Altarea PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altarea Bundle

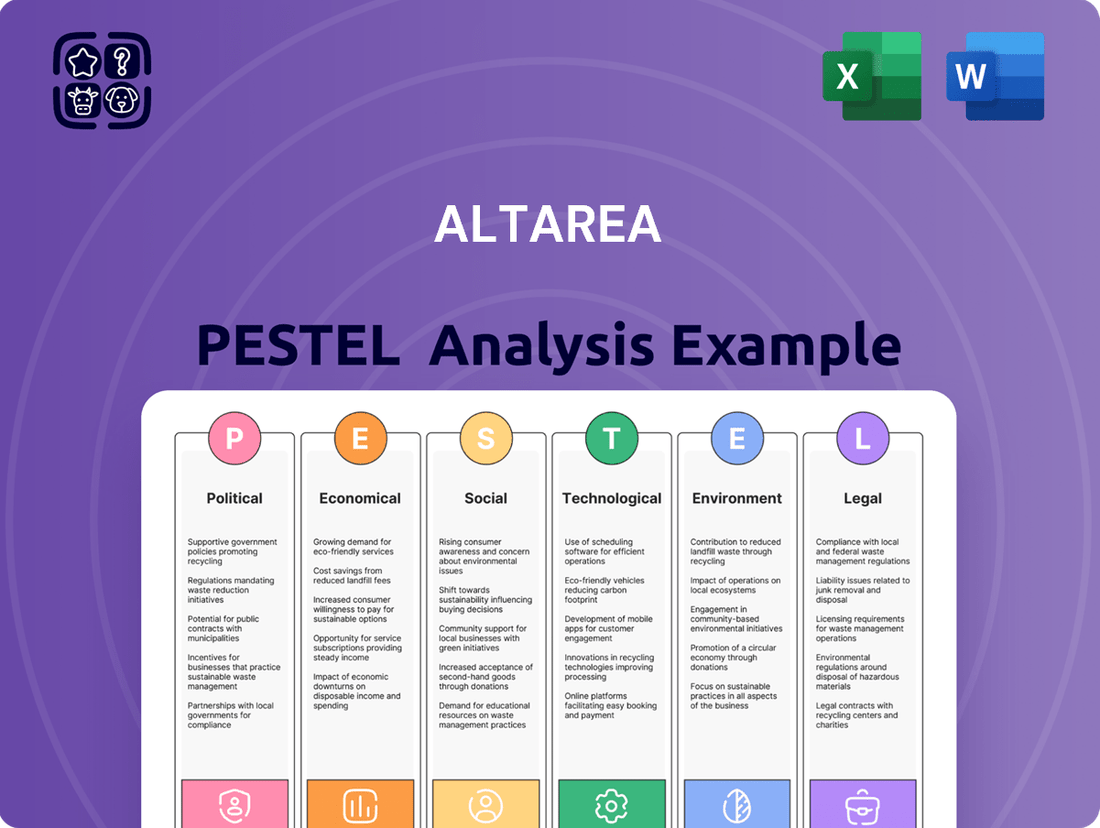

Navigate the complex external environment impacting Altarea with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Gain a crucial competitive advantage by leveraging these expert insights for your strategic planning. Download the full analysis now and unlock actionable intelligence.

Political factors

French government policies and urban planning significantly shape Altarea's business. New regulations, like Paris's 'Bioclimatic Local Planning Scheme' (PLU-b), anticipated by late 2024 or early 2025, will steer urban development towards climate adaptation and increased social housing. This means Altarea's projects will need to increasingly focus on sustainable design and mixed-use approaches to meet these evolving urban visions.

The French government's active support for the housing market, aiming to boost new home construction and affordability, directly impacts Altarea's residential projects. Initiatives like simplifying urban planning rules, such as enabling office-to-housing conversions, are designed to streamline development.

However, upcoming stricter energy efficiency standards, notably the ban on renting properties with a G energy rating starting in 2025, create both hurdles and prospects for Altarea, particularly concerning renovation and upgrading existing stock.

France's commitment to sustainability is reshaping the construction sector, impacting companies like Altarea. New regulations, such as the mandate for public buildings to incorporate at least 50% timber or natural materials, alongside the RE2020 environmental regulation, are driving significant changes. These rules impose stricter requirements on energy consumption and carbon emissions for new constructions.

