Alstom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alstom Bundle

Navigate the complex global landscape impacting Alstom with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the future of rail and mobility. Gain actionable intelligence to inform your strategic decisions and secure a competitive advantage.

Unlock critical insights into the external forces driving Alstom's performance, from evolving social trends to stringent environmental regulations. This expertly crafted analysis provides the clarity needed to anticipate challenges and capitalize on opportunities. Download the full version to elevate your market strategy.

Political factors

Governments globally are channeling substantial funds into sustainable mobility, with a strong emphasis on rail and green transport. For instance, the European Union's Green Deal aims to significantly boost rail freight and passenger transport, projecting a 50% increase in rail freight by 2030. This political commitment directly fuels demand for Alstom's expertise in electrified and hydrogen-powered trains.

These government initiatives translate into tangible opportunities for Alstom. In 2024, the UK government announced a £1 billion investment in rail upgrades, including electrification projects. Such policy decisions create a predictable and growing market for Alstom's innovative rolling stock and signaling solutions, solidifying its position in the sustainable transport sector.

The political environment significantly shapes Alstom's operational landscape through a complex web of regulatory frameworks and technical standards. These regulations, particularly concerning safety, environmental impact, and interoperability, directly influence Alstom's product design, manufacturing processes, and ability to compete in global markets. For instance, adherence to standards like the European Rail Traffic Management System (ERTMS) is not merely a compliance issue but a prerequisite for securing major contracts and ensuring seamless operations across different countries.

Changes in these political dictates can have substantial financial and operational repercussions. For 2024 and into 2025, Alstom, like its competitors, must navigate evolving emissions standards and digitalization mandates within the rail sector. These shifts often necessitate significant investment in research and development to adapt existing product lines or create entirely new solutions, impacting project timelines and budget allocations. For example, the push for increased digitalization in rail signaling, driven by political will to enhance efficiency and safety, requires substantial upfront investment in software and hardware upgrades.

Alstom's extensive global manufacturing and sales network makes it highly susceptible to shifts in geopolitical stability and international trade policies. For instance, ongoing trade disputes, such as those impacting global supply chains in 2024, can directly influence the cost of components and the accessibility of key markets for Alstom's rolling stock and signaling solutions.

Changes in trade agreements, the imposition of tariffs, or escalating political tensions in regions where Alstom operates, like the Middle East or parts of Eastern Europe, can disrupt established supply chains, inflate production costs, and limit market access. These factors necessitate careful navigation of diverse regulatory landscapes.

Alstom's strategy of maintaining a diversified geographical presence, with significant operations in Europe, North America, and Asia, serves as a crucial risk mitigation tool. This diversification helps buffer the company against the adverse effects of political instability or unfavorable trade policy shifts in any single region, ensuring operational resilience.

Public Procurement Policies and Local Content Requirements

Government procurement policies and local content requirements are critical for Alstom. Many nations favor domestic suppliers and mandate a certain percentage of locally sourced components or labor to foster job creation and technological advancement. This directly impacts Alstom's bidding success and operational setup in various markets.

For instance, in 2024, several European countries continued to emphasize local manufacturing in their rail infrastructure tenders, influencing Alstom's supply chain decisions. These requirements often necessitate establishing or expanding local production sites and forging partnerships with regional businesses, which can, in turn, affect cost structures and overall operational agility.

- Impact on Bidding: Local content rules can be a decisive factor in winning large government contracts for rail projects.

- Operational Adjustments: Alstom often needs to adapt its global supply chain and manufacturing footprint to meet these regional demands.

- Economic Development Focus: Governments use these policies to stimulate local economies, driving Alstom's investment in local facilities and R&D.

- Cost Implications: Sourcing locally can sometimes increase production costs compared to leveraging established global supply chains.

Political Support for Public Transportation

Political support for public transportation, particularly rail, is a significant driver for Alstom's growth. Governments worldwide are increasingly recognizing the benefits of shifting passengers from road and air to rail for environmental and efficiency reasons. This trend is evident in substantial investments being made in public transport infrastructure. For instance, the European Union's Green Deal aims to boost sustainable transport, with significant funding allocated to rail projects. In 2024, many nations are continuing to implement policies that favor rail, such as tax incentives for electric rail and subsidies for public transport operators.

These supportive policies directly translate into opportunities for Alstom, a major player in rail manufacturing and signaling. Urban planning initiatives are also crucial, with cities integrating public transport networks to reduce congestion and emissions.

- Government funding for rail infrastructure projects globally is projected to reach hundreds of billions of dollars annually through 2025, directly benefiting rolling stock manufacturers like Alstom.

