Altarea Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altarea Bundle

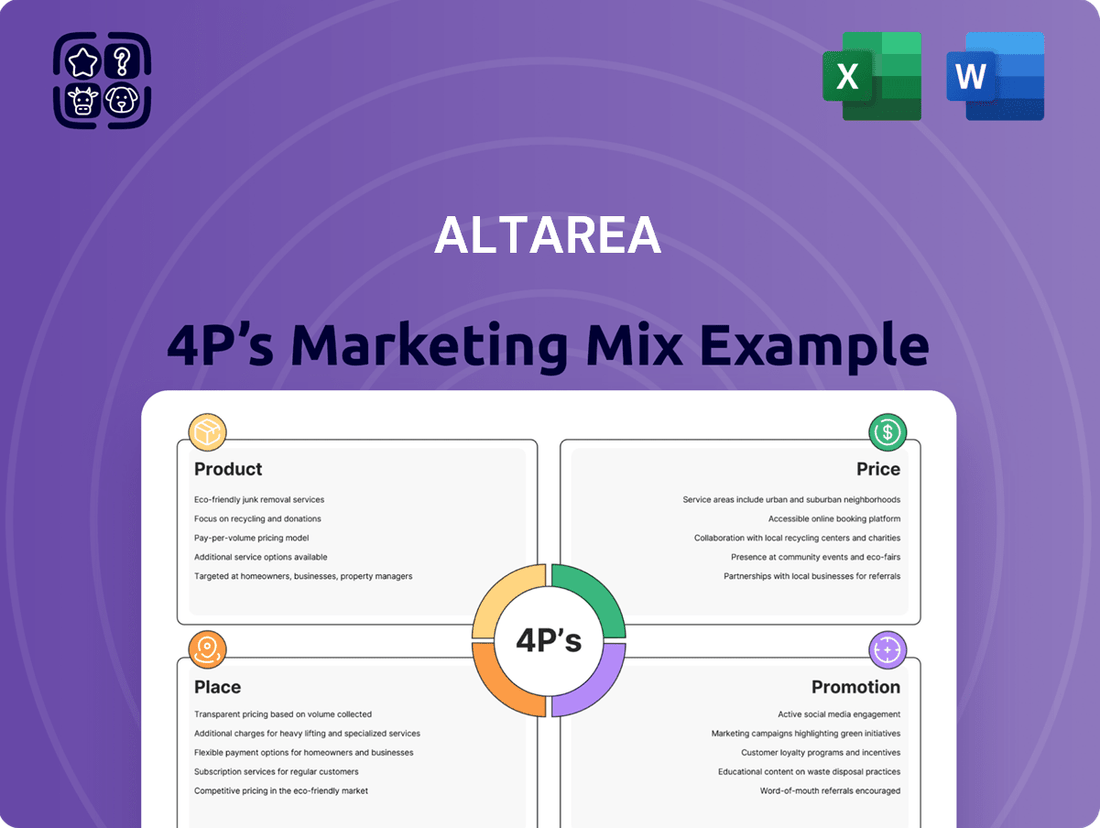

Discover how Altarea masterfully orchestrates its Product, Price, Place, and Promotion strategies to capture market share and drive customer loyalty. This analysis reveals the synergistic interplay of their marketing elements, offering a blueprint for success.

Unlock a comprehensive understanding of Altarea's marketing genius. Our full 4Ps analysis provides actionable insights into their product innovation, pricing tactics, distribution network, and promotional campaigns, all in an editable, presentation-ready format.

Ready to elevate your marketing strategy? Get instant access to a professionally crafted, in-depth 4Ps Marketing Mix Analysis of Altarea. Save valuable time and gain a competitive edge with this essential business tool.

Product

Altarea's residential developments cater to a broad spectrum of French housing needs, encompassing new builds, serviced residences, and innovative co-living models. This diverse portfolio reflects a strategic approach to capturing different market segments and lifestyle preferences.

The introduction of the 'Access' program in May 2024 underscores Altarea's commitment to affordability and sustainability. This initiative specifically targets first-time homebuyers with low-carbon housing options and streamlined financing, addressing a critical demand in the current market.

By focusing on accessible, eco-friendly housing, Altarea is positioning itself to benefit from government incentives and growing consumer interest in sustainable living. This strategic move is expected to drive sales and enhance brand reputation in the competitive French real estate sector.

Altarea's commercial property strategy centers on large-scale, innovative, and sustainable retail environments like shopping centers and retail parks. This focus aims to create engaging customer experiences and adapt to evolving consumer habits.

