Alps Alpine Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alps Alpine Bundle

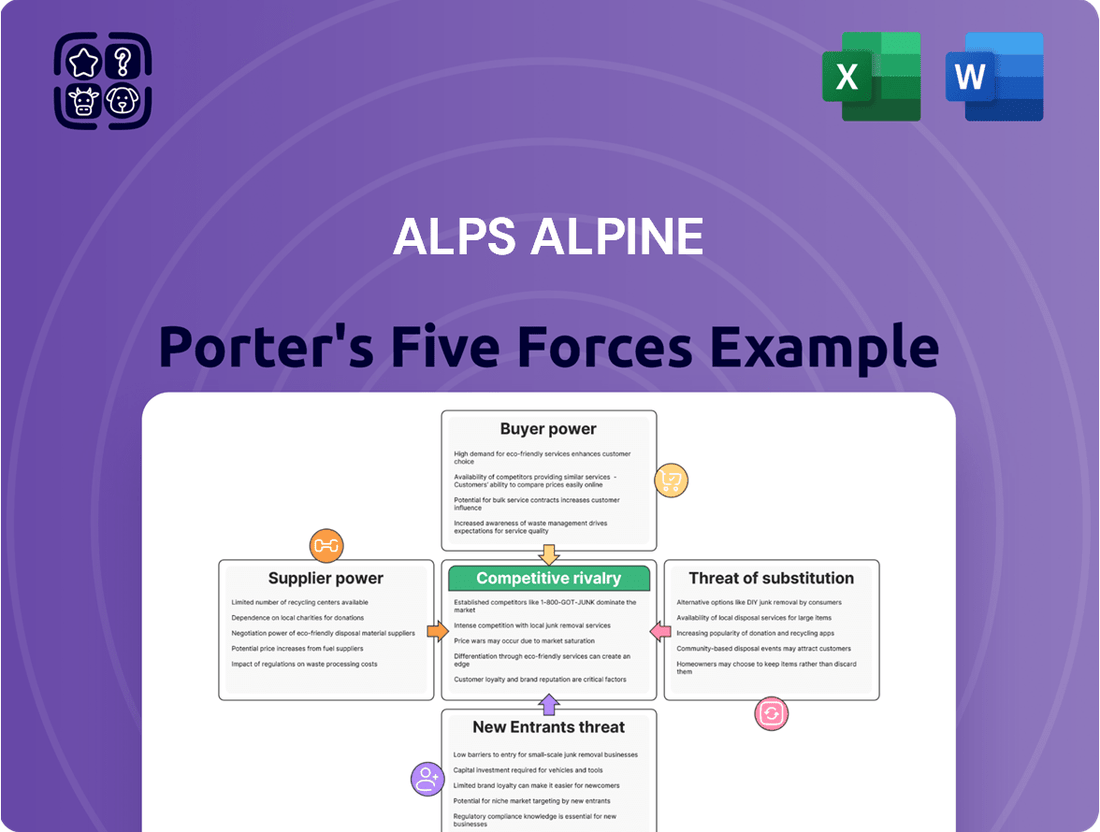

Alps Alpine faces a dynamic competitive landscape, with the threat of new entrants and the bargaining power of buyers presenting significant challenges.

Understanding the intensity of rivalry among existing competitors is crucial for strategic positioning.

The availability of substitute products also demands careful consideration of Alps Alpine's value proposition.

Furthermore, the bargaining power of suppliers can impact cost structures and operational efficiency.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alps Alpine’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The automotive electronics sector, including Alps Alpine, heavily depends on specialized suppliers for critical components like advanced semiconductors and high-tech materials. This concentration grants these suppliers significant leverage over pricing and supply terms, a trend continuing into 2024. Alps Alpine mitigates this by engaging approximately 1,300 global suppliers. The company strategically selects key suppliers, who account for a large portion of transaction value, to foster close collaboration and manage potential risks. This approach helps stabilize procurement amidst specialized component market dynamics.