- Policies encouraging modal shift, such as carbon taxes on air travel and increased road tolls, are making rail a more competitive option.

- Alstom's order books in 2024 and 2025 reflect this trend, with a strong demand for metro, tram, and regional train solutions in key markets like France, Germany, and the United Kingdom.

Government investment in sustainable mobility, particularly rail, is a major growth driver for Alstom, with initiatives like the EU Green Deal targeting a 50% increase in rail freight by 2030. The UK's 2024 £1 billion rail upgrade investment further exemplifies this trend, creating a predictable market for Alstom's solutions.

Regulatory frameworks, including safety and environmental standards like ERTMS, directly shape Alstom's product development and market access, demanding continuous adaptation to evolving political dictates. For instance, digitalization mandates in rail signaling, driven by political will for efficiency, require significant R&D investment for companies like Alstom through 2025.

Geopolitical stability and trade policies significantly impact Alstom's global operations and supply chains, with trade disputes in 2024 affecting component costs and market access, necessitating strategic geographical diversification.

Local content requirements in government tenders are crucial, influencing Alstom's bidding success and operational setup, as seen with European countries emphasizing local manufacturing in rail tenders during 2024.

What is included in the product

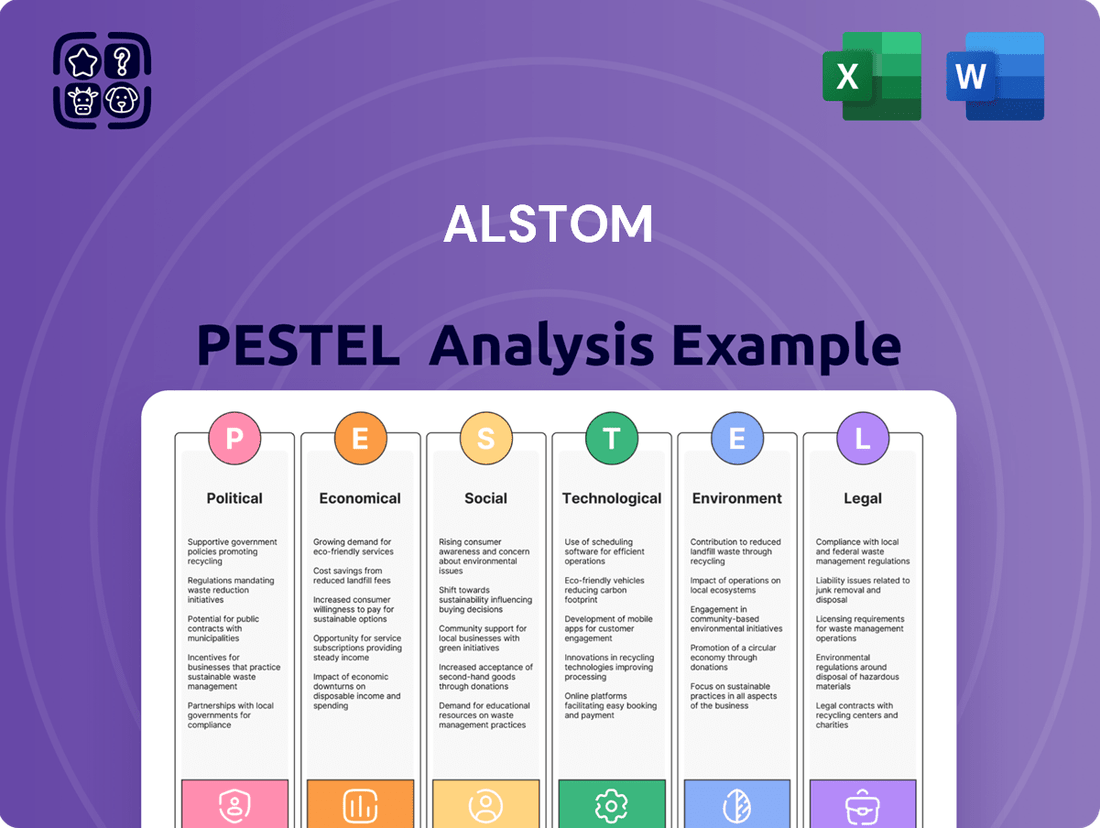

This Alstom PESTLE analysis examines the intricate interplay of political, economic, social, technological, environmental, and legal forces shaping the company's operating landscape.

It provides a strategic framework for understanding external influences that present both challenges and opportunities for Alstom's global railway and energy sectors.

A concise Alstom PESTLE analysis that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Provides a clear, actionable overview of the political, economic, social, technological, environmental, and legal landscape impacting Alstom, easing the burden of extensive research.

