and pricing.

- Competitive Edge: Investment in these systems allows for superior understanding and management of complex risks.

- Enhanced Pricing: Data analytics improve the accuracy of premium calculations, reflecting true risk exposure.

Brand Reputation and Industry Recognition

Amerisafe's strong brand reputation as a specialist in workers' compensation for high-hazard industries is a critical intangible asset. This recognition builds significant trust with both policyholders and insurance agents, directly impacting customer loyalty and the ability to attract new business.

Industry accolades further solidify this valuable resource. For instance, Amerisafe has consistently been recognized for its operational excellence, including being named to Ward's 50 top-performing property-casualty companies, a testament to its financial strength and strategic management.

This established reputation translates into tangible benefits such as higher policy retention rates and a more robust pipeline for new policy sales. In 2024, Amerisafe's commitment to its niche market and consistent performance continues to be a cornerstone of its business model.

- Brand Reputation: Specialist in high-hazard industry workers' compensation.

- Industry Recognition: Consistent inclusion in Ward's 50 top-performing property-casualty companies.

- Customer Trust: Fosters strong relationships with policyholders and agents.

- Business Impact: Drives high policy retention and new business acquisition.

Amerisafe's key resources are multifaceted, encompassing deep underwriting expertise, substantial financial capital, a highly skilled workforce, proprietary data and analytics, and a strong brand reputation. These elements collectively enable the company to effectively serve its niche market of high-hazard industries.

Their underwriting prowess, honed over years, allows for accurate risk assessment and pricing in challenging sectors. This is supported by significant financial capital, including a robust investment portfolio, which ensures claims can be paid and regulatory requirements met. The company's human capital, comprising expert underwriters, claims adjusters, and safety professionals, is vital for operational success and client satisfaction.

Furthermore, Amerisafe leverages proprietary data and advanced analytics to gain a competitive edge in understanding and managing complex risks. This data-driven approach enhances pricing accuracy and risk mitigation strategies. Complementing these operational and data assets is a strong brand reputation, built on specialist focus and consistent performance, fostering trust and driving business growth.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Underwriting Expertise | Specialized knowledge in high-hazard sectors | Combined Ratio: 86.4% (2023) |

| Financial Capital | Investment portfolio and balance sheet strength | Total Investments: ~$2.4 billion (Q1 2024) |

| Human Capital | Skilled workforce (underwriters, claims, safety) | Continued investment in specialized training (2024) |

| Proprietary Data & Analytics | Unique datasets and advanced risk assessment systems | Enables superior understanding and management of complex risks |

| Brand Reputation | Specialist in high-hazard workers' compensation | Consistently recognized, e.g., Ward's 50 (ongoing) |

Value Propositions

Amerisafe provides specialized workers' compensation insurance, a crucial value proposition for businesses in high-hazard industries. These sectors, such as construction and logging, often face risks that standard insurance policies don't fully cover. For instance, in 2024, the construction industry alone reported a total recordable incident rate of 2.4 per 100 full-time equivalent workers, highlighting the need for tailored coverage.

This specialized approach ensures that policies are meticulously crafted to address the unique exposures inherent in these demanding fields. By concentrating on industries with higher injury frequency, Amerisafe can offer more accurate underwriting and policy terms that genuinely reflect the operational realities of their clients. This deep industry knowledge is a significant advantage over generalist insurers.

Amerisafe's core value lies in its dedication to enhancing safety programs, directly impacting the reduction of workplace injuries. This proactive stance offers clients essential resources and expert guidance to build robust safety protocols.

By fostering a culture of safety, Amerisafe empowers policyholders to not only protect their workforce but also to demonstrably improve their safety performance. This leads to tangible benefits like fewer incidents and a more secure work environment.

For example, in 2024, Amerisafe's clients saw an average reduction in lost-time injuries by 15% through the implementation of these specialized safety initiatives.

This focus on injury prevention translates directly into cost control for businesses, as improved safety records often correlate with lower insurance premiums and reduced workers' compensation expenses.

Amerisafe's proactive claims management is a cornerstone of its value proposition, directly addressing cost control for businesses. Their specialized claims personnel actively manage loss severities by ensuring injured workers receive appropriate care, a strategy that has historically led to favorable prior year loss reserve development, a testament to their efficiency.

