Allianz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allianz Bundle

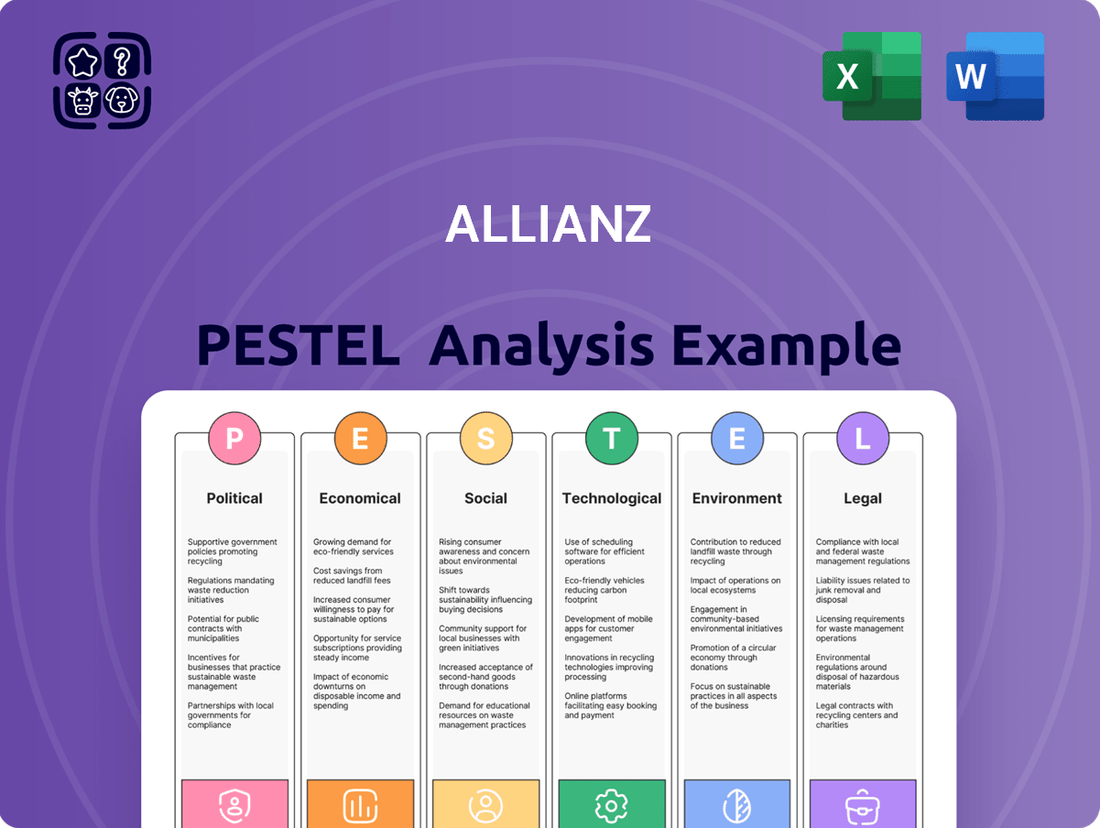

Navigate the complex external forces shaping Allianz's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this global insurance giant. Equip yourself with actionable intelligence to refine your own strategic planning and investment decisions. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Global geopolitical tensions, including ongoing trade disputes and regional conflicts, can significantly influence Allianz's international operations and investment strategies. For instance, the persistent trade friction between major economies like the United States and China, which saw tariffs impacting billions in goods in 2023 and continuing into 2024, can lead to economic slowdowns in crucial markets. This slowdown directly affects investment returns and the demand for insurance products.

Allianz's operations are significantly influenced by regulatory stability. While efforts like the IAIS's work on Insurance Capital Standards (ICS) aim for global alignment, differing approaches to data privacy, such as the GDPR in Europe versus evolving regulations in the US, present compliance hurdles.

The increasing focus on climate risk disclosures, with varying mandates across the EU, UK, and other major markets, also adds layers of complexity to Allianz's reporting and risk management frameworks, requiring tailored strategies for each jurisdiction.

Government shifts and reforms in healthcare systems, especially in key markets like the United States, have a direct impact on the health insurance industry. For instance, proposed changes to the Affordable Care Act (ACA) in 2024 could alter coverage mandates and subsidies, influencing demand for private insurance plans.

