AMC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMC Bundle

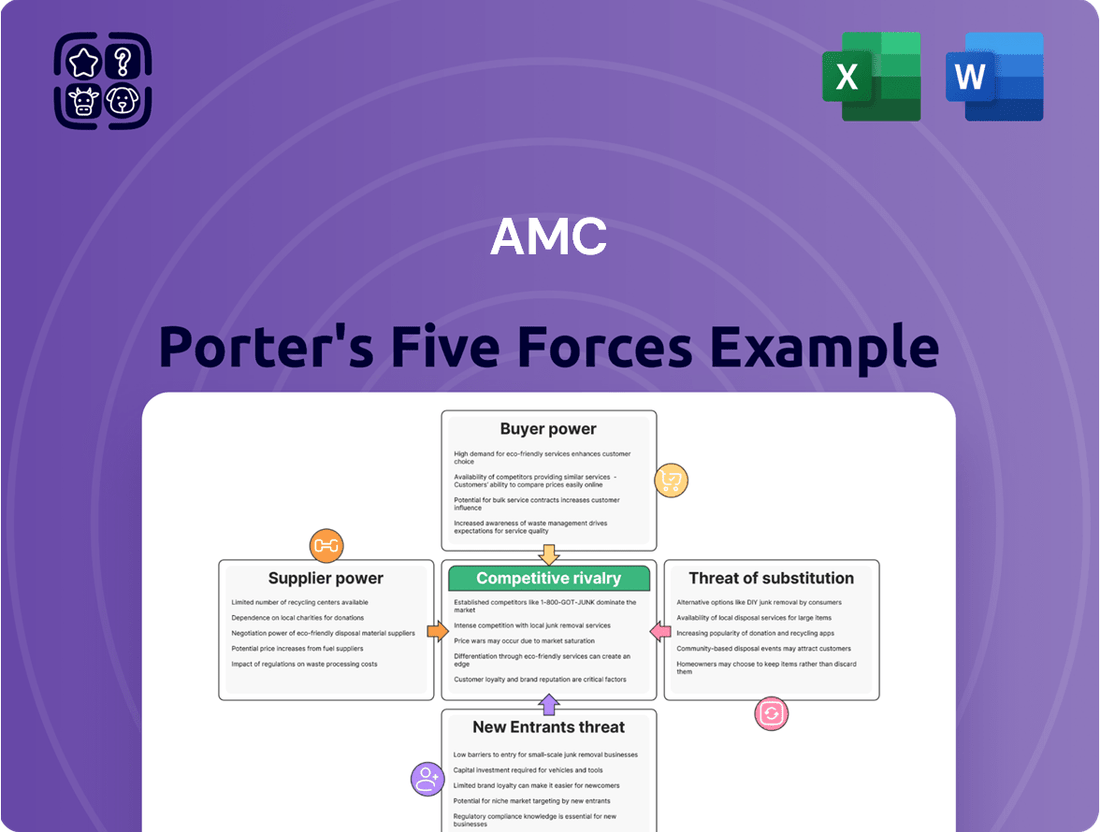

Porter's Five Forces Analysis provides a powerful framework for understanding the competitive landscape of any industry. For AMC, this means dissecting the bargaining power of buyers, the threat of new entrants, the power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

By examining these forces, we can gain a clearer picture of the profitability potential and strategic challenges facing AMC. Understanding buyer power, for instance, helps reveal how much pricing leverage customers have, while analyzing supplier power highlights the impact of raw material or service costs.

The threat of new entrants is crucial for assessing how easily new players could disrupt AMC's market share. Similarly, the threat of substitutes indicates how vulnerable AMC's core offerings are to alternative solutions that satisfy customer needs.

Finally, the intensity of rivalry among existing competitors directly influences pricing strategies and market share dynamics for AMC. This comprehensive view is essential for informed strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AMC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Major film studios like Walt Disney, Warner Bros., Universal, Sony, and Paramount dominate content creation, forming a concentrated supply base for AMC. This limited number of key suppliers grants them significant bargaining power over exhibitors. These studios control the blockbuster films crucial for attracting audiences; for example, in 2024, major studio releases accounted for over 80% of the domestic box office. AMC's revenue is heavily dependent on these few studios, enabling them to dictate terms for licensing fees and revenue sharing, which directly impacts AMC's profitability.

The substantial costs associated with producing and marketing major films, often exceeding $200 million for blockbusters in 2024, empower studios significantly. To recoup these massive investments, studios demand favorable distribution terms from exhibitors like AMC, including a larger share of box office revenues. This often means studios receive 60-70% of ticket sales during a film's initial weeks. This financial pressure directly translates into stronger bargaining power for studios over theater chains, dictating terms for content supply.

