ALSO Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

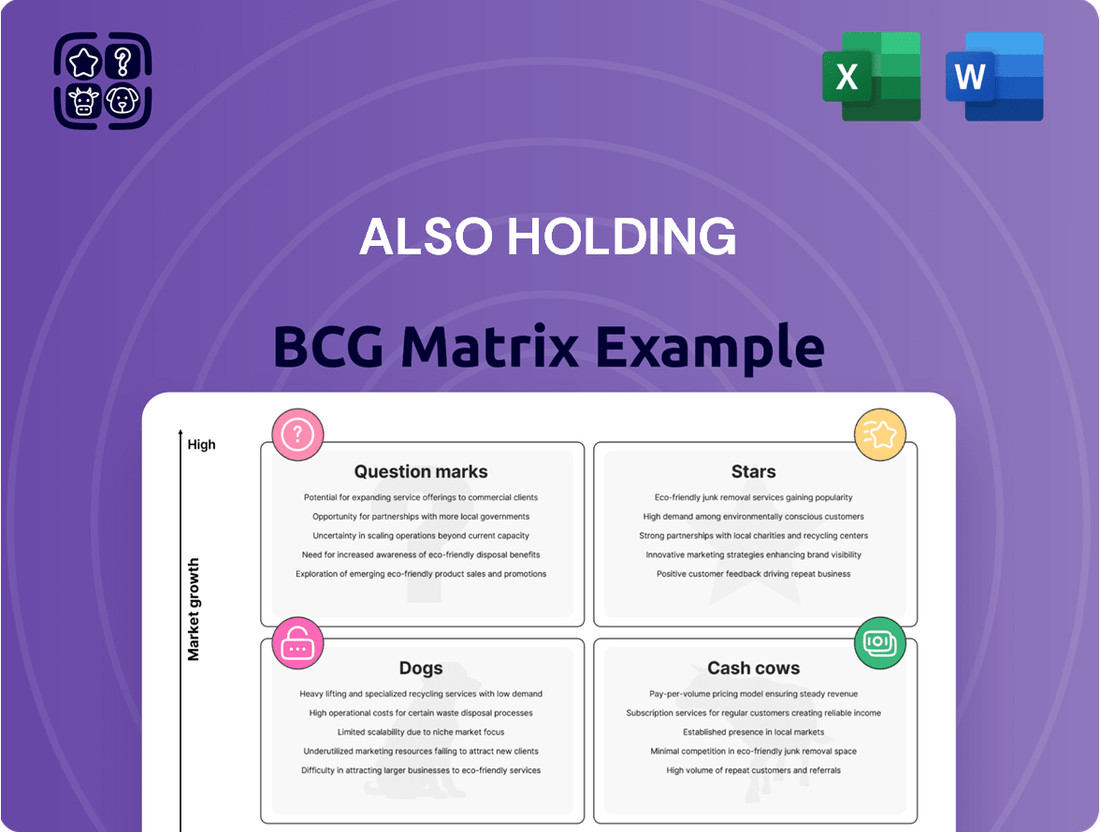

Unlock the strategic power of the ALSO Holding BCG Matrix with this insightful preview. See how their diverse portfolio is segmented into Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market performance and growth potential.

This snapshot highlights key areas for investment and divestment, but for a truly comprehensive understanding and actionable strategies, you need the full picture.

Purchase the complete ALSO Holding BCG Matrix to receive detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing their product portfolio and driving future success.

Don't miss out on the strategic clarity that will empower your decision-making.

Stars

Cloud Solutions and Services represent a major growth engine for ALSO Holding. In 2024, their cloud revenue surged by an impressive 31%, reaching EUR 1,133 million. This growth is attributed to an expanding user base and more effective monetization strategies.

ALSO is solidifying its role as a crucial indirect cloud provider across the EMEA region. The upcoming financial consolidation with Westcoast, effective from March 2025, is projected to boost total revenue past €15 billion, highlighting the scale and importance of their cloud operations.

