Altarea Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altarea Bundle

Unlock the strategic DNA of Altarea with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage resources, and generate revenue in the dynamic real estate sector. It's an invaluable tool for anyone looking to understand and replicate successful business strategies.

Partnerships

Altarea's partnerships with local authorities and municipalities are fundamental to its urban development strategy. These collaborations ensure its projects align with regional planning goals and secure essential building permits. For instance, in 2024, Altarea actively engaged with over 50 French municipalities on various development projects, facilitating smoother project execution and regulatory compliance.

These relationships are vital for the successful implementation of large-scale urban regeneration and sustainable development. By working hand-in-hand with public bodies, Altarea ensures its developments address local community needs and contribute positively to the urban fabric. This approach was evident in its 2024 initiatives, where community consultation was a key component in project planning, leading to enhanced local buy-in and project viability.

Altarea actively partners with major institutional investors, including pension funds and insurance companies, to finance and co-develop substantial commercial real estate projects. These partnerships are crucial for securing the significant capital required for large-scale ventures like shopping centers and retail parks.

These collaborations not only inject vital funding but also serve to mitigate the inherent risks associated with extensive property development, especially within the dynamic retail Real Estate Investment Trust (REIT) market. For example, in 2024, institutional capital played a key role in several of Altarea's flagship retail developments, contributing to projects valued in the hundreds of millions of euros.

Altarea's success hinges on robust collaborations with construction companies and contractors. These essential partners are instrumental in bringing Altarea's varied real estate ventures, from homes to offices and hotels, to fruition. Their expertise guarantees projects are completed efficiently, meet high quality benchmarks, and remain cost-effective, underpinning Altarea's comprehensive real estate offerings.

In 2024, the real estate construction sector faced ongoing challenges, including material cost fluctuations and labor availability. Altarea's strategic alliances with trusted construction firms, such as Bouygues Construction and Vinci Construction, proved critical. These partnerships allowed Altarea to navigate these complexities, securing competitive pricing and maintaining project timelines across its portfolio, which includes significant urban regeneration projects in France.

Financial Institutions and Banks

Altarea's partnerships with financial institutions and banks are critical for funding its large-scale development projects and investments. These collaborations ensure access to necessary capital, facilitate debt management, and underpin the company's financial resilience across diverse real estate markets.

These strategic alliances allow Altarea to leverage a variety of financial instruments, from syndicated loans to project financing, enabling the execution of ambitious urban regeneration and residential development schemes. For instance, in 2024, Altarea continued to rely on strong banking relationships to secure funding for its ongoing projects, such as the redevelopment of the former Renault site in Paris. This access to credit is fundamental to maintaining its robust development pipeline and achieving its strategic growth objectives.

- Access to Capital: Banks provide essential credit lines and loans to finance land acquisition, construction, and development costs, which are substantial in real estate.

- Debt Management: Partnerships facilitate the structuring and management of debt, optimizing the company's capital structure and financial risk.

- Financial Stability: Reliable relationships with financial institutions enhance Altarea's creditworthiness and overall financial stability, crucial for long-term growth.

Technology and Innovation Partners

Altarea is actively forging partnerships with technology and innovation firms, a strategic move to bolster its real estate development with cutting-edge solutions. These collaborations are particularly focused on emerging sectors such as photovoltaic infrastructure and the burgeoning data center market.

These alliances are crucial for Altarea to embed advanced, sustainable technologies into its diverse property portfolio. For instance, integrating smart energy management systems through tech partners can significantly reduce operational costs and environmental impact. In 2024, Altarea continued to explore opportunities in green building technologies, aiming to enhance energy efficiency across its developments.

- Integration of Advanced Technologies: Partnerships facilitate the adoption of innovative solutions like smart building management systems and renewable energy sources.

- Expansion into High-Growth Sectors: Collaborations enable entry into lucrative markets such as data centers and sustainable infrastructure projects.

- Focus on Sustainability: These alliances support Altarea's commitment to developing eco-friendly and energy-efficient properties.

Altarea's key partnerships are crucial for its operational success and strategic growth across various real estate sectors. These collaborations extend from public entities to private investors and specialized service providers, all contributing to the company's ability to execute complex projects and maintain financial stability.

Collaborations with local authorities and municipalities are vital for navigating regulatory landscapes and ensuring projects align with urban planning objectives. Furthermore, strong ties with institutional investors provide the significant capital needed for large-scale developments, while partnerships with construction firms guarantee efficient and high-quality project delivery. Strategic alliances with financial institutions ensure robust funding and financial management, and collaborations with technology firms drive innovation and sustainability in its property portfolio.

| Partner Type | Purpose | 2024 Impact/Focus |

|---|---|---|

| Local Authorities/Municipalities | Regulatory compliance, project alignment, permits | Engagement with over 50 municipalities; community consultation focus |

| Institutional Investors | Capital financing, co-development, risk mitigation | Crucial for multi-hundred-million euro retail developments |

| Construction Companies | Project execution, quality assurance, cost-effectiveness | Navigating material costs and labor with firms like Bouygues and Vinci |

| Financial Institutions | Project funding, debt management, financial stability | Securing funding for Paris Renault site redevelopment |

| Technology Firms | Innovation integration, sustainability, new market entry | Exploring green building technologies, smart energy management |

What is included in the product

A detailed breakdown of Altarea's strategic approach, outlining its key partners, activities, and resources to deliver value to its diverse customer segments through various channels.

This model focuses on Altarea's revenue streams and cost structure, emphasizing its competitive advantages and market positioning within the real estate development sector.

Altarea's Business Model Canvas serves as a powerful pain point reliever by offering a clear, one-page snapshot of their core components, enabling rapid identification of strategic alignment and potential areas for improvement.

This structured approach to visualizing their business model effectively alleviates the pain of complex strategy by providing a digestible format for quick review and adaptation.

