Alstom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alstom Bundle

Alstom navigates a complex railway manufacturing landscape, shaped by powerful buyer demands and intense rivalry. Understanding these forces is crucial for strategic advantage.

The complete report reveals the real forces shaping Alstom’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alstom depends on a worldwide web of suppliers for highly specialized parts like traction systems, bogies, and signaling gear. These are absolutely vital for Alstom's intricate transportation solutions.

The specialized and often limited number of manufacturers producing these critical components can give them considerable influence over Alstom. For instance, in 2023, Alstom reported supply chain disruptions affecting production timelines, highlighting how supplier dependencies can impact operations.

Fluctuations in the prices of essential raw materials like steel, aluminum, and rare earth metals, along with energy costs, directly impact Alstom's production expenses. For instance, the London Metal Exchange (LME) saw significant volatility in aluminum prices throughout 2024, with prices ranging from approximately $2,100 to $2,500 per metric ton, directly affecting Alstom's input costs.

Suppliers of these basic commodities can exert considerable power, particularly during periods of global price volatility or anticipated supply shortages. The ongoing geopolitical tensions in Eastern Europe and disruptions in key mining regions in 2024 continued to create uncertainty in the supply chains for critical metals, giving suppliers leverage.

While Alstom is a significant global buyer, the inherent nature of these commodity markets means the company remains susceptible to broader economic forces and supply-demand imbalances. For example, increased demand for electric vehicles in 2024 put upward pressure on rare earth metal prices, a key component in Alstom's traction systems.

Suppliers offering advanced digital mobility, predictive maintenance, and autonomous system technologies are gaining significant leverage over Alstom. This is because Alstom's strategic direction heavily relies on innovation in these very areas. For instance, companies specializing in AI-driven signaling systems or advanced battery technology for rail transport can dictate terms due to their unique expertise.

These technology providers often hold exclusive patents or proprietary knowledge, which makes it costly and complex for Alstom to switch to alternative suppliers. This situation can limit Alstom's operational flexibility and increase its dependency. For example, if a key supplier for a critical autonomous driving software holds a patent, Alstom might face higher licensing fees or be locked into a long-term contract, impacting its cost structure.

Labor and Skilled Workforce

The availability of a skilled workforce, especially in engineering and specialized technical roles, significantly impacts supplier power for companies like Alstom. A tight labor market or strong union presence can drive up labor costs for Alstom's suppliers. For instance, in 2024, the global shortage of skilled engineers, particularly in advanced manufacturing and digital technologies, continued to put upward pressure on wages. This increased cost for suppliers can translate into higher prices for components and services provided to Alstom, affecting its overall cost structure and operational efficiency.

Labor unions can further amplify supplier bargaining power by negotiating higher wages and benefits. When suppliers face these increased labor costs, they may pass them on to Alstom. This dynamic is particularly relevant in regions with strong labor protections and a history of collective bargaining. The impact on Alstom is a potential increase in its cost of goods sold and a need for strategic sourcing to mitigate these rising expenses.

- Skilled Labor Shortage: A global deficit in specialized engineers and technicians in 2024 directly benefits suppliers by increasing demand for their workforce.

- Union Influence: Strong labor unions in supplier organizations can negotiate for higher wages, increasing supplier costs.

- Cost Pass-Through: Suppliers facing higher labor expenses may pass these costs onto Alstom, impacting its profitability.

- Regional Variations: The bargaining power of labor can differ significantly by region, influencing Alstom's supply chain costs.

Limited Supplier Base for Niche Solutions

For highly specialized rail components and technologies, Alstom often faces a limited pool of qualified suppliers. This scarcity, driven by rigorous industry certifications and the complexity of bespoke solutions, significantly enhances the bargaining power of these few providers. For instance, in the realm of advanced signaling systems or specialized rolling stock components, a handful of companies might hold the necessary patents and expertise.

The high barriers to entry, including extensive R&D investment and compliance with strict safety regulations, make it difficult and costly for Alstom to cultivate alternative suppliers. This dependence on a narrow supplier base can translate into increased procurement costs and less flexibility in contract negotiations. In 2024, the global rail signaling market, a key area for such specialization, was valued at approximately $10 billion, with a significant portion dominated by a few major players.

