Amerisafe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amerisafe Bundle

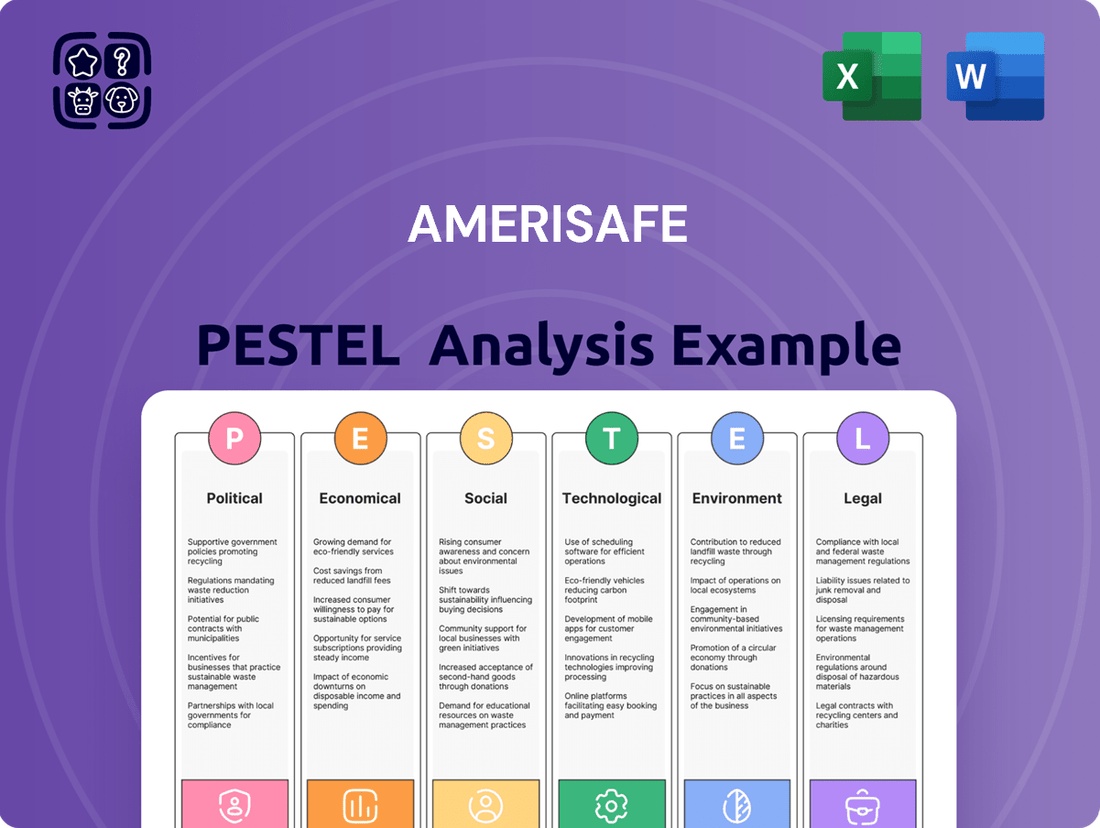

Gain a critical understanding of the external forces shaping Amerisafe's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and future growth. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategic approach. Download the full PESTLE analysis now to unlock a comprehensive view of Amerisafe's operating landscape and secure your competitive advantage.

Political factors

AmeriSafe navigates a complex web of government regulations, especially within the workers' compensation sector. These regulations are largely state-specific, but federal oversight also plays a role, influencing everything from claims processing to safety program requirements.

The upcoming 2025 presidential election could bring significant changes to this landscape. A new administration might alter the intensity of regulatory enforcement, potentially affecting AmeriSafe's compliance costs and operational strategies. For example, a more hands-off approach could ease certain burdens, while a stricter one might necessitate increased investment in compliance measures.

For instance, shifts in regulatory focus could impact how AmeriSafe implements and monitors its safety programs. The emphasis might move towards more proactive safety initiatives or a streamlined approach to claims management, directly influencing the company's operational efficiency and risk mitigation efforts.

Workers' compensation laws are a critical political factor for AmeriSafe, as these regulations differ significantly from state to state. For instance, during 2024 and into 2025, several states have seen legislative updates impacting premium calculations and benefit payouts, directly influencing AmeriSafe's cost structure and service offerings.

AmeriSafe's operational footprint spans 27 states, necessitating a constant vigilance over these evolving legal landscapes. Changes in areas such as medical fee schedules or return-to-work program mandates require agile adjustments to underwriting practices and claims management to ensure ongoing compliance and profitability in each market.

Occupational Safety and Health Administration (OSHA) policies are foundational to AmeriSafe’s business, particularly given its focus on high-hazard industries. These regulations directly shape workplace safety standards and drive the demand for injury prevention services that AmeriSafe provides to its clients. For instance, OSHA’s commitment to updating standards, such as its exploration of new heat hazard protections and potential revisions to Personal Protective Equipment (PPE) requirements by 2025, directly influences the safety programs AmeriSafe develops and implements.