Economic factors

Alstom's fortunes are significantly influenced by the health of the global economy and the appetite for infrastructure investment. A strong global economic outlook, projected by the IMF to reach 3.2% in 2024 and a similar pace in 2025, typically translates into higher spending on transportation infrastructure. This directly benefits Alstom by increasing demand for its rolling stock and signaling solutions.

However, economic slowdowns can have a dampening effect. For instance, the lingering effects of inflation and interest rate hikes in major economies during 2023 and into 2024 could lead to deferred or scaled-back infrastructure projects. This directly impacts Alstom's order book and revenue streams, as seen in the cautious approach some governments take towards large capital expenditures during uncertain economic periods.

Alstom's access to financing and capital markets is a cornerstone of its operational and growth strategy. The company's ability to secure capital, whether through debt or equity, directly impacts its capacity to invest in innovation, expand manufacturing, and complete large-scale infrastructure projects. Favorable lending environments and successful capital raises are therefore crucial economic determinants for Alstom's performance.

In 2024, Alstom demonstrated strong capital management by executing a significant deleveraging plan. This included a €1 billion rights offering, which bolstered its equity base, and the issuance of €750 million in subordinated perpetual securities. These moves were instrumental in substantially reducing the company's net debt, thereby improving its financial flexibility and creditworthiness.

Inflation and fluctuating raw material costs, particularly for steel and energy, directly influence Alstom's manufacturing expenses and overall profitability. For instance, in early 2024, global steel prices saw volatility, and energy prices remained a key concern for industrial manufacturers across Europe. Effectively navigating these cost pressures through robust hedging, streamlined supply chains, and strategic supplier contracts is paramount for Alstom to sustain healthy profit margins and competitive pricing on its rail projects.

Currency Exchange Rate Fluctuations

Alstom, as a global player with a presence in many nations, is significantly exposed to the volatility of currency exchange rates. Fluctuations can directly alter the translated value of its international revenues, expenses, and ultimately, its profitability, creating a dynamic financial landscape. For instance, in the first half of 2024, Alstom reported that foreign exchange had a negative impact of €50 million on its sales due to the strengthening of the Euro against other major currencies. This highlights the critical need for sophisticated financial strategies to mitigate currency-related risks and ensure stable financial performance across its diverse operations.

The company actively manages these exposures through various hedging instruments and operational strategies. For example, Alstom might invoice in a stronger currency where possible or match its currency-denominated revenues and costs. This proactive approach is vital, especially considering the economic uncertainties and potential for sharp currency movements observed throughout 2024 and projected into 2025. The company's financial health is intrinsically linked to its ability to navigate these currency markets effectively.

- Impact on Reported Earnings: Currency fluctuations can distort Alstom's reported financial results, making it challenging to compare performance across different periods or regions without accounting for exchange rate movements.

- Cost of Goods Sold: Changes in exchange rates directly affect the cost of imported components and raw materials, influencing Alstom's gross margins.

- Competitive Positioning: A strong domestic currency can make Alstom's products more expensive for foreign buyers, potentially impacting sales volumes and market share.

- Financial Hedging Costs: While essential, currency hedging strategies themselves incur costs, which need to be factored into the overall financial management.

Competitive Landscape and Pricing Pressure

The rail transport sector is intensely competitive, with global giants like CRRC Corporation Limited, Siemens AG, and Stadler Rail AG constantly vying for lucrative contracts. This fierce rivalry directly translates into significant pricing pressure, forcing companies like Alstom to operate with razor-thin margins on many projects.

To navigate this challenging economic environment, Alstom must prioritize relentless innovation and cost-efficiency. Offering compelling value propositions that go beyond just price is crucial for retaining market share and ensuring sustained profitability in the face of aggressive competition.

- Market Share Dynamics: Alstom competes with CRRC, which reported revenues of approximately €43.5 billion in 2023, and Siemens Mobility, a division of Siemens AG, which saw significant growth in its order intake in the fiscal year ending September 2023, reaching €23.5 billion.

- Pricing Strategies: The need to win bids often leads to aggressive pricing, impacting Alstom's gross profit margins, which have historically fluctuated around 10-15% for rolling stock and signaling projects.

- Innovation Investment: Companies in this space, including Alstom, are investing heavily in R&D, with Alstom allocating a substantial portion of its revenue towards developing new technologies like hydrogen-powered trains and advanced digital signaling systems to differentiate themselves.

Economic growth directly fuels Alstom's business, with global projections suggesting a 3.2% GDP increase in 2024 and similar growth expected for 2025, indicating potential for increased infrastructure spending. However, economic headwinds like inflation and interest rate hikes, which persisted into early 2024, can lead to project delays, impacting Alstom's order pipeline.

