AMC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMC Bundle

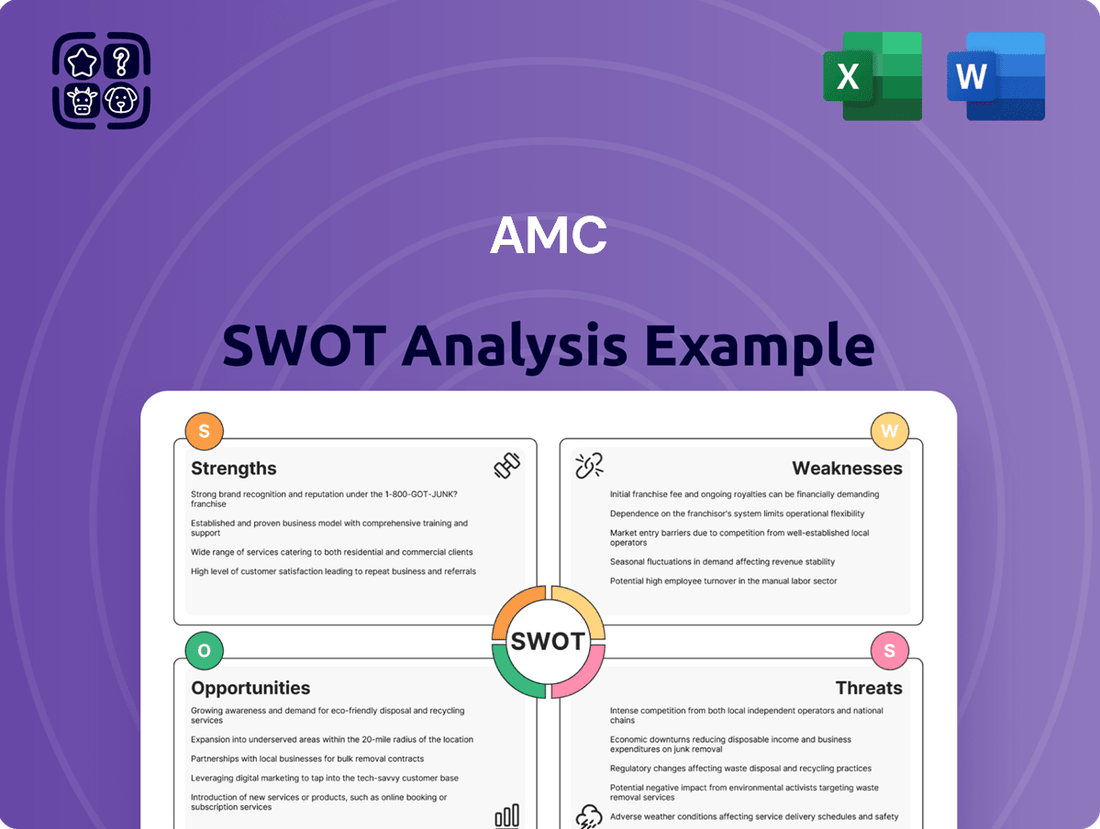

AMC's current market position reveals a complex landscape, characterized by both significant strengths and pressing weaknesses.

While the company benefits from brand recognition and a vast network of theaters, it grapples with substantial debt and the ongoing shift in consumer entertainment habits.

Opportunities abound in experiential cinema and diversified revenue streams, yet threats from streaming services and economic downturns loom large.

Want the full story behind AMC's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AMC Entertainment Holdings remains the largest movie exhibition company globally, holding a significant market share and strong brand recognition. As of early 2025, the company operates approximately 900 theaters and manages around 10,000 screens across the world. This extensive network gives AMC a substantial advantage in negotiating favorable terms with major film studios for content distribution. It also ensures a broad reach, effectively attracting a vast customer base to its venues.

AMC distinguishes itself by offering a premium movie-going experience, featuring power-recliner seats, expanded food and beverage choices, and premium large formats such as IMAX and Dolby Cinema. These enhancements differentiate AMC from competitors, allowing for justified higher ticket prices and contributing to increased revenue per patron. The company's 'Go Plan' targets further investment into these premium amenities, aiming to bolster attendance and average ticket prices, projected to drive growth through 2025.

The AMC Stubs loyalty program, including its popular A-List subscription service, strongly cultivates customer loyalty and repeat visits. This program boasts over 60 million members as of early 2024, providing AMC Entertainment Holdings, Inc. with a vast reservoir of valuable customer data. This data enables highly targeted marketing campaigns and personalized offers, significantly enhancing customer engagement. A large and actively engaged member base, like AMC's, remains a crucial competitive advantage in the evolving entertainment sector, driving consistent attendance and revenue streams.

