Alstom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alstom Bundle

Curious about Alstom's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings might be positioned as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock strategic advantage and make informed decisions about resource allocation, dive into the complete analysis.

Don't let this preview be your only insight. Purchase the full Alstom BCG Matrix to gain a comprehensive understanding of each product's market share and growth potential, equipping you with the data-driven clarity needed to navigate the competitive landscape effectively.

This is your opportunity to move beyond speculation and into decisive action. Secure the complete Alstom BCG Matrix to receive actionable strategies and detailed quadrant placements, empowering you to optimize your investments and drive future success.

Stars

Alstom's Avelia Horizon high-speed trains are a prime example of a company's investment in a high-growth segment. New orders from operators such as Proxima in France and ONCF in Morocco highlight the strong demand for this next-generation technology.

These advanced trains are currently undergoing crucial homologation tests throughout 2024. This rigorous testing is paving the way for their entry into revenue service by early 2026, signaling a robust market position and significant future potential for Alstom in the high-speed rail sector.

Alstom's Urbalis system is a star in the digital and urban signalling segment, significantly boosting capacity and efficiency in metro networks. This advanced, automated signalling technology is in high demand, evidenced by Alstom securing contracts like the modernization of Lyon metro's Line D.

The company's commitment to digital solutions, including Urbalis, positions it advantageously in a market increasingly prioritizing smart urban transport infrastructure. This focus aligns with global trends towards greater automation and data-driven operations in public transit systems.

Alstom's Services and Maintenance Contracts segment is a star performer, driven by a vast installed base and an extensive depot network. This robust infrastructure supports high growth and a significant market share in this sector.

Long-term maintenance agreements are key revenue drivers. For instance, the 15-year contract for Avelia Horizon trains and a seven-year extension for the JFK International Airport's AirTrain exemplify the stable and expanding income streams generated by these crucial service contracts.

Hydrogen-Powered Trains (Coradia iLint)

Alstom's Coradia iLint is a pioneer in hydrogen-powered passenger trains, marking a significant step in sustainable rail transport.

The technology is still nascent, but with over 30 countries actively exploring hydrogen train deployments, its market potential is substantial, driven by global decarbonization efforts.

- Market Position: First-mover advantage in the emerging hydrogen train sector.

- Growth Potential: High, fueled by global sustainability mandates and decarbonization targets in transportation.

- Challenges: Infrastructure development for hydrogen refueling and cost competitiveness compared to established diesel or electric trains.

- Strategic Importance: Alstom is positioning itself as a leader in future zero-emission mobility solutions.

Integrated Turnkey Systems

Integrated Turnkey Systems represent Alstom's strong position in the market, offering complete transport solutions. This includes everything from trains and trams to the necessary track, power, and signaling systems, all managed as one project. Such comprehensive offerings are crucial for large, complex infrastructure developments.

Alstom's success in securing major contracts highlights the value of these integrated systems. For instance, the S-Bahn Rheinland project in Germany, a significant undertaking for regional rail, demonstrates their capacity to manage and deliver multifaceted transportation networks. This ability to handle end-to-end solutions is a key differentiator.

The company's focus on integrated systems allows them to capture high-value projects, often in markets with substantial growth potential for public transportation upgrades. This strategic approach positions Alstom favorably in the competitive landscape of global transport infrastructure providers.

- Market Leadership: Alstom's ability to deliver comprehensive, integrated transport systems, encompassing rolling stock, infrastructure, and signaling, solidifies its leadership in large-scale transportation projects.

- Key Contract Example: The S-Bahn Rheinland contract in Germany exemplifies Alstom's capability to execute complex, high-value solutions within expanding transportation markets.

- Strategic Advantage: Offering turnkey solutions allows Alstom to manage the entire project lifecycle, providing a significant competitive edge and capturing substantial revenue from major infrastructure investments.

Alstom's Avelia Horizon and Urbalis systems, along with its Services and Maintenance Contracts, are clearly positioned as Stars in the BCG matrix. These segments benefit from high market growth and strong competitive positions, as evidenced by ongoing contracts and technological advancements. The company's investment in these areas, such as the 2024 homologation tests for Avelia Horizon and the Lyon metro contract for Urbalis, underscores their potential for continued high returns and market leadership.