Rising healthcare costs are a persistent concern. In 2024, the US experienced a significant increase in medical inflation, with some estimates suggesting it outpaced general inflation. This trend directly pressures insurers like Allianz, likely leading to higher premiums for health insurance products and forcing adjustments to their pricing strategies to maintain profitability.

Climate Risk Regulation

Governments worldwide are intensifying scrutiny on how insurers manage and disclose climate-related financial risks. This heightened regulatory focus directly impacts companies like Allianz, necessitating robust strategies for climate risk exposure and mitigation.

Property and casualty insurers are now facing new mandates. These include detailed disclosures of potential financial impacts stemming from climate events, the integration of climate considerations into their underwriting processes, and reporting on the carbon intensity of their investment portfolios. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) has already prompted significant changes in how financial products are categorized and reported based on sustainability criteria, affecting insurers' investment strategies.

- Increased Disclosure Requirements: Insurers must now report on the financial implications of climate change, including physical risks (e.g., extreme weather) and transition risks (e.g., shifts to a low-carbon economy).

- Climate Integration in Underwriting: Regulations are pushing insurers to embed climate risk assessments into their core underwriting functions, influencing pricing and product development.

- Investment Portfolio Scrutiny: A growing trend involves mandatory reporting on insurers' exposure to carbon-intensive assets and their strategies for decarbonizing investment portfolios, with some jurisdictions exploring capital requirements linked to climate risk.

- Global Regulatory Alignment: Efforts by bodies like the Network for Greening the Financial System (NGFS) are driving greater consistency in climate risk management expectations across different regulatory environments, impacting global insurers like Allianz.

Political Stability and Investment Climate

Political stability is a cornerstone for Allianz's operations, directly shaping the investment climate and the confidence of global investors. Regions experiencing political transitions or unpredictable policy shifts can see foreign investment falter, leading to market volatility that impacts Allianz's substantial asset management portfolio. For instance, in 2024, emerging markets with significant political uncertainty experienced an average 5% higher cost of capital compared to their more stable counterparts, a factor directly influencing investment returns.

Allianz's global footprint means it must navigate a complex web of political landscapes. Policy unpredictability can disrupt long-term financial planning and investment strategies. A 2024 report by the World Economic Forum highlighted that countries with consistent regulatory frameworks saw a 7% higher inflow of foreign direct investment, benefiting companies like Allianz that rely on stable market conditions for growth.

- Impact on Investment: Political instability can lead to capital flight and reduced foreign direct investment, affecting Allianz's asset management performance.

- Policy Uncertainty: Unpredictable government policies can hinder long-term strategic planning and increase operational risks for Allianz.

- Market Volatility: Political events can trigger sharp market fluctuations, impacting the value of Allianz's investment holdings and insurance liabilities.

- Regulatory Environment: Changes in political regimes can lead to shifts in financial regulations, requiring Allianz to adapt its business practices and compliance measures.

Political stability is crucial for Allianz's global operations, directly influencing investment climates and investor confidence. Unpredictable policy shifts in regions experiencing political transitions can lead to market volatility, impacting Allianz's asset management portfolio. For example, in 2024, emerging markets with significant political uncertainty saw an average 5% higher cost of capital compared to stable counterparts, affecting investment returns.

Allianz must navigate diverse political landscapes, where policy unpredictability can disrupt long-term financial planning. A 2024 World Economic Forum report indicated that countries with consistent regulatory frameworks attracted 7% higher foreign direct investment, benefiting companies like Allianz that depend on stable market conditions.

Government reforms, particularly in healthcare systems like the US, directly impact the health insurance sector. Proposed changes to the Affordable Care Act in 2024 could alter coverage mandates and subsidies, influencing demand for private insurance plans and affecting Allianz's health insurance business.

| Political Factor | Impact on Allianz | 2024 Data/Trend |

| Political Stability | Affects investment climate and investor confidence. | Emerging markets with political uncertainty had a 5% higher cost of capital in 2024. |

| Policy Predictability | Influences long-term financial planning and strategic investments. | Countries with consistent regulations saw 7% higher FDI in 2024. |

| Healthcare Reforms | Impacts demand for health insurance products. | US ACA reforms in 2024 could alter coverage mandates and subsidies. |

What is included in the product

This PESTLE analysis critically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Allianz, providing a comprehensive understanding of its operating landscape.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges across these critical external dimensions.