Changes in OSHA's enforcement strategies also play a significant role. An increase in targeted inspections or modifications to electronic injury reporting mandates can necessitate adjustments in how AmeriSafe’s clients manage their compliance obligations. This, in turn, impacts the scope and nature of the safety and risk management services AmeriSafe offers, ensuring its solutions remain aligned with regulatory expectations and client needs.

Data Privacy and Cybersecurity Regulations

The evolving landscape of data privacy and cybersecurity regulations presents a critical political and legal challenge for AmeriSafe. Both federal and state governments are intensifying their scrutiny, with new rules expected to impact how companies handle sensitive information. For instance, the National Association of Insurance Commissioners (NAIC) is anticipated to release updated privacy protection model laws by late 2025, and various states are considering or implementing their own cyber insurance reforms.

These regulatory shifts demand that AmeriSafe maintain stringent data security measures and ensure complete transparency in its data handling procedures. Failure to comply with these growing mandates can result in significant financial penalties, potentially reaching millions of dollars depending on the severity of the infraction and the jurisdiction. Such non-compliance also carries the risk of severe reputational damage, which can erode customer trust and impact long-term business viability.

- Federal and State Data Privacy Initiatives: Increased government focus on protecting consumer data.

- NAIC Model Law (Late 2025): Expected to set new standards for privacy protection in the insurance sector.

- State-Level Cyber Insurance Reforms: Jurisdictions are updating regulations concerning cybersecurity for insurers.

- Compliance Costs: Investment in robust data security infrastructure and transparent data governance is essential.

- Penalties for Non-Compliance: Substantial fines and reputational damage are significant risks.

Political Stability and Trade Policies

AmeriSafe's business is indirectly influenced by broader political stability and evolving trade policies. For instance, a stable political environment fosters economic growth, which in turn supports sectors like manufacturing and construction that are key clients for AmeriSafe. In 2024, a focus on domestic manufacturing reshoring initiatives, potentially driven by trade policy shifts, could lead to increased activity in these industries, thus boosting demand for workers' compensation insurance.

Economic volatility, often a byproduct of political uncertainty, can directly impact AmeriSafe. Fluctuations in employment levels and the rate of new business formation, both tied to the political climate, affect the overall demand for insurance. For example, if political instability leads to a slowdown in construction projects, fewer workers will be employed, reducing the need for AmeriSafe's services.

A stable political climate is generally more conducive to the sustained growth of AmeriSafe's client base. Countries with predictable governance and clear economic policies tend to see more robust business expansion. According to the World Bank’s 2024 Ease of Doing Business report, nations with higher political stability generally exhibit stronger economic performance, benefiting industries that AmeriSafe serves.

- Political Stability: Contributes to predictable economic conditions, supporting client industries like manufacturing and construction.

- Trade Policies: Shifts can influence domestic industrial activity, potentially increasing demand for workers' compensation.

- Economic Volatility: Political uncertainty can lead to job market fluctuations, directly impacting insurance demand.

- Business Formation: A stable political outlook generally encourages new business creation, expanding AmeriSafe's potential client pool.

AmeriSafe's operations are significantly shaped by a complex regulatory environment, particularly concerning workers' compensation laws that vary by state. The company must remain agile to adapt to legislative updates impacting premium calculations and benefit payouts, as seen in several states during 2024 and into 2025. These changes directly influence AmeriSafe's cost structure and service offerings across its 27-state operational footprint.

Federal policies, such as those from OSHA, are also foundational, dictating workplace safety standards and driving demand for injury prevention services. Anticipated OSHA updates by 2025, like potential new heat hazard protections, will directly influence the safety programs AmeriSafe develops. Furthermore, evolving data privacy and cybersecurity regulations, with the NAIC expected to release updated model laws by late 2025, necessitate robust data security and transparent handling procedures to avoid substantial penalties.

Political stability plays a crucial indirect role, fostering economic conditions favorable to AmeriSafe's key client industries like manufacturing and construction. Initiatives promoting domestic manufacturing reshoring, potentially influenced by trade policies in 2024, could boost demand for workers' compensation. Conversely, political uncertainty can create economic volatility, impacting employment levels and new business formation, thereby directly affecting the demand for AmeriSafe's services.

What is included in the product

Amerisafe's PESTLE analysis delves into the external macro-environmental factors impacting the company, examining Political, Economic, Social, Technological, Environmental, and Legal forces.

This comprehensive evaluation provides actionable insights for strategic planning, helping identify potential threats and opportunities within the company's operating landscape.

The Amerisafe PESTLE analysis provides a clear, summarized version of external factors, making it easy to reference during meetings and presentations, thus relieving the pain point of information overload.