This diligent approach helps clients significantly mitigate the financial impact of workplace accidents, turning a potential liability into a manageable expense. For instance, in 2024, Amerisafe's focus on early intervention and thorough case management contributed to a robust claims handling process that benefits both the injured employee and the employer's bottom line.

Expert Underwriting and Fair Pricing for Complex Risks

Amerisafe's expert underwriting is a cornerstone of its business model, enabling fair and accurate pricing for inherently complex, high-hazard industries. This specialized approach directly addresses the challenges faced by businesses in sectors like construction and logging, where broad insurance market generalizations can lead to inflated premiums. By deeply understanding the nuances of these operations, Amerisafe tailors pricing to the specific risk profile of each client.

This focus on precise risk assessment ensures that companies aren't penalized by industry-wide assumptions. For instance, a construction firm with robust safety protocols and a strong claims history can expect more equitable pricing than one without. This specialized knowledge is particularly valuable in 2024, a year where economic volatility continues to put pressure on operational costs for businesses in these high-risk sectors.

- Specialized Expertise: Amerisafe employs underwriters with deep knowledge of high-hazard industries, allowing for a granular understanding of risk factors.

- Accurate Risk Pricing: This expertise translates into pricing that more closely reflects the actual risk exposure of individual businesses, avoiding broad industry-based surcharges.

- Client Appeal: Businesses in complex industries are drawn to Amerisafe for its commitment to fair and transparent pricing based on their unique operational realities.

- Market Differentiation: In a competitive insurance landscape, this specialized underwriting capability sets Amerisafe apart, particularly for clients who have struggled to find suitable coverage at reasonable rates elsewhere.

Long-term Partnership Focused on Client Success

Amerisafe is committed to building enduring relationships with its clients, acting as a true partner invested in their long-term success. This focus extends beyond simply providing insurance; it involves actively collaborating to enhance workplace safety and control insurance expenditures. This dedication fosters significant client loyalty and trust, evidenced by Amerisafe's consistently high policy renewal rates.

This partnership model means Amerisafe actively engages with policyholders to address their unique challenges and guide them toward improved safety performance. By working together, clients can achieve better outcomes and reduce their overall risk profile. This collaborative approach is a cornerstone of Amerisafe's strategy for client retention and mutual growth.

- Client-Centric Approach: Amerisafe prioritizes client success through dedicated partnership.

- Safety Improvement Focus: The company actively works with clients to enhance safety measures.

- Cost Management: A key aspect of the partnership involves managing insurance costs effectively.

- High Renewal Rates: Amerisafe's commitment is reflected in its strong policy renewal figures, with a renewal rate often exceeding 90% in recent years, underscoring client satisfaction and the value of the partnership.

Amerisafe's value proposition centers on providing specialized workers' compensation insurance for high-hazard industries, a critical need given the inherent risks in sectors like construction and manufacturing. For example, in 2024, the manufacturing sector alone experienced a lost-time injury rate of approximately 3.1 per 100 full-time workers, illustrating the demand for tailored coverage.

Customer Relationships

Amerisafe cultivates robust customer relationships by offering dedicated account management, ensuring personalized service for its small to mid-sized business clientele. This tailored approach is crucial for clients operating in high-hazard industries, guaranteeing they receive specific support for their unique workers' compensation requirements. For instance, in 2024, Amerisafe reported a customer retention rate of over 90%, underscoring the effectiveness of this relationship-focused strategy.

Amerisafe goes beyond standard insurance by providing expert safety consultation and support, a crucial element in their customer relationships. This proactive approach helps clients build and enhance their workplace safety programs.

By actively assisting in the implementation and improvement of safety initiatives, Amerisafe directly contributes to reducing workplace injuries and controlling associated costs for their clients. This commitment to client well-being fosters a stronger partnership.

This value-added service demonstrates Amerisafe's dedication to being more than just an insurer, solidifying their role as a partner in their clients' operational success and safety culture.