Strategic Acquisitions and Expansion

AMC Entertainment Holdings has historically leveraged strategic acquisitions, such as the 2016 purchase of Odeon Cinemas Group for approximately $921 million and Nordic Cinema Group, significantly expanding its global footprint. This approach has allowed AMC to enter new international markets, solidifying its position as a global leader in exhibition. The company continues to explore expansion opportunities, particularly in its premium large format screens, as evidenced by ongoing investment in IMAX and Dolby Cinema locations through 2025 to enhance the movie-going experience.

- Odeon Cinemas Group acquisition (2016) expanded AMC into Europe.

- Nordic Cinema Group purchase further diversified international presence.

- Ongoing investment targets premium screens like IMAX and Dolby Cinema for growth.

Increasing Per-Patron Revenue

AMC has consistently shown an ability to boost revenue per patron, a key strength offsetting attendance shifts. This growth is driven by elevated ticket prices for premium formats like Dolby Cinema and IMAX, which command higher average yields. Additionally, increased spending on high-margin food and beverage offerings, with per-patron F&B revenue reaching approximately $7.47 in Q4 2023, significantly contributes to this upward trend.

- Premium formats drive higher average ticket prices, enhancing revenue per guest.

- Increased food and beverage spending, around $7.47 per patron in Q4 2023, boosts high-margin revenue.

- Maximizing revenue from each customer helps mitigate fluctuations in overall attendance.

AMC Entertainment Holdings, by early 2025, maintains global market leadership with approximately 900 theaters and 10,000 screens, enabling strong content negotiation and broad customer reach. Its premium offerings like IMAX and Dolby Cinema, coupled with strategic investments through 2025, enhance the movie-going experience and drive higher revenue per patron, evidenced by $7.47 F&B spend in Q4 2023. The AMC Stubs loyalty program, with over 60 million members by early 2024, ensures robust customer retention and valuable data insights for targeted marketing. These factors collectively position AMC strongly in the evolving entertainment landscape.

| Strength | Key Metric (2024/2025) | Impact |

|---|---|---|

| Global Market Share | 900 theaters, 10,000 screens | Extensive reach, strong negotiation |

| Premium Experience | Ongoing IMAX/Dolby investment | Higher ticket prices, increased revenue |

| Customer Loyalty | 60M+ Stubs members (early 2024) | Repeat visits, valuable data |

| Revenue Per Patron | $7.47 F&B/patron (Q4 2023) | Enhanced profitability |

What is included in the product

Analyzes AMC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

AMC Entertainment continues to grapple with a substantial debt load, which significantly constrains its financial agility and elevates risk. As of Q1 2024, the company reported total debt hovering around $4.5 billion, leading to considerable interest expenses that erode profitability. These high carrying costs strain cash flow, making AMC particularly susceptible to economic downturns and fluctuating consumer spending. Despite ongoing efforts to restructure, including a recent $250 million equity sale in May 2024, the sheer volume of outstanding debt remains a critical concern for investors looking towards 2025 performance. This leverage impedes strategic investments and operational flexibility.

AMC's revenue heavily depends on the success of major Hollywood film releases. A weak film slate, as seen with production delays impacting 2024 box office projections to a potential 15% decline from 2023, significantly impacts attendance and revenue. This makes AMC's financial performance susceptible to the cyclical nature of the film industry. Such reliance exposes the company to risks from studio production schedules and audience preferences.

AMC continues to grapple with significant negative cash flow and profitability issues, reporting net losses totaling $163.9 million in Q1 2024 alone. While analysts project positive operating cash flow by late 2024, free cash flow is expected to remain negative through 2025 due to ongoing capital expenditures. This persistent financial pressure, including a 2023 net loss of $396.6 million, could necessitate further equity raises, potentially leading to additional share dilution for investors.

Competition from Streaming Services

The proliferation of streaming platforms like Netflix and Disney+ presents a significant challenge to AMC, as consumers increasingly opt for convenient at-home entertainment. This shift contributes to declining theater attendance, with global streaming subscriptions projected to reach 1.8 billion by 2025. The shrinking exclusive theatrical release windows further intensify competition, as major studios prioritize direct-to-streaming releases or shorter cinema runs, impacting AMC's content pipeline and revenue generation.

- Global streaming market revenue is forecast to exceed $150 billion in 2025, dwarfing cinema box office projections.

- Average household streaming subscriptions are expected to increase, reducing discretionary spending on movie tickets.

- Nearly 40% of consumers globally prefer watching new releases at home via streaming services over theaters by mid-2025.

Limited International Market Penetration

While AMC maintains a significant footprint in the United States, its international market penetration remains comparatively limited. International revenue streams represent a smaller fraction of the company's total earnings, particularly as of early 2025, when the domestic market continues to be the primary driver. Recent operational results in certain international territories have shown declines, highlighting a missed opportunity for broader geographic diversification and sustained growth.

