ALSO Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

ALSO Holding navigates a complex marketplace, where understanding the intensity of industry rivalry and the bargaining power of buyers is crucial for sustained success. The threat of new entrants and the availability of substitutes also exert significant pressure, shaping strategic decisions.

Suppliers can wield considerable influence, potentially impacting ALSO Holding's cost structure and operational efficiency. A nuanced understanding of these five forces is key to identifying competitive advantages and potential vulnerabilities.

The complete report reveals the real forces shaping ALSO Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The ICT sector, where ALSO Holding operates, faces supplier concentration, especially for crucial components and software. Giants like Microsoft and Intel, along with major hardware manufacturers, form a relatively consolidated supplier landscape.

This concentration grants significant bargaining power to these key vendors. Their indispensable products and dominant market positions mean ALSO Holding, and many others in the industry, depend heavily on them for their product portfolios.

For instance, Intel's market share in CPUs, consistently over 80% in recent years, highlights its leverage. Similarly, Microsoft's Windows operating system is a foundational element for a vast majority of PCs and servers, giving it considerable sway over hardware compatibility and pricing.

This means a select few suppliers can exert substantial influence over product availability, dictating terms that affect pricing and the direction of technological advancements, impacting companies like ALSO Holding's cost structure and product offerings.

Switching costs for ALSO Holding to change a major supplier can be quite significant. These costs aren't just about finding a new vendor; they involve the effort to integrate new products, re-certify systems, and manage potential disruptions to their extensive reseller network.

This creates a strong dependency on existing, established supplier relationships. It means that switching to alternative vendors for core products isn't a simple or quick decision for ALSO, impacting their flexibility.

The technology embedded within current supplier offerings and the absolute necessity for seamless integration across ALSO's entire ecosystem further escalate these switching costs. For instance, if a key software component is deeply integrated, replacing it could require substantial redevelopment.

In 2024, the IT distribution market, where ALSO operates, saw continued consolidation and a focus on value-added services, making supplier integration even more critical. Disruptions due to supplier changes could directly impact the reliability of services offered to over 120,000 resellers.

The uniqueness of offerings from many leading hardware and software vendors significantly bolsters supplier power. These companies often provide proprietary operating systems or specialized enterprise software that are difficult to substitute, making them critical components for IT solutions. This indispensability means ALSO Holding has limited leverage to negotiate better terms when these essential, unique products are required to meet end-customer needs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they start selling directly to customers or a wider reseller base, bypassing distributors like ALSO Holding, is a potential concern.

However, this risk is significantly reduced because suppliers often lack the extensive infrastructure and expertise required to manage a complex reseller network, logistics, and financial services – areas where ALSO excels. For instance, major technology suppliers typically rely on established distribution partners to reach a fragmented market efficiently.

Suppliers generally find it more cost-effective and strategically sound to utilize distributors for market penetration rather than investing heavily in building their own direct sales and support channels. This allows them to focus on their core product development.

In 2024, the global IT distribution market continued to demonstrate the value of specialized distribution services, with companies like ALSO providing essential value-added services that are difficult for manufacturers to replicate internally.

- Complexity Barrier: Suppliers face high costs and operational complexity in managing broad reseller networks and providing logistics.

- Focus on Core Competencies: Manufacturers typically prefer to concentrate on product innovation and manufacturing, leaving distribution to specialists.

- Market Reach Efficiency: Distributors offer suppliers a more efficient pathway to a diverse customer base than direct sales.

- Value-Added Services: ALSO's expertise in areas like financing and logistics makes it difficult for suppliers to replicate these services cost-effectively.

Importance of ALSO to Suppliers

The extensive reach of ALSO Holding, boasting approximately 135,000 resellers across 30 European countries, makes its B2B marketplace an essential gateway for numerous vendors. This broad network is crucial for suppliers looking to access a wide customer base efficiently.

For smaller or specialized suppliers, ALSO offers indispensable market access, sophisticated logistics, and vital financial services. These capabilities are often too resource-intensive for such companies to develop on their own, highlighting ALSO's role as an enabler.