This segment, which includes PaaS, SaaS, and IaaS brokering, is a strategic priority for ALSO. The company is channeling significant investment into further developing and expanding its digital platforms to capture more of the cloud market.

Cybersecurity Solutions represent a Stars category for ALSO Holding. The company is significantly bolstering its cybersecurity offerings to meet the escalating need for strong digital defenses in today's dynamic IT landscape. This strategic expansion includes new product introductions, such as the HYVER platform from partner CYE, specifically designed to streamline cybersecurity for small and medium-sized businesses (SMBs) through their Managed Service Provider (MSP) network, reaching customers across 32 countries.

This segment is demonstrably a standout performer within ALSO's digital platforms, showcasing both robust growth and a clear market emphasis. For instance, in 2024, ALSO reported substantial year-on-year growth in its cybersecurity business, driven by increased demand from businesses seeking to protect against sophisticated cyber threats. The HYVER platform, in particular, has seen rapid adoption among MSPs, enabling them to offer advanced, yet accessible, security solutions to their end clients.

ALSO Holding is strategically positioning its AI and Data Analytics Platforms in the 'Star' quadrant of the BCG Matrix. The company's substantial investments in these areas underscore their importance for future IT solutions, with digital platforms, including AI, demonstrating robust performance within the Service division.

This strategic emphasis directly addresses the accelerating AI integration trend across the Information and Communications Technology (ICT) market. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, with significant growth expected in enterprise applications, a segment where ALSO operates.

The strong performance of ALSO's AI-driven digital platforms positions them to capture substantial growth opportunities. By centralizing AI within its Service division, ALSO is not just keeping pace with industry trends but actively driving them, ensuring these platforms remain high-growth, high-market-share assets.

Sustainable IT Solutions

Sustainable IT Solutions represent a significant growth area for ALSO, aligning with their 'WIN with LESS' strategy. This initiative actively addresses climate change and champions a circular economy within the IT sector.

The company has set an ambitious target of a 30% reduction in carbon emissions by 2025. In 2023 alone, ALSO saw a substantial 23% increase in its sustainable product offerings, demonstrating a tangible commitment to eco-friendly IT.

This segment's expansion is fueled by escalating ecological awareness and growing regulatory mandates. ALSO is strategically positioning itself to capitalize on this high-growth market by building a robust presence.

- Growth Driver: Increasing ecological demands and regulatory pressures are propelling the sustainable IT solutions market.

- Company Commitment: ALSO's 'WIN with LESS' strategy actively targets climate change and promotes a circular economy.

- Performance Metric: A 23% increase in sustainable product lineup in 2023 highlights ALSO's dedication.

- Future Target: The company aims for a 30% reduction in carbon emissions by 2025.

Digital Workplace Solutions

Digital Workplace Solutions, encompassing collaboration tools and remote work infrastructure, demonstrate robust market demand. In 2024, the global digital workplace market was valued at approximately $65 billion, with projections indicating continued expansion. ALSO Holding's strategic focus on this area, offering Workplace as a Service (WaaS) and Device as a Service (DaaS), positions it to capitalize on this trend.

This segment is a strong performer within the BCG matrix due to sustained digital transformation initiatives. Businesses worldwide are investing in modernizing their IT infrastructure to support hybrid and remote work models. For example, by the end of 2024, an estimated 70% of enterprises were expected to have adopted some form of hybrid work policy, fueling the need for these solutions.

- High Demand: The market for digital workplace solutions remains exceptionally strong.

- ALSO's Offerings: Comprehensive services like WaaS and DaaS directly address client IT infrastructure evolution.

- Growth Drivers: Ongoing digital transformation across businesses consistently fuels sustained growth in this segment.

- Market Value: The digital workplace market reached around $65 billion in 2024, showcasing significant economic activity.

Cybersecurity Solutions, AI and Data Analytics Platforms, and Sustainable IT Solutions are ALL identified as Stars within ALSO Holding's BCG Matrix. These segments exhibit high growth potential and strong market positions, driven by increasing demand and strategic company investment.