What is included in the product

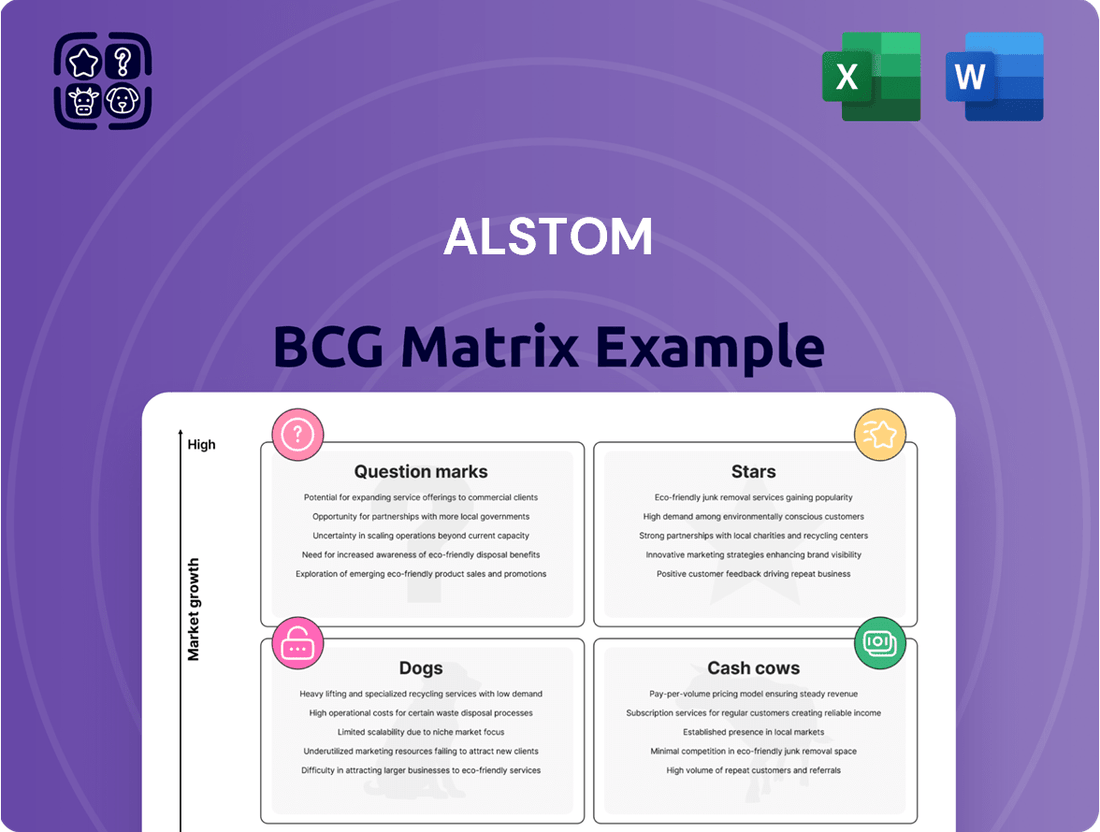

The Alstom BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

This analysis helps Alstom identify which units to invest in, divest from, or maintain for optimal resource allocation and future growth.

Alstom BCG Matrix: A clear visual of business unit performance, simplifying strategic decisions and relieving the pain of uncertainty.

Cash Cows

Alstom's conventional rolling stock, encompassing metros, trams, and commuter trains, is a cornerstone of its business, firmly positioned as a Cash Cow in the BCG Matrix. This segment benefits from Alstom's deep-rooted expertise and a substantial market share in established urban and regional transportation networks.

These offerings consistently deliver robust sales and significant cash flow. For instance, Alstom secured a significant €1.5 billion contract in 2024 for the supply and maintenance of 102 Metropolis metro trains for the Greater Paris region, highlighting the sustained demand and Alstom's strong execution capabilities in this mature market.

Alstom's legacy train fleet overhaul and modernization efforts represent a significant Cash Cow. Contracts like the one with Metrolinx for Bi-Level commuter rail cars, valued at approximately $700 million, highlight a consistent and reliable revenue source derived from servicing existing assets.

These projects capitalize on Alstom's deep-rooted expertise in maintaining and upgrading mature train fleets. This focus on essential services for established assets typically demands less substantial research and development expenditure when contrasted with the significant investment required for pioneering new train technologies.

