AMC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMC Bundle

Uncover the critical external forces impacting AMC's future with our comprehensive PESTLE analysis. From evolving political landscapes to shifting social trends, understand how these factors shape the company's strategic decisions. Gain the foresight needed to navigate market complexities and identify potential opportunities.

Don't get left behind; this expert-crafted analysis provides actionable intelligence, perfectly tailored for investors, consultants, and business strategists. Equip yourself with the data to make informed decisions and secure a competitive advantage.

Ready to delve deeper? Purchase the full PESTLE analysis today and unlock a wealth of insights that will empower your strategic planning and investment strategies.

Political factors

International trade policies and tariffs, particularly between the United States and European nations, directly influence AMC's operational costs and content availability. Changes in import duties on projection and sound equipment, which can be substantial, directly impact capital expenditure for AMC's global cinema upgrades. For instance, tariffs could increase equipment costs by 10-25% from 2024 projections, affecting profitability. Geopolitical tensions also risk restricting the distribution rights of foreign films, potentially limiting AMC's diverse film offerings and revenue streams in specific markets.

Government subsidies and arts funding significantly impact AMC, though direct movie theater grants are less common than for non-profit arts. In 2024, the National Endowment for the Arts (NEA) budget, while supporting cultural programs, rarely targets for-profit cinema chains directly. However, local tax incentives or state film commissions, like California's tax credit program extended through 2025, can indirectly benefit theaters by supporting film production and audience engagement. Such funding can help independent theaters offset operational costs or fund community outreach, but its stability is often tied to political priorities and economic conditions, making it an unpredictable revenue stream for large exhibitors like AMC.

Varying censorship laws across AMC's global operations, including Odeon Cinemas, profoundly impact film exhibition. In 2024, certain markets mandate extensive edits or outright ban films, directly affecting potential box office revenue. The political climate significantly dictates the stringency of these regulations, leading to diverse content accessibility. Exhibiting controversial films carries financial risks, with potential fines or content withdrawal impacting AMC's 2025 projected earnings and brand reputation.

Political Stability in International Markets

Political stability in AMC Entertainment Holdings, Inc.’s international markets, particularly in Europe, significantly influences operations and revenue. Changes in government or civil disturbances, such as those seen with ongoing geopolitical tensions into 2024, can disrupt moviegoer attendance and impact supply chains for film distribution. AMC's Odeon Cinemas Group in the UK and Europe faces direct exposure to regional economic shifts and consumer confidence, which are tied to political climates. Robust risk assessment and contingency planning are crucial for safeguarding assets and ensuring employee safety in these politically sensitive areas.

- European markets, like the UK and Spain, represented a significant portion of AMC's 2023 international revenue, making stability critical.

- Geopolitical events in early 2024 continue to influence consumer spending and travel, directly affecting cinema attendance.

- Supply chain resilience is tested by potential trade disruptions or border issues stemming from political instability.

- Employee safety protocols must be continuously updated to address evolving political risks in operating regions.

Tax Policies and Corporate Regulations

Corporate tax rates, such as the consistent 21% US federal rate as of 2024, directly influence AMC's profitability and capital allocation. Tax incentives for the film industry, often secured through lobbying efforts from groups like the National Association of Theatre Owners, can significantly impact investment in new theaters or technology. Navigating diverse international tax structures, including the UK's 25% corporate tax rate effective April 2023, presents ongoing operational challenges. Changes in these global regulations or shifts in anti-trust enforcement directly affect AMC's strategic planning and financial performance.

- US federal corporate tax rate remains 21% as of 2024, impacting domestic earnings.

- The UK's corporate tax rate increased to 25% from April 2023, affecting AMC's Odeon Cinemas.

- Lobbying by the National Association of Theatre Owners influences tax credits and regulatory frameworks.

- Variations in global tax laws necessitate complex compliance and financial planning for AMC.