- Limited Supplier Options: The specialized nature of many rail components restricts the number of viable suppliers.

- High Switching Costs: Developing new, certified suppliers for niche rail solutions is a lengthy and expensive process.

- Price and Terms Influence: A concentrated supplier market allows dominant firms to dictate higher prices and less favorable terms to Alstom.

Alstom's reliance on a select group of suppliers for highly specialized components, such as advanced signaling systems, grants these providers significant leverage. The complexity and stringent certification requirements for these parts create high barriers to entry, limiting the number of viable alternatives for Alstom. This scarcity allows these specialized suppliers to influence pricing and contract terms, as evidenced by the concentrated nature of the global rail signaling market, valued around $10 billion in 2024, where a few key players hold substantial market share.

Furthermore, the increasing demand for innovative digital mobility solutions and autonomous systems means that technology providers with unique patents and proprietary knowledge hold considerable bargaining power. Alstom's strategic focus on these areas makes it difficult and costly to switch suppliers, potentially leading to higher licensing fees or long-term contractual dependencies that impact cost structures.

The bargaining power of suppliers is also amplified by factors like the global shortage of skilled engineers in 2024, which drives up labor costs for suppliers. These increased operational expenses are often passed on to Alstom, affecting its procurement costs and overall profitability. Strong labor unions within supplier organizations can further negotiate for higher wages, exacerbating this cost-pass-through effect.

| Factor | Impact on Alstom | Example/Data (2024 unless specified) |

| Supplier Specialization & Scarcity | Increased procurement costs, limited negotiation flexibility | Concentrated rail signaling market ($10 billion value), few dominant players |

| Technological Innovation & Patents | Higher licensing fees, contractual lock-in | AI-driven signaling systems, advanced battery tech suppliers |

| Skilled Labor Shortage | Higher input costs passed to Alstom | Global deficit in specialized engineers impacting supplier wages |

| Union Influence | Increased supplier labor costs | Negotiation for higher wages and benefits by unions |

What is included in the product

This analysis dissects the competitive landscape for Alstom, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the rail industry.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Alstom's bargaining power of customers is significantly shaped by large-scale public procurement. National governments and public transport authorities are key clients, often initiating massive infrastructure projects that require substantial rolling stock, signaling systems, and maintenance services. These public entities wield considerable influence due to the immense volume of their orders, which can represent a large portion of a manufacturer's revenue.

The purchasing decisions of these public bodies are frequently tied to broader political objectives, the allocation of public funds, and overarching national development strategies. For instance, in 2024, many European nations continued to invest heavily in rail infrastructure as part of their green transition initiatives, creating substantial demand but also empowering these buyers through the scale of their commitments.

Customers often seek extensive, long-term service and maintenance contracts, sometimes extending for decades, alongside their equipment purchases. This creates a consistent revenue flow for Alstom but also grants customers significant leverage in negotiating pricing and service level agreements throughout the contract's duration.

The extended commitment allows customers to secure advantageous terms from the outset and ensures Alstom's accountability for performance over many years. For instance, Alstom's service contracts are crucial, contributing a substantial portion of its revenue, with figures from recent years showing robust growth in this segment, underscoring customer reliance and their subsequent bargaining power.

Alstom's customers, particularly large public transport authorities and national railway operators, often have highly specific technical and operational requirements. These can range from unique track gauges and stringent climate resilience needs to specific passenger capacity and critical interoperability standards with existing infrastructure. For instance, a new metro line project in a dense urban environment will have vastly different demands than a high-speed rail upgrade in a different country.

This demand for extensive customization significantly bolsters customer bargaining power. Alstom must invest heavily in engineering and design to tailor its rolling stock and signaling systems to each unique project. This bespoke approach can limit Alstom's ability to leverage economies of scale through standardization, as each project may require distinct modifications, impacting production efficiency and potentially increasing costs.

Availability of Alternative Suppliers

The availability of alternative suppliers significantly impacts the bargaining power of customers in the integrated transport systems market. While the sector features major global players such as Siemens Mobility, CRRC, and Hitachi Rail, this concentration actually empowers customers.

