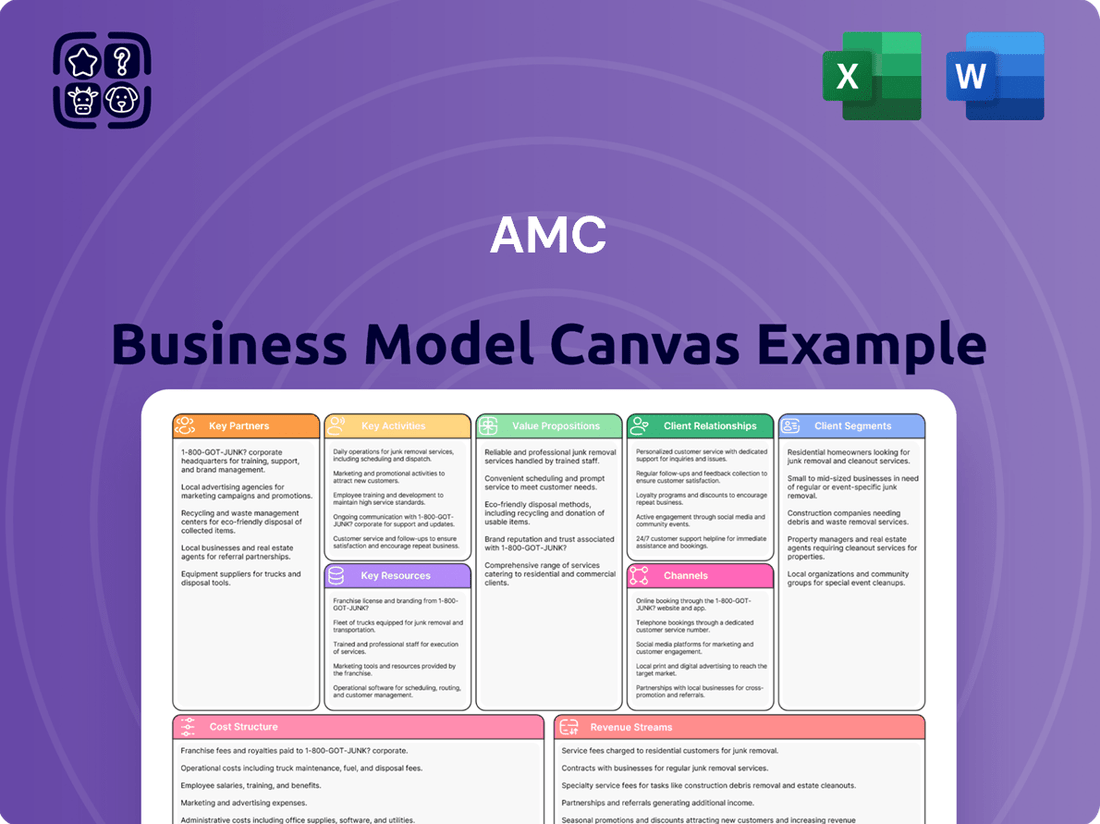

AMC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMC Bundle

Unlock the full strategic blueprint behind AMC's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into AMC’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how AMC operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out AMC’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in AMC’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

AMC Entertainment’s most vital non-customer relationships are with major film studios, including Disney, Warner Bros., Universal, and Paramount. These partnerships are foundational, directly supplying the core product—the movies—that fill AMC’s theaters. The negotiation of film licensing fees and exhibition windows is a continuous, critical activity that profoundly impacts AMC’s profitability. For instance, in 2024, the continued importance of exclusive theatrical windows for blockbusters like those from Warner Bros. Discovery remains a key revenue driver for exhibitors like AMC.

Partnerships with leading premium format technology providers like IMAX and Dolby are fundamental to AMC's value proposition. These collaborations allow AMC to offer an unparalleled, high-fidelity audio and visual experience, commanding higher ticket prices. As of early 2024, AMC operated over 400 IMAX screens and more than 150 Dolby Cinema locations, which are crucial for differentiating the immersive in-theater experience from at-home streaming. This strategic focus on premium formats continues to be a key driver for enhanced per-patron revenue.

High-margin concession sales are a crucial revenue stream for AMC, underpinning profitability. Partnerships with major suppliers like The Coca-Cola Company and other leading snack manufacturers are vital for this segment. These relationships ensure a consistent and diverse supply of popular food and beverage items across all locations. For instance, AMC reported an average food and beverage revenue per patron of $7.94 in Q1 2024, demonstrating the segment's ongoing significance. Strategic supplier agreements often include co-marketing efforts and promotional pricing, further enhancing revenue streams and customer appeal.

