Alps Alpine PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alps Alpine Bundle

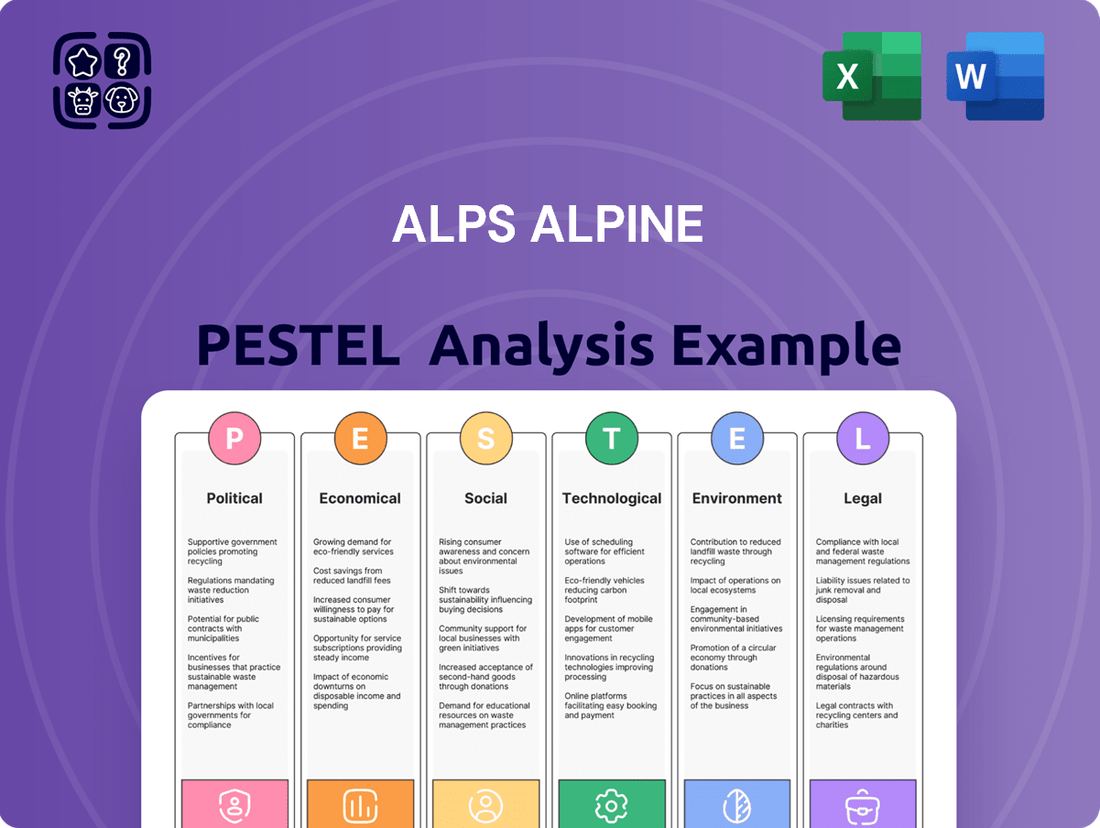

Unlock the full potential of Alps Alpine's market by understanding the intricate web of external forces at play. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental factors that are shaping the company's trajectory. Gain a critical edge in your strategic planning and investment decisions.

Discover how shifting regulations, evolving consumer behaviors, and technological advancements present both challenges and opportunities for Alps Alpine. Equip yourself with actionable intelligence to navigate these complexities and identify growth avenues.

Don't get left behind in a rapidly changing global landscape. Our comprehensive PESTLE analysis provides the insights you need to anticipate market shifts and proactively adapt your strategies.

Make informed decisions with confidence. Download the full Alps Alpine PESTLE analysis today and gain a profound understanding of the external environment impacting their success. Your competitive advantage awaits.

Political factors

International trade agreements and tariffs directly impact Alps Alpine's cost of raw materials and access to key markets. For instance, ongoing trade tensions could see U.S. tariffs on electronic components from Asia, potentially increasing Alps Alpine's production costs in 2024 by an estimated 3-5% for affected inputs. The company must navigate complex trade relationships, such as those between the US, China, and the EU, to optimize its global supply chain. Strategic sourcing adjustments are crucial to maintain competitive pricing and profitability through 2025, amidst fluctuating global trade policies.