Alstom's Adessia Stream commuter trains operate within the regional rail sector, a market characterized by stability and consistent demand. This segment, while not experiencing rapid expansion, offers predictable revenue streams, making it a classic Cash Cow.

The S-Bahn Cologne contract, a significant deal for Alstom, exemplifies this. It not only involves the supply of trains but also incorporates long-term service agreements, ensuring a steady flow of income. This demonstrates Alstom's established position in a mature but dependable market.

Propulsion Systems and Components

Alstom's propulsion systems and components segment operates as a cash cow. The company holds a significant market share in supplying essential propulsion components for numerous train fleets, notably a substantial part of New York City Transit's fleet. This strong position in a mature, critical market segment ensures consistent and stable cash flow, primarily driven by the ongoing need to maintain existing rail infrastructure.

These supply agreements are vital for Alstom's financial stability. For instance, Alstom secured a contract in 2023 to supply its innovative ONIX City buses to the RATP Group in Paris, showcasing continued demand for its propulsion technologies. The ongoing revenue from these long-term contracts, which are essential for operational continuity, solidifies this segment's cash cow status.

Key aspects of this cash cow segment include:

- High Market Share: Dominant position in supplying propulsion components for established rail networks.

- Mature Market: Operating in a stable, well-established sector with predictable demand.

- Stable Cash Flow: Consistent revenue generation from essential maintenance and supply agreements.

- Critical Infrastructure Role: Components are vital for the ongoing operation of public transportation systems.

Standardized Signalling Solutions

Alstom's standardized signalling solutions, while perhaps less dynamic than their digital counterparts, function as reliable cash cows. These are typically found in established rail networks where the technology is proven and demand remains steady. This segment generates consistent revenue, allowing Alstom to fund more innovative ventures.

These ongoing projects in mature markets, such as upgrades to existing conventional signalling systems, ensure consistent execution and contribute significantly to Alstom's overall profitability. They don't demand the substantial new investments characteristic of star performers, making them a dependable source of funds. For instance, Alstom secured a significant contract in 2024 for the modernization of conventional signalling on a key European line, highlighting the continued reliance on these solutions.

- Mature Markets: Alstom's standardized signalling is deployed in established rail infrastructure, ensuring a consistent customer base.

- Consistent Revenue: These projects provide predictable income streams without requiring heavy R&D or market development expenditure.

- Profitability Driver: The mature nature of these solutions allows for efficient execution and healthy profit margins, bolstering overall company finances.

Alstom's conventional rolling stock, particularly its metro and commuter train offerings, firmly occupies the Cash Cow quadrant of the BCG Matrix. These products benefit from Alstom's established market presence and a consistent, predictable demand in mature transportation systems. The company's ability to leverage its extensive experience in these segments ensures stable revenue generation and strong cash flow, often through long-term maintenance and upgrade contracts.

The sustained demand for Alstom's established train fleets is evident in major contracts. For instance, in 2024, Alstom secured a substantial €1.5 billion deal to supply 102 Metropolis metro trains for the Greater Paris region, underscoring the ongoing need for these mature technologies. Similarly, a contract with Metrolinx for Bi-Level commuter rail cars, valued around $700 million, demonstrates a reliable revenue stream derived from servicing existing assets.

Alstom's propulsion systems and components also represent a key cash cow. The company maintains a significant market share in supplying essential parts for numerous train fleets, including a substantial portion of New York City Transit's fleet. This strong position in a critical, mature market segment ensures consistent cash flow, primarily driven by the ongoing need for maintenance and replacement of existing infrastructure.

| Segment | BCG Position | Key Characteristics | 2024/Recent Data Point |

| Conventional Rolling Stock (Metro, Commuter) | Cash Cow | High Market Share, Mature Market, Stable Demand | €1.5 billion contract for Paris Metropolis metro trains |

| Legacy Fleet Overhaul & Modernization | Cash Cow | Servicing Existing Assets, Predictable Revenue | ~$700 million contract for Metrolinx Bi-Level cars |

| Propulsion Systems & Components | Cash Cow | Critical Infrastructure Role, Stable Cash Flow | Supplies key components for NYC Transit fleet |

Full Transparency, Always

Alstom BCG Matrix

The Alstom BCG Matrix document you are previewing is the identical, fully completed report you will receive immediately after your purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered without any watermarks or sample content, ensuring you get a professional and ready-to-use tool for evaluating Alstom's business portfolio.

