Altarea Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altarea Bundle

Altarea navigates a complex real estate landscape where buyer power is significant, and the threat of new entrants is moderate. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Altarea’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of landowners is a key consideration for Altarea, particularly in its urban transformation and mixed-use development projects. The availability and cost of suitable land directly impact project feasibility and acquisition expenses. For instance, in 2024, the French real estate market, especially in prime urban areas where Altarea operates, continued to see robust demand, potentially increasing the leverage of landowners in negotiations.

When prime land is scarce or subject to stringent zoning regulations, landowners can command higher prices, directly affecting Altarea's development costs and profit margins. This scarcity can significantly influence the overall financial viability of a project, making the relationship management with landowners a strategic imperative for Altarea's success in securing the necessary sites.

Construction companies and contractors hold significant bargaining power, particularly when facing industry-wide challenges like escalating material costs and a persistent labor shortage. In 2024, these pressures have intensified, impacting project timelines and budgets across the sector.

For a large-scale developer like Altarea, securing reliable and cost-effective construction partners is paramount. The ability to negotiate favorable terms with these contractors, potentially by fostering relationships with a broad and competitive base of firms, is crucial for mitigating the suppliers' leverage and ensuring project viability.

Fluctuations in the prices of key construction materials like steel, concrete, and timber directly impact Altarea's project costs. For instance, global steel prices saw significant volatility in 2023, with some periods experiencing double-digit percentage increases year-over-year, directly squeezing developer margins.

If there are few providers for specialized or sustainable materials, which Altarea is increasingly prioritizing, these suppliers gain considerable leverage. This can lead to higher input costs and potentially longer lead times, affecting project timelines and profitability.

Global supply chain disruptions, as seen in recent years, further amplify the bargaining power of raw material suppliers. These disruptions can create shortages, driving up prices and giving suppliers more control over terms and availability.

Financial Institutions

Financial institutions wield significant bargaining power over real estate developers like Altarea, primarily due to their control over access to crucial financing. This includes development loans for projects and mortgages for potential buyers, both of which are essential for a developer's success. Recent trends in the French market, such as rising interest rates and more stringent lending criteria, have amplified this leverage, making it more challenging for developers to secure favorable terms.

Altarea's strategy to mitigate this supplier power involves bolstering its financial stability and cultivating a diverse range of funding sources. By not being overly reliant on any single financial institution, Altarea can negotiate from a stronger position. This diversification can include exploring alternative financing options beyond traditional bank loans, potentially reducing the impact of any single lender's increased bargaining power.

- Access to financing is critical for real estate developers.

- Rising interest rates and tighter lending conditions in France increase banks' leverage.

- Altarea's financial health and diversified funding reduce dependence on individual lenders.

Specialized Consultants and Architects

For its urban transformation and sustainable development projects, Altarea depends on specialized knowledge from architects, urban planners, and environmental consultants. The scarcity of professionals possessing the precise skills needed for innovative or complex mixed-use developments can significantly amplify their bargaining power, especially when demand for their unique services is high.

In 2024, the demand for sustainability-focused architectural services saw a notable increase, with reports indicating a 15% rise in projects incorporating green building certifications. This trend suggests that consultants with expertise in areas like net-zero energy design or circular economy principles are in a strong position.

- High Demand for Niche Expertise: Projects requiring advanced sustainable design or complex urban integration often necessitate consultants with very specific, hard-to-find skill sets.

- Limited Supply of Specialized Talent: The pool of architects and planners with proven track records in large-scale, innovative urban regeneration is not vast, giving them leverage.

- Impact on Project Costs: When specialized consultants are scarce, their fees can represent a significant portion of a project's budget, influencing Altarea's overall development costs.

Suppliers of raw materials and specialized services hold considerable sway over Altarea's operations. The availability and cost of essential inputs like steel, concrete, and timber, coupled with the scarcity of specialized consultants in areas like sustainable urban planning, directly impact project budgets and timelines. In 2024, persistent inflation and ongoing supply chain challenges continued to empower these suppliers, particularly those offering niche expertise or environmentally certified materials.

The bargaining power of landowners is a key consideration for Altarea, particularly in its urban transformation and mixed-use development projects. The availability and cost of suitable land directly impact project feasibility and acquisition expenses. For instance, in 2024, the French real estate market, especially in prime urban areas where Altarea operates, continued to see robust demand, potentially increasing the leverage of landowners in negotiations.