Studios wield substantial power by controlling the theatrical release window, the period a film is exclusively shown in theaters. This window, often around 45 days for major releases in 2024, has significantly shrunk from the pre-pandemic 75-90 days. This reduction directly impacts AMC's ability to generate revenue from popular films over an extended period. The ongoing trend of shorter windows, heavily influenced by the rise of streaming services, continues to exert financial pressure on exhibitors like AMC.

Significance of Content to Exhibitors

Theaters like AMC are fundamentally reliant on content provided by major film studios to attract customers. Without a steady stream of popular movies, exhibitors have little to offer, making studio products indispensable. This dependency grants studios considerable power in negotiations, as evidenced by their ability to demand significant revenue splits, often exceeding 50% of ticket sales for major releases. For instance, top 2024 blockbusters like Dune: Part Two or Inside Out 2 are crucial for driving traffic.

- Studios typically command 50-60% of box office revenue.

- Major 2024 releases are vital for theater attendance.

- Exclusivity windows are a key negotiation point for studios.

- Content scarcity amplifies supplier power over exhibitors.

Potential for Studio Consolidation

The possibility of further mergers and acquisitions among major film studios significantly threatens exhibitors like AMC. Increased consolidation reduces the number of content suppliers, strengthening their collective bargaining power and potentially leading to less favorable terms for theater chains. Fewer studios could mean less competition for distribution slots and more control over theatrical windows and film rental fees. This trend can directly impact AMC's profitability and operational flexibility as studios dictate terms for major releases.

- In 2024, major studios like Warner Bros. Discovery and Paramount Global continue to be subjects of acquisition speculation.

- Consolidation, such as the 2019 Disney-Fox merger, significantly reduced the number of major content creators.

- Film rental fees typically represent 50-60% of box office revenue for exhibitors.

- Streamlined studio landscapes offer fewer options for diversified film programming for theaters.

Ongoing studio consolidation, with entities like Warner Bros. Discovery and Paramount Global facing 2024 acquisition speculation, amplifies supplier power over AMC. Fewer major content creators, exemplified by the 2019 Disney-Fox merger, reduce AMC's negotiation leverage. This enables studios to demand higher film rental fees, typically 50-60% of box office revenue, and dictate shorter theatrical windows, often around 45 days in 2024, directly impacting AMC's profitability and content diversification options.

| Supplier Dynamic | 2024 Impact | Exhibitor Effect |

|---|---|---|

| Studio Consolidation | Warner Bros. Discovery & Paramount Global M&A speculation | Reduced content options, higher fees |

| Film Rental Fees | 50-60% of box office revenue for studios | Direct pressure on AMC's margins |

| Theatrical Windows | Major releases often 45 days exclusively | Limited revenue generation period for AMC |

What is included in the product

This analysis dissects the competitive forces shaping AMC's market, including buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry.

Uncover potential threats and opportunities with a visual breakdown of industry competition, empowering proactive strategy development.

Customers Bargaining Power

Moviegoers today face a vast array of entertainment choices, including the convenience of streaming services, engaging live events, and diverse recreational activities. This abundance significantly increases customers' bargaining power, as they can easily opt for alternatives to a traditional movie theater experience. Platforms like Netflix and Disney+ continue to expand their content libraries, offering compelling options at home. For instance, streaming subscriptions maintained strong growth into 2024, with global video streaming revenue projected to reach over $120 billion, highlighting consumer preference for at-home content delivery compared to the still recovering 2024 domestic box office, which is projected to remain below pre-pandemic levels.

Moviegoers are notably sensitive to the cost of tickets and concessions, which significantly influences their decision to visit a cinema. This price sensitivity compels AMC to maintain competitive pricing, especially as the average ticket price in the U.S. was approximately $10.74 in Q1 2024. The growing availability of more affordable streaming services and premium video-on-demand (PVOD) options intensifies this pressure, offering consumers cheaper at-home entertainment alternatives. Consequently, AMC often implements value-driven promotions, like AMC Stubs discounts and Tuesday movie deals, to attract and retain customers in a highly competitive market.

Customers face virtually no financial barriers to choose another movie theater or alternative entertainment, making loyalty highly fluid. This low switching cost empowers consumers, as they can easily opt for streaming services, which continued to gain traction in 2024, or other leisure activities. AMC must consistently enhance the in-theater experience, such as premium formats or diverse concessions, to retain patrons. For instance, a 2024 survey showed many consumers prioritize home viewing for convenience over cinema visits for standard releases.