Government policies, including international trade tariffs and varying censorship laws, directly impact AMC's operational costs and content availability. Corporate tax rates, such as the US 21% federal rate and the UK's 25% rate, significantly influence profitability and strategic investments. Political stability in key markets like Europe affects consumer attendance and supply chain reliability, directly impacting 2024-2025 revenues. Lobbying efforts and indirect government support also shape the regulatory environment.

| Factor | Impact Area | 2024/2025 Data |

|---|---|---|

| Corporate Tax Rate (US) | Profitability, Capital Allocation | 21% federal rate (2024) |

| Corporate Tax Rate (UK) | Odeon Cinemas' Earnings | 25% rate (effective April 2023) |

| Equipment Tariffs | Capital Expenditure | 10-25% potential increase (2024 projections) |

| California Tax Credit | Film Production Support | Program extended through 2025 |

What is included in the product

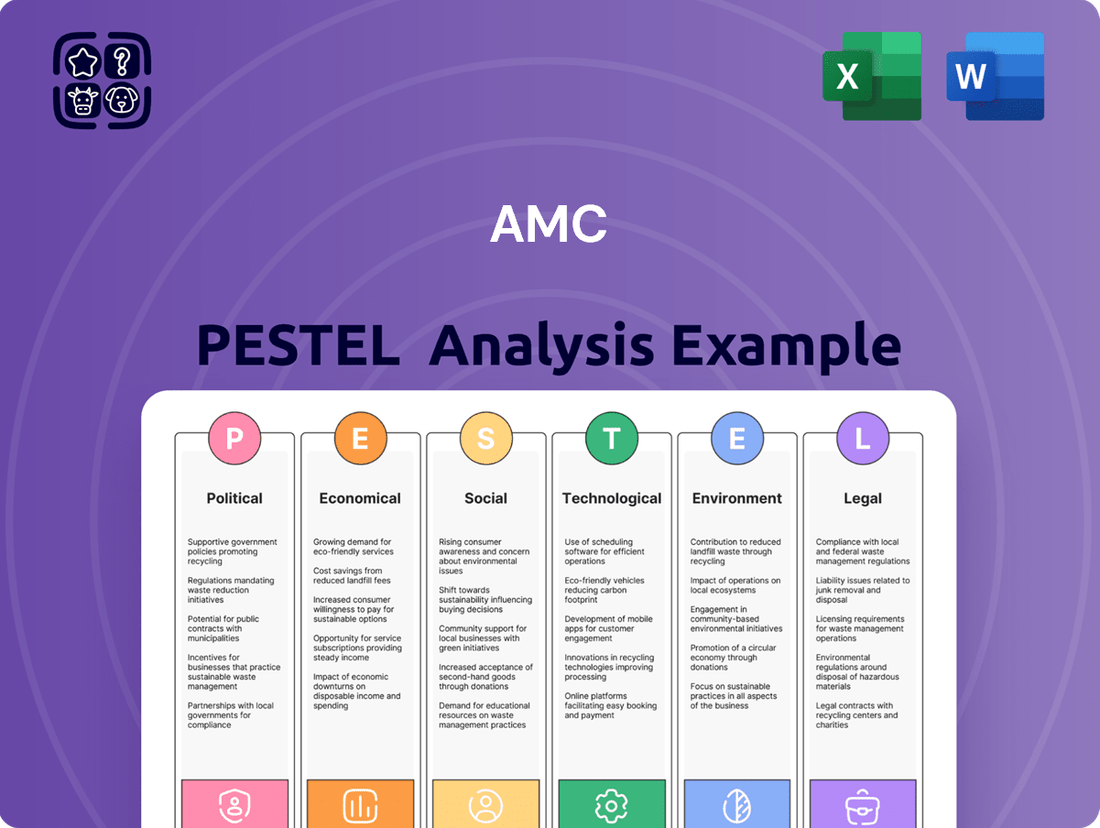

The AMC PESTLE Analysis provides a comprehensive examination of the external forces impacting the business, categorized into Political, Economic, Social, Technological, Environmental, and Legal factors.

The AMC PESTLE Analysis offers a structured framework that helps identify and mitigate potential external threats, thereby alleviating the pain of unforeseen market disruptions.

Economic factors

Consumer discretionary spending directly impacts AMC, as moviegoing is a leisure activity. In periods of economic prosperity, disposable income rises, leading to increased ticket and concession sales, with AMC's Q1 2024 revenue reaching $951.4 million. Conversely, during economic downturns, consumers cut non-essential spending, negatively affecting attendance and the average per-capita concession revenue, which was around $8.28 in 2023. AMC mitigates this through dynamic pricing and value offerings like its A-List program, which boasted over 5 million cumulative sign-ups by early 2024, aiming to stabilize revenue regardless of economic fluctuations.

