Alps Alpine SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alps Alpine Bundle

Alps Alpine possesses significant strengths in its robust technological expertise and established global presence, crucial for navigating the competitive automotive and electronics sectors. However, it faces considerable threats from rapid technological shifts and intense market competition, demanding constant innovation and strategic adaptation.

Understanding these dynamics is key to forecasting Alps Alpine's future trajectory. Our comprehensive SWOT analysis delves deeper into these factors, providing a nuanced view of their opportunities for expansion and the weaknesses that require mitigation.

Want the full story behind Alps Alpine’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alps Alpine boasts a strong brand reputation and a significant global footprint in electronics, particularly in automotive and consumer sectors. The company operates in over 30 countries, with major production facilities spanning Japan, China, and the United States. This global network is underpinned by over seven decades of experience, effectively combining Alps Electric's device development with Alpine Electronics' system and software design. For the fiscal year ending March 31, 2024, Alps Alpine reported net sales of JPY 964.8 billion, demonstrating its extensive market reach and operational scale.

Alps Alpine maintains a robust commitment to innovation, clearly demonstrated by its substantial investment in research and development. In fiscal year 2023, the company allocated approximately 6.7% of its revenue, totaling about ¥29 billion, to R&D initiatives. This strategic focus has yielded a portfolio of cutting-edge products and numerous patents, solidifying its position as a technological leader. The company prioritizes future-oriented technologies for a smart mobility society, including advancements in autonomous driving and vehicle connectivity solutions.

Alps Alpine has demonstrated robust financial health, achieving a record-breaking revenue of JPY 1.2 trillion for the fiscal year ending March 2024, marking a 15% year-over-year increase. The company also reported a significant 22.9% rise in operating profit, reaching ¥25,295 million for the nine months ending December 31, 2024. This strong financial stability is well-supported by a diverse product portfolio and consistent demand across its key markets.

Strategic Focus on High-Growth Segments

Alps Alpine demonstrates a strong strategic focus by positioning itself within high-growth sectors, particularly automotive electronics. This market is projected to reach USD 593.1 billion by 2034, offering significant opportunities. The company is actively developing technologies crucial for electric vehicles, autonomous driving, and advanced in-vehicle infotainment systems. This alignment with CASE (Connected, Autonomous, Shared & Services, Electric) represents a core pillar of its future business expansion and market relevance.

- Automotive electronics market expected to reach USD 593.1 billion by 2034.

- Key involvement in Electric Vehicle (EV) technology development.

- Focus on autonomous driving and advanced infotainment systems.

- Strategic alignment with CASE mobility trends.

Commitment to Sustainability

Alps Alpine deeply integrates sustainability into its core strategy, targeting a 50% carbon emission reduction by 2030. The company also aims for 100% renewable energy use in manufacturing facilities by 2025. Its Integrated Report 2024 emphasizes Safety and Environment as crucial value areas. This focus on eco-friendly operations addresses increasing consumer and regulatory demand effectively.

- 2030 Goal: 50% carbon emission reduction.

- 2025 Goal: 100% renewable energy in manufacturing.

- Integrated Report 2024 highlights Safety and Environment.

Alps Alpine demonstrates robust strengths through its extensive global presence and strong brand reputation, achieving JPY 1.2 trillion in revenue for fiscal year 2024. The company maintains strong financial health, supported by a significant commitment to innovation with 6.7% of revenue invested in R&D in FY2023. This strategic focus on high-growth sectors like automotive electronics, projected to reach USD 593.1 billion by 2034, positions it well for future growth. Furthermore, its strong sustainability initiatives, targeting 100% renewable energy in manufacturing by 2025, enhance its market appeal and operational resilience.

