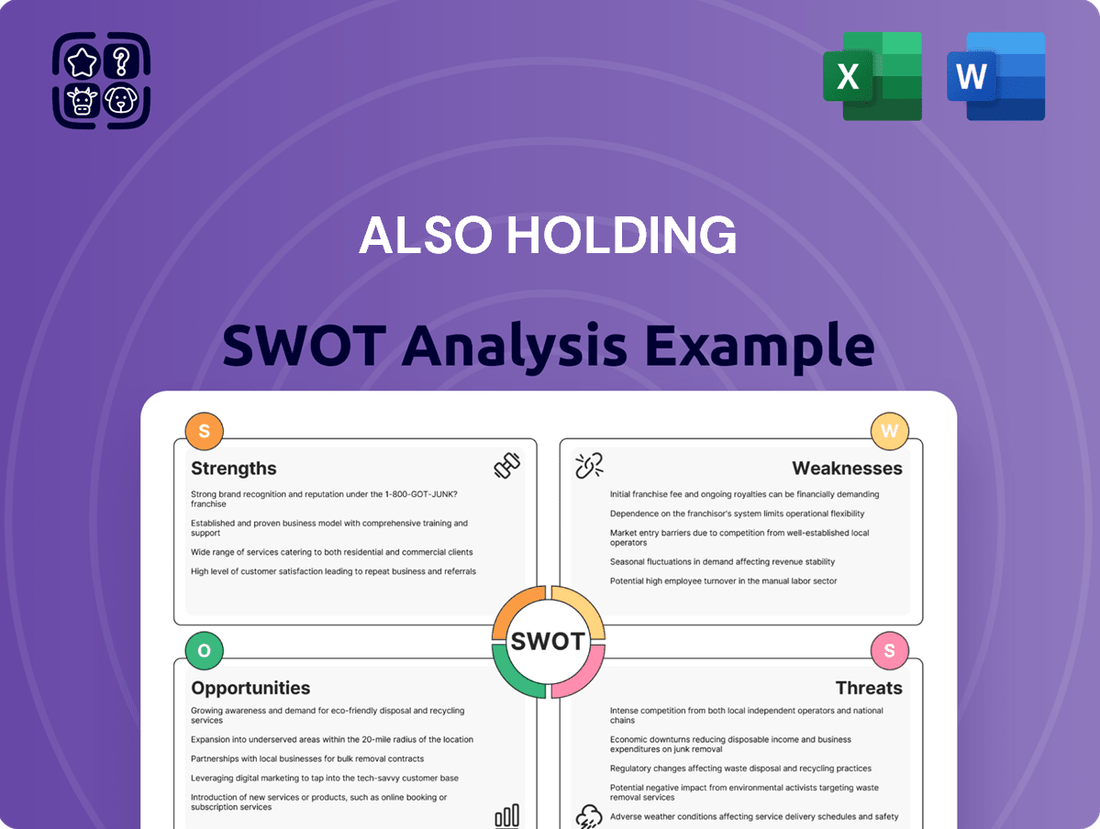

ALSO Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

ALSO Holding showcases robust strengths in its diversified portfolio and established market presence, but faces potential threats from evolving industry regulations and competitive pressures. Understanding these internal capabilities and external challenges is crucial for strategic decision-making.

Unlock the complete picture behind ALSO Holding's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to leverage their opportunities and mitigate risks.

Strengths

ALSO Holding boasts an extensive B2B ecosystem and marketplace, a significant strength that underpins its market position. This vast network connects over 800 vendors with more than 135,000 resellers.

This robust marketplace extends its reach globally, operating across 31 European countries and engaging with 144 countries through its Platform-as-a-Service (PaaS) partners. Such a broad and established digital infrastructure facilitates efficient distribution and unparalleled market access for IT products and services.

The company's strategic evolution from a traditional distributor to a sophisticated technology solutions provider, powered by its advanced digital platforms, further enhances the value and reach of this ecosystem.

ALSO Holding exhibits remarkable financial strength, evident in its record revenue of €12.5 billion for 2023 and sales surpassing €12 billion in 2024. This consistent top-line growth underscores the company's market resilience and effective business model.

The company's operational efficiency is highlighted by its best-ever EBITDA in the final quarter of 2024, with preliminary figures ranging between €230-240 million. This strong profitability demonstrates excellent cost management and revenue generation capabilities.