Customers can leverage the presence of these formidable competitors to solicit multiple bids. This allows them to negotiate aggressively on critical factors like price, technological specifications, and delivery timelines. For Alstom, this competitive landscape necessitates a strong value proposition to win contracts.

For instance, in 2024, major rail infrastructure projects often see intense bidding. Alstom's ability to secure deals depends on its competitive pricing and technological edge against rivals like Siemens, which reported €19.1 billion in revenue for its Mobility division in fiscal year 2023, and CRRC, a global leader in rolling stock manufacturing.

- Competitive Bidding: Customers can compare offerings from Alstom, Siemens Mobility, CRRC, and Hitachi Rail, fostering price competition.

- Negotiation Leverage: The existence of multiple strong suppliers grants customers significant power to negotiate terms and pricing.

- Value Proposition Focus: Alstom must continuously differentiate its products and services to remain competitive and attractive to buyers.

Budgetary Constraints and Public Scrutiny

Public sector clients, a significant customer base for Alstom, operate under stringent budgetary limitations and intense public oversight concerning infrastructure investments. This financial pressure translates into aggressive price negotiations and a pronounced emphasis on cost-effectiveness from their perspective.

Alstom faces the challenge of clearly articulating the value proposition and long-term economic benefits of its offerings to secure and maintain these crucial contracts. For instance, in 2024, many government transport projects faced budget reviews, necessitating greater justification for capital expenditures.

- Budgetary Pressures: Public sector clients often have fixed budgets, limiting their ability to absorb price increases.

- Public Scrutiny: Spending on public infrastructure is closely monitored, pushing customers to demand the lowest possible prices.

- Value Demonstration: Alstom must prove that its solutions offer superior long-term value, not just initial cost savings.

- Negotiation Leverage: The need to secure public funding gives customers significant bargaining power in price discussions.

The bargaining power of Alstom's customers is substantial, primarily due to the concentrated nature of the rail industry and the significant scale of procurement. Large public transport authorities and national railway operators often represent a large portion of Alstom's business, giving them considerable leverage in negotiations.

Customers can effectively pit major global competitors like Siemens Mobility, CRRC, and Hitachi Rail against each other, driving down prices and demanding favorable terms. This competitive landscape is evident in 2024's major rail projects, where Alstom's ability to secure contracts hinges on its pricing and technological offerings compared to rivals, such as Siemens Mobility's reported €19.1 billion revenue for its Mobility division in fiscal year 2023.

Furthermore, the demand for highly customized solutions for specific infrastructure projects, such as unique track gauges or interoperability requirements, limits Alstom's ability to standardize and achieve economies of scale. This necessitates significant engineering investment per project, empowering buyers who can dictate precise specifications.

Public sector clients, a core customer segment, face stringent budgetary controls and public scrutiny, compelling them to negotiate aggressively on price and demand demonstrable long-term value. This financial pressure, amplified by ongoing budget reviews in 2024 for many government transport projects, grants customers significant bargaining power.

| Customer Type | Key Bargaining Factors | Impact on Alstom |

|---|---|---|

| Public Transport Authorities/National Railways | Large order volumes, long-term service contracts, specific technical requirements | High negotiation leverage on price, terms, and customization; need for strong value proposition |

| Government Bodies | Budgetary constraints, public scrutiny, focus on cost-effectiveness | Intense price pressure, demand for cost-benefit analysis, emphasis on long-term economic benefits |

| Competitors (Siemens, CRRC, Hitachi) | Availability of alternative suppliers, competitive bidding processes | Necessity for competitive pricing and technological differentiation; risk of losing contracts to rivals |