| Metric | FY2024 Data | FY2023 R&D |

|---|---|---|

| Net Sales | JPY 1.2 Trillion | N/A |

| Operating Profit (9M Dec 2024) | JPY 25,295 Million | N/A |

| R&D Investment | N/A | ~6.7% of Revenue |

What is included in the product

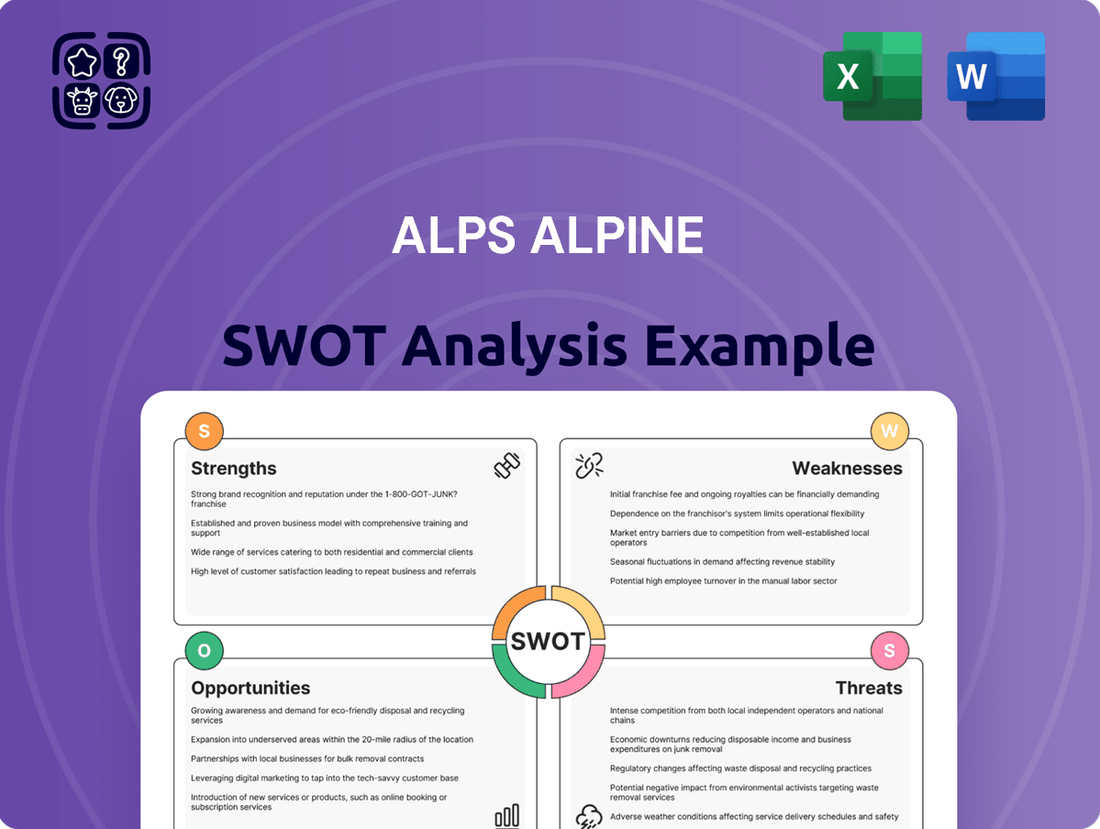

Analyzes Alps Alpine’s competitive position through key internal and external factors, identifying its core strengths, potential weaknesses, market opportunities, and prevailing threats.

Offers a clear, actionable framework to identify and address potential threats and weaknesses, turning strategic challenges into opportunities for improvement.

Weaknesses

Alps Alpine faces a significant weakness due to its high reliance on the automotive sector. A substantial portion of the company's revenue comes from this industry, making it vulnerable to its inherent cyclical nature and potential downturns. For instance, in fiscal year 2022, roughly 70% of its net sales were derived directly from automotive components. This concentration exposes Alps Alpine to considerable risks linked to fluctuations in global automobile production and sales volumes, impacting overall financial performance. Such dependence limits diversification and amplifies market-specific vulnerabilities.

Alps Alpine's financial performance faces significant headwinds from external economic factors. Currency fluctuations, particularly a stronger yen, can dampen overseas sales, while soaring raw material and energy prices directly erode operating income; for instance, the 2024 fiscal outlook highlighted cost pressures. Consumer market weakness, especially in specific product segments like automotive displays, also presents ongoing challenges, impacting sales volumes in key regions. These vulnerabilities underscore a dependence on global economic stability and supply chain resilience for sustained profitability. Adapting to these volatile conditions remains a critical strategic imperative for 2025.

Alps Alpine faces intense competition from major global players in the automotive and electronics sectors, including giants like Denso and Continental, alongside specialized suppliers. This highly competitive landscape puts significant pressure on pricing strategies and market share, as seen in the global automotive electronics market which is projected to reach approximately $400 billion by 2025. Such fierce rivalry often leads to compressed profit margins, impacting overall profitability. Maintaining technological leadership and cost efficiency is crucial to navigate this challenging environment effectively.

Operational Challenges in New Product Launches

Alps Alpine often encounters operational challenges during new product launches, which directly impacts profitability. For instance, difficulties in achieving targeted yield rates for new module products, particularly in European facilities, have demonstrably lowered operating income. These issues highlight the inherent complexities and significant risks involved in scaling up production and integrating new technologies effectively. Such setbacks can delay market penetration and reduce expected financial returns through mid-2025.

- Yield rate shortfalls in new module production have negatively impacted 2024 operating income.

- Complexities in scaling new technologies contribute to launch delays and cost overruns.

- Profitability targets for new products remain vulnerable to early operational inefficiencies.

Decline in Specific Market Segments

Alps Alpine has experienced a notable decline in specific market segments, particularly in components like smartphone camera actuators. This segment faced significant headwinds, contributing to a reported operating loss of approximately JPY 3.4 billion in the first quarter of fiscal year 2024 for their Electronic Components business, impacting overall profitability. The decrease in sales of products for the mobile market has been a consistent factor, highlighting a vulnerability to rapid shifts in consumer electronics demand.

- Fiscal Q1 2024 saw an operating loss of JPY 3.4 billion in Electronic Components.

- Smartphone camera actuator sales specifically impacted performance.

- The mobile market segment's decline remains a key weakness.

Alps Alpine faces challenges in optimizing its cost structure, particularly amid significant R&D investments and capital expenditures required for next-generation technologies. Despite a projected capital expenditure of approximately JPY 65 billion for fiscal year 2024, achieving proportionate returns on these investments remains a key pressure point. This substantial outlay, necessary for future growth, can strain short-term profitability if market adoption of new products, such as those for advanced driver-assistance systems (ADAS), is slower than anticipated. Managing these high fixed costs while maintaining competitive pricing is critical for sustainable financial health through 2025.

| Fiscal Year | Capital Expenditure (JPY Billion) | Operating Income (JPY Billion) |

|---|---|---|

| FY2023 (Actual) | 57.3 | 20.8 |

| FY2024 (Projected) | 65.0 | 26.0 |

| FY2025 (Projected) | ~60.0 | ~30.0 |

What You See Is What You Get

Alps Alpine SWOT Analysis

The preview you see is the actual Alps Alpine SWOT analysis document you'll receive upon purchase. This ensures transparency and no surprises, providing you with professional quality insights. You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at Alps Alpine's strategic position.

Opportunities

The global shift towards electric vehicles (EVs) and autonomous driving presents a significant growth opportunity for Alps Alpine. The EV market is projected to reach approximately 60 million units globally by 2025, which directly drives demand for the company's electronic components and advanced infotainment systems. Alps Alpine is actively developing critical technologies like hands-off detection ECUs and other solutions supporting Level 3 and Level 4 autonomous driving systems, capitalizing on this expanding sector.

The automotive infotainment market presents a significant opportunity, projected to reach approximately $35 billion by 2025, driven by surging consumer demand for seamless connectivity and advanced features. Alps Alpine, with its strong legacy in car navigation and premium audio systems, is well-positioned to capitalize on this expansion. The industry trend towards software-defined vehicles, coupled with the integration of AI and 5G connectivity, creates new avenues for the company's innovative products and services. This enables Alps Alpine to enhance user experience and secure new partnerships in the evolving mobility landscape.

Alps Alpine is strategically pivoting towards software and service-based models, moving beyond its traditional hardware focus. This includes licensing its advanced proprietary audio technologies to third-party brands and infotainment system suppliers. This strategic shift is expected to unlock new, high-margin revenue streams, bolstering the company's financial performance in the 2024-2025 fiscal year. It also significantly strengthens its competitive position within the rapidly evolving software-defined vehicle market, aligning with industry trends and demand for integrated digital solutions.

Innovation in Human-Machine Interfaces (HMI) and Sensors

The increasing demand for intuitive human-machine interfaces (HMI) in vehicles and smart devices presents significant growth opportunities for Alps Alpine. The company is actively innovating in this space, exemplified by its Haptic Reactor technology, which enhances user experience through tactile feedback, a market projected to reach over $15 billion by 2025 in automotive applications alone. Furthermore, Alps Alpine's deep expertise in sensor technology, including magnetic sensors critical for the over 1.4 billion smartphones sold annually, opens new market avenues beyond automotive, leveraging its established position in precision components.

- Global automotive HMI market is expected to exceed $15 billion by 2025, driven by advanced cockpit designs.

- Alps Alpine's haptic feedback solutions align with this trend, enhancing safety and user engagement.

- The company's sensor technology, including magnetic sensors, is critical for consumer electronics, a market segment generating trillions annually.

- Strategic expansion into industrial and healthcare sectors using sensor expertise offers diversification potential.

Focus on Sustainable and Eco-Friendly Solutions

The increasing global emphasis on sustainability and environmental responsibility creates significant opportunities for Alps Alpine. Their commitment to developing eco-friendly products and reducing their carbon footprint aligns well with this trend. Demand for energy-efficient components in electric vehicles (EVs) and smart energy solutions is surging, with global EV sales projected to exceed 17 million units in 2024, driving demand for advanced, sustainable electronics. Furthermore, the push for a circular economy, including material recycling and reduced waste, offers new avenues for growth in their manufacturing processes and product lifecycle management.

- Global EV market growth is a key driver for sustainable component demand.

- Alps Alpine aims for a 30% reduction in CO2 emissions by 2030 (Scope 1+2).