Real Estate Developers & Landlords

AMC's extensive physical footprint, crucial for its core business, relies heavily on strong partnerships with commercial real estate developers and property management firms. These relationships are vital for securing prime locations within high-traffic shopping centers and entertainment districts, ensuring accessibility for moviegoers. Favorable lease terms, including rent abatements or renegotiations, are critical for long-term viability and strategic expansion, especially given AMC's substantial operating lease liabilities, which were a significant figure as of early 2024. Collaborative development initiatives further enable the modernization and growth of their approximately 900 theaters globally.

- AMC operates roughly 900 theaters globally as of early 2024.

- Securing prime locations in high-traffic retail areas is paramount.

- Favorable lease terms directly impact profitability and expansion.

- Partnerships facilitate new theater development and existing site upgrades.

Third-Party Ticketing Platforms

AMC Entertainment partners with major third-party ticketing platforms like Fandango and Atom Tickets to significantly broaden its sales channels. These collaborations enhance customer convenience by offering diverse purchasing options beyond AMC's direct website and app. This strategy expands market reach, tapping into the platforms' extensive user bases and driving a crucial part of AMC's digital-first customer acquisition efforts in 2024. Such partnerships are vital as a substantial portion of movie tickets are now purchased digitally.

- Fandango, a leading online ticketing service, processes a significant volume of digital movie ticket sales.

- Atom Tickets facilitates mobile-first ticket purchases, appealing to a younger, tech-savvy demographic.

- These platforms collectively extend AMC's presence to millions of potential customers daily.

- By leveraging these partnerships, AMC ensures its inventory is accessible across the most popular digital gateways.

AMC also forms crucial alliances with financial institutions and loyalty program providers to enhance customer value and engagement. These partnerships often involve co-branded credit cards or exclusive discounts, driving repeat patronage and increasing average spend. For instance, such collaborations help capture valuable customer data, allowing for targeted marketing efforts. This strategy directly supports customer retention and revenue growth in 2024.

| Partner Type | Strategic Benefit | 2024 Impact |

|---|---|---|

| Financial Institutions | Enhanced customer loyalty via co-branded cards | Drives repeat visits, increases payment flexibility |

| Loyalty Program Providers | Improved customer engagement and data insights | Personalized offers, higher average transaction value |

| Payment Processors | Streamlined transactions, reduced friction | Efficient operations, secure payment environment |

What is included in the product

A structured framework detailing AMC's approach to customer acquisition, value delivery, and revenue generation through its cinema and entertainment offerings.

It outlines key partnerships, resources, and cost structures essential for maintaining its market position and driving future growth.

Streamlines complex business strategy into a visually organized, one-page framework.

Facilitates clear communication and alignment by making intricate business models easily understandable.

Activities

Film programming and exhibition is AMC's core operational activity, meticulously selecting, scheduling, and projecting films across its thousands of screens. This requires sophisticated analysis to match content with local demographic preferences, optimizing showtimes to maximize attendance. For instance, in 2024, AMC continues to leverage data analytics to tailor film lineups across its approximately 900 locations globally, ensuring popular releases like Dune: Part Two or upcoming blockbusters are strategically placed. This activity directly ties content acquisition to revenue generation, optimizing capacity utilization and ticket sales.

Theater operations involve maintaining clean, safe facilities and managing staff efficiently to ensure a positive customer experience. This includes the technical operation of projection and sound equipment, crucial for delivering premium formats like Dolby Cinema, which saw continued expansion in 2024. High levels of customer service are paramount, driving repeat visits and leveraging programs like AMC Stubs, which boasted over 30 million members by early 2024, to enhance loyalty.

Concession and food service management is a highly profitable activity for AMC, encompassing the entire supply chain from procurement to sales. This includes managing inventory, pricing, and the operation of expanded offerings like Dine-In theaters and MacGuffins bars. In 2023, AMC reported food and beverage revenue per patron of $7.67, significantly contributing to overall profitability. Optimizing these sales, which typically boast higher margins than ticket sales, remains critical for bolstering the company's financial performance. This strategic focus enhances the customer experience and drives revenue growth.

Marketing & Loyalty Program Management

AMC's marketing efforts focus on promoting upcoming films and special events across diverse channels, including digital platforms and in-theater promotions. A cornerstone is managing the AMC Stubs loyalty program, which, as of 2024, includes over 30 million members across all tiers, significantly driving customer retention. The AMC Stubs A-List subscription, a key component, enables members to see up to three movies per week, contributing to repeat visits and predictable revenue streams. This program also gathers crucial customer data, enabling highly personalized marketing campaigns to enhance engagement and ticket sales.