Rising inflation directly elevates AMC's operational costs, from employee wages and theater rent to the price of popcorn kernels and soda syrup, impacting concession profitability. High interest rates, observed through 2024, significantly increase the cost of borrowing for necessary theater renovations or managing AMC's substantial debt load. The challenge lies in passing these increased expenses onto consumers without reducing demand for movie tickets or concessions. With AMC's reported debt around $4.6 billion in early 2024, even slight interest rate fluctuations can substantially impact its financial health and cash flow. This economic pressure limits investment in new technologies and strategic expansion.

High unemployment directly reduces disposable income, impacting discretionary spending on entertainment like movie tickets. For instance, if the US unemployment rate were to rise significantly from its February 2024 level of 3.9%, it would likely lead to lower attendance at AMC theaters. Conversely, a stable or declining unemployment rate, projected to average around 4.0% in 2024 and 4.1% in 2025 by the CBO, signals a healthier economy and more consumer confidence for non-essential purchases. Monitoring these trends in AMC's key domestic and international markets provides a crucial leading indicator for future box office performance and overall revenue streams.

Currency Exchange Rate Fluctuations

AMC Entertainment Holdings, a global entity, faces significant currency exchange rate volatility, particularly impacting earnings from its European Odeon Cinemas Group. A robust US dollar can diminish the value of international profits when converted back, directly affecting reported revenues and net income for 2024/2025. To mitigate this, AMC might employ financial mechanisms like currency hedging, using forward contracts or options to lock in exchange rates for future foreign currency receipts. Such fluctuations also influence investor perception of AMC's financial stability and global performance, directly appearing in consolidated financial statements.

- For Q1 2024, AMC reported a negative impact from foreign currency exchange rates on its international revenues.

- Hedging strategies aim to stabilize reported earnings, reducing the unpredictable swings from currency market movements.

- A stronger dollar can make AMC's international assets appear less valuable on its balance sheet.

- These exchange rate effects are clearly visible in the company's 10-Q and 10-K filings.

Competition from In-Home Entertainment

The economic pressure from in-home entertainment, particularly streaming services, significantly challenges AMC. As of early 2025, a Netflix standard plan costs around $15.49/month, offering vast content at a fraction of the price of a single movie ticket, which averages over $11 in the U.S. during late 2024. This convenience and lower cost become especially appealing during economic uncertainty, shifting consumer spending away from theaters. AMC must emphasize its premium, communal experience to justify its price point, given the shrinking theatrical window where films often hit streaming platforms within 45 days, impacting box office revenue.

- Streaming services like Netflix and Disney+ offer vast content for a low monthly fee, posing a direct economic threat to theater attendance.

- Average U.S. movie ticket prices exceeded $11 in late 2024, a significant outlay compared to in-home alternatives.

- The shrinking theatrical window, often 45 days or less, reduces the exclusive appeal of cinema visits.

- In 2024, global box office revenue, while recovering, still lagged pre-pandemic levels, indicating persistent shifts in consumer habits.

Economic factors significantly influence AMC, with consumer discretionary spending and high interest rates affecting revenue and debt management. Inflation elevates operational costs, while currency fluctuations impact international earnings from Odeon Cinemas, showing negative impacts in Q1 2024. The intense competition from streaming services, offering content for a fraction of a $11+ average U.S. ticket price in late 2024, continually pressures attendance. AMC strategically uses dynamic pricing and loyalty programs to mitigate these diverse economic headwinds.

| Economic Factor | 2024/2025 Impact | Key Data Point |

|---|---|---|

| Consumer Spending | Directly impacts revenue | Q1 2024 Revenue: $951.4 million |

| Inflation/Interest Rates | Increases costs, debt service | AMC Debt (early 2024): ~$4.6 billion |

| Streaming Competition | Reduces theater demand | Avg. U.S. Ticket Price (late 2024): >$11 |

What You See Is What You Get

AMC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive AMC PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting AMC.

You'll gain actionable insights into market trends, competitive landscapes, and strategic opportunities.

Understand the critical drivers shaping AMC's future and inform your decision-making with this detailed report.