Economic factors

Economic cycles significantly shape AmeriSafe's operational landscape. Periods of robust economic expansion, like the projected moderate growth for the US in 2024-2025, tend to correlate with increased business formation and higher employment numbers. This translates to a larger pool of potential clients and expanded payrolls for existing ones, directly boosting AmeriSafe's premium volumes for workers' compensation insurance.

Conversely, economic downturns or recessions present challenges. Should the US economy experience a slowdown in 2025, as some forecasts suggest a potential dip in GDP growth, AmeriSafe could see its client base contract as businesses downsize or close. Reduced payrolls across industries would naturally lead to lower premium collections, potentially impacting revenue and profitability.

Employment rates are a direct barometer of economic health and thus critical for AmeriSafe. For instance, the US unemployment rate, hovering around 3.9% in early 2024, indicates a relatively tight labor market, which is generally favorable for insurance providers. A sustained low unemployment rate suggests more businesses are operating and hiring, expanding AmeriSafe's market reach.

However, any significant uptick in unemployment, perhaps to 4.5% or higher as might occur in a recessionary scenario, would signal a shrinking workforce and fewer insured employees. This would directly reduce the demand for workers' compensation coverage, impacting AmeriSafe's financial performance negatively.

Medical inflation is a significant concern for AmeriSafe. In 2024, healthcare costs are projected to rise by approximately 6.5%, outpacing general inflation. This means the price of medical treatments, hospital stays, and prescription drugs needed to treat workplace injuries are increasing, directly impacting the cost of workers' compensation claims.

Wage growth, another factor, is also contributing to higher claim costs. As wages increase, the potential indemnity payments for lost wages during recovery also rise. For instance, average wage growth in the US was around 4.5% in late 2024, a trend expected to persist, further inflating claim severity for insurers like AmeriSafe.

The combination of rising medical expenses and higher wage payouts puts considerable pressure on AmeriSafe's underwriting profitability. Insurers must carefully manage claims to mitigate these escalating costs, especially for severe or long-term injuries which are disproportionately affected by medical inflation.

The workers' compensation insurance sector has seen a decade of profitability, drawing in new players and intensifying competition. This influx has resulted in lower premiums for policyholders and a softening of the market, which could affect AmeriSafe's ability to grow its premium income. For instance, in the first quarter of 2024, the industry experienced a combined ratio of 88.7%, indicating a profitable underwriting environment, but one ripe for competitive pressure.

While AmeriSafe has maintained strong underwriting performance, these heightened competitive pressures might necessitate adjustments to its strategic approach. The need to adapt is crucial, as a sustained softening market, even with solid underlying results, could lead to margin compression. For example, if competitors aggressively lower rates to gain market share, AmeriSafe may need to consider innovative product offerings or enhanced service models to differentiate itself and protect its profitability, rather than solely relying on price competition.

Interest Rates and Investment Income

AmeriSafe's investment income is directly sensitive to interest rate fluctuations. As of early 2024, the Federal Reserve maintained a relatively high federal funds rate, which generally benefits investment income streams. However, expectations for rate cuts later in 2024 and into 2025 could present a headwind, potentially reducing net investment income if AmeriSafe's investable assets also decline.

Factors like special dividends paid out by AmeriSafe could reduce the pool of assets available for investment. If this reduction in assets coincides with a period of falling interest rates, the impact on net investment income could be amplified. Effective capital management and strategic allocation of its investment portfolio are therefore crucial for mitigating potential earnings erosion from this segment.

For instance, if AmeriSafe held a significant portion of its investments in short-term bonds, a decrease in interest rates would directly impact the yield on those holdings. Conversely, a diversified portfolio with longer-term assets might offer more stability, but could also be more sensitive to rate changes over time.

- Interest Rate Environment (2024-2025): Anticipated interest rate cuts by major central banks could pressure investment income yields.

- Impact of Asset Reduction: Special dividends or other capital distributions can shrink the investment base, exacerbating the effect of lower rates.

- Net Investment Income Sensitivity: AmeriSafe's earnings are exposed to changes in both the volume of investable assets and the prevailing interest rate environment.

- Strategic Imperative: Robust capital management and adaptive investment strategies are essential to maintain earnings from investment income.

Premium Rate Adjustments and Reserve Strength

Amerisafe's workers' compensation segment has historically demonstrated robust underwriting strength, supported by healthy reserves. However, recent trends suggest a potential gradual decline in this reserve strength, a critical factor for long-term financial stability. This necessitates careful monitoring and strategic adjustments.

State-level premium rate adjustments are a direct response to evolving economic conditions and workplace safety trends. For instance, certain states have implemented premium rate increases for the 2024-2025 period. These adjustments are crucial for insurers to maintain profitability amidst changing risk landscapes and to adequately fund future claims.

- Premium Rate Adjustments: States like Florida have seen workers' compensation rate increases, with proposed average increases of 4.5% for 2024, reflecting rising medical costs and claim severity.

- Reserve Strength Indicators: While specific overall reserve ratios for AmeriSafe are proprietary, industry-wide trends in casualty insurance indicate that a loss ratio exceeding 70% can put pressure on reserving adequacy over time.