What You See Is What You Get

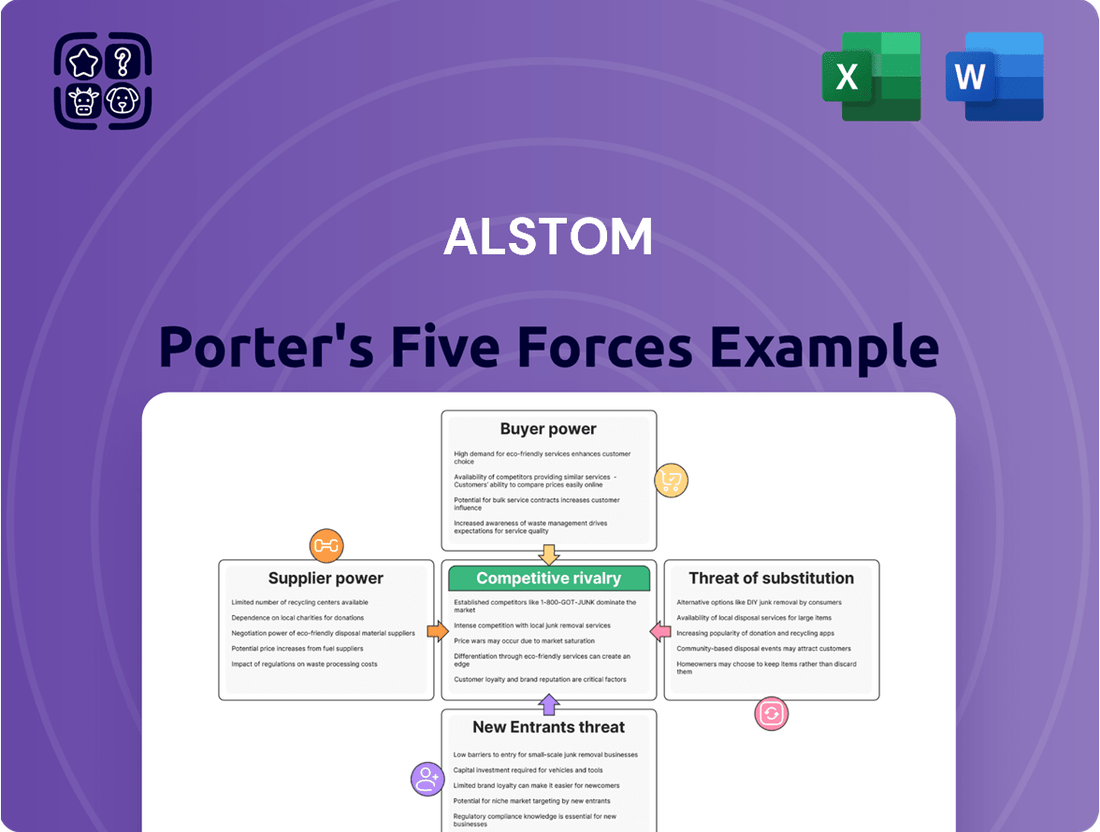

Alstom Porter's Five Forces Analysis

This preview showcases the complete Alstom Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the railway industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility. You can confidently expect this professionally formatted and ready-to-use analysis to provide valuable strategic insights for Alstom.

Rivalry Among Competitors

The global rail transport system market operates as an oligopoly, dominated by a handful of major players like Alstom, Siemens Mobility, CRRC, and Hitachi Rail. This concentrated structure means intense rivalry as these giants vie for substantial, lucrative contracts across the globe. Gaining significant market share is a formidable challenge due to the established positions and resources of these key competitors.

The rail industry, including Alstom's sector, is characterized by exceptionally high fixed costs. Significant capital is tied up in advanced manufacturing plants, extensive research and development for new train technologies, and the cultivation of a specialized, highly skilled workforce. These upfront and ongoing investments create a substantial financial commitment for any player in this market.

These high fixed costs, coupled with specialized assets that have limited alternative uses, erect formidable exit barriers. Companies are essentially locked into the industry, as divesting these assets would likely result in substantial losses. This economic reality forces firms to remain active and compete fiercely, even when market conditions are unfavorable, simply to cover their operational expenses and utilize existing capacity.

Consequently, competitive rivalry is intensified. Firms are disincentivized from leaving the market, leading to a persistent and often aggressive competition among existing players. For instance, in 2023, the global railway market was valued at approximately $230 billion, with ongoing large-scale infrastructure projects demanding continuous investment and capacity utilization from companies like Alstom, further cementing the impact of high fixed costs and exit barriers on rivalry.

