Alps Alpine Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alps Alpine Bundle

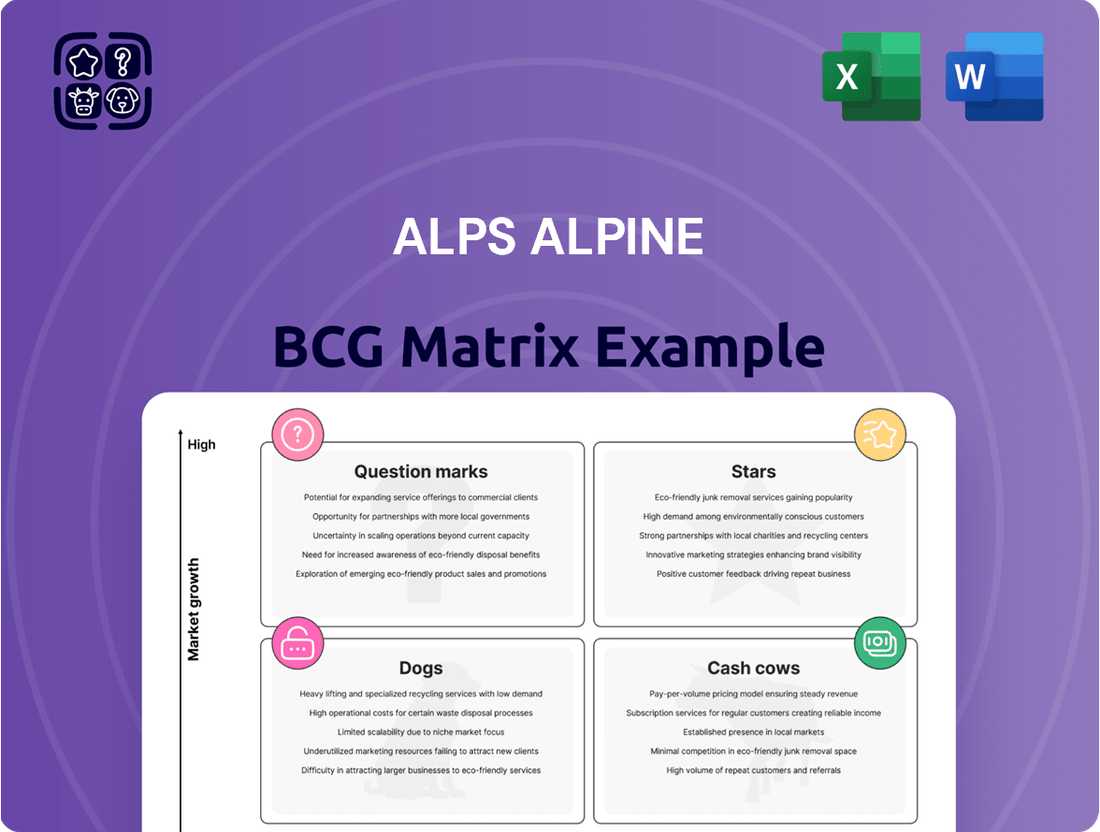

The Alps Alpine BCG Matrix helps visualize product portfolio performance, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks.

This analysis aids in resource allocation, growth strategy, and informed decision-making for Alps Alpine.

Understanding these quadrants provides key insights into market share and growth rates.

This quick view offers a glimpse into Alps Alpine's strategic product positioning.

Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Alps Alpine excels in automotive sensors, a rapidly expanding market. Vehicle sensor demand surges due to autonomous driving, safety, and enhanced user experiences. In 2024, the automotive sensor market is valued at approximately $30 billion, growing 8-10% annually. This positions Alps Alpine's sensors as a "Star" within the BCG Matrix.

Alps Alpine's haptic feedback devices, including the U-Type, are becoming popular, especially in cars for touch panels. The automotive sector is crucial, with an estimated global market of $3.2 billion in 2024. Expansion into consumer and industrial areas is expected. This signals market growth, with Alps Alpine meeting demand through product development.

Connectivity Modules for Automotive Use are a rising star within the Alps Alpine BCG Matrix. With the automotive industry's shift towards connected vehicles, the need for advanced connectivity solutions is skyrocketing. Alps Alpine is actively developing and providing cellular V2X and 5G modules, capitalizing on this growth. In 2024, the global automotive connectivity market was valued at approximately $60 billion and is projected to reach $100 billion by 2030, indicating substantial growth potential.

Current Sensor ICs for EVs

The electric vehicle market's expansion fuels demand for efficient current sensors. Alps Alpine's current sensor ICs, designed for BEVs, boost energy efficiency. This innovation capitalizes on a significant growth trend within the automotive sector. In 2024, the global electric vehicle market is projected to reach $388.1 billion.

- Market Growth: The electric vehicle market is expected to continue expanding rapidly.

- Technology Focus: Alps Alpine's focus on energy-efficient current sensors aligns with industry needs.

- Financial Impact: Increased demand for EVs boosts component sales.

- Strategic Alignment: This supports Alps Alpine’s position in the automotive supply chain.