- Focus on eco-friendly materials and energy-efficient designs enhances market appeal.

- Demand for sensor solutions in smart grid and renewable energy systems is expanding.

Alps Alpine is poised for growth by leveraging the expanding electric vehicle and autonomous driving markets, with the EV sector projected to reach 60 million units globally by 2025. The automotive infotainment market, estimated at $35 billion by 2025, also offers significant opportunities for its advanced systems and software-defined vehicle solutions. Further potential lies in the $15 billion automotive HMI market and diversified sensor applications in consumer electronics and industrial sectors.

| Opportunity Area | Market Size/Projection | Key Driver |

|---|---|---|

| EVs & Autonomous Driving | ~60M units (2025) | Global adoption, regulatory push |

| Automotive Infotainment | ~$35B (2025) | Connectivity, software-defined vehicles |

| HMI & Sensor Tech | >$15B (HMI, 2025) | User experience, smart device integration |

Threats

Alps Alpine faces significant threats from global economic slowdowns and geopolitical instability, which directly disrupt critical supply chains and temper consumer demand. Ongoing conflicts and trade tensions, such as those impacting global shipping lanes, inflate operational costs and cause production delays for key components. A potential recessionary environment in 2024-2025 could further depress sales in the automotive and consumer electronics markets, vital to the company's revenue streams. For instance, a 1% decline in global auto production could directly impact Alps Alpine's sensor and infotainment component sales.

Alps Alpine faces intense competition from global electronics manufacturers and agile new entrants, particularly in the rapidly evolving automotive technology sector. The shift towards software-defined vehicles, projected to comprise a significant portion of new car sales by 2025, introduces new business models and players. This dynamic landscape challenges Alps Alpine's market share, with established rivals like Samsung, Panasonic, and Sony continually innovating. Maintaining a competitive edge requires substantial investment in R&D, especially as the automotive semiconductor market is expected to exceed $80 billion by 2025.

The electronics industry faces rapid technological shifts, potentially rendering Alps Alpine's products obsolete without continuous innovation. The accelerating shift towards software-defined vehicles, projected to comprise a significant portion of new car sales by 2025, demands different skill sets and faster development cycles, challenging traditional hardware-centric models. Failure to integrate advancements in AI, 5G, and IoT, crucial for future automotive and consumer electronics, could severely impact market competitiveness. Staying agile is key as the global automotive software market is expected to reach $50 billion by 2025.

Supply Chain Disruptions and Raw Material Costs

Alps Alpine faces significant threats from global supply chain disruptions and fluctuating raw material costs, impacting its operational stability. Geopolitical tensions, like the ongoing Red Sea shipping challenges in early 2024, continue to strain logistics networks. This vulnerability can lead to increased production expenses, directly affecting profitability.

- The company reported a 1.2% decline in operating profit for Q3 FY2024 (ending December 2023), partly due to rising material costs.

- Semiconductor shortages, while easing, remain a potential bottleneck for automotive and consumer electronics components into 2025.

- Increased energy prices, particularly in Europe and Asia, directly elevate manufacturing overheads for Alps Alpine's facilities.

Increasingly Stringent Regulations and Cybersecurity

Alps Alpine navigates an environment of increasingly stringent automotive regulations, encompassing mandates for vehicle safety, emissions, and quality control. The escalating connectivity in modern vehicles also magnifies cybersecurity threats, necessitating substantial investments to protect vehicle systems and proprietary data. Compliance with these evolving regulations and robust cybersecurity risk mitigation are critical challenges impacting operational costs and product development cycles for the company.

- Global automotive cybersecurity market projected to reach $8.9 billion by 2025.

- EU's UNECE WP.29 regulations mandate cybersecurity management systems for new vehicle types from July 2024.

- Compliance costs for new emissions standards, like Euro 7, are estimated to increase vehicle prices.

- Data breaches in the automotive sector could cost companies millions in fines and reputational damage.

Alps Alpine faces significant threats from ongoing global economic volatility and geopolitical tensions, impacting supply chains and consumer demand. Intense competition in evolving automotive tech, coupled with rapid technological shifts, demands continuous R&D investment to avoid product obsolescence. Rising raw material costs, stringent regulations, and escalating cybersecurity risks further challenge profitability and operational stability.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Economic & Geopolitical | Supply Chain Disruption | 1.2% operating profit decline (Q3 FY2024) |

| Competition & Tech Shift | Market Share Erosion | Automotive software market $50B by 2025 |

| Regulatory & Cyber | Increased Costs | Global automotive cybersecurity $8.9B by 2025 |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Alps Alpine's official financial reports, comprehensive market research studies, and expert industry analyses to provide a thorough and accurate strategic overview.