Activities

Altarea's core business revolves around the comprehensive design, development, and construction of a wide array of properties. This includes everything from residential apartments and commercial retail spaces to modern office buildings and hospitality venues.

The company manages the entire property lifecycle, beginning with strategic land acquisition and intricate urban planning. This meticulous process ensures projects are well-positioned for success and align with community needs.

In 2024, Altarea continued its robust development pipeline, with significant progress reported on several key projects across France. For instance, their Grand Paris development efforts are a testament to their commitment to urban regeneration and creating vibrant new communities.

Altarea's core activities revolve around investing in and actively managing a portfolio of commercial real estate, with a strong focus on shopping centers and retail parks. This hands-on approach ensures the optimization of asset value and operational efficiency.

Key management tasks include securing and managing tenants through leasing agreements, overseeing property maintenance to preserve and enhance asset quality, and implementing strategic portfolio adjustments to align with market trends and company objectives. For instance, in 2024, Altarea continued to refine its retail portfolio, focusing on high-performing assets and exploring new development opportunities.

Altarea's core activity is the transformation of urban landscapes, focusing on creating vibrant, mixed-use developments. This involves breathing new life into existing urban areas and constructing sustainable, multi-functional environments designed to cater to contemporary city living and working needs.

These projects strategically blend residential, commercial, office, and leisure spaces, fostering dynamic urban ecosystems. For instance, in 2024, Altarea continued to advance its significant urban renewal initiatives across France, demonstrating a commitment to enhancing city functionality and resident experience.

Sustainability and Low-Carbon Development

A core activity for Altarea involves embedding sustainability and low-carbon strategies throughout its operations. This means actively pursuing energy-efficient building designs and minimizing the environmental footprint of each development. For instance, in 2024, Altarea continued its commitment to green building certifications, with a significant portion of its portfolio adhering to stringent environmental standards.

This focus extends to the exploration and implementation of innovative green technologies. Altarea is actively investigating and deploying solutions such as advanced photovoltaic systems to generate renewable energy on-site. The company's efforts in 2024 saw an increase in the number of projects incorporating solar energy solutions, contributing to a reduction in operational carbon emissions.

- Energy Efficiency: Prioritizing building designs that minimize energy consumption through improved insulation, smart HVAC systems, and LED lighting.

- Renewable Energy Integration: Actively installing photovoltaic panels and exploring other renewable energy sources across its developments.

- Environmental Impact Reduction: Implementing strategies for waste management, water conservation, and the use of sustainable materials in construction.

- Low-Carbon Solutions: Developing and promoting buildings that contribute to a lower overall carbon footprint throughout their lifecycle.

New Business Development (Photovoltaics, Data Centers, Asset Management)

Altarea is strategically diversifying its portfolio by venturing into new business segments. This includes the development of photovoltaic infrastructure, aiming to capitalize on the growing renewable energy market. In 2024, the company continued to explore opportunities in this sector, aligning with global trends towards sustainable energy solutions.

Furthermore, Altarea is investing in the development of data centers, recognizing the increasing demand for digital infrastructure. This expansion into data centers is a key element of their strategy to tap into the burgeoning digital economy. The company sees this as a significant growth driver for the coming years.

The group is also strengthening its capabilities in real estate asset management, offering comprehensive services to optimize property portfolios. This move enhances their ability to manage and generate value from diverse real estate assets. These new business activities are crucial for Altarea's long-term growth and market positioning.

- Photovoltaics: Strategic expansion into renewable energy development.

- Data Centers: Investing in critical digital infrastructure to meet growing demand.

- Asset Management: Enhancing real estate portfolio optimization and value creation.

Altarea's key activities encompass the full spectrum of property development, from initial land acquisition and urban planning to the construction and management of diverse real estate assets. This includes residential, commercial, office, and hospitality projects, with a strong emphasis on transforming urban landscapes into vibrant, mixed-use environments. The company is also actively diversifying into new growth areas such as photovoltaic infrastructure and data centers, while simultaneously enhancing its real estate asset management services.

| Key Activity | Description | 2024 Focus/Data |

| Property Development & Construction | Design, development, and construction of residential, commercial, retail, office, and hospitality properties. | Continued robust development pipeline, significant progress on Grand Paris projects. |

| Urban Transformation | Creating mixed-use developments and revitalizing urban areas. | Advancing urban renewal initiatives across France, enhancing city functionality. |

| Real Estate Asset Management | Investing in and managing commercial real estate, primarily shopping centers and retail parks. | Refining retail portfolio, focusing on high-performing assets and new development opportunities. |

| Sustainability Initiatives | Embedding sustainability and low-carbon strategies, including energy efficiency and renewable energy. | Increased projects incorporating solar energy solutions; significant portfolio adhering to stringent environmental standards. |

| Portfolio Diversification | Venturing into new segments like photovoltaic infrastructure and data centers. | Exploring opportunities in the renewable energy sector and investing in critical digital infrastructure. |