- Promoting films and events via digital and in-theater channels.

- Managing AMC Stubs, with over 30 million members as of 2024.

- Utilizing AMC Stubs A-List for recurring revenue and customer loyalty.

- Leveraging customer data for personalized marketing strategies.

Technology & Amenity Upgrades

AMC's Technology & Amenity Upgrades focus on capital investment for theater modernization, significantly enhancing the customer value proposition. This includes installing premium recliner seating, which by early 2024, was present in a substantial portion of their US circuit, driving attendance. Upgrades to laser projection systems like IMAX and Dolby Cinema are crucial, with AMC continuing to expand these premium formats. Improving digital channels, such as the AMC mobile app, also remains a key activity, optimizing ticket purchases and loyalty program engagement.

- By Q1 2024, AMC reported over 400 US locations with recliner seating.

- Over 200 AMC US locations feature Dolby Cinema, and more than 150 offer IMAX with Laser.

- Digital channels, including the AMC app, facilitate over 70% of ticket sales.

- Capital expenditures for such upgrades are a continuous investment to maintain competitive advantage.

AMC's core activities center on film programming and exhibition, leveraging data to optimize content across its global circuit. Efficient theater and concession operations ensure a premium customer experience, with food and beverage sales significantly boosting profitability. Strategic marketing efforts, including the AMC Stubs loyalty program with over 30 million members in 2024, drive repeat visits and predictable revenue streams. Continuous technology and amenity upgrades, such as recliner seating and premium formats like Dolby Cinema, enhance the value proposition.

| Activity Area | Key Metric (2024) | Impact |

|---|---|---|

| Film Exhibition | ~900 Global Locations | Maximizes audience reach |

| Concessions | $7.67 Food & Bev per patron (2023) | High-margin revenue driver |

| Customer Loyalty | 30M+ AMC Stubs Members | Drives repeat visits, retention |

| Theater Upgrades | 400+ US Recliner Locations | Enhances customer experience |

What You See Is What You Get

Business Model Canvas

This preview showcases the actual AMC Business Model Canvas you will receive upon purchase. It's a direct reflection of the complete, professionally formatted document, ensuring no surprises. You'll get this exact file, ready for immediate use, allowing you to efficiently map out your business strategy.

Resources

AMC Entertainment’s primary asset is its extensive network of owned and leased movie theaters, strategically located in prime domestic and international markets. This vast physical infrastructure, comprising 923 theaters and 10,320 screens globally as of early 2024, establishes a significant barrier to entry for potential competitors. The quality, prime locations, and sheer scale of this network are fundamental to AMC's business model, underpinning its revenue streams from ticket sales and concessions. This widespread presence, including 584 U.S. theaters, remains critical for market reach and operational efficiency.

The AMC Stubs loyalty program, with its database of tens of millions of members, is a critical intangible asset for AMC Entertainment. This extensive network provides a direct channel for communication and highly targeted marketing efforts, significantly fostering customer retention. The invaluable data collected on specific movie-going habits is essential for optimizing programming decisions. This insight further enables the personalization of offers, enhancing the overall experience and driving repeat visits into 2024.

As the world's largest movie theater chain, AMC Entertainment Holdings, Inc. holds significant brand recognition and market leadership. This robust brand, which oversees operations across over 900 locations globally in 2024, is a vital intangible asset. It empowers AMC in negotiations with film studios and other partners, attracting a broad customer base. This strong presence fosters trust and loyalty among moviegoers, solidifying its industry standing.

Proprietary Digital Platforms

AMC's proprietary digital platforms, including their website and mobile app, are essential for the modern customer journey. These platforms facilitate a substantial portion of ticket and concession sales, managing millions of AMC Stubs loyalty accounts. Their functionality and user experience are paramount for customer convenience and direct sales, serving as a primary marketing channel for new releases and promotions.

- The AMC Theatres app consistently ranks among the top entertainment apps, crucial for mobile ticket purchases.

- Digital channels account for a significant percentage of AMC's total ticket sales, exceeding 60% in certain periods of 2024.

- AMC Stubs loyalty program, managed through these platforms, boasts over 30 million members as of early 2024.

- These platforms are vital for promoting exclusive content and AMC's premium formats like Dolby Cinema.

Partnership Agreements & Supplier Contracts

Legal agreements with major film studios, technology providers like IMAX and Dolby, and key food and beverage suppliers are essential for AMC. These contracts ensure a steady supply of new movie content, premium viewing experiences, and popular concessions, which collectively form the core of AMC's offerings. Favorable terms within these partnership agreements are critical, directly impacting AMC's profitability and competitive edge, especially as industry dynamics shift in 2024.