Altarea, with its strategic focus on sustainable development, must continually adapt its building practices to meet these evolving environmental standards. This includes integrating more eco-friendly materials and energy-efficient technologies into its projects to comply with the increasingly stringent regulations.

Government support mechanisms, like the 'Green Industry Tax Credit,' offer financial encouragement for businesses to adopt sustainable building solutions. This incentive aims to accelerate the uptake of environmentally responsible materials and innovative technologies within the construction industry.

Political Stability and Investment Climate

The political landscape in France, a key market for Altarea, significantly shapes the real estate investment climate. A stable political environment fosters investor confidence, crucial for attracting capital for large-scale developments. Conversely, political uncertainty can dampen market activity and investment volumes, impacting Altarea's strategic growth. For instance, the French government's commitment to sustainable development and urban regeneration policies, as seen in initiatives supporting energy-efficient building retrofits, directly influences opportunities and operational costs for companies like Altarea.

Investor sentiment towards the Eurozone as a whole also plays a vital role. While the Eurozone economy showed signs of resilience in late 2023 and early 2024, any emerging political instability within member states could create ripple effects. Altarea's ability to secure financing and execute ambitious projects is intrinsically tied to the predictability and supportive nature of the broader political and economic framework across Europe.

Key political considerations for Altarea include:

- Regulatory Environment: Changes in French zoning laws, environmental regulations, and tax policies can directly impact development feasibility and profitability.

- Government Support for Housing: Public sector initiatives and subsidies aimed at boosting housing construction or affordability can create new avenues for growth.

- Geopolitical Stability: Broader European and global political stability influences international investor appetite for French real estate assets.

EU Directives and Taxonomy Alignment

As a prominent European real estate developer, Altarea's operations are significantly influenced by EU directives, notably the EU Taxonomy Regulation. This regulation mandates detailed reporting on the environmental sustainability of economic activities, a crucial aspect for companies like Altarea aiming for sustainable development and urban transformation.

Compliance with Taxonomy eligibility and alignment reporting is becoming a critical benchmark for real estate firms across the EU. For instance, by the end of 2024, financial market participants are expected to report on the Taxonomy alignment of their portfolios, a trend that will increasingly shape investment decisions and company valuations in 2025.

- EU Taxonomy Regulation: Requires disclosure of environmentally sustainable economic activities, impacting reporting for real estate companies.

- Reporting Obligations: Increased emphasis on Taxonomy eligibility and alignment reporting for 2024 and beyond.

- Sustainable Development Focus: Aligns with Altarea's strategic commitment to sustainable development and urban regeneration projects.

Government policies directly impact Altarea's development and renovation projects. Upcoming regulations, such as stricter energy efficiency standards like the ban on renting G-rated properties from 2025, necessitate upgrades to existing buildings. Furthermore, French urban planning schemes, like Paris's PLU-b, are steering development towards climate adaptation and social housing, requiring Altarea to integrate sustainable and mixed-use designs.

The French government's focus on boosting housing construction and affordability, through measures like simplifying planning rules for office-to-housing conversions, creates opportunities for Altarea's residential segment. Simultaneously, the push for sustainable construction is evident in mandates for public buildings to use at least 50% timber and adherence to RE2020 environmental regulations, driving changes in material sourcing and energy consumption for new builds.

EU directives, particularly the EU Taxonomy Regulation, also significantly influence Altarea. By the end of 2024, financial market participants must report on Taxonomy alignment, a trend expected to grow in 2025. This regulation mandates detailed disclosure on the environmental sustainability of economic activities, aligning with Altarea's commitment to sustainable urban transformation and influencing investment decisions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Altarea, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights.

Economic factors

The interest rate environment is a critical factor for Altarea, as it directly impacts real estate demand. As of late 2024, mortgage rates have shown some volatility, but projections for 2025 indicate a potential slight decrease, possibly moving towards the 6% to 6.5% range for prime borrowers. This anticipated easing could boost affordability and stimulate activity in both residential and commercial property markets.

Altarea’s financial health and the viability of its development projects are closely tied to these lending conditions. Higher rates increase borrowing costs for both Altarea and its customers, potentially slowing down sales and project financing. Conversely, a more favorable interest rate trajectory in 2025 could unlock new opportunities and improve purchasing power for a broader segment of buyers.

