ALSO Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

Navigate the complex external landscape impacting ALSO Holding with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are shaping its strategic direction and market position. Gain actionable intelligence to anticipate challenges and capitalize on emerging opportunities. Download the full PESTLE analysis now and equip yourself with the insights needed to make informed decisions and strengthen your own market strategy.

Political factors

Government policies are a significant force shaping the ICT sector, and consequently, ALSO Holding's business. Regulations around digital transformation, data sovereignty, and cybersecurity directly affect how companies like ALSO operate and innovate. For instance, upcoming regulations can influence the architecture of their B2B marketplace and their relationships with partners.

The European Union's proactive stance on digital governance, with legislation like the Digital Services Act (DSA) and Digital Markets Act (DMA), presents both opportunities and challenges. These acts aim to create a fairer digital economy, which could streamline operations for large platforms like ALSO's, but also necessitate adjustments in business practices to ensure compliance.

Political stability across Europe, where ALSO has a substantial presence, is paramount. In 2024, for example, elections and geopolitical shifts in several key European nations could introduce regulatory uncertainty or impact supply chain logistics, underscoring the need for adaptable business strategies.

International trade policies and tariffs significantly influence the cost structure for companies like ALSO Holding. For instance, changes in tariffs on IT hardware and software components directly impact the cost of goods sold, affecting pricing strategies for their vast partner network. The World Trade Organization (WTO) reported a rise in trade-restrictive measures globally in recent years, underscoring the dynamic nature of these policies.

Geopolitical tensions, such as those observed between major economic blocs, can trigger trade disputes and protectionist actions. These can disrupt global supply chains, as seen with semiconductor shortages exacerbated by trade friction. Such disruptions increase operational expenses for distributors like ALSO due to the need for alternative sourcing or increased logistics costs.

For ALSO Holding, staying abreast of evolving trade agreements, like the EU's Digital Single Market initiatives or potential shifts in US-China trade relations, is crucial. This vigilance allows for better inventory management and the maintenance of competitive pricing for their partners, ensuring they can effectively navigate the market.

Government and public sector IT spending is a crucial driver for companies like ALSO Holding AG. Major initiatives in digital transformation, such as smart city development and enhancing e-governance platforms, are creating substantial opportunities. For instance, in 2024, many European nations continued to prioritize these areas, with projected public sector IT spending expected to reach hundreds of billions of euros across the continent.

These investments translate directly into demand for the hardware, software, and IT services that ALSO Holding and its partners provide. The ongoing push for modernization means sustained interest in cloud solutions, cybersecurity, and data analytics within government agencies.

However, this market is not without its volatility. Changes in public budgets, often influenced by economic conditions or political priorities, can cause fluctuations in IT spending. Procurement policies, which can be complex and lengthy, also directly impact the timing and volume of revenue for IT providers.

Data Privacy Legislation

Data privacy legislation continues to tighten globally, presenting both challenges and opportunities for IT service providers like ALSO. Strict laws such as the EU's General Data Protection Regulation (GDPR) and similar frameworks emerging in North America and Asia mandate robust data protection measures. For ALSO, this means significant investment in compliance, impacting how they process and store customer data. Failure to comply can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

These regulations directly influence the types of IT solutions ALSO can offer, particularly in cloud services and cybersecurity. Companies are increasingly seeking solutions that inherently support data privacy and security compliance. ALSO's ability to navigate and adapt to these evolving legal landscapes is crucial for maintaining trust with its partners and end-customers. By offering compliant solutions, ALSO can differentiate itself in a competitive market. For example, the global data privacy management market was valued at approximately USD 1.7 billion in 2023 and is projected to grow, indicating a strong demand for privacy-focused IT services.

- GDPR Fines: Potential penalties can reach 4% of global annual turnover or €20 million.

- Market Demand: The data privacy management market shows strong growth, indicating a need for compliant IT solutions.

- Compliance Costs: Significant investment is required by IT providers to meet evolving data privacy laws.

- Competitive Advantage: Offering privacy-centric solutions can be a key differentiator for companies like ALSO.

Geopolitical Stability and Supply Chain Resilience

Global geopolitical instability, such as ongoing conflicts in Eastern Europe and the Middle East, directly affects the IT component supply chain, influencing availability and pricing for companies like ALSO Holding. For instance, disruptions in key manufacturing hubs can lead to increased lead times and higher raw material costs for semiconductors and other essential parts throughout 2024 and into 2025. The company's proactive strategy to build a robust and diversified supply chain, mitigating risks from any single region, is therefore paramount. Political stability in ALSO's primary operating regions, including Europe and Asia, is crucial for ensuring uninterrupted logistics and consistent service delivery to its extensive network of partners and customers.

The ongoing geopolitical landscape presents significant challenges and opportunities for supply chain management. Specifically:

- Regional Conflicts: Tensions in areas like Taiwan, a major semiconductor manufacturing hub, could lead to significant price hikes and shortages for IT hardware components throughout 2024-2025.