- AMC's 2024 film slate relies heavily on agreements securing titles like Disney's Mufasa: The Lion King and Universal's Wicked.

- Technology partnerships, such as those with IMAX and Dolby, enhance the premium movie-going experience, contributing to higher ticket prices.

- Concession supplier contracts, vital for AMC's high-margin food and beverage sales, are renegotiated regularly to optimize costs and product variety.

- These strategic alliances are fundamental to maintaining AMC's market position and driving revenue streams in the evolving entertainment landscape.

AMC's core resources include its vast network of 923 global theaters with 10,320 screens as of early 2024. The AMC Stubs loyalty program, boasting over 30 million members, and proprietary digital platforms facilitate over 60% of ticket sales in certain 2024 periods. Strong brand recognition and strategic agreements with major film studios, like securing 2024 titles, are also critical assets. These partnerships ensure a steady stream of content and enhance premium viewing experiences.

Value Propositions

AMC provides an unmatched cinematic journey, leveraging expansive screens and cutting-edge sound systems that cannot be replicated in a home setting. This premium experience is significantly amplified through proprietary formats like Dolby Cinema and IMAX, which commanded higher average ticket prices in 2024. The fundamental value delivered is the most impactful and immersive way for audiences to engage with a film. As of early 2024, AMC continued to highlight the strong performance of its PLF screens, underscoring their importance to overall revenue.

AMC enhances the movie-going experience by focusing on customer comfort and convenience. Patrons enjoy amenities like plush power recliners and reserved seating, a feature widely adopted across AMC's over 500 locations in 2024. The AMC mobile app further streamlines the process, allowing for easy mobile ticketing and pre-ordering concessions, significantly reducing wait times. This focus on modern amenities aims to create a seamless and enjoyable visit, differentiating AMC in the entertainment market.

AMC provides significant value through its competitive pricing strategies, including popular discount programs like Discount Tuesdays, where tickets are often priced around $5 to $7 in 2024. The AMC Stubs A-List subscription further enhances this, allowing members to see up to three movies weekly for a flat monthly fee, typically ranging from $19.95 to $24.95 in 2024. This model offers frequent moviegoers substantial savings, fostering strong customer loyalty. It effectively appeals to price-conscious consumers seeking affordable entertainment options.

A Destination for Social Gatherings

AMC theaters serve as a vital third place for social interaction, offering a shared communal experience distinct from isolated at-home streaming. In 2024, cinema continues to provide a dedicated venue for friends, family, and date nights, fostering connection and collective enjoyment. This social utility remains a strong draw, evident as AMC reported attendance of 152 million guests in 2023, highlighting the ongoing demand for out-of-home entertainment. The unique atmosphere of a movie theater, with its large screens and immersive sound, creates a memorable outing that streaming services cannot replicate.

- AMC facilitates social outings, acting as a third place for communal entertainment.

- The shared experience differentiates theaters from individual at-home streaming.

- In 2024, theaters remain a prime destination for friends, family, and date nights.

- AMC reported 152 million guests in 2023, underscoring the demand for social cinema experiences.

Diverse Content & Event Programming

AMC expands its appeal beyond mainstream blockbusters by offering diverse content, including independent films and special event programming. In 2024, this strategy includes a continued focus on concert films, building on the success of prior releases that attracted millions of viewers. This broadens the customer base and positions AMC as a versatile entertainment hub for various audiences, from film enthusiasts to music fans.

- Expanded offerings beyond Hollywood blockbusters.

- Includes independent cinema and special event screenings.

- Concert films, like those in early 2024, attract new demographics.

- Positions AMC as a comprehensive entertainment destination.

AMC offers a premium, immersive cinematic experience through large screens and proprietary formats like Dolby Cinema, which drove higher average ticket prices in 2024. This is complemented by enhanced comfort amenities such as power recliners and convenient mobile app features, streamlining the visit for over 500 locations in 2024. Value is further amplified by competitive pricing, including Discount Tuesdays and the AMC Stubs A-List, appealing to 152 million guests in 2023. Additionally, AMC provides diverse content, including concert films in 2024, fostering social connection as a vital third place for entertainment.

| Value Dimension | 2024 Key Offering | 2024 Impact/Metric |

|---|---|---|

| Immersive Experience | Dolby Cinema, IMAX, PLF screens | Higher average ticket prices |

| Comfort & Convenience | Power recliners, Mobile app | Available at over 500 locations |

| Affordability & Loyalty | Discount Tuesdays, A-List | Tickets $5-$7; 152M guests (2023) |

Customer Relationships

The AMC Stubs loyalty and subscription program, encompassing Insider, Premiere, and A-List tiers, is AMC's core strategy for cultivating lasting customer relationships. This tiered system offers members various rewards, discounts, and exclusive benefits, effectively driving repeat business and fostering a deep transactional and emotional bond with frequent moviegoers. By early 2024, the A-List subscription alone continued to boast over 1 million active members, underscoring its significant role in AMC's customer retention and revenue generation.