The French real estate market is showing signs of stabilization and a slow recovery in 2024, with projections for a modest uptick in transaction volumes by 2025 compared to the dip experienced post-pandemic. Following a period of price adjustments, the market is expected to see prices level off or even experience slight growth, though this will vary significantly by region.

Altarea's financial performance is intrinsically linked to these evolving real estate dynamics. The company's revenue and profitability are directly influenced by the health and activity within the various property segments it operates in, making market trends a critical factor in its business outlook.

Construction costs in France have seen a notable increase, with wages and material prices climbing. For instance, the producer price index for construction materials rose by 6.5% in the year leading up to April 2024, according to INSEE data. This trend directly impacts developers like Altarea, potentially squeezing profit margins and forcing difficult decisions regarding pricing and project viability.

The economic pressure is compounded by a potential dip in customer purchasing power, creating a challenging environment where developers must balance rising expenses with market affordability. Furthermore, the push for more sustainable and energy-efficient building practices, while crucial, often involves higher upfront material costs, adding another layer of financial complexity to development projects.

Household Purchasing Power and Consumer Confidence

Household purchasing power, a key driver for real estate demand, is influenced by income levels and interest rates. For instance, in early 2024, many economies saw a stabilization or slight decrease in inflation, which, coupled with steady employment figures, supported consumer spending. This increased disposable income can translate into greater demand for housing, directly benefiting Altarea's residential segment.

Consumer confidence, however, remains a critical barometer for retail performance. Economic uncertainties, such as geopolitical tensions or unexpected inflation spikes, can dampen consumer sentiment, leading to reduced spending on discretionary items, a factor that directly impacts Altarea's retail property portfolio. For example, a dip in consumer confidence surveys in late 2023 indicated a cautious approach to spending among households.

- Household disposable income growth: In the Eurozone, real disposable income saw a modest increase in Q4 2023, providing a potential tailwind for housing demand.

- Consumer confidence indices: The European Commission's consumer confidence indicator showed fluctuations throughout 2023 and early 2024, reflecting ongoing economic sentiment shifts.

- Retail sales volume: Retail sales volumes in key European markets experienced varied performance, with non-essential goods sales often more sensitive to confidence levels.

Investment Volumes and Foreign Investment

Investment volumes in French commercial real estate experienced a dip in 2024, with preliminary data for 2025 suggesting a gradual recovery. A notable portion of this investment activity originates from foreign capital, signaling a robust, albeit cautious, return of international investor confidence.

This renewed interest is particularly concentrated in prime assets and sectors demonstrating strong underlying growth drivers, such as residential properties and logistics facilities. For instance, the French commercial real estate investment market saw transactions totaling approximately €25 billion in 2024, a decrease from previous years, but forecasts for 2025 anticipate a rebound to around €30-35 billion, with foreign investors accounting for an estimated 40-50% of this volume.

Altarea's financial strategy, including its capacity to secure necessary funding and successfully divest properties, is directly impacted by these market dynamics. The prevailing investment climate, characterized by foreign investor appetite and sector preferences, shapes the opportunities and challenges Altarea faces in its asset management and development endeavors.

- 2024 French commercial real estate investment volumes: ~€25 billion

- 2025 projected French commercial real estate investment volumes: €30-35 billion

- Foreign investment share in 2025 projected: 40-50%

- Key investor focus sectors: Living, Logistics

Economic factors significantly shape Altarea's operational landscape. The prevailing interest rate environment, with projections for 2025 suggesting a slight decrease towards 6-6.5% for prime borrowers, directly influences real estate demand and affordability.

Rising construction costs, evidenced by a 6.5% increase in the producer price index for construction materials up to April 2024, alongside potential dips in consumer purchasing power, create margin pressures for developers like Altarea.

Household disposable income saw a modest increase in the Eurozone in Q4 2023, supporting housing demand, though consumer confidence remained a key variable impacting retail performance due to economic uncertainties.