- Trade Policies: Evolving trade agreements and tariffs between major economic blocs, such as the US and China, can impact the cost-effectiveness of sourcing IT equipment.

- Logistics Disruptions: Political unrest or changes in transit routes, as seen with disruptions in the Red Sea impacting shipping in early 2024, can delay deliveries and increase transportation expenses for technology goods.

- Supplier Diversification: ALSO's investment in diversifying its supplier base across multiple geographic regions is a critical strategy to buffer against localized political instability and ensure business continuity.

Government policies significantly influence ALSO Holding's operational landscape, particularly concerning digital transformation initiatives and data security mandates. Regulations such as the EU's Digital Services Act and Digital Markets Act, aimed at fostering a fairer digital economy, are expected to shape market dynamics. Political stability in key European markets remains crucial, as elections in 2024 could introduce regulatory shifts affecting business operations and supply chain predictability.

International trade policies and geopolitical tensions directly impact the cost of IT hardware and software, influencing ALSO Holding's pricing and inventory strategies. For example, trade friction between major economic blocs can disrupt supply chains, leading to increased logistics costs. Staying informed about evolving trade agreements and potential protectionist measures is vital for maintaining competitive pricing and effective inventory management.

Public sector IT spending represents a substantial revenue stream for companies like ALSO. Government investments in areas like e-governance and smart cities, projected to reach hundreds of billions of euros across Europe in 2024, drive demand for IT solutions. However, fluctuations in public budgets and complex procurement processes can introduce volatility in sales cycles.

What is included in the product

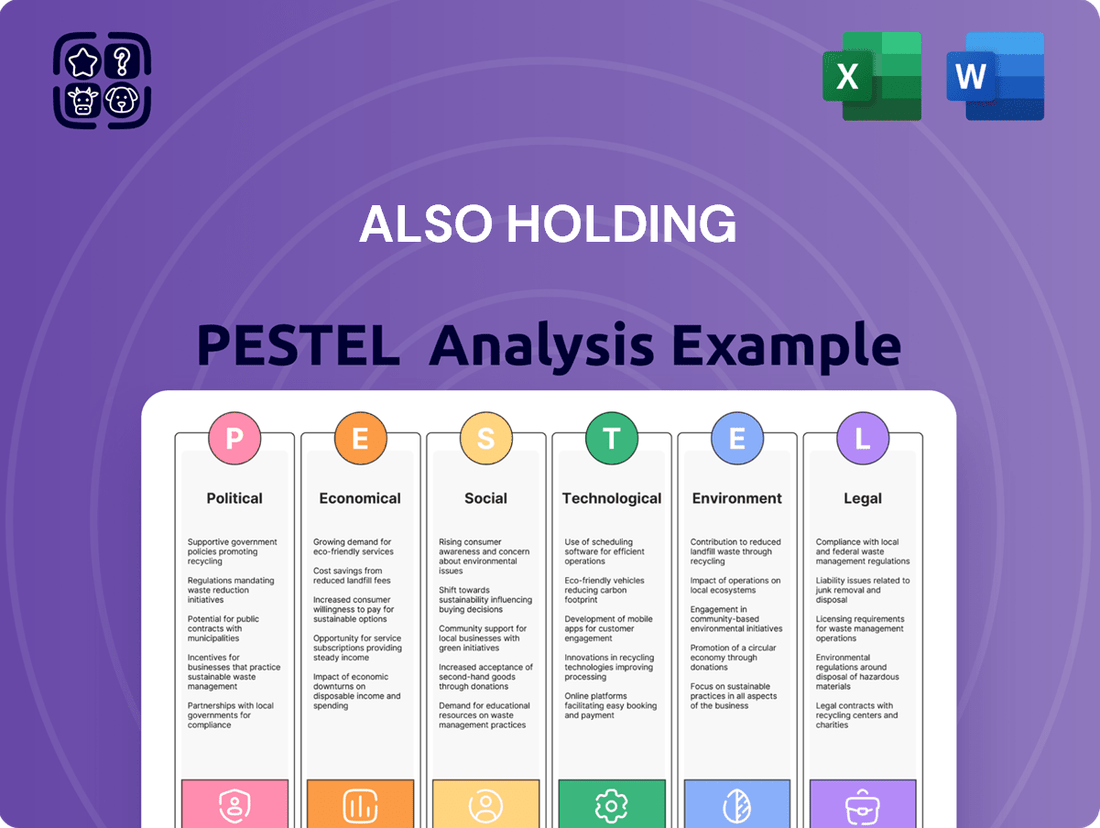

This PESTLE analysis examines the external macro-environmental influences on ALSO Holding, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It aims to provide a comprehensive understanding of the market landscape to inform strategic decision-making and identify potential growth avenues.