The significant market reach and robust distribution infrastructure provided by ALSO serve to moderate the bargaining power suppliers might otherwise wield.

Essentially, ALSO represents a substantial and consistent revenue stream for its suppliers, thereby influencing their reliance on the platform.

- Market Access: ALSO's network of 135,000 resellers provides vendors unparalleled reach across 30 European countries.

- Support Services: Crucial logistics, financial services, and market access are provided, especially beneficial for smaller suppliers.

- Revenue Stream: The platform constitutes a significant revenue source for many suppliers, influencing their negotiation leverage.

The bargaining power of suppliers for ALSO Holding is considerable due to the concentrated nature of key technology components and software, with companies like Intel and Microsoft holding significant market sway. This concentration means ALSO, and the broader IT distribution sector, are heavily reliant on these vendors for their core product offerings, impacting pricing and innovation. In 2024, the IT distribution market continued to emphasize value-added services, making the integration of these essential supplier products even more critical for meeting the needs of ALSO's extensive reseller network.

| Factor | Description | Impact on ALSO Holding | Key Data/Example (2024 Context) |

|---|---|---|---|

| Supplier Concentration | Few dominant players for critical hardware/software. | High reliance, limited negotiation leverage. | Intel's consistent >80% CPU market share. |

| Switching Costs | Integration complexity, system re-certification. | Significant barriers to changing key suppliers. | Deep integration of proprietary software requires substantial redevelopment. |

| Uniqueness of Offerings | Proprietary technologies difficult to substitute. | Reduced leverage in negotiating terms for essential products. | Indispensable role of specific operating systems and specialized enterprise software. |

| Forward Integration Threat | Suppliers selling directly. | Mitigated by ALSO's distribution expertise. | Manufacturers often lack ALSO's infrastructure for reaching 135,000 resellers. |