When prime land is scarce or subject to stringent zoning regulations, landowners can command higher prices, directly affecting Altarea's development costs and profit margins. This scarcity can significantly influence the overall financial viability of a project, making the relationship management with landowners a strategic imperative for Altarea's success in securing the necessary sites.

Construction companies and contractors hold significant bargaining power, particularly when facing industry-wide challenges like escalating material costs and a persistent labor shortage. In 2024, these pressures have intensified, impacting project timelines and budgets across the sector.

For a large-scale developer like Altarea, securing reliable and cost-effective construction partners is paramount. The ability to negotiate favorable terms with these contractors, potentially by fostering relationships with a broad and competitive base of firms, is crucial for mitigating the suppliers' leverage and ensuring project viability.

Fluctuations in the prices of key construction materials like steel, concrete, and timber directly impact Altarea's project costs. For instance, global steel prices saw significant volatility in 2023, with some periods experiencing double-digit percentage increases year-over-year, directly squeezing developer margins.

If there are few providers for specialized or sustainable materials, which Altarea is increasingly prioritizing, these suppliers gain considerable leverage. This can lead to higher input costs and potentially longer lead times, affecting project timelines and profitability.

Global supply chain disruptions, as seen in recent years, further amplify the bargaining power of raw material suppliers. These disruptions can create shortages, driving up prices and giving suppliers more control over terms and availability.

Financial institutions wield significant bargaining power over real estate developers like Altarea, primarily due to their control over access to crucial financing. This includes development loans for projects and mortgages for potential buyers, both of which are essential for a developer's success. Recent trends in the French market, such as rising interest rates and more stringent lending criteria, have amplified this leverage, making it more challenging for developers to secure favorable terms.

Altarea's strategy to mitigate this supplier power involves bolstering its financial stability and cultivating a diverse range of funding sources. By not being overly reliant on any single financial institution, Altarea can negotiate from a stronger position. This diversification can include exploring alternative financing options beyond traditional bank loans, potentially reducing the impact of any single lender's increased bargaining power.

For its urban transformation and sustainable development projects, Altarea depends on specialized knowledge from architects, urban planners, and environmental consultants. The scarcity of professionals possessing the precise skills needed for innovative or complex mixed-use developments can significantly amplify their bargaining power, especially when demand for their unique services is high.

In 2024, the demand for sustainability-focused architectural services saw a notable increase, with reports indicating a 15% rise in projects incorporating green building certifications. This trend suggests that consultants with expertise in areas like net-zero energy design or circular economy principles are in a strong position.

| Supplier Type | Bargaining Power Factors | Impact on Altarea | 2024 Trend Example | Mitigation Strategy |

|---|---|---|---|---|

| Landowners | Land scarcity, zoning regulations | Higher acquisition costs, project feasibility | Robust demand in prime urban areas | Strategic site acquisition, long-term relationships |

| Construction Contractors | Labor shortages, material cost volatility | Increased project costs, timeline delays | Intensified industry pressures | Diversified contractor base, competitive bidding |

| Material Suppliers | Limited providers of specialized/sustainable materials, supply chain disruptions | Higher input costs, lead time issues | Volatility in steel prices, global disruptions | Bulk purchasing, alternative material sourcing |

| Financial Institutions | Control over financing access, interest rate environment | Cost of capital, loan availability | Rising interest rates, tighter lending criteria in France | Financial stability, diversified funding sources |

| Specialized Consultants | Scarcity of niche expertise (e.g., sustainable design) | Higher service fees, project complexity | 15% rise in green building certification projects | Early engagement, long-term partnerships |