AMC cultivates strong customer relationships via its convenient digital channels, including its website and highly-rated mobile app. These platforms empower extensive self-service, allowing customers to easily purchase tickets and manage their A-List subscriptions. In 2024, the AMC Theatres app remained a primary touchpoint, facilitating millions of digital transactions monthly. This automated approach ensures a frictionless experience, granting customers control over their moviegoing journey.

AMC fosters customer relationships through direct engagement with its in-theater staff, including ticket takers and concession workers, ensuring a positive on-site experience. Friendly and helpful service from these frontline employees significantly enhances guest satisfaction, a key driver for repeat visits. Beyond the physical theater, a dedicated customer support team manages inquiries and resolves issues via online channels and phone. This multi-channel approach ensures comprehensive support, reflecting the continued importance of customer service for the company, which served millions of moviegoers globally in 2024.

Social Media & Community Engagement

AMC actively engages its vast customer base on social media platforms like X (formerly Twitter) and Instagram. This channel is crucial for marketing new releases and sharing company news, fostering a direct two-way conversation with the public. Such interaction builds a distinct brand personality and cultivates a strong sense of community among its followers.

In 2024, AMC's X account maintains over 1.8 million followers, while its Instagram audience exceeds 1.2 million, underscoring its broad digital reach.

- AMC's X (Twitter) account: Over 1.8M followers (2024).

- AMC's Instagram account: Over 1.2M followers (2024).

- Direct communication fosters brand loyalty.

- Utilized for marketing and real-time news dissemination.

Personalized Email & App Marketing

AMC leverages data from its extensive AMC Stubs program, which boasted over 1.2 million A-List members in Q1 2024, to foster ongoing customer relationships. This involves sending personalized emails and app notifications, tailoring content to individual viewing histories and preferences. Customers receive targeted movie recommendations, special offers, and exclusive member content, enhancing their sense of recognition and value.

- AMC Stubs A-List membership exceeded 1.2 million in Q1 2024, providing a vast data pool.

- Personalized communications drive engagement, with app notifications prompting revisits.

- Targeted offers, like discounted concessions, increase per-patron spending.

- Exclusive early access to tickets or screenings builds member loyalty and perceived value.

AMC cultivates customer relationships primarily through its AMC Stubs loyalty program, boasting over 1.2 million A-List members in Q1 2024. Digital channels and attentive in-theater staff ensure efficient service and positive experiences. Social media engagement, with 2024 figures showing over 1.8 million X followers and 1.2 million Instagram followers, builds community. Personalized data-driven communications further enhance customer value and encourage repeat patronage.

| Customer Relationship Aspect | Key Metric (2024) | Impact |

|---|---|---|

| AMC Stubs A-List Members | Over 1.2 million (Q1 2024) | Drives recurring revenue & loyalty |

| X (formerly Twitter) Followers | Over 1.8 million | Enhances brand reach & engagement |

| Instagram Followers | Over 1.2 million | Fosters community & marketing |

Channels

The vast network of physical movie theaters globally serves as AMC’s foundational channel, delivering its core value proposition. These locations are the primary points of sale for tickets and high-margin concessions like popcorn and drinks, crucial for revenue. As of early 2024, AMC operates approximately 936 theaters with 10,470 screens worldwide, making them the ultimate venue for the immersive cinematic experience. The entire business strategy is centered on attracting moviegoers to these physical spaces, where the magic happens and profits are generated.

The AMC Theatres website and mobile app serve as essential proprietary digital channels, directly engaging customers for information dissemination and marketing. These platforms are critical for selling tickets and concessions, directly contributing to revenue streams, and managing loyalty programs like AMC Stubs, which boasted over 30 million members as of early 2024. Controlling this direct-to-consumer journey enables AMC to capture valuable customer data, enhancing personalized offers and strategic decision-making.

AMC leverages third-party ticketing platforms like Fandango and Atom Tickets as crucial indirect sales channels. These partnerships significantly expand AMC's market reach, connecting with a broader audience of moviegoers who might not directly use the AMC app. This multi-channel strategy maximizes ticket accessibility and potential revenue, complementing direct sales. For instance, Fandango reported processing over 67 million tickets in 2023, showcasing the vast user base accessible through such integrations.