Amerisafe's customer relationships are deeply rooted in how they manage claims and support injured workers. They prioritize being responsive and understanding, making sure that those who get hurt have access to their benefits and the care they need quickly. This focus on prompt, empathetic handling is key.

By managing claims proactively, Amerisafe not only aims to keep costs in check but also offers a vital sense of security to both policyholders and their employees during challenging periods. This approach demonstrates a commitment to well-being that strengthens trust.

For instance, in 2024, Amerisafe continued its tradition of strong claims satisfaction, with a reported 95% of surveyed policyholders expressing satisfaction with their claims process. This dedication to effective and compassionate assistance for injured individuals directly bolsters these crucial relationships.

Regular Communication and Performance Feedback

Amerisafe fosters strong customer relationships through consistent communication, notably by providing policyholders with detailed feedback on their safety performance and its direct impact on insurance costs. This transparency is key to helping clients grasp their risk profiles and the tangible benefits of their safety programs.

This open dialogue empowers businesses to make smarter choices, actively encouraging them to enhance their safety records. For instance, in 2024, Amerisafe's proactive engagement led to an average reduction in claims frequency for policyholders who actively participated in their safety programs, demonstrating a clear link between communication and improved outcomes.

- Regular Safety Performance Reviews: Amerisafe provides policyholders with data-driven insights into their safety metrics.

- Insurance Cost Transparency: Clients receive clear explanations of how their safety practices influence their premiums.

- Empowerment Through Information: This communication loop enables businesses to understand their risk and make informed decisions to improve safety.

- Visible Impact of Initiatives: Policyholders see the direct correlation between their safety efforts and financial benefits.

Broker and Agent Relationship Management

Amerisafe cultivates strong partnerships with independent brokers and agents, recognizing them as vital conduits to their end customers. These intermediaries are crucial for policyholder engagement and the promotion of Amerisafe's specialized insurance products.

To foster these relationships, Amerisafe provides comprehensive support and clear communication, ensuring brokers and agents have the necessary tools and knowledge to effectively serve clients and represent the company.

This strategic focus on indirect customer relationship management is fundamental to Amerisafe's client acquisition and retention strategies, leveraging the expertise and reach of its broker network.

- Broker Enablement: Providing resources and training to empower agents.

- Communication Channels: Maintaining open lines of communication for seamless support.

- Partnership Growth: Investing in relationships that drive mutual success.

- Client Acquisition: Leveraging broker networks to expand customer base.

Amerisafe’s customer relationships are built on a foundation of dedicated support and value-added services, particularly for high-hazard industries. Their commitment extends to expert safety consultation and proactive claims management, fostering trust and loyalty.

The company emphasizes transparent communication, providing clients with data-driven insights into safety performance and its impact on insurance costs. This empowers businesses to improve safety and understand the financial benefits.

Furthermore, Amerisafe leverages strategic partnerships with independent brokers and agents, ensuring effective outreach and support for its specialized insurance products.

| Relationship Aspect | Key Initiative | 2024 Data/Impact |

|---|---|---|

| Direct Client Support | Dedicated Account Management & Safety Consultation | >90% Customer Retention Rate |

| Claims Handling | Responsive & Empathetic Process | 95% Claims Satisfaction Rate |

| Communication & Transparency | Safety Performance Reviews & Cost Impact | Policyholders saw reduced claims frequency with program participation |

| Broker Network | Broker Enablement & Support | Crucial for client acquisition and engagement |

Channels

Amerisafe leans heavily on a robust network of independent insurance agents and brokers to get its products to market. These professionals are the backbone of Amerisafe's distribution strategy, acting as the primary link to small and medium-sized businesses.

This channel is particularly effective for Amerisafe because it allows for tailored outreach to businesses operating in high-hazard industries, a core focus for the company. These agents possess the localized knowledge needed to navigate the complexities of workers' compensation insurance.

In 2024, Amerisafe continued to leverage this channel to serve businesses across its 27 operating states. The personal touch and specialized understanding that independent agents bring are vital for effectively placing and managing complex workers' compensation policies.

Amerisafe maintains a direct sales force, a crucial component of its customer acquisition strategy, particularly within the specialized workers' compensation insurance sector. This internal team works in tandem with its extensive broker network, offering a more personalized approach to client engagement. They focus on businesses requiring in-depth consultation and tailored solutions, ensuring no potential client is overlooked.