Governments worldwide are tightening vehicle safety regulations, particularly for Advanced Driver-Assistance Systems (ADAS) and autonomous driving features, with Euro NCAP 2025 protocols emphasizing Level 3 and Level 4 autonomy. This presents both a challenge and an opportunity for Alps Alpine, a key supplier of crucial sensors and human-machine interface (HMI) systems. Compliance demands significant R&D investment, for instance, the automotive sector's R&D spend is projected to grow by 7% in 2024, but it also solidifies Alps Alpine's position as an indispensable partner for OEMs aiming to meet these stringent new standards.

Government incentives, like the US federal tax credit up to $7,500 for eligible EVs in 2024, significantly boost consumer and manufacturer demand, directly benefiting Alps Alpine. These policies accelerate the market shift towards electric and autonomous vehicle technologies, where Alps Alpine specializes in components such as advanced battery management sensors and sophisticated in-cabin infotainment systems. Political support for green transportation and smart mobility infrastructure, exemplified by global investments projected to reach over $1 trillion in EV charging infrastructure by 2030, is a key driver of growth for the company's specialized solutions.

Geopolitical Instability

Geopolitical instability, including ongoing conflicts and political tensions, significantly impacts global supply chains, leading to increased logistical costs and market uncertainty. For a global manufacturer like Alps Alpine, with operations spanning multiple continents, this exposure includes risks like the interruption of critical raw material supplies or the closure of key shipping routes. For instance, global container shipping rates saw spikes over 150% in early 2024 due to Red Sea disruptions, directly affecting import/export expenses. Diversifying its manufacturing footprint and supplier base is a crucial strategy to mitigate the impact of such geopolitical events, enhancing resilience against supply shocks.

- Global supply chain disruptions from geopolitical events caused over 150% spikes in container shipping rates in early 2024.

- Alps Alpine faces risks of raw material supply interruptions, critical for its estimated $6.5 billion in annual component sales.

- Closure of key shipping routes, like those impacted by Red Sea tensions, directly elevates Alps Alpine's logistical costs.

- Diversifying its global manufacturing footprint, including facilities in Asia and North America, is vital for Alps Alpine's resilience.

Data Privacy and Cybersecurity Legislation

As vehicle connectivity expands, Alps Alpine faces heightened scrutiny under data privacy regulations like Europe's GDPR, which can impose fines up to 4% of global annual revenue for non-compliance. National security concerns, such as U.S. Department of Commerce restrictions on hardware from certain regions, further complicate data handling for connected vehicle modules. Alps Alpine must invest significantly in cybersecurity and data protection, with global automotive cybersecurity spending projected to exceed $5 billion by 2025, to ensure its infotainment systems comply with these evolving global laws.

- GDPR fines can reach 4% of global annual revenue.

- U.S. Department of Commerce issues restrictions impacting connected vehicle data.

- Global automotive cybersecurity spending is forecast to surpass $5 billion by 2025.

Political factors significantly influence Alps Alpine's operations, with trade tariffs potentially increasing 2024 production costs by 3-5% on affected inputs. Stricter vehicle safety regulations, like Euro NCAP 2025, necessitate substantial R&D investment while opening new market opportunities. Government incentives for EVs, such as the US federal tax credit up to $7,500, boost demand for Alps Alpine's specialized components. Geopolitical instability, causing over 150% spikes in early 2024 shipping rates, also directly impacts logistical costs and supply chain stability.

| Political Factor | 2024-2025 Impact on Alps Alpine | Relevant Data Point |

|---|---|---|

| Trade Tariffs | Increased production costs | 3-5% cost increase on affected inputs |

| Vehicle Safety Regulations | R&D investment, market opportunity | 7% projected R&D growth in automotive |

| EV Incentives | Boosted demand for components | US EV tax credit up to $7,500 |

| Geopolitical Instability | Supply chain disruption, higher logistics | 150%+ shipping rate spikes in early 2024 |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors influencing Alps Alpine, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for business growth.

A clear, actionable summary of the Alps Alpine PESTLE analysis, highlighting key external factors that can be leveraged to mitigate operational risks and identify new market opportunities.