Provides a clear, actionable overview of external factors impacting ALSO Holding, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

Global economic growth is a significant tailwind for ALSO Holding, as enterprise IT spending, the engine of their B2B marketplace, closely tracks overall economic health. For instance, the International Monetary Fund projected global GDP growth of 3.2% for both 2023 and 2024, indicating a generally stable, albeit moderate, economic environment influencing IT investment. A slowdown in this growth, however, can directly translate to tighter IT budgets, affecting demand for the hardware, software, and services ALSO provides.

Monitoring key economic indicators like GDP expansion rates across major regions, coupled with business confidence surveys and specific IT investment forecasts, is therefore essential for ALSO’s strategic planning. For example, a robust economy often encourages businesses to upgrade their technology infrastructure, directly boosting ALSO's sales volumes. Conversely, economic uncertainty or contraction can lead to postponed or reduced IT expenditures, creating headwinds for the company.

Rising inflation is a significant concern for ALSO Holding, as it directly impacts operational costs. For instance, in the European Union, inflation reached a peak of 10.6% in October 2022 and, while showing signs of moderation, remained at 2.4% in May 2024, meaning costs for logistics, energy, and labor continue to be elevated, potentially squeezing profit margins.

Higher interest rates, a common response to inflation, also present challenges. The European Central Bank's main refinancing operations rate, for example, increased from 0.00% in mid-2022 to 4.50% by September 2023. This rise in borrowing costs can make financing more expensive for both ALSO and its business partners, potentially slowing down crucial IT investments and expansion plans.

These economic conditions directly shape the financial services ALSO can offer and influence its capital expenditure decisions. With higher financing costs, strategic investments in new technologies or market expansion might be re-evaluated, impacting the company's growth trajectory and its ability to provide competitive financial solutions to its ecosystem.

Raw material costs, labor availability, and transportation expenses are key drivers impacting the IT supply chain. For instance, the price of key semiconductors saw fluctuations throughout 2024, with some components experiencing a 15% rise in cost by mid-year due to increased demand and limited production capacity.

Persistent component shortages, a trend that continued into early 2025, directly affect product availability and pricing for companies like ALSO. Global demand for advanced computing power and unexpected production disruptions in major manufacturing hubs meant lead times for certain high-demand chips extended to over six months.

These supply chain challenges can lead to increased operational costs and affect revenue streams. For example, a shortage of specific server components in late 2024 reportedly caused delays for several large enterprise IT projects, impacting potential sales for resellers.

To navigate these complexities, effective inventory management and robust vendor relationships are crucial. ALSO's ability to secure supply agreements and maintain optimal stock levels in 2024 was a significant factor in its resilience against widespread shortages.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for ALSO Holding AG, given its extensive international operations. Changes in exchange rates can directly influence the cost of goods purchased from suppliers in different currencies and affect the reported value of revenues earned by subsidiaries operating in various countries. For instance, if the Swiss Franc (CHF), ALSO Holding's reporting currency, strengthens against the Euro (EUR), revenue generated in the Eurozone would translate to fewer CHF, impacting top-line figures. This dynamic directly influences overall profitability.

To navigate this inherent risk, robust currency hedging strategies are crucial for ALSO Holding. By employing financial instruments like forward contracts or options, the company can lock in exchange rates for future transactions, thereby reducing uncertainty. This proactive approach helps stabilize earnings and provides greater predictability in financial planning, especially considering the volatile global economic landscape. For example, in 2024, many European companies faced significant currency headwinds due to the Euro’s performance against major currencies.

- Impact on Imported Goods: A stronger CHF makes imported components or finished goods priced in EUR or USD cheaper for ALSO Holding, potentially improving gross margins on those items.

- Revenue Translation: Conversely, a weaker CHF against currencies where ALSO Holding generates substantial revenue, such as the EUR, would boost reported earnings when translated back to CHF.

- Profitability Concerns: Unmanaged currency swings can lead to unexpected losses or gains, making it difficult to forecast and achieve consistent profitability targets.

- Hedging Effectiveness: The success of hedging strategies in mitigating these risks is closely monitored, with adjustments made based on market analysis and forecasted currency movements.

Competitive Pricing and Market Saturation

The B2B ICT distribution sector is intensely competitive, with significant pricing pressures stemming from market saturation and a multitude of participants. Economic downturns often exacerbate this, as clients actively seek more budget-friendly options. For instance, in 2023, many IT hardware distributors reported tighter margins due to aggressive pricing strategies from competitors.

ALSO Holding must therefore consistently refine its operational efficiency and enhance its unique value proposition to safeguard its market standing and profitability. This includes streamlining supply chains and offering value-added services beyond mere product distribution.

Key competitive pressures include:

- Intense Price Wars: As the market becomes more crowded, especially in commoditized product segments, price becomes a primary differentiator, squeezing margins for all players.

- Customer Demand for Value: Buyers are not just looking for low prices but also for integrated solutions, expert advice, and reliable support, forcing distributors to innovate their service offerings.