- Financial Pressures: Inflationary pressures on medical costs and ongoing litigation expenses contribute to the financial pressures faced by workers' compensation insurers, influencing rate decisions.

- Evolving Workplace Trends: The rise in remote work and the impact of new technologies on workplace safety present evolving risk profiles that necessitate ongoing evaluation and potential adjustments to pricing models.

Amerisafe must proactively manage its reserve levels and strategically adjust premium rates to ensure sustained profitability and the capacity to meet future obligations. This dual focus is paramount for navigating the dynamic workers' compensation market.

Economic expansion in 2024-2025, with projected US GDP growth around 2.5%, generally benefits AmeriSafe by increasing business activity and payrolls, leading to higher premium volumes.

Conversely, a potential economic slowdown in 2025 could reduce demand for workers' compensation insurance as businesses contract or close.

The unemployment rate, a key economic indicator, influences AmeriSafe's market size; a low rate like the 3.9% seen in early 2024 signifies more employment and thus more potential clients.

Rising medical inflation, estimated at 6.5% for 2024, and wage growth, around 4.5% in late 2024, directly increase the cost of claims for AmeriSafe, impacting profitability.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on AmeriSafe |

|---|---|---|---|

| US GDP Growth | ~2.5% | ~2.0-2.5% | Positive for premium volume (expansion); Negative for premium volume (slowdown) |

| US Unemployment Rate | ~3.9% | ~3.8-4.0% | Favorable (low rate); Unfavorable (high rate) |

| Medical Inflation | ~6.5% | ~5.5-6.0% | Increases claim costs |

| Wage Growth | ~4.5% | ~4.0-4.5% | Increases claim severity (indemnity payments) |

Same Document Delivered

Amerisafe PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Amerisafe details all critical external factors influencing the company's operations and strategic decisions. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences that shape Amerisafe's market position and future prospects. This is the real, ready-to-use file you’ll get upon purchase, offering a complete strategic overview.

Sociological factors

The demographic landscape of the workforce is evolving, with a notable trend towards an aging population. This shift presents unique challenges and opportunities for companies like AmeriSafe, particularly in managing workers' compensation risks. As workers age, there can be an increased susceptibility to certain types of injuries and potentially longer recovery periods, which directly influences claim costs.

For instance, data from the Bureau of Labor Statistics (BLS) in 2023 indicated that workers aged 55 and over experienced a higher incidence rate of days away from work due to injuries compared to younger age groups. This underscores the need for tailored safety protocols and claims management strategies that account for the physiological changes associated with aging.

AmeriSafe's specialization in high-hazard industries, such as construction and manufacturing, magnifies the importance of addressing these demographic trends. Implementing proactive safety measures and ergonomic assessments that consider the capabilities and potential vulnerabilities of an older workforce is crucial for mitigating risk and ensuring operational efficiency in 2024 and beyond.

Organizations are increasingly prioritizing a proactive safety culture, moving beyond basic compliance to actively prevent incidents. AmeriSafe’s focus on safety programs, including training and incentive initiatives, directly taps into this trend. This cultural shift is demonstrating tangible results, with companies investing in these programs seeing an average reduction in recordable incident rates by as much as 20% in 2024.

Employee engagement in safety is becoming a key metric for businesses. AmeriSafe's model, which encourages client investment in safety training and reward programs, fosters this engagement. In 2025, companies with high employee participation in safety initiatives reported a 15% decrease in lost-time injuries compared to those with lower engagement.

Societal attitudes are shifting, with a growing recognition of mental health's importance in overall well-being and workplace safety. This heightened awareness directly translates into a rise in mental injury claims filed by employees. For example, in 2024, mental health conditions accounted for a significant portion of disability claims across various industries, with some reports indicating increases of over 15% year-over-year in certain sectors.

In response, insurers and employers are significantly boosting their investments in mental health resources. This includes expanding access to counseling services, implementing stress management programs, and adopting digital platforms that offer mental health support. By 2025, it's projected that corporate spending on employee mental well-being initiatives will surpass $60 billion globally.

AmeriSafe, as a provider of safety and claims management services, must proactively adapt to these changes. This means evolving claims processes to more effectively handle mental health-related claims and developing new safety services that promote holistic employee well-being, addressing both physical and psychological health.

Impact of Gig Economy and Non-Traditional Work

The expanding gig economy presents significant hurdles for traditional workers' compensation coverage, as a substantial portion of contract workers operate without insurance. This evolving landscape necessitates a re-evaluation of existing policies by insurers and policymakers to guarantee comprehensive protection for all workers, irrespective of their employment status. For instance, in 2024, an estimated 36% of the US workforce participated in gig work, with many lacking employer-provided benefits.