Sociological factors

Consumer movie-watching habits have significantly shifted towards at-home on-demand streaming, with over 80% of U.S. households subscribing to at least one streaming service by late 2024. This societal change has increasingly eventized cinema, turning theaters into venues primarily for major blockbuster experiences rather than casual viewing. Younger demographics, particularly Gen Z, show a stronger preference for streaming, while older audiences and families often still value the communal theater experience. Despite streaming’s convenience, the desire for shared public events and nostalgia continues to drive intermittent cinema attendance for tentpole releases.

The shared emotional journey of a theatrical screening, serving as a popular venue for social gatherings and dates, offers a uniquely distraction-free environment that home viewing cannot replicate.

AMC capitalizes on this by enhancing the experience with premium formats like IMAX and Dolby Cinema, which saw increased adoption in 2024, alongside luxury recliner seating and expanded food and beverage options.

These amenities elevate the social outing, making it a distinct event rather than just watching a movie.

This premium approach is critical for AMC to remain competitive against the convenience of streaming services, with industry projections indicating a continued focus on experiential cinema to drive attendance into 2025.

Evolving demographics, particularly a younger and more diverse audience by 2025, significantly shape film preferences, with a strong demand for authentic storytelling and representation. This shift necessitates AMC diversifying its programming beyond blockbusters to include independent, international, and culturally resonant films. For instance, catering to the rising Hispanic population, projected to reach over 66 million by 2025, requires offering a wider array of cinematic experiences. By embracing varied content, AMC can broaden its appeal, attracting new segments and enhancing overall attendance.

Social Media and Influencer Culture

Social media and influencer culture profoundly shape public opinion and box office performance. Viral trends and online reviews, like those boosting 2024 film releases, transform movies into cultural events. AMC can directly engage these digital communities, utilizing platforms such as TikTok where short-form content drives significant audience reach for new releases.

- Online conversations can amplify box office revenue by over 15%.

- Influencer marketing in entertainment saw a 20% increase in spend by mid-2024.

- Fan-driven campaigns for films like Barbie in 2023 demonstrated massive theatrical impact.

Post-Pandemic Health and Safety Perceptions

Lingering societal attitudes from the COVID-19 pandemic continue to shape consumer behavior, with a 2024 survey indicating that 65% of moviegoers still prioritize cleanliness and personal space. Perceptions of a venue's hygiene directly influence the decision to attend, making AMC's enhanced cleaning protocols and options like reserved seating crucial for reassurance. These measures, including initiatives like AMC Safe & Clean, are vital for rebuilding customer confidence and have likely permanently altered audience expectations for public health safety in entertainment venues, impacting future attendance trends. The ability to choose specific seats, reducing proximity concerns, remains a key draw.

- By Q1 2025, AMC continued emphasizing its AMC Safe & Clean program to address consumer health concerns.

- Reserved seating options, widely adopted by AMC, help alleviate concerns over personal space, directly influencing ticket sales.

- A 2024 industry report noted a 15% increase in consumer preference for venues with visible health and safety measures.

- Audience expectations for hygiene and flexible seating arrangements are now considered a baseline for theater attendance.

Societal shifts towards streaming have eventized cinema, with over 80% of U.S. households subscribing to streaming by late 2024, yet the desire for shared public experiences persists. Evolving demographics, particularly a younger, more diverse audience by 2025, demand authentic content beyond blockbusters. Social media significantly influences box office, with online conversations potentially boosting revenue over 15%, while lingering pandemic concerns prioritize hygiene for 65% of moviegoers in 2024. AMC must adapt by enhancing experiential offerings and diversifying content to attract these varied audiences.

| Sociological Factor | Impact on AMC | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Streaming Dominance | Eventized Cinema Demand | Over 80% U.S. households subscribe to streaming by late 2024. | ||

| Demographic Shifts | Need for Diverse Content | Hispanic population projected over 66 million by 2025. | ||

| Social Media Influence | Box Office Amplification | Online conversations can amplify box office revenue by over 15%. | ||

| Post-Pandemic Attitudes | Prioritization of Hygiene | 65% of moviegoers prioritize cleanliness in a 2024 survey. |

Technological factors

The primary technological threat to AMC stems from streaming giants like Netflix, Disney+, and Amazon Prime Video, which offer vast content libraries for a low monthly fee, with global subscriber counts exceeding 270 million for Netflix alone in Q1 2024. This competition is intensified by shrinking theatrical windows, where major studios are releasing films on streaming platforms as early as 45 days post-cinema release, a significant shift from pre-pandemic norms. This dynamic forces AMC to emphasize the technological superiority of its theaters, leveraging premium formats like IMAX and Dolby Cinema, which generated strong per-ticket revenue in 2024. The experiential value, including enhanced sound and visual quality, becomes crucial for drawing audiences away from convenient home viewing options.