Alstom's financial health is also tied to its ability to access capital, with recent actions like a €1 billion rights offering in early 2024 strengthening its balance sheet. The company's profitability is directly affected by raw material costs, such as steel, which experienced price volatility in early 2024, and energy prices, a persistent concern for manufacturers.

Currency fluctuations present a significant risk, with a reported €50 million negative impact on Alstom's sales in the first half of 2024 due to Euro strengthening. This underscores the critical need for effective hedging strategies to mitigate financial performance volatility across its global operations.

| Economic Factor | 2024/2025 Projection/Observation | Impact on Alstom |

| Global GDP Growth | IMF: 3.2% (2024), similar for 2025 | Positive correlation with infrastructure investment demand |

| Inflation & Interest Rates | Lingering effects from 2023 into 2024 | Potential for project deferrals, impacting order book |

| Capital Access | €1bn rights offering (early 2024) | Strengthened financial flexibility and creditworthiness |

| Raw Material Costs | Steel price volatility, persistent energy costs (early 2024) | Increased manufacturing expenses, impacting profit margins |

| Currency Exchange Rates | Negative €50m sales impact from Euro strength (H1 2024) | Distorted reported earnings, affects competitive pricing |

Preview Before You Purchase

Alstom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alstom PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It offers a detailed examination of Alstom's market position and future outlook within the global rail industry.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain valuable insights into the challenges and opportunities Alstom faces in a dynamic business landscape.

Sociological factors

Urbanization and population growth are key drivers for Alstom. By 2050, it's projected that 68% of the world's population will live in urban areas, according to the UN. This surge in city dwellers directly translates to a heightened demand for efficient, sustainable public transportation, a core offering for Alstom. The need for advanced metro, tram, and commuter rail systems is becoming increasingly critical to manage this influx.

The increasing density of urban populations necessitates integrated transport solutions. Alstom's expertise in developing comprehensive mobility networks, from signaling to rolling stock, positions it well to capitalize on this trend. For instance, in 2023, Alstom secured a significant contract to supply new metro trains for the Grand Paris Express project, a clear example of meeting urban expansion needs.

Growing public awareness of climate change is significantly reshaping consumer preferences, with a marked shift towards sustainable travel options. This trend directly benefits Alstom, as travelers increasingly seek out environmentally friendly transportation, boosting demand for the company's green mobility solutions.

Consumers and policymakers alike are prioritizing low-carbon transit, such as electric and hydrogen-powered trains. This aligns perfectly with Alstom's strategic focus on pioneering green technologies, reinforcing its commitment to reducing CO2 emissions and its role in decarbonizing the transport sector.

For instance, in 2023, the global sustainable tourism market was valued at approximately $2.5 trillion, with projections indicating continued robust growth. This expansion underscores the increasing consumer willingness to choose and even pay a premium for travel that minimizes environmental impact, directly benefiting companies like Alstom offering greener alternatives.

Public perception of rail transport significantly shapes ridership and support for new infrastructure. Concerns about safety, punctuality, and ease of use directly influence passenger numbers and public willingness to back rail expansion projects. For instance, a 2023 survey by the European Union indicated that while 70% of respondents see rail as an environmentally friendly transport option, only 55% expressed high confidence in its punctuality across major European lines.

Negative incidents, such as derailments or significant delays, can severely damage public trust and consequently affect investment decisions. Alstom's proactive approach to safety and reliability is therefore paramount. The company's investment in predictive maintenance technologies, which saw a 15% reduction in unexpected service disruptions in their European fleet during 2024, directly addresses these concerns, aiming to bolster public confidence and encourage continued growth in rail travel.

Workforce Skills and Availability

The availability of a skilled workforce, encompassing engineers, technicians, and specialized manufacturing personnel, is a critical sociological factor for Alstom. The company's ability to innovate, produce, and maintain complex rail systems hinges on attracting and retaining top talent. For instance, in 2024, Alstom highlighted a global need for over 7,500 new employees, with a significant portion requiring technical and engineering expertise to meet the growing demand for sustainable mobility solutions.

Challenges in skill availability can directly impact production timelines and Alstom's capacity to undertake new projects. The ongoing digital transformation within the rail industry necessitates a workforce proficient in areas like data analytics, AI, and cybersecurity, alongside traditional mechanical and electrical engineering skills. This evolving skill landscape presents both an opportunity and a challenge for Alstom's human resources strategy.

- Talent Demand: Alstom's 2024 recruitment drive targets over 7,500 new hires globally, emphasizing technical and engineering roles.