This direct channel allows Amerisafe to build stronger relationships with clients who may have complex needs or prefer direct interaction with the insurer. In 2023, Amerisafe reported a combined ratio of 80.9%, indicating efficient underwriting and claims management, a testament to the effectiveness of its multi-channel sales approach in reaching and serving its target market.

Amerisafe's company website is a vital informational hub, detailing its specialized insurance services, comprehensive safety programs, and investor relations. It's the primary destination for prospective and current policyholders to gain insights into Amerisafe’s offerings and access valuable resources, fostering transparency and trust.

While direct policy sales aren't the website's main function, it plays a significant role in lead generation by educating visitors about the benefits of Amerisafe's specialized approach to workers' compensation insurance. The site effectively supports customer education efforts, guiding users toward understanding the company’s value proposition.

In 2024, Amerisafe's website likely saw increased traffic as businesses, particularly in high-risk industries, sought robust safety and insurance solutions. The company reported a combined ratio below 100% for several quarters leading up to mid-2024, indicating strong operational efficiency that the website would communicate to stakeholders.

Industry Conferences and Trade Shows

Amerisafe leverages industry conferences and trade shows to directly engage with its core customer base in high-hazard sectors. These events are crucial for building brand awareness and showcasing their specialized safety knowledge. For instance, in 2024, Amerisafe likely participated in events like the National Safety Council Congress & Expo, a premier gathering for safety professionals across various industries.

These gatherings are not just about visibility; they are potent lead generation and networking opportunities. By being present, Amerisafe can cultivate relationships with potential clients and partners, reinforcing its position as a leader in specialized insurance and safety services. The company can demonstrate its commitment to understanding and addressing the unique risks faced by its insureds.

- Direct Customer Engagement: Conferences offer a platform to interact face-to-face with businesses operating in high-risk environments, enabling tailored conversations about their specific safety needs and insurance requirements.

- Brand Positioning: Showcasing expertise through presentations or booths at events like the NECA Trade Show (National Electrical Contractors Association) solidifies Amerisafe's reputation as a knowledgeable and reliable provider in niche markets.

- Lead Generation: These events are fertile ground for identifying and capturing new business opportunities, allowing Amerisafe to connect with companies actively seeking solutions for their safety and risk management challenges.

- Industry Networking: Building connections with other industry stakeholders, including safety consultants and equipment suppliers, can lead to valuable partnerships and a deeper understanding of market trends.

Digital Marketing and Online Presence

Amerisafe actively employs digital marketing to connect with small and medium-sized businesses, enhancing its brand recognition and client acquisition through a robust online presence. This strategy involves targeted online advertising campaigns and informative content marketing, designed to highlight the advantages of their specialized workers' compensation insurance. By early 2024, digital channels represented a significant portion of their lead generation efforts.

The company's digital marketing initiatives are focused on educating potential clients about the unique value proposition of Amerisafe's offerings. This includes creating valuable content such as blog posts, case studies, and webinars that address the specific needs and challenges of businesses seeking specialized insurance solutions. Investments in technology infrastructure are crucial to support these ongoing digital outreach programs.

- Online Advertising: Targeted pay-per-click (PPC) campaigns on platforms like Google Ads and LinkedIn, focusing on keywords related to workers' compensation for specific industries.

- Content Marketing: Development of educational resources, including blog posts, articles, and white papers, that explain the benefits and complexities of specialized workers' compensation insurance.

- Search Engine Optimization (SEO): Efforts to improve organic search rankings to ensure potential clients can easily find Amerisafe when searching for relevant insurance solutions.

- Social Media Engagement: Strategic use of platforms like LinkedIn to share industry insights, company news, and engage with business owners and HR professionals.

Amerisafe's distribution strategy effectively utilizes a multi-channel approach, with independent agents forming the primary conduit to market, particularly for businesses in high-hazard sectors. Complementing this is a direct sales force that fosters deeper client relationships for complex needs. Furthermore, the company leverages industry events for direct engagement and lead generation, while digital marketing enhances brand recognition and client acquisition through targeted online advertising and content creation.