Investment volumes in French commercial real estate, projected to rebound to €30-35 billion in 2025 from an estimated €25 billion in 2024, with foreign investors expected to contribute 40-50%, highlight the importance of market dynamics for Altarea's financial strategies.

| Economic Factor | Data Point | Implication for Altarea |

| Interest Rates (2025 Projection) | 6% - 6.5% | Potential boost to real estate demand and affordability. |

| Construction Material Costs (April 2024) | +6.5% increase | Increased development costs, potential margin squeeze. |

| Household Disposable Income (Eurozone Q4 2023) | Modest increase | Support for housing demand. |

| French CRE Investment (2024) | ~€25 billion | Dip in investment activity. |

| French CRE Investment (2025 Projection) | €30-35 billion | Projected recovery in investment, influencing funding and divestment. |

Preview the Actual Deliverable

Altarea PESTLE Analysis

The preview shown here is the exact Altarea PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This document provides a comprehensive examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Altarea's operations and strategic direction. You'll gain valuable insights into the external forces shaping the company's landscape.

Sociological factors

Societal demographics are undergoing significant transformations, with an aging population and shifting work attitudes directly influencing housing requirements. For instance, in France, the proportion of individuals aged 65 and over is projected to reach 25% by 2030, a trend that necessitates a greater demand for accessible and comfortable living spaces.

This demographic evolution is coupled with a pronounced preference for enhanced quality of life and a move towards less congested locales. Data from 2024 indicates a sustained interest in suburban and rural areas offering better environmental quality, impacting urban development strategies.

Consequently, Altarea's strategy of developing mixed-use urban environments must remain agile, adapting its offerings to cater to these evolving inhabitant needs, such as incorporating more green spaces and flexible living arrangements.

Altarea's commitment to urban transformation directly mirrors shifting lifestyle preferences. As more people seek vibrant city living combined with accessible green spaces, developers like Altarea are prioritizing mixed-use projects that blend residential, commercial, and recreational elements.

The surge in remote work, a trend significantly amplified in 2024 and continuing into 2025, fuels a desire for living environments that offer both urban convenience and a degree of natural respite. This has led to increased demand for properties incorporating parks, communal gardens, and pedestrian-friendly designs within city centers.

For instance, in 2024, urban regeneration projects focusing on sustainability and community engagement have seen higher occupancy rates and rental yields. Altarea's strategy of developing these types of environments caters to a market increasingly valuing quality of life alongside urban connectivity.

French consumers are increasingly focused on sustainability, with a significant portion of the population prioritizing energy-efficient homes. This heightened awareness directly influences purchasing decisions, leading to a noticeable premium for properties with better energy performance certificates (EPCs).

In 2024, data indicates that homes with higher energy ratings in France command a premium, with some studies suggesting a difference of up to 10% in sale price compared to lower-rated properties. This trend is expected to accelerate as regulatory pressures and environmental consciousness grow.

Altarea's strategic commitment to sustainable development and low-carbon initiatives aligns perfectly with these evolving consumer preferences. By investing in energy-efficient construction and renovation, Altarea is well-positioned to meet this demand and capture market share in the evolving real estate landscape.

Social Housing and Affordability Demands

The increasing demand for social and affordable housing, especially in metropolitan areas like Paris, creates a dual dynamic for developers such as Altarea. New urban planning regulations in Paris are mandating a substantial proportion of public housing by 2035, directly impacting residential development by requiring a dedicated percentage of floor space for social housing projects.

This societal shift necessitates that Altarea's development strategies actively incorporate objectives for social inclusion and equitable housing access. For instance, the Grand Paris development plan aims for 30% social housing in new developments, a significant factor for companies operating in the region.

- Increased regulatory requirements for social housing allocation in new developments.

- Growing public pressure for accessible housing options in urban centers.

- Potential for partnerships with public entities to meet social housing mandates.

- Impact on project profitability due to mandated affordable housing components.

Impact of Remote Work on Property Demand

The shift towards remote and hybrid work models has significantly reshaped housing preferences. Many individuals now prioritize larger living spaces and access to outdoor areas, often found in suburban or exurban locations, as their homes become primary workspaces. This trend has been evident in market data, with reports indicating a sustained interest in single-family homes with dedicated office spaces.

For instance, in 2024, surveys continued to show a strong preference for home offices, with a significant percentage of remote workers indicating they would seek properties offering this amenity. This societal change directly influences property demand, potentially reducing the appeal of smaller, urban apartments for some segments of the population and increasing demand for properties with more square footage or flexible layouts.

- Increased Demand for Larger Homes: Post-2020, many markets saw a surge in demand for single-family homes, often exceeding pre-pandemic levels, as people sought more space for remote work and family life.

- Suburban Migration: Data from 2024 and early 2025 indicates a continued, albeit potentially moderating, trend of migration from dense urban cores to more affordable and spacious suburban and exurban areas.