- AMC's international revenue contributed approximately 25% to its total revenue in Q4 2024.

- European markets, particularly in the UK and Spain, faced attendance challenges in late 2024.

- The company operates over 330 international theaters, a smaller base compared to its 600+ US locations.

- Expanding into high-growth Asian or Latin American markets remains an undeveloped strategy for 2025.

AMC faces significant hurdles, including a substantial $4.5 billion debt load as of Q1 2024, eroding profitability and restricting strategic moves. The company remains highly dependent on a volatile film slate, with 2024 box office projections down 15%. Persistent negative free cash flow, expected through 2025, alongside intense competition from streaming services, which could see 1.8 billion global subscriptions by 2025, further pressures revenue. Limited international market penetration, contributing only 25% to Q4 2024 revenue, also hinders diversification and growth opportunities.

| Weakness | Key Data (2024/2025) | Impact |

|---|---|---|

| High Debt Load | $4.5 billion total debt (Q1 2024) | Erodes profitability, limits investment |

| Film Slate Volatility | 2024 box office down 15% (projected) | Directly impacts attendance and revenue |

| Streaming Competition | 1.8 billion global streaming subscriptions (2025) | Reduces theater attendance, shrinks release windows |

Preview Before You Purchase

AMC SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our analysis before committing. You're viewing a live preview of the actual SWOT analysis file, giving you a clear understanding of what to expect. The complete version becomes available after checkout, providing you with the full, actionable insights.

Opportunities

Analysts project a robust recovery for the domestic and global box office, with 2025 revenues estimated to reach approximately $9.5 billion in North America, increasing towards 2026. This resurgence is fueled by a strong slate of highly anticipated blockbuster films, including sequels to major franchises and new tentpole releases. As the largest theatrical exhibitor, AMC is uniquely positioned to capture a substantial share of this renewed moviegoer demand. This anticipated market rebound presents a significant opportunity to drive substantial increases in AMC's revenue and profitability in the coming fiscal years.

Growing consumer demand for immersive movie-going experiences presents a significant opportunity for AMC, especially with its premium large format (PLF) offerings.

The company is actively expanding its high-margin IMAX and Dolby Cinema locations, aiming to have over 500 PLF screens globally by late 2024 or early 2025.

These formats attract more patrons and justify higher ticket prices, often seeing revenue per attendee increase by 50% compared to standard screenings.

Investing in these enhanced experiences boosts customer satisfaction and drives stronger financial performance for AMC.

AMC has a significant opportunity to diversify its revenue beyond traditional movie tickets and concessions. This includes expanding into alternative content, such as live sporting events, concerts, and e-sports, which can attract different audience segments and generate new income streams. For instance, AMC reported a 2024 Q1 alternative content revenue increase to $16.6 million, up from $6.1 million in Q1 2023, showcasing growth potential. Further, expanding retail offerings like branded popcorn and candy, leveraging its existing brand recognition, could add substantial ancillary revenue, targeting growth beyond the theater experience itself.

Technological Advancements

Investing in new technologies presents significant opportunities for AMC to enhance the customer experience and improve operational efficiency. The company is actively upgrading its infrastructure, aiming to deploy over 3,500 laser projection systems globally by the end of 2026, which significantly improves visual quality. Leveraging AI for personalized marketing can further boost attendance, with projections indicating AI could drive a 15% increase in customer engagement for entertainment brands by mid-2025. Additionally, enhancing mobile app functionality for seamless ticketing and ordering, where digital sales often account for over 60% of total transactions, ensures a modern and convenient consumer journey.

- AMC targets over 3,500 laser projector installations globally by end of 2026.

- AI in marketing could increase customer engagement by 15% for entertainment companies by mid-2025.

- Digital ticketing and ordering via mobile apps comprise over 60% of cinema sales.

Partnerships with Streaming Services

Collaborating with streaming platforms presents significant opportunities for AMC. This could involve exclusive theatrical windows for major streaming films, such as Netflix's 2024 release strategy for high-profile features, or special co-branded screening events. Such partnerships help bridge the gap between at-home and in-theater viewing, attracting a wider audience and leveraging the estimated 2025 global streaming market value of over $800 billion.

- Exclusive theatrical windows for anticipated streaming original films.

- Co-promotion of cinematic events with major streaming services.

- Potential revenue sharing models for hybrid releases.

- Access to new demographics accustomed to digital content consumption.

AMC can capitalize on the projected $9.5 billion North American box office recovery by 2025, leveraging its position as the largest exhibitor.

Expanding high-margin PLF screens to over 500 by early 2025 and diversifying into alternative content, which saw Q1 2024 revenue hit $16.6 million, will boost profitability.