Economic factors

The semiconductor industry is inherently cyclical, with market fluctuations directly impacting Alps Alpine's production costs and component availability. Projections for 2025 indicate the global semiconductor market could reach approximately $650 billion, driven significantly by AI and data center investments. This strong demand might tighten supply for the automotive sector, a critical segment for Alps Alpine, as automotive semiconductor revenue is forecast to grow by 15% in 2025. Alps Alpine's profitability is sensitive to these market shifts, requiring strategic procurement and inventory management to navigate potential shortages or price hikes effectively. Maintaining stable supply chains is crucial for their operational continuity and financial performance.

As a Japanese company with significant international sales, Alps Alpine is highly exposed to currency exchange rate volatility, particularly between the Japanese Yen, US Dollar, and Euro. For instance, the Yen's depreciation to levels around JPY155 against the USD in early 2024 generally benefits export profitability, but a sudden strengthening could decrease the competitiveness of its products. The company's reported financial performance, measured in Yen, is directly impacted by these macroeconomic shifts. This exposure necessitates robust hedging strategies to mitigate currency risks.

Alps Alpine's financial health is directly tied to global automotive market sales and production trends. Economic downturns, like the projected moderation in global vehicle sales growth to around 2.5% in 2024, can reduce demand for their components and infotainment systems. Rising interest rates, impacting auto loan affordability, further suppress new vehicle purchases, directly affecting the company's revenue streams. Conversely, a robust market, particularly the projected 20-25% growth in EV sales for 2025, drives increased demand for Alps Alpine's advanced solutions in premium and electric vehicle segments.

Inflation and Cost of Raw Materials

Inflationary pressures continue to elevate the cost of essential raw materials, energy, and labor, significantly squeezing profit margins for manufacturers like Alps Alpine. For instance, global commodity price volatility saw key materials like copper and aluminum remain elevated into early 2025, impacting production expenses. Alps Alpine must manage these rising costs through aggressive operational efficiency improvements and cost structure reforms, potentially passing on some price increases to automotive and consumer electronics customers. Persistent inflation, with global rates projected around 4.5% for 2024 by the IMF, also dampens overall consumer demand, creating a challenging economic environment for sales volumes.

- Raw material costs: Copper and rare earth element prices saw continued volatility into Q1 2025.

- Energy expenses: Global energy markets remained sensitive, impacting manufacturing overheads for Alps Alpine.

- Labor costs: Wage inflation, especially in key manufacturing regions, pressured operating expenses into 2025.

- Consumer demand: Elevated inflation, such as the Eurozone's 2.5% projected for 2025, could curb discretionary spending on electronics.

Capital Investment and R&D Spending

Alps Alpine's strategy prioritizes significant capital investment and R&D spending to lead in technology. Economic conditions critically shape the availability and cost of funding for these essential expenditures. In its fiscal year 2025 financial results, the company reported robust profitability recovery, directly supporting its capacity to fund strategic initiatives in high-growth sectors and management reforms.

- FY2025 profitability recovery enhances internal funding for R&D.

- Strategic investments target high-growth areas.

- Economic stability influences capital market access and rates.

- Alps Alpine maintains technological leadership via sustained R&D.

Alps Alpine faces a dynamic economic landscape, with the global semiconductor market projected to reach $650 billion in 2025, influencing component availability. Currency volatility, like the Yen at JPY155 against the USD in early 2024, significantly impacts export competitiveness and financial reporting. Moderated global vehicle sales growth of 2.5% in 2024 is balanced by a strong 20-25% EV sales growth forecast for 2025. Persistent inflationary pressures, with global rates around 4.5% in 2024, continue to elevate material and labor costs, directly affecting profit margins.

| Metric | 2024 Projection | 2025 Projection |

|---|---|---|

| Global Semiconductor Market | ~ $600 Billion | ~ $650 Billion |

| Global Vehicle Sales Growth | ~ 2.5% | ~ 3.0% |

| EV Sales Growth | ~ 20% | ~ 25% |

| Global Inflation Rate (IMF) | ~ 4.5% | ~ 3.8% |

Preview the Actual Deliverable

Alps Alpine PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Alps Alpine PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a comprehensive understanding of the external landscape for strategic decision-making.

Sociological factors

Modern consumers increasingly view vehicles as extensions of their digital lives, demanding seamless smartphone integration, high-quality audio, and intuitive human-machine interfaces. This escalating expectation drives significant demand for Alps Alpine's advanced HMI, infotainment systems, and premium sound solutions. The global automotive infotainment market is projected to reach approximately $35 billion by 2025, underscoring this shift. Vehicles are transforming from mere transport modes into personalized, connected living spaces, with premium audio systems alone seeing a 5-7% annual growth in adoption as of 2024.