A significant strength is ALSO's substantial cash position, which stood at approximately €731 million according to preliminary 2024 results. This robust liquidity provides ample capacity for strategic investments, potential acquisitions, and organic growth initiatives.

Furthermore, this financial solidity supports a stable and growing shareholder return policy, marked by a proposed 13th consecutive dividend increase. This consistent dividend growth signals confidence in future earnings and financial stability.

ALSO Holding's strategic pivot towards high-growth digital platforms is a key strength. The company has successfully diversified its revenue streams, emphasizing higher-margin solutions and services in areas like cloud, AI, IoT, and cybersecurity. This focus is directly addressing the increasing demand driven by global digital transformation initiatives.

The financial performance underscores this strategic advantage. Cloud services, a prime example of their digital platform focus, experienced a substantial 20% revenue increase to €3 billion in 2023. Furthermore, this segment saw an impressive 31% surge in the first half of 2024, reaching €1,133 million, demonstrating robust market adoption and ALSO's ability to scale these offerings effectively.

Proven M&A Strategy and Integration Capability

ALSO Holding's proven Mergers & Acquisitions (M&A) strategy and integration capability is a significant strength. The company has a robust history of successful inorganic growth, evidenced by its completion of 27 acquisitions over the last ten years. This consistent execution demonstrates a deep understanding of identifying synergistic targets and integrating them effectively into its existing operational framework.

A prime example of this strength is the February 2025 acquisition of Westcoast. This strategic move alone is projected to add approximately €4.2 billion in revenue, significantly bolstering ALSO's market position, particularly in the UK, Ireland, and France. Such impactful acquisitions underscore the company's capacity to drive substantial top-line growth and achieve meaningful market expansion through targeted M&A.

- 27 acquisitions completed in the past decade

- February 2025: Westcoast acquisition adds ~€4.2 billion in revenue

- Enhanced market leadership in UK, Ireland, and France

- Demonstrated ability to drive top-line growth and market expansion

Commitment to Sustainability and Corporate Responsibility

Sustainability is deeply embedded in ALSO Holding AG's operational philosophy, driving efforts to significantly reduce its environmental impact. The company has set ambitious targets, aiming for a 30% reduction in carbon emissions by 2025. By the end of 2023, they had already achieved a substantial 22% reduction compared to 2020 levels, demonstrating consistent progress.

ALSO Holding AG actively implements eco-friendly operational practices across its business. This includes a robust recycling program designed to minimize waste and conserve resources. Furthermore, the company is increasingly focusing on offering products that meet rigorous sustainability certifications, reflecting a commitment to a greener supply chain and aligning with growing global demand for environmentally responsible solutions.

- Environmental Commitment: 30% carbon emission reduction target by 2025.

- Progress Achieved: 22% carbon emission reduction from 2020 levels by 2023.

- Key Initiatives: Eco-friendly practices and comprehensive recycling programs.

- Product Strategy: Increasing percentage of certified sustainable product offerings.

ALSO Holding's extensive B2B ecosystem, connecting over 800 vendors with more than 135,000 resellers across 31 European countries and 144 countries via PaaS partners, provides unparalleled market access and efficient distribution. This digital infrastructure, coupled with a strategic shift to a technology solutions provider, significantly amplifies its market reach and product delivery capabilities.

The company's financial performance is a core strength, with revenues consistently exceeding €12 billion, reaching €12.5 billion in 2023 and surpassing €12 billion in 2024. This robust growth is complemented by strong operational efficiency, evidenced by a record EBITDA in Q4 2024, estimated between €230-€240 million, showcasing effective cost management and profit generation.

A substantial cash position, approximately €731 million in preliminary 2024 results, provides significant financial flexibility for strategic investments and growth. This financial stability supports a shareholder return policy with a proposed 13th consecutive dividend increase, reflecting confidence in sustained earnings and financial health.

ALSO's strategic focus on high-growth digital platforms like cloud, AI, IoT, and cybersecurity is a key differentiator. Cloud services alone saw a 20% revenue increase to €3 billion in 2023 and a remarkable 31% surge in the first half of 2024, reaching €1,133 million, indicating strong market adoption and scalability.