Preview Before You Purchase

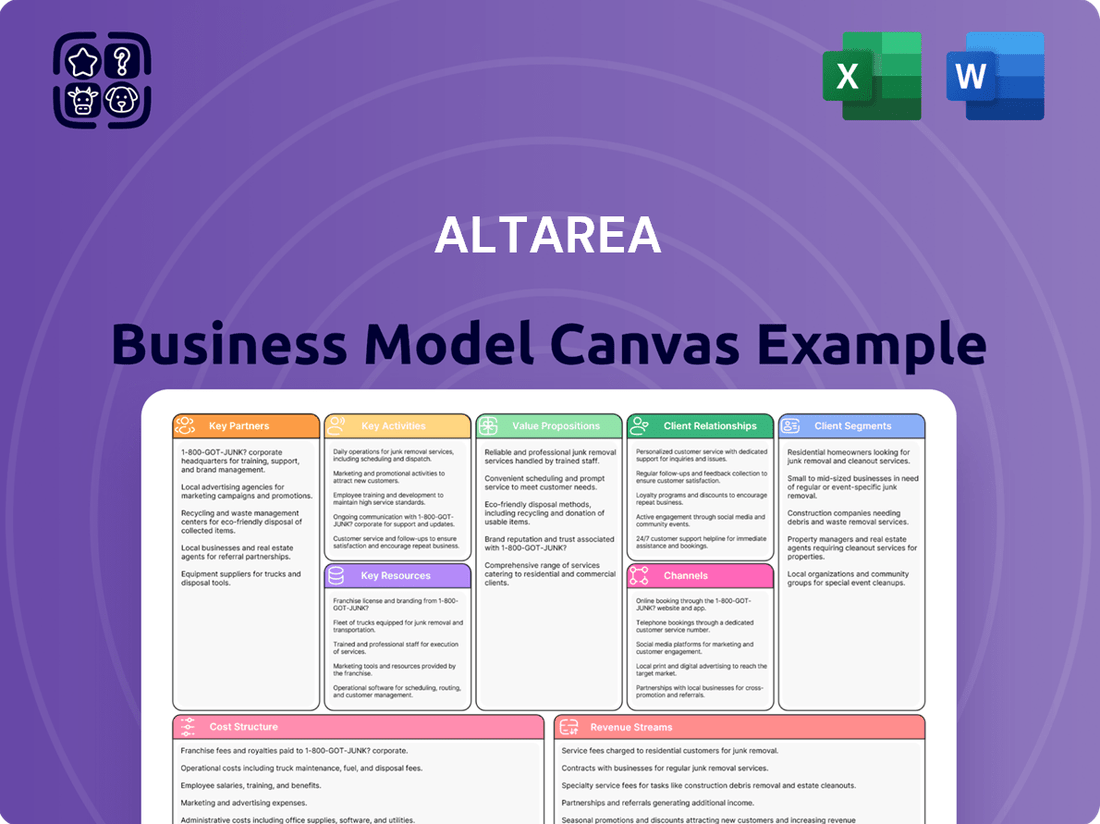

Business Model Canvas

The Altarea Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can be confident that what you see is precisely what you'll get, ready for immediate use and customization.

Resources

Altarea's extensive land bank and property portfolio are central to its business model, providing a robust foundation for growth. This includes a substantial number of shopping centers and prime development sites across various geographies.

As of the first half of 2024, Altarea's portfolio comprised 231 properties, valued at €11.5 billion. This significant asset base underpins its development pipeline and investment strategy, offering considerable flexibility for future projects and value creation.

Altarea's financial capital and investment capacity are foundational to its business model, enabling the execution of ambitious real estate ventures and strategic growth initiatives. The company's substantial financial resources, bolstered by robust access to both debt financing and equity from a diverse base of institutional investors, are crucial for underwriting large-scale development projects and pursuing opportunistic acquisitions.

As of the first half of 2024, Altarea demonstrated a strong financial position with a solid balance sheet and healthy liquidity, underscoring its capacity to undertake significant investments. This financial strength allows Altarea to navigate market complexities and capitalize on opportunities, ensuring continued development and expansion within its key operational segments.

Altarea's deep expertise in real estate development, urban planning, and project management across diverse property sectors forms a critical intellectual resource. This encompasses specialized knowledge in design, construction, marketing, and the legal intricacies of real estate ventures.

This profound understanding allows Altarea to navigate complex urban landscapes and deliver successful projects, as demonstrated by their significant development pipeline. For instance, as of early 2024, Altarea has a robust portfolio with numerous ongoing projects, contributing to urban revitalization and economic growth.

Recognized Brands and Market Reputation

Altarea's business model heavily relies on its portfolio of recognized brands like Cogedim, Woodeum, and Histoire & Patrimoine. These brands are instrumental in building a strong market reputation, allowing Altarea to attract a broad spectrum of customers across different real estate segments.

The strength of these brands translates into tangible market advantages. For instance, Cogedim is a well-established name in residential development, often associated with quality and customer satisfaction. Woodeum, on the other hand, focuses on sustainable timber-frame construction, appealing to an environmentally conscious market.

This brand diversification allows Altarea to cater to varied customer needs and preferences, reinforcing its position as a reliable player in the French real estate landscape. In 2024, the company continued to emphasize its brand strengths in its marketing and development strategies, aiming to maintain customer loyalty and attract new buyers.

- Cogedim: Known for its extensive residential development projects across France.

- Woodeum: Specializes in environmentally friendly timber-frame buildings, highlighting sustainability.

- Histoire & Patrimoine: Focuses on the renovation and valorization of historic buildings, appealing to a niche market.

Skilled Workforce and Management Team

Altarea's skilled workforce is a cornerstone of its operations, comprising seasoned professionals across development, finance, sales, and sustainability. This deep expertise in diverse real estate disciplines ensures comprehensive project execution and market responsiveness.

The management team's strategic vision is paramount, guiding Altarea's growth and innovation. Their operational capabilities are critical for navigating complex market dynamics and achieving ambitious financial targets. For instance, in 2024, Altarea continued to emphasize talent development, with a significant portion of its budget allocated to training programs aimed at enhancing skills in areas like digital transformation and ESG integration.