For Alps Alpine, the costs to switch suppliers for advanced components like proprietary semiconductors or specialized sensors are substantial. These expenses go beyond new component prices, encompassing significant R&D, re-tooling, and re-qualification efforts to integrate them into complex automotive systems. For instance, the automotive industry's average R&D expenditure as a percentage of revenue remained high in 2024, reflecting the complexity of new product integration. This high financial and operational barrier effectively locks Alps Alpine into existing supplier relationships, considerably boosting the bargaining power of these key suppliers.

The prices of critical raw materials for electronic components, like rare earth metals, copper, and aluminum, exhibit significant volatility. This instability, often fueled by geopolitical tensions such as the ongoing conflict in Eastern Europe and persistent supply chain disruptions, directly elevates suppliers' costs. For example, copper prices saw notable fluctuations in early 2024, impacting input expenses. Suppliers frequently pass these increased costs onto manufacturers like Alps Alpine, thereby limiting the company's ability to effectively control its procurement expenditures.

Supplier Dependence on the Automotive Sector

While some automotive component suppliers offer highly specialized products, many also depend heavily on the large-volume orders from the global automotive industry. Alps Alpine's significant scale and its role as a major Tier 1 supplier provide it with a degree of counter-leverage against its suppliers. In 2024, the automotive sector continues to be a dominant force, making suppliers motivated to maintain strong relationships with key players like Alps Alpine. This ensures a steady stream of business and consistent revenue, especially given the sector's projected growth in vehicle production, with global light vehicle production estimated to reach around 90 million units in 2024.

- Major automotive suppliers often dedicate significant production capacity to a few large customers.

- Alps Alpine's market position, with reported net sales of approximately JPY 928 billion for the fiscal year ending March 2024, gives it leverage.

- Suppliers prioritize maintaining consistent order flows from large Tier 1 players to stabilize their revenue streams.

- The high volume demands of the automotive industry make it a critical customer base for many component manufacturers.

Forward Integration Threat is Low

The likelihood of a component supplier, such as a semiconductor manufacturer, integrating forward to produce complex infotainment or HMI systems for automotive OEMs is relatively low. This is due to the immense R&D investment required, with top automotive suppliers like Bosch investing billions annually in 2024 for advanced systems. Furthermore, the specialized system integration expertise and established, long-term relationships with global automotive OEMs like Toyota and Volkswagen pose significant barriers. This low threat of forward integration helps to moderate supplier power over companies like Alps Alpine, ensuring more stable supply chains.

- Immense R&D investment: Billions required for new system development.

- Specialized system integration expertise: Deep knowledge of automotive architectures.

- Established OEM relationships: Long-term contracts and trust with automakers.

- High barrier to entry: Significant capital and time to market for new entrants.

Alps Alpine faces significant supplier power for specialized components due to high switching costs and volatile raw material prices, impacting procurement costs in 2024. However, Alps Alpine's substantial scale, with net sales around JPY 928 billion in FY2024, offers considerable counter-leverage. Suppliers depend heavily on consistent, large-volume orders from the automotive sector, which is projected to produce 90 million light vehicles in 2024. The low threat of component suppliers integrating forward into complex systems further moderates their power.

| Factor | Impact on Supplier Power | 2024 Data Point |

|---|---|---|

| Specialized Components | High leverage due to concentration | Automotive R&D high in 2024 |

| Raw Material Volatility | Elevated supplier costs | Copper price fluctuations early 2024 |

| Alps Alpine Scale | Counter-leverage for procurement | Net sales JPY 928 billion (FY2024) |

| Automotive Volume | Supplier dependence on orders | 90 million light vehicles projected 2024 |

What is included in the product

This analysis unpacks the competitive forces shaping Alps Alpine's market, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Effortlessly understand and address supplier leverage, reducing the pain of unfavorable terms.

Customers Bargaining Power

Alps Alpine's core business relies heavily on a highly concentrated group of major automotive original equipment manufacturers (OEMs). These large automakers, including key players like Toyota and Volkswagen, command substantial purchasing volumes. Their collective buying power allows them to exert significant pressure on Alps Alpine's pricing, quality standards, and delivery schedules. For instance, in 2024, the top ten global automakers represented a substantial portion of automotive electronics demand. This high customer concentration grants these OEMs significant bargaining power over Alps Alpine.