What is included in the product

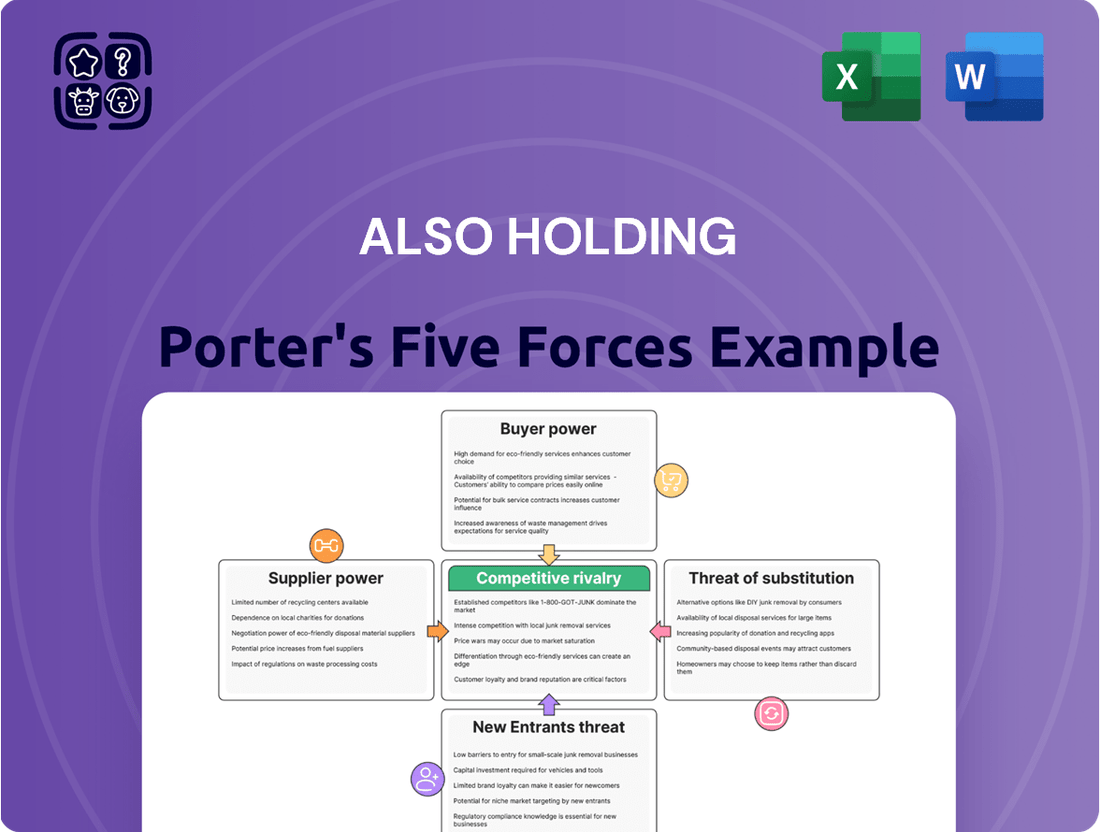

Uncovers key drivers of competition, customer influence, and market entry risks tailored to ALSO Holding's IT distribution and services landscape.

Instantly visualize competitive pressures with pre-built charts, simplifying complex Porter's Five Forces insights for strategic clarity.

Customers Bargaining Power

ALSO Holding serves a vast network of approximately 135,000 resellers, a figure that points to a highly fragmented customer base. This broad distribution means that individual customers hold very little bargaining power. The sheer number of resellers significantly dilutes the influence any single entity can exert on pricing or terms.

While certain large resellers might possess a marginally greater degree of leverage due to their volume, the overall structure of ALSO's customer ecosystem prevents any one reseller from dictating terms. This fragmentation is a key factor in maintaining strong supplier relationships and stable revenue streams.

Resellers might incur costs when switching from ALSO, such as the expense and effort of integrating with new IT platforms, reconfiguring supply chains, and possibly forfeiting specialized product access or financial benefits. For instance, a reseller accustomed to ALSO's streamlined order processing might face significant downtime and training expenses to adapt to a new system.

ALSO actively works to elevate these switching costs by providing a robust, integrated ecosystem that encompasses logistics, financing, and advanced IT solutions. This holistic approach creates a sticky environment where the convenience of a single, efficient partner becomes a strong deterrent to seeking alternatives.

The value proposition of ALSO's one-stop-shop model, offering a seamless experience from procurement to delivery and financing, makes it challenging for resellers to untangle themselves and migrate to competitors. This integrated service delivery, a key differentiator for ALSO, directly impacts customer loyalty by raising the perceived cost of switching.

Resellers in the Information and Communications Technology (ICT) sector are notoriously sensitive to price, often operating with slim profit margins. This means they are constantly on the hunt for the best deals, directly influencing how companies like ALSO Holding must structure their own pricing to remain competitive. For instance, in 2024, the average gross profit margin for ICT resellers globally hovered around 15-20%, making even small price fluctuations significant.

This intense price sensitivity from resellers puts considerable pressure on companies like ALSO to maintain aggressive pricing strategies. Failing to do so can result in lost sales volume, as resellers will naturally gravitate towards suppliers offering more favorable terms. This dynamic can squeeze ALSO's own profitability, forcing a careful balancing act between market share and margin preservation.

The trend towards commoditization in many hardware and software segments further amplifies this customer price sensitivity. When products become less differentiated, price becomes the primary deciding factor for resellers. In 2023, certain categories of standard networking equipment saw price drops of up to 10% year-over-year due to increased competition and commoditization, illustrating this point.

Availability of Substitute Distributors

The IT distribution landscape is characterized by significant competition, meaning customers, or resellers in this context, have numerous alternatives. Major global IT distributors such as TD Synnex and Ingram Micro provide robust competition to players like ALSO Holding. This widespread availability of substitute distributors empowers customers by offering them choices, which in turn can lead to increased bargaining power. Consequently, these choices can place downward pressure on ALSO's pricing strategies and the very nature of its service offerings as it strives to remain competitive.

The fragmented structure of the IT distribution market further amplifies customer choice. Resellers can readily source products and services through a variety of channels, not solely relying on one distributor. For instance, in 2024, the global IT distribution market was valued at approximately $400 billion, with numerous regional and specialized distributors vying for market share. This fragmentation ensures that resellers are not locked into single supplier relationships, enhancing their ability to negotiate favorable terms.

- Competitive IT Distribution Market: Global players like TD Synnex and Ingram Micro offer resellers viable alternatives to ALSO Holding.

- Customer Choice and Bargaining Power: The availability of substitute distributors grants resellers significant leverage, potentially driving down prices and influencing service levels.

- Market Fragmentation: The IT distribution sector's fragmented nature provides resellers with multiple avenues to procure IT products and solutions.

Customers' Ability to Backward Integrate

Customers' ability to backward integrate, meaning they could bypass distributors and source directly from manufacturers or develop their own capabilities, is a key factor in assessing bargaining power. For resellers in the IT distribution landscape, this ability is often limited.

Resellers typically do not possess the necessary scale, capital, or established infrastructure to effectively bypass established distributors like ALSO Holding. Developing in-house logistics, financial services, and extensive supplier relationships would be prohibitively expensive and complex for most. For instance, the capital expenditure required to build a comparable distribution network can run into millions of euros, a significant barrier for smaller to medium-sized resellers.

ALSO's business model is designed precisely to counter this by offering a comprehensive B2B marketplace. This includes not only product aggregation but also essential logistics and financial services, making it economically impractical for the vast majority of their reseller customers to replicate these functions independently. This reliance on ALSO’s integrated offerings significantly constrains the resellers' power to negotiate better terms through backward integration.

- Limited Scale of Resellers: Most resellers lack the sales volume to justify direct manufacturer relationships or building independent logistics.

- High Capital Requirements for Integration: Establishing direct sourcing, warehousing, and financial services demands substantial upfront investment, often exceeding reseller budgets.

- ALSO's Value Proposition: The comprehensive B2B marketplace, including logistics and financing, removes the economic incentive for resellers to integrate backward.

- Reduced Customer Bargaining Power: The inability to easily bypass distributors like ALSO reinforces their reliance, thereby lowering customer bargaining power.

Customers in the IT distribution sector, primarily resellers, exhibit significant price sensitivity due to tight profit margins, often in the 15-20% range globally as of 2024. This sensitivity is exacerbated by the commoditization of many IT products, where price becomes the primary differentiator, leading to potential year-over-year price drops of up to 10% in some categories, as observed in 2023.

The bargaining power of customers is further influenced by the fragmented nature of the IT distribution market, valued at roughly $400 billion in 2024, which offers resellers numerous alternatives to distributors like ALSO Holding. This broad availability of substitute distributors, including major players like TD Synnex and Ingram Micro, grants customers considerable leverage, enabling them to negotiate better pricing and service terms.

Furthermore, the limited ability of most resellers to backward integrate—sourcing directly from manufacturers or developing their own logistics and financial services—due to high capital requirements (potentially millions of euros) significantly reduces their leverage. ALSO's comprehensive B2B marketplace, encompassing these services, makes it economically impractical for resellers to bypass the distributor, thus diminishing their bargaining power.

Preview the Actual Deliverable

ALSO Holding Porter's Five Forces Analysis

This preview showcases the complete, professionally written Porter's Five Forces Analysis for ALSO Holding, offering an in-depth examination of competitive pressures. The document displayed is precisely what you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently expect to download this exact, fully formatted analysis, ready for immediate use in your strategic planning. What you see here is the final, actionable report, providing comprehensive insights into ALSO Holding's market landscape.

Rivalry Among Competitors

The ICT distribution landscape features a mix of global giants like TD Synnex and Ingram Micro, alongside a considerable number of smaller, regional, and niche players. ALSO Holding AG operates within this competitive environment as a major European technology provider, contending with these established, often larger, entities.

In 2024, the market demonstrated a trend towards consolidation, with the top fifteen distributors collectively holding more than 61% of the global IT distribution market share. This concentration highlights the significant presence of a few dominant companies and intensifies the rivalry for all participants, including ALSO Holding.

The ICT market's robust growth, projected to expand from USD 5,751 billion in 2024 to USD 9,691.5 billion by 2033 at a 6.5% CAGR, offers a dynamic environment. This expansion, fueled by digital transformation, cloud, AI, and cybersecurity, can temper direct rivalry by increasing the overall market size. However, this very growth attracts new entrants and intensifies competition for dominance in lucrative segments.

ALSO Holding actively combats intense competitive rivalry by moving beyond simple product distribution. Their strategy centers on building a comprehensive ecosystem that integrates logistics, financial services, and IT solutions. This comprehensive offering, particularly their focus on digital platforms like cloud, AI, and cybersecurity, sets them apart from competitors who might only offer hardware or software.

By evolving from a transactional "box mover" to a value-added technology solutions provider, ALSO significantly reduces direct price-based competition. This strategic shift means customers are drawn to the integrated benefits and expertise, rather than solely focusing on the lowest price for individual components. In 2023, ALSO reported a significant portion of their revenue growth coming from these higher-margin, faster-growing solution and service segments, underscoring the effectiveness of this differentiation strategy.

Switching Costs for Competitors' Customers

ALSO actively works to increase switching costs for its customers through deeply integrated service platforms and comprehensive agreements. However, competitors are equally engaged in retaining their existing client bases. They employ similar strategies such as offering bundled services, implementing loyalty incentives, and nurturing strong customer relationships to minimize churn. This creates a dynamic environment where customer loyalty is a constant battleground.

The high cost associated with acquiring new customers in a mature market intensifies the focus on retention. For instance, in the IT distribution sector, customer acquisition costs can represent a significant portion of a company's sales and marketing budget. Therefore, the ability of companies like ALSO to effectively lock in resellers via robust service agreements and seamless platform integration is a critical competitive advantage. This strategic imperative drives innovation in customer service and platform development.

- Customer Retention Focus: Competitors are actively implementing loyalty programs and integrated service offerings to keep their existing customers.

- Acquisition Costs: Acquiring new customers in the mature IT distribution market is expensive, making retention a key strategic focus for all players.

- Platform Integration: Companies like ALSO leverage comprehensive service agreements and platform integration to create significant switching costs for resellers.

- Competitive Landscape: The struggle for customer loyalty is fierce, with significant effort invested in maintaining client relationships and minimizing customer attrition.

Exit Barriers

High fixed costs within the distribution sector, a core area for ALSO Holding, act as significant exit barriers. Companies invest heavily in logistics networks, warehousing, and specialized IT systems, making it costly to divest or cease operations. This capital intensity means that even during periods of reduced profitability, businesses may continue to operate, contributing to sustained competitive rivalry.

Specialized assets further entrench companies in the market. For instance, tailored fleet management systems or specific warehouse automation technologies are not easily redeployed, forcing distributors to maintain operations. Established long-term contracts with suppliers and customers also lock companies into the market, preventing a swift exit and perpetuating competition. In 2024, the ongoing investments in digital transformation within the IT and logistics infrastructure for distributors are likely to have further amplified these exit barriers.

- High Capital Investment: The need for substantial upfront capital in logistics and IT infrastructure creates significant hurdles for exiting the market.

- Specialized Assets: Investments in unique distribution technology and infrastructure are difficult to liquidate or repurpose, encouraging continued operation.

- Long-Term Contracts: Existing agreements with suppliers and clients bind companies to market participation, reducing flexibility to leave.

- Sustained Rivalry: The combination of these factors can lead to prolonged intense competition, as companies are reluctant to incur losses from exiting.

Competitive rivalry in the ICT distribution sector is intense, with global players like TD Synnex and Ingram Micro alongside numerous regional specialists. ALSO Holding AG operates in this demanding environment, facing pressure from larger, established companies.

The market, while growing, shows consolidation trends, as evidenced by the top fifteen distributors holding over 61% market share in 2024. This concentration means companies must differentiate beyond price, with ALSO focusing on integrated solutions and digital platforms to reduce direct price wars.

Customer retention is a critical battleground, with high acquisition costs in this mature market pushing companies to build loyalty through integrated platforms and services. This strategic emphasis on value-added offerings and customer lock-in helps mitigate intense head-to-head competition for individual transactions.

High fixed costs, including significant investments in logistics and IT infrastructure, coupled with specialized assets and long-term contracts, create substantial exit barriers. These factors contribute to sustained competitive rivalry as companies are incentivized to continue operations despite potential profitability challenges.

| Competitor Type | Market Share (2024 Est.) | Key Strategies |

|---|---|---|

| Global Giants (e.g., TD Synnex, Ingram Micro) | > 61% (Top 15 Combined) | Scale, broad portfolios, extensive logistics networks |

| Major European Players (e.g., ALSO Holding) | Significant, but varies by region | Value-added services, digital platforms, ecosystem building |

| Regional & Niche Players | Smaller, localized share | Specialized expertise, tailored customer service |

SSubstitutes Threaten

Resellers might consider bypassing distributors like ALSO and sourcing directly from manufacturers, particularly for high-volume or niche products. This could reduce costs and offer more control over the supply chain.

However, for the vast majority of resellers, the practicalities of direct sourcing are daunting. The logistical hurdles of managing multiple vendor relationships, the significant upfront financial investment in inventory, and the challenge of accessing a broad product portfolio make this approach inefficient and expensive compared to using a consolidated distributor.

ALSO's established position as a central B2B marketplace significantly streamlines the procurement process. By offering a single point of contact for a wide array of products, simplified credit terms, and consolidated logistics, it provides a more cost-effective and operationally efficient solution for most resellers.

In 2023, ALSO Holding reported revenue of €13.7 billion, underscoring the scale of its operations and the value it provides in simplifying complex supply chains for a broad reseller base.

The proliferation of cloud marketplaces, such as those offered by AWS, Azure, and Google Cloud, alongside direct subscription services from software giants like Microsoft 365, presents a significant substitute for traditional software distribution channels. These platforms allow customers to bypass intermediaries like ALSO, accessing software and cloud services directly.

However, ALSO proactively addresses this threat by cultivating its own robust cloud marketplace and providing direct subscription-based cloud services. This strategic pivot positions ALSO not as a bypassed entity, but as a crucial facilitator within the evolving cloud ecosystem.

This strategy is clearly paying off. In 2024, ALSO experienced a substantial 31% surge in its cloud revenue, reaching EUR 1,133 million. This demonstrates their successful adaptation to the shift towards direct cloud consumption models.

Large vendors may try selling directly to end-customers, bypassing distributors. This strategy is usually confined to massive accounts or specialized product categories. Vendors often lack the widespread reach, local presence, and crucial services such as financing, logistics, and technical support that distributors offer to their extensive reseller networks.

Distributors like ALSO Holding are vital for vendors to penetrate markets and effectively manage their sales channels. For instance, in 2024, the IT distribution market, where ALSO operates, continued to demonstrate the value of this intermediary role, with robust demand for comprehensive service offerings that individual vendors struggle to replicate across diverse customer segments.

Specialized Service Providers

The threat of specialized service providers exists for ALSO Holding, particularly in specific IT service niches. End-customers might bypass traditional resellers to engage directly with highly specialized consultancies offering tailored solutions, potentially diminishing the need for hardware and software sourced through intermediaries. For instance, niche cybersecurity firms or IoT integration specialists could attract clients seeking highly specific expertise not readily available through broad-line distributors.

To mitigate this, ALSO Holding has strategically broadened its scope beyond mere product distribution. The company actively expands its own 'Solutions' and 'Service' divisions. These divisions offer a comprehensive suite of IT services, encompassing areas like advanced cybersecurity, Internet of Things (IoT) implementation, virtualization technologies, and artificial intelligence (AI) solutions.

This strategic pivot allows ALSO to capture value further up the IT service chain, directly competing with specialized providers. For example, in 2024, ALSO reported significant growth in its Services segment, contributing to its overall revenue diversification and strengthening its competitive position against niche players.

- Broadening Service Portfolio: ALSO's investment in cybersecurity, IoT, virtualization, and AI services directly addresses customer needs for specialized solutions.

- Direct Customer Engagement: By offering end-to-end solutions, ALSO reduces the reliance on specialized third-party providers for critical IT functions.

- Competitive Advantage: This strategy positions ALSO as a comprehensive IT partner rather than just a hardware or software distributor, enhancing its value proposition.

- Market Adaptation: The expansion into services reflects a proactive response to evolving market demands, where integrated solutions are increasingly preferred.

Internal IT Departments of Large Enterprises

Large enterprises with well-established internal IT departments present a notable substitute threat. These organizations often possess the internal expertise and resources to manage their own IT procurement, integration, and maintenance, potentially bypassing external channel partners like ALSO. For instance, a major financial institution might have a dedicated team capable of negotiating directly with hardware manufacturers for bulk purchases, thus diminishing the need for a distributor.

However, this threat is often mitigated by the inherent complexities and scale of modern IT environments. Even sophisticated internal IT teams frequently rely on distributors for several key reasons. These include gaining access to a broader range of vendors and product portfolios than they could manage directly, benefiting from the purchasing power that allows for competitive pricing on large-scale deployments, and securing specialized technical support for niche or cutting-edge technologies.

Furthermore, the rapid pace of technological change means that even large enterprises can find it challenging to maintain in-house expertise across all emerging areas. Distributors can act as valuable aggregators of knowledge and solutions, simplifying the adoption of new technologies. For example, a company looking to implement advanced AI solutions might find it more efficient to work with a distributor that has pre-vetted multiple vendors and offers integrated support.

- Internal IT capabilities can reduce reliance on external resellers for direct procurement.

- Distributors offer advantages in bulk purchasing power and vendor diversity.

- Specialized support for complex projects and emerging technologies remains a key value proposition of distributors.

- ALSO's ecosystem strategy aims to adapt to and cater to the evolving needs of these sophisticated enterprise IT departments.

The threat of substitutes for distributors like ALSO Holding arises from various channels that allow customers to bypass intermediaries. This includes direct sourcing from manufacturers, cloud marketplaces, and specialized service providers.

In 2024, cloud revenue for ALSO surged by 31% to EUR 1,133 million, demonstrating a successful adaptation to direct cloud consumption models. This highlights how cloud platforms themselves act as significant substitutes for traditional distribution, yet ALSO's own cloud offerings are mitigating this threat.

While large enterprises with strong internal IT departments can self-manage procurement, distributors offer crucial advantages like broader vendor access, bulk purchasing power, and specialized support, which remain vital for efficient IT management.

The IT distribution market in 2024 continued to show robust demand for the comprehensive service offerings that distributors provide, a role that individual vendors often struggle to replicate across diverse customer segments.

Entrants Threaten

Entering the ICT distribution sector demands substantial upfront capital. This includes building or leasing warehouses, establishing efficient logistics networks, investing in sophisticated IT systems for inventory and order management, and stocking significant inventory levels. For instance, major distributors often manage hundreds of millions in inventory.

ALSO, as an established player, benefits from its considerable asset base and substantial cash reserves, which naturally erects a high barrier for nascent competitors seeking to replicate its operational scale and financial muscle. In 2023, ALSO Holding reported revenues of €11.6 billion, indicating the scale of operations requiring significant capital.

Furthermore, the ICT distribution landscape necessitates robust financial services to support its business partners. Offering competitive credit lines to resellers and managing the associated financial risks adds another layer of capital intensity, making it challenging for undercapitalized entrants to compete effectively.

Established players like ALSO benefit from significant economies of scale in purchasing, logistics, and operational efficiency, allowing them to offer competitive pricing and services. For instance, in 2023, ALSO's revenue reached €13.1 billion, reflecting their substantial market presence and the operational efficiencies gained from high transaction volumes.

New entrants would struggle to match these cost advantages, especially when dealing with high-volume, low-margin products prevalent in the IT distribution sector. Replicating the purchasing power that comes with such scale is a considerable barrier.

ALSO's extensive network, built over years of operation, and its volume purchasing power are difficult for newcomers to replicate quickly. This established infrastructure provides a significant cost advantage.

New companies entering the IT distribution market face a significant hurdle in accessing established distribution channels and building crucial vendor and reseller relationships. For instance, ALSO Holding boasts an impressive network of over 800 vendors and approximately 135,000 resellers spanning multiple European countries.