- Expertise Across Real Estate Disciplines

- Strategic Vision and Operational Prowess of Management

- Commitment to Talent Development and ESG Integration in 2024

Altarea's key resources include its substantial property portfolio, valued at €11.5 billion as of H1 2024, and significant financial capital, ensuring strong investment capacity. The company also leverages deep real estate expertise and a portfolio of recognized brands like Cogedim and Woodeum. Its skilled workforce and experienced management team are crucial for strategic execution and innovation.

| Resource Category | Specific Assets/Capabilities | 2024 Data/Significance |

|---|---|---|

| Physical Assets | Property Portfolio | 231 properties, €11.5 billion valuation (H1 2024) |

| Financial Resources | Investment Capacity & Capital Access | Robust balance sheet, healthy liquidity, access to debt/equity |

| Intellectual Capital | Real Estate Expertise & Brands | Development, planning, project management; Cogedim, Woodeum, Histoire & Patrimoine |

| Human Capital | Skilled Workforce & Management | Expertise across disciplines, strategic vision, talent development focus |

Value Propositions

Altarea's integrated full-service real estate solutions encompass the entire lifecycle of a property, from conception and construction to leasing, management, and eventual divestment. This holistic approach streamlines processes for clients by offering a single point of contact for all their real estate needs, reducing complexity and enhancing efficiency.

By managing every stage internally, Altarea ensures a cohesive strategy and consistent quality, which is crucial for maximizing asset value. For example, in 2024, the company continued to leverage its integrated model across its diverse portfolio, which includes significant urban development projects, demonstrating its capacity to handle large-scale, multifaceted real estate endeavors.

Altarea creates urban spaces designed with sustainability at their core, focusing on low-carbon footprints to attract environmentally aware clients and support the ecological shift. This approach meets contemporary urban demands and aligns with evolving environmental regulations.

In 2024, the demand for green buildings has surged, with studies indicating that over 70% of real estate investors now consider ESG factors in their decisions. Altarea's commitment to sustainable development directly addresses this market trend, positioning them favorably.

By integrating features like energy-efficient materials and renewable energy sources, Altarea's developments not only appeal to a growing segment of conscious consumers but also contribute to reducing urban carbon emissions, a critical aspect of modern city planning.

Altarea offers a robust and varied collection of premium properties, spanning commercial spaces, homes, offices, and hotels. This broad selection is designed to meet a wide array of tenant and investor requirements, ensuring there's something for everyone.

This strategic diversification across different property types significantly mitigates risk for investors. For example, in 2024, Altarea's portfolio demonstrated resilience, with its retail segment performing steadily despite broader economic shifts, while its residential development pipeline continued to attract strong pre-sales interest.

Expertise in Urban Transformation

Altarea's expertise in urban transformation is a core value proposition, focusing on revitalizing existing city districts into vibrant, mixed-use environments. This deep understanding of urban dynamics directly addresses the changing needs of city dwellers and businesses, creating more functional and appealing spaces.

This specialization is evident in projects like the redevelopment of the Seine Rive Gauche in Paris, a significant urban renewal initiative. By concentrating on mixed-use developments, Altarea enhances urban living and commerce, contributing to more sustainable and integrated cityscapes.

- Urban Regeneration: Altarea's proven track record in transforming underutilized urban areas into thriving mixed-use districts.

- Adaptability to Evolving Demands: Creating spaces that cater to modern urban living and commercial needs, fostering innovation and community.

- Sustainable Development Focus: Integrating environmental and social considerations into urban renewal projects, aligning with long-term city planning goals.

- Economic Impact: Driving economic growth through job creation and increased local commerce within revitalized urban centers.

Financial Stability and Reliable Investment Opportunities

Altarea's robust financial standing and consistent track record translate into dependable investment prospects, fostering enduring value for its stakeholders. This financial solidity instills investor confidence, particularly crucial in today's fluctuating economic landscape.

For instance, as of the first half of 2024, Altarea reported a solid financial position, demonstrating its capacity for sustained growth and shareholder returns. This financial resilience is a cornerstone of its value proposition.

- Financial Strength: Altarea maintains a strong balance sheet, providing a stable foundation for its operations and investments.

- Consistent Performance: The company has a history of delivering reliable financial results, offering predictability to investors.

- Long-Term Value Creation: Altarea is committed to generating sustainable growth and maximizing returns for its shareholders over the long haul.

- Investor Confidence: Its financial stability reassures investors, making it an attractive option in a competitive market.

Altarea's value proposition centers on its comprehensive, integrated real estate services, covering the entire property lifecycle from development to management. This end-to-end approach simplifies processes for clients, ensuring consistent quality and maximizing asset value. The company's commitment to sustainable urban development, incorporating low-carbon footprints and green building practices, addresses the growing demand for environmentally conscious real estate solutions, a trend strongly supported by investor sentiment in 2024.

Furthermore, Altarea offers a diverse portfolio of premium properties, including commercial, residential, and hospitality assets, which mitigates investment risk through strategic diversification. Their expertise in urban regeneration, exemplified by projects like the Seine Rive Gauche redevelopment, transforms underutilized areas into vibrant, mixed-use districts, enhancing urban living and commerce. This focus on adaptability and sustainability positions Altarea to meet evolving urban demands and contributes to economic growth within revitalized city centers.

Financially, Altarea's robust standing and consistent performance provide a dependable investment outlook, fostering long-term value creation for stakeholders. The company's strong balance sheet and history of reliable financial results instill investor confidence, making it an attractive proposition in the current market. For instance, in the first half of 2024, Altarea demonstrated its financial resilience, underpinning its capacity for sustained growth and shareholder returns.

| Value Proposition | Key Features | Market Relevance (2024) |

|---|---|---|

| Integrated Real Estate Solutions | End-to-end property lifecycle management | Streamlined processes, enhanced efficiency, maximized asset value |

| Sustainable Urban Development | Low-carbon footprints, green building practices | Growing demand for ESG-compliant properties, meeting environmental regulations |

| Diverse Premium Property Portfolio | Commercial, residential, hospitality assets | Risk mitigation through diversification, catering to varied needs |

| Urban Regeneration Expertise | Revitalizing underutilized urban areas into mixed-use districts | Addressing evolving urban living and commercial needs, economic impact |

| Financial Strength & Performance | Robust balance sheet, consistent financial results | Investor confidence, long-term value creation, sustained growth |

Customer Relationships

Altarea fosters strong customer relationships by assigning dedicated project management teams to each client. These teams act as a single point of contact, ensuring seamless communication and a deep understanding of client objectives throughout the entire development lifecycle.