Dogs

Certain legacy Bombardier Transportation projects, now under Alstom's umbrella, are proving to be a drag on performance. These ventures, acquired as part of the 2021 deal, have struggled with commercial viability and execution challenges, leading to negative free cash flow in prior periods. For instance, in 2023, Alstom reported a significant free cash flow deficit, partly attributed to these inherited projects.

These underperforming assets hold a low market share within their respective transportation segments. They consume valuable resources and capital without generating adequate returns, fitting the profile of 'Dogs' in the BCG matrix. Alstom's strategic focus in 2024 and beyond involves a critical evaluation of these projects, with divestment or substantial restructuring being likely paths forward to improve overall profitability and cash generation.

Certain regional rail lines experiencing persistent technical issues with Alstom's rolling stock can be categorized as 'dogs' within the BCG matrix. For instance, the hydrogen trains deployed on the Bad Homburg – Brandoberndorf line in Germany have encountered operational challenges, necessitating temporary fleet replacements. This situation signifies a low market share and profitability in those specific, troubled regional segments, impacting overall brand perception and financial performance.

Alstom's decision to divest its US conventional signalling operations likely places this business unit in the 'Dogs' category of the BCG Matrix. This suggests a market with limited growth potential and potentially a weak competitive position for Alstom within that specific segment.

This strategic move allows Alstom to shed assets that are not performing well or are unlikely to generate substantial future returns. By exiting these lower-growth areas, the company can reallocate capital and management focus towards more promising ventures, such as its high-speed rail or urban mobility solutions.

While specific financial figures for the disposed US conventional signalling operations are not publicly detailed in Alstom's 2024 reports, the divestiture itself signals a clear strategic pruning of underperforming or non-core assets. This is a common tactic to streamline operations and enhance overall company profitability and growth trajectory.

Highly Niche or Obsolete Product Lines

Within Alstom's diverse offerings, certain highly niche or obsolete product lines might be categorized as Dogs. These are typically older technologies or specialized equipment that no longer align with the company's strategic focus on sustainable and digital mobility. For instance, legacy signaling systems or certain types of older rolling stock that have limited market demand and low growth prospects would fit this description. Alstom's 2023/2024 financial reports, while not explicitly detailing product line performance in this manner, indicate a strong push towards modern, eco-friendly solutions, implying a divestment or phasing out of less relevant assets.

These Dog products are characterized by their low market share and minimal growth potential, often requiring significant investment for maintenance or upgrades without a clear return. Their contribution to Alstom's overall revenue is likely diminishing as the market shifts towards newer, more efficient technologies.

- Low Market Share: Products in this category struggle to capture significant portions of their respective markets.

- Minimal Growth Potential: Demand for these offerings is stagnant or declining.

- Limited Strategic Alignment: They do not support Alstom's future vision for sustainable mobility.

- Resource Drain: May require ongoing investment for maintenance or compliance without substantial revenue generation.

Inefficient Manufacturing Facilities

Inefficient manufacturing facilities, particularly those in the rolling stock sector struggling with supply chain disruptions, can be classified as dogs within a strategic framework like the BCG Matrix. These operations are resource-intensive but yield suboptimal returns, hindering overall company performance.

Such facilities often face issues like outdated machinery, poor workflow management, and significant downtime. For instance, in 2024, the global rail manufacturing industry experienced an average of 15% increase in production costs due to persistent supply chain bottlenecks, impacting the efficiency of many plants.

- High operational costs: Facilities with elevated energy consumption, excessive waste, and high labor costs per unit produced.

- Low production output: Plants failing to meet production targets or experiencing frequent quality control issues.

- Supply chain vulnerabilities: Operations heavily reliant on suppliers facing delays or quality problems, leading to production stoppages.

- Technological obsolescence: Older manufacturing equipment that cannot compete with newer, more efficient technologies.

Certain legacy projects inherited from Bombardier Transportation, now under Alstom's management, are categorized as Dogs due to their persistent commercial viability and execution challenges. These ventures, acquired in 2021, have contributed to negative free cash flow, as evidenced by Alstom's significant deficit in 2023.

These underperforming assets hold a low market share within their respective transportation segments and consume valuable resources without generating adequate returns. Alstom's strategy for 2024 and beyond includes a critical evaluation of these projects, with divestment or substantial restructuring being likely outcomes to improve profitability.