Alps Alpine's strategic focus on long-term OEM partnerships significantly diminishes customer bargaining power. Once their components, like infotainment systems, are integrated into a vehicle model, it establishes high switching costs for automotive OEMs. Changing a critical system mid-cycle, especially with vehicle platforms evolving for 2024 models, is incredibly complex and expensive due to re-engineering and recalibration. This 'design-win' model provides Alps Alpine with stable revenue streams and substantially reduces buyer power for the duration of that vehicle's production run, often spanning several years.

Automotive OEMs operate in a fiercely competitive market, putting them under constant pressure to reduce costs. This pressure flows directly to suppliers like Alps Alpine, resulting in aggressive price negotiations and demands for annual cost reductions, often around 3% to 5%. The global automotive market's projected modest growth of approximately 1.5% in 2024, combined with ongoing profitability challenges, intensifies this customer bargaining power. OEMs expect suppliers to absorb cost increases and invest in innovation while maintaining highly competitive pricing.

Increasing Demand for Advanced HMI and Infotainment

The escalating consumer demand for sophisticated in-vehicle experiences, including advanced Human-Machine Interfaces (HMI) and infotainment systems, significantly impacts customer bargaining power. As of 2024, the global automotive HMI market is projected to reach substantial growth, driven by features like enhanced connectivity and advanced driver-assistance systems (ADAS). Alps Alpine's expertise in providing cutting-edge solutions, such as their integrated cockpit systems, empowers them to offer unique value. This specialized capability reduces the leverage of automotive manufacturers who critically need these innovative technologies to meet market expectations and differentiate their vehicles. Consequently, customers find their options limited, increasing their reliance on key suppliers like Alps Alpine.

- Global automotive HMI market value projected to exceed $30 billion by 2025.

- ADAS integration is a primary driver, with Level 2+ ADAS penetration increasing in new vehicles in 2024.

- Alps Alpine's R&D investment in 2023 was approximately JPY 60 billion, supporting advanced HMI development.

- Connectivity features are becoming standard, with over 70% of new vehicles in major markets offering embedded telematics in 2024.

Threat of Backward Integration by OEMs

Major automakers increasingly possess the capability to develop and manufacture their own advanced electronic systems and software, posing a real threat of backward integration for suppliers like Alps Alpine. As vehicles become profoundly software-defined, tech-savvy Original Equipment Manufacturers (OEMs) are actively choosing to bring more development in-house, as seen with Volkswagen's Cariad or Mercedes-Benz's MB.OS initiatives in 2024. This burgeoning internal capability significantly empowers customers, granting them additional leverage in negotiations with external suppliers of automotive components and systems.

- OEMs like Volkswagen (Cariad) and Mercedes-Benz (MB.OS) are heavily investing in in-house software development as of 2024.

- The shift towards software-defined vehicles prompts OEMs to internalize critical electronic system design.

- This potential for backward integration enhances the bargaining power of major automotive customers.

Automotive OEMs exert significant bargaining power over Alps Alpine due to high concentration and intense cost pressures, demanding aggressive price reductions. However, Alps Alpine's long-term design-win partnerships create high switching costs, mitigating some customer leverage. Additionally, their specialized expertise in advanced HMI and ADAS, crucial for 2024 vehicle models, limits customer options. The increasing threat of OEM backward integration into software development further influences this dynamic.

| Factor | Impact on Bargaining Power | 2024 Data Point |

|---|---|---|

| Customer Concentration | High Power | Top 10 global automakers drive substantial demand. |

| Switching Costs | Reduced Power | High re-engineering costs for 2024 vehicle platforms. |

| OEM Cost Pressure | High Power | Typical 3%-5% annual cost reduction demands. |

| Alps Alpine's Expertise (HMI/ADAS) | Reduced Power | Global HMI market projected to exceed $30B by 2025. |

| Backward Integration Threat | Increased Power | OEMs like VW (Cariad) investing in in-house software. |

Same Document Delivered

Alps Alpine Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This preview showcases the complete Porter's Five Forces analysis for Alps Alpine, detailing the competitive landscape and strategic implications for the automotive components industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry. This professionally crafted analysis will equip you with a comprehensive understanding of the market dynamics affecting Alps Alpine.