- Focus on Home Office Functionality: Properties offering dedicated home office space or the potential to create one are commanding higher interest and, in some cases, higher prices.

Societal shifts continue to shape housing demands, with an aging French population, projected to reach 25% over 65 by 2030, driving a need for accessible living spaces. Simultaneously, a growing preference for quality of life and less urban density, evident in 2024 data showing sustained interest in suburban areas, influences development strategies.

The rise of remote and hybrid work, a significant trend in 2024-2025, fuels demand for homes with more space and outdoor access, pushing some towards suburban locations. This necessitates adaptable urban development, like Altarea's mixed-use projects, that integrate green spaces and flexible living arrangements to meet evolving lifestyle preferences.

Consumer focus on sustainability is paramount, with French buyers prioritizing energy-efficient homes, a trend supported by 2024 data showing a price premium for higher energy ratings. Altarea's commitment to sustainable development aligns with this, as energy-efficient construction is increasingly valued.

There's a growing societal demand for social and affordable housing, particularly in urban centers. New regulations, like those in Paris aiming for 30% social housing in new developments, directly impact developers like Altarea, requiring strategies that incorporate social inclusion and equitable housing access.

| Sociological Factor | Trend | Impact on Altarea | Supporting Data (2024/2025) |

| Demographic Aging | Increasing proportion of elderly | Demand for accessible housing | France: 25% over 65 projected by 2030 |

| Lifestyle Preferences | Shift to suburban/rural, quality of life | Need for mixed-use, green spaces | Sustained interest in non-urban areas |

| Work Flexibility | Remote/hybrid work | Demand for larger homes, home offices | High preference for home office amenities |

| Sustainability Focus | Consumer demand for energy efficiency | Premium for green properties | Up to 10% price premium for high EPCs |

| Social Housing Demand | Increased need for affordable options | Requirement for social housing inclusion | Paris: 30% social housing mandate in new builds |

Technological factors

The French PropTech market is booming, with a projected compound annual growth rate of 15% through 2027, fueled by a strong desire for digital tools that boost efficiency and transparency in real estate. Innovations like advanced property management platforms, immersive virtual tours, and secure blockchain transactions are actively transforming how properties are bought, sold, and managed.

Altarea can capitalize on this trend by integrating these PropTech advancements to refine its operational workflows and introduce novel property offerings, thereby strengthening its market position and customer experience.

The increasing global emphasis on sustainability and energy efficiency, strongly supported by government incentives and regulations, is a significant technological driver for smart building technologies. For instance, the European Union's Energy Performance of Buildings Directive aims to improve energy performance, encouraging investments in smart systems.

These technologies, such as IoT sensors for real-time energy monitoring and AI-driven building management systems, optimize resource consumption, reduce operational costs, and enhance occupant comfort and productivity. This aligns perfectly with Altarea's strategic commitment to sustainable development, offering a pathway to integrate advanced solutions across its portfolio.

In 2024, the global smart building market was valued at over $80 billion and is projected to grow significantly, indicating strong market adoption and technological advancement. Altarea's integration of these solutions can therefore lead to enhanced asset value and a stronger competitive position.

The real estate sector is experiencing a significant digital shift, with customers now expecting smooth online experiences for property transactions. This means platforms for listings, virtual tours, and digital project management are becoming standard. For instance, in 2024, the global proptech market was valued at over $20 billion, highlighting the growing investment in these digital solutions.

Altarea must embrace this technological evolution to stay competitive. Investing in advanced digital tools, such as AI-powered property matching and blockchain for secure transactions, will be crucial. By Q3 2024, major real estate firms reported a 25% increase in online engagement following the integration of virtual reality viewing options.

Data Analytics and AI in Property Development

The integration of data analytics and AI is revolutionizing property development. These technologies allow for sophisticated market analysis, identifying optimal locations and predicting future demand with greater accuracy. For instance, AI-driven platforms can process vast datasets on demographics, economic indicators, and consumer behavior to pinpoint lucrative investment opportunities.

Altarea can leverage these advancements to refine its development strategies. By utilizing AI for site selection, the company can reduce risks associated with choosing less viable locations. Furthermore, predictive analytics can help forecast construction costs and potential rental yields, leading to more efficient resource allocation and enhanced project profitability.