The company's proven M&A strategy, including 27 acquisitions over the past decade, demonstrates a strong capability for inorganic growth. The February 2025 acquisition of Westcoast, adding an estimated €4.2 billion in revenue, significantly strengthens market leadership in the UK, Ireland, and France, highlighting effective market expansion and revenue acceleration.

Sustainability is a growing strength, with a target of 30% carbon emission reduction by 2025, having already achieved a 22% reduction by the end of 2023. Eco-friendly practices, recycling programs, and an increasing offering of certified sustainable products underscore a commitment to environmental responsibility and alignment with market trends.

What is included in the product

Provides a comprehensive analysis of ALSO Holding's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

ALSO Holding's reliance on IT spending makes it vulnerable to economic downturns. For instance, a muted IT spending environment observed in 2024 directly impacted the company's revenue growth. This sensitivity to broader economic conditions and shifts in IT investment behavior presents a significant weakness.

Despite diversification efforts, a substantial part of ALSO's business remains intrinsically linked to the overall performance of the IT market. This concentration means that any slowdown in IT sector investment can disproportionately affect the company's financial results, as seen with consumer spending restraint in key European markets.

Consumer spending restraint, particularly evident in major European markets such as Germany, Poland, and the Netherlands, has directly translated into revenue declines for certain segments of ALSO's operations. This highlights the direct impact of consumer confidence and purchasing power on the company's top line.

The IT distribution sector is fiercely competitive, with ALSO navigating a market featuring at least 37 active competitors. This high level of competition can exert downward pressure on pricing and make it challenging to sustain or grow market share, demanding ongoing innovation and distinct offerings.

Despite ALSO's robust market standing, the sheer volume of market participants mandates continuous strategic adaptation to counter competitive pressures. For instance, in 2023, the IT distribution market saw significant consolidation and new entrants, further intensifying the landscape.

While ALSO Holding strategically aims for higher-margin services, a significant portion of its revenue still originates from transactional hardware and software distribution. This traditional segment inherently carries thinner profit margins when contrasted with cloud and IT services.

For example, in the first quarter of 2024, hardware and traditional software still constituted a considerable revenue base, even as the company emphasized its growing service portfolio. This reliance means that profitability hinges on meticulous cost management within these established areas.

The challenge lies in balancing the operational efficiency of these lower-margin segments with the aggressive expansion of more lucrative service lines, such as managed services and cloud solutions.

This dynamic creates a potential for margin pressure if the growth in higher-margin services doesn't outpace the volume and associated margins of transactional business effectively.

Complexity of Integration and Operational Management

ALSO Holding's extensive international presence, encompassing 31 European countries and a partner network reaching 144 worldwide, presents significant hurdles in integrating new acquisitions and managing diverse operational systems. This vast geographical spread necessitates highly sophisticated management structures and considerable investment to ensure smooth operations and continued expansion.

The challenge lies in harmonizing disparate IT systems, business processes, and corporate cultures inherited from numerous acquisitions. For instance, integrating a newly acquired logistics network in Eastern Europe with existing French operations requires meticulous planning and execution to avoid disruptions.

- Operational Complexity: Managing operations across 31 European countries and 144 worldwide through partners inherently creates complex logistical and administrative burdens.

- Integration Challenges: Seamlessly integrating diverse IT infrastructures, supply chains, and business processes from acquired companies is a continuous and resource-intensive undertaking.

- Resource Allocation: The scale of operations demands substantial financial and human resources dedicated to managing integration and ensuring operational efficiency across all markets.

- Risk of Inefficiency: Without robust management, the complexity can lead to inefficiencies, increased costs, and a slower response to market changes.

Reliance on Key Vendor Relationships

ALSO Holding's reliance on its network of hardware and software manufacturers presents a potential vulnerability. A significant dependence on a few dominant vendors means that any disruption in these key relationships could directly impact product availability and pricing. For instance, if a major cloud provider or hardware manufacturer were to alter its distribution agreements or focus on direct sales, it could negatively affect ALSO's product portfolio and margins. This dependency was highlighted in earlier analyses, and ongoing market shifts continue to make vendor relationship management critical for 2024 and 2025.

The potential for key vendors to change their distribution strategies poses a notable weakness. If these influential partners decide to prioritize direct-to-customer sales or exclusive partnerships with competitors, ALSO could face challenges in maintaining its market share and competitive pricing. This risk is amplified in rapidly evolving tech sectors where vendor alliances can shift quickly.