Consumers increasingly prioritize vehicles with advanced safety and convenience features, driving demand for technologies like ADAS and automated parking. This societal shift directly boosts Alps Alpine's sensor and communication segment, a key area for their 2025 growth strategy. For instance, global ADAS market revenue is projected to reach over $65 billion by 2025, with a significant portion allocated to sensor and communication components. As drivers grow accustomed to these sophisticated systems, they become essential purchasing criteria, pushing automakers to integrate more advanced solutions, benefiting companies like Alps Alpine.

The growing shift towards Mobility as a Service (MaaS) and subscription models, projected to reach a global market value of over $250 billion by 2025, is redefining vehicle ownership. This trend increasingly favors ride-sharing and car-sharing services over traditional private car sales. For Alps Alpine, this means a pivotal shift in the B2B customer landscape, with large fleet operators and mobility service providers becoming primary clients. These entities prioritize robust in-vehicle infotainment, advanced connectivity, and durable user interfaces, aligning perfectly with Alps Alpine's core technological strengths and product offerings.

Increasing Environmental and Social Awareness

Consumers increasingly base purchasing decisions on a company's environmental, social, and governance (ESG) performance. Alps Alpine's commitment to sustainability, detailed in its recent integrated reports, is vital for maintaining brand reputation and attracting environmentally conscious customers and investors.

Developing eco-friendly products and ensuring a responsible supply chain are critical. For instance, Alps Alpine aims for carbon neutrality by 2050, with interim targets significantly reducing CO2 emissions from its operations and products by 2030. This aligns with a 2024 trend showing that 78% of consumers prioritize sustainable brands.

- Alps Alpine targets net-zero CO2 emissions across its value chain by 2050.

- The company is actively developing products with reduced environmental impact, such as energy-efficient components.

- Supply chain transparency and ethical sourcing are key focus areas for 2024-2025.

- Brand perception is significantly boosted by strong ESG ratings, attracting a growing segment of investors.

Demographics and Personalization

Demographic shifts significantly shape Alps Alpine's product strategy. An aging population, particularly in Japan where over 29% of residents are 65 or older by early 2024, drives demand for intuitive, accessible vehicle technology like enhanced voice controls and larger, simpler displays. Simultaneously, younger consumers, representing the majority of new vehicle buyers globally, seek extensive personalization and customization options within their vehicle cockpits. Alps Alpine must develop flexible HMI solutions, such as modular infotainment systems and adaptable digital dashboards, to cater to this diverse user base and maintain market relevance.

- Japan's aging population reached over 29% aged 65+ by early 2024, influencing demand for user-friendly vehicle tech.

- Global consumer surveys in 2024 indicate a strong preference for personalized in-car experiences among younger demographics.

- Alps Alpine is focusing on adaptable HMI solutions, including advanced voice recognition and configurable displays, for 2025 vehicle models.

Societal shifts prioritize seamless digital integration, driving the automotive infotainment market to nearly $35 billion by 2025. Consumer demand for advanced safety features, like ADAS, fuels a market projected at over $65 billion by 2025. The rise of Mobility as a Service, valued at over $250 billion by 2025, redefines customer engagement for Alps Alpine. Furthermore, ESG performance and diverse demographic needs, including an aging population impacting 29% of Japan by 2024, shape product development.

| Sociological Trend | 2024/2025 Market Value/Growth | Impact on Alps Alpine |

|---|---|---|

| Digital Integration | Infotainment: ~$35B by 2025 | Increased demand for HMI/audio |

| Advanced Safety (ADAS) | >$65B by 2025 | Boosts sensor/communication segment |

| Mobility as a Service (MaaS) | >$250B by 2025 | Shifts to B2B fleet clients |

| ESG & Demographics | Japan 65+: 29% (2024) | Eco-friendly products, diverse HMI |

Technological factors

The progression towards Level 3 (L3) and higher autonomous driving technologies remains a core technological driver for Alps Alpine, demanding sophisticated sensor fusion and powerful computing platforms. This shift necessitates advanced Human-Machine Interface (HMI) solutions to ensure safe and intuitive vehicle operation. Alps Alpine’s collaboration with leaders like Qualcomm is crucial, integrating their Snapdragon Digital Chassis platforms, which are projected to be in over 400 million vehicles by 2026, to develop next-generation automotive cockpits. This strategic focus positions the company to capitalize on the estimated $240 billion global autonomous vehicle market by 2030.