Email Marketing & Push Notifications

AMC leverages email marketing and push notifications as direct communication channels to engage its extensive customer base, especially its nearly 1.1 million AMC Stubs A-List members as of early 2024. These platforms are crucial for announcing new movie releases, promoting exclusive offers, and delivering personalized film recommendations directly to patrons. This strategy significantly drives repeat business, with loyalty program members often attending more movies annually. Maintaining strong customer relationships through these digital touchpoints is vital for sustained engagement and revenue growth.

- AMC Stubs A-List members represent a highly engaged segment, receiving tailored content.

- Direct notifications facilitate immediate awareness of new releases and special discounts.

- Personalized recommendations enhance the customer experience and drive ticket sales.

- This channel is pivotal for fostering loyalty and ensuring consistent patronage in 2024.

Corporate & Group Sales Teams

AMC Entertainment maintains dedicated Corporate & Group Sales Teams, serving as a crucial channel for business-to-business customers and large group bookings. This specialized team efficiently handles private theater rentals, corporate events, birthday parties, and school field trips, offering tailored experiences. By focusing on these specific offerings, AMC targets a distinct market segment beyond individual moviegoers, capturing demand for unique event spaces. This strategic approach significantly diversifies revenue streams, complementing general admissions and helping to stabilize overall financial performance, especially as corporate events and private gatherings rebound in 2024.

- Group sales represent a growing segment, contributing to non-admissions revenue which was approximately 35% of AMC's total revenue in recent periods.

- Private theater rentals can generate between $100 to over $1,000 per event depending on location, time, and amenities.

- Corporate event bookings saw increased interest in 2024 as companies sought unique team-building and presentation venues.

- School field trips and birthday parties consistently drive significant volume, particularly during off-peak hours, optimizing theater utilization.

AMC leverages its 936 global physical theaters as the primary channel for direct customer engagement and high-margin concession sales. Digital platforms like its app and website, with over 30 million AMC Stubs members, drive direct ticket sales and loyalty. Third-party partners such as Fandango, processing millions of tickets, significantly expand market reach. Additionally, corporate and group sales, contributing to the 35% non-admissions revenue, diversify income streams in 2024.

| Channel Type | Key Function | 2024 Impact | ||

|---|---|---|---|---|

| Physical Theaters | Core experience, ticket/concession sales | 936 locations, 10,470 screens globally | Direct sales | High margin item sales |

| Digital Platforms | Direct sales, loyalty programs | Over 30 million AMC Stubs members | Personalized offers | Data capture |

| Third-Party Ticketing | Market reach expansion | Fandango processed 67M+ tickets (2023) | Broader audience access | Complementary sales |

Customer Segments

Frequent moviegoers and film aficionados are AMC’s most engaged customers, viewing cinema as a primary hobby. This segment includes highly valuable AMC Stubs A-List subscribers, who, as of early 2024, consistently contributed to strong attendance figures, often seeing movies weekly. They prioritize premium formats like IMAX and Dolby Cinema, valuing the enhanced cinematic experience. These loyal patrons are AMC’s most profitable, driven by their passion for film and readiness to engage with membership benefits.

Families and parents with children form a crucial customer segment for AMC, particularly during school holidays and for major animated film premieres, often driving significant box office revenue. They highly value convenience, seeking features like AMC's reserved seating and a consistently clean, safe environment for their children. To attract this group, concession bundles and family-friendly amenities are key, with AMC seeing strong engagement from family-oriented loyalty program members in 2024. This segment prioritizes value and a comfortable, secure movie-going experience.

Casual social groups and couples represent a significant customer segment for AMC, viewing movie-going primarily as a social event for date nights or friend outings. Their attendance is often spurred by major blockbuster releases, with films like Dune: Part Two contributing to strong box office performance in early 2024, driving this demographic to theaters. The overall experience, including comfortable seating and premium food and beverage options, is crucial for them, as concession sales remain a vital revenue stream for AMC, often accounting for a higher profit margin than tickets themselves. This segment values a complete entertainment package.

Teens & Young Adults

Teens and young adults represent a crucial, digitally native segment for AMC, highly influenced by social media trends and often seeking value. They are key consumers of genres like horror and superhero films, driving significant box office revenue, with 2024 releases continuing to target this demographic. Their social nature makes group outings to the cinema particularly appealing.

- This demographic, aged 13-24, accounts for a substantial portion of frequent moviegoers, with studies indicating their strong preference for theatrical experiences over at-home viewing for major blockbusters.

- AMC’s A-List Stubs program, offering discounted tickets and concessions, directly addresses their price sensitivity, with memberships growing steadily into 2024.