- Skill Gaps: Shortages in specialized manufacturing and advanced digital skills can impede project execution and innovation.

- Industry Transformation: The need for expertise in data analytics, AI, and cybersecurity is growing alongside traditional engineering disciplines.

- Retention Focus: Attracting and retaining skilled personnel is paramount for maintaining Alstom's competitive edge in complex rail system development.

Social Equity and Accessibility in Transportation

Societal expectations for equitable and accessible transportation are a significant driver for Alstom. This means designing trains, metros, and trams that cater to everyone, including those with disabilities, and ensuring that transport networks reach diverse communities. For instance, by 2025, many cities are expected to have stricter regulations on accessibility, pushing Alstom to integrate features like level boarding and visual/auditory information systems as standard. This focus directly shapes product development and project requirements.

Alstom's commitment to social equity is reflected in its efforts to make mobility solutions usable by the widest possible range of people. This includes not only physical accessibility but also affordability and coverage across different socioeconomic groups. For example, projects like the development of low-floor trams or accessible metro car designs are directly influenced by these evolving social demands. The company's 2024 sustainability reports highlight increased investment in R&D for inclusive design, aiming to meet the growing demand for transport that serves all citizens.

- Accessibility Mandates: Many countries are updating or introducing stricter accessibility regulations for public transport by 2025, impacting Alstom's design specifications.

- Inclusive Design Investment: Alstom reported a 15% increase in R&D spending on inclusive design features in its 2024 financial year.

- Community Impact: Projects in developing regions often prioritize solutions that enhance connectivity for underserved populations, aligning with social equity goals.

Public perception of rail transport significantly influences ridership and support for new infrastructure projects. Alstom's focus on safety and reliability is crucial; for instance, their investment in predictive maintenance reduced unexpected service disruptions by 15% in their European fleet during 2024, aiming to build public trust.

The availability of a skilled workforce is vital for Alstom's operations and innovation. In 2024, the company sought over 7,500 new hires globally, with a strong emphasis on technical and engineering expertise to support the growing demand for sustainable mobility.

Societal expectations for equitable and accessible transportation are shaping Alstom's product development. By 2025, many cities are expected to implement stricter accessibility regulations, requiring features like level boarding and advanced information systems as standard.

Alstom's 2024 sustainability reports indicate a 15% increase in R&D investment for inclusive design features, reflecting a commitment to creating mobility solutions that cater to a wider range of users and communities.

| Sociological Factor | Impact on Alstom | Supporting Data/Trend |

| Public Perception of Rail | Affects ridership and project support. | Predictive maintenance reduced disruptions by 15% (2024) to enhance trust. |

| Skilled Workforce Availability | Essential for innovation and project execution. | Targeted over 7,500 new hires globally in 2024, focusing on technical roles. |

| Demand for Accessibility | Drives product design and compliance. | Increased R&D investment by 15% in inclusive design (2024); stricter regulations expected by 2025. |

Technological factors

Alstom's core business, centered on rail transport, is profoundly shaped by breakthroughs in green traction technologies. Innovations like hydrogen and battery-powered trains are not just trends; they are becoming foundational to the industry's future, directly influencing Alstom's product development and market positioning.

As a recognized leader, Alstom is at the forefront of hydrogen-powered passenger trains, exemplified by its Coradia iLint model which has seen commercial deployment. The company is also committed to a holistic approach to decarbonizing rail assets, considering the entire lifecycle of its products to minimize environmental impact.

These technological advancements are essential for Alstom to provide genuinely sustainable mobility solutions. They enable the company to meet increasingly stringent environmental regulations and the growing demand from operators and passengers for greener transportation options, aligning with global sustainability targets for 2024 and beyond.

The rail sector is undergoing a significant transformation driven by digitalization, artificial intelligence, big data, and robust cybersecurity measures. Alstom is at the forefront of this evolution, channeling investments into cutting-edge driverless rail technology, predictive maintenance systems, and AI-driven operational enhancements. These advancements are designed to elevate system performance, boost efficiency, and significantly improve the passenger experience.

These smart mobility solutions are not just incremental improvements; they are fundamental to future-proofing transportation networks. For instance, Alstom's focus on AI-powered operations can lead to optimized energy consumption and reduced operational costs. In 2023, Alstom reported a significant increase in its digital services portfolio, contributing to a substantial portion of its overall revenue, highlighting the growing market demand for these intelligent solutions.

Technological advancements in signaling and infrastructure are paramount for Alstom's growth, particularly with the ongoing rollout of systems like the European Rail Traffic Management System (ERTMS). This digital transformation is designed to boost rail network efficiency and capacity, with ERTMS Level 2 adoption projected to reach significant milestones across European corridors by 2025, enhancing interoperability and speed.