Companies in the rail sector actively differentiate their products and services by focusing on advanced technology, sustainability, and robust service offerings. Alstom, for instance, highlights its broad product range, encompassing high-speed trains, metro systems, and digital mobility solutions, all while prioritizing eco-friendly and efficient operations.

Alstom's commitment to innovation is evident in its continuous development of features like autonomous train operation and predictive maintenance technologies. This focus on cutting-edge advancements is crucial for staying ahead in a market where technological superiority directly translates to a competitive advantage.

In 2024, Alstom secured significant orders, such as the €1.3 billion contract for 100 new metro trains for the Paris region, underscoring its strong project execution and the market's demand for its differentiated offerings. This success reflects the company's ability to meet complex client needs through its technological and service capabilities.

Geographic Market Competition

Geographic market competition for Alstom is intense and often plays out on a regional basis. While Alstom maintains a strong presence in its home market of Europe, it also faces significant competition in other key areas such as the Americas and the Asia/Pacific region. Success in one territory does not automatically translate to dominance in another, given the distinct local regulations, varied customer preferences, and unique political landscapes that characterize each market.

Alstom's ability to win substantial contracts in diverse geographies underscores its global reach and competitive standing. For instance, securing orders in major markets like Germany, France, and North America highlights its capacity to navigate different competitive environments. This global footprint is crucial as the rail industry is not monolithic; each region presents its own set of challenges and opportunities.

- European Dominance: Alstom consistently demonstrates strong competitive performance within Europe, its historical stronghold.

- Americas & APAC Presence: The company actively competes and secures orders in the Americas and Asia/Pacific, showcasing its global strategy.

- Regional Nuances: Success factors differ significantly across regions due to local regulations, customer demands, and political factors.

- Order Wins: Alstom's ability to secure orders in diverse markets like Germany, France, and North America indicates its widespread competitive capability.

Strategic Partnerships and Acquisitions

Competitors in the rail industry actively pursue strategic partnerships and acquisitions to bolster their capabilities, extend market reach, and broaden their product offerings. Alstom's own integration of Bombardier Transportation in 2021, a landmark deal valued at approximately €5.5 billion, significantly reshaped its competitive standing. This move aimed to create a more robust entity capable of competing effectively on a global scale.

However, this consolidation trend is not unique to Alstom. Rivals such as Hitachi Rail have also strategically expanded their operations through acquisitions, notably acquiring Thales's Ground Transportation Systems business in 2023 for €1.1 billion. These strategic maneuvers are constantly redefining the competitive arena, thereby intensifying the rivalry among key players.

- Alstom's acquisition of Bombardier Transportation for €5.5 billion in 2021.

- Hitachi Rail's acquisition of Thales's Ground Transportation Systems for €1.1 billion in 2023.

- These moves consolidate market share and enhance technological integration.

- Increased scale allows for greater R&D investment and broader geographic presence.

Competitive rivalry in the rail sector, impacting Alstom, is fierce due to the oligopolistic market structure dominated by a few large players. High fixed costs and significant exit barriers compel existing companies to compete aggressively, making market entry difficult for new entrants. Strategic consolidation through mergers and acquisitions further intensifies this rivalry as companies like Alstom and Hitachi Rail aim to gain scale and technological advantages.

| Competitor Action | Year | Value |

| Alstom acquires Bombardier Transportation | 2021 | €5.5 billion |

| Hitachi Rail acquires Thales' Ground Transportation Systems | 2023 | €1.1 billion |

| Alstom secures Paris metro train order | 2024 | €1.3 billion |

SSubstitutes Threaten

Road transport, encompassing automobiles and buses, poses a significant threat to rail transport, particularly for short to medium-distance passenger and freight movements. Its inherent flexibility and door-to-door delivery capability make it an attractive alternative for many consumers and businesses. In 2023, the global automotive industry saw sales of over 78 million vehicles, highlighting the widespread accessibility of personal road transport.