Rivalry Among Competitors

The automotive electronics and infotainment market is intensely competitive, featuring numerous established global players vying for market share. Alps Alpine faces significant rivalry from industry giants like Bosch, Continental, Harman, and Visteon. Additionally, competition stems from fellow Japanese firms such as Denso and Tokai Rika, alongside a growing number of emerging technology companies. This crowded landscape, particularly evident in 2024 with ongoing supply chain adjustments and evolving EV demands, exerts considerable pressure on pricing strategies and overall profitability for all participants.

The electronics and automotive components industry, where Alps Alpine operates, demands significant upfront investments in research and development, cutting-edge manufacturing facilities, and advanced technology. These high fixed costs, exemplified by the capital-intensive nature of semiconductor and component production, compel companies to sustain high production volumes to achieve crucial economies of scale. Furthermore, the specialized nature of these assets creates substantial exit barriers, as they are not easily repurposed. This forces companies like Alps Alpine to engage in intense competition, even when market conditions lead to lower profitability, as seen in the fluctuating demand patterns observed in 2024 for automotive electronics.

Competition within the automotive components sector, especially for Alps Alpine, is heavily driven by relentless technological innovation and product differentiation. Companies are in a constant race to offer the most advanced Human-Machine Interface (HMI), connectivity, and sensor solutions. This fuels an expensive research and development race, with major players investing significantly; for instance, Alps Alpine projected R&D expenses of JPY 45 billion for the fiscal year ending March 2024, demonstrating the industry's commitment. This investment aims to integrate cutting-edge features like AI, augmented reality, and seamless connectivity to meet evolving OEM and consumer demands for sophisticated in-car experiences.

Industry Consolidation and Strategic Partnerships

The automotive electronics industry is experiencing significant consolidation and a surge in strategic partnerships, driven by the complex integration of hardware and software for next-generation vehicles. Companies are increasingly collaborating to combine specialized expertise, which redefines competitive dynamics. For example, Alps Alpine has strategically partnered with TS TECH and DSP Concepts, reflecting the necessity to jointly develop advanced solutions for software-defined vehicles. This trend, prominent in 2024, mitigates some direct rivalry while intensifying competition for those unable to form similar alliances.

- Alps Alpine's Q1 2024 sales for its Automotive business segment reached 155.7 billion JPY.

- The company aims to increase its software-related sales ratio to 20% by 2025.

- Strategic alliances are crucial for navigating the shift toward connected and autonomous mobility.

Pressure from Chinese Competitors

The competitive landscape in China, a pivotal automotive market, is intensely challenging for global players like Alps Alpine. Local Chinese suppliers are rapidly strengthening their market share, often engaging in aggressive price competition. This dynamic significantly pressures profit margins for international firms, exemplified by the average 2024 operating margin for some Chinese automotive electronics firms being 5-7% lower than their global counterparts. This fierce local rivalry is fundamentally reshaping the global competitive environment within the automotive electronics sector.

- In 2024, Chinese automotive component manufacturers increased their domestic market share by an estimated 3% compared to 2023.

- Price competition from Chinese rivals has led to an estimated 8-12% reduction in average selling prices for certain automotive electronics components.

- Some global suppliers reported a 2024 year-on-year revenue decline of up to 5% in the Chinese market due to local competition.

- Chinese automotive electronics exports grew by approximately 15% in the first quarter of 2024, indicating increasing global reach.

Alps Alpine navigates intense competitive rivalry in automotive electronics, facing numerous global players and emerging technology firms, which significantly pressures pricing and profitability. High fixed costs and substantial R&D investments, exemplified by Alps Alpine's projected JPY 45 billion for FY2024, fuel a continuous race for technological differentiation. Furthermore, the Chinese market presents fierce competition from local suppliers, leading to estimated 8-12% reductions in average selling prices for certain components in 2024. Strategic partnerships are crucial for navigating this dynamic landscape, as consolidation reshapes traditional rivalries.

| Metric | 2024 Data | Impact |

|---|---|---|

| Alps Alpine Projected R&D (FY2024) | JPY 45 billion | Drives innovation, high fixed costs |

| Chinese Market Share Growth (2024) | ~3% for local firms | Intensified local rivalry |

| Chinese Price Competition Impact (2024) | 8-12% ASP reduction | Pressure on profit margins |

SSubstitutes Threaten

The primary substitute threat to Alps Alpine's native infotainment systems stems from the direct integration of smartphones and tablets. Platforms like Apple CarPlay and Android Auto, projected to be in over 90% of new cars by 2024, offer seamless navigation, communication, and media streaming, directly replacing some in-car functions. While these systems can substitute for basic infotainment, the prevailing trend in 2024 is toward deeper embedded integration within the vehicle's Human-Machine Interface. This evolution makes the infotainment system a necessary host for these smartphone projections, shifting the dynamic from pure substitution to essential hosting.