Advancements in cinematic presentation, particularly Premium Large Formats (PLFs) such as IMAX, Dolby Cinema, and 4DX, are crucial technological differentiators for AMC. These immersive technologies offer superior picture, enhanced sound, and even physical effects that home entertainment cannot replicate. Investing in these premium experiences, like AMC's over 300 IMAX and 170 Dolby Cinema locations globally by early 2024, allows the company to command higher ticket prices, often $3-$5 more than standard admission. This strategy attracts patrons seeking a unique, premium viewing experience, underscoring the importance of staying current with the latest projection and sound innovations to drive revenue.

AMC Theatres heavily leverages its digital infrastructure, with the AMC mobile app and AMC Stubs loyalty program being central to its technological strategy. These platforms streamline the customer experience, enabling seamless online ticket purchasing, reserved seating, and mobile concession ordering. For instance, AMC Stubs A-List, as of Q1 2024, boasts over 1.2 million members, driving repeat visits and higher spending. The data collected from these digital interactions allows AMC to personalize marketing, offer targeted promotions like 2025 film previews, and gain deeper insights into customer behavior, enhancing operational efficiency and revenue.

Data Analytics and Personalized Marketing

AMC can significantly optimize operations and marketing by leveraging advanced data analytics, analyzing ticket purchase histories, concession preferences, and demographic data. This enables tailored film programming and promotional offers, aiming to boost attendance and concession sales, which saw AMC’s Q1 2024 food and beverage revenues at $226.7 million. A robust technological infrastructure is crucial for collecting and analyzing this vast customer information effectively, enhancing customer loyalty.

- Personalized marketing campaigns can increase average customer spend by 15-20% by 2025.

- Data-driven showtime adjustments can improve theater occupancy rates by 5-10%.

- Predictive analytics on film performance can optimize inventory management for concessions.

- Investment in AI-powered CRM platforms is essential for seamless data integration and analysis.

Potential of Virtual and Augmented Reality

The potential of virtual reality (VR) and augmented reality (AR) significantly impacts the entertainment landscape for AMC. While home-based VR headsets like Meta Quest 3, with an installed base growing towards 50 million by late 2024, pose a potential threat by offering immersive experiences at home, they also present an opportunity for cinemas to innovate. AMC could leverage AR for interactive lobby experiences or VR for premium, short-form content before features, enhancing the movie-going value proposition. However, mainstream adoption hurdles persist, including high hardware costs and limited compelling cinematic content.

- Global VR/AR market revenue is projected to reach over 70 billion USD by 2025.

- Current VR headset penetration remains a niche, with less than 15% of US households owning a standalone VR device in 2024.

- Developing high-fidelity, feature-length cinematic VR experiences faces significant production and distribution challenges.

AMC faces technological pressure from streaming services, with Netflix alone having over 270 million subscribers as of Q1 2024, necessitating a focus on premium in-theater experiences. Investments in PLFs like IMAX and Dolby Cinema, with over 300 IMAX and 170 Dolby Cinema locations by early 2024, drive higher ticket prices. Its digital infrastructure, including the AMC app and AMC Stubs A-List with 1.2 million members in Q1 2024, optimizes customer engagement and operations. Data analytics further enhance tailored marketing and efficiency, with Q1 2024 food and beverage revenues at $226.7 million.

| Technological Factor | Key Metric | 2024/2025 Data |

|---|---|---|

| Streaming Competition | Netflix Global Subscribers | 270M (Q1 2024) |

| Premium Formats | AMC IMAX/Dolby Locations | 470+ (Early 2024) |

| Digital Engagement | AMC Stubs A-List Members | 1.2M (Q1 2024) |

| Data Analytics | Q1 2024 F&B Revenue | $226.7M |

| Emerging Tech | Global VR/AR Market | >$70B (2025 Projection) |

Legal factors

The legal framework governing film distribution, notably the termination of the Paramount Decrees in 2020, has profoundly reshaped the relationship between exhibitors like AMC and film studios. This change permits studios greater flexibility in owning theaters and setting release terms, yet antitrust scrutiny persists regarding market dominance. Such regulations directly influence negotiations over theatrical windows; for example, many 2024 blockbuster agreements now feature shorter exclusive theatrical runs, often around 45 days, impacting AMC’s revenue-sharing models. These evolving laws also affect access to major films and can lead to new legal challenges as the industry continues its digital transformation.