The automotive sector is rapidly transitioning to Software-Defined Vehicles (SDVs), where software dictates core functionalities, enabling lucrative over-the-air updates and new subscription-based revenue streams, projected to reach 30 billion USD globally by 2030.

Alps Alpine is adapting by developing hardware that supports this new architecture, crucial as vehicle software lines of code are expected to exceed 300 million by 2025.

They have also begun external sales of software licenses, aiming to capture a share of this expanding market beyond traditional hardware.

This shift necessitates a strong focus on advanced software development capabilities alongside their established hardware expertise to remain competitive.

The evolution of Human-Machine Interface (HMI) is rapidly advancing beyond traditional touchscreens, integrating gesture control, advanced voice recognition, and haptic feedback. Alps Alpine is at the forefront, developing innovative input devices like its AirInput™ Panel and compact haptic reactors to enhance in-cabin user experience.

These innovations aim to significantly reduce driver distraction, a critical safety concern, while improving vehicle control and comfort. The global automotive HMI market is projected to reach approximately $27 billion by 2025, underscoring the strategic importance of Alps Alpine's focus on creating more intuitive and safer interactions within modern vehicles.

Connectivity and Vehicle-to-Everything (V2X)

The integration of 5G and advanced communication technologies is enabling Vehicle-to-Everything (V2X) communication, allowing real-time data exchange between vehicles, infrastructure, and pedestrians. This connectivity is fundamental for enhancing traffic safety and advancing autonomous driving features. Alps Alpine's connectivity modules are essential components for facilitating these crucial data exchanges, supporting the ongoing rollout of C-V2X solutions in new vehicle models throughout 2024. The global V2X market is projected to reach approximately $1.5 billion by 2025, highlighting the significant demand for these sophisticated communication systems.

- V2X market projected at $1.5 billion by 2025.

- Alps Alpine modules support 2024 C-V2X deployments.

Generative AI in the Cockpit

Generative AI is revolutionizing the in-vehicle experience, delivering intelligent and personalized digital assistants. Alps Alpine actively collaborates on GenAI-powered cockpit platforms, aiming for deployment in 2025 models. This integration enables unprecedented customization, proactive assistance, and seamless natural language interaction, transforming the digital cabin. The global automotive AI market is projected to reach $14 billion by 2025, highlighting this critical area for innovation.

- GenAI integration for personalized in-car digital assistants.

- Alps Alpine targets 2025 for GenAI cockpit platform deployment.

- Enables customization and natural language interaction.

- Automotive AI market projected to hit $14 billion by 2025.

Alps Alpine is strategically advancing in autonomous driving with Snapdragon Digital Chassis, targeting over 400 million vehicles by 2026. The shift to Software-Defined Vehicles, where software lines of code exceed 300 million by 2025, drives new revenue via OTA updates and software licenses. Innovations in HMI, like gesture control, enhance user experience, with the market projected at $27 billion by 2025. Furthermore, 5G-enabled V2X communication, supporting 2024 C-V2X deployments, and Generative AI for personalized cockpits in 2025 models are crucial, with the automotive AI market reaching $14 billion by 2025.

| Technological Factor | Key Development | Market Projection (2025) |

|---|---|---|

| Autonomous Driving | Snapdragon Digital Chassis integration | $240B (2030) |

| Software-Defined Vehicles | Software code > 300M lines | $30B (2030) |

| Advanced HMI | AirInput™ Panel, haptic feedback | $27B |

| V2X Communication | 2024 C-V2X deployments | $1.5B |

| Generative AI | 2025 cockpit platform deployment | $14B |

Legal factors

The legal framework for autonomous vehicle testing and deployment varies significantly, creating a complex global patchwork. As of early 2024, over 30 US states have distinct AV laws, while the EU's Automated Driving Systems regulation, effective July 2024, aims for more unified Level 3 and 4 deployment standards. These diverse regulations dictate where and how Alps Alpine's AV technologies can be tested and commercially deployed, directly impacting market access and development timelines. Establishing clear national and international standards, like those advanced by UNECE for vehicle type approval, is critical for future growth and widespread adoption. Without harmonization, navigating these varied legal landscapes presents ongoing challenges for global market expansion.