The vast and well-established road infrastructure, coupled with the high penetration of private vehicle ownership and extensive bus networks, ensures that road transport is a readily available substitute. This widespread availability means that potential rail customers can easily opt for road-based solutions.

However, this threat is somewhat mitigated by growing concerns over traffic congestion and environmental impact. In 2024, many urban areas are implementing stricter emissions standards and congestion charges, which could subtly shift demand back towards more sustainable rail options, especially for intercity travel.

For very long-distance passenger travel, particularly cross-country or international routes, air travel presents a faster substitute to high-speed rail. While high-speed rail competes effectively on routes up to 800-1000 km, beyond that, air travel generally offers quicker transit times. For example, in 2024, the average flight time for a 1,500 km journey is around 2-3 hours, compared to potentially 6-8 hours by high-speed rail, not including station transfers.

However, rail's lower carbon footprint and city-center-to-city-center convenience can be competitive advantages, especially as environmental concerns grow. In 2023, the aviation industry accounted for approximately 2.5% of global CO2 emissions, whereas high-speed rail's emissions per passenger-kilometer are significantly lower, often by over 80%.

Futuristic transportation concepts like hyperloop represent a potential long-term threat to Alstom's traditional rail business, especially high-speed rail. While still in developmental stages, these technologies aim for unprecedented travel speeds, but significant technological, regulatory, and financial challenges remain before widespread adoption is feasible.

For instance, the estimated cost for a hyperloop system can range from $100 million to $1 billion per mile, highlighting the substantial capital investment required. Alstom's strategic focus on innovation, including advancements in autonomous mobility solutions, serves to proactively address and mitigate the impact of such disruptive future technologies.

Digital Communication and Remote Work

The rise of digital communication and remote work, significantly boosted by events in 2020 and continuing through 2024, presents a subtle threat to passenger rail demand by reducing the necessity for business travel. Companies are increasingly leveraging platforms like Zoom and Microsoft Teams, which offer cost-effective alternatives to physical meetings, potentially impacting the volume of commuter and business-related rail journeys. For instance, a 2023 report indicated that while business travel was recovering, it remained below pre-pandemic levels, with a significant portion attributed to hybrid work models.

While not a direct replacement for the physical movement of goods or people, this shift can indirectly diminish overall passenger rail utilization. However, it's crucial to note that this trend is counterbalanced by other factors. Urbanization continues to drive demand for efficient public transportation, and a growing global emphasis on sustainability, as seen in various national climate action plans throughout 2024, still fuels investment in rail infrastructure as an environmentally friendly solution.

- Digital Communication Adoption: Global adoption of video conferencing tools saw a surge, with estimates suggesting a sustained increase in remote work arrangements even post-pandemic.

- Business Travel Impact: While recovering, business travel in 2023 was still estimated to be around 10-15% lower than 2019 levels in many developed economies, partly due to remote work policies.

- Rail Demand Nuance: The threat is indirect, impacting a segment of passenger rail rather than replacing the core function of rail transport for commuting and leisure.

- Counterbalancing Trends: Urban population growth and the imperative for green transport solutions continue to support rail investment and demand.

Alternative Freight Logistics

The threat of substitutes for rail freight is significant, with trucking, shipping, and air cargo offering viable alternatives. These modes compete based on factors like urgency, volume, and distance. For instance, while rail excels in bulk, long-haul efficiency and environmental benefits, trucking provides crucial flexibility for last-mile deliveries, a segment where rail often struggles to compete directly.

Rail freight's competitiveness hinges on its ability to leverage its inherent strengths while mitigating weaknesses. Innovations in intermodal transportation, seamlessly integrating rail with other modes, are vital. According to recent industry reports from 2024, intermodal freight volume continues to grow, highlighting the importance of this strategy for rail to maintain its market share against more agile substitutes.

- Trucking: Offers superior flexibility for last-mile delivery and shorter hauls, often at a higher per-unit cost for long distances.

- Shipping (Maritime): The most cost-effective option for very large volumes and international trade, but significantly slower than rail or air.

- Air Cargo: The fastest option for time-sensitive goods, but also the most expensive, making it unsuitable for bulk commodities.