AmeriSafe must consider strategic adaptations to cater to this growing segment of non-traditional workers. This could involve developing specialized insurance products or modifying current offerings to accommodate the unique needs and risk profiles of independent contractors and freelancers. The challenge lies in ensuring that these flexible work arrangements do not leave individuals vulnerable in case of injury or illness sustained during work-related activities.

- Gig Economy Growth: Projections indicate that by 2027, over 80% of US companies plan to increase their adoption of the gig economy model.

- Uninsured Workers: A significant percentage of gig workers, estimated to be around 40% in late 2024, do not have access to workers' compensation or similar safety nets.

- Policy Adaptation Needs: Regulatory bodies are increasingly discussing legislative changes to address the coverage gaps for independent contractors, with several states considering new frameworks in 2025.

- AmeriSafe's Opportunity: Innovating insurance solutions for the gig workforce could unlock a new market segment, with a potential market size estimated in the billions annually.

Public Perception of Workplace Safety

Public and employee expectations for workplace safety are on the rise, fueled by increased transparency and easier access to injury statistics. This growing awareness translates into greater demands from regulatory bodies and labor unions for more proactive safety initiatives, pushing companies beyond mere compliance.

AmeriSafe's core business, focused on safety programs and effective claims management, directly addresses these evolving expectations. By prioritizing prevention and efficient resolution, AmeriSafe is well-positioned to not only meet but exceed these heightened demands, thereby strengthening its standing as a leader in specialty insurance.

The company's commitment to safety is a significant differentiator. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to emphasize data-driven enforcement, highlighting companies with strong safety records. AmeriSafe's proactive approach aligns with this trend, potentially leading to fewer incidents and lower costs for its clients.

- Increased Scrutiny: Public access to injury data, like that shared by OSHA, means companies are under greater watch.

- Union Influence: Unions are leveraging safety data to negotiate for more robust preventative measures.

- Regulatory Pressure: Agencies like OSHA are increasingly focusing on proactive safety, not just reactive measures.

- AmeriSafe's Advantage: The company’s expertise in safety programs and claims management directly meets these growing demands.

Societal expectations for employee well-being are expanding, with a notable surge in focus on mental health. This shift means companies, including those AmeriSafe serves, are increasingly investing in mental health resources, with global corporate spending on employee well-being initiatives projected to exceed $60 billion by 2025.

The rise of the gig economy also presents a significant sociological factor, as many contract workers lack traditional safety nets. By late 2024, an estimated 40% of gig workers did not have access to workers' compensation, highlighting a growing need for adaptable insurance solutions.

Public demand for transparency in workplace safety is growing, with easier access to injury statistics influencing expectations. This increased awareness is pushing companies towards more proactive safety measures beyond simple compliance, a trend AmeriSafe's preventative focus is well-suited to address.

The aging workforce is another key sociological trend, with older workers often facing higher injury risks and longer recovery times. Data from 2023 showed workers aged 55 and over had a higher incidence rate of days away from work due to injuries, underscoring the need for tailored safety protocols.

Technological factors

Artificial intelligence is fundamentally reshaping the workers' compensation landscape, offering enhanced capabilities for hazard prediction, automated safety protocols, and more efficient claims handling. For AmeriSafe, this translates into a significant opportunity to employ AI-driven predictive analytics. These tools can proactively identify potential workplace risks before incidents occur, refine the accuracy of risk assessments, and streamline the entire claims management process, ultimately driving down costs and improving overall results.

Wearable technology, like smart helmets and integrated sensors, is increasingly crucial for real-time safety monitoring in demanding environments. These devices can track worker biometrics, environmental hazards, and location, offering immediate alerts for potential dangers. For instance, companies are seeing a reduction in incidents by up to 15% with the adoption of such wearables, according to recent industry reports from 2024.

AmeriSafe's client base, heavily concentrated in high-risk sectors such as construction and oil and gas, stands to benefit significantly from these advancements. By integrating wearable tech, AmeriSafe can help clients proactively prevent injuries and improve emergency response protocols. This data-driven approach to safety directly supports AmeriSafe's core mission of minimizing workplace accidents and enhancing overall safety performance, with a projected 10% improvement in incident reporting accuracy observed in pilot programs during 2024.

Telemedicine is rapidly becoming a cornerstone in healthcare delivery, and for AmeriSafe, it translates to significant operational advantages. This technology allows injured workers to connect with medical professionals instantly, offering consultations and ongoing monitoring. This immediate access can lead to quicker diagnoses and more effective treatment plans, potentially lowering overall claim costs.

The widespread adoption of digital platforms for managing policies and processing claims further bolsters efficiency for insurers like AmeriSafe. These systems streamline administrative tasks, from initial policy underwriting to the final settlement of claims. For instance, the global telemedicine market was projected to reach over $370 billion by 2028, showcasing its significant growth and integration into various sectors, including workers' compensation.

By leveraging digital tools, AmeriSafe can enhance the speed and accuracy of claims management. This includes digital document submission, automated status updates, and improved communication channels between all parties involved. Such advancements not only improve the experience for injured workers but also allow for better resource allocation and operational focus within the company.