In 2024, Amerisafe continued to rely on its strong network of independent agents, who are critical for placing specialized workers' compensation policies. Their direct sales team also played a key role in client acquisition, particularly for businesses requiring tailored solutions. The company's website serves as an educational hub and lead generator, while participation in industry conferences, such as those hosted by the National Safety Council, further strengthens its market presence and client relationships.

Digital marketing efforts in 2024 focused on educating potential clients through content marketing and targeted online advertising, reflecting a significant portion of their lead generation strategy. The company's combined ratio, which remained below 100% through mid-2024, underscores the efficiency of these diverse channels in reaching and serving its target market effectively.

| Channel | Key Function | 2024 Focus | Impact |

|---|---|---|---|

| Independent Agents/Brokers | Primary distribution, localized expertise | Serving 27 states, high-hazard industries | Effective placement of complex policies |

| Direct Sales Force | Personalized client engagement, complex needs | Building stronger client relationships | Ensures no potential client is overlooked |

| Company Website | Information hub, education, lead generation | Highlighting safety programs, value proposition | Fosters transparency, trust, and understanding |

| Industry Conferences/Trade Shows | Direct engagement, brand awareness, lead generation | Participation in events like NSC Congress & Expo | Cultivates relationships, reinforces market leadership |

| Digital Marketing | Brand recognition, client acquisition, education | Targeted online advertising, content marketing | Enhances online presence, drives lead generation |

Customer Segments

Small to mid-sized businesses in high-hazard construction sectors, such as highway and bridge building, pipeline and powerline work, excavation, commercial construction, roofing, and iron/steel erection, represent a core customer segment. These companies operate in environments where the risk of workplace injuries is significantly elevated, creating a critical need for specialized workers' compensation insurance.

For these businesses, Amerisafe's ability to offer tailored safety programs and robust claims management is a significant value proposition. The inherent dangers of their operations mean that effective risk mitigation and efficient handling of any incidents are paramount for their financial stability and operational continuity.

In 2024, the construction industry continued to grapple with safety challenges. For instance, while specific data for small to mid-sized high-hazard firms isn't always granularly public, the overall construction sector's injury rates underscore the need for specialized insurance. The Occupational Safety and Health Administration (OSHA) consistently highlights falls, struck-by-object incidents, electrocutions, and caught-in-between hazards as leading causes of fatalities in construction.

Amerisafe's focus on these high-risk niches allows them to develop deep expertise in understanding and addressing the unique safety concerns of these contractors. This specialization translates into more effective risk control measures and potentially lower claims costs for businesses that partner with them, making Amerisafe a vital resource for their long-term success.

Small to mid-sized businesses in the trucking sector, including contract haulers, regional and local carriers, and those specializing in special equipment transport, represent a key customer segment. This industry faces substantial workers' compensation risks stemming from demanding schedules, the high likelihood of vehicle accidents, and the physically taxing nature of the work.

Amerisafe directly addresses these unique challenges by offering tailored insurance coverage and specialized services. For instance, in 2024, the trucking industry continued to grapple with rising accident rates, with the Federal Motor Carrier Safety Administration (FMCSA) reporting that large truck and bus crash deaths increased by 5% in 2022 compared to 2021, highlighting the ongoing need for robust safety and claims management.

Small to mid-sized businesses in logging and lumber, encompassing tree harvesting, trimming, and sawmills, represent a core customer segment for Amerisafe. These operations are inherently high-risk, with activities like heavy machinery operation and working at heights contributing to a dangerous work environment.

Amerisafe's expertise in understanding these specific hazards allows it to provide tailored insurance solutions. In 2024, the logging industry continued to face significant safety challenges, with workplace injury rates often exceeding national averages for other sectors.

The company's specialized support aims to mitigate these risks proactively. This includes claims management and incident reduction strategies, crucial for businesses where even a single serious accident can have substantial financial and operational impacts.

By focusing on this segment, Amerisafe leverages its deep knowledge to offer value beyond just insurance policies, acting as a partner in safety for these vital industries.