The core interface of vehicles is rapidly evolving, with new human-machine interface technologies emerging as significant substitutes. Advanced voice assistants, gesture controls, and augmented reality head-up displays (HUDs) are gaining traction, moving beyond traditional touchscreens and physical buttons. While Alps Alpine often integrates these innovations, a competitor mastering a new modality first poses a substantial threat. For instance, the global automotive voice assistant market is projected to grow, reaching an estimated $3.5 billion by 2029, reflecting a clear shift in consumer preference and a potential for substitution if Alps Alpine lags in these areas.

For the end-user, such as a driver, the transition between utilizing a vehicle’s native infotainment system and a connected smartphone like Apple CarPlay or Android Auto carries virtually no financial burden. This seamless shift means consumers face minimal friction when opting for their preferred interface. Consequently, infotainment system manufacturers, including Alps Alpine, are compelled to significantly enhance their user experience to rival the established familiarity and vast application ecosystems of personal mobile devices. This competitive pressure is intensified by the fact that over 80% of new vehicles in 2024 offer smartphone integration, making a compelling native system crucial for differentiation.

Aftermarket Solutions

The automotive aftermarket presents a notable threat as it offers a wide array of substitute solutions, from simple phone integration devices to advanced head unit replacements. While these alternatives typically do not directly impact new vehicle sales, their robust availability significantly influences original equipment manufacturer (OEM) decisions. This vibrant aftermarket can limit the perceived value and willingness to pay for expensive, factory-installed high-end audio and infotainment systems offered by Alps Alpine.

- The global automotive aftermarket was valued at over $400 billion in 2023, expected to grow significantly by 2024.

- Consumers often opt for aftermarket upgrades due to lower costs, greater customization, and faster technology adoption compared to OEM offerings.

- Aftermarket solutions can erode the premium positioning of integrated OEM systems, pushing Alps Alpine to innovate faster.

- The prevalence of DIY installations and specialized shops makes these substitutes readily accessible.

Shift to Software and App-Based Services

As vehicles increasingly become software-defined, the core value proposition is shifting away from traditional hardware components towards advanced software and integrated services. This presents a significant threat of substitution for companies like Alps Alpine, as OEMs could opt for compelling, hardware-agnostic software platforms from new entrants. Such a move would diminish reliance on the integrated hardware/software solutions offered by conventional Tier 1 suppliers, potentially impacting revenue streams.

Projections for the global automotive software market indicate continued robust expansion, with significant growth expected through 2024 and beyond. This trend underlines the increasing importance of software-centric solutions over purely hardware-based offerings.

- The global automotive software market was valued at approximately $22.7 billion in 2023 and is projected to reach $29.4 billion by 2024.

- OEMs are increasingly investing in in-house software development and partnerships with pure-play software companies.

- Consumer demand for advanced infotainment and connectivity features drives software integration.

- Shift to subscription-based in-car services creates new revenue models independent of hardware.

The primary threat of substitutes for Alps Alpine stems from smartphone integration like Apple CarPlay, present in over 90% of new cars by 2024, and evolving human-machine interfaces such as advanced voice assistants. The robust automotive aftermarket, valued over $400 billion in 2023, offers accessible, customizable alternatives. Moreover, the shift towards software-defined vehicles, with the automotive software market reaching $29.4 billion in 2024, enables OEMs to prioritize hardware-agnostic solutions, diminishing reliance on traditional integrated systems.

| Substitute Type | 2024 Impact | Key Driver |

|---|---|---|

| Smartphone Integration | >90% new cars offer | Seamless user experience |

| Aftermarket Solutions | >$400B market (2023) | Cost, customization |

| Software-Defined Vehicles | >$29.4B software market | OEMs' in-house development |