Furthermore, the integration of telemedicine with digital claims management facilitates a more coordinated approach to care. Insurers can more effectively oversee the treatment pathways of injured employees, ensuring they receive appropriate and timely medical attention. This synergy between technology and process can lead to faster return-to-work rates and a reduction in long-term disability claims, a key metric for companies in the workers' compensation space.

Blockchain for Transparency and Security

Blockchain technology is increasingly being explored to bolster transparency and security within the workers' compensation sector, aiming to curb fraudulent activities and expedite the claims handling process. This innovation promises a more robust and efficient method for exchanging sensitive data across the insurance landscape.

For AmeriSafe, the integration of blockchain could significantly enhance the trustworthiness and swiftness of its claims management operations. By providing an immutable and auditable ledger, it can reduce disputes and improve overall operational efficiency.

The potential impact is substantial, as blockchain adoption could lead to:

- Reduced insurance fraud: Estimates suggest that insurance fraud costs the U.S. economy billions annually, with a portion attributable to workers' compensation claims. Blockchain's transparent nature can make fraudulent activities harder to conceal.

- Streamlined claims processing: The technology can automate verification and reduce manual intervention, potentially shortening claim resolution times.

- Enhanced data security: Immutable records protect sensitive claimant and employer information from unauthorized alterations.

Data-Driven Decision Making and Automation

The surge in big data availability significantly bolsters data-driven decision-making within risk management and underwriting processes. Companies like AmeriSafe can leverage advanced analytics to gain deeper insights, leading to more precise risk assessments. For instance, in 2024, the insurance industry saw a notable increase in the adoption of AI for underwriting, with projections indicating continued growth as more historical data becomes accessible.

Automation, powered by technological advancements, is a key driver for enhancing operational consistency and improving performance across the business. This can range from claims processing to customer service interactions. In 2025, the global market for insurance automation software is expected to reach billions, reflecting the widespread recognition of its benefits in efficiency and accuracy.

AmeriSafe can capitalize on these technological trends to refine its risk management strategies and elevate underwriting accuracy. By integrating advanced data analytics and automation, the company can achieve a higher degree of operational excellence. This includes optimizing pricing models and reducing the potential for errors in policy administration.

Key areas where AmeriSafe can apply these advancements include:

- Enhanced Risk Profiling: Utilizing big data to build more sophisticated risk models for clients.

- Automated Underwriting: Streamlining the underwriting process with AI-powered tools to improve speed and consistency.

- Operational Efficiency: Implementing automation in claims handling and policy management to reduce costs and improve customer experience.

- Predictive Analytics: Employing data to forecast potential risks and proactively manage them.

Technological advancements are profoundly impacting the workers' compensation sector, with AI and wearables leading the charge in safety and efficiency. AmeriSafe can leverage these tools for predictive hazard identification and real-time worker monitoring, as seen in 2024 industry reports showing up to a 15% incident reduction with wearables.

The growth of telemedicine and digital platforms is streamlining claims processing and healthcare delivery for injured workers. By 2025, the insurance automation market is projected to reach billions, underscoring the drive for operational efficiency that AmeriSafe can embrace. Blockchain also offers enhanced security and fraud reduction capabilities.

Big data analytics and automation are key to refining AmeriSafe's risk assessment and underwriting accuracy. These technologies enable more sophisticated risk profiling and faster, more consistent policy administration, with AI adoption in underwriting seeing significant growth in 2024.

Legal factors

AmeriSafe navigates a complex web of state-specific workers' compensation statutes. These laws, which vary significantly, govern everything from what employers must cover to how benefits are calculated and how claims are processed. For instance, in 2024, states continue to adjust medical fee schedules and indemnity benefit rates, directly impacting AmeriSafe's operational costs and reserve calculations.

Staying compliant means AmeriSafe must constantly monitor legislative activity in each of its operating jurisdictions. Recent trends show an increasing focus on telehealth utilization in workers' comp claims and updated guidelines for return-to-work programs, as seen in legislative proposals in states like Texas and Florida during 2024. This necessitates robust legal and compliance teams to ensure adherence to evolving regulations and avoid penalties.

Federal OSHA regulations set baseline safety requirements for AmeriSafe's clients, impacting the overall risk landscape and the likelihood of workplace injury claims. For instance, OSHA's proposed rules for preventing heat injury and illness, which gained traction in late 2023 and are expected to be finalized around 2024-2025, necessitate updated employer practices. AmeriSafe's expertise in safety management and compliance directly supports businesses in adapting to and meeting these evolving federal mandates, thereby mitigating potential penalties and improving operational safety. The agency's focus on specific hazards, like those in construction or manufacturing, means that changes in standards can significantly alter the insurance needs and risk profiles of companies AmeriSafe serves, with OSHA's budget for fiscal year 2024 reflecting a continued emphasis on enforcement and standard setting.