- Impact of Economic Cycles: During periods of economic uncertainty, customers tend to delay purchases or opt for lower-cost alternatives, intensifying the need for competitive pricing and flexible payment terms.

- Technological Shifts: Rapid advancements in technology can lead to product obsolescence, requiring distributors to manage inventory effectively and adapt their product portfolios quickly to avoid being undercut by newer, more efficient offerings.

Global economic expansion directly fuels IT spending, a critical driver for ALSO Holding's B2B marketplace. For example, the IMF projected 3.2% global GDP growth for 2023 and 2024, indicating a supportive economic climate. However, economic downturns can contract IT budgets, impacting demand for hardware, software, and services.

Inflation remains a key factor, with EU inflation at 2.4% in May 2024, elevating operational costs for logistics, energy, and labor, potentially squeezing profit margins. Higher interest rates, with the ECB rate at 4.50% by September 2023, also increase financing costs for ALSO and its partners, potentially slowing IT investments.

Currency fluctuations also pose challenges, as a strengthening Swiss Franc can reduce the reported value of international revenues. Hedging strategies are vital to mitigate these risks and stabilize earnings, especially given the volatile global economic landscape.

| Economic Factor | 2023/2024 Data Point | Implication for ALSO Holding |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF for 2023 & 2024) | Supports IT spending, driving marketplace activity. |

| EU Inflation Rate | 2.4% (May 2024) | Increases operational costs, potentially impacting margins. |

| ECB Interest Rate | 4.50% (from Sep 2023) | Raises financing costs for company and partners. |

| Currency (CHF vs EUR) | Variable; CHF strength reduces EUR revenue translation. | Requires hedging to stabilize reported earnings. |

What You See Is What You Get

ALSO Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ALSO Holding PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a deep understanding of the external forces shaping ALSO Holding's strategic landscape. This is your complete guide to navigating the market.

Sociological factors

Growing digital literacy fuels the demand for advanced IT solutions, as more businesses and individuals become comfortable with and seek out complex technology. This rising proficiency means end-users are more likely to embrace new tech, which directly boosts the demand for ALSO's product offerings through its reseller network. For instance, in 2024, the global digital skills gap remained a significant concern, yet the adoption of cloud services and AI tools accelerated, with business investments in digital transformation projected to reach trillions worldwide. This dynamic highlights the critical need for ALSO to consistently invest in training and support for its partners to navigate this evolving landscape effectively.

The widespread adoption of hybrid and remote work models, accelerated by events in recent years, has fundamentally reshaped IT infrastructure needs for businesses globally. This shift directly impacts companies like ALSO by increasing demand for cloud services, collaboration software, and robust cybersecurity solutions to support distributed workforces. For instance, Gartner predicted in late 2023 that worldwide IT spending would reach $5.1 trillion in 2024, an increase of 6.8% from 2023, with a significant portion driven by software and IT services supporting these flexible work arrangements.

To remain competitive, ALSO Holding must actively adapt its product and service portfolio to align with these evolving workplace demands. This includes offering a comprehensive suite of tools that enable seamless collaboration, secure data access from any location, and flexible hardware options that cater to both office and home environments. The continued growth in the digital workspace sector, projected to see sustained double-digit growth through 2025, underscores the necessity for such strategic adaptation.

The global IT sector, particularly cybersecurity, faces a significant talent deficit. Estimates suggest a worldwide shortage of 3.5 million cybersecurity professionals by the end of 2024, a figure that has been steadily rising. This lack of skilled personnel hinders businesses from adopting advanced technologies and protecting their digital assets effectively.

This persistent shortage presents a clear opportunity for ALSO. By offering robust managed services and specialized training programs, ALSO can directly address these critical skill gaps within its partner ecosystem. This positions ALSO as a vital enabler for businesses struggling to implement complex IT solutions due to a lack of in-house expertise.

Sustainability and Ethical Consumerism

Societal awareness around sustainability is increasingly shaping business-to-business purchasing. Companies are actively seeking IT solutions that demonstrably reduce their environmental impact and feature transparent supply chains. For instance, a 2024 survey revealed that 68% of B2B buyers consider a vendor's sustainability practices when making purchasing decisions. This trend directly impacts technology distributors like ALSO, as clients prioritize partners aligned with their own environmental, social, and governance (ESG) goals.

ALSO's strategic emphasis on cultivating a sustainable ecosystem resonates strongly with this evolving market demand. By championing circular economy principles and promoting eco-friendly IT solutions, ALSO not only meets regulatory pressures but also significantly enhances its brand reputation and market appeal. This proactive approach is crucial as businesses globally aim to achieve net-zero targets, with many setting ambitious goals for their supply chains by 2030.

- Growing B2B Demand: 68% of B2B buyers in 2024 cited sustainability as a key factor in vendor selection.