Deterioration in relationships with critical suppliers could lead to:

- Reduced product availability: Key hardware or software offerings might become scarce.

- Unfavorable terms of trade: Vendors could impose less advantageous pricing or payment conditions.

- Increased competition: Competitors might secure exclusive access to sought-after products.

- Impact on revenue streams: A decline in the availability or attractiveness of core products directly affects sales performance.

ALSO Holding faces a notable weakness in its dependence on a few key vendors for its product portfolio. A shift in distribution strategies by these major suppliers, such as a move towards direct sales or exclusive partnerships with rivals, could significantly impact ALSO's market share and pricing power. This exposure was evident when, for example, certain cloud service providers adjusted their partner programs in late 2023, necessitating rapid adaptation by distributors like ALSO.

The company's profitability is also constrained by its substantial revenue derived from traditional hardware and software distribution, which typically offers lower margins compared to services. For instance, in the first half of 2024, while service revenue grew, hardware still represented a significant portion of sales, demanding stringent cost management. This reliance creates a delicate balance, requiring service growth to outpace transactional business to improve overall profitability.

Furthermore, ALSO's extensive international operations across 31 European countries and 144 global partners introduce significant complexity. Integrating diverse IT systems, supply chains, and corporate cultures from acquisitions, such as recent expansions in Eastern Europe, requires substantial resources and meticulous planning to avoid inefficiencies and operational disruptions. This complexity can strain resource allocation and slow responses to market changes.

| Weakness Area | Description | Impact Example (2024/2025 Relevance) |

|---|---|---|

| Vendor Dependency | Reliance on a few key hardware and software manufacturers. | Potential for reduced product availability or unfavorable pricing if major vendors alter distribution strategies, as seen with cloud provider program shifts in late 2023. |

| Margin Mix | Significant revenue from lower-margin hardware/software distribution. | Profitability hinges on efficient cost management in transactional segments, even as service revenue grows, as hardware remained a substantial sales component in H1 2024. |

| Operational Complexity | Managing operations across many countries and partners. | Integration challenges with acquisitions in diverse markets like Eastern Europe require significant resources and can lead to inefficiencies if not managed meticulously. |

Preview the Actual Deliverable

ALSO Holding SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report covering ALSO Holding's Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into ALSO Holding's market position.

Opportunities

The escalating demand for cloud computing and Anything-as-a-Service (XaaS) models creates a substantial avenue for ALSO Holding's expansion. The company has already noted a robust increase in its cloud services revenue, with a strategic emphasis on further developing these offerings, including growing the number of unique users and improving monetization strategies.

By capitalizing on its existing platforms, ALSO can effectively drive future revenue streams through digital transformation services such as Workplace as a Service and Infrastructure as a Service. For instance, in the first half of 2024, ALSO reported a significant surge in its cloud business, with revenue increasing by 20% year-on-year, underscoring the immense potential in this sector.

The burgeoning fields of Artificial Intelligence (AI), the Internet of Things (IoT), and advanced cybersecurity present significant growth prospects for ALSO. By investing in these areas, ALSO can enhance its existing services and develop entirely new digital solutions.

ALSO's commitment to building new digital platforms and AI-powered applications is a direct response to these evolving market demands. This focus allows them to tap into sectors that are rapidly expanding and increasingly reliant on digital integration.

This strategic push into emerging technologies enables ALSO to diversify its portfolio and reach new customer bases. For instance, as of early 2024, the global AI market was projected to reach over $200 billion, highlighting the sheer scale of the opportunity.

ALSO's established merger and acquisition (M&A) approach offers a direct route for growth beyond organic means and entering new markets. The company's 2023 acquisition of Westcoast, a prominent IT distributor, significantly bolstered its presence across the UK, Ireland, and France, demonstrating a clear strategy for future geographical expansion and partnership opportunities.

By strategically identifying and integrating businesses that complement its existing operations, ALSO can effectively increase its market share and diversify its service offerings. For instance, the integration of Westcoast is expected to unlock considerable synergies, contributing to a stronger overall market position and enhanced profitability in the coming years.

Leveraging PC Refresh Cycle and AI PCs

The PC market is seeing a significant uplift driven by an anticipated refresh cycle in 2025, further amplified by the introduction of AI-ready PCs. This presents a prime opportunity for hardware sales growth. For ALSO Holding, with over 25% of its revenue historically linked to the PC segment, this trend is particularly advantageous.