Influence of Customer Reviews and Social Media

The opinions and reviews shared by customers on social media and review websites significantly influence others' decisions to see a movie or visit a particular theater. Negative reviews or word-of-mouth can directly impact AMC's attendance and profitability, especially with the immediate spread of information online. For instance, in 2024, a movie’s Rotten Tomatoes audience score often dictates its box office trajectory. This collective customer base gains a powerful form of indirect bargaining power, compelling theaters to prioritize service quality and the overall movie-going experience.

- Online reviews influence over 90% of consumer purchase decisions, including entertainment choices.

- Social media discussions can amplify positive or negative sentiment for AMC locations instantly.

- A dip in average customer rating by even one star can lead to significant revenue loss for businesses.

- Platforms like Google Reviews and Yelp provide real-time feedback that impacts theater foot traffic.

Demand for Premium and Differentiated Experiences

While customers have numerous entertainment choices, there is a growing demand for premium theatrical experiences that cannot be easily replicated at home. This includes formats like IMAX and Dolby Cinema, along with luxury seating and enhanced food and beverage options. By offering these premium amenities, AMC can reduce customer power to some extent by providing a unique value proposition. In 2024, AMC continues to emphasize its premium large format screens, which consistently command higher ticket prices.

- AMC reported that premium formats like IMAX and Dolby Cinema contributed significantly to its revenue in early 2024.

- Luxury recliner seating is now available in over 60% of AMC’s domestic circuit.

- Enhanced food and beverage offerings, including dine-in options, drive higher per-patron spending.

Customers wield strong bargaining power due to abundant entertainment alternatives, including streaming services projected to exceed $120 billion in global revenue for 2024. Their high price sensitivity, with average U.S. ticket prices at $10.74 in Q1 2024, and low switching costs further empower them. Online reviews and social media also heavily influence attendance, compelling AMC to prioritize service and unique experiences like premium formats. While premium offerings help, customers retain significant leverage in their entertainment choices.

| Factor | Impact on AMC | 2024 Data |

|---|---|---|

| Entertainment Alternatives | High customer choice | Global streaming revenue projected >$120B |

| Price Sensitivity | Pressure on ticket/concession pricing | Avg. U.S. ticket price ~$10.74 (Q1 2024) |

| Switching Costs | Easy for customers to choose alternatives | Many prioritize home viewing for convenience |

Same Document Delivered

AMC Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis document you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the automotive industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This professionally formatted analysis is ready for your immediate use and understanding, providing a complete picture of AMC's competitive landscape without any surprises.

Rivalry Among Competitors

AMC faces intense competition from major chains like Regal Cinemas and Cinemark, which collectively hold significant market share. In 2024, these rivals aggressively compete on factors such as location, ticket pricing, and premium amenities like IMAX or Dolby Cinema. This direct rivalry forces AMC to continuously invest in theater upgrades and enhanced customer loyalty programs, impacting profit margins. For instance, Cinemark reported a 2024 Q1 revenue of $634.6 million, underscoring the scale of their operations.

The major theater chains are in a constant battle to maintain and grow their market share. As the largest chain, AMC holds a significant portion, leading in North American screen count with over 7,800 screens as of early 2024, but this position is constantly challenged by formidable competitors like Cinemark and Regal Cinemas. This intense rivalry for dominance drives aggressive competitive actions, including diverse pricing strategies and enhanced premium formats. For instance, AMC's A-List subscription program, which continued strong into 2024, directly competes with rivals' loyalty schemes and value propositions.

Independent and smaller theaters present a competitive rivalry by serving niche audiences and fostering unique, community-focused experiences. These venues often cultivate strong local followings, challenging major chains like AMC in specific geographic markets. While they might not compete on scale, their curated film selections or specialized events, such as film festivals, attract dedicated patrons. However, smaller operators frequently face challenges like studio-imposed minimum run times for major film releases, impacting their flexibility and profitability in 2024.

Focus on Differentiating the Experience

To combat intense competitive rivalry, theater chains like AMC are increasingly focused on differentiating the movie-going experience. This involves significant investments in premium large formats and luxury amenities, creating a more compelling reason for customers to choose their venues. The goal is to elevate the overall outing beyond just the film itself, enhancing customer loyalty and attracting higher spending. For example, AMC continues to upgrade its auditoriums with power recliners and MacGuffins Bar & Lounge concepts across its portfolio.

- AMC reported that over 70% of its domestic theatre circuit featured recliner seating as of early 2024.

- Premium Large Format (PLF) screens, like IMAX and Dolby Cinema, continue to drive higher per-person spending for exhibitors.