What is included in the product

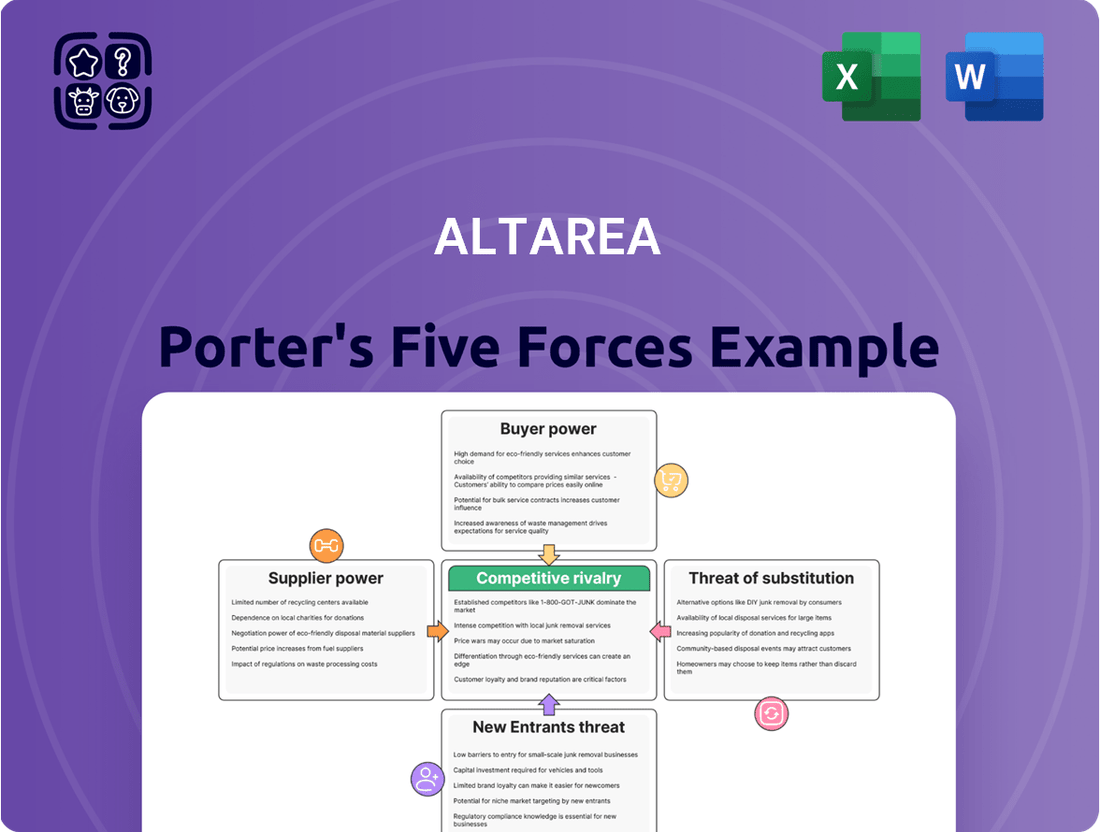

This analysis dissects the competitive forces impacting Altarea, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the real estate sector.

Visualize competitive intensity with a dynamic Porter's Five Forces dashboard, instantly highlighting key threats to inform strategic adjustments.

Customers Bargaining Power

Individual residential buyers can wield significant bargaining power, especially in softer markets. For instance, in early 2024, many European property markets experienced a slowdown, with transaction volumes decreasing. This environment naturally shifts leverage towards buyers, who can negotiate more favorable terms and prices.

Altarea has acknowledged this dynamic by strategically developing more affordable housing options. Their commitment to creating low-carbon, accessible homes directly addresses the price sensitivity of many individual buyers. This approach is crucial for capturing market share when affordability becomes a primary concern.

The company's dual focus on first-time buyers and institutional investors for its residential projects highlights a sophisticated understanding of current market needs. By catering to both individual aspirations and investor demands, Altarea aims to maintain robust sales pipelines even amidst fluctuating buyer power.

Institutional investors wielding substantial capital for commercial properties like shopping centers and office buildings exert considerable bargaining power. Their ability to select from numerous investment opportunities means they can negotiate favorable terms on large-scale acquisitions. For instance, Altarea's recent disposals of logistics sites to major funds demonstrate how these buyers, focused on maximizing returns, can influence deal structures.

The bargaining power of retail tenants within Altarea's portfolio is a key consideration. While Altarea's prime locations and high-traffic centers generally provide a strong negotiating position, the retail landscape in 2024 presented challenges. Reports indicated a rise in retail insolvencies and a general downturn in consumer spending, which could embolden tenants to seek more favorable lease agreements, such as reduced rents or shorter terms, to mitigate their own risks.

Corporate Office Tenants

Corporate tenants, particularly those looking for substantial or premium office spaces, often wield significant bargaining power. This is especially true in markets where supply might be plentiful or where tenants have a clear alternative. For instance, a company leasing a large block of space can negotiate more favorable lease terms, rent reductions, or tenant improvement allowances.