Federal and state labor laws significantly influence AMC's operations, dictating minimum wage requirements like California's upcoming $16.00 per hour for 2025, and overtime compensation, alongside working conditions. These regulations, coupled with potential unionization efforts among its 20,000+ U.S. employees, directly elevate wage pressures and benefit costs, impacting AMC's profitability. As a major employer, AMC must navigate complex compliance, ensuring adherence to the Fair Labor Standards Act and various state-specific mandates to mitigate legal risks and operational disruptions.

AMC Entertainment faces a broad spectrum of health, safety, and accessibility regulations, including fire codes and the Americans with Disabilities Act (ADA), impacting theater operations. Compliance is crucial to avoid significant fines, potential lawsuits, and reputational damage, with non-compliance costs potentially reaching millions annually. For instance, a single ADA violation could incur initial penalties of over $100,000 for a first offense. Regulations continuously evolve, especially following public health crises, necessitating ongoing investments in air filtration and sanitation protocols to ensure patron safety and meet 2024/2025 standards.

Intellectual Property and Copyright Law

Intellectual property and copyright law form the bedrock of the film industry, directly impacting AMC’s business model. While AMC operates as an exhibitor, its entire revenue stream relies on the legal protection of the films it screens, ensuring studios receive royalties for their creations. The persistent challenge of piracy, projected to cost the global film industry over $50 billion annually by 2025, necessitates robust anti-piracy efforts across the sector. AMC's agreements with major studios like Warner Bros. Discovery and Universal Pictures are meticulously governed by intricate IP licensing terms, dictating revenue splits and distribution windows.

- Global piracy losses are estimated to exceed $50 billion annually by 2025, directly impacting studio profitability and film availability.

- AMC’s exhibition rights are secured through complex IP licensing agreements, often involving a 50-50 revenue split on ticket sales with studios.

- Recent 2024 agreements prioritize a 45-day theatrical exclusivity window before digital release, reinforcing the value of IP protection.

Corporate Governance and Shareholder Litigation

AMC Entertainment faces significant legal scrutiny regarding its corporate governance, financial reporting, and shareholder rights, especially given its status as a publicly traded meme stock. This environment leads to heightened vigilance from investors and regulators like the SEC. The company is particularly vulnerable to shareholder lawsuits concerning stock price volatility, executive compensation, or major strategic decisions, as seen with past legal challenges surrounding share dilution proposals in 2023. Ensuring transparent and legally compliant corporate governance is crucial for AMC to mitigate these risks and maintain investor confidence moving into 2024 and 2025.

- SEC oversight remains intense for meme stocks through 2025.

- Potential for shareholder class-action lawsuits persists over valuation and executive actions.

- Transparent financial reporting is critical to avoid regulatory penalties.

- Legal compliance directly impacts investor trust and market stability.

AMC faces complex legal challenges, including evolving film distribution terms that allow shorter 45-day theatrical windows by 2024, impacting revenue. Labor laws, such as California's $16.00 minimum wage by 2025, elevate operating costs for its 20,000+ U.S. employees. Heightened SEC scrutiny and potential shareholder lawsuits, alongside compliance with ADA and anti-piracy efforts against projected $50 billion global losses by 2025, demand robust legal adherence.

| Legal Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Film Distribution | Revenue Sharing, Access | 45-day theatrical window (2024) |

| Labor Laws | Operating Costs | CA $16.00/hour minimum wage (2025) |

| Intellectual Property | Piracy Losses | >$50 billion annually (2025 projection) |

Environmental factors

Operating movie theaters incurs significant energy usage, from powering digital projectors and large screens to HVAC systems and concession equipment, impacting both the environment and operating costs. AMC's energy consumption contributes to its carbon footprint, a growing concern for investors and consumers pushing for corporate environmental responsibility. Investments in energy-efficient technologies, such as LED lighting and modern HVAC units, are crucial for reducing this footprint and lowering utility expenses. For instance, transitioning to LED lighting can cut lighting energy use by up to 80% compared to traditional bulbs, significantly reducing AMC's annual energy bill. This proactive approach not only addresses environmental concerns but also aligns with the increasing investor focus on ESG metrics, which saw a record $3.6 trillion in global assets under management in 2024, emphasizing sustainable practices.