The demand for more advanced and intelligent computing devices is expected to translate into higher unit sales and potentially improved pricing power. This dual impact of increased volume and value could lead to a re-acceleration of revenue for companies like ALSO. For instance, IDC projected a 3.4% year-over-year growth in the global PC market for 2024, with this momentum likely to continue into 2025, especially with AI PCs becoming more mainstream.

- Anticipated PC refresh cycle in 2025.

- Emergence of AI-ready PCs driving demand.

- ALSO Holding’s significant exposure to the PC market (over 25% of revenue).

- Expectation of boosted unit sales and pricing for more powerful devices.

Increased Demand for Sustainable IT Solutions

The global push for environmental responsibility is fueling a significant increase in demand for IT solutions that minimize ecological impact. This presents a prime opportunity for companies like ALSO Holding, which have proactively integrated sustainability into their core strategies. By offering certified eco-friendly products and actively pursuing green initiatives, ALSO is well-positioned to capture market share from environmentally conscious businesses and consumers.

This alignment with sustainability trends can unlock new avenues for growth. ALSO's commitment can attract a broader range of partners and customers who prioritize environmental, social, and governance (ESG) factors. For instance, the IT services market focused on sustainability is projected to grow substantially; by 2025, spending on green IT services is expected to reach billions globally, driven by corporate net-zero targets and regulatory pressures.

- Growing Market: The global market for green IT is expanding rapidly, with projections indicating significant growth through 2025 and beyond.

- Customer Preference: An increasing number of businesses and end-users are actively seeking out and preferring IT products and services with a demonstrable commitment to sustainability.

- Partnership Potential: ALSO's strong sustainability credentials can serve as a magnet for partnerships with like-minded organizations, creating a more robust and ethically aligned ecosystem.

- Competitive Advantage: Demonstrating a clear focus on sustainability can differentiate ALSO from competitors, providing a key advantage in an increasingly crowded marketplace.

The increasing adoption of cloud services and Everything-as-a-Service (XaaS) models presents a significant growth runway for ALSO Holding. The company's strategic focus on expanding its cloud offerings, evidenced by a 20% year-on-year revenue increase in its cloud business during the first half of 2024, highlights this opportunity.

Emerging technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and advanced cybersecurity are creating new avenues for service development and revenue generation. With the global AI market projected to exceed $200 billion by early 2024, ALSO's investment in these areas positions it for substantial expansion.

The anticipated PC refresh cycle in 2025, bolstered by the introduction of AI-ready PCs, is expected to drive hardware sales. Given that over 25% of ALSO Holding's revenue is historically linked to the PC segment, this trend is particularly beneficial, with global PC market growth projected to continue into 2025.

ALSO’s strategic merger and acquisition (M&A) approach, exemplified by the 2023 acquisition of Westcoast, provides a clear path for entering new markets and expanding its geographical footprint. This strategy allows for accelerated growth beyond organic development.

The growing demand for sustainable IT solutions offers a competitive advantage. As businesses increasingly prioritize ESG factors, ALSO’s commitment to environmental responsibility positions it to capture market share, with the green IT services market expected to reach billions globally by 2025.

Threats

Global economic slowdowns present a substantial risk, potentially curbing IT expenditures by both businesses and consumers. This muted spending environment, evident in 2024, directly affects ALSO's top and bottom lines.

Persistent economic uncertainty could prompt companies to postpone crucial investments in hardware, software, and IT services, thereby hindering ALSO's expansion plans.

For instance, the International Monetary Fund (IMF) projected a global GDP growth of 3.2% for 2024, a slight slowdown from previous years, indicating a cautious spending climate for technology.

The IT distribution sector faces fierce rivalry. Traditional distributors are challenged by vendors selling directly to customers and by innovative newcomers. This dynamic can force price reductions, squeeze profit margins, and necessitate ongoing investment in unique offerings to maintain market position.

For instance, in 2024, the global IT distribution market experienced significant shifts, with some traditional players struggling to adapt to the rise of e-commerce platforms and direct-to-consumer sales strategies. Companies like ALSO Holding must continually innovate to counter these pressures, as evidenced by their strategic focus on value-added services and cloud solutions to differentiate themselves from pure price competition.