The evolving landscape of work, with hybrid models becoming more prevalent, further amplifies tenant influence. Companies are increasingly prioritizing locations that offer better centrality, accessibility, and amenities to attract and retain employees. This shift means landlords must adapt their offerings to meet these new demands, potentially leading to concessions to secure or keep desirable tenants.

Altarea's strategic focus on office properties in key areas like Ile-de-France and other regional developments underscores the importance of understanding and responding to these tenant preferences. In 2024, the office market continued to see a recalibration of demand, with a premium placed on modern, well-located, and flexible spaces. This environment allows strong corporate tenants to negotiate from a position of strength.

- Tenant Leverage: Large corporate tenants can negotiate rent, lease duration, and fit-out contributions.

- Hybrid Work Impact: Demand for central, accessible, and amenity-rich offices increases tenant bargaining power.

- Market Responsiveness: Landlords like Altarea must cater to evolving tenant needs to secure leases.

- 2024 Trends: The office sector in 2024 saw continued tenant-driven negotiations due to flexible work arrangements.

Public Authorities and Municipalities

Public authorities and municipalities hold considerable sway over Altarea's operations, particularly given its focus on urban transformation and large-scale development projects. Their role as key stakeholders, akin to customers in many respects, stems from their control over essential approvals, zoning regulations, and the potential for public-private partnerships. For instance, securing planning permission for major urban regeneration schemes, a core part of Altarea's business, is entirely dependent on municipal consent.

The bargaining power of these public entities is amplified by their ability to shape urban planning policies and grant or deny permits, directly impacting project timelines and feasibility. Altarea's strategy of developing mixed-use urban environments necessitates close collaboration and negotiation with these governmental bodies. In 2024, the pace of urban development projects across Europe, where Altarea operates, often hinges on the efficiency and willingness of local authorities to streamline approval processes.

- Regulatory Control: Municipalities dictate zoning laws and building permits, directly influencing project scope and viability.

- Partnership Dependence: Altarea often relies on public-private partnerships, giving authorities leverage in negotiations.

- Project Timelines: Delays in municipal approvals can significantly impact project delivery and profitability for Altarea.

- Strategic Alignment: The success of Altarea's urban transformation projects depends on aligning with municipal development goals.

Individual residential buyers' bargaining power is amplified in softer markets, as seen in early 2024 European property slowdowns where transaction volumes decreased, allowing buyers to negotiate better terms. Altarea counters this by offering more affordable, low-carbon housing, targeting price-sensitive first-time buyers. This strategy aims to maintain sales even when buyer leverage is high.

Same Document Delivered

Altarea Porter's Five Forces Analysis

This preview displays the complete Altarea Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the real estate development sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file. This means you'll receive the same in-depth analysis, ready for immediate use without any placeholders or surprises.

Rivalry Among Competitors

The French real estate market is quite fragmented, featuring large, established developers like Altarea alongside a multitude of smaller, specialized firms. This means competition is often fierce, particularly for prime land and development opportunities. For instance, in the residential sector, where Altarea has faced some headwinds, this fragmentation intensifies the struggle for market share.

Altarea faces intense competition from major national property developers like Nexity, Icade, Bouygues, Vinci, and Eiffage. These rivals operate across residential, commercial, and logistics sectors, offering similar integrated services. For instance, Nexity, a prominent player, reported a revenue of €7.1 billion in 2023, highlighting the scale of competition Altarea navigates.

These major developers frequently vie for the same large-scale urban development projects, creating a highly competitive landscape. Their ability to offer comprehensive solutions, from planning to construction and management, means Altarea must continually innovate and differentiate its offerings to secure these significant contracts and maintain market share.

Competitive rivalry is particularly intense within Altarea's established core segments. In the retail real estate sector, Altarea faces significant competition from other Real Estate Investment Trusts (REITs) that also focus on managing shopping centers, each vying for tenants and foot traffic.

Within the residential segment, the competition is notably fierce. Altarea is continuously adapting its residential offerings to meet evolving market conditions and consumer preferences, facing off against a broad range of developers and property managers.

Furthermore, the burgeoning logistics and data center markets, areas Altarea is also exploring, are attracting a growing number of both new entrants and established players, intensifying the competitive landscape across these growth sectors.