- Expanded food and beverage options, including dine-in services, contribute significantly to increased concession revenue per patron.

- In 2024, the focus on experiential elements directly counters streaming service convenience by offering unique out-of-home entertainment.

Impact of Industry Consolidation

Mergers and acquisitions within the exhibition industry significantly alter the competitive landscape for companies like AMC. While consolidation can lead to greater market power for the combined entity, it also intensifies the rivalry between the remaining major players. The potential for further consolidation remains a key dynamic, with major chains constantly evaluating strategic moves. This dynamic forces innovation and efficiency to maintain market share, as seen with AMC's 2024 strategic initiatives.

- In 2024, the top three cinema chains in North America, including AMC, commanded over 60% of the market share.

- AMC Entertainment Holdings, Inc. reported a Q1 2024 revenue of $951.4 million, reflecting ongoing industry shifts.

- The industry saw a 2024 focus on premium formats like IMAX and Dolby Cinema to enhance competitive differentiation.

- Smaller regional chains continue to face acquisition pressure from larger entities like AMC and Cinemark.

AMC faces fierce rivalry from major chains like Cinemark and Regal, competing aggressively on pricing, amenities, and market share across the industry.

This intense competition drives AMC to continuously invest in premium experiences, with over 70% of its domestic theaters featuring recliner seating by early 2024.

The top three cinema chains, including AMC, commanded over 60% of the North American market in 2024, intensifying focus on premium formats and enhanced customer loyalty programs.

| Metric | AMC (Q1 2024) | Cinemark (Q1 2024) | Regal (2024 Est.) |

|---|---|---|---|

| Revenue | $951.4 million | $634.6 million | N/A |

| Domestic Recliners | >70% of Theaters | N/A | N/A |

| Market Share (Top 3) | >60% of NA market | >60% of NA market | >60% of NA market |

SSubstitutes Threaten

The most significant substitute for movie theaters like AMC is the vast array of streaming services such as Netflix, Disney+, and Amazon Prime Video. These platforms offer extensive content libraries, including exclusive titles, at a low monthly cost. For instance, Netflix reported over 270 million global paid subscribers in Q1 2024, highlighting their massive reach. The convenience of at-home viewing makes these services a persistent and major threat to traditional theater attendance.

The traditional exclusive theatrical window has significantly shrunk, reducing the incentive for many consumers to visit cinemas. By 2024, some major studios, like Universal, have deals allowing films to move to premium video-on-demand as early as 17 days after their theatrical debut. This rapid availability on streaming platforms or for home purchase directly competes with the cinema experience. Consequently, consumers often choose to wait for home access, diminishing AMC's ticket sales and concession revenue. This trend fundamentally alters the value proposition of a theater visit for many potential moviegoers.

Advances in home entertainment technology, including large, high-resolution televisions and sophisticated sound systems, have made the at-home viewing experience increasingly immersive. The proliferation of affordable 4K UHD TVs, with sales continuing strong into 2024, offers unparalleled visual clarity at home. While it may not fully replicate the big screen, the quality of home setups has improved significantly, providing a highly satisfying alternative for many consumers. This trend, coupled with the widespread adoption of streaming services, directly competes with the cinema experience. Consumers often weigh the convenience and cost-effectiveness of home viewing against a trip to AMC.

Alternative Live and At-Home Entertainment

Theaters face intense competition for consumers' discretionary spending from a vast array of entertainment alternatives. This includes live events like concerts and sporting events, which saw a robust return in 2024, alongside at-home activities such as video gaming, which generated over 180 billion dollars globally in 2024. The sheer volume and accessibility of these substitutes create a highly competitive environment for consumers' time and money, directly impacting cinema attendance.

- Global video game revenue reached approximately 184 billion dollars in 2024.

- Live event ticket sales, including concerts and sports, demonstrated strong recovery and growth in 2024.

- Streaming services continued to expand, with leading platforms investing billions in new content in 2024.

Piracy and Illegal Distribution

The illegal distribution of movies online remains a significant threat to AMC and the broader film industry. Piracy provides a free, albeit illegal, substitute for both theatrical viewing and legitimate streaming services, directly siphoning off potential revenue from the entire value chain. In 2024, digital piracy continues to evolve, impacting box office receipts and subscription numbers. This unauthorized access directly competes with AMC’s offerings, diminishing the incentive for consumers to pay for content.

- Global digital piracy cost the entertainment industry an estimated $213 billion in 2023.

- Illegal streaming accounted for over 80% of digital piracy in 2023.

- The Motion Picture Association reported billions of visits to piracy sites annually in recent years.