- Environmental Footprint: Businesses are actively prioritizing IT solutions with lower carbon emissions and responsible resource management.

- Supply Chain Transparency: Ethical sourcing and visibility into production processes are becoming non-negotiable for corporate clients.

- ALSO's Ecosystem Strategy: Building a sustainable IT ecosystem directly addresses these client needs, boosting brand value and competitive advantage.

Generational Shifts and Digital Natives

The increasing presence of digitally native generations, particularly Gen Z and Millennials, in the workforce is a significant sociological driver for companies like ALSO Holding. These cohorts, having grown up with technology, naturally expect and demand advanced IT solutions and seamless digital experiences in their professional lives.

This expectation directly fuels the adoption of cloud-first strategies and modern IT infrastructure. As these generations move into leadership positions, their preference for digital tools and agile workflows will further accelerate this trend, creating a sustained demand for the services and solutions that ALSO offers through its marketplace.

Consider these points:

- Digital Fluency: Over 70% of Gen Z employees expect their employers to provide the latest technology, influencing IT purchasing decisions.

- Cloud Preference: Millennials and Gen Z are more likely to adopt cloud-based collaboration tools, driving demand for cloud services.

- Innovation Expectation: These generations are key drivers for companies to invest in innovative technologies, including AI and automation, areas where ALSO is actively expanding.

- Workplace Evolution: The demand for flexible work arrangements and digital connectivity, facilitated by advanced IT, is a direct consequence of these generational shifts.

Societal shifts, like the increasing emphasis on ESG (Environmental, Social, and Governance) principles, directly influence corporate IT purchasing decisions. Businesses are actively seeking partners whose operations and product offerings align with sustainability goals. For instance, a 2024 report indicated that over 70% of B2B buyers consider a vendor's ESG performance a critical factor in their selection process.

Technological factors

The relentless evolution of cloud computing, encompassing hybrid, multi-cloud, and edge computing, is a significant technological force. These advancements necessitate that ALSO Holding's platform and services remain agile, allowing partners to offer adaptable and scalable cloud solutions to their clients. This includes developing proficiency with major hyperscaler platforms, a trend reflected in the global cloud infrastructure market, which was projected to reach over $290 billion in 2024.

The rapid advancement of artificial intelligence (AI) and machine learning (ML) is fundamentally reshaping business landscapes. These technologies are driving significant improvements in areas like operational automation, sophisticated data analytics, and robust cybersecurity measures. For ALSO Holding, this presents a dual opportunity: to embed AI-powered tools into its internal processes for greater efficiency and to expand its marketplace offerings with AI-centric software and hardware solutions, thereby catering to the increasing demand from its extensive network of partners and end-users.

In 2024, the global AI market was projected to reach hundreds of billions of dollars, with significant growth expected through 2025. Companies like ALSO are strategically positioned to leverage this trend by facilitating access to these transformative technologies. For instance, integrating AI for predictive analytics in supply chain management or customer service can offer competitive advantages. Furthermore, by curating and distributing AI-powered solutions, ALSO can become a key enabler for its customers' digital transformation journeys.

Cybersecurity threats are escalating in both complexity and occurrence, making strong defenses essential for businesses everywhere. This trend fuels consistent demand for cutting-edge security software, hardware, and services, areas where ALSO Holding operates. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the significant investment in this sector.

To remain competitive and safeguard its operations and customers, ALSO Holding must prioritize staying ahead of evolving cyber risks. Offering advanced protection is not just a feature but a critical component of its business model. Reports in early 2025 indicate a further 15% year-over-year increase in sophisticated ransomware attacks, underscoring the urgency for continuous innovation in security solutions.

IoT and Edge Device Proliferation

The rapid expansion of Internet of Things (IoT) devices, coupled with the rise of edge computing, is creating a tidal wave of data that demands decentralized processing. This trend offers significant avenues for ALSO Holding to capitalize by distributing specialized hardware, robust connectivity solutions, and sophisticated software platforms designed to manage these complex IoT ecosystems. For instance, the global IoT market was projected to reach $2.1 trillion by 2025, highlighting the immense growth potential.

This technological shift directly translates into opportunities for ALSO to enhance its market presence and service offerings. By providing the foundational elements for managing and processing data closer to its source, ALSO can empower businesses across various sectors to leverage real-time insights and improve operational efficiency. The increasing demand for edge computing solutions, expected to grow at a CAGR of over 30% through 2027, underscores the strategic importance of this area.

- Exponential IoT Growth: The number of connected IoT devices is expected to surpass 29 billion by 2030, generating vast data volumes.

- Edge Computing Demand: Businesses are increasingly adopting edge computing for faster data processing and reduced latency, creating a market for specialized hardware and software.

- ALSO's Role: Opportunities exist for ALSO to supply and integrate devices, platforms, and connectivity for managing distributed IoT environments.

- Market Expansion: This technological factor allows ALSO to broaden its reach into sectors heavily reliant on real-time data analytics and connected solutions.