Impact of Market Conditions on Competition

Current market conditions, including rising interest rates and increased construction costs, are significantly intensifying competition within the real estate development sector. For instance, the average interest rate for a 30-year fixed mortgage in the US hovered around 7.0% in early 2024, a notable increase from previous years, impacting buyer affordability and demand.

Developers are now contending with a more constrained pool of buyers and investors, which naturally leads to heightened price competition. This environment necessitates a stronger focus on differentiated product offerings and robust operational efficiency to stand out. Companies are increasingly investing in unique design elements, sustainable building practices, and enhanced amenity packages to attract a discerning clientele.

- Rising Interest Rates: Mortgage rates impacting buyer purchasing power.

- Increased Construction Costs: Higher material and labor expenses squeezing developer margins.

- Economic Uncertainties: General economic slowdown affecting consumer confidence and investment.

- Need for Differentiation: Developers must offer unique value propositions to attract buyers.

Differentiation Through Urban Transformation and Sustainability

Altarea is carving out a distinct market position by championing urban transformation and sustainable, low-carbon development initiatives. This strategic focus inherently creates a competitive advantage. For instance, in 2024, Altarea announced a significant expansion of its sustainable portfolio, aiming for 50% of its new developments to meet stringent eco-certifications by 2027.

However, the competitive landscape is evolving rapidly. Many rival developers are also increasingly embedding Environmental, Social, and Governance (ESG) principles into their core business strategies. This trend means Altarea cannot afford to rest on its laurels; continuous innovation and clear leadership in sustainability are crucial to sustain its differentiation.

- Urban Transformation Focus: Altarea's commitment to revitalizing urban areas provides a unique selling proposition.

- Sustainability Leadership: Emphasis on low-carbon projects appeals to environmentally conscious investors and tenants.

- Rising ESG Integration: Competitors are also adopting sustainability, intensifying the need for Altarea to innovate.

- Maintaining Competitive Edge: Consistent demonstration of leadership in sustainable urban development is key to staying ahead.

Competitive rivalry within the French real estate sector is intense, with Altarea facing strong opposition from established national developers like Nexity, Icade, Bouygues, Vinci, and Eiffage. These competitors often target the same large urban development projects, necessitating continuous innovation from Altarea to secure contracts and maintain its market share. The fragmentation of the market, with numerous smaller, specialized firms also vying for opportunities, further amplifies this rivalry.

The current economic climate, characterized by rising interest rates and increased construction costs, is intensifying competition by constraining buyer purchasing power and squeezing developer margins. For instance, in early 2024, average mortgage rates remained elevated, impacting demand. This environment forces developers to compete more aggressively on price and to differentiate their offerings through unique design, sustainability, and enhanced amenities to attract a discerning clientele.

| Competitor | 2023 Revenue (Approx.) | Key Sectors |

|---|---|---|

| Nexity | €7.1 billion | Residential, Commercial, Logistics |

| Icade | €3.1 billion | Healthcare, Residential, Commercial |

| Bouygues Immobilier | €3.2 billion (part of Bouygues Group) | Residential, Commercial, Urban Development |

| Vinci Immobilier | €2.5 billion (part of Vinci Group) | Residential, Commercial, Urban Development |

| Eiffage Immobilier | €1.8 billion (part of Eiffage Group) | Residential, Commercial, Public Facilities |

SSubstitutes Threaten

For residential buyers, the threat of substitutes is significant. Renting remains a viable alternative to purchasing a new home, and the market for existing homes offers another substitute for new construction. In 2024, economic uncertainty and persistent affordability challenges continue to push many potential buyers towards these alternatives, impacting demand for new builds.

For office tenants, co-working spaces and serviced offices are significant substitutes for traditional office leases, especially impacting secondary markets. The rise of permanent remote work arrangements further intensifies this threat. In 2024, the demand for flexible office solutions continued to grow, with co-working space utilization rates in major European cities averaging around 75% by Q3 2024, according to industry reports. This means Altarea's office developments must offer superior value, like prime locations and cutting-edge amenities, to remain competitive.

The threat of substitutes for Altarea's retail property segment, particularly its shopping centers and retail parks, is significant due to the continued growth and convenience of online retail and e-commerce. While Altarea's retail REIT has demonstrated resilience, the overall retail sector has seen numerous business failures, underscoring this substitution pressure.