- AI-powered property analytics are transforming real estate investment decisions.

- Altarea can employ these tools for enhanced market analysis and site selection.

- Predictive modeling assists in forecasting future trends and optimizing development strategies.

- The global PropTech market, encompassing AI and data analytics, was valued at over $20 billion in 2023 and is projected to grow significantly.

Building Information Modeling (BIM)

Building Information Modeling (BIM) is revolutionizing the real estate development sector by providing detailed digital blueprints that streamline the entire project lifecycle. For a company like Altarea, embracing BIM can lead to significant operational improvements. For instance, a report by Dodge Data & Analytics in 2023 indicated that 70% of construction firms are now using BIM, a substantial increase from previous years, highlighting its growing industry adoption and the competitive necessity for its implementation. This technology allows for enhanced collaboration among architects, engineers, and contractors, minimizing costly rework and improving budget adherence.

The adoption of BIM directly impacts project efficiency and quality. By creating a unified digital model, Altarea can better visualize complex designs, identify potential clashes before construction begins, and optimize resource allocation. Studies suggest BIM can reduce project costs by 10-20% and shorten project timelines by up to 15%, directly benefiting Altarea's large-scale developments. This digital approach also facilitates better facility management post-construction, offering long-term value.

- Enhanced Collaboration: BIM platforms enable real-time data sharing, fostering seamless communication among all project stakeholders.

- Cost Control: Accurate digital models allow for precise material estimation and early identification of cost overruns, potentially saving Altarea millions on major projects.

- Risk Mitigation: Virtual prototyping and clash detection through BIM significantly reduce on-site errors and delays.

- Improved Project Delivery: Streamlined workflows and better planning contribute to faster project completion and higher overall quality.

Technological advancements are reshaping the real estate landscape, with PropTech innovations driving efficiency and transparency. The global PropTech market, valued at over $20 billion in 2024, is a testament to this digital shift, with AI and data analytics playing a crucial role in investment decisions and site selection.

Smart building technologies, supported by initiatives like the EU's Energy Performance of Buildings Directive, are optimizing resource consumption and reducing operational costs. The smart building market exceeded $80 billion in 2024, indicating strong adoption and technological progress.

Building Information Modeling (BIM) is revolutionizing project lifecycles, with 70% of construction firms using it in 2023, leading to improved collaboration, cost control, and risk mitigation. These technologies offer significant potential for operational improvements and enhanced project delivery.

Legal factors

Altarea's development projects are heavily influenced by urban planning and zoning regulations. For instance, Paris's Bioclimatic Local Planning Scheme (PLU-b) mandates specific standards for building materials and architectural design, directly impacting project feasibility and cost. These evolving rules, often prioritizing energy efficiency and sustainable practices, necessitate adaptive design strategies for Altarea.

Stricter energy performance regulations, such as the upcoming ban on renting G-rated properties starting in 2025, directly impact Altarea's real estate holdings. This legal mandate requires properties to meet specific energy efficiency standards, evidenced by Energy Performance Certificates (EPCs).

Compliance with these mandates, including potential renovations to upgrade older buildings, represents a significant financial consideration for Altarea. Failure to meet these energy standards could result in penalties and limit rental income streams, affecting the overall portfolio value.

France's RE2020 environmental regulation significantly impacts Altarea by mandating reduced energy consumption and carbon emissions in new constructions. This means Altarea must carefully select building materials and construction methods to meet increasingly stringent targets, affecting project costs and timelines.

The RE2020 standards are designed to evolve, with stricter obligations and lower tolerance thresholds being introduced incrementally until 2031. For instance, the initial phase focused on improving thermal performance and reducing carbon footprint, with future iterations expected to further tighten requirements on lifecycle carbon emissions and resilience.

EU Taxonomy and ESG Reporting Obligations

Altarea, as a significant player in the real estate sector, must adhere to the EU Taxonomy's stringent disclosure requirements. This means transparently reporting on its environmental, social, and governance (ESG) performance, a critical step for aligning with sustainability goals and attracting capital. For instance, by the end of 2024, companies like Altarea are expected to report on the alignment of their economic activities with the Taxonomy's environmental objectives.

Compliance is not merely a regulatory hurdle; it's a strategic imperative for securing green investments and bolstering Altarea's market reputation in 2025. Integrating ESG criteria into core operations and reporting frameworks is essential for demonstrating commitment and achieving competitive advantage.