A key growth area for Altarea is travel retail, exemplified by their significant win to operate shops across 45 new Grand Paris Express stations. This deal, expected to contribute substantially to their 2024-2025 revenue streams, positions them at the forefront of high-traffic retail development.

Altarea's business property segment is diverse, encompassing offices, logistics platforms, industrial spaces, hotels, and educational facilities. This broad offering caters to a variety of commercial needs.

The company's strategic emphasis is on urban logistics, particularly within the dynamic Paris region. This focus is supported by a robust pipeline of logistics projects currently in development, positioning Altarea to capitalize on growing demand for efficient urban distribution networks.

New Businesses: Photovoltaic and Data Centers

Altarea is expanding its portfolio by venturing into photovoltaic infrastructure and eco-responsible data centers. This strategic move diversifies its revenue streams and aligns with growing market demand for sustainable energy and digital solutions. The company is focusing on integrated solar power solutions, including rooftop installations and solar car park shades, alongside innovative agrivoltaic systems.

The data center initiative emphasizes building a network of sovereign and local facilities, catering to the increasing need for secure and efficient data storage. For instance, by 2024, the European data center market was projected to reach over €30 billion, highlighting the significant growth potential in this sector. Altarea's investment in these areas positions it to capitalize on these trends.

Key aspects of Altarea's new business ventures include:

- Photovoltaic Infrastructure: Development of building-integrated photovoltaics (BIPV), solar car park shades, and agrivoltaic projects.

- Data Centers: Construction of a network of sovereign and local data centers focused on eco-responsibility.

- Market Alignment: Addressing the increasing demand for renewable energy and secure, localized data storage solutions.

- Growth Potential: Tapping into expanding markets with strong projected growth rates for both solar energy and data center services.

Urban Transformation and Mixed-Use Projects

Altarea's product strategy centers on urban transformation through mixed-use projects. These developments blend residential, retail, and office spaces, alongside other amenities, to create vibrant urban hubs that cater to evolving city needs. A key focus is on low-carbon and sustainable design principles.

This approach is exemplified by projects like the redevelopment of the former Paris-Bercy train station, which is being transformed into a sustainable, mixed-use district. Altarea's commitment to sustainability is a significant differentiator, aiming to reduce environmental impact while enhancing urban living. For instance, in 2023, Altarea announced its goal to achieve carbon neutrality for its new developments by 2030, aligning with broader climate objectives.

- Holistic Urban Development: Altarea creates integrated urban ecosystems by combining living, working, and leisure spaces.

- Sustainability Focus: Projects emphasize low-carbon materials and energy-efficient designs to promote environmental responsibility.

- Adaptability to Urban Needs: The strategy addresses evolving urban lifestyles and demands for convenience and community.

- Economic Revitalization: Mixed-use projects often act as catalysts for economic growth and improved city infrastructure.

Altarea's product strategy is centered on creating integrated, mixed-use urban developments that prioritize sustainability and cater to evolving lifestyle needs. This includes a diverse range of offerings from residential units and serviced apartments to innovative co-living spaces, alongside large-scale retail environments and specialized business properties like logistics and offices.

The company is actively expanding into new growth areas such as photovoltaic infrastructure and eco-responsible data centers, demonstrating a forward-looking approach to diversification. A key initiative is the 'Access' program, launched in May 2024, which targets first-time homebuyers with affordable, low-carbon housing solutions.

Altarea's commitment to urban transformation is evident in projects like the redevelopment of the former Paris-Bercy train station into a sustainable, mixed-use district. The company aims for carbon neutrality in its new developments by 2030, reinforcing its dedication to environmental responsibility.

| Product Segment | Key Offerings | Strategic Focus | 2024/2025 Data/Initiatives |

|---|---|---|---|

| Residential | New builds, serviced residences, co-living | Affordability, sustainability, diverse lifestyles | 'Access' program (May 2024) for first-time homebuyers |

| Commercial Retail | Shopping centers, retail parks | Engaging customer experiences, adapting to habits | Operating shops at 45 new Grand Paris Express stations |

| Business Property | Offices, logistics, industrial, hotels | Urban logistics in Paris region | Robust pipeline of logistics projects |

| New Ventures | Photovoltaic infrastructure, data centers | Renewable energy, secure data storage | Focus on BIPV, solar car parks, agrivoltaics; sovereign data centers |

What is included in the product

This analysis provides a comprehensive breakdown of Altarea's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand Altarea's market positioning, offering a benchmark for competitive analysis and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Place

Altarea boasts an extensive operational footprint throughout France, with a particularly strong foothold in the dynamic Paris Region. This strategic positioning extends to major urban centers and numerous medium-sized cities, underscoring its commitment to broad market penetration. As of the first half of 2024, Altarea's development pipeline included approximately 5.5 million square meters of projects across the country, demonstrating its substantial capacity and reach.