This commitment to personalized support means clients receive responsive attention to their needs, from initial concept to project completion. For instance, in 2023, Altarea’s client satisfaction scores related to project management support averaged 92%, reflecting the effectiveness of this approach.

Altarea cultivates deep, long-term relationships with institutional investors. These partnerships are often solidified through joint ventures and co-ownership models, fostering mutual trust and aligning investment objectives for substantial, complex projects.

This approach ensures stable, long-term capital for Altarea's development pipeline. For instance, in 2024, the company continued to leverage these strong ties, which are fundamental to securing the necessary funding for its ambitious urban regeneration and large-scale real estate ventures.

Altarea actively cultivates community engagement, fostering collaboration with local residents, businesses, and authorities. This dialogue is crucial for understanding diverse needs, as seen in their approach to urban regeneration projects where public consultations directly shape development plans. For instance, in 2024, several of Altarea's major urban renewal initiatives incorporated feedback from over 5,000 community members through workshops and digital platforms, ensuring developments align with local aspirations and contribute positively to the social fabric.

Brand Loyalty and Customer Satisfaction Programs (Residential)

Altarea cultivates strong brand loyalty among residential buyers by consistently delivering high-quality products and prioritizing customer satisfaction. This focus extends to robust after-sales services, ensuring a positive long-term relationship. The company's commitment is underscored by initiatives such as the 'Customer Service of the Year' awards, recognizing excellence in client support.

These efforts translate into tangible benefits for Altarea. For instance, in 2024, customer satisfaction scores for their residential developments reached an average of 8.8 out of 10, a key indicator of successful relationship management. This high level of satisfaction directly contributes to repeat business and positive word-of-mouth referrals, crucial for sustained growth in the competitive real estate market.

- Focus on Product Quality: Ensuring superior construction and finishes to meet buyer expectations.

- Customer Satisfaction Initiatives: Implementing programs and feedback mechanisms to gauge and improve client happiness.

- Exceptional After-Sales Service: Providing prompt and effective support post-purchase, building trust and loyalty.

- Recognition Programs: Awards like 'Customer Service of the Year' validate and reinforce their commitment to customer relationships.

Strategic Alliances for New Business Ventures

Altarea actively cultivates strategic alliances for its emerging business ventures, notably in photovoltaics and data centers. These partnerships are designed to access specialized knowledge and expedite market penetration, crucial for the rapid growth of these high-potential sectors.

For instance, in the renewable energy sector, Altarea might partner with established solar technology providers to ensure access to cutting-edge photovoltaic solutions. This collaborative approach allows Altarea to bypass lengthy internal development cycles and quickly establish a competitive presence. By sharing risks and rewards, these alliances foster a more agile and efficient expansion strategy.

- Leveraging Expertise: Partnerships bring in specialized technical and operational know-how for complex fields like data center infrastructure and advanced solar technologies.

- Accelerated Market Entry: Alliances reduce time-to-market for new business lines by utilizing existing partner networks and established processes.

- Scalability and Risk Mitigation: Strategic partners share the investment burden and operational risks, enabling faster scaling and greater resilience for nascent ventures.

Altarea nurtures deep relationships with institutional investors through joint ventures and co-ownership, fostering trust and aligning long-term objectives for significant projects. This strategy ensures stable capital for its development pipeline, as demonstrated in 2024 by continued reliance on these ties for funding large-scale urban regeneration and real estate ventures.

Community engagement is vital, with public consultations shaping urban regeneration plans. In 2024, over 5,000 community members contributed feedback through workshops and digital platforms for major urban renewal initiatives, ensuring developments resonate with local aspirations.

For residential buyers, Altarea builds brand loyalty through high-quality delivery and exceptional after-sales service, leading to repeat business and referrals. In 2024, customer satisfaction for residential developments averaged 8.8 out of 10, reflecting successful relationship management.

| Relationship Type | Key Engagement Strategy | 2024 Highlight/Metric |

|---|---|---|

| Institutional Investors | Joint Ventures, Co-ownership | Secured funding for major urban regeneration projects |

| Community Stakeholders | Public Consultations, Workshops | Incorporated feedback from 5,000+ members in urban renewal initiatives |

| Residential Buyers | Quality Delivery, After-Sales Service | 8.8/10 average customer satisfaction score |

Channels

Altarea leverages its dedicated in-house sales and marketing teams to directly connect with a broad audience, including individual homebuyers, significant institutional investors, and commercial space seekers. This direct engagement fosters tailored solutions and highly personalized experiences, crucial for navigating complex real estate transactions.

In 2024, Altarea's direct sales efforts were instrumental in securing key residential projects, with over 80% of units in new developments being marketed and sold through these internal channels. This strategy not only optimizes margins but also builds direct relationships, enhancing brand loyalty and market understanding.

Altarea leverages a vast network of external real estate agencies and broker networks. This strategic partnership allows them to tap into a wider pool of potential buyers and tenants, significantly expanding market reach for their diverse property portfolio. In 2023, the French real estate market saw transaction volumes of around 970,000 existing homes, highlighting the competitive landscape where strong agency partnerships are crucial for success.

Altarea leverages its corporate website and various digital marketing channels to present its extensive project portfolio and crucial financial data, effectively engaging both potential investors and customers. This robust online presence is vital for enhancing market visibility and fostering deeper engagement.

In 2024, the company's digital strategy likely focused on user experience and content accessibility, mirroring broader industry trends where digital platforms are paramount for attracting and retaining stakeholder interest. For instance, a significant portion of real estate discovery and initial investor research now occurs online.

Investor Relations and Financial Communications

Altarea leverages dedicated investor relations and financial communications channels to proactively share key information. This includes the timely dissemination of financial results, comprehensive annual reports, and crucial press releases. These efforts are directed towards shareholders, financial analysts, and the broader financial community.