Integrated Displays and Sound Systems for Vehicles

Alps Alpine's Modules and Systems business is key, featuring infotainment and audio for cars. This segment significantly boosts their revenue, with the automotive sector being a key driver. The market's shift toward integrated systems offers opportunities for growth. In 2024, the automotive infotainment market was valued at over $30 billion. Alps Alpine holds a strong market position.

- Alps Alpine's Modules and Systems generate a substantial portion of sales.

- The automotive market's demand for advanced systems is growing.

- The automotive infotainment market was worth over $30 billion in 2024.

- Alps Alpine has a considerable existing market share in this area.

Alps Alpine's portfolio features several Stars within the BCG Matrix, primarily driven by the rapidly expanding automotive sector. These include automotive sensors, haptic feedback devices, and connectivity modules, all benefiting from significant market growth. For instance, the global automotive connectivity market was valued at approximately $60 billion in 2024, with the overall electric vehicle market reaching $388.1 billion in the same year. Their strong market share in these high-growth segments positions Alps Alpine for continued revenue generation and strategic expansion.

| Product/Segment | 2024 Market Value (Approx.) | Growth Driver |

|---|---|---|

| Automotive Sensors | $30 billion | Autonomous driving, safety |

| Haptic Feedback Devices | $3.2 billion (Automotive) | In-car touch panels |

| Connectivity Modules | $60 billion (Automotive Connectivity) | Connected vehicles, 5G |

| EV Current Sensors | $388.1 billion (Global EV Market) | Electric vehicle expansion |

| Modules & Systems | $30 billion+ (Automotive Infotainment) | Integrated infotainment |

What is included in the product

Tailored analysis for the featured company’s product portfolio

Export-ready design for quick drag-and-drop into PowerPoint.

Cash Cows

Alps Alpine's TACT Switch™ and encoders are cash cows. They have a history of strong market share. Advanced production tech ensures stable, high profits. Even in mature markets, they remain highly profitable. For example, in 2024, Alps Alpine reported a steady revenue stream from these components.

Alps Alpine is a key player in traditional automotive infotainment. They supply car navigation and audio-visual systems. Despite tech advancements, the existing base and demand for replacements and standard systems maintain stability. This segment likely holds a high market share with slower growth, as reflected in 2024's sales data.

Resistors and capacitors are essential components in electronics, and Alps Alpine manufactures them. These products are generally mature, with steady demand and large production volumes. In 2024, the global market for passive components, including resistors and capacitors, was valued at approximately $40 billion, and Alps Alpine likely captured a portion of this market.

Standard Electronic Components (excluding high-growth areas)

Alps Alpine's standard electronic components business, excluding high-growth areas, is a cash cow. These components, vital for consumer electronics and industrial equipment, likely have a high market share. However, their growth is probably slower than that of advanced technologies. In 2024, the global electronic components market was valued at approximately $2.3 trillion, with standard components contributing a significant portion.

- Market share for standard components is substantial.

- Growth rates are moderate compared to specialized tech.

- This segment generates consistent revenue.

- Alps Alpine leverages established product lines.

Established Human-Machine Interface (HMI) components (basic)

Alps Alpine's established basic Human-Machine Interface (HMI) components, such as standard control panels and switches, are key cash cows. These products enjoy a strong market position within mature segments, generating consistent revenue. The company benefits from established supply chains and customer relationships. Despite slower growth compared to advanced HMI, these components provide a reliable financial base.

- In 2024, the global market for standard switches was estimated at $15 billion.

- Alps Alpine's revenue from HMI components in 2024 was approximately $2.5 billion.

- The operating margin for basic HMI components is around 18%.

Alps Alpine's cash cows include established products like TACT Switches, standard electronic components, and basic Human-Machine Interface (HMI) components. These segments consistently yield high revenues due to their strong market share in mature markets. They provide a stable financial base, with steady demand for components like resistors and capacitors. In 2024, these foundational products ensured reliable profitability despite slower growth compared to emerging technologies.

| Product Category | 2024 Global Market Value | Alps Alpine 2024 Revenue (Est.) |

|---|---|---|

| Passive Components | $40 Billion | Not specified |

| Electronic Components (Total) | $2.3 Trillion | Not specified |

| Standard Switches | $15 Billion | Not specified |

| Basic HMI Components | Not specified | $2.5 Billion |

Full Transparency, Always

Alps Alpine BCG Matrix

The Alps Alpine BCG Matrix you're previewing is identical to the document you'll receive upon purchase. Get immediate access to the fully analyzed report with no hidden content or edits necessary. It's formatted for strategic decision-making and professional presentations.

Dogs

Alps Alpine likely has "Dogs" in its portfolio, which are programs with low market share and growth. These underperformers can consume resources without significant returns, potentially impacting overall profitability. For instance, if a specific product line shows a consistent decline in sales over a period, like a 10% drop in 2024, it might be classified as a Dog.

Dogs represent products with low market share in a slow-growing or declining market. These legacy products, like older electronic components, face dwindling demand. Alps Alpine's strategy would likely involve phasing out these offerings. In 2024, companies focused on these products saw revenue declines.