For example, global e-commerce sales are projected to reach $8.1 trillion by 2024, a substantial portion of total retail spending. This digital shift directly competes with physical retail spaces by offering consumers an alternative channel for purchasing goods, often with greater selection and competitive pricing.

Altarea's strategic move to expand its presence in station travel retail aims to mitigate this threat by focusing on locations with captive audiences and specific, less easily substituted, consumer needs related to convenience and impulse purchases during transit.

Investment in Other Asset Classes

The threat of substitutes for real estate investment is significant, as investors have a wide array of alternative asset classes to consider. In 2024, with interest rates remaining a key factor, many investors are weighing the potential returns of real estate against those offered by other markets. For instance, the S&P 500 saw substantial gains through mid-2024, making equities a compelling alternative.

When economic conditions shift, capital can flow rapidly between asset classes. Higher interest rates, a prevalent theme in 2024, can make fixed-income investments like bonds more attractive, potentially drawing funds away from real estate. This reallocation is particularly pronounced when real estate development projects face increased financing costs or slower rental growth.

- Competition from Stocks: The S&P 500's performance in early 2024, reaching new highs, presents a strong alternative for capital seeking growth.

- Bonds as Substitutes: Rising interest rates in 2024 have increased the attractiveness of bond yields, offering a more stable income stream for some investors compared to real estate.

- Alternative Investments: Venture capital and private equity funds continue to attract significant capital, offering diversification and potentially higher returns, albeit with greater risk.

- Capital Reallocation: Investor sentiment towards real estate can quickly change based on perceived risk and reward relative to other asset classes, especially during periods of economic uncertainty.

Government-backed or Social Housing Initiatives

Government-backed housing programs or increased investment in social housing can present a significant threat of substitution for private residential developers like Altarea. These initiatives often target lower-income segments, offering more affordable alternatives that reduce demand for market-rate private housing. For instance, in 2024, many European countries continued to bolster social housing budgets to address affordability crises, potentially diverting demand from private developers.

Altarea's strategic focus on its new generation offer, which emphasizes affordability, demonstrates an understanding of this competitive pressure. By catering to a broader spectrum of the market, including those who might otherwise be served by public initiatives, Altarea aims to mitigate the impact of substitutes. This approach acknowledges the evolving policy landscape and the persistent need for accessible housing solutions across different income brackets.

The increasing prevalence of such government interventions means that developers must be agile and responsive to policy shifts.

- Government Housing Programs: Initiatives like affordable housing mandates or direct public construction projects can directly compete with private offerings.

- Social Housing Investment: Increased public funding for social housing can absorb demand that might otherwise go to private developers, especially in urban areas.

- Affordability Focus: Developers like Altarea are responding by creating more affordable housing options to capture market share that might be tempted by subsidized alternatives.

- Policy Landscape: Changes in government housing policy, such as tax incentives for affordable housing or stricter regulations on private development, can significantly alter the substitute threat.

The threat of substitutes for Altarea's real estate ventures is multifaceted, encompassing alternative asset classes and different housing or office solutions. For residential buyers, renting and the resale market are key substitutes, with economic conditions in 2024 influencing these choices. Similarly, office tenants can opt for flexible co-working spaces, a trend amplified by continued remote work adoption, as evidenced by 75% utilization rates in European co-working spaces by Q3 2024.

For retail, the primary substitute remains online e-commerce, with global sales projected to hit $8.1 trillion in 2024, directly challenging physical retail spaces. Investors also face substitutes in other asset classes like stocks, with the S&P 500 showing strong performance in early 2024, and bonds becoming more attractive due to rising interest rates. Government housing programs further represent a substitute threat, particularly in affordability-challenged markets where public initiatives can divert demand from private developers.

| Segment | Primary Substitutes | 2024 Trend/Data Point | Impact on Altarea |

|---|---|---|---|

| Residential | Renting, Existing Homes | Economic uncertainty favoring rental market | Reduced demand for new builds |

| Office | Co-working, Serviced Offices, Remote Work | 75% co-working utilization (Europe, Q3 2024) | Need for premium office offerings |

| Retail | E-commerce | $8.1 trillion global e-commerce sales projected | Pressure on physical retail centers |

| Investment | Stocks (e.g., S&P 500), Bonds | S&P 500 reaching new highs (early 2024) | Capital reallocation away from real estate |

Entrants Threaten

The real estate development and investment sector, particularly for large-scale ventures like those Altarea engages in, demands substantial capital. This presents a significant hurdle for new players, as obtaining funding for land acquisition, construction, and sustained investment is inherently difficult and typically necessitates a demonstrated history of success. For instance, in 2024, the average cost of a major commercial real estate development project can easily run into hundreds of millions of dollars, a sum prohibitive for many aspiring entrants.