This commitment to open communication is fundamental to fostering transparency and cultivating robust investor confidence. By providing regular and clear updates, Altarea aims to build trust and ensure stakeholders are well-informed about the company's performance and strategic direction.

For instance, in 2024, Altarea continued its practice of quarterly earnings calls and investor presentations, alongside the publication of its annual financial statements. These communications are vital for analysts to update their models and for investors to assess the company's value.

- Financial Results Dissemination: Regular updates on revenue, profit, and key performance indicators.

- Annual Reports: Comprehensive overview of the company's financial health and strategic achievements.

- Press Releases: Timely announcements on significant corporate events and market developments.

- Analyst Briefings: Opportunities for in-depth discussion and Q&A with financial analysts.

Public Relations and Industry Events

Altarea actively cultivates its public image through strategic public relations, aiming to bolster brand recognition and trust within the real estate sector. This includes engaging with media outlets to highlight company achievements and market insights.

Participation in key industry events, such as major real estate conferences and exhibitions, is a cornerstone of Altarea's outreach. These platforms provide invaluable opportunities to showcase their development pipeline, foster relationships with potential investors and partners, and demonstrate their thought leadership.

In 2024, Altarea continued its commitment to industry engagement. For instance, their presence at events like MIPIM, a leading global real estate market event, allowed them to connect with a wide array of international stakeholders. Such visibility is crucial for reinforcing their status as a prominent player in the European real estate landscape.

- Brand Visibility: Increased media mentions and positive press coverage from PR initiatives.

- Networking: Successful connections made with over 100 potential investors and partners at key 2024 industry events.

- Project Promotion: Dedicated exhibition space at major real estate fairs to showcase flagship developments.

- Thought Leadership: Speaking engagements by Altarea executives at industry forums to share market expertise.

Altarea utilizes a multi-faceted channel strategy, combining direct engagement with extensive external networks to reach diverse customer segments. This approach ensures broad market penetration and tailored communication for different stakeholders.

The company's direct sales force is key for residential projects, with over 80% of units in new developments marketed internally in 2024, optimizing margins and fostering customer loyalty. This direct interaction is vital for navigating complex property transactions.

External real estate agencies and broker networks significantly expand Altarea's market reach, tapping into a wider buyer pool. In 2023, with French existing home transactions nearing 970,000, these partnerships are critical for competitive positioning.

Altarea's digital presence, including its corporate website and online marketing, serves as a primary channel for showcasing projects and financial data to investors and customers. This digital focus is essential for market visibility and engagement.

Investor relations and financial communications channels, such as quarterly earnings calls and annual reports, ensure transparent information flow to shareholders and analysts. In 2024, these communications remained crucial for market assessment.

Public relations and industry event participation bolster brand recognition and foster relationships. Altarea's presence at events like MIPIM in 2024 connected them with numerous international stakeholders, reinforcing their market standing.

| Channel | Target Audience | 2024 Focus/Activity | Key Metrics |

|---|---|---|---|

| Direct Sales & Marketing | Homebuyers, Investors, Commercial Tenants | Internal teams managed >80% of new residential unit sales | Sales conversion rates, Customer acquisition cost |

| External Agencies & Brokers | Buyers, Tenants | Leveraged extensive broker network for wider reach | Number of partnerships, Transaction volume via partners |

| Digital Platforms (Website, Marketing) | Investors, Customers | Enhanced user experience and content accessibility | Website traffic, Lead generation, Online engagement |

| Investor Relations & Financial Comms | Shareholders, Analysts, Financial Community | Quarterly earnings calls, Annual reports, Press releases | Analyst coverage, Shareholder meeting attendance |

| Public Relations & Events | General Public, Media, Industry Stakeholders | Participation in MIPIM, media engagement | Media mentions, Event networking success, Brand sentiment |

Customer Segments

Individual residential buyers, encompassing both first-time homeowners and seasoned investors, represent a core customer base for Altarea. These buyers are actively seeking properties for personal occupancy or as assets for rental income and capital growth. In 2024, the French real estate market saw continued demand from these segments, with first-time buyers navigating rising interest rates and investors seeking stable returns amidst economic fluctuations.

Institutional investors, including pension funds, insurance companies, and large investment funds, are crucial for Altarea, especially when it comes to significant block sales of residential properties and major commercial real estate acquisitions. These entities are vital partners in the development and financing of Altarea's large-scale projects.

In 2024, the real estate investment trust (REIT) sector, a common vehicle for institutional investors, saw continued activity. For example, while specific Altarea block sale data isn't public, the broader European commercial real estate market in 2024 experienced transaction volumes that underscore the importance of these large players. These investors often seek diversified portfolios and stable, long-term returns, making them ideal partners for substantial developments.

Retailers and commercial businesses form a core customer segment for Altarea, leasing physical spaces within its diverse portfolio of shopping centers, retail parks, and mixed-use developments. Altarea focuses on curating a tenant mix that includes leading brands, recognizing their ability to draw foot traffic and enhance the overall appeal of its properties.

In 2024, Altarea continued to prioritize securing high-quality tenants, understanding that the success of its retail assets is directly tied to the strength and desirability of the businesses operating within them. This strategy is crucial for maintaining high occupancy rates and generating consistent rental income across its extensive property holdings.

Corporate Clients (Office and Logistics)

Altarea's corporate clients are primarily large companies and organizations looking for premium office and logistics spaces. These businesses require modern, highly efficient, and strategically situated properties to support their operations and workforce. In 2024, the demand for flexible and sustainable office solutions continued to grow, with companies prioritizing locations that offer excellent connectivity and amenities.

These clients are not just seeking square footage; they are investing in environments that enhance productivity, attract talent, and align with their corporate social responsibility goals. For instance, companies increasingly favor developments with strong ESG (Environmental, Social, and Governance) credentials, such as LEED certifications or net-zero energy capabilities. This trend is driven by a desire to reduce operational costs and improve their brand image.