As modern vehicles transform into data centers on wheels, Alps Alpine faces stringent data protection laws like Europe's GDPR and China's PIPL, which became fully effective in 2021. These regulations, with potential fines reaching billions for non-compliance, govern the collection, use, and transfer of personal data generated by connected cars. Alps Alpine must design its infotainment and connectivity systems for 2024 and 2025 models to be compliant by default, ensuring user privacy. This proactive approach is crucial for securing data against unauthorized access and maintaining trust in a rapidly evolving automotive landscape where data breaches can lead to significant financial and reputational damage.

Global regulators are increasingly mandating robust cybersecurity for vehicles, with the UNECE WP.29 regulations, notably UN R155, becoming a critical standard for new vehicle types from July 2024. For Alps Alpine, this means its advanced electronic components, especially connectivity modules and infotainment systems, must meet stringent cybersecurity benchmarks. Compliance requires rigorous testing and secure-by-design principles throughout the development lifecycle, potentially increasing R&D expenditures by an estimated 10-15% on cybersecurity measures for new automotive products by 2025. Failure to adhere could result in significant fines and market access restrictions, impacting revenue projections.

Intellectual Property (IP) Rights

In the highly competitive technology sector, safeguarding Intellectual Property (IP) through patents, trademarks, and copyrights is paramount for companies like Alps Alpine. The company invests significantly in Research and Development, with R&D expenses projected around JPY 70 billion for fiscal year 2024, emphasizing innovations in sensors, human-machine interface (HMI), and software solutions. Protecting these advancements is crucial for maintaining a strong competitive edge and market position. The varying global legal frameworks for IP protection directly influence Alps Alpine's ability to effectively defend its proprietary technologies against infringement, impacting its operational strategies and profitability.

- Alps Alpine holds over 10,000 active patents globally, crucial for its automotive and IoT solutions.

- The company's R&D expenditure for FY2024 is estimated at approximately JPY 70 billion, highlighting innovation focus.

- Effective IP enforcement varies significantly across key markets like China, Europe, and North America.

- Patent litigation risks are a constant concern, with potential costs impacting the company's financial outlook.

Product Liability and Safety Standards

Determining liability in accidents involving vehicles with advanced automation, especially those featuring Level 3 or higher autonomous driving systems projected for 2025 adoption, presents a complex legal challenge for component suppliers like Alps Alpine. Evolving product liability laws are increasingly defining the responsibility matrix, shifting focus from solely the automaker or driver to include component manufacturers. Adherence to the highest functional safety standards, such as ISO 26262:2018, is crucial; ensuring compliance mitigates legal exposure and strengthens defenses against potential claims. This legal landscape directly impacts R&D and manufacturing processes, with safety compliance costs estimated to rise by 10-15% by mid-2025 for advanced automotive electronics.

- Liability for autonomous vehicle components remains a key legal battleground for suppliers.

- ISO 26262:2018 certification is a critical legal safeguard, not just a technical benchmark.

- New regulations by 2025 will further clarify the legal obligations of automotive tech providers.

- Compliance costs are notably increasing, impacting profitability margins for component suppliers.

Alps Alpine navigates complex global legal frameworks for autonomous driving, data privacy, and cybersecurity, with new regulations like EU's July 2024 AV standards and UN R155 impacting product development.

Compliance with data protection laws such as GDPR and PIPL is crucial for connected car systems, requiring proactive design for 2024/2025 models to avoid significant fines.

Protecting over 10,000 patents, alongside managing evolving product liability for Level 3+ AV components by 2025, significantly influences R&D and operational costs.

| Legal Area | Key Regulation/Metric | Impact for 2024/2025 |

|---|---|---|

| Autonomous Vehicles | EU AV Systems Regulation | Effective July 2024 for Level 3/4 deployment. |

| Cybersecurity | UN R155 (WP.29) | Mandatory for new vehicle types from July 2024. |

| Intellectual Property | Active Patents | Over 10,000 patents globally as of 2024. |

Environmental factors

Stricter global regulations, such as the Euro 7 standards expected to take effect for new vehicle types from July 2025, significantly impact the automotive sector. While primarily targeting powertrain emissions, these mandates indirectly increase demand for Alps Alpine's lightweight components and energy-efficient electronic systems. The push for vehicle electrification, a direct consequence of these regulations, is a major growth driver, with EV components projected to constitute a substantial portion of the company's 2024-2025 automotive revenue.