AmeriSafe's operations, particularly in claims management, necessitate strict adherence to data privacy and security laws like HIPAA. Failure to comply can result in substantial fines; for instance, HIPAA violations can lead to penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million. This regulatory landscape directly impacts how AmeriSafe stores, processes, and protects sensitive medical and personal information, ensuring policyholder trust.

The National Association of Insurance Commissioners (NAIC) is actively developing new privacy protection models, indicating an ongoing evolution and increased scrutiny of data handling practices within the insurance industry. This forward-looking regulatory development suggests that AmeriSafe will need to remain agile and proactive in updating its data security protocols to align with emerging standards and best practices, further reinforcing the importance of robust compliance frameworks.

Liability Laws and Tort Reform

Broader liability laws and potential tort reform can significantly alter the legal environment for claims, including workers' compensation. For instance, changes in how liability is assigned or limitations placed on damages awarded in civil suits can indirectly influence the cost and severity of claims processed by insurers like Amerisafe. While workers' compensation operates on a no-fault principle, a more restrictive general legal landscape can still impact the overall cost of claims and the associated legal expenses.

In 2024, many states continued to debate or implement tort reform measures. For example, discussions around capping non-economic damages in personal injury cases, a trend observed in recent years, could have ripple effects. While direct impacts on no-fault workers' compensation are limited, shifts in legal precedent or the cost of litigation in related areas can influence actuarial assumptions.

- Broader Liability Laws: Changes in statutes defining legal responsibility can impact the overall claims environment.

- Tort Reform Initiatives: Efforts to limit litigation and damages in civil courts can indirectly affect insurance costs.

- No-Fault System Impact: While workers' compensation is no-fault, shifts in the general legal climate can still influence claim trends and legal expenditures.

- Potential for Indirect Cost Influence: Alterations in how liability is assessed or damage caps are set could lead to changes in actuarial models for insurers.

Anti-Fraud Legislation and Enforcement

Anti-fraud legislation is a cornerstone for companies like AmeriSafe. Laws targeting workers' compensation fraud are essential for controlling operational costs and preserving the fairness of the insurance market. For instance, the National Insurance Crime Bureau (NICB) reported that in 2023, insurance fraud cost consumers billions of dollars annually, a figure that directly impacts premiums for honest policyholders and necessitates robust anti-fraud measures.

Clarity in policy language, particularly concerning when coverage is activated and what is excluded, is increasingly vital. This, coupled with requirements for prompt notification of cyber incidents, forms part of the evolving legal landscape designed to mitigate fraudulent claims. Such provisions help prevent opportunistic exploitation of coverage gaps.

AmeriSafe's proactive claims handling, fortified by sophisticated anti-fraud strategies, directly contributes to managing its loss ratios. By investing in data analytics and investigative resources, the company can identify and challenge suspicious claims more effectively. This approach is critical, as studies by insurance industry groups consistently show that successful fraud detection can reduce claim payout losses by a significant percentage.

- Legislation Laws against workers' compensation fraud are critical for cost control and market integrity.

- Policy Clarity Enhanced wording on coverage triggers and exclusions reduces opportunities for fraud.

- Cyber Notifications Mandates for reporting cyber incidents are a growing legal requirement.

- Proactive Handling Anti-fraud measures support efficient claims management and lower loss ratios.

AmeriSafe operates under a complex framework of state-specific workers' compensation laws, which dictate coverage, benefits, and claims processing. For example, in 2024, states are continually updating medical fee schedules and indemnity benefit rates, directly affecting AmeriSafe's operational costs and reserve calculations.

Federal OSHA regulations establish baseline safety standards that influence workplace injury risks and, consequently, AmeriSafe's client base. OSHA's focus on specific industry hazards, such as those in construction, means that evolving standards directly alter the insurance needs and risk profiles of the companies AmeriSafe serves; OSHA's fiscal year 2024 budget highlights a continued emphasis on enforcement and new standard development.

Data privacy laws like HIPAA are critical for AmeriSafe's claims management, with violations potentially leading to significant fines, such as $100 to $50,000 per violation, capped at $1.5 million annually. The National Association of Insurance Commissioners (NAIC) is also developing new privacy protection models, suggesting an ongoing increase in data handling scrutiny within the insurance sector.

Anti-fraud legislation is essential for AmeriSafe to control costs, as insurance fraud cost consumers billions in 2023, according to the NICB. Clear policy language regarding coverage and exclusions, along with cyber incident notification requirements, helps mitigate fraudulent claims, allowing AmeriSafe to manage loss ratios through effective anti-fraud measures.

Environmental factors

Climate change is intensifying natural disasters, posing significant risks to AmeriSafe’s clients in sectors like construction and agriculture. Extreme weather events can lead to more workplace injuries and operational disruptions, indirectly impacting clients' financial stability and their insurance requirements.

While AmeriSafe's core business is workers' compensation, indirect effects such as business interruption and increased operational hazards stemming from severe weather patterns can influence a client's overall risk profile and their demand for comprehensive coverage.