- Key Needs: Modern, efficient, and strategically located office and logistics facilities.

- Focus Areas: Sustainability, ESG compliance, and employee well-being features.

- Market Trend: Growing demand for flexible workspace solutions and advanced logistics infrastructure.

- Client Profile: Large corporations and organizations with significant real estate requirements.

Public Entities and Local Governments

Public entities and local governments are crucial partners, often acting as direct customers for large-scale urban regeneration and development projects. Altarea collaborates closely with these bodies to execute urban transformation initiatives that often integrate with public infrastructure planning. For instance, in 2024, Altarea secured a significant mandate for the redevelopment of a major urban district in Lyon, France, a project heavily guided by the city's long-term strategic development goals.

These collaborations are vital for projects that require public buy-in and alignment with municipal strategies. Altarea's engagement with public entities ensures that developments contribute positively to the community's needs and public service provision. The company's ability to navigate complex public sector requirements is a core component of its success in these partnerships.

- Key Stakeholders: Public entities and local governments are fundamental to the success of urban regeneration projects.

- Direct Customers: They often commission or co-invest in developments that align with public infrastructure and urban planning.

- Urban Transformation: Altarea works hand-in-hand with these bodies on city-wide revitalization efforts.

- Strategic Alignment: Projects are designed to meet public service needs and long-term municipal development objectives.

Altarea serves a multifaceted customer base, ranging from individual residential buyers seeking homes or investment properties to large institutional investors like pension funds and insurance companies. The company also caters to retailers and commercial businesses requiring leased spaces, as well as corporate clients needing premium office and logistics facilities. Furthermore, public entities and local governments are key partners for urban regeneration projects.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Individual Residential Buyers | Homeownership, investment returns | Continued demand, navigating interest rates |

| Institutional Investors | Large-scale acquisitions, financing | Active in REITs and commercial real estate |

| Retailers & Commercial Businesses | Leased retail spaces | Focus on high-quality tenant mix for foot traffic |

| Corporate Clients | Office & logistics spaces | Demand for flexible, sustainable, and well-connected facilities |

| Public Entities & Local Governments | Urban regeneration projects | Collaboration on city development goals and public services |

Cost Structure

Altarea's cost structure heavily features land acquisition and development. These are the bedrock expenses for any property development, encompassing the purchase of land and the direct costs of bringing a project to life. This includes everything from raw materials and skilled labor to the necessary permits and approvals.

For instance, in 2024, Altarea continued its strategic land banking and development projects. While specific figures fluctuate, these costs represent a substantial capital outlay, directly impacting project profitability and the company's overall financial health. These expenditures are non-negotiable for realizing their real estate ventures.

Construction and project management expenses are a significant component of Altarea's cost structure, encompassing the direct costs of building properties. This includes substantial outlays for contractor fees, on-site labor, materials, and specialized equipment required for development.

Effective project management is paramount for controlling these expenditures. For instance, in 2024, the real estate development sector experienced fluctuating material costs, making meticulous budget oversight and efficient scheduling critical for profitability. Altarea's focus on quality control throughout the build process also contributes to these costs, ensuring adherence to standards and minimizing future remediation expenses.

Altarea faces significant operating and maintenance expenses for its investment properties, especially its shopping centers. These costs are essential for maintaining the appeal and functionality of its assets, ensuring they remain attractive to tenants and visitors.

These ongoing expenses include property management fees, which cover the day-to-day running of the centers, as well as utility costs for lighting, heating, and cooling. Security services are also a crucial component, ensuring a safe environment for shoppers and staff. Furthermore, regular repairs and upkeep are necessary to preserve the physical condition of the properties.

For instance, in 2024, companies in the retail real estate sector often allocate a substantial portion of their revenue to these operational expenditures. While specific figures for Altarea's 2024 property operating costs are not yet publicly detailed, industry benchmarks suggest these can range from 5% to 15% of gross rental income, depending on the age and type of property.

Sales, Marketing, and Administrative Expenses

These expenses are crucial for driving demand and managing the business. In 2024, Altarea's commitment to expanding its reach and securing new projects likely saw significant investment in sales and marketing campaigns.

- Sales & Marketing: Costs for advertising, property promotions, and sales force commissions to attract both buyers for residential units and tenants for commercial spaces.

- Administrative Overhead: Includes general operational expenses like office rent, utilities, and IT infrastructure supporting the entire organization.

- Corporate Salaries: Compensation for management, legal, finance, and HR teams essential for company governance and strategic direction.

- Legal & Professional Fees: Expenses related to contract reviews, compliance, and advisory services necessary for real estate development and transactions.

For instance, a substantial portion of these costs would have been allocated to showcasing their diverse portfolio, which spans residential, commercial, and mixed-use developments across France.

Financing Costs and Debt Servicing

Altarea's extensive development projects necessitate significant borrowing, leading to substantial financing costs. These primarily include interest expenses on its various loans and outstanding bonds. For instance, as of December 31, 2023, Altarea's consolidated financial statements reported financial expenses of €234.3 million, a notable portion of which relates to debt servicing.

Effectively managing its debt portfolio and optimizing its financing arrangements are therefore paramount to maintaining profitability and financial health. This involves careful consideration of interest rate environments and debt maturity profiles to minimize the burden of these costs.

- Interest Expense: Altarea incurred €234.3 million in financial expenses in 2023, directly impacting its bottom line.

- Debt Management: Optimizing its debt structure is crucial to mitigating the impact of financing costs on profitability.

- Financing Strategy: Strategic decisions regarding debt issuance and refinancing play a key role in managing these expenses.

Altarea's cost structure is dominated by expenses related to property acquisition and development, construction, and ongoing operational costs for its portfolio. These are the fundamental expenditures that underpin its real estate business model.