- EU Taxonomy Alignment: Mandatory reporting on the proportion of Taxonomy-aligned turnover, capital expenditure, and operating expenditure.

- ESG Data Integration: Requirement to collect and report detailed ESG data, impacting financial reporting and investor relations.

- Green Finance Attraction: Enhanced ability to attract investors seeking sustainable and ESG-compliant assets, potentially lowering the cost of capital.

- Reputational Enhancement: Demonstrating robust ESG practices builds trust with stakeholders and strengthens brand image in the competitive real estate market.

Property Transaction and Ownership Laws

Property transaction and ownership laws are fundamental to Altarea's operations, dictating how real estate can be acquired, developed, and managed. These regulations encompass everything from zoning ordinances to outright ownership rights, directly impacting the feasibility and profitability of Altarea's projects.

Specifically, laws governing the conversion of office buildings into residential units are crucial. For instance, in 2024, France, where Altarea is a major player, continued to see discussions around streamlining regulations for such conversions to address housing shortages. The ability to adapt existing structures, as opposed to new builds, offers significant cost and time advantages, making legal flexibility in this area a key enabler.

Changes in urban planning rules, such as potential exceptions or fast-tracked approval processes for office-to-residential conversions, can dramatically influence market dynamics and Altarea's development pipeline. These legal shifts can unlock new investment opportunities and accelerate project timelines, directly affecting Altarea's ability to respond to market demand for housing.

- Land Use Regulations: Laws dictating how land can be utilized, including zoning, are paramount for Altarea's development strategy.

- Property Ownership Rights: Clear title and ownership laws ensure secure transactions and investments for Altarea.

- Conversion Legislation: Specific laws enabling or restricting the transformation of commercial spaces into residential units directly impact Altarea's adaptive reuse projects.

- Planning Permissions: The legal framework for obtaining planning and building permits dictates project timelines and costs for Altarea.

Legal frameworks surrounding energy efficiency, like France's RE2020 regulation, mandate reduced carbon emissions in new constructions, impacting Altarea's material choices and project timelines. Furthermore, upcoming regulations, such as the 2025 ban on renting G-rated properties, compel property upgrades, representing a significant financial consideration for Altarea's existing portfolio.

Environmental factors

Altarea's commitment to urban transformation is deeply intertwined with climate change adaptation. The company is actively designing more resilient buildings and urban spaces capable of withstanding extreme weather. This focus is critical as cities worldwide, including Paris, grapple with the escalating impacts of climate change, from heatwaves to increased precipitation.

The Paris PLU-b, or Urban Planning and Mobility Master Plan, underscores this by explicitly aiming to foster a bioclimatic city. This directive influences Altarea's development strategies, pushing for designs that minimize environmental impact and enhance natural resource efficiency. For instance, in 2024, a significant portion of new construction in Paris is mandated to meet stringent energy performance standards, reflecting this bioclimatic push.

This strategic alignment with climate resilience is not just an environmental imperative but also a financial one. Investments in sustainable and resilient urban development are increasingly seen as crucial for long-term value creation, mitigating risks associated with climate-related disruptions and aligning with evolving investor and regulatory expectations. Altarea's projects are increasingly incorporating green infrastructure, such as permeable surfaces and urban greening, to manage stormwater and reduce the urban heat island effect.

France's RE2020 regulation sets ambitious goals for cutting carbon emissions from new buildings, pushing developers like Altarea to prioritize sustainability. This means a significant shift towards using low-carbon materials and construction techniques.

Altarea must adapt to these evolving standards, which require a documented reduction in the carbon footprint of new constructions. For instance, the RE2020 regulation mandates a 30% reduction in the carbon footprint of new homes by 2025 compared to previous standards, a target Altarea is actively working towards.

Meeting these progressively stricter emission reduction thresholds throughout a building's lifecycle is crucial. This impacts everything from material sourcing to energy efficiency during operation, directly influencing Altarea's project planning and execution strategies.

New urban planning regulations in Paris, effective from 2024, mandate an increase in green spaces per resident, aiming to bolster existing biodiversity and establish new ecological pathways. Altarea's development ventures must now actively incorporate these biodiversity enhancements, contributing to the city's goal of a greener urban fabric and reinforcing its sustainability pledges.