- Piracy reduces potential box office revenue by an estimated 15-20% for major releases.

AMC faces a significant threat from substitutes, primarily streaming services like Netflix with over 270 million subscribers in Q1 2024, offering convenient and affordable home viewing. The shrinking theatrical window, with some films moving to home release in as little as 17 days by 2024, further reduces the incentive for cinema visits. Advanced home entertainment systems and other leisure activities, including video gaming which generated over 180 billion dollars globally in 2024, also divert consumer spending. Digital piracy continues to be a major concern, impacting potential box office revenue.

| Substitute Type | 2024 Data/Trend | Impact |

|---|---|---|

| Streaming Services | Netflix: 270M+ subs Q1 2024 | Convenience, content access |

| Home Entertainment | Strong 4K UHD TV sales | Improved home viewing quality |

| Video Gaming | Global revenue: $180B+ | Alternative leisure spending |

Entrants Threaten

Entering the movie theater market demands substantial capital investment, acting as a significant barrier for new entrants. Costs for a new cinema construction can range from $5 million to over $20 million in 2024, covering land and building. Expensive equipment like digital projectors cost over $50,000 per screen, with high-end sound systems and seating adding significantly. A single IMAX screen setup alone can exceed $1 million, making these high startup costs formidable for potential competitors.

Large, established cinema chains like AMC Entertainment Holdings Inc., with its approximately 900 theaters and 10,000 screens globally as of early 2024, benefit immensely from economies of scale. This vast size enables AMC to secure more favorable film distribution terms and volume discounts from suppliers. New entrants face a significant hurdle, struggling to match these cost advantages and spread their fixed operational costs across a comparable footprint. The sheer scale of incumbents creates a formidable barrier, making it difficult for smaller, newer players to compete effectively on pricing or profitability.

Established theater chains such as AMC Entertainment Holdings Inc. boast strong brand recognition and deeply ingrained customer loyalty, often reinforced through robust programs like AMC Stubs, which had over 32 million members as of early 2024. New entrants face a substantial barrier, needing to invest heavily in marketing and branding to merely begin building a competitive customer base. Overcoming this loyalty, cemented by years of consistent service and rewards, presents a formidable challenge for any potential new competitor. This high cost of customer acquisition significantly deters new players from entering the market.

Access to Film Distribution

New entrants face a significant hurdle in securing access to blockbuster content, as they would need to establish licensing agreements with major film studios. Established chains like AMC Entertainment Holdings, Inc. possess long-standing relationships and substantial negotiating power, making it difficult for an unproven player to secure favorable terms or even obtain desirable films. In 2024, major studios continue to prioritize established distribution channels for their high-grossing titles, further solidifying this barrier. This makes it challenging for any new entrant to compete effectively for market share.

- AMC's 2024 market share in North America remains dominant, around 20-25%.

- Major studios control over 80% of top-grossing films globally.

- New entrants lack the leverage for preferential film booking windows.

- Securing premium content is crucial, as top 10 films often account for over 30% of annual box office.

Technological and Experiential Barriers

New entrants into the cinema industry face high technological and experiential barriers. The sector increasingly focuses on premium formats such as IMAX and Dolby Cinema, which require significant capital investment and specialized partnerships. For instance, the global movie theater market, valued at approximately $45.6 billion in 2024, sees continued investment in these advanced technologies. A new player would struggle to replicate the established premium experience and scale necessary to compete with industry leaders like AMC.

- High cost of premium projection and sound systems.

- Need for specialized licensing and partnerships for formats like IMAX.

- Difficulty in quickly establishing a recognizable premium brand experience.

- Existing players hold advantageous real estate and distribution agreements.

The threat of new entrants for AMC remains low due to immense capital requirements, with a new cinema costing $5M-$20M in 2024. AMC's economies of scale, vast brand recognition with 32M AMC Stubs members, and strong studio content relationships, controlling over 20% of North American market share, form formidable barriers. New players struggle to match these advantages and secure crucial premium content, as major studios control over 80% of top-grossing films.

| Barrier Type | AMC Advantage (2024) | New Entrant Challenge |

|---|---|---|

| Capital Costs | Existing infrastructure | $5M-$20M per new cinema |

| Economies of Scale | 900 theaters, 10,000 screens | Cannot match volume discounts |

| Brand Loyalty | 32M AMC Stubs members | High customer acquisition cost |

| Content Access | Dominant 20-25% NA share | Lack of preferential film booking |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including industry-specific market research reports, company financial filings, and expert interviews. This blend of quantitative and qualitative information allows for a robust assessment of competitive intensity and strategic positioning.