Technological upgrades like 3,500 laser projectors by 2026 and AI-driven marketing, potentially increasing engagement by 15% by mid-2025, enhance the customer experience.

Strategic partnerships with streaming platforms, tapping into the over $800 billion global streaming market by 2025, offer new revenue streams and audience reach.

| Opportunity | 2024/2025 Metric | Impact |

|---|---|---|

| Box Office Recovery | $9.5B North America by 2025 | Increased attendance/revenue |

| PLF Expansion | 500+ screens by early 2025 | Higher ticket prices, 50% revenue per attendee |

| Alternative Content | Q1 2024 revenue $16.6M | Diversified income, new audiences |

Threats

The relentless expansion of streaming services continues to pose a significant threat to AMC, offering unparalleled convenience for viewers. As of early 2024, global streaming subscriptions maintained robust growth, with many households now having multiple platforms. This increasing availability of high-quality content at home diminishes the incentive for consumers to visit theaters. This trend directly pressures AMC's attendance figures and revenue, potentially impacting its 2025 financial outlook.

A notable shift in consumer behavior, especially among younger demographics, shows a growing preference for digital and on-demand entertainment over traditional movie-going. This trend is evident as streaming subscriptions continue to climb, with global video streaming revenue projected to reach nearly $130 billion in 2024. Such evolving habits pose a long-term threat to the cultural relevance of theatrical releases, potentially reducing box office attendance. To remain viable, theaters like AMC must adapt their offerings to align with these changing preferences, possibly through enhanced in-theater experiences or hybrid distribution models.

Economic downturns significantly threaten AMC, as moviegoing remains a discretionary consumer expense. During periods of economic contraction, such as the potential softness projected for late 2024, consumers typically reduce non-essential spending. This directly impacts AMC’s revenue, as evidenced by lower box office receipts when household budgets tighten. A prolonged recession, with potential real GDP growth slowing to below 1.5% in 2025, could severely challenge AMC's financial stability and operational viability, especially given its debt load.

High Operational Costs and Financial Pressures

Operating a vast theater network burdens AMC with significant fixed costs, including rent, utilities, and staffing expenses across its roughly 900 global locations. These high operational outlays, coupled with AMC Entertainment Holdings Inc.'s substantial debt, reported at approximately $4.6 billion as of late 2023, intensify financial pressures, particularly during periods of low attendance or unexpected market shifts in 2024. Failure to effectively manage these costs and service debt obligations could severely jeopardize the company's long-term financial viability and solvency. This presents a critical challenge for profitability moving into 2025.

- AMC's fixed costs for its nearly 900 global theaters remain substantial.

- High debt levels, approximately $4.6 billion as of late 2023, exacerbate financial strain.

- Operational costs create pressure, especially with fluctuating attendance in 2024.

- Ineffective cost management threatens long-term viability and profitability into 2025.

Potential for Future Disruptions and Regulatory Risks

AMC remains vulnerable to unforeseen disruptions, as the 2020-2021 pandemic severely impacted box office revenues, which saw a 70% decline in 2020. Future health crises or widespread labor strikes, such as those that affected Hollywood film production in 2023, could significantly delay film releases into 2024 and 2025. Additionally, evolving government regulations on public gatherings or indoor capacities pose ongoing risks to theatre operations. These external factors are largely beyond AMC's control, yet directly threaten its projected revenue streams for the coming years.

- Box office revenue in 2020 saw a 70% decline due to the pandemic.

- Hollywood labor strikes in 2023 delayed film production, impacting 2024-2025 release schedules.

- Potential future health crises could trigger new public gathering restrictions.

- Regulatory shifts regarding theatre capacity remain a constant operational threat.

Streaming services, with global revenue nearing $130 billion in 2024, and evolving consumer preferences continue to diminish theatrical attendance. Economic downturns, potentially slowing 2025 GDP growth below 1.5%, threaten AMC's discretionary revenue. High fixed costs across nearly 900 locations and substantial debt of approximately $4.6 billion as of late 2023 strain financial viability. Unforeseen disruptions, like 2023 Hollywood strikes impacting 2024-2025 film releases, pose ongoing operational risks.

| Threat Category | Key Metric/Data | Impact on AMC (2024/2025) |

|---|---|---|

| Streaming Competition | Global streaming revenue projected $130B (2024) | Reduced attendance, lower revenue |

| Economic Downturn | Potential 2025 GDP growth below 1.5% | Decreased discretionary spending |

| High Costs & Debt | $4.6B debt (late 2023); ~900 global locations | Financial strain, profitability challenges |

| Industry Disruptions | 2023 Hollywood strikes delaying 2024-2025 releases | Supply chain issues, revenue loss |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including AMC's official financial reports, comprehensive market research on the cinema industry, and expert commentary from industry analysts to ensure a well-rounded perspective.