Alstom's commitment to innovation extends to digital mobility solutions, enabling the company to provide interconnected and intelligent transport systems. For instance, their recent contracts in 2024 for digital signaling upgrades in various regions underscore the demand for these sophisticated technologies, contributing to safer and more streamlined rail operations.

Automation and Autonomous Mobility

The push towards automation and autonomous mobility is a major technological force shaping Alstom's future. The company is actively developing fully automated metro systems, like those in Paris and Riyadh, which are designed to boost transport capacity and improve energy efficiency. This focus on driverless trains necessitates substantial investment in research and development, particularly in sophisticated control systems and artificial intelligence.

Alstom is exploring autonomous train prototypes, aiming to unlock further operational benefits. For instance, the development of its new generation of metros and regional trains incorporates advanced automation features. This technological shift is crucial for meeting the growing demand for efficient and sustainable public transportation solutions globally.

- R&D Investment: Alstom's commitment to innovation in automation is evident in its continuous R&D spending, which supports the development of complex control systems and AI for autonomous operations.

- Operational Efficiency: Fully automated systems promise significant gains in transport capacity and energy savings, with pilot projects demonstrating potential for reduced operational costs.

- Market Demand: The increasing global demand for smart, efficient, and high-capacity urban mobility solutions directly fuels Alstom's strategic focus on autonomous technologies.

Materials Science and Manufacturing Innovations

Alstom's production efficiency and sustainability are significantly influenced by advancements in materials science and manufacturing, including technologies like 3D printing and the integration of recycled materials. These innovations allow for the creation of trains that are not only lighter and more robust but also possess a reduced environmental footprint.

Alstom has set an ambitious target: to incorporate 25% recycled content in its new rolling stock designs by 2025. This initiative underscores the company's dedication to the principles of a circular economy, aiming to minimize waste and maximize resource utilization.

The adoption of these cutting-edge manufacturing techniques and materials directly contributes to Alstom's strategic goals:

- Enhanced Product Performance: Lighter materials improve energy efficiency in train operations.

- Increased Durability: Advanced materials contribute to longer product lifespans and reduced maintenance needs.

- Environmental Responsibility: Utilizing recycled content and sustainable manufacturing processes lowers the carbon footprint of Alstom's rolling stock.

- Cost Optimization: Innovations in manufacturing can lead to more streamlined and cost-effective production processes.

Technological advancements are reshaping Alstom's rail sector, with a strong focus on green traction like hydrogen and battery-powered trains, as seen in their Coradia iLint model. Digitalization, AI, and big data are driving innovations in driverless technology and predictive maintenance, enhancing operational efficiency and passenger experience. For instance, Alstom's digital services portfolio saw significant growth in 2023, contributing substantially to revenue.

Legal factors

Alstom navigates a stringent regulatory landscape, both internationally and nationally, covering critical areas like safety, environmental emissions, and the technical interoperability of its rail systems. For instance, the European Union's Technical Specifications for Interoperability (TSIs) mandate specific standards for rolling stock and infrastructure, directly impacting Alstom's product development and market access across member states.

Adhering to these varied legal frameworks is not optional; it's a prerequisite for Alstom to successfully deploy and operate its trains and signaling systems globally. Failure to meet these complex requirements, such as specific noise pollution limits or crashworthiness standards, can result in significant financial penalties and, more critically, exclusion from key markets, impacting Alstom's revenue streams.

Alstom's core business hinges on winning substantial public procurement contracts, making adherence to complex contract law and public procurement regulations paramount. These regulations dictate everything from fair tender processes to the precise contractual obligations and dispute resolution pathways, directly impacting Alstom's ability to secure and successfully deliver projects.

Navigating these legal frameworks is not just about compliance; it's a strategic imperative. For instance, the European Union's public procurement directives, which set standards for transparency and competition, directly influence Alstom's bidding strategies across the continent. Failure to comply can lead to disqualification from tenders or legal challenges, as seen in past cases involving procurement disputes in the rail sector.

Alstom operates within a framework of increasingly stringent environmental regulations, particularly concerning CO2 emissions and particulate matter. These laws directly influence the design of its rolling stock and signaling systems, pushing for greater energy efficiency and reduced environmental impact throughout the product lifecycle.

The company has publicly committed to ambitious sustainability goals, aiming for net-zero carbon emissions across its entire value chain by 2050, a target that aligns with international climate agreements. This commitment necessitates continuous investment in research and development to meet evolving legal requirements and to drive innovation in green transportation solutions.