Alstom's divestiture of its US conventional signalling operations signifies a strategic move to shed underperforming assets, placing this business unit in the 'Dogs' category. This decision reflects a market with limited growth potential and a potentially weak competitive position for Alstom in that specific segment.

The company's focus is shifting towards more promising areas like high-speed rail and urban mobility, implying a phasing out of less relevant or obsolete product lines. This aligns with Alstom's broader strategy of prioritizing sustainable and digital mobility solutions.

Question Marks

Alstom's pursuit of fully autonomous train prototypes for both freight and passenger services positions them within a high-growth potential market where their current market share is likely nascent. This strategic direction suggests a significant investment in research and development for these advanced technologies.

The development and commercialization of autonomous trains require substantial R&D expenditure. Success in this area will be heavily influenced by the rate of market adoption and the evolution of regulatory frameworks governing such operations.

Alstom's Avelia Stream high-speed single-deck train is positioned as a potential star in the BCG matrix. This new product targets a growing market segment, indicating significant future demand. Alstom is investing heavily to secure a strong foothold in this emerging sector.

Alstom is heavily investing in advanced predictive maintenance and digital depot solutions, aiming to revolutionize how rail infrastructure is managed. This focus on condition-based and smart maintenance tools taps into a segment with significant growth potential, promising enhanced operational efficiency for its clients.

While these digital services represent a strategic growth area, Alstom’s current market penetration in these highly specialized offerings is likely still developing. For instance, the global predictive maintenance market is projected to reach over $28 billion by 2028, indicating a vast opportunity for new entrants and innovators like Alstom.

New Market Entries in Emerging Sustainable Technologies

Alstom's strategic push into emerging sustainable mobility technologies beyond its established hydrogen train offerings positions these ventures as potential question marks within its portfolio. These areas, like advanced energy recovery systems or innovative lightweight materials for rail, exhibit significant growth prospects but currently hold minimal market share due to their nascent adoption phases.

These new market entries are characterized by substantial investment and development efforts, mirroring the typical profile of question mark businesses. For instance, Alstom's reported investment in research and development for sustainable solutions reached €1.2 billion in 2023, a portion of which is allocated to exploring these nascent technologies.

- High Growth Potential: Emerging technologies like advanced battery storage for rail or novel aerodynamic designs offer substantial long-term market expansion opportunities as sustainability mandates intensify globally.

- Low Current Market Share: Despite their promise, these technologies are in early adoption stages, meaning their current contribution to Alstom's overall revenue is negligible, reflecting their question mark status.

- Significant R&D Investment: Alstom is actively channeling resources into these areas, evidenced by its commitment to innovation in areas like regenerative braking systems, which can recover up to 30% of a train's kinetic energy.

- Strategic Importance: These question marks represent Alstom's forward-looking strategy to diversify its sustainable mobility solutions and capture future market leadership in a rapidly evolving industry.

Expansion into New Geographic Markets with Limited Presence

Expanding into new geographic markets where Alstom's presence is currently limited presents a significant question mark, particularly in regions with burgeoning demand for transport solutions. These markets often require substantial upfront capital to establish operations, build brand recognition, and compete effectively against entrenched local competitors. For instance, Alstom's strategic focus on emerging economies in Southeast Asia, where infrastructure development is accelerating, exemplifies this challenge.

- Market Entry Costs: Significant investment is needed for establishing local manufacturing, sales networks, and after-sales support.

- Competitive Landscape: Facing established local players and other global competitors requires tailored strategies to gain traction.

- Regulatory Hurdles: Navigating diverse and sometimes complex regulatory environments in new territories can delay market penetration.

- Demand Volatility: While demand may be growing, it can also be subject to economic fluctuations and political instability in emerging markets.

Alstom's investments in nascent sustainable mobility technologies, such as advanced energy recovery systems and novel lightweight materials, represent classic question marks in the BCG matrix. These ventures are characterized by high growth potential due to increasing sustainability demands but currently hold minimal market share, reflecting their early adoption stages.

BCG Matrix Data Sources

Our Alstom BCG Matrix is constructed using a blend of Alstom's official financial disclosures, independent market research reports, and detailed industry analysis to provide a comprehensive view of their business units.