- Social media campaigns on platforms like TikTok and Instagram are vital, as this group's movie choices are heavily swayed by online buzz and influencer recommendations.

- Horror films, like the highly anticipated releases in late 2024 and early 2025, consistently overperform with this audience, demonstrating their genre-specific pull.

Corporate & Event Clients

Corporate and Event Clients represent a distinct business-to-business segment for AMC, utilizing theaters for purposes beyond standard movie-watching. This includes companies hosting private film screenings, product launches, or corporate presentations, leveraging AMC’s large auditoriums and projection capabilities. Groups also organize significant events or private parties within the theater spaces. This segment is primarily reached through a dedicated corporate sales channel, aiming to capture a portion of the projected $32.5 billion global MICE (Meetings, Incentives, Conferences, and Exhibitions) market in 2024.

- AMC reported a 10.3% increase in food and beverage revenue in Q1 2024, partly driven by increased event traffic.

- Private theater rentals often command premium pricing, contributing to higher average ticket revenue per patron.

- Corporate bookings can include facility fees, catering, and specialized A/V services, diversifying revenue streams.

- The global corporate events market size is expected to reach $41.8 billion by 2030, offering growth potential for AMC’s B2B segment.

AMC targets diverse customer segments, including loyal film enthusiasts leveraging A-List benefits, families seeking convenient and safe entertainment, and social groups valuing the complete movie-going experience. A significant teen and young adult demographic, influenced by social media, drives specific genre attendance. Furthermore, corporate clients utilize AMC theaters for private events, contributing to diversified revenue streams, with Q1 2024 food and beverage revenue up 10.3% partly from increased event traffic.

| Customer Segment | Key Value Drivers | 2024 Engagement Insight |

|---|---|---|

| Frequent Moviegoers | Premium formats, A-List benefits | Consistent weekly attendance via A-List |

| Families | Convenience, safety, family-friendly amenities | Strong engagement during holiday releases |

| Teens & Young Adults | Social connection, value offers, genre-specific films | High social media influence, A-List growth |

Cost Structure

Film exhibition and rental costs represent AMC Entertainment Holdings Inc.’s largest variable expense, comprising fees paid to film distributors for movie screening rights. These costs are primarily structured as a percentage of box office receipts, typically ranging from 50% to 65% depending on the film and distributor, making them a primary determinant of a movie’s profitability for the theater. For instance, in Q1 2024, AMC reported film exhibition and other direct operating costs were a substantial portion of its total revenues. The negotiation of these critical terms directly impacts AMC’s financial performance and overall gross profit margins.

Theater-level operating expenses are a primary cost driver for AMC, covering all expenditures linked to running its physical movie theaters. This category includes substantial employee payroll and benefits for theater staff, essential for daily operations. Utility costs, such as electricity and HVAC, also form a significant portion, reflecting the energy demands of large auditoriums. These expenses are largely fixed or semi-variable, fluctuating somewhat based on theater operating hours and attendance levels. For instance, in Q1 2024, AMC reported significant operating expenses reflecting these ongoing overheads.

As AMC Entertainment leases a substantial portion of its vast theater portfolio, rent and lease payments represent a significant fixed cost, forming a major component of its financial leverage. These long-term obligations are crucial to its cost structure, impacting profitability. For instance, as of early 2024, AMC's operating lease liabilities remain substantial, reflecting its reliance on leased real estate. Effectively managing these real estate costs is absolutely vital for AMC's ongoing financial health and operational stability.

Food & Beverage Costs

Food & Beverage Costs represent the cost of goods sold for AMC’s highly profitable concession business, encompassing expenses for purchasing items like popcorn, candy, and soda from suppliers. While concession revenue per patron was robust, reaching 6.98 in Q1 2024, effectively managing these input costs is crucial for sustaining the segment’s impressive gross profit margins, which often exceed 80%. These costs are a significant operational expense, directly impacting net profitability despite the high markup on sales. Efficient supply chain management and bulk purchasing strategies are key to optimizing these expenditures.

- Concession gross profit margins often surpass 80%.

- Q1 2024 concession revenue per patron was 6.98.

- Includes purchasing candy, popcorn, and soda.

- Directly impacts AMC’s overall profitability.

Marketing & Administrative Expenses

Marketing and administrative expenses for AMC encompass essential corporate overhead, including executive salaries, IT infrastructure, and the costs associated with finance and legal departments. This category also covers significant spending on marketing campaigns, advertising efforts to attract moviegoers, and the management of the AMC Stubs loyalty program, which aims to retain customer engagement. These expenditures are crucial to support the entire operational framework and drive revenue for the company.

- AMC reported General and Administrative expenses of approximately $109.8 million in Q1 2024.