Compliance with these environmental mandates is not merely a legal obligation but a strategic imperative for Alstom, serving as a significant catalyst for developing more sustainable and competitive offerings in the global rail market.

Intellectual Property Rights and Patents

Alstom's ability to protect its innovations through intellectual property rights (IPR), including patents, trademarks, and trade secrets, is fundamental to its competitive edge in the mobility sector. These legal protections are vital for safeguarding its advanced technologies and preventing competitors from exploiting them. For instance, in 2023, Alstom continued to actively manage its patent portfolio, filing numerous new applications to cover advancements in areas like hydrogen propulsion and digital signaling, reflecting the ongoing importance of IPR in its strategy.

The legal landscape surrounding IPR directly impacts Alstom's capacity to maintain its market position. Robust patent protection allows the company to monetize its research and development investments and deter imitation. Failure to adequately protect these assets can result in significant financial losses and a dilution of its technological leadership. The cost of defending patents can be substantial; for example, major players in the rail industry have historically spent millions on litigation to enforce or defend their IPR.

- Patent Protection: Alstom relies on a strong patent portfolio to safeguard its proprietary technologies in areas like high-speed rail, signaling systems, and sustainable mobility solutions.

- Trademark Enforcement: Protecting its brand name and product identifiers through trademarks is crucial for maintaining customer trust and market recognition.

- Trade Secret Management: Confidential manufacturing processes and design know-how are protected as trade secrets, requiring stringent internal controls.

- Litigation Risk: Alstom faces potential costs and disruptions from legal battles related to intellectual property infringement claims, either as a claimant or defendant.

Labor Laws and Employment Regulations

Alstom, a global employer with over 86,000 individuals across 184 nationalities as of early 2024, navigates a complex web of labor laws and employment regulations worldwide. These regulations directly influence human resource strategies and operational expenditures, covering aspects like fair working conditions, employee entitlements, and collective negotiation frameworks.

Adherence to these diverse legal requirements is critical for Alstom's smooth operation and reputation. For instance, in France, where Alstom has a significant presence, labor laws often mandate specific working hours, minimum wage requirements, and robust employee protections, impacting payroll and benefits costs.

- Compliance with varying national labor laws: Alstom must ensure its HR practices align with regulations in countries such as Germany, the UK, and the United States, each with distinct employment standards.

- Impact on operational costs: Differences in minimum wage, overtime pay, and social security contributions across jurisdictions can significantly affect Alstom's overall labor expenses.

- Employee rights and collective bargaining: Alstom's approach to employee representation and union negotiations is shaped by legal frameworks that vary considerably by country, influencing its industrial relations.

- Health and safety regulations: Strict adherence to workplace health and safety laws, a key concern for Alstom's manufacturing and operational sites, requires ongoing investment in safety protocols and training.

Alstom operates under a stringent legal framework governing safety, environmental impact, and technical standards for rail systems globally. For example, the European Union's Technical Specifications for Interoperability (TSIs) set mandatory standards for rolling stock and infrastructure, directly affecting Alstom's product development and market access across member states.

Compliance with these diverse legal requirements is essential for Alstom's global operations, impacting everything from product design to market entry. Failure to meet specific legal mandates, such as noise pollution limits or crashworthiness standards, can lead to significant financial penalties and market exclusion.

The company's reliance on public procurement contracts means strict adherence to contract law and public procurement regulations is vital. These regulations dictate fair tender processes and contractual obligations, directly influencing Alstom's ability to secure and deliver projects. For instance, in 2023, Alstom secured a €1.3 billion contract for the supply of 100 regional trains for the Czech Republic, underscoring the importance of navigating public tender processes successfully.

Alstom's intellectual property rights (IPR) are crucial for its competitive edge, with patents protecting its innovations in areas like hydrogen propulsion and digital signaling. As of early 2024, Alstom continues to actively manage its patent portfolio, filing numerous new applications to safeguard its technological advancements.

Environmental factors

Climate change is a major environmental force influencing Alstom, compelling the company to accelerate the decarbonization of transportation. This pressure fuels Alstom's innovation in developing sustainable mobility solutions.

Alstom has set an ambitious goal to cut its Scope 1 and 2 emissions by 40% by 2030, a target it has already surpassed, achieving this milestone over five years ahead of schedule. For the fiscal year 2024/25, Alstom reported an 8% reduction in these emissions compared to March 2024, demonstrating significant progress.

These environmental imperatives are directly driving Alstom's investment in and development of cutting-edge technologies like hydrogen-powered trains and battery-electric trains, positioning the company as a leader in the transition to a low-carbon transport sector.