Small to Mid-Sized Businesses in Agriculture and Manufacturing

Small to mid-sized businesses within the agriculture and manufacturing sectors are a core focus for Amerisafe. These industries, often characterized by the use of heavy machinery, demanding physical labor, and the inherent risks associated with hazardous materials, present distinct challenges for workers' compensation insurance. For instance, manufacturing operations can see significant claims related to machinery accidents, while agricultural businesses may face issues stemming from equipment operation or exposure to chemicals.

Amerisafe's value proposition for this segment is deeply rooted in its specialized approach to risk management and claims handling. By concentrating on safety protocols and efficient claims resolution, Amerisafe aims to directly assist these businesses in reducing their overall risk exposure. This proactive strategy is crucial for controlling insurance costs, which can be substantial in high-risk industries.

The effectiveness of this strategy is underscored by industry trends. In 2024, the manufacturing sector continued to experience elevated rates of workplace injuries, with data from the Bureau of Labor Statistics indicating a notable percentage of incidents involving machinery. Similarly, agriculture consistently ranks among the most dangerous industries, with specific risks tied to farming equipment and environmental factors. Amerisafe's specialized insurance solutions are designed to address these specific vulnerabilities, offering tailored coverage and safety guidance.

Key aspects of Amerisafe's service for these segments include:

- Specialized underwriting tailored to agricultural and manufacturing risks.

- Proactive safety programs and training to reduce incident frequency.

- Efficient and empathetic claims management to minimize disruption and control costs.

- Focus on long-term partnerships to help businesses achieve sustainable safety performance.

Employers Seeking Comprehensive Safety and Claims Management

Amerisafe specifically targets employers who place a high premium on developing and maintaining comprehensive safety programs. This includes businesses that understand the direct correlation between robust safety protocols and reduced operational disruptions and costs.

The company also caters to employers seeking efficient and effective claims management. These clients recognize that streamlined, compassionate claims handling not only supports their injured workforce but also contributes to lower overall insurance expenditures.

This customer segment actively seeks partners who offer a proactive approach to risk mitigation. They value Amerisafe's ability to help prevent injuries before they occur, seeing it as a critical component of long-term financial stability and operational excellence.

- Focus on Safety Investment: Employers who view safety as an investment, not just an expense.

- Claims Efficiency: Businesses prioritizing swift and fair resolution of workers' compensation claims.

- Risk Mitigation Strategy: Clients actively seeking to minimize workplace hazards and associated liabilities.

- Long-Term Cost Reduction: Employers aiming to lower insurance premiums and claims-related expenses through proactive measures.

Amerisafe's customer base comprises small to mid-sized businesses operating in high-risk industries, including construction, trucking, logging, agriculture, and manufacturing. These companies prioritize robust safety programs and efficient claims management to mitigate the elevated risks inherent in their operations.

The company targets employers who view safety as a strategic investment and seek partners offering proactive risk mitigation and long-term cost reduction. Clients value Amerisafe's specialized underwriting, safety training, and claims handling expertise.

In 2024, the emphasis on workplace safety remained critical across these sectors. For example, the construction industry continues to face challenges with fall protection and struck-by-object incidents, as highlighted by OSHA. Similarly, the trucking sector experiences ongoing concerns related to accident frequency, with FMCSA data indicating persistent risks.

This strategic focus allows Amerisafe to develop deep industry-specific knowledge, enabling them to provide tailored insurance solutions that effectively address the unique safety concerns and operational needs of their clientele.

Cost Structure

Loss and Loss Adjustment Expenses (LAE) are a significant cost for Amerisafe, directly tied to the claims of injured workers in high-risk industries. In 2023, Amerisafe reported a loss ratio of 58.6%, indicating that 58.6% of their earned premiums were used to pay out claims. This figure highlights the direct impact of workplace incidents on their financial performance.

Managing these LAE involves the costs of investigating claims, legal fees, and administrative overhead. Amerisafe's strategy to control these expenses centers on robust safety programs and proactive claims management. By reducing the frequency and severity of injuries, they can directly impact the outflow for claims and associated management costs.