This vast and deeply integrated ecosystem, cultivated over many years, represents a formidable barrier to entry. Newcomers would require substantial time and investment to replicate such an extensive and trusted network, making it difficult to gain comparable market access and establish credibility.

The sheer scale and longevity of ALSO's relationships with its partners are not easily overcome. This established network serves as a critical competitive advantage, effectively limiting the ability of new entrants to quickly penetrate the market and secure the necessary channel partnerships.

Product and Service Differentiation

ALSO Holding presents a robust defense against new entrants through its extensively diversified portfolio. Covering hardware, software, and IT services, with a strategic emphasis on cloud, AI, and cybersecurity, ALSO operates as a comprehensive technology solutions provider. For instance, in 2023, ALSO reported a revenue of €12.1 billion, demonstrating the scale of its operations.

New competitors would find it exceptionally challenging to match this breadth and depth. To gain traction, they would need to present a highly specialized or niche value proposition that addresses unmet market needs not already covered by ALSO's integrated offerings. The sheer complexity involved in managing such a wide array of product categories and value-added services presents a significant barrier to entry.

Consider the following aspects of differentiation:

- Broad Technology Spectrum: ALSO's engagement spans from foundational hardware to advanced AI and cybersecurity solutions, creating a comprehensive ecosystem.

- Integrated Service Delivery: The ability to offer end-to-end solutions, from procurement to managed services, is a key differentiator that new entrants would struggle to replicate.

- Market Reach and Partnerships: Established relationships with numerous vendors and a wide customer base provide ALSO with significant market leverage, a hurdle for newcomers.

Regulatory Hurdles and Compliance

The threat of new entrants into the IT distribution and services market, particularly for a company like ALSO Holding, is significantly mitigated by the complex web of regulatory hurdles and compliance requirements across its operating regions. Navigating these intricate landscapes is a substantial barrier for any newcomer.

Operating across multiple European countries necessitates a deep understanding and adherence to diverse trade regulations, stringent data privacy laws such as the General Data Protection Regulation (GDPR), and varying tax compliance frameworks. Established companies, including ALSO, have already invested in the necessary expertise, infrastructure, and systems to effectively manage these complexities. This established operational capability presents a formidable challenge for new entrants attempting to enter the market.

Furthermore, the ongoing costs and operational complexity associated with maintaining compliance with these regulations add a significant financial and administrative burden, deterring many potential new market participants. For example, in 2024, the cost of compliance for businesses operating in the EU continued to be a major consideration, with GDPR-related fines alone reaching substantial figures for non-compliant entities.

- Regulatory Complexity: Operating in multiple European countries involves mastering diverse trade, data privacy (GDPR), and tax laws.

- Established Expertise: Companies like ALSO possess existing knowledge and systems to handle these regulatory demands.

- Cost of Compliance: New entrants face elevated operational costs and administrative burdens to meet legal requirements.

- Market Entry Barrier: The combined effect of regulatory complexity and compliance costs significantly raises the barrier to entry.

The threat of new entrants into the IT distribution sector is considerably low for ALSO Holding due to the immense capital requirements for establishing operations, including warehousing, logistics, and IT systems. For instance, in 2023, ALSO Holding reported revenues of €13.1 billion, highlighting the scale of investment needed to compete at this level.

Newcomers face significant challenges in replicating ALSO's established vendor and reseller networks, which have been cultivated over many years. ALSO's extensive ecosystem, featuring over 800 vendors and approximately 135,000 resellers as of recent reports, provides a substantial market access advantage that is difficult and costly for new firms to duplicate.

Furthermore, regulatory complexities across various European markets, including data privacy laws like GDPR, impose significant compliance burdens and costs on new entrants. Companies like ALSO have already invested in the expertise and infrastructure to navigate these regulations, creating a substantial barrier to entry for unprepared competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ALSO Holding is built upon a foundation of financial reports, industry expert analyses, and market intelligence platforms. We also incorporate data from company filings and relevant trade publications to provide a comprehensive view of the competitive landscape.