Digital Workplace Solutions are also positioned as Stars, reflecting their robust market demand and ALSO's strategic focus on services like WaaS and DaaS. The company's commitment to these high-growth areas solidifies their role as key contributors to ALSO's overall performance and future strategy.

| BCG Category | Key Segments | 2024 Data/Context | Growth Driver | ALSO's Strategy |

|---|---|---|---|---|

| Stars | Cybersecurity Solutions | Substantial year-on-year growth reported in 2024. HYVER platform seeing rapid MSP adoption. | Escalating need for digital defenses against sophisticated cyber threats. | Bolstering offerings, new product introductions (HYVER). |

| Stars | AI and Data Analytics Platforms | Global AI market projected to reach hundreds of billions in 2024. Strong performance in Service division. | Accelerating AI integration trend across ICT market, especially enterprise applications. | Centralizing AI within Service division, driving industry trends. |

| Stars | Sustainable IT Solutions | 23% increase in sustainable product offerings in 2023. Target of 30% carbon emission reduction by 2025. | Escalating ecological awareness and growing regulatory mandates. | 'WIN with LESS' strategy, circular economy focus. |

| Stars | Digital Workplace Solutions | Global market valued at ~$65 billion in 2024. 70% of enterprises expected to adopt hybrid work by end of 2024. | Sustained digital transformation, support for hybrid and remote work models. | Offering WaaS and DaaS, capitalizing on IT infrastructure evolution. |

What is included in the product

The ALSO Holding BCG Matrix analyzes its business units based on market share and growth, guiding strategic investment and resource allocation.

The ALSO Holding BCG Matrix offers a clear, one-page overview, instantly clarifying which business units need investment and which are self-sustaining.

Cash Cows

Traditional hardware distribution remains a cornerstone for ALSO Holding, representing a significant portion of their business. This segment, encompassing everything from personal computers to enterprise servers and networking equipment, consistently generates substantial revenue for the company.

Despite a more mature market with slower growth rates, this sector acts as a reliable cash generator. ALSO's robust logistics infrastructure and well-established distribution network are key to their success here, ensuring efficient delivery and predictable income streams from these established product lines.

For instance, in 2024, the traditional hardware distribution segment continued to be a primary revenue driver for ALSO, underpinning their financial stability. This segment's ability to produce consistent cash flow is vital for funding investments in more dynamic and rapidly expanding areas of the technology market.

Standard software licensing represents a significant cash cow for ALSO Holding within its B2B marketplace model. The company's role in distributing essential software like operating systems and office suites benefits from consistent, high-volume demand.

This mature market allows ALSO to leverage its extensive reseller network and strong vendor partnerships, translating into predictable revenue streams with minimal need for aggressive marketing spend. For instance, in 2024, the ongoing need for productivity software across businesses ensures this segment remains a stable contributor.

ALSO Holding's logistics and warehousing services are a prime example of a cash cow within their B2B marketplace model for the ICT sector. These operations are crucial, providing a stable foundation that supports the entire ecosystem.

The efficiency of these services is a direct result of significant scale and deeply embedded, well-honed processes. This operational excellence translates into consistent and predictable cash flows, a hallmark of a strong cash cow.

In 2023, ALSO reported a substantial portion of its revenue and profit derived from its distribution and logistics segments, underscoring the maturity and stability of these operations. While growth in this specific segment might be moderate, its contribution to overall profitability and its role in enabling other, faster-growing parts of the business are invaluable.

These services are not just about moving goods; they are a critical enabler for ALSO's partners, ensuring timely delivery and reliable inventory management. This reliability fosters strong customer loyalty and reinforces ALSO's position as a key player in the ICT supply chain.

Basic Financial Services for Resellers

Basic Financial Services for Resellers, within ALSO Holding's portfolio, represent a classic cash cow. These services, which include vital credit and leasing options, are provided to a vast network of 135,000 resellers. This established offering generates stable and predictable income, leveraging ALSO's substantial market share among its partners.