Altarea’s retail portfolio is built on the foundation of strategically positioned shopping and leisure centers and retail parks, serving as critical hubs within its distribution network. These locations are chosen for their high foot traffic and accessibility, ensuring maximum reach for the brands they house.

The company is actively broadening its footprint in the travel retail sector, with a particular focus on major railway stations. This strategic move in 2024 aims to tap into a captive audience, offering convenience and impulse purchase opportunities for commuters and travelers alike.

Altarea leverages direct sales, notably with its Access program designed for first-time homebuyers, to connect directly with a key consumer segment. This approach allows for tailored customer engagement and a more personal buying experience.

Simultaneously, Altarea actively pursues block sales to institutional investors and social landlords, diversifying its distribution strategy. This caters to large-scale demand and strengthens relationships with significant market players.

In 2023, Altarea reported a significant portion of its sales volume coming from these partnerships, underscoring the strategic importance of institutional clients in its overall revenue generation. This dual focus on individual buyers and large-scale partners is crucial for market penetration and sales velocity.

Online Platforms and Digital Presence

Altarea, while rooted in physical real estate development, actively uses its online platforms to enhance its market communication and investor relations. Its website serves as a crucial hub for financial publications, press releases, and essential investor information, promoting transparency and accessibility.

This digital footprint complements Altarea's tangible assets by offering a readily available channel for stakeholders to engage with the company's performance and strategic direction. For instance, in 2024, the company's investor relations section likely saw significant traffic as it published its annual reports and provided updates on its project pipeline.

- Website Functionality: Serves as a primary source for financial reports, press releases, and corporate news.

- Investor Engagement: Facilitates communication and information dissemination to shareholders and potential investors.

- Digital Complement: Enhances the reach of physical marketing efforts by providing online access to company information.

- Transparency: Supports Altarea's commitment to open communication regarding its financial performance and strategic initiatives.

Integrated Real Estate Services

Altarea's integrated real estate services encompass the entire property lifecycle, from initial design and construction through to ongoing management and strategic investment. This comprehensive approach, often referred to as controlling the value chain, allows for greater oversight and efficiency in delivering its diverse portfolio. For instance, in 2023, Altarea reported a robust pipeline of development projects, underscoring its capacity to manage multiple stages of real estate creation and operation simultaneously.

This integrated model is key to optimizing accessibility and operational efficiency across Altarea's holdings. By managing all aspects internally, the company can streamline processes, reduce third-party dependencies, and ensure consistent quality. This is particularly evident in their retail and residential segments where seamless integration of services enhances customer experience and operational flow. In 2024, the company continued to emphasize this strategy, aiming to leverage synergies between its development and asset management divisions.

- Full Value Chain Control: Design, construction, management, and investment are all managed internally.

- Portfolio Optimization: Integrated services enhance efficiency and accessibility for diverse property types.

- Synergy Focus: Maximizing benefits from the connection between development and asset management.

- Operational Efficiency: Streamlined processes and reduced external dependencies drive better performance.

Altarea's strategic placement of its retail and residential assets is a cornerstone of its 'Place' strategy. The company prioritizes high-traffic urban locations, particularly within the Paris Region, and is expanding into travel retail hubs like major train stations. This focus ensures maximum accessibility and customer engagement for its diverse property offerings.

By controlling the entire property lifecycle, from development to management, Altarea optimizes the accessibility and operational efficiency of its portfolio. This integrated approach, evident in its robust 2023 development pipeline, allows for seamless customer experiences and strong market penetration. The company's commitment to both direct sales to individuals and block sales to institutional investors further diversifies its market reach.

| Metric | 2023 Data | 2024 Outlook/Activity |

|---|---|---|

| Development Pipeline (sqm) | Approx. 5.5 million (H1 2024) | Continued expansion in key urban and travel retail locations. |

| Geographic Focus | France, strong presence in Paris Region | Broadening footprint in travel retail (railway stations). |

| Sales Channels | Direct sales (Access program), Block sales to institutional investors | Diversification of distribution strategy, strengthening institutional partnerships. |

Full Version Awaits

Altarea 4P's Marketing Mix Analysis

The preview shown here is the actual Altarea 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers all aspects of their marketing strategy, ensuring you have the complete picture. You're viewing the exact version you'll download, ready for immediate use.