- Intermodal Solutions: The integration of rail with trucking and shipping is crucial for rail to offer competitive end-to-end logistics, addressing the limitations of each mode individually.

The threat of substitutes for Alstom's rail business is multifaceted, encompassing road transport, air travel, and even emerging technologies. Road transport, particularly for shorter distances, remains a strong substitute due to its flexibility and door-to-door service, with global vehicle sales exceeding 78 million in 2023. Air travel offers a faster alternative for long-haul passenger journeys, though rail boasts a significantly lower carbon footprint, a key differentiator as environmental concerns intensify. Futuristic concepts like hyperloop, despite current developmental hurdles and high costs, represent a potential long-term disruption.

The increasing adoption of digital communication and remote work, a trend solidified in 2024, indirectly impacts passenger rail demand by reducing the need for business travel. While business travel in 2023 was still recovering, it remained below pre-pandemic levels, with hybrid models contributing to this. However, urbanization and the push for sustainable transport continue to support rail investment, creating a nuanced demand landscape.

For freight, trucking, shipping, and air cargo are significant substitutes, each with distinct advantages. Trucking excels in last-mile delivery, while maritime shipping is cost-effective for bulk international trade. Air cargo is the fastest but most expensive. The growth of intermodal freight solutions in 2024 underscores the importance of integrating rail with other transport modes to remain competitive against these substitutes.

| Substitute | Key Advantages | Limitations for Rail | 2023/2024 Relevance |

|---|---|---|---|

| Road Transport (Automobiles/Buses) | Flexibility, Door-to-door delivery | Congestion, Environmental impact | 78M+ global vehicle sales (2023); Emission standards tightening |

| Air Travel | Speed for long distances | Higher carbon footprint, Airport transfers | 2-3 hour travel time for 1,500 km vs. 6-8 hours by rail; Rail 80%+ lower CO2/passenger-km |

| Digital Communication/Remote Work | Reduced need for business travel | Indirect impact on passenger volume | Business travel ~10-15% below 2019 levels (2023); Sustained hybrid work |

| Trucking (Freight) | Last-mile delivery, Shorter hauls | Higher per-unit cost for long distances | Crucial for end-to-end logistics |

| Maritime Shipping (Freight) | Cost-effective for bulk/international | Slower transit times | Most cost-effective for very large volumes |

| Air Cargo (Freight) | Fastest for time-sensitive goods | Most expensive | Unsuitable for bulk commodities |

Entrants Threaten

Entering the rail manufacturing and services sector requires substantial capital for research and development, specialized production facilities, and rigorous testing infrastructure. The sheer cost of designing, producing, and certifying trains and sophisticated signaling systems presents a significant hurdle for newcomers.

For instance, developing a new high-speed train platform can easily run into billions of euros, a sum that most potential entrants cannot readily access. This high entry cost effectively deters many smaller or less-funded companies from even attempting to compete with established players like Alstom, thereby limiting the threat of new entrants.

The rail industry is a heavily regulated sector, with stringent safety, interoperability, and environmental standards. These requirements mandate extensive testing and certification, making entry a costly and time-consuming endeavor for newcomers. For instance, in 2024, the European Union continued to emphasize the importance of harmonized safety standards across member states, with ongoing updates to technical specifications for interoperability (TSIs) that new entrants must meticulously adhere to.

Developing advanced rail technologies, such as high-speed trains and sophisticated signaling systems, demands significant engineering prowess and ongoing innovation. Alstom's substantial investment in research and development, evidenced by its robust patent portfolio, establishes a formidable technological barrier for potential new competitors.

Aspiring entrants would find it challenging to match Alstom's established technical expertise and intellectual property base in a timely manner. For instance, Alstom's commitment to innovation is reflected in its significant R&D spending, which in 2023 reached €1.2 billion, underscoring the high cost and expertise required to compete.

Established Customer Relationships and Long-Term Contracts

Alstom's deep-rooted relationships with governments and public transport operators globally act as a significant barrier. These partnerships often translate into multi-year, even multi-decade, contracts for rolling stock and signaling systems. For instance, Alstom secured a €700 million contract in 2024 for 100 new Metropolis trains for the Paris metro, highlighting the scale and duration of such agreements.