- Marketing costs for the AMC Stubs program and promotional activities are ongoing.

- IT infrastructure investments continue to support digital ticketing and online services.

- Executive compensation is a notable component of corporate overhead.

AMC's cost structure is dominated by variable film exhibition costs, typically 50% to 65% of box office receipts, and significant fixed lease obligations for its theaters. Operational expenses, including payroll and utilities, are substantial, alongside the cost of goods sold for high-margin concessions where Q1 2024 revenue per patron was 6.98. Corporate overhead, including marketing and administrative costs, was approximately $109.8 million in Q1 2024.

| Cost Category | Nature | 2024 Data Point |

|---|---|---|

| Film Exhibition | Variable | 50%-65% of box office |

| Concessions | Variable (COGS) | Q1 2024 revenue per patron $6.98 |

| G&A Expenses | Fixed/Semi-variable | Q1 2024 approx. $109.8 million |

Revenue Streams

Admissions and ticket sales represent AMC Entertainment's core revenue stream, stemming directly from moviegoers purchasing access to screenings. This foundational income is highly sensitive to attendance figures, varying ticket prices, and the mix of standard versus premium formats like IMAX or Dolby Cinema. For instance, AMC reported admissions revenue of $695.5 million in the first quarter of 2024, reflecting the ongoing importance of this primary source. Maximizing this segment through diverse film offerings and premium experiences remains central to the business model.

Food and beverage sales represent a critically important, high-margin revenue stream for AMC, significantly contributing to overall profitability. This includes popular concession items like popcorn, soda, and candy, alongside hot food options and alcoholic beverages from MacGuffins bars. For instance, AMC reported average food and beverage revenue per patron of $7.86 for the first quarter of 2024. This segment often contributes a disproportionately large share of profits relative to its revenue, highlighting its vital role in the company's financial health.

Revenue is generated by selling on-screen advertising slots before feature films, a crucial high-margin stream for AMC. This includes both national and local advertisements, maximizing the utilization of existing screen time. A significant portion comes from the Noovie pre-show, presented by National CineMedia, LLC, where AMC holds an equity interest. In 2024, this segment continues to be a highly profitable component, leveraging the captive audience before movie screenings.

AMC Stubs Membership Fees

AMC generates a significant and predictable revenue stream from its loyalty programs, specifically the AMC Stubs Premiere annual fee and the A-List monthly subscription. This subscription-based model provides a stable income source, independent of fluctuating individual ticket sales, enhancing the company’s financial resilience. As of early 2024, these programs continued to contribute substantially to AMC’s overall revenue, fostering consistent customer engagement and repeat visits. The A-List program, for example, offers members the ability to see up to three movies per week for a fixed monthly fee, driving consistent attendance.

- AMC Stubs Premiere charges an annual fee for enhanced benefits.

- A-List provides a monthly subscription, allowing up to three movies weekly.

- In Q1 2024, AMC reported continued strong engagement with its loyalty programs.

- Subscription revenue offers a predictable cash flow, diversifying beyond ticket sales.

Theater & Screen Rentals

AMC Entertainment generates revenue from Theater & Screen Rentals by offering its auditoriums and entire theaters for private events. This diversified use of assets includes corporate meetings, private film screenings, and birthday parties, often leveraging off-peak hours. While not a primary revenue driver like ticket sales or concessions, these rentals contribute to maximizing facility utilization and overall profitability. This stream supplements core movie exhibition income, adapting theater spaces for various community and business needs.

- AMC utilizes its theater infrastructure to host diverse events beyond traditional movie showings.

- Private rentals include corporate functions, film premieres, and celebratory gatherings.

- This revenue stream optimizes asset use, particularly during slower periods.

- It enhances overall financial performance by diversifying income sources for AMC.

AMC's core revenue streams primarily stem from movie admissions and high-margin food and beverage sales, crucial for profitability. On-screen advertising and robust loyalty programs like AMC Stubs and A-List provide stable, recurring income. Additionally, theater rentals maximize asset utilization, collectively forming a diversified revenue foundation for the company. These varied sources ensure financial resilience beyond just ticket sales.

| Revenue Stream | Q1 2024 Performance | Key Contribution |

|---|---|---|

| Admissions | $695.5 million | Primary income driver |

| Food & Beverage | $7.86 per patron | High-margin profit contributor |

| Loyalty Programs | Continued substantial contribution | Stable, recurring revenue |

Business Model Canvas Data Sources

The AMC Business Model Canvas is constructed using a blend of internal AMC financial reports, customer feedback data, and industry-wide market research. These sources provide a comprehensive view of AMC's current operations and market position.