The financial services segment is characterized by its maturity, exhibiting low growth rates. However, its high market share within the reseller ecosystem ensures it remains a consistent and reliable source of funds for the company. In 2023, ALSO reported a significant portion of its revenue stemming from these value-added services, underscoring their importance.

- Extensive Network: Serves 135,000 resellers.

- Stable Income: Provides predictable revenue streams through credit and leasing.

- Market Dominance: Holds a high market share among its partners.

- Low Growth, High Share: A mature offering that reliably generates cash.

Core IT Infrastructure Services

Core IT Infrastructure Services, a cornerstone of ALSO Holding's offerings, function as a classic Cash Cow within the BCG framework. These services, encompassing fundamental support, maintenance, and warranty management, are characterized by their high volume and stability. Their essential nature for reseller partners and end-customers ensures a consistent revenue stream, requiring minimal incremental investment for growth. The sheer scale of these operations translates into significant efficiency and reliable profitability in a mature market segment.

The predictability of these services allows ALSO to leverage their established infrastructure effectively. For instance, in 2023, ALSO reported a substantial portion of its revenue stemming from its extensive service portfolio, which heavily features these foundational IT support elements. This consistent demand underpins their Cash Cow status.

- High Volume, Low Growth: These services cater to a broad customer base with ongoing needs, but the market for basic IT infrastructure support is largely saturated, leading to low growth potential.

- Stable Revenue Stream: The essential nature of these services provides a predictable and reliable source of income for ALSO Holding.

- Minimal Investment Required: As a mature offering, these services benefit from existing infrastructure and processes, reducing the need for significant new capital expenditure.

- Profitability Driver: High operational efficiency due to scale allows these services to contribute significantly to ALSO's overall profitability.

The traditional hardware distribution segment for ALSO Holding consistently acts as a reliable cash generator. This mature market, while experiencing slower growth, forms a bedrock of revenue, supported by ALSO's efficient logistics and established distribution network. In 2024, this segment remained a key revenue driver, providing financial stability and funding for expansion into other technology areas.

Standard software licensing further solidifies ALSO's cash cow status. The high-volume demand for essential software, coupled with ALSO's extensive reseller network and strong vendor relationships, ensures predictable income with minimal marketing investment. The ongoing need for productivity software across businesses in 2024 maintained this segment's stable contribution.

ALSO's logistics and warehousing services are a prime example of a cash cow, providing a stable foundation for their ICT B2B marketplace. Operational excellence, driven by scale and refined processes, yields consistent and predictable cash flows. In 2023, distribution and logistics contributed substantially to ALSO's revenue and profit, highlighting their maturity and stability.

Basic financial services for resellers, including credit and leasing, are a classic cash cow for ALSO Holding, serving 135,000 partners. Despite low growth rates, their high market share ensures a stable and reliable income stream. In 2023, these value-added services significantly boosted ALSO's revenue.

Core IT infrastructure services, such as support and maintenance, are also considered cash cows. Their high volume and stability, stemming from essential needs, provide a consistent revenue stream with minimal new investment. In 2023, the extensive service portfolio, including these foundational IT support elements, represented a substantial portion of ALSO's revenue.

| Segment | BCG Status | 2023 Revenue Contribution (Approx.) | Key Characteristics | 2024 Outlook |

|---|---|---|---|---|

| Traditional Hardware Distribution | Cash Cow | Substantial | Mature market, high volume, stable demand | Continued revenue driver, stable financial contribution |

| Standard Software Licensing | Cash Cow | Significant | Predictable demand, strong network effects | Reliable income, minimal marketing spend needed |

| Logistics and Warehousing | Cash Cow | Substantial | Operational efficiency, scale-driven profitability | Enabler for other segments, consistent cash flow |

| Basic Financial Services for Resellers | Cash Cow | Significant | High market share, low growth, stable income | Continued predictable revenue from existing base |

| Core IT Infrastructure Services | Cash Cow | Substantial | Essential services, minimal investment, high efficiency | Consistent demand underpinning profitability |

What You See Is What You Get

ALSO Holding BCG Matrix

The preview you're currently viewing is the definitive ALSO Holding BCG Matrix document you will receive immediately after your purchase. This means the detailed analysis, clear visualizations, and strategic insights you see are precisely what will be delivered, ensuring no discrepancies or missing information.