Promotion

Altarea actively disseminates its financial health and strategic direction through press releases and comprehensive annual reports, specifically aimed at investors and financial analysts. These communications underscore significant milestones like revenue increases and Funds From Operations (FFO) figures, alongside proposed dividends, all designed to bolster investor trust and attract further investment.

For instance, in its 2023 results, Altarea reported a revenue of €1.9 billion and an FFO of €345 million, demonstrating a solid operational performance. The company's commitment to shareholder returns was evident with a proposed dividend of €10.50 per share for 2023, reinforcing its financial stability and appeal to the investment community.

Altarea champions low-carbon urban transformation, showcasing its dedication through detailed impact reports and robust ESG performance disclosures. This commitment resonates with a growing segment of investors and stakeholders prioritizing environmental and social responsibility.

In 2023, Altarea reported a 27% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating tangible progress in its sustainability goals. Their ESG strategy is a key driver for attracting capital and enhancing long-term value.

Altarea actively promotes product innovations like its 'Access' affordable housing initiative. These campaigns emphasize key features such as low-carbon construction and efficient living spaces, aiming to attract first-time homebuyers and those seeking value.

For instance, in 2024, Altarea's commitment to sustainable development saw a notable increase in projects incorporating eco-friendly materials and energy-saving technologies, directly aligning with consumer demand for greener living solutions.

Industry Recognition and Awards

Altarea actively uses industry recognition and awards to bolster its brand image and trustworthiness. For instance, Cogedim, a part of Altarea, was recognized as the 'Best Customer Service of the Year' in Property Development, a significant achievement that validates their commitment to client satisfaction.

These accolades act as strong testimonials, highlighting the company's dedication to delivering high-quality products and services. Such awards are crucial for differentiating Altarea in a competitive market and reinforcing its reputation as a customer-focused organization.

- Cogedim named 'Best Customer Service of the Year' in Property Development.

- Awards enhance brand reputation and credibility.

- Recognition validates quality and customer-centric approach.

Partnerships and Urban Transformation Initiatives

Altarea actively engages in partnerships for urban transformation, highlighting its role in significant city development projects. This strategy showcases their expertise and commitment to improving urban landscapes, often collaborating with public entities. For instance, their involvement in the Grand Paris Express project exemplifies their capacity for large-scale, impactful contributions to infrastructure and urban planning.

These collaborations are crucial for positioning Altarea as a key player in shaping future cities. By participating in initiatives like the Grand Paris Express, which aims to revolutionize public transport in the Paris region, Altarea demonstrates its strategic vision and ability to execute complex, long-term development plans. Such projects often involve substantial investment and intricate stakeholder management, areas where Altarea seeks to prove its leadership.

- Urban Regeneration Focus: Altarea prioritizes projects that revitalize urban areas, fostering sustainable growth and community development.

- Public-Private Collaboration: The company actively seeks partnerships with local governments and authorities to align its development strategies with public interest and urban planning goals.

- Major Infrastructure Involvement: Examples like the Grand Paris Express project underscore Altarea's commitment to participating in transformative infrastructure development that enhances connectivity and economic activity.

- Expertise Showcase: These initiatives serve as a platform to demonstrate Altarea's capabilities in managing complex urban development projects from conception to completion.

Altarea utilizes a multi-faceted promotional strategy, communicating financial performance and sustainability commitments through press releases and annual reports. These efforts highlight key metrics like revenue and Funds From Operations (FFO), alongside dividend announcements, to attract and retain investors.

The company's dedication to environmental, social, and governance (ESG) principles is a significant promotional tool, emphasizing low-carbon urban transformation and reporting tangible emission reductions. This focus appeals to a growing base of socially conscious investors.

Product innovations, such as the 'Access' affordable housing initiative, are promoted by showcasing features like sustainable construction and energy efficiency, targeting specific consumer segments. Industry recognition, like Cogedim's 'Best Customer Service' award, further enhances brand credibility and reinforces a customer-centric image.