Energy Efficiency and Renewable Energy Integration

The drive to enhance building energy performance and incorporate renewable energy sources presents a key environmental consideration for Altarea. Regulations mandating green building practices and solar installations on specific structures and parking areas, alongside the objective of achieving nearly zero-energy buildings, compel Altarea to focus on energy-efficient designs and investigate renewable energy options such as photovoltaics.

This shift is underscored by growing global commitments to decarbonization. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) continues to push for higher energy efficiency standards, with member states implementing stricter renovation and new-build requirements. By 2024, many countries are seeing increased incentives for solar panel installations on residential and commercial properties, aiming to meet ambitious renewable energy targets. Altarea's strategic planning must therefore align with these evolving environmental mandates, potentially impacting development costs and operational efficiencies.

- Regulatory Push: Increasing government mandates for green building certifications and solar integration on new and existing properties.

- Energy Efficiency Standards: Growing demand for nearly zero-energy buildings (nZEB) and retrofitting existing stock for improved performance.

- Renewable Energy Adoption: Expansion of solar photovoltaic (PV) capacity, with global installations projected to reach new highs in 2024-2025, driven by cost reductions and supportive policies.

- Market Demand: A rising preference among tenants and buyers for sustainably built and energy-efficient properties.

Sustainable Materials and Circular Economy Principles

The growing emphasis on sustainable materials, particularly timber and natural resources, is reshaping construction. For instance, France's "Climate and Resilience Law" mandates that new public buildings utilize at least 50% wood, bio-based, or recycled materials by 2030, directly influencing Altarea's procurement strategies and design choices.

Embracing circular economy principles is no longer optional but a strategic imperative. This involves prioritizing renovations and adaptive reuse of existing structures over new builds, alongside the increased integration of recycled content in construction. For example, the European Union's Construction and Demolition Waste Directive aims to increase recycling rates, pushing companies like Altarea to explore innovative uses for reclaimed materials.

- Mandate for Sustainable Materials: France's 2030 target for 50% wood/bio-based/recycled materials in new public buildings.

- Circular Economy Focus: Shift towards renovation and adaptive reuse of existing properties.

- Recycled Content Integration: Increasing use of recycled materials in construction projects to meet environmental goals.

- Waste Reduction Targets: EU directives pushing for higher recycling rates in construction and demolition waste.

Environmental factors are increasingly shaping Altarea's operations, driven by stringent regulations and growing market demand for sustainability. The company must navigate evolving building codes and carbon emission targets, such as France's RE2020, which mandates a 30% reduction in new home carbon footprints by 2025 compared to previous standards. This necessitates a focus on low-carbon materials and energy-efficient construction techniques.

Urban planning in Paris, particularly from 2024, emphasizes increased green spaces and biodiversity, influencing development strategies to incorporate ecological enhancements. Furthermore, the push for nearly zero-energy buildings and the integration of renewable energy sources, like solar photovoltaics, are key considerations, supported by EU directives like the Energy Performance of Buildings Directive.

Altarea's commitment to circular economy principles is also paramount, with a growing emphasis on using sustainable materials like timber and recycled content, and prioritizing renovation and adaptive reuse. France's Climate and Resilience Law, aiming for 50% wood, bio-based, or recycled materials in new public buildings by 2030, exemplifies this trend.

| Environmental Factor | Key Regulations/Drivers | Impact on Altarea | 2024-2025 Data/Projections |

|---|---|---|---|

| Climate Change Adaptation | Paris PLU-b (Bioclimatic City) | Designing resilient buildings and urban spaces | Increased investment in green infrastructure |

| Carbon Emissions | France's RE2020 | Reducing carbon footprint of new constructions | Mandated 30% reduction in new home carbon footprint by 2025 |

| Biodiversity | Paris Urban Planning Regulations (from 2024) | Incorporating green spaces and ecological pathways | Requirement for increased green spaces per resident |

| Energy Performance | EU EPBD, nZEB targets | Focus on energy-efficient designs, solar integration | Growing incentives for solar installations |

| Sustainable Materials & Circularity | France's Climate & Resilience Law, EU Waste Directives | Use of timber, bio-based, recycled materials; adaptive reuse | 50% target for sustainable materials in new public buildings by 2030 |

PESTLE Analysis Data Sources

Our Altarea PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic research institutions, and reputable industry-specific reports. We meticulously gather insights on political stability, economic forecasts, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive view.