Entrants Threaten

Entering the automotive components market presents a substantial barrier due to the immense capital investment required for new entrants. Companies must commit significant funds to cutting-edge research and development, with global automotive R&D spending projected to exceed $100 billion in 2024. Establishing advanced manufacturing facilities, capable of producing high-quality, automotive-grade parts, often necessitates investments upward of hundreds of millions of dollars. Furthermore, rigorous testing and certification processes for safety and reliability demand considerable resources. This formidable financial hurdle effectively deters many potential new competitors from entering the sector.

Incumbent firms like Alps Alpine benefit from substantial economies of scale in procurement and manufacturing, leveraging their extensive operational footprint. For example, Alps Alpine's reported sales for the fiscal year ending March 2024 were approximately JPY 964 billion, reflecting massive production volumes difficult for new entrants to match. This scale allows for significant cost advantages, with established supply chains and optimized production lines. Furthermore, decades of experience provide deep knowledge in product development and quality control, creating a high barrier to entry for newcomers who would face considerable cost and quality disadvantages without similar operational history.

New entrants face a significant barrier due to the deeply entrenched relationships established suppliers like Alps Alpine hold with global automotive OEMs. Gaining access to these OEMs is incredibly challenging, as the industry prioritizes long-term trust and proven reliability. The design and rigorous validation process for new vehicle components often spans several years, making it difficult for newcomers to quickly integrate. For instance, a new component can take 3-5 years from concept to mass production within an OEM's supply chain, a timeframe that heavily favors incumbents. Established players are already deeply embedded, holding a significant competitive advantage in securing new business.

Stringent Regulatory and Safety Standards

The automotive sector, where Alps Alpine operates, imposes incredibly stringent safety, environmental, and quality regulations that differ significantly across global regions. Achieving compliance demands substantial specialized expertise and considerable financial investment, particularly with evolving standards like Euro 7 emissions or UN ECE R155 cybersecurity rules in 2024. Navigating these complex regulatory hurdles presents a formidable barrier, effectively deterring many potential new entrants from even considering the market.

- Global regulatory compliance costs for automotive suppliers are estimated to be in the tens of millions annually.

- New vehicle models in 2024 face over 100 distinct regulatory requirements across major markets.

- Product development cycles are extended by up to 18 months solely due to certification processes.

- Non-compliance can result in fines exceeding 100 million Euros for major automotive players.

Technological Expertise and Intellectual Property

Established players like Alps Alpine possess extensive patent portfolios and proprietary technology in critical areas such as sensors, Human-Machine Interface (HMI), and connectivity. A new entrant faces significant hurdles, needing to invest heavily in research and development to create competitive technology. Developing such advanced systems, crucial for the automotive sector, is both time-consuming and capital-intensive. Alternatively, licensing existing technology from incumbents proves to be an expensive endeavor, impacting profitability.

- The global automotive HMI market, where Alps Alpine is a key player, was valued at approximately USD 15.6 billion in 2023.

- Developing new, competitive automotive sensor or HMI technology requires substantial R&D investment, often running into hundreds of millions of dollars annually for established firms.

- Proprietary intellectual property creates a high barrier to entry, as the cost and time to replicate leading-edge solutions are prohibitive for newcomers.

New entrants face substantial hurdles in the automotive components market, primarily due to immense capital requirements for R&D and manufacturing, with global R&D exceeding $100 billion in 2024. Established players like Alps Alpine benefit from significant economies of scale and entrenched OEM relationships, making market penetration incredibly difficult. Stringent regulatory compliance and proprietary technology further solidify these barriers, ensuring a low threat from new competitors.

| Barrier Type | Key Metric | 2024 Data Point |

|---|---|---|

| Capital Investment | Global Auto R&D | >$100 Billion |

| Economies of Scale | Alps Alpine FY24 Sales | JPY 964 Billion |

| Regulatory Compliance | New Vehicle Req. | >100 Distinct Rules |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alps Alpine leverages data from company annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.

We integrate information from trade publications, financial news outlets, and macroeconomic data providers to assess the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes.