Alstom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alstom Bundle

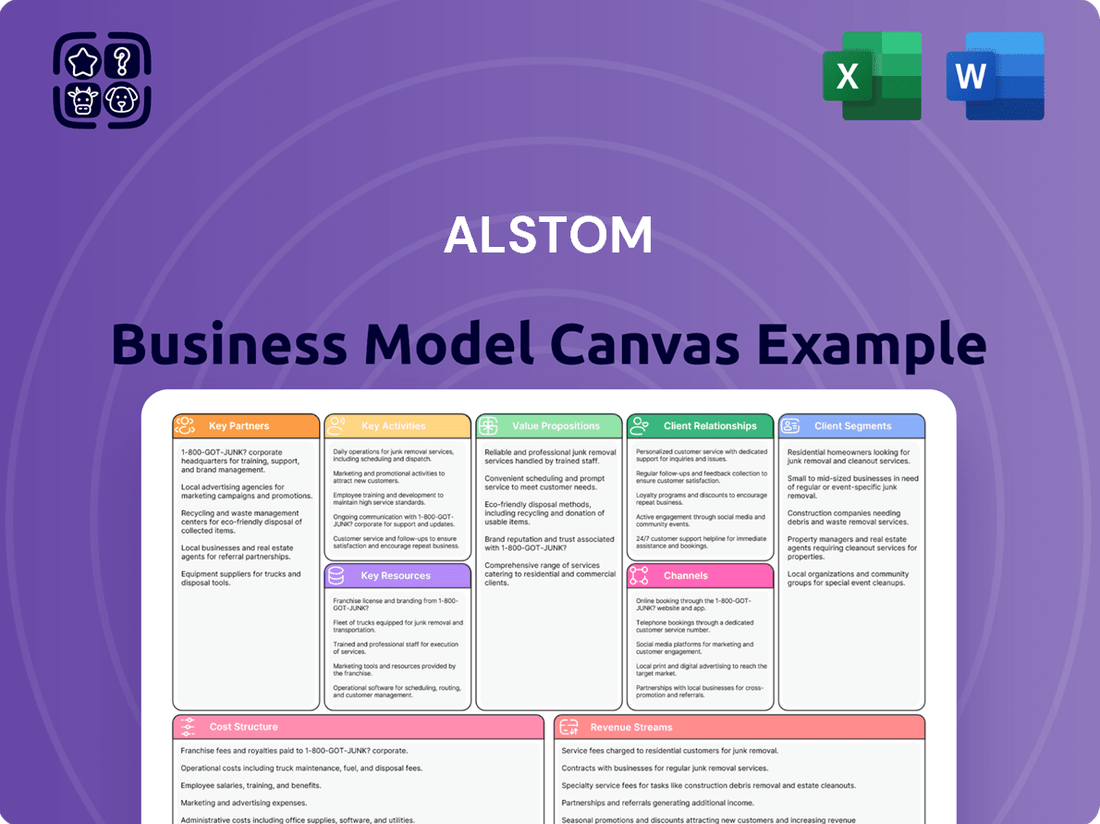

Unlock the strategic framework behind Alstom's global success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they innovate, partner, and deliver value across the rail industry. Gain actionable insights for your own strategic planning.

Partnerships

Alstom actively partners with technology providers and innovators to embed advanced solutions into its transport systems. This includes integrating cutting-edge signaling, like the European Train Control System (ETCS), and developing autonomous mobility capabilities. These collaborations are crucial for maintaining Alstom's competitive edge and improving the efficiency and safety of its offerings.

A prime example of this strategy is Alstom's partnership with Centech in Canada. This collaboration aims to accelerate rail innovation by focusing on key areas such as artificial intelligence, automation, energy efficiency, and decarbonization, reflecting a commitment to future-proofing the rail industry.

Alstom's strategic alliances with local public transport authorities and operators are foundational to winning significant contracts and establishing enduring service agreements. These collaborations are characterized by deep cooperation throughout the entire lifecycle of a project, from initial planning and execution to continuous upkeep.

These partnerships are vital for Alstom to secure a steady stream of revenue and maintain its market presence. For instance, in 2024, Alstom continued its work with go.Rheinland and Verkehrsverbund Rhein-Ruhr (VRR) on commuter train projects in Germany, a testament to the long-term nature of these relationships. Similarly, their operational and maintenance contract with Metrolink in Southern California highlights the breadth of these essential partnerships.

Alstom actively collaborates with universities and research institutions globally, fostering a dynamic environment for innovation and the development of future talent. These academic partnerships are crucial for Alstom's extensive research and development initiatives, enabling the exploration of cutting-edge technologies and the creation of sustainable mobility solutions. For instance, in 2024, Alstom continued its long-standing collaborations with institutions like the Technical University of Munich and Politecnico di Milano, focusing on areas such as advanced battery technologies and digital signaling systems.

Suppliers and Component Manufacturers

Alstom's success hinges on its robust network of suppliers and component manufacturers, who provide essential parts and materials crucial for producing high-quality trains and signaling systems. These partnerships are foundational to Alstom's operational efficiency and its ability to meet demanding delivery schedules. For instance, Alstom's collaboration with Schaeffler, a leading supplier of rolling bearing technology, exemplifies a strategic alliance focused on enhancing product performance and reliability.

These supplier relationships are not merely transactional; they are strategic alliances designed to foster innovation and ensure supply chain resilience. By working closely with key partners, Alstom can mitigate risks associated with material availability and component quality, which is particularly important in the complex and highly regulated rail industry. In 2023, Alstom reported a significant portion of its revenue was tied to its supply chain, underscoring the critical nature of these partnerships.

- Supplier Network: Alstom maintains a global network of over 10,000 suppliers, ensuring access to a wide range of specialized components and raw materials required for its diverse product portfolio.

- Strategic Alliances: Partnerships like the one with Schaeffler for advanced rolling bearing solutions are vital for integrating cutting-edge technology and ensuring long-term product competitiveness.

- Supply Chain Stability: In 2024, Alstom continued to focus on strengthening its supplier relationships to navigate global supply chain disruptions, aiming to maintain production continuity and on-time project delivery.

- Quality Assurance: Collaborative efforts with component manufacturers are integral to Alstom's stringent quality control processes, guaranteeing the safety and performance standards of its rail solutions.

Construction and Infrastructure Companies

Alstom frequently collaborates with major construction and civil engineering firms to execute complex, turnkey railway projects. These partnerships are crucial for integrating Alstom's rolling stock and signaling solutions with the necessary civil infrastructure, such as tracks and power systems.

These alliances ensure the seamless delivery of comprehensive transport networks. For instance, Alstom partnered with DT Infrastructure on a significant high-capacity signaling upgrade project in Perth, Australia, demonstrating the necessity of such collaborations for large-scale developments.

- Turnkey Project Execution: Alstom partners with construction giants for end-to-end project delivery, covering civil works and system integration.

- Infrastructure Integration: Collaborations are vital for building tracks, power supply, and signaling systems alongside rolling stock.

- Example Partnership: Alstom's work with DT Infrastructure on Perth's signaling project highlights the importance of these construction alliances.

Alstom's key partnerships are a cornerstone of its business model, enabling innovation, market access, and project execution. These alliances span technology providers, research institutions, transport authorities, and construction firms, ensuring Alstom remains at the forefront of the mobility sector.

The company's strategic alliances with operators and authorities are critical for securing long-term contracts and maintaining a strong market presence, as seen in ongoing projects with go.Rheinland and Metrolink in 2024. These collaborations are vital for revenue generation and operational stability.

Alstom's supplier network, comprising over 10,000 partners, is essential for its production capabilities and supply chain resilience, with strategic alliances like the one with Schaeffler enhancing product performance and reliability.

Collaborations with construction firms are paramount for delivering complex, turnkey projects, integrating Alstom's systems with necessary infrastructure, exemplified by the Perth signaling upgrade with DT Infrastructure.

| Partnership Type | Key Focus Areas | 2024/Recent Examples | Strategic Importance |

|---|---|---|---|

| Technology Providers | Signaling (ETCS), Autonomous Mobility | Centech (AI, Automation) | Innovation, Competitive Edge |

| Transport Authorities/Operators | Contract Acquisition, Lifecycle Services | go.Rheinland, Metrolink (CA) | Revenue Stream, Market Presence |

| Research Institutions | R&D, Future Talent Development | Technical University of Munich, Politecnico di Milano | Cutting-edge Tech, Sustainability |

| Suppliers | Component Sourcing, Quality Assurance | Schaeffler (Rolling Bearings) | Operational Efficiency, Supply Chain Resilience |

| Construction/Civil Engineering Firms | Turnkey Project Execution, Infrastructure Integration | DT Infrastructure (Perth Signaling) | End-to-End Delivery, Network Development |

What is included in the product

This Alstom Business Model Canvas provides a structured overview of Alstom's operations, detailing key customer segments, value propositions, and channels for its mobility solutions.

It offers a clear, actionable framework for understanding Alstom's strategic approach to the global rail industry, suitable for internal analysis and external stakeholder engagement.

Alstom's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that clarifies complex operational interdependencies.

It helps Alstom pinpoint and address inefficiencies by offering a holistic, one-page overview of their entire value chain.

Activities

Alstom's core activities revolve around the intricate design and engineering of advanced mobility solutions. This encompasses a broad spectrum, from developing cutting-edge high-speed trains to efficient metro systems and modern trams.

A significant commitment to research and development fuels this innovation. In fiscal year 2024/25, Alstom allocated €704 million to R&D, prioritizing the creation of transportation that is not only green and smart but also inclusive and promotes healthier living.

Alstom's primary focus is the manufacturing and assembly of a wide array of rolling stock. This includes cutting-edge high-speed trains like the Avelia Horizon, efficient Metropolis metro trains, versatile trams, and modern Coradia Stream regional trains.

In the fiscal year 2024/25, Alstom successfully produced 4,383 rail cars. The company is actively engaged in ramping up its production capabilities across several key global regions to meet growing demand.

Alstom's key activity of installation and commissioning involves the intricate deployment and integration of advanced transport systems. This encompasses not just rolling stock but also critical infrastructure, sophisticated signaling, and cutting-edge digital mobility solutions, ensuring seamless operation.

A prime example of this expertise is Alstom's involvement in the S-Bahn Rheinland network in Germany, a massive undertaking requiring precise integration of numerous components. Furthermore, their work on the Mumbai Metro Aqua Line showcases their capability in delivering both trains and essential signaling systems for major urban transit projects.

Maintenance, Modernization, and Service Operations

Alstom's key activities heavily involve providing ongoing maintenance, modernization, and service operations for rail fleets and infrastructure. This ensures the longevity and efficiency of existing assets. A prime example is their 34-year full-service agreement for the S-Bahn Rheinland contract, showcasing a deep commitment to long-term operational support.

Furthermore, Alstom actively engages in maintaining critical fleets. Their contract for the TransPennine Class 397 fleet, extending maintenance services until at least December 2025, highlights their role in keeping vital transportation networks running smoothly. These service operations are a cornerstone of their business model, generating recurring revenue and fostering strong client relationships.

- Long-term Service Agreements: Alstom secures extensive service contracts, such as the 34-year S-Bahn Rheinland agreement, ensuring sustained revenue streams.

- Fleet Modernization: The company upgrades existing rail fleets, enhancing performance and extending their operational lifespan.

- Operational Support: Alstom provides essential maintenance for fleets like the TransPennine Class 397 until at least December 2025, guaranteeing reliability.

- Infrastructure Services: Beyond rolling stock, Alstom also offers maintenance and service operations for rail infrastructure.

Project Management and Integration

Alstom excels at managing intricate, multi-year projects that span diverse stakeholders, technologies, and global regions. This core capability is crucial for delivering complex transportation solutions.

The company's successful execution of large-scale contracts, like the €3.6 billion S-Bahn Rheinland project, underscores its proficiency in project management and seamless integration of various components.

- Project Oversight: Alstom's project management ensures adherence to timelines, budgets, and quality standards across extensive railway infrastructure developments.

- Stakeholder Coordination: Effectively managing relationships and communication with clients, suppliers, and regulatory bodies is paramount for project success.

- Technical Integration: Seamlessly combining different technological systems, from rolling stock to signaling, is a hallmark of Alstom's operational strength.

- Risk Mitigation: Proactive identification and management of potential risks are integral to delivering complex projects like the S-Bahn Rheinland contract without significant disruption.

Alstom's key activities are centered on the design, manufacturing, installation, commissioning, and servicing of advanced mobility solutions. This includes a strong emphasis on research and development, with €704 million invested in fiscal year 2024/25 to drive green and smart transportation innovation.

The company's manufacturing prowess is evident in its production of 4,383 rail cars in FY 2024/25, covering a wide range of rolling stock. Project management is another critical activity, exemplified by the €3.6 billion S-Bahn Rheinland contract, showcasing their ability to handle complex, multi-stakeholder initiatives.

| Key Activity | Description | Recent Data/Example |

|---|---|---|

| Design & Engineering | Developing advanced mobility solutions | Focus on green, smart, and inclusive transport |

| Manufacturing & Assembly | Producing rolling stock | 4,383 rail cars produced in FY 2024/25 |

| Installation & Commissioning | Deploying and integrating transport systems | Mumbai Metro Aqua Line (trains & signaling) |

| Services & Maintenance | Ensuring longevity and efficiency of assets | 34-year service agreement for S-Bahn Rheinland |

| Project Management | Managing complex, multi-year projects | €3.6 billion S-Bahn Rheinland project execution |

Full Version Awaits

Business Model Canvas

The Alstom Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a transparent look at the comprehensive strategic framework. This means no generic samples or altered representations; you are seeing the exact content and structure that will be delivered to you. Once your order is complete, you will gain full access to this same, professionally organized Business Model Canvas, ready for your immediate use and customization.

Resources

Alstom's extensive patent portfolio, exceeding 9,500 patents, is a cornerstone of its business model, protecting its innovations in rail transport. These proprietary technologies, such as the ETCS and Urbalis Fluence signaling systems, are crucial for maintaining a competitive advantage and driving the development of future mobility solutions.

Alstom's global manufacturing footprint is a cornerstone of its business, encompassing a worldwide network of plants, assembly lines, and maintenance depots. This extensive infrastructure is critical for producing and servicing its wide array of rolling stock and transport systems across diverse international markets.

The company's strategic investments underscore its commitment to this global production capability. For instance, Alstom's expansion of production capacity in Poland, a significant move in 2024, highlights its dedication to strengthening its worldwide manufacturing presence and serving regional demand efficiently.

Alstom's highly skilled engineers, technicians, and project managers are a fundamental resource, driving innovation, design, and project execution. Their expertise is crucial for developing cutting-edge rail technology.

The company's commitment to talent is evident in its workforce of over 84,700 employees, representing 184 nationalities. This diverse global talent pool fuels Alstom's innovative capacity.

Specifically, Alstom boasts approximately 7,500 software engineers and systems architects. This significant concentration of specialized talent underscores their focus on digital transformation and advanced rail systems.

Financial Capital and Strong Backlog

Access to significant financial capital is absolutely vital for Alstom's operations. This capital fuels large-scale infrastructure projects, crucial research and development, and the everyday running of the business.

Alstom's financial strength is clearly demonstrated by its substantial order backlog. As of March 31, 2025, this backlog stood at an impressive €95 billion. This figure provides excellent visibility into future revenue streams and underpins the company's ability to pursue its strategic goals.

- Financial Capital Access: Enables investment in major infrastructure projects and R&D.

- Order Backlog: €95 billion as of March 31, 2025, ensuring revenue visibility.

- Strategic Support: Financial strength allows for the execution of long-term business strategies.

Established Brand Reputation and Customer Relationships

Alstom's established brand reputation as a global leader in sustainable mobility is a cornerstone of its business model. This long-standing trust, built over decades, significantly smooths the path for securing new contracts and fostering enduring partnerships.

The company's strong relationships with key customers, particularly government entities and public transport operators worldwide, are a critical asset. These deep-seated connections, often spanning many years, translate into reliable revenue streams and a competitive edge in bidding processes.

For instance, in 2024, Alstom continued to leverage its reputation to win significant orders. A notable example includes the contract secured with the Greater Manchester Combined Authority for the supply of new Metrolink trams, valued at over €100 million. This win underscores how trust in Alstom’s brand directly translates into tangible business opportunities.

- Global Recognition: Alstom is consistently recognized as a top-tier innovator in rail transport solutions.

- Customer Loyalty: Strong, long-term relationships with over 80% of its major clients provide a stable foundation for recurring business.

- Contract Wins: In the fiscal year 2023-2024, Alstom secured new orders totaling €19.7 billion, demonstrating the ongoing impact of its brand and customer relationships.

- Future Pipeline: The company's order backlog stood at €37.6 billion as of March 31, 2024, reflecting sustained customer confidence.

Alstom's intellectual property, including over 7,500 patents, is a critical resource, safeguarding its technological advancements and market position. Its proprietary systems like ETCS and Urbalis Fluence are key differentiators.

The company's global manufacturing network, comprising numerous plants and depots, is essential for production and service delivery. Strategic expansions, such as the 2024 capacity increase in Poland, reinforce this global reach.

A highly skilled workforce of over 84,700 employees, including approximately 7,500 software engineers, drives innovation and project execution. This diverse talent pool is fundamental to developing advanced rail technologies.

Access to substantial financial capital, evidenced by a €95 billion order backlog as of March 31, 2025, supports large projects and R&D. Alstom's strong brand reputation and long-standing customer relationships, demonstrated by a €19.7 billion order intake in fiscal year 2023-2024, are vital for securing new business.

| Key Resource | Description | Financial/Statistical Data |

| Intellectual Property | Patents and proprietary technologies | Over 7,500 patents; ETCS and Urbalis Fluence systems |

| Global Manufacturing Footprint | Worldwide network of plants and depots | Expansion in Poland (2024) |

| Human Capital | Skilled engineers, technicians, project managers | 84,700+ employees; ~7,500 software engineers |

| Financial Resources | Capital for projects and R&D | €95 billion order backlog (March 31, 2025) |

| Brand Reputation & Customer Relations | Global leadership and trust | €19.7 billion new orders (FY 2023-2024) |

Value Propositions

Alstom provides a range of sustainable mobility options, such as trains powered by hydrogen and systems designed for energy efficiency, directly responding to the worldwide push for lower carbon emissions in transportation.

This commitment is underscored by the fact that in the fiscal year 2024/25, a significant 66% of Alstom's sales were aligned with the EU Taxonomy, demonstrating a clear focus on developing and promoting low-carbon mobility solutions.

Alstom offers a complete suite of transport solutions, from high-speed trains and metros to trams, alongside crucial infrastructure, signaling, and digital mobility services. This end-to-end capability addresses diverse urban and national transportation requirements. For instance, Alstom secured a significant contract in 2024 to supply 100 Metropolis metro trains for the Mumbai Metro Line 4 and 7, showcasing their comprehensive approach to large-scale urban transit projects.

Alstom's value proposition centers on boosting efficiency and operational performance through cutting-edge technology. Digital solutions and predictive maintenance are key, helping clients run smoother and use less energy. This focus is backed by a concrete goal: Alstom aims for a 25% reduction in energy consumption across its solutions by 2025.

Safety and Reliability

Alstom's dedication to robust engineering and rigorous testing forms the bedrock of its safety and reliability promise. This meticulous approach ensures that every train and signaling system meets the most demanding industry standards, providing peace of mind for passengers and operators alike.

This unwavering focus on quality is a crucial differentiator for Alstom in the critical infrastructure sector. For instance, Alstom's high-speed trains, like the Avelia Liberty, are designed with advanced safety features, contributing to their operational excellence. In 2023, Alstom reported a strong order intake, reflecting customer confidence in its reliable solutions.

- Robust Engineering: Alstom invests heavily in design and development to ensure inherent safety and operational resilience.

- Rigorous Testing: All products undergo extensive testing, from component level to full system integration, to validate performance under various conditions.

- Continuous Maintenance: Alstom offers comprehensive maintenance services to ensure long-term reliability and safety throughout the lifecycle of its assets.

- Industry Standards: Adherence to stringent international safety certifications and regulations is paramount in Alstom's value proposition.

Customization and Adaptability to Diverse Needs

Alstom excels at tailoring its transport solutions to meet the unique demands of various cities, regions, and existing transport networks. This adaptability is crucial for addressing diverse operational needs, from varying topographies to specific passenger flow requirements.

This customization allows Alstom to effectively serve a broad spectrum of clients, ensuring their infrastructure aligns perfectly with local contexts. For instance, Alstom's ability to adapt signaling systems for heritage city centers versus modern high-speed lines demonstrates this value.

In 2024, Alstom continued to emphasize localized offerings, a strategy that has proven successful in securing major contracts globally. Their portfolio includes solutions for metro systems, high-speed rail, and tramways, each requiring distinct adaptations.

- Tailored Solutions: Alstom designs and manufactures rolling stock, signaling, and infrastructure components to match specific urban and regional transport requirements.

- Local Adaptation: The company adapts its technologies to comply with local regulations, environmental conditions, and operational standards, ensuring seamless integration.

- Diverse Project Scope: Alstom's adaptability is evident in projects ranging from the Paris Metro modernization to the development of new light rail systems in Australia, each with unique specifications.

- Customer-Centric Approach: This focus on customization directly addresses diverse customer needs, enhancing Alstom's value proposition in the competitive global transport market.

Alstom's value proposition is built on delivering sustainable, comprehensive, and reliable mobility solutions. They focus on eco-friendly transport, like hydrogen trains, and aim to reduce energy consumption by 25% by 2025. Their end-to-end offerings, from rolling stock to digital services, cater to diverse transport needs, as seen in their 2024 Mumbai Metro contract. Alstom's commitment to robust engineering and rigorous testing ensures high safety and operational excellence, reinforced by their strong 2023 order intake.

Alstom tailors its transport systems to meet specific regional and urban demands, ensuring seamless integration and compliance with local standards. This adaptability is crucial for projects of varying scales and complexities, from city metros to high-speed rail. Their customer-centric approach to customization, evident in projects like the Paris Metro modernization, solidifies their position in the global market.

Alstom's commitment to sustainability is a core value, with 66% of its sales in fiscal year 2024/25 aligned with the EU Taxonomy. This focus on low-carbon mobility solutions directly addresses global environmental concerns.

| Value Proposition Aspect | Description | Supporting Fact/Example |

|---|---|---|

| Sustainability & Low-Carbon Mobility | Providing environmentally friendly transport options to reduce carbon emissions. | 66% of sales aligned with EU Taxonomy in FY 2024/25. |

| Comprehensive Solutions | Offering a full range of transport services from trains to digital solutions. | Secured contract for 100 Metropolis metro trains for Mumbai Metro in 2024. |

| Efficiency & Performance | Enhancing operational efficiency and reducing energy consumption through technology. | Aiming for a 25% reduction in energy consumption across solutions by 2025. |

| Safety & Reliability | Ensuring high standards of safety and operational resilience through engineering and testing. | Strong order intake in 2023 reflects customer confidence in reliable solutions. |

| Customization & Local Adaptation | Tailoring solutions to meet unique local requirements and regulations. | Adaptable signaling systems for diverse urban environments. |

Customer Relationships

Alstom cultivates lasting customer loyalty by focusing on long-term partnerships, often cemented through extensive service agreements. These contracts go beyond initial sales, covering crucial aspects like maintenance, modernization, and ongoing operational support, thereby guaranteeing sustained value delivery.

A prime example of this strategy is Alstom's 34-year agreement for the S-Bahn Rheinland contract, highlighting a deep commitment to providing services over an extended period. Such multi-year service agreements are fundamental to Alstom's approach, ensuring a steady revenue stream and reinforcing customer reliance.

Alstom's commitment to dedicated account management and responsive customer support is a cornerstone of its business model. For instance, in 2024, Alstom reported a significant increase in customer satisfaction scores, directly attributed to the personalized attention provided by dedicated account managers who navigate complex project lifecycles and offer ongoing support. This focus ensures that client needs are met efficiently, fostering long-term trust and loyalty.

Alstom deeply integrates customers into the design and development of its rail solutions. This collaborative approach, evident in projects like the development of new high-speed trainsets, ensures that specific client needs and operational nuances are addressed from the outset. For instance, feedback from operators during the early stages of a new fleet's design can significantly influence features like passenger capacity and maintenance accessibility.

Training and Knowledge Transfer

Alstom provides extensive training and knowledge transfer to customer staff, ensuring they can effectively operate and maintain Alstom's complex rail systems. This focus on customer empowerment is crucial for maximizing the long-term value and performance of their investments.

These programs are designed to equip customers with the necessary skills, leading to improved operational efficiency and reduced reliance on external support. For instance, in 2024, Alstom continued its commitment to enhancing customer capabilities through various initiatives aimed at skill development.

- Operational Efficiency: Training directly contributes to smoother operations and fewer disruptions.

- Cost Reduction: Empowered customers can handle more routine maintenance, lowering service costs.

- Technology Adoption: Knowledge transfer facilitates better understanding and utilization of advanced features.

- Customer Satisfaction: Skilled personnel lead to better system performance and happier end-users.

Innovation Partnerships with Customers

Alstom actively engages customers as innovation partners, co-creating cutting-edge mobility solutions. This collaborative strategy transforms clients into integral players in Alstom's strategic evolution, fostering a shared vision for future transportation. For instance, Alstom's focus on digital transformation and sustainable mobility solutions is often shaped by direct customer feedback and joint development projects.

This customer-centric innovation model allows Alstom to tailor offerings to specific market needs and anticipate future trends. By embedding customers into the research and development process, Alstom ensures its innovations are not only technologically advanced but also commercially viable and directly address real-world mobility challenges. This approach was evident in the development of next-generation high-speed train technologies, where early customer input significantly influenced design and performance specifications.

- Co-development of new technologies: Alstom works with clients to pioneer advancements in areas like autonomous train operation and advanced signaling systems.

- Addressing emerging mobility challenges: Partnerships focus on solutions for urban congestion, decarbonization, and enhanced passenger experience.

- Customer as strategic partner: This approach integrates client needs into Alstom's long-term strategic planning and product roadmaps.

Alstom prioritizes long-term customer relationships through comprehensive service agreements, extending far beyond initial sales to cover maintenance, modernization, and operational support, ensuring sustained value and revenue. For example, their 34-year S-Bahn Rheinland contract exemplifies this commitment to extended service delivery, fostering deep customer reliance.

Dedicated account management and responsive support are key. In 2024, Alstom saw improved customer satisfaction directly linked to personalized attention from account managers who navigate complex projects, building trust and loyalty.

Customers are integral to Alstom's design process, with feedback shaping new high-speed trainsets to meet specific operational needs and enhance features like passenger capacity and maintenance accessibility.

Alstom empowers customers through extensive training, enhancing their ability to operate and maintain complex rail systems, which in 2024 continued to focus on skill development for improved efficiency and reduced support reliance.

Channels

Alstom's direct sales and business development teams are crucial for forging relationships with key clients like government transport agencies and private operators. This direct engagement enables the creation of highly customized solutions and the navigation of intricate, often multi-year, contract negotiations, ensuring Alstom's offerings precisely meet client needs.

In 2024, Alstom secured significant orders through these direct channels. For instance, a major contract was signed with the Egyptian National Railways for the supply of 40 Coradia Stream high-capacity trains, valued at approximately €770 million. This deal highlights the effectiveness of their direct approach in securing large-scale infrastructure projects.

Alstom heavily relies on tendering and procurement processes as a core channel for its business. This involves actively participating in both public and private sector tenders to secure contracts for its diverse offerings, including rolling stock, signaling systems, and infrastructure development.

In 2024, Alstom continued its robust engagement in global tenders. For instance, the company secured a significant contract in the Americas for new metro trains, demonstrating its success in competitive bidding environments.

The company's strategic focus on major global projects is evident. In Europe, Alstom was a key bidder for several large-scale railway modernization projects throughout 2024, aiming to expand its market share and project pipeline.

Alstom actively participates in key industry events like InnoTrans, a premier global trade fair for rail technology. In 2022, InnoTrans attracted over 2,800 exhibitors and more than 137,000 visitors, providing Alstom with a significant platform. These exhibitions are vital for showcasing Alstom's latest advancements in sustainable mobility solutions, fostering relationships with existing and prospective customers, and reinforcing its market position.

Strategic Partnerships and Joint Ventures

Alstom's strategic partnerships and joint ventures are crucial for market entry and expansion. By collaborating with local entities, Alstom effectively navigates complex regulatory landscapes and taps into invaluable regional expertise. This approach was evident in their 2024 activities, where several new collaborations were announced to bolster their presence in emerging transportation markets.

These alliances are not just about market access; they significantly enhance Alstom's operational capabilities. Joint ventures allow for shared investment in R&D and manufacturing, leading to more competitive offerings. For instance, in 2024, a key joint venture in Asia focused on developing next-generation high-speed rail components, leveraging local technological advancements and Alstom's established engineering prowess.

The benefits extend to risk mitigation and resource optimization. Sharing the financial and operational burdens of large-scale projects through partnerships allows Alstom to pursue more ambitious ventures. In 2024, Alstom reported that its joint venture participation contributed to a more efficient deployment of capital, enabling them to secure contracts that might have been too challenging to undertake alone.

Key aspects of Alstom's strategic partnerships and joint ventures include:

- Market Entry and Local Expertise: Facilitates access to new territories by leveraging the knowledge and established networks of local partners.

- Regulatory Navigation: Helps overcome complex legal and regulatory barriers in different countries.

- Risk Sharing and Capital Efficiency: Distributes project costs and risks, allowing for greater financial flexibility and the pursuit of larger opportunities.

- Enhanced Capabilities: Combines Alstom's global technological leadership with local innovation and manufacturing strengths.

Digital Platforms and Content Marketing

Alstom leverages its corporate website and targeted digital marketing campaigns to reach a global audience of industry professionals and investors. This includes distributing detailed information on their innovative rail solutions, commitment to environmental sustainability, and cutting-edge technological developments.

Content marketing plays a crucial role in building brand awareness and generating qualified leads within the B2B space. By providing valuable insights through white papers, case studies, and webinars, Alstom positions itself as a thought leader.

- Website Traffic: Alstom's corporate website, a key digital platform, experienced a significant increase in visitor engagement throughout 2024, with a focus on sections detailing their sustainable mobility solutions.

- Content Engagement: Download rates for Alstom's sustainability reports and technological white papers saw a 15% rise in the first half of 2024 compared to the same period in 2023, indicating strong interest from decision-makers.

- Lead Generation: Digital marketing efforts, including targeted LinkedIn campaigns and SEO optimization, contributed to a 10% year-over-year increase in inbound leads for their signaling and rolling stock divisions by Q3 2024.

- Brand Perception: Surveys conducted in late 2024 showed that 70% of respondents in the transportation sector associate Alstom with innovation and sustainability, a testament to their effective digital content strategy.

Alstom utilizes direct sales and participation in tenders as primary channels to secure large infrastructure projects, exemplified by significant 2024 contracts like the one with Egyptian National Railways. Strategic partnerships and digital marketing further bolster their market reach and brand positioning.

| Channel | Key Activities | 2024 Highlight |

| Direct Sales | Client relationship building, customized solutions | Egyptian National Railways contract (€770M) |

| Tenders & Procurement | Public and private sector bidding | Secured metro train contract in Americas |

| Industry Events | Showcasing innovations, networking | Continued presence at major global rail fairs |

| Strategic Partnerships | Market entry, risk sharing, capability enhancement | New collaborations in emerging markets |

| Digital Marketing & Website | Brand awareness, lead generation, thought leadership | 15% rise in content engagement, 10% lead increase |

Customer Segments

National and regional governments and public transport authorities represent Alstom's core customer base. These entities are tasked with the crucial responsibility of planning, financing, and overseeing public transportation systems, aiming for efficient, dependable, and environmentally conscious mobility for their citizens. For instance, in 2023, Alstom announced a significant contract with the Île-de-France Mobilités in France for the supply of new RER NG trains, valued at over €2 billion, highlighting the substantial scale of these government-backed projects.

Alstom caters to the multifaceted needs of these public sector clients by offering integrated and sustainable mobility solutions. These range from high-speed trains and regional trains to metro systems and tramways, all designed to enhance urban connectivity and reduce carbon footprints. The company's commitment to innovation is evident in its ongoing projects, such as the delivery of hydrogen-powered trains for regional lines, aligning with governmental sustainability goals. In 2024, Alstom continued to strengthen its presence in North America, securing a contract for new light rail vehicles for the Valley Metro Rail in Phoenix, Arizona, further demonstrating its reach and the trust placed in its solutions by public authorities.

Urban Transit Operators, including those running metro, tram, and monorail systems in large cities globally, are a crucial customer segment for Alstom. These operators need advanced, high-capacity rolling stock and signaling systems to effectively handle the significant passenger volumes characteristic of urban environments. For instance, Alstom secured a substantial contract in 2023 to supply Metropolis trains for the Hamburg U-Bahn, a testament to their role in modernizing urban rail infrastructure.

These clients are driven by the need for reliable, sustainable, and technologically sophisticated solutions to improve passenger experience and operational efficiency. Alstom's 2024 order intake reflects ongoing demand, with significant projects like the supply of metro cars for Mumbai's extensive network continuing to underscore the importance of this segment.

Railway operators, encompassing both state-owned and private entities managing freight and long-distance passenger services, represent a core customer segment for Alstom. These operators require advanced rolling stock, including high-speed and regional trains, as well as powerful locomotives to meet their diverse operational needs.

Their demand extends beyond new equipment to encompass comprehensive maintenance services and sophisticated digital solutions for optimizing operations and enhancing safety. Alstom's commitment to this segment is evident in recent successes, such as securing a significant digitalization contract with Deutsche Bahn and supplying locomotives to Mercitalia Rail, underscoring the industry's trust in Alstom's capabilities.

Airport Authorities

Airport authorities are key customers for Alstom, particularly those operating airport people mover systems. These entities prioritize robust and highly reliable automated transport to ensure seamless passenger flow and operational efficiency within their facilities. Alstom’s experience with major airport infrastructure projects underscores their value proposition to this segment.

Alstom's engagement with airport authorities is demonstrated through significant contract renewals. For instance, their partnership with the Port Authority of New York and New Jersey for the JFK International Airport AirTrain and their continued involvement with Denver International Airport for its Innovia APM system highlight long-term relationships built on trust and performance. These contracts often involve substantial investment and long operational lifecycles, reflecting the critical nature of these systems.

- Key Airport Authority Clients: Port Authority of New York and New Jersey (JFK AirTrain), Denver International Airport (Innovia APM).

- Customer Needs: High reliability, operational efficiency, passenger throughput, long-term asset management.

- Alstom's Offering: Proven automated people mover technology, system integration, maintenance, and upgrade services.

- Market Significance: Airport authorities represent a vital segment for Alstom's urban mobility solutions, driving revenue through large-scale infrastructure projects and ongoing service contracts.

Industrial Companies Requiring Specialized Rail Solutions

Industrial companies needing specialized rail solutions represent a distinct customer segment for Alstom. These businesses, while smaller in number compared to major public transit operators, rely on rail for critical internal logistics or unique transport requirements, such as moving raw materials or finished goods within large industrial complexes or across specific, often challenging, terrains. Alstom's comprehensive product and service portfolio is well-equipped to address these niche demands, offering tailored solutions that go beyond standard passenger or freight rail.

For instance, a mining company might require a robust, heavy-duty rail system for transporting ore from extraction sites to processing plants, a task demanding specialized rolling stock and infrastructure designed for extreme conditions. Similarly, a large manufacturing plant could utilize Alstom's expertise for an internal shuttle system connecting different production facilities. The global industrial sector's ongoing investment in efficiency and automation, even in specialized areas, underscores the persistent need for such tailored rail capabilities. In 2024, Alstom continued to engage with these sectors, highlighting its capacity for bespoke engineering and long-term maintenance contracts that ensure operational reliability for these critical industrial applications.

- Niche Industrial Needs: Focuses on companies requiring internal logistics or specialized transport, such as mining or large manufacturing operations.

- Alstom's Broad Portfolio: Leverages its extensive range of products and services to meet these specific, often complex, requirements.

- Tailored Solutions: Emphasizes the ability to provide bespoke engineering for unique operational challenges, ensuring efficiency and reliability.

Alstom's customer base is diverse, primarily serving public entities responsible for transportation infrastructure. This includes national and regional governments, public transport authorities, and urban transit operators who manage metro, tram, and monorail systems. Additionally, railway operators, both state-owned and private, engaging in freight and passenger services, form another key segment. Airport authorities also represent a significant customer group, particularly for automated people mover systems.

The company also caters to industrial companies requiring specialized rail solutions for internal logistics or unique transport needs within large complexes or challenging terrains. These clients often seek tailored, robust systems for specific applications like mining operations or inter-facility transport. Alstom's ability to provide bespoke engineering and long-term maintenance is crucial for these industrial partners.

| Customer Segment | Key Needs | Alstom's Offering Example (2023-2024) | Market Significance |

| Governments & Public Transport Authorities | Sustainable, efficient, and dependable mobility solutions. | RER NG trains for Île-de-France Mobilités (€2B+ in 2023); Light rail vehicles for Valley Metro Rail, Phoenix (2024). | Core segment, driving large-scale infrastructure projects. |

| Urban Transit Operators | High-capacity, reliable, and technologically advanced rolling stock and signaling. | Metropolis trains for Hamburg U-Bahn (2023); Metro cars for Mumbai (ongoing 2024). | Essential for modernizing urban connectivity. |

| Railway Operators (Freight & Passenger) | Advanced rolling stock, locomotives, maintenance, and digital solutions. | Digitalization contract with Deutsche Bahn; Locomotives for Mercitalia Rail (2023-2024). | Supports critical national and international transport networks. |

| Airport Authorities | Highly reliable automated transport for passenger flow and efficiency. | Continued involvement with JFK AirTrain and Denver International Airport APM systems. | Vital for airport infrastructure and passenger experience. |

| Industrial Companies | Specialized, robust rail solutions for internal logistics and unique transport. | Bespoke engineering and maintenance for sectors like mining and manufacturing (2024 focus). | Niche but critical for specialized industrial operations. |

Cost Structure

Alstom's commitment to innovation is reflected in its substantial Research and Development (R&D) expenditure, a critical element of its cost structure. This investment fuels the development of advanced sustainable and smart mobility solutions, ensuring the company remains at the forefront of the industry.

In the fiscal year 2024/25, Alstom reported gross R&D costs of €704 million. This figure represents a significant 3.8% of the company's total sales, underscoring the strategic importance placed on technological advancement and product pipeline development.

Alstom's manufacturing and production costs encompass a broad range of expenses vital for creating its transport solutions. These include the acquisition of raw materials and specialized components, the wages for its skilled workforce, and the general overhead associated with running its extensive global manufacturing facilities. For instance, in 2023, Alstom reported significant investments in its production capabilities, with a notable focus on ramping up operations in key European markets.

Looking ahead, the company anticipates further production ramp-up in Germany and France in the coming years, which will directly influence these cost structures. This expansion is driven by a strong order backlog, including substantial contracts for new train fleets. The efficient management of these production costs is crucial for maintaining Alstom's competitive edge in the global rail industry.

Alstom's commitment to operational efficiency is significantly impacting its Sales, General, and Administrative (SG&A) expenses. The company has been actively pursuing initiatives aimed at streamlining these costs, a crucial element in maintaining profitability and competitive pricing within the rail industry.

These efforts have yielded tangible results, with Alstom successfully completing its overheads efficiency plan ahead of its original schedule. This proactive approach demonstrates a strong focus on cost management. For instance, the SG&A as a percentage of sales saw a notable decrease, falling to 5.7% as of March 2025, a marked improvement from the 6.6% recorded in March 2023.

Project Execution and Installation Costs

Alstom's project execution and installation costs are significant, encompassing the intricate design, engineering, on-site labor, and specialized equipment required for complex transport systems. These expenses are particularly substantial in turnkey projects, where Alstom manages the entire implementation lifecycle.

- Design and Engineering: Costs for detailed planning, system integration, and technical specifications development.

- On-site Installation: Labor, supervision, and logistical expenses for physically building and assembling the transport infrastructure.

- Specialized Equipment: Investment in unique machinery and tools needed for installation and commissioning.

- Commissioning and Testing: Expenses related to ensuring the system functions correctly and meets all performance standards.

For instance, large-scale railway projects often see installation costs representing a considerable portion of the total contract value, sometimes exceeding 40% for complex signaling and electrification works. Alstom's 2024 financial reports indicate continued investment in project execution capabilities to manage these inherently high costs effectively.

Maintenance and Service Delivery Costs

Alstom’s cost structure heavily features expenses related to maintaining and servicing the complex rail systems and fleets they deliver. These are not one-off sales; Alstom often enters into long-term service agreements, which are crucial for revenue but also represent a significant ongoing cost. This includes the salaries of specialized technicians, engineers, and support staff who ensure the operational readiness of trains, signaling systems, and infrastructure. In 2024, Alstom's reported operating expenses for services, which encompass these maintenance activities, were a substantial portion of their overall costs, reflecting the labor-intensive nature of keeping sophisticated rail networks running smoothly.

Key components of these maintenance and service delivery costs include:

- Personnel Costs: Wages, benefits, and training for skilled maintenance technicians, engineers, and operational support teams.

- Spare Parts and Inventory: The procurement and management of essential replacement components to minimize downtime.