The French real estate sector presents a formidable barrier to entry due to its intricate web of regulations. Urban planning laws, stringent environmental standards, and the necessity of obtaining various building permits demand significant expertise and time investment. For instance, the lengthy approval processes for new developments can add months, if not years, to project timelines, increasing upfront costs and risk for newcomers.

Altarea, boasting over three decades of operation and established brands such as Cogedim, enjoys significant brand recognition and a robust reputation within the French real estate sector. Newcomers would face a substantial hurdle, requiring extensive time and capital to cultivate comparable trust and credibility among consumers, collaborators, and local governing bodies.

Access to Land and Development Opportunities

Securing prime land for development presents a significant hurdle for new entrants in the real estate sector. Altarea's established relationships and deep understanding of the market allow it to effectively identify and acquire desirable land parcels. This can make it difficult for newcomers to compete for these sought-after opportunities, particularly in dense urban environments where land availability is scarce.

In 2024, the competition for prime development sites remained intense across major European cities. For instance, land prices in Paris, a key market for Altarea, continued to see upward pressure, with some prime commercial plots trading at over €20,000 per square meter. This high cost of entry and the difficulty in securing suitable locations act as a substantial barrier for potential new competitors.

- Limited Land Availability: Urban land scarcity in 2024 meant fewer opportunities for new developers.

- High Acquisition Costs: Prime land prices, exceeding €20,000/sqm in Paris, deter new entrants.

- Altarea's Network Advantage: Established relationships facilitate Altarea's access to land.

- Competitive Disadvantage: Newcomers face challenges competing for attractive development sites.

Integrated Business Model and Expertise

Altarea's integrated business model, spanning residential, retail, and office spaces, alongside emerging sectors like photovoltaics and data centers, presents a significant barrier to new entrants. This diversification allows Altarea to leverage synergies across its operations, something a new competitor would struggle to replicate from the outset.

Newcomers often begin with a narrower focus, lacking the established expertise and cross-sectoral advantages that Altarea has cultivated. For instance, in 2024, Altarea continued its strategic expansion into new activities, demonstrating a commitment to a broad operational scope that requires substantial capital and diverse skill sets to match.

- Diversified Operations: Altarea’s multi-segment approach reduces reliance on any single market.

- Synergistic Advantages: Cross-pollination of expertise and resources between segments enhances efficiency.

- Barriers to Entry: Replicating Altarea's integrated model requires significant capital investment and broad market knowledge.

- Expertise Depth: Altarea's long-standing presence across various real estate sectors builds deep, hard-to-acquire expertise.

The threat of new entrants for Altarea is generally low due to substantial capital requirements and regulatory complexities in French real estate development. High upfront costs, estimated in the hundreds of millions for major projects in 2024, coupled with lengthy approval processes for urban planning and environmental standards, create significant barriers. Altarea's established brand reputation, built over three decades, and its strategic land acquisition capabilities further solidify its position against potential newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High cost of land acquisition and development. | Significant hurdle for new players without established funding. | Major commercial project costs can exceed €100 million. |

| Regulatory Environment | Complex urban planning, environmental laws, and permit processes. | Requires extensive expertise, time, and increases upfront risk. | Development approvals can add months to project timelines. |

| Brand & Reputation | Altarea's established trust and credibility. | New entrants need substantial time and investment to build comparable recognition. | Decades of successful projects build strong consumer and stakeholder confidence. |

| Land Access | Difficulty securing prime development sites. | Altarea's relationships provide an advantage in competitive land markets. | Prime Paris land prices can exceed €20,000/sqm. |

| Operational Scale | Altarea's diversified and integrated business model. | Challenging for new entrants to replicate the breadth of expertise and synergies. | Expansion into photovoltaics and data centers requires broad market knowledge. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive approach, drawing data from company annual reports, industry-specific market research, and publicly available financial filings to provide a robust understanding of competitive dynamics.