Governments are increasingly promoting a circular economy, with the EU's Circular Economy Action Plan targeting enhanced material recovery by 2025. This necessitates Alps Alpine to consider the entire product lifecycle, from design to disposal. Adhering to e-waste directives, like the WEEE Directive, requires using recyclable materials and designing components for easy disassembly. This approach contributes to a more sustainable production model, especially as global e-waste volumes are projected to exceed 74 million metric tons by 2030.

Alps Alpine faces increasing legal and investor-driven demands for robust ESG disclosures. Regulations like the EU's Corporate Sustainability Reporting Directive (CSRD), effective for large companies in 2025 for 2024 data, mandate transparent reporting on carbon footprint and renewable energy usage. Investors, managing over $35 trillion in ESG assets by 2025, heavily scrutinize these metrics, influencing capital allocation. Strong ESG performance, including a commitment to net-zero emissions by 2050, is now crucial for market access and reputation among customers and regulators.

Restrictions on Hazardous Substances

Regulations like the EU's Restriction of Hazardous Substances (RoHS) Directive significantly limit specific hazardous materials in electronic components. Alps Alpine, as a global supplier, must ensure its products, including those for automotive and consumer electronics, comply with these stringent rules across markets like Europe and Asia. This necessitates robust supply chain management and material selection to produce environmentally safer components. For instance, the global electronics industry is actively working towards reducing substances, with compliance costs estimated to be significant, impacting material sourcing strategies for companies like Alps Alpine.

- RoHS 3 (Directive 2015/863/EU) continues to broaden restricted substances, impacting new product development cycles for 2024-2025.

- Compliance with global environmental regulations, including China RoHS and Korea RoHS, adds complexity to Alps Alpine's supply chain operations.

- The company invests in R&D for lead-free solder and halogen-free materials to meet evolving environmental standards and avoid market access barriers.

- Ensuring traceability of materials from over 1,000 suppliers is crucial for demonstrating adherence to global hazardous substance restrictions.

Climate Change and Physical Risks

Climate change presents tangible physical risks to Alps Alpine's global operations and intricate supply chains, with extreme weather events like floods or droughts potentially disrupting manufacturing facilities and critical transportation routes. The company is actively assessing these risks, aiming to build greater resilience into its worldwide operations to mitigate future impacts. Furthermore, there is a significant environmental expectation for Alps Alpine to contribute substantially to global decarbonization efforts by aggressively reducing greenhouse gas emissions across its entire value chain. This commitment aligns with broader sustainability goals for 2025 and beyond.

- Alps Alpine targets 30% reduction in Scope 1 and 2 GHG emissions by FY2030 (from FY2019 levels).

- The company aims for a 15% reduction in Scope 3 GHG emissions by FY2030.

- Resilience efforts include supply chain diversification and business continuity planning for climate-related disruptions.

Alps Alpine navigates a complex environmental landscape shaped by evolving regulations like Euro 7 (July 2025) and the EU CSRD (effective 2025 for 2024 data), demanding lighter components, circular economy practices, and transparent ESG reporting. Strict RoHS compliance and e-waste directives necessitate a focus on recyclable materials and supply chain traceability. Furthermore, climate change risks and investor scrutiny (over $35 trillion in ESG assets by 2025) drive the company's commitment to significant GHG emission reductions, including targets for Scope 1, 2, and 3 by FY2030.

| Environmental Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Regulatory Compliance | Product design, material sourcing | Euro 7 standards (July 2025), EU CSRD (effective 2025) |

| ESG Investor Scrutiny | Capital allocation, market access | Over $35 trillion in ESG assets by 2025 |

| GHG Emission Reduction | Operational sustainability, climate resilience | Scope 1 & 2 GHG reduction 30% by FY2030 (vs. FY2019) |

PESTLE Analysis Data Sources

Our Alps Alpine PESTLE Analysis is informed by a comprehensive review of official government publications, reputable industry associations, and leading financial news outlets. This ensures a robust understanding of regulatory changes, economic trends, and market dynamics affecting the automotive sector.