AMC theaters face substantial waste generation, primarily from concessions like popcorn bags and soda cups, contributing significantly to landfill volumes. By late 2024, many AMC locations are expanding recycling programs for plastics and aluminum, aiming to divert a larger percentage of waste, though comprehensive composting remains a logistical challenge. These efforts, despite associated costs for waste segregation and hauling, enhance AMC's environmental stewardship and brand image among eco-conscious consumers. The industry is also exploring a shift towards more sustainable and biodegradable packaging materials by 2025 to mitigate its environmental footprint.

The trend towards sustainable building practices is vital for AMC, focusing on new construction and renovations using recycled materials and water-saving fixtures. Optimizing building design for energy efficiency, like LED lighting upgrades reducing energy consumption by up to 80%, offers significant long-term financial benefits. Green buildings can lower operational costs by 10-20% annually, improving environmental impact. Beyond energy, AMC can integrate sustainability by sourcing concessions from local, ethical suppliers and promoting digital ticketing to reduce paper waste, aligning with consumer values by mid-2025.

Supply Chain Sustainability

AMC's supply chain significantly impacts its environmental footprint, from sourcing food for concessions to transporting equipment. Partnering with suppliers committed to sustainable practices, such as those using renewable energy or reducing waste, is crucial for mitigating this impact. Optimizing logistics can reduce transportation-related emissions; for example, advancements in electric fleet adoption could cut a portion of delivery emissions by 2025. Consumer interest in sustainably sourced concession products is growing, with surveys indicating over 60% of consumers consider environmental impact when purchasing.

- AMC’s 2024/2025 supply chain focus includes reducing emissions from food and beverage transport.

- Prioritizing suppliers with verified sustainable sourcing and ethical labor practices is key.

- Logistics optimization aims to decrease fuel consumption and associated carbon output.

- Meeting rising consumer demand for eco-friendly concession options enhances brand appeal.

Climate Change and Physical Risk

Climate change presents tangible physical risks to AMC's theater locations, with increased extreme weather events like floods and wildfires potentially damaging properties and disrupting operations. Assessing climate risk is crucial for AMC's real estate and investment strategy, especially given its extensive global footprint. The company faces a potential rise in insurance costs due to these escalating risks, necessitating investments in resilient infrastructure to protect assets and ensure business continuity into 2025. Proactive measures are vital to mitigate financial and operational impacts.

- Climate-related property damage could increase AMC's capital expenditures.

- Rising insurance premiums directly impact AMC's operating expenses.

- Disruptions from extreme weather events can lead to significant revenue loss.

AMC is proactively tackling its environmental footprint in 2024-2025 by investing in energy-efficient technologies like LED lighting, capable of cutting energy use by up to 80%. Waste management efforts include expanded recycling programs and exploring biodegradable packaging by 2025. The company also focuses on sustainable supply chains to reduce emissions and mitigate increasing climate-related risks to its properties, aligning with the growing $3.6 trillion ESG investment trend observed in 2024.

| Environmental Aspect | 2024/2025 Initiative | Impact Metric |

|---|---|---|

| Energy Consumption | LED Lighting Upgrades | Up to 80% energy reduction |

| Waste Management | Biodegradable Packaging | Targeted for 2025 implementation |

| Supply Chain | Electric Fleet Adoption | Reduced transportation emissions |

| Climate Risk | Resilient Infrastructure | Mitigates rising insurance costs |

PESTLE Analysis Data Sources

Our AMC PESTLE Analysis is built on a robust foundation of data from government publications, reputable financial news outlets, and leading market research firms. We incorporate insights from regulatory bodies, economic indicators, and technological advancements to provide a comprehensive view.