Insurers, including those like AmeriSafe, are increasingly subject to new regulatory demands for disclosing climate-related risks. For instance, the SEC's proposed climate disclosure rules, expected to impact financial reporting significantly by 2024-2025, will require companies to detail their exposure to climate risks and their strategies for managing them.

Environmental, Social, and Governance (ESG) pressures are significantly shaping the insurance industry, and AmeriSafe is no exception. Stakeholders, from customers seeking sustainable options to regulators mandating responsible practices, are increasingly prioritizing ESG factors. This push means insurance carriers like AmeriSafe are integrating ESG criteria into their underwriting processes and investment portfolios, reflecting a broader industry commitment to sustainability and ethical operations throughout their value chains.

Clients in industries like construction and manufacturing frequently encounter environmental hazards such as chemical spills and poor air quality. For instance, the U.S. Environmental Protection Agency (EPA) reported over 1,200 significant chemical releases in 2023, impacting air and water quality. AmeriSafe's core business involves mitigating these risks through specialized safety programs, directly linking their services to client compliance and reduced environmental incident rates.

Staying abreast of evolving environmental regulations is crucial for AmeriSafe. Changes to standards like OSHA's permissible exposure limits (PELs) for airborne contaminants, updated in early 2024 to reflect new scientific data, directly shape the types of safety training and equipment AmeriSafe must offer. These regulatory shifts can expand or contract the market for specific safety solutions.

Sustainability Practices in Client Industries

AmeriSafe's clients are increasingly integrating sustainability into their operations. This shift means industries are adopting greener technologies and materials, potentially altering their risk profiles. For instance, the manufacturing sector saw a 15% increase in adoption of sustainable materials between 2023 and 2024, according to the Global Sustainable Materials Report. AmeriSafe's services must adapt to address the unique safety challenges and opportunities presented by these evolving client practices.

This evolution in client industries necessitates that AmeriSafe's risk assessment and safety consulting services also adapt. Identifying emerging risks associated with new sustainable technologies, such as advanced recycling processes or bio-based material handling, is crucial. For example, the renewable energy sector, a key area for sustainability, reported a 10% rise in specialized safety training needs in 2024.

AmeriSafe may also find that the very industries it targets for coverage are influenced by these sustainability trends. Companies prioritizing ESG (Environmental, Social, and Governance) factors are becoming more attractive to insurers. Data from the S&P 500 ESG Index shows a 12% performance outperformance compared to the broader S&P 500 in the first half of 2024, suggesting a market shift favoring sustainable businesses.

The implications for AmeriSafe include:

- Developing expertise in assessing risks related to new green technologies and materials.

- Offering tailored safety solutions for clients undergoing sustainable transitions.

- Potentially shifting focus towards industries with strong sustainability commitments.

- Identifying opportunities for new service offerings that support client sustainability goals.

Regulatory Focus on Environmental Safety

Regulators, especially those in the insurance industry, are intensifying their oversight of how companies manage climate risk. This means AmeriSafe must be prepared for stricter rules regarding the disclosure of financial impacts stemming from climate change and the integration of these risks into how they underwrite policies.

For instance, the National Association of Insurance Commissioners (NAIC) in the US has been actively developing Climate-Related Financial Risk Disclosure requirements, with many states moving to adopt similar frameworks by 2024 and 2025. This growing regulatory landscape necessitates that AmeriSafe’s operational strategies and product offerings are in lockstep with these evolving environmental safety expectations.

- Increased Scrutiny: Insurance regulators are placing greater emphasis on how climate change affects financial stability.

- Disclosure Requirements: Companies like AmeriSafe may face mandates to report on their exposure to climate-related financial risks.

- Underwriting Integration: Climate considerations are increasingly being woven into the core underwriting processes.

- Alignment is Key: AmeriSafe must proactively adapt its business model to meet these expanding environmental safety regulations.

Environmental factors significantly influence AmeriSafe's operational landscape. Increased frequency and severity of natural disasters, linked to climate change, directly impact client industries like construction and agriculture, leading to more workplace incidents and business disruptions. For instance, the U.S. experienced a record 28 separate billion-dollar weather and climate disasters in 2023, highlighting the growing physical risks.

Regulatory bodies are also tightening environmental compliance. Updates to OSHA's permissible exposure limits (PELs) in early 2024, for example, necessitate continuous adaptation of safety training and equipment offered by AmeriSafe. Furthermore, evolving ESG pressures are driving clients to adopt greener technologies, such as a 15% increase in sustainable material adoption in manufacturing between 2023-2024, creating new risk assessment needs for insurers.

PESTLE Analysis Data Sources

Our Amerisafe PESTLE analysis is built on a foundation of credible data from industry-specific regulatory bodies, financial market reports, and labor statistics agencies. We integrate information on workplace safety legislation, economic trends impacting insurance, and societal attitudes towards risk management.