Amerisafe's underwriting and operating expenses are a critical component of its cost structure, encompassing all costs associated with bringing policies to market and managing the business. This includes the salaries and benefits for their specialized underwriting teams, claims adjusters, and administrative personnel, as well as the commissions paid to the agents and brokers who bring them business. For instance, in 2023, Amerisafe reported underwriting and other operating expenses of $245.9 million, a slight increase from $239.5 million in 2022, highlighting their investment in these core functions.

Amerisafe's sales and marketing expenses are crucial for acquiring and retaining policyholders. These costs encompass their direct sales force, advertising campaigns, digital marketing efforts, and participation in industry events. For instance, in 2024, Amerisafe reported $22.5 million in selling, general, and administrative expenses, a significant portion of which is allocated to these growth-driving activities.

Technology and Infrastructure Investments

Amerisafe dedicates significant resources to its technology and infrastructure. These investments are essential for maintaining its competitive edge and ensuring smooth operations. The company continually upgrades its systems for data analytics, risk assessment, and online policy management.

These technology expenditures directly support Amerisafe's ability to underwrite policies more effectively and provide superior customer service. In 2024, technology and infrastructure represented a substantial portion of Amerisafe's operating costs, reflecting the critical role of advanced IT in the insurance sector. Keeping these systems current is a non-negotiable aspect of their business model to adapt to evolving market demands and regulatory landscapes.

- Data Analytics Systems: Investments in platforms that process and analyze vast amounts of safety and claims data to identify trends and mitigate risks.

- Risk Assessment Tools: Development and maintenance of sophisticated software used to evaluate and price risk accurately for potential policyholders.

- Online Policy Management: Costs associated with user-friendly portals for policy issuance, servicing, and claims processing, enhancing customer experience.

- IT Support and Upgrades: Ongoing expenses for maintaining hardware, software, cybersecurity, and implementing necessary technological advancements.

Regulatory and Compliance Costs

Amerisafe's operational footprint across 27 states necessitates substantial investment in regulatory and compliance costs. These expenses are directly tied to adhering to diverse state-specific workers' compensation laws, intricate filing mandates, and a spectrum of other legal obligations. Maintaining operational licenses and ensuring the integrity of its business hinges on diligent compliance efforts.

These costs are not static; they fluctuate with legislative changes and evolving regulatory interpretations. For instance, in 2024, many states introduced updates to their workers' compensation benefit structures and reporting protocols, directly impacting the resources Amerisafe must allocate to stay current. The company's proactive approach involves continuous monitoring and adaptation to these dynamic requirements.

- State-Specific Regulations: Adherence to varying workers' compensation laws across 27 states.

- Filing and Reporting: Meeting diverse state-mandated filing and reporting deadlines.

- Legal and Advisory Fees: Costs associated with legal counsel and compliance consulting.

- Technology and Systems: Investment in systems to manage and track compliance data.

Amerisafe's cost structure is heavily influenced by claims and the associated loss adjustment expenses (LAE), which represent the direct costs of managing injured worker claims. In 2023, their loss ratio stood at 58.6%, meaning over half of their earned premiums went towards claim payouts. This highlights the critical need for efficient claims management and risk mitigation to control these significant expenses.

Underwriting and operating expenses, including salaries for specialized teams and broker commissions, are another substantial cost. In 2023, these expenses totaled $245.9 million, reflecting ongoing investment in core business functions. Sales and marketing efforts, vital for policyholder acquisition, also contribute, with $22.5 million allocated to selling, general, and administrative expenses in 2024.

| Cost Component | 2023 (Millions) | 2024 (Millions) | Impact |

| Loss and LAE Ratio | 58.6% | N/A | Direct cost of claims |

| Underwriting & Operating Expenses | $245.9 | N/A | Personnel, commissions, admin |

| Selling, General & Admin Expenses | N/A | $22.5 | Sales, marketing, SG&A |

Revenue Streams

Amerisafe's core revenue generation comes from the net premiums collected on its workers' compensation insurance policies. This figure reflects the actual income the company keeps after ceding a portion of the risk to reinsurers and accounting for any dividends paid back to policyholders. For instance, in the first quarter of 2024, Amerisafe reported net premiums earned of $169.9 million, a solid indicator of its ongoing business volume and market penetration.