Dogs

Niche legacy software offerings within ALSO Holding's portfolio likely represent products with a very small, perhaps even shrinking, customer base. These could be specialized applications that once served a particular industry need but are now largely superseded by newer technologies. Their market share is expected to be minimal, with little to no growth anticipated in the foreseeable future.

These legacy products typically generate very low revenue for ALSO. However, they can still incur ongoing costs related to maintenance, support, or even inventory management if physical media is involved. The challenge is that these resources could be better allocated to more promising areas of the business.

For instance, if a legacy software package requires annual maintenance fees of $50,000 but only generates $30,000 in revenue, it represents a net loss. Such situations, when aggregated across multiple niche offerings, can drain valuable capital and operational focus from growth-oriented segments. In 2024, companies across the tech sector were increasingly scrutinizing their product portfolios for such underperformers.

Therefore, niche legacy software offerings are strong candidates for divestiture or discontinuation. Selling these products, even at a low valuation, can free up capital and management attention, allowing ALSO to invest more heavily in its star performers or question marks, thereby optimizing resource allocation for higher returns.

Stocking obsolete hardware components for older IT systems would fall into the Dogs quadrant of the BCG Matrix. These items typically experience very low demand and exhibit minimal market growth, often leading to stagnant inventory and consequently, very limited sales. For instance, a 2024 report indicated that companies holding inventory of components for systems older than 10 years saw an average of 80% of that inventory remain unsold for over a year, tying up capital.

While these components might be necessary for very specific, rare support or maintenance cases, they generally do not contribute significantly to overall profitability. In fact, they can incur substantial holding costs, including storage, insurance, and the risk of obsolescence becoming even more pronounced. The carrying cost for such obsolete inventory can range from 15% to 30% of the inventory's value annually, a significant drain on resources.

Highly commoditized IT accessories, such as basic USB drives or generic mouse pads, often fall into the Dogs category within the BCG Matrix. These items typically feature low growth and low market share, characterized by intense price competition and minimal differentiation.

For instance, in 2024, the global market for computer peripherals, while large, saw many segments experiencing price erosion due to oversupply and the ubiquity of essential components. Products in this segment often operate on wafer-thin margins, sometimes as low as 1-3%, making them difficult to profit from significantly.

Such products can become cash traps, consuming resources for inventory management and marketing without generating substantial returns. Their low profitability means they contribute little to a company's overall financial health and may even drain resources that could be better allocated to more promising business units.

Underperforming Regional Markets

Even with a wide European reach, some of ALSO Holding's regional markets may not be performing as well. These specific areas might have a small market share and not much potential for future growth, even after the company has put money into them.

These regions could be using up valuable resources without bringing in the returns the company hoped for. This situation makes them prime candidates for a thorough strategic evaluation, possibly leading to a reduction in operations or a complete divestment.

For instance, in 2024, while the overall European IT distribution market showed resilience, certain smaller economies within the region experienced slower growth. Data from Canalys indicated that while Western Europe saw moderate gains, some Eastern European markets lagged, with growth rates dipping below 3% for specific segments where ALSO might have a presence.

- Underperforming Regions: Areas with low market share and limited growth prospects.

- Resource Drain: These markets may consume capital without delivering expected returns.

- Strategic Review: Candidates for scaling back operations or potential divestment.

- Market Context (2024): Some Eastern European markets showed growth rates below 3% in specific IT segments.

Outdated Managed Services Offerings

Managed services that have not evolved with current technological trends or market demands, such as those relying on older infrastructure or less efficient processes, could represent dogs in the BCG Matrix.