The Information and Communication Technology (ICT) sector is defined by its relentless pace of innovation, making technological obsolescence a significant threat. Products and solutions that are cutting-edge today can become outdated rapidly, demanding constant adaptation from companies like ALSO.

To maintain relevance, ALSO must commit substantial resources to research and development, ensuring its product and service portfolio evolves in sync with market demands. This ongoing investment is crucial for staying competitive in a dynamic environment.

Failure to anticipate and integrate emerging technologies, such as advancements in artificial intelligence or novel cloud infrastructure models, poses a direct risk to ALSO's market position. Falling behind in these critical areas could erode its competitive advantage and diminish its overall market relevance.

For instance, the global ICT market saw significant growth in R&D spending in 2024, with many companies increasing their innovation budgets to combat obsolescence. ALSO's ability to strategically invest in these evolving technologies will be a key determinant of its future success.

Supply Chain Disruptions and Geopolitical Risks

As a significant distributor of IT hardware, ALSO faces considerable threats from global supply chain disruptions. These can manifest as shortages of critical components, like semiconductors, which saw prices surge in 2024 due to high demand and limited production capacity. Logistical hurdles, including port congestion and rising shipping costs, also present ongoing challenges, impacting the timely delivery of goods.

Geopolitical events further amplify these risks. For instance, ongoing trade tensions and regional conflicts can directly impede the flow of goods and lead to increased import duties or restrictions. These disruptions directly affect ALSO's ability to secure inventory, potentially raising operational expenses and causing delivery delays for both resellers and the ultimate consumers. Such issues can erode customer satisfaction and negatively impact the company's financial results, especially if market demand outstrips available supply.

- Component Shortages: The global semiconductor shortage, exacerbated by increased demand for electronics in 2023-2024, directly impacts IT hardware availability.

- Logistical Costs: Shipping rates saw volatility throughout 2024, with some routes experiencing significant price increases, directly affecting ALSO's cost of goods.

- Geopolitical Instability: Ongoing trade disputes and regional conflicts can lead to unpredictable tariffs and supply chain interruptions, impacting product sourcing and pricing.

- Delivery Delays: Supply chain bottlenecks can result in extended lead times, potentially frustrating customers and impacting sales performance.

Cybersecurity Risks and Data Privacy Regulations

As a major player in IT services and digital platforms, ALSO Holding confronts substantial cybersecurity threats. Data breaches and sophisticated cyberattacks pose an ongoing risk, potentially compromising sensitive customer and company information. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the pervasive nature of these threats.

Furthermore, the company must navigate an increasingly complex landscape of data privacy regulations. Stricter rules like the General Data Protection Regulation (GDPR) in Europe demand continuous investment in compliance measures and robust data protection protocols. Non-compliance can lead to severe consequences, including significant financial penalties and damage to brand reputation.

- Cybersecurity Threats: ALSO's reliance on digital infrastructure exposes it to data breaches and cyberattacks, a growing global concern with projected annual costs of $10.5 trillion by 2025.

- Regulatory Compliance: Evolving data privacy laws, such as GDPR, necessitate ongoing investment and adaptation to avoid penalties and maintain customer trust.

- Impact of Non-Compliance: Failure to protect data or adhere to regulations can result in substantial fines, reputational damage, and erosion of customer confidence.

The IT distribution sector faces intense competition from vendors selling directly to customers and from agile new entrants. This pressure can lead to price wars, squeezing profit margins and requiring continuous investment in differentiation, as seen in the evolving strategies of companies like ALSO throughout 2024.

Technological obsolescence is a significant threat in the fast-paced ICT market. Companies like ALSO must invest heavily in R&D to keep their offerings current, a challenge highlighted by substantial global R&D spending increases in 2024 to counter this rapid evolution.

Supply chain disruptions, including component shortages like semiconductors and rising logistical costs, continue to impact the availability and pricing of IT hardware. Geopolitical instability further exacerbates these risks, potentially causing delivery delays and increased operational expenses.

Cybersecurity threats remain a critical concern, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. ALSO Holding must also navigate complex data privacy regulations, like GDPR, requiring ongoing investment to avoid severe penalties and reputational damage.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from ALSO Holding's official financial reports, comprehensive market research, and expert industry analyses to provide a well-informed strategic overview.