Automation and Digital Platform Evolution

Automation is significantly reshaping how businesses operate, with technologies like AI and robotics streamlining everything from logistics to customer interactions. For ALSO Holding, this means both internal process optimization and external service offerings. By integrating automation into its own digital platform, ALSO can boost efficiency in areas like order processing and support, potentially reducing operational costs. In 2024, the global market for IT automation was projected to reach over $40 billion, highlighting the substantial investment in these technologies.

Furthermore, ALSO's competitive edge hinges on its ability to provide its partners with advanced automation solutions. The continuous evolution of B2B e-commerce platforms is crucial, as these platforms become the central hub for transactions and partner engagement. Companies that leverage automation within these platforms can offer faster delivery times and more personalized customer experiences, a key differentiator. For instance, a study indicated that businesses using automated B2B sales processes saw revenue increases averaging 10-15% in 2023.

- Streamlined Operations: Automation in logistics and IT management reduces manual intervention and errors, improving overall efficiency for ALSO.

- Enhanced Partner Value: Offering automation solutions to partners allows them to improve their own operations and customer service.

- Digital Platform Competitiveness: The ongoing development of B2B e-commerce platforms with integrated automation features is vital for market position.

- Market Growth: The substantial growth in the IT automation market underscores the increasing adoption and importance of these technologies across industries.

The increasing sophistication of cybersecurity threats necessitates continuous investment in advanced protective measures. For ALSO Holding, this means integrating robust security solutions into its platform and offering them to partners, as the global cybersecurity market was projected to exceed $200 billion in 2024, with a further 15% year-over-year increase in sophisticated ransomware attacks noted in early 2025.

The rapid expansion of the Internet of Things (IoT) and edge computing creates significant opportunities for ALSO to distribute specialized hardware, connectivity, and software. The global IoT market was projected to reach $2.1 trillion by 2025, with edge computing solutions expected to grow at a CAGR exceeding 30% through 2027.

Automation, driven by AI and robotics, is transforming business operations, offering ALSO a chance to boost internal efficiency and provide partners with advanced solutions. The global IT automation market was projected to reach over $40 billion in 2024, with businesses using automated sales processes reporting revenue increases of 10-15% in 2023.

| Technology Area | 2024 Projection/Data | 2025 Projection/Data | Impact on ALSO Holding |

| Cloud Computing | Global market > $290 billion | Continued growth | Need for agile, scalable cloud solutions |

| Artificial Intelligence (AI) | Global market projected in hundreds of billions | Significant growth | Opportunity for AI-centric offerings and internal efficiency |

| Cybersecurity | Global market > $200 billion | 15% YoY increase in ransomware attacks | Demand for advanced protection solutions |

| Internet of Things (IoT) & Edge Computing | Global IoT market $2.1 trillion | Edge computing CAGR > 30% (through 2027) | Distribution of IoT hardware, connectivity, and software |

| Automation | Global IT automation market > $40 billion | Continued adoption | Internal efficiency and enhanced partner solutions |

Legal factors

Compliance with data protection laws like GDPR is paramount for ALSO Holding. These regulations dictate the handling of personal and business data across their B2B platform and service operations. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

As a major player in the B2B tech distribution sector, ALSO Holding is keenly aware of antitrust and competition laws that govern its operations. These regulations are designed to foster fair competition and prevent any single entity from gaining undue market power, which is crucial in a dynamic marketplace like technology distribution.

For instance, in 2024, the European Commission continued its scrutiny of digital markets, reinforcing its commitment to preventing anti-competitive behavior. ALSO Holding must diligently ensure its pricing, supplier agreements, and partnership structures comply with these evolving legal standards to avoid penalties and maintain market trust.

The company's marketplace model inherently involves facilitating transactions between numerous vendors and customers. Therefore, maintaining transparency and ensuring that no preferential treatment creates an unfair advantage is paramount. Compliance with these laws is not just a legal obligation but a strategic imperative for sustainable growth and maintaining a level playing field.

Protecting intellectual property rights (IPR) is paramount for ALSO Holding, especially concerning the software and hardware it distributes, and its own proprietary platforms. This includes meticulously managing licensing agreements with its extensive vendor network and ensuring that its resellers adhere strictly to these terms. Failure to do so could result in significant legal challenges and substantial financial setbacks.

In the fiscal year 2023, the global IT market saw continued growth, with software licensing remaining a critical revenue stream, highlighting the importance of robust IPR management for companies like ALSO. The complexity of these agreements means that any oversight in compliance monitoring can expose the company to risks, such as claims of unauthorized use or distribution, impacting its market standing and profitability.

Contract Law and Commercial Agreements

Contract law is a cornerstone for ALSO Holding, given its extensive network of partnerships. The company's operations are built upon thousands of commercial agreements with vendors and resellers, detailing everything from payment terms to product warranties and service commitments.