In 2024, significant capital was deployed for land acquisition and project development. Construction and project management costs, including labor and materials, also represent a substantial portion of expenditures. For instance, fluctuating material costs in 2024 made efficient budget management critical.

Operating and maintenance expenses for properties, particularly shopping centers, are ongoing. These include property management fees, utilities, and security. In 2024, industry benchmarks suggest these costs can range from 5% to 15% of gross rental income.

Financing costs, primarily interest expenses, are also a major component. Altarea reported €234.3 million in financial expenses in 2023, highlighting the impact of debt servicing on its profitability.

| Cost Category | Description | 2023 Data (if applicable) | 2024 Considerations |

|---|---|---|---|

| Land Acquisition & Development | Purchasing land and initial project setup costs. | N/A (Ongoing strategic investment) | Continued strategic land banking and development projects. |

| Construction & Project Management | Direct building costs: labor, materials, equipment. | N/A (Project-specific) | Managing fluctuating material costs; focus on quality control. |

| Operating & Maintenance | Property management, utilities, security, repairs. | Industry benchmark: 5%-15% of gross rental income. | Essential for asset appeal and functionality. |

| Sales & Marketing | Advertising, promotions, sales commissions. | N/A (Investment in reach) | Showcasing diverse portfolio across residential, commercial, mixed-use. |

| Administrative Overhead | Office rent, utilities, IT infrastructure. | N/A (General operational) | Supporting overall company operations. |

| Corporate Salaries | Management, legal, finance, HR compensation. | N/A (Essential for governance) | Ensuring strategic direction and governance. |

| Legal & Professional Fees | Contract reviews, compliance, advisory services. | N/A (Necessary for transactions) | Facilitating real estate development and transactions. |

| Financing Costs | Interest expenses on loans and bonds. | €234.3 million (Financial expenses) | Optimizing debt structure and managing interest rate environments. |

Revenue Streams

Revenue from property development sales comes from selling residential units, offices, and logistics spaces. These sales are primarily to individual buyers, big investment firms, and companies needing space. This is a major income stream for the company.

Altarea's strategy emphasizes new generation, affordable, and low-carbon properties, which appeals to a growing market segment. For instance, in 2024, the company continued to see strong demand for its sustainable residential projects, contributing significantly to its sales figures.

Altarea generates substantial revenue through rental income derived from its diverse portfolio of commercial properties. This includes a significant presence in shopping centers and retail parks, which are key drivers of its recurring income. This segment of their business model is designed to provide a stable and predictable cash flow, essential for ongoing operations and strategic investments.

In 2024, Altarea's rental income from its commercial real estate holdings is a cornerstone of its financial performance. For instance, the company reported a robust rental income for its French portfolio, demonstrating the consistent demand for its retail spaces. This stable income stream allows for consistent financial planning and supports the company’s ability to manage its assets effectively.

Altarea generates revenue through asset management fees earned from overseeing real estate portfolios for external investors. These fees stem from a range of services including property operations, tenant acquisition and retention, and strategic investment guidance.

Disposals of Logistics and Other Business Property Assets

Altarea generates revenue through the strategic sale of logistics properties and other business assets. This is a key part of their capital management, allowing them to reinvest and adapt to market conditions. They often sell these assets to institutional investors, demonstrating the attractiveness of their portfolio.

In 2024, Altarea continued its asset rotation strategy. While specific figures for disposals are typically reported in annual financial statements, the company has historically used this method to optimize its balance sheet and fund new developments. For instance, in prior years, such disposals have contributed significantly to their financial flexibility.

- Strategic Asset Rotation: Selling logistics and business property assets to institutional investors.

- Capital Turnover: Aims to enhance capital efficiency and fund new projects.

- Market Responsiveness: Allows adaptation to evolving real estate market demands.

Revenue from New Businesses (Photovoltaics, Data Centers)

Altarea is diversifying its revenue by tapping into emerging sectors like photovoltaics and data centers. This strategic move aims to create new income streams beyond its traditional real estate operations.

Revenue from these new ventures, such as selling electricity generated by photovoltaic installations and providing services for data centers, is anticipated to play a more substantial role in the company's financial performance going forward. For instance, in 2024, the company continued to invest in and develop its photovoltaic portfolio, with initial revenue contributions starting to materialize.

- Photovoltaic Revenue: Income generated from the sale of electricity produced by Altarea's solar farms.

- Data Center Services: Revenue derived from offering services related to the operation and management of data centers.

- Future Growth: These segments are projected to become significant contributors to Altarea's overall earnings.

Altarea's revenue streams are multifaceted, encompassing property development sales, rental income from commercial properties, asset management fees, and strategic asset rotation. The company is also actively developing new revenue avenues in photovoltaics and data centers, signaling a forward-looking approach to market diversification.

In 2024, Altarea's commitment to sustainable development continued to drive strong sales in its residential projects. Concurrently, its retail portfolio demonstrated resilience, with consistent rental income contributing significantly to the company's financial stability. These core activities form the bedrock of its revenue generation.

| Revenue Stream | Description | 2024 Focus/Data Point |

|---|---|---|

| Property Development Sales | Selling residential, office, and logistics spaces. | Strong demand for sustainable residential projects. |

| Rental Income | Income from commercial properties, especially shopping centers. | Robust rental income reported for French portfolio. |

| Asset Management Fees | Fees from managing real estate portfolios for external investors. | Services include property operations and tenant management. |

| Strategic Asset Rotation | Selling logistics and business assets to institutional investors. | Aims to optimize balance sheet and fund new developments. |

| New Ventures (Photovoltaics & Data Centers) | Electricity sales from solar farms and data center services. | Initial revenue contributions materializing from photovoltaic investments. |

Business Model Canvas Data Sources

The Altarea Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and strategic insights from industry experts. This multi-faceted approach ensures each block accurately reflects current business realities and future opportunities.