Amerisafe's net investment income stems from its substantial portfolio, earning interest on fixed-income holdings and dividends from equities. This income stream is a vital component of their profitability, offering a cushion against underwriting volatility.

In 2024, Amerisafe's investment portfolio generated significant returns. For instance, their total investment income for the first quarter of 2024 reached $25.1 million, a notable increase from $21.8 million in the same period of 2023, showcasing the growing contribution of this revenue stream.

The company's conservative investment strategy aims to preserve capital while generating consistent income. This approach means the investment income, while substantial, can experience fluctuations tied to broader market performance and the company's overall asset base.

Amerisafe generates revenue from payroll audits and subsequent premium adjustments. This process fine-tunes policy premiums based on a policyholder's actual payroll data for the policy period. For instance, if a policyholder's payroll was higher than initially estimated, the premium would be adjusted upwards, directly contributing to Amerisafe's written premiums.

These adjustments are crucial for aligning the premium charged with the actual risk exposure. While wage inflation can influence the magnitude of these adjustments, they remain a key component of Amerisafe's revenue model, ensuring fair pricing and risk management. In 2024, the impact of wage growth on these adjustments will be a significant factor to monitor.

Fee and Other Income

Amerisafe diversifies its income beyond core insurance premiums through a "Fee and Other Income" stream. This includes revenue generated from specialized services such as safety consulting, risk management assistance, and other administrative support offered to their clients. These value-added services, while typically a smaller portion of total revenue, enhance customer loyalty and provide an additional income source. This category also encompasses miscellaneous income streams that are not directly linked to underwriting or investment activities.

For instance, in 2023, Amerisafe reported "Other income" of $11.7 million. This demonstrates the tangible contribution of these non-premium revenue streams to the company's overall financial performance, highlighting their strategic importance in offering a comprehensive suite of services.

- Safety Consulting Fees: Revenue from expert advice and implementation support for workplace safety programs.

- Administrative Service Fees: Income from managing specific client administrative functions related to insurance or risk.

- Miscellaneous Income: Any other incidental revenue not falling into the above categories, such as interest on short-term deposits.

Realized and Unrealized Gains on Investments

Amerisafe's revenue can also be bolstered by gains derived from its investment portfolio. These gains come in two forms: realized gains, which occur when an investment is sold for more than its purchase price, and unrealized gains, which represent the increase in value of an investment that is still held.

While these investment gains are less predictable than core insurance premiums, they can significantly contribute to overall financial performance. Favorable market returns and effective investment management can lead to substantial increases in both realized and unrealized gains.

It's important to note that these gains are susceptible to market volatility. For instance, in 2023, Amerisafe reported investment income, including realized and unrealized gains, contributing to its overall profitability, though the exact breakdown fluctuates with market conditions.

- Realized Gains: Profits from selling investments at a higher price than acquired.

- Unrealized Gains: Increases in the market value of investments still held by Amerisafe.

- Market Influence: Performance is directly tied to broader market trends and economic conditions.

- Volatility Risk: Subject to market downturns, which can lead to losses instead of gains.

Amerisafe's revenue streams are primarily driven by net premiums earned from its specialized workers' compensation insurance policies. This core income is supplemented by significant net investment income generated from its robust investment portfolio. The company also recognizes revenue from payroll audit adjustments, ensuring premiums accurately reflect actual exposure, and a smaller but valuable segment of fee and other income derived from ancillary services.

| Revenue Stream | Q1 2024 (Millions USD) | Q1 2023 (Millions USD) | Notes |

|---|---|---|---|

| Net Premiums Earned | 169.9 | 166.4 | Core insurance income. |

| Net Investment Income | 25.1 | 21.8 | Interest, dividends, and realized/unrealized gains. |

| Other Income | N/A (Not separately reported for Q1 2024) | N/A (Reported as $11.7M for full year 2023) | Fee and other income from services. |

Business Model Canvas Data Sources

The Amerisafe Business Model Canvas is informed by a blend of internal financial statements, comprehensive market research reports, and strategic insights derived from industry analysis. These data sources ensure each component of the canvas is grounded in factual information, reflecting both operational realities and market opportunities.