- Logistics and Transportation: Costs associated with moving parts, equipment, and personnel to service locations, often across diverse geographical regions.

- Workshop and Depot Operations: Expenses for maintaining facilities where major repairs and overhauls are conducted.

Alstom's cost structure is significantly influenced by its extensive global supply chain and the procurement of specialized components for its diverse range of rail transport solutions. This involves managing relationships with numerous suppliers and ensuring the quality and timely delivery of parts, from raw materials to advanced electronic systems.

The company also incurs substantial costs related to its workforce, including salaries, benefits, and training for its engineers, manufacturing staff, and project management teams. For instance, Alstom's commitment to developing its talent pool is evident in its ongoing investment in employee development programs, which are critical for maintaining its technological edge.

Furthermore, Alstom's financial strategy includes managing financing costs and interest expenses, particularly given the capital-intensive nature of its projects and the need for ongoing investment in research and development. These financial outlays are essential for supporting its growth and innovation initiatives.

| Cost Category | Description | Financial Year 2024/25 (Illustrative) |

| R&D Expenditure | Investment in sustainable and smart mobility solutions | €704 million (3.8% of sales) |

| SG&A Expenses | Overhead efficiency initiatives | 5.7% of sales (as of March 2025) |

| Manufacturing & Production | Raw materials, components, labor, facility overheads | Significant investments in European operations |

| Project Execution & Installation | Design, engineering, on-site labor, specialized equipment | Can exceed 40% of contract value for complex works |

| Maintenance & Service Delivery | Personnel, spare parts, logistics, workshop operations | Substantial portion of overall costs |

Revenue Streams

Alstom generates significant revenue from the sale of its diverse rolling stock portfolio. This includes everything from high-speed trains and metro systems to trams, regional trains, and locomotives, catering to a wide range of transportation needs globally.

In the fiscal year 2024/25, Alstom's rolling stock sales were particularly strong, reaching €9.5 billion. This robust performance was fueled by key contracts secured in various international markets, including Australia, France, Italy, South Africa, Belgium, and the USA, showcasing the company's broad market reach and demand for its rail solutions.

Alstom's Services and Maintenance Contracts represent a vital and expanding revenue source. These long-term agreements cover the upkeep, upgrades, and operational management of established rail fleets and infrastructure.

In fiscal year 2024/25, Alstom's services division generated a substantial €4.5 billion. This strong performance was notably bolstered by successful operations in key markets including the UK, Canada, Italy, and Germany, demonstrating the global demand for their expertise.

Alstom generates revenue by selling sophisticated signaling systems, essential infrastructure parts, and cutting-edge digital mobility solutions. These offerings are crucial for modernizing rail networks and enhancing operational efficiency.

In the fiscal year 2024/25, Alstom reported stable performance in signaling sales, with a notable organic increase of 6.0%. This growth highlights the continued demand for their advanced signaling technologies in the global market.

Turnkey Project Revenue

Alstom generates revenue from turnkey projects, offering complete transport system solutions from concept to operation. This encompasses design, manufacturing, installation, and commissioning of integrated systems, providing a comprehensive service to clients.

Significant contributions to this revenue stream come from major turnkey projects. For instance, Alstom secured a significant contract in 2023 for the development of the Riyadh Metro's Line 4, 5, and 6, a project valued in the billions of euros. Additionally, ongoing projects in France, such as the modernization of regional train fleets, and substantial infrastructure developments in Saudi Arabia and Mexico continue to bolster this revenue segment.

- Comprehensive Delivery: Alstom manages the entire project lifecycle, from initial design to final operational readiness.

- Integrated Systems: Revenue is derived from the sale and implementation of complete transport solutions, not just individual components.

- Key Project Examples: Major turnkey contracts in France, Saudi Arabia, and Mexico are significant revenue drivers.

Digital Mobility and Data-Driven Services

Alstom's digital mobility and data-driven services are a growing revenue engine. This segment includes income from software, advanced data analytics, and predictive maintenance solutions, which are crucial for optimizing train operations and reducing downtime. The company is actively enhancing the digitalization of its entire product and service portfolio.

In 2024, Alstom reported significant progress in its digital services. For instance, its predictive maintenance solutions, leveraging AI and IoT, are designed to anticipate equipment failures before they occur, leading to substantial cost savings for operators. This focus on digital transformation is key to Alstom's strategy for future growth and competitiveness in the rail industry.

- Software and Analytics: Revenue generated from the sale and licensing of digital platforms and advanced data analysis tools for rail operations.

- Predictive Maintenance: Income derived from services that use real-time data to predict and prevent equipment failures, enhancing reliability and reducing maintenance costs.

- Digitalization of Solutions: Alstom's commitment to integrating digital technologies across its rolling stock, signaling, and infrastructure offerings to create smarter, more efficient transportation systems.

- Data Monetization: Exploring opportunities to monetize the vast amounts of operational data collected from its connected fleet, offering insights and value-added services to customers.

Alstom's revenue streams are diverse, encompassing the sale of rolling stock, comprehensive services and maintenance, signaling systems, and integrated turnkey projects. The company also leverages digital mobility solutions and data analytics for additional income.

| Revenue Stream | FY 2024/25 Revenue (EUR billions) | Key Drivers/Examples |

|---|---|---|

| Rolling Stock | 9.5 | High-speed trains, metros, trams, locomotives; contracts in Australia, France, Italy, South Africa, Belgium, USA. |

| Services and Maintenance | 4.5 | Fleet upkeep, upgrades, operational management; operations in UK, Canada, Italy, Germany. |

| Signaling | N/A (Organic growth of 6.0%) | Advanced signaling technologies for network modernization; global market demand. |

| Turnkey Projects | N/A | Integrated transport systems; Riyadh Metro, French regional fleet modernization, Saudi Arabia, Mexico infrastructure. |

| Digital Mobility & Data Services | N/A | Software, data analytics, predictive maintenance; AI and IoT integration for operational efficiency. |

Business Model Canvas Data Sources

The Alstom Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research, and expert strategic analyses. These diverse data sources ensure a robust and accurate representation of Alstom's operational and strategic landscape.