These services might struggle to attract new customers or retain existing ones, leading to low market share and minimal profitability. For instance, a managed IT service provider still heavily reliant on on-premises server management, while the market shifts aggressively towards cloud-based solutions, would likely find itself in this category. In 2024, companies offering only legacy IT support without cloud migration or cybersecurity enhancements are particularly vulnerable.

Consider these indicators:

- Declining Revenue: A consistent year-over-year drop in revenue for a specific managed service offering. For example, a 15% revenue decrease in 2023 for a company's traditional desktop support services.

- Low Customer Acquisition: An inability to attract new clients for the service, potentially with less than 5 new contracts secured in the last fiscal year.

- High Customer Churn: Existing clients increasingly opting out of the service, perhaps with a churn rate exceeding 20% annually for that particular offering.

- Minimal Investment: Lack of recent capital expenditure or R&D allocated to improving or updating the service, indicating a lack of future potential.

Products or services categorized as Dogs within ALSO Holding's portfolio typically exhibit both low market share and low market growth. These are often mature offerings that have seen better days, struggling to gain traction in the current market landscape.

For instance, in 2024, some older hardware models in ALSO's distribution might fall into this category. These products face intense competition from newer, more advanced alternatives, leading to stagnant or declining sales volumes. This can result in them becoming cash drains, consuming resources for inventory and marketing without generating significant returns.

The strategic approach for Dogs is usually to either divest them or discontinue them altogether. This frees up capital and management focus for more promising areas of the business, such as Stars or potential Question Marks. In 2024, many tech distributors were actively pruning their portfolios to shed these low-performing assets.

For example, a specific line of older, less popular printers distributed by ALSO might have a market share of less than 2% in a segment that is growing at only 1% annually. The associated costs of warehousing and supporting such products could outweigh the minimal revenue they generate.

Question Marks

ALSO's investment in IoT solutions and platforms positions it within a high-growth sector, but one where market share is still fluid. This strategic focus aims to capture future revenue streams in a rapidly evolving technological landscape.

Currently, these IoT ventures are in a high investment phase, demanding substantial capital for development and market penetration, which results in low immediate returns. This mirrors the typical characteristics of a question mark in the BCG matrix, requiring careful management and strategic decisions.

For instance, the global IoT market was projected to reach $1.1 trillion in 2024, showcasing immense potential, yet also highlighting the competitive and capital-intensive nature of establishing a strong presence. ALSO's commitment here reflects a long-term vision.

The success of ALSO's IoT offerings hinges on achieving rapid market adoption and scaling its platforms effectively. Without swift market penetration, these investments could continue to consume cash without generating sufficient returns, potentially hindering their transition out of the question mark category.

Targeting specific industry verticals with bespoke cloud solutions, such as those for healthcare or manufacturing, represents a significant avenue for high growth. This strategy, however, necessitates deep specialization and dedicated market entry efforts. ALSO is actively cultivating its market presence within these focused sectors.

These specialized areas currently demand substantial investment to achieve meaningful traction and secure a considerable market share. For instance, the global healthcare cloud computing market was projected to reach $60.3 billion in 2024 and is expected to grow significantly, highlighting the potential for companies like ALSO to capture value.

Advanced AI development and integration services would position ALSO Holding in the 'Question Marks' quadrant of the BCG Matrix. This signifies high market growth potential alongside uncertain market share. Significant investment in research and development is crucial here, as demonstrated by global AI market projections. For instance, the global AI market was valued at approximately USD 136.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030, according to Grand View Research. This rapid expansion indicates a fertile ground for new ventures, but also highlights the inherent risks in establishing a strong market position.

Venturing into custom AI solutions means tackling complex projects requiring specialized expertise. Consider that the global AI talent shortage remains a significant hurdle, with demand for AI professionals far outstripping supply. Companies are increasingly seeking tailored AI applications to solve unique business challenges, moving beyond off-the-shelf platforms. This demand fuels the high-growth aspect, but the investment in top-tier talent and advanced infrastructure presents substantial upfront costs and operational risks for ALSO.