The sheer value and extended commitment of these contracts, alongside a robust backlog, create substantial hurdles for newcomers. It’s not just about offering a product; it’s about building trust and demonstrating a consistent ability to deliver complex, large-scale projects over many years. This established credibility is a powerful deterrent.

New entrants face immense difficulty in displacing incumbent suppliers who have proven reliability and a history of successful project execution. The capital investment required to even bid on these projects, coupled with the need to establish a reputation for dependability, makes the threat of new entrants relatively low in this segment of the rail industry.

- Long-Term Contracts: Alstom's success in securing deals like the €700 million Paris metro order in 2024 underscores the long-term nature of customer commitments.

- High Switching Costs: The complexity and integrated nature of rail systems mean that switching suppliers is costly and disruptive for operators.

- Proven Track Record: Decades of successful project delivery build a strong reputation that new companies struggle to replicate quickly.

- Governmental Relationships: Established trust and collaboration with public authorities are crucial and take years to cultivate.

Economies of Scale and Experience Curve Effects

Existing players like Alstom leverage substantial economies of scale across manufacturing, global procurement, and extensive service networks. This scale translates into lower per-unit costs, making it difficult for newcomers to compete on price. For instance, Alstom's integrated approach to train manufacturing, from component sourcing to final assembly and maintenance, creates significant cost efficiencies.

The experience curve effect further solidifies this advantage. Alstom's decades of operational experience enable continuous learning and process optimization, leading to reduced production times and improved quality. This accumulated knowledge, often proprietary, represents a steep learning curve for any new entrant aiming to achieve similar operational excellence and cost structures.

- Economies of Scale: Alstom's large production volumes in rolling stock and signaling systems reduce per-unit manufacturing costs.

- Procurement Power: Bulk purchasing of components and materials provides significant cost advantages over smaller, new competitors.

- Global Service Network: Alstom's established worldwide service infrastructure offers cost-effective maintenance and support, a barrier for new entrants.

- Experience Curve: Accumulated knowledge in project execution and operational efficiency leads to lower costs over time.

The threat of new entrants into the rail industry is generally considered low for Alstom. This is primarily due to the immense capital investment required for R&D, manufacturing facilities, and the stringent regulatory landscape that demands extensive testing and certification. For example, developing a new high-speed train platform can cost billions of euros, a significant barrier for most potential competitors.

Alstom's established technological expertise, protected by a strong patent portfolio, and its significant R&D spending, which was €1.2 billion in 2023, further solidify this advantage. Furthermore, long-standing relationships with governments and operators, evidenced by multi-year contracts like the €700 million Paris metro order in 2024, create high switching costs and a proven track record that new entrants struggle to match.

Economies of scale in manufacturing, procurement power, and a global service network contribute to Alstom's cost competitiveness, making it difficult for newcomers to compete on price. The experience curve effect, derived from decades of operational learning, also provides a distinct advantage in efficiency and cost reduction.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High costs for R&D, production, and certification. | Deters smaller or less-funded companies. | Developing a new high-speed train platform can cost billions of euros. |

| Regulation & Certification | Strict safety, interoperability, and environmental standards. | Costly and time-consuming entry process. | Ongoing updates to EU TSIs in 2024 require meticulous adherence. |

| Technology & IP | Advanced engineering, innovation, and patents. | Difficult to match Alstom's expertise and IP base. | Alstom's 2023 R&D spending was €1.2 billion. |

| Customer Relationships & Switching Costs | Long-term contracts and integrated systems. | High hurdles to displace incumbents. | Alstom's €700 million Paris metro contract secured in 2024. |

| Economies of Scale & Experience | Large-scale production, procurement, and operational learning. | Cost advantages and efficiency difficult to replicate. | Alstom's integrated manufacturing and global service network. |

Porter's Five Forces Analysis Data Sources

Our Alstom Porter's Five Forces analysis leverages data from Alstom's annual and sustainability reports, industry-specific market research from firms like IHS Markit, and public financial databases such as Bloomberg.