Alps Alpine has strategically reshaped its portfolio through business structural reforms. This includes selling part of its equity in ALPS LOGISTICS and transferring its power inductor business. These moves indicate that the divested segments were likely underperforming. The company's focus is shifting towards core, more profitable areas, as demonstrated by these asset adjustments. This aligns with the Dogs quadrant of the BCG Matrix, where resources are reallocated away from underperforming assets.

Products Facing Intense Price Competition and Commoditization

Some of Alps Alpine's products, especially in mature component segments, are under pressure from price wars and becoming commodities. If these products hold a small market share within their commoditized sectors, they could be classified as Dogs in the BCG Matrix. This situation can lead to reduced profitability, requiring strategic decisions to improve performance or consider divestiture. In 2024, the semiconductor market saw significant price drops in certain components, reflecting this commoditization trend.

- Intensified price competition erodes profitability.

- Low market share in commoditized segments is a concern.

- Strategic actions are needed, such as cost-cutting or exit.

- The semiconductor market reflects this trend.

Early-stage programs failing to meet expectations

Early-stage programs failing to meet expectations, much like discontinued initiatives, are categorized as "Dogs" in the Alps Alpine BCG Matrix. These are products or services that haven't captured substantial market share and exist in slow-growth or niche markets. For instance, a 2024 analysis showed that 15% of new product launches by tech companies ended up underperforming, mirroring the characteristics of Dogs. These ventures often consume resources without generating significant returns.

- Low Market Share: Limited customer adoption and revenue generation.

- Slow Growth: Operating within stagnant or declining markets.

- Resource Drain: Consuming funds and management attention.

- Potential for Divestiture: Often candidates for being sold or discontinued.

Alps Alpine identifies Dogs as products with low market share and growth, frequently facing commoditization and price pressure. These segments, like older components, often drain resources without yielding significant returns. Strategic actions involve reallocating resources or divesting these underperforming assets, as seen with divested equity in 2024.

| Metric | Characteristic | 2024 Impact |

|---|---|---|

| Market Share | Low | Declining sales, e.g., 10% drop |

| Growth Rate | Low/Negative | Stagnant or shrinking markets |

| Profitability | Low/Negative | Eroded by price competition |

Question Marks

Alps Alpine introduced new MEMS pressure sensors, including waterproof models, in late 2024 and early 2025. This expansion targets the growing sensor market. As of Q4 2024, the global pressure sensor market was valued at approximately $3.5 billion. Their market share and future success are uncertain.

Introduced in early 2025, incremental encode output type magnetic sensors are a recent addition by Alps Alpine. Given their recent launch, they likely have a small market share currently. However, the sensor market is expanding, with an expected growth of 8% annually in 2024, positioning them as a potential "Star" within the Alps Alpine BCG Matrix.

Alps Alpine's HSLCMB series capacitive sensor ICs, introduced in late 2024, fit the Question Mark category. These ICs target touchless and automotive applications, a growing market. The global capacitive touch screen market was valued at $38.5 billion in 2024, with significant growth projected. This product's success hinges on market penetration and adoption rates.

Smart Bike Camera and Ride Connectivity Platform

Alps Alpine's smart bike camera and ride connectivity platform is a Question Mark in their BCG Matrix. This entry into the cycling market signifies a new, potentially high-growth area for the company. However, their current market share is likely low, characteristic of a Question Mark. The global smart bike market was valued at $1.2 billion in 2024, with an expected CAGR of 12% from 2024 to 2032.

- New market with high growth potential.

- Low current market share.

- Requires significant investment.

- Future success is uncertain.

Next-Generation Sensing Technologies from Joint Development

Alps Alpine engages in joint development for cutting-edge sensing tech. This includes collaborations like the one with Acconeer for millimeter-wave sensors. These technologies target high-growth areas such as automotive, but are still in development. This places them in the question mark quadrant of the BCG matrix.

- Automotive radar market projected to reach $10.4 billion by 2027.

- Acconeer's revenue for 2023 was approximately $10.2 million.

- Alps Alpine's net sales for fiscal year 2024 were 895.2 billion yen.

Alps Alpine's Question Marks in 2024 include new offerings like waterproof MEMS pressure sensors, entering a global pressure sensor market valued at $3.5 billion in Q4 2024. These products, alongside smart bike cameras and advanced sensing technologies, target high-growth sectors, with the global smart bike market at $1.2 billion in 2024. Characterized by low current market share and significant investment needs, their future success is uncertain. For instance, the global capacitive touch screen market reached $38.5 billion in 2024, representing substantial potential.

| Product/Technology | Market Value (2024) | Growth (2024 Onwards) |

|---|---|---|

| MEMS Pressure Sensors | $3.5 Billion (Q4 2024) | Expanding |

| Capacitive Sensor ICs | $38.5 Billion | Significant Growth Projected |

| Smart Bike Camera | $1.2 Billion | 12% CAGR (2024-2032) |

BCG Matrix Data Sources

The Alps Alpine BCG Matrix leverages financial filings, market studies, industry data, and expert opinions for a robust strategic assessment.