Growing worries about the availability of raw materials are pushing companies like Alstom to embrace circular economy ideas. This means designing products and running operations in ways that minimize waste and maximize the use of resources. Alstom is committed to eco-design, aiming for 25% recycled content in its new trains by 2025.

This commitment extends to recycling operational waste and actively promoting repair and reuse initiatives. By focusing on these principles, Alstom aims to not only reduce its environmental footprint but also build resilience against future resource shortages.

Alstom's operations are heavily tied to energy consumption, making the shift towards cleaner sources a critical environmental factor. The company has set an ambitious target to power its global sites entirely with renewable electricity by the end of 2025.

This transition is already well underway, with Alstom reporting an impressive 88% renewable electricity usage as of March 2025. This proactive approach not only curtails direct operational CO2 emissions but also positions Alstom as a contributor to broader sustainability objectives and the global energy transition.

Waste Management and Pollution Control

Alstom views effective waste management and pollution control as core environmental duties. The company is committed to reducing waste at its source, boosting recycling efforts, and ensuring the safe disposal of any hazardous materials. In 2024, Alstom achieved a recycling rate of 78%, with a clear objective to reach 80% by 2025, demonstrating a consistent drive for improvement.

A significant environmental challenge Alstom is addressing is the reduction of particulate emissions, particularly those generated from train braking systems. This focus aligns with stricter global regulations and growing public concern over air quality. Alstom is investing in innovative technologies to mitigate these emissions.

- Waste Minimization: Alstom actively works to reduce the volume of waste produced across its operations.

- Recycling Initiatives: The company reported a 78% recycling rate in 2024 and aims for 80% in 2025.

- Hazardous Material Handling: Strict protocols are in place for the responsible management and disposal of hazardous substances.

- Emission Control: Efforts are concentrated on lowering particulate emissions from braking systems.

Biodiversity and Ecosystem Protection

Alstom's large infrastructure projects, such as railway construction, can have indirect effects on biodiversity and local ecosystems. For instance, the company's high-speed rail projects in Europe, while crucial for sustainable transport, necessitate careful planning to minimize habitat fragmentation. In 2024, Alstom continued to emphasize environmental impact assessments, with a significant portion of its project planning budget allocated to ecological surveys and mitigation strategies. This includes measures like wildlife crossings and habitat restoration, aiming to offset potential disruptions.

Responsible sourcing and supply chain management are also key. Alstom's commitment to sustainability extends to ensuring its suppliers adhere to environmental standards, protecting biodiversity throughout its value chain. By 2025, the company aims to have 90% of its key suppliers audited for environmental compliance, a figure that has steadily increased from 75% in 2023, reflecting a growing focus on ecosystem protection.

- Habitat Mitigation: Alstom implements specific measures like wildlife corridors and noise barriers to reduce the impact of new infrastructure on local fauna.

- Supply Chain Audits: In 2024, Alstom conducted over 500 supplier audits focusing on environmental management and biodiversity protection practices.

- Ecosystem Restoration: The company is involved in several projects that include active ecosystem restoration components, such as reintroducing native plant species in areas affected by construction.

Alstom's environmental strategy is deeply intertwined with climate change mitigation, driving innovation in decarbonized transport solutions. The company has made significant strides in reducing its emissions, surpassing its 2030 target for Scope 1 and 2 emissions by achieving a 40% reduction ahead of schedule and reporting an 8% reduction in fiscal year 2024/25.

The company is also committed to resource efficiency, aiming for 25% recycled content in new trains by 2025 and achieving an 88% renewable electricity usage across its global sites by the end of 2025. Waste management is another key focus, with Alstom reporting a 78% recycling rate in 2024 and targeting 80% for 2025.

Alstom is actively addressing particulate emissions from braking systems and managing the ecological impact of its infrastructure projects, including biodiversity protection and supply chain environmental compliance, with 90% of key suppliers targeted for environmental audits by 2025.

| Environmental Metric | Target/Status | Year |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 40% reduction (achieved ahead of schedule) | FY 2024/25 (vs. baseline) |

| Recycled Content in New Trains | 25% | 2025 |

| Renewable Electricity Usage | 100% | End of 2025 |

| Recycling Rate | 80% | 2025 |

| Key Supplier Environmental Audits | 90% | 2025 |

PESTLE Analysis Data Sources

Our Alstom PESTLE Analysis is meticulously constructed using a blend of public and proprietary data, encompassing official government reports, industry-specific market research, and global economic indicators. This comprehensive approach ensures that every factor—political, economic, social, technological, legal, and environmental—is grounded in current, verifiable insights relevant to Alstom's operational landscape.