Emerging Technologies (e.g., Quantum Computing Readiness)

Investing in nascent, high-potential technologies such as quantum computing readiness or advanced blockchain services positions them as Stars in the BCG Matrix context. These fields promise significant future growth but currently hold minimal market share, necessitating speculative investment for long-term strategic advantage. Returns from these ventures are inherently distant and uncertain, requiring a long-term investment horizon and a high tolerance for risk.

The quantum computing market, while still in its early stages, is projected to grow substantially. For instance, by 2030, the global quantum computing market is expected to reach tens of billions of dollars, with some estimates suggesting it could exceed $60 billion. Companies like IBM, Google, and Microsoft are making significant investments in this area. Similarly, the blockchain sector continues to evolve, with applications beyond cryptocurrencies gaining traction in supply chain management, healthcare, and finance.

- Quantum Computing Readiness: Represents a high-risk, high-reward investment in a technology with transformative potential but currently limited commercial application.

- Advanced Blockchain Services: Investments here focus on the evolving utility of blockchain beyond cryptocurrencies, targeting future market penetration.

- Market Position: Both are characterized by very low current market share but high growth potential, fitting the 'Star' quadrant in a strategic analysis.

- Investment Rationale: These are speculative investments aimed at securing future competitive advantage and capturing emerging market opportunities.

Expansion into New, Untapped Geographies

ALSO Holding's strategy of expanding into new, untapped geographies positions them firmly in the "Question Marks" quadrant of the BCG matrix. These markets represent high-growth potential but currently hold a low market share for ALSO. This expansion is a calculated move to capture future market dominance.

Entering these nascent markets demands substantial initial capital outlay. This investment covers building essential infrastructure, forging strategic local alliances, and cultivating market demand. The success and profitability hinges on effectively penetrating these new territories and achieving swift, scalable growth.

- High Growth Potential: Emerging markets often exhibit faster economic growth rates compared to mature economies, offering significant revenue expansion opportunities.

- Low Initial Market Share: As a new entrant, ALSO starts with a minimal presence, necessitating aggressive market development and customer acquisition.

- Significant Investment Required: Costs associated with market entry, including logistics, marketing, and regulatory compliance, are considerable.

- Risk of Failure: Without successful penetration and scaling, these investments may not yield the expected returns, posing a financial risk.

The development and integration of AI-driven solutions represent a key area for ALSO Holding, fitting the 'Question Marks' category due to high market growth and uncertain market share. This requires significant investment in R&D to capitalize on the rapidly expanding AI sector. For example, the global AI market was valued at approximately USD 136.6 billion in 2022 and is projected for substantial growth, underscoring the opportunity and the associated investment needs.

ALSO's commitment to custom AI development, while promising, faces challenges like a global AI talent shortage, demanding substantial upfront investment in specialized expertise and infrastructure. However, the demand for tailored AI applications to address unique business needs fuels this high-growth potential.

Entering new, untapped geographical markets positions ALSO Holding within the 'Question Marks' quadrant. These regions offer high growth potential but currently represent a low market share for the company, necessitating significant capital for infrastructure, local partnerships, and market cultivation.

The success of these new market entries hinges on achieving effective penetration and rapid, scalable growth. Without it, the substantial investments made may not generate the anticipated returns, posing a considerable financial risk.

| Strategic Area | BCG Quadrant | Market Growth | Market Share | Investment Rationale |

|---|---|---|---|---|

| IoT Solutions | Question Mark | High | Low/Fluid | Capture future revenue in evolving tech landscape. |

| AI Development & Integration | Question Mark | High | Low/Uncertain | Capitalize on rapid AI market expansion. |

| New Geographical Markets | Question Mark | High | Low | Establish future market dominance. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from ALSO Holding's financial reports, market share analysis, and industry growth projections to accurately position each business unit.