Altarea also promotes its expertise through strategic partnerships in major urban development projects, such as the Grand Paris Express. This showcases their capacity for large-scale, impactful urban regeneration and public-private collaboration.

| Promotional Activity | Key Metrics/Examples | Target Audience |

|---|---|---|

| Financial & ESG Reporting | €1.9 billion revenue (2023), €345 million FFO (2023), €10.50 dividend per share (2023), 27% GHG intensity reduction (vs. 2019) | Investors, Financial Analysts |

| Product & Brand Marketing | 'Access' affordable housing, Cogedim 'Best Customer Service' award | Homebuyers, General Public, Industry Stakeholders |

| Strategic Partnerships | Grand Paris Express project involvement | Public Entities, Urban Planners, Investors |

Price

Altarea's value-based pricing for its residential products, especially the 'Access' offer, centers on affordability and accessibility. This strategy aims to match monthly mortgage payments with prevailing rental costs, making homeownership a tangible goal for first-time buyers and those with tighter budgets. For instance, in 2024, the average rent for a comparable property in many French urban areas often exceeded €800 per month, a figure Altarea seeks to rival with its repayment structures.

Altarea's pricing strategy for its commercial properties is fundamentally based on competitive rental income. The company actively works to ensure its retail and office spaces command attractive rents by maintaining high occupancy levels, which stood at an impressive 97.3% across its portfolio as of the first half of 2024. This focus on tenant retention and desirability directly translates into stable, positive rental growth, a key driver for investor confidence and property valuation.

Altarea's strategic disposal of assets, particularly logistics sites, is a key element in its capital management. This approach allows the company to free up capital and focus on more promising investments, directly impacting its financial flexibility.

In late 2024, Altarea successfully completed logistics transactions totaling €390 million. This significant revenue generation from disposals bolsters the company's financial standing and provides the necessary resources for future growth initiatives and strategic acquisitions.

Dividend Policy and Shareholder Returns

Altarea's dividend policy underscores its dedication to rewarding shareholders. For the 2024 fiscal year, the company proposed a dividend of €8.00 per share, offering investors the flexibility of receiving either cash or a portion in shares. This consistent approach to dividend distribution is a significant factor in its attractiveness to the investment community.

This stable dividend payout strategy is a cornerstone of Altarea's shareholder return proposition. It signals financial health and a commitment to providing tangible value beyond share price appreciation.

- Proposed 2024 Dividend: €8.00 per share.

- Payment Options: Cash or partial share payment.

- Policy Focus: Stable and consistent shareholder returns.

- Investor Appeal: Enhances attractiveness through reliable income generation.

Adaptation to Market Conditions and Economic Factors

Altarea's pricing and investment strategies are carefully calibrated to respond to prevailing economic conditions. This includes adapting to fluctuations in interest rates and shifts in market demand, allowing the company to effectively navigate challenging real estate cycles. For instance, in 2024, the company likely adjusted its development pipeline and pricing models in response to the European Central Bank's monetary policy and evolving investor sentiment towards real estate assets.

The company's strategic emphasis on low-carbon and next-generation products is a direct adaptation to changing market preferences and increasingly stringent regulatory environments. This forward-looking approach not only aligns with sustainability goals but also positions Altarea to capture demand for environmentally conscious and future-proof real estate solutions. By 2025, the demand for green building certifications and energy-efficient properties is expected to continue its upward trajectory, further validating this strategy.

- Interest Rate Sensitivity: Altarea's pricing adjusts to interest rate changes, impacting development costs and buyer affordability.

- Market Demand Responsiveness: The company modifies its investment and product offerings based on real-time market demand signals.

- Sustainability as a Driver: Investment in low-carbon and new-generation properties caters to growing consumer and regulatory demand for eco-friendly solutions.

- Navigating Real Estate Cycles: Strategic pricing and investment allow Altarea to maintain resilience through various phases of the real estate market.

Altarea's pricing for residential properties, like the 'Access' offer, focuses on making homeownership achievable by aligning monthly payments with rental costs, a strategy crucial in 2024 when average rents in French cities often surpassed €800. For commercial spaces, pricing is driven by competitive rental income, supported by a strong occupancy rate of 97.3% in the first half of 2024, ensuring stable returns.

| Product Segment | Pricing Strategy | Key Metric/Example (2024/H1 2024) |

|---|---|---|

| Residential ('Access' Offer) | Value-based, affordability-focused | Monthly payments comparable to average rents (e.g., >€800/month in urban areas) |

| Commercial (Retail/Office) | Competitive rental income | 97.3% portfolio occupancy |

4P's Marketing Mix Analysis Data Sources

Our Altarea 4P's analysis is grounded in comprehensive data, including official company reports, real estate market data, and competitor analysis. We leverage insights from Altarea's public disclosures, investor relations materials, and extensive industry research to detail their product offerings, pricing strategies, distribution networks, and promotional activities.