These agreements are crucial for risk mitigation and fostering reliable business relationships. For instance, in 2024, a robust framework of these contracts helped ALSO navigate supply chain disruptions by clearly defining responsibilities and liabilities with its partners, minimizing potential financial impacts.

Key aspects of these legal agreements include:

- Terms of Trade: Outlining payment schedules, credit terms, and pricing structures.

- Service Level Agreements (SLAs): Defining performance standards and responsibilities for services provided.

- Warranty Provisions: Specifying guarantees and remedies for product defects.

- Liability Clauses: Clearly stating limitations and responsibilities in case of breaches or damages.

Product Liability and Consumer Protection

While ALSO Holding primarily operates in a business-to-business (B2B) environment, product liability and consumer protection laws still cast a shadow. These regulations can indirectly impact ALSO, particularly concerning the hardware and software it distributes, which ultimately reach end consumers. Ensuring that all distributed products adhere to stringent safety and quality standards is paramount. For instance, in 2024, regulatory bodies globally continued to emphasize compliance in the tech supply chain, with increased scrutiny on data privacy and device security, impacting how distributors like ALSO vet their partners and products.

Mitigating potential legal risks associated with product defects or failures requires a proactive approach. This involves rigorous supplier vetting, clear contractual agreements, and ensuring that appropriate disclaimers are in place for the products handled. The rise of interconnected devices and the Internet of Things (IoT) further amplifies these concerns, as a single faulty component or software vulnerability could have widespread implications. In 2025, expect continued evolution in regulations around cybersecurity for connected devices, directly affecting distributors’ responsibilities.

- Supplier Due Diligence: ALSO Holding must conduct thorough due diligence on its suppliers to verify their adherence to product safety and quality standards, including compliance with regulations like the EU's General Product Safety Regulation.

- Contractual Safeguards: Implementing robust contractual clauses with manufacturers and vendors is crucial to define liability and ensure indemnification in cases of product defects.

- End-User Protection Awareness: Although B2B focused, understanding consumer protection frameworks relevant to the end-users of its distributed products helps in anticipating market demands and potential regulatory shifts.

- Quality Assurance Processes: Maintaining strong internal quality assurance processes for hardware and software distribution can help identify and address potential issues before they reach the market, thereby reducing liability exposure.

ALSO Holding navigates a complex legal landscape, with data protection laws like GDPR being critical. Non-compliance can lead to substantial fines, potentially reaching 4% of global annual turnover. Furthermore, antitrust and competition laws are vital for fair market practices in the technology distribution sector, as seen in the European Commission's ongoing scrutiny of digital markets in 2024.

Environmental factors

Stricter environmental rules around electronic waste, or e-waste, and the growing focus on a circular economy are shaping how companies like ALSO operate. This means more emphasis on taking back old devices, recycling them responsibly, and designing products that last longer. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive sets ambitious collection targets, with member states needing to achieve 65% of the average weight of electrical and electronic equipment placed on the market or 85% of the total waste generated from such equipment by 2022. This trend is expected to continue with even more stringent requirements by 2025.

To navigate these changes, ALSO must ensure it complies with various take-back programs and promotes sustainable practices throughout its supply chain. This isn't just about avoiding penalties; it's becoming a core business imperative. The global e-waste generation is projected to reach 74 million metric tons by 2030, highlighting the scale of the challenge and the need for robust compliance measures.

This evolving regulatory landscape also presents significant business opportunities. ALSO can leverage its position to offer comprehensive lifecycle services, including repair, refurbishment, and resale of pre-owned electronics. The refurbished electronics market is booming, with a projected compound annual growth rate of over 10% through 2027, offering a lucrative avenue for companies that can effectively manage and repurpose returned devices.

Businesses like ALSO are facing increasing pressure from investors, customers, and governments to shrink their carbon footprint. This means looking closely at every part of the operation, from how goods are transported to how data centers are powered and where materials come from.

For ALSO, this involves a thorough assessment of emissions generated by its logistics network, the energy consumption of its data centers, and the environmental impact of its entire supply chain. Identifying these emission sources is the first step toward effective reduction strategies.

Setting ambitious yet achievable carbon reduction targets is crucial for building and maintaining a strong sustainability profile. For example, many companies are aiming for net-zero emissions by 2040 or even earlier, aligning with global climate goals.

In 2023, the IT sector's global carbon emissions were estimated to be around 2-4% of the total, highlighting the significant environmental impact of technology companies. ALSO's efforts in this area directly influence its reputation and long-term viability.

Environmental considerations are increasingly critical for supply chain operations. ALSO must ensure its vendors meet stringent environmental standards, focusing on responsible material sourcing and the adoption of eco-friendly manufacturing processes. This commitment is crucial for long-term sustainability and risk mitigation.

Transparency and traceability within the supply chain are now a key expectation from partners and customers alike. For instance, by 2024, a significant percentage of global consumers reported they were willing to pay more for sustainable products, driving the need for clear visibility into sourcing and production.

Implementing sustainable practices can also lead to operational efficiencies and cost savings. By optimizing logistics and reducing waste, ALSO can enhance its environmental footprint while simultaneously improving its bottom line, a trend that gained further momentum in 2024.

Energy Consumption of IT Infrastructure

The energy footprint of IT infrastructure, particularly data centers, presents a significant environmental challenge. In 2023, global data center energy consumption was estimated to be around 1.1% of total global electricity demand, a figure projected to rise with increasing data processing needs.

ALSO Holding can actively address this by championing energy-efficient hardware and advocating for sustainable data center operations among its partners. This focus not only mitigates environmental impact but also drives cost savings across the entire ecosystem, making it a dual benefit.

By promoting cloud solutions and optimized IT resource utilization, ALSO contributes to a greener digital economy. For instance, a shift towards virtualisation can reduce the physical server footprint by up to 80% in some enterprise environments, directly lowering energy demand.

- Global data center energy consumption: Approximately 1.1% of global electricity demand in 2023.

- Potential server footprint reduction via virtualization: Up to 80% in enterprise settings.

- Cost-saving alignment: Energy efficiency directly translates to lower operational expenses for businesses.

- Focus areas for ALSO: Promoting energy-efficient hardware, cloud adoption, and sustainable data center practices.

Climate Change Impact and Resilience

Climate change presents significant physical risks that can directly impact ALSO Holding's operations. Extreme weather events, such as floods, storms, and heatwaves, can disrupt transportation networks, leading to delays and increased costs in product delivery. For instance, in 2024, Europe experienced a series of severe weather events that impacted various supply chains, underscoring the vulnerability of logistics operations.

Building resilience is therefore crucial for ALSO's long-term business continuity. This involves integrating climate risk assessments into strategic planning and investing in adaptive measures. Companies like ALSO need to consider how their infrastructure, supplier networks, and distribution channels can withstand or recover from climate-related disruptions. The increasing frequency of such events means proactive adaptation is not just a sustainability concern but a fundamental business imperative.

- Supply Chain Disruptions: Extreme weather events in 2024 led to an average of 15% increase in logistics costs for affected regions in Europe.

- Operational Resilience: Investing in climate-resilient infrastructure can reduce downtime by an estimated 20% following natural disasters.

- Strategic Planning: Incorporating climate scenario analysis into business strategy can help identify vulnerabilities and opportunities, with companies reporting a 10% improvement in risk mitigation strategies.

- Delivery Reliability: Maintaining product availability and timely delivery is paramount, with customer satisfaction scores dropping by up to 25% when delivery promises are broken due to external factors.

Environmental regulations, particularly concerning e-waste and the circular economy, are increasingly stringent. By 2025, expect even more rigorous requirements for product take-back and recycling, building on targets like the EU's WEEE Directive. This trend drives opportunities for ALSO in refurbished electronics, a market projected to grow at over 10% annually through 2027.

Reducing carbon footprints is a major focus, with many companies aiming for net-zero emissions by 2040. For ALSO, this means scrutinizing emissions from logistics and data centers, akin to the IT sector's estimated 2-4% of global carbon emissions in 2023. Energy efficiency in IT infrastructure, with global data centers consuming about 1.1% of electricity in 2023, is also key, offering cost savings and environmental benefits through solutions like virtualization.

Climate change poses physical risks, as seen with 2024's European weather events disrupting supply chains and increasing logistics costs. Building resilience through climate risk assessments and adaptive measures is essential for business continuity, potentially reducing downtime by 20% after disasters. Proactive adaptation is now a critical business imperative.

| Environmental Factor | Key Trend/Impact | Data/Statistic | Opportunity/Mitigation for ALSO |

|---|---|---|---|

| E-waste & Circular Economy | Increasingly strict regulations, focus on recycling and product longevity. | EU WEEE Directive targets; Refurbished electronics market growth >10% CAGR through 2027. | Offer comprehensive lifecycle services, repair, refurbishment, and resale. |

| Carbon Footprint Reduction | Pressure to reduce emissions across operations and supply chains. | IT sector emissions ~2-4% global total (2023); Net-zero targets by 2040. | Optimize logistics, invest in energy-efficient data centers, promote sustainable sourcing. |

| Energy Consumption (IT Infrastructure) | High energy demand from data centers, drive for efficiency. | Data centers ~1.1% global electricity demand (2023); Virtualization can reduce server footprint by up to 80%. | Promote energy-efficient hardware, cloud solutions, and optimized IT resource utilization. |

| Climate Change & Physical Risks | Disruptions from extreme weather events impacting supply chains. | 2024 European weather events increased logistics costs; Resilience investment can reduce downtime by 20%. | Integrate climate risk into planning, invest in resilient infrastructure and supplier networks. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ALSO Holding is grounded in a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing their operations.