A clear, actionable summary of Allianz's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decision-making.

Economic factors

Global economic growth is showing resilience, but risks remain. Projections for 2025 suggest a moderate expansion, with advanced economies like the US and Eurozone navigating a delicate balance between avoiding a significant downturn and controlling inflation. For instance, the IMF's April 2024 forecast anticipated global growth at 3.2% for both 2024 and 2025, a slight uptick from earlier expectations, signaling a potential soft landing scenario.

However, specific regions face headwinds. Germany's economic outlook for 2025, for example, is anticipated to be subdued, with growth forecasts hovering around 1% or less, according to various economic institutes. This slower pace in key European markets can directly impact Allianz's premium income from insurance products and fees generated from its asset management divisions due to reduced consumer spending and corporate investment.

The interest rate environment is a critical factor for Allianz. In 2024, rising interest rates have boosted Allianz's investment income, particularly benefiting its life insurance segment through increased demand for annuities. For instance, by the end of Q1 2024, the U.S. Federal Reserve's benchmark interest rate remained elevated, providing a favorable backdrop for fixed-income investments.

Looking ahead to 2025, the trajectory of central bank monetary policies, including potential rate cuts, will directly influence bond yields and, consequently, Allianz's investment returns. A gradual easing of monetary policy in major economies could lead to lower yields on fixed-income assets, requiring strategic adjustments in Allianz's investment portfolio to maintain profitability.

Persistent inflation in 2024 and early 2025 continues to be a significant concern for insurers like Allianz. Rising costs for repairs, replacement parts, and medical services directly translate to higher claims severity, especially in property and casualty lines. For instance, the cost of building materials saw double-digit percentage increases throughout 2023, a trend expected to persist, albeit at a slower pace, into 2024.

While inflation showed some signs of cooling by the end of 2024, with consumer price index (CPI) figures moderating from their peaks, the underlying pressures remain. Sustained elevated inflation, even if not at its highest point, can still significantly erode underwriting margins. This necessitates careful premium adjustments to maintain profitability, a balancing act Allianz must navigate to avoid pricing itself out of the market while adequately covering increasing claim expenses.

Capital Market Volatility and Investment Performance

Capital market volatility, evident in both equity and bond markets, directly influences Allianz's asset management arm and overall investment performance. For instance, the MSCI World Index experienced significant fluctuations throughout 2024, with periods of sharp declines followed by recoveries, impacting the value of assets managed by Allianz.

Factors like the ongoing discussions around potential tariffs and the lingering effects of trade disputes contribute to market uncertainty. This uncertainty can lead to concentration risk concerns within equity portfolios, affecting the performance of assets under management. For example, in Q3 2024, certain technology-heavy indices saw increased volatility due to geopolitical tensions, a sector where many asset managers hold significant exposure.

- Equity Market Volatility: The CBOE Volatility Index (VIX) averaged around 18 in the first half of 2024, indicating elevated market uncertainty compared to historical norms.

- Bond Market Sensitivity: Rising interest rate expectations in major economies during 2024 led to increased volatility in bond prices, impacting fixed-income portfolio returns.

- Geopolitical Impact: International trade disputes and regional conflicts in 2024 created spillover effects, contributing to broader capital market swings and affecting Allianz's global investment strategies.

Insolvency Trends and Business Demand

Global insolvencies are projected to rise significantly, with estimates suggesting a 10% increase in 2024 compared to 2023, particularly impacting the United States and Western Europe. This trend directly translates to increased claims for credit insurers and a potential dampening of demand for other business insurance products as companies face financial strain.

The uptick in insolvencies is a clear indicator of a wider global economic slowdown and is exacerbated by persistent geopolitical tensions, which disrupt supply chains and create market uncertainty. For instance, S&P Global Market Intelligence reported a 70% year-over-year increase in U.S. business bankruptcies in the first quarter of 2024.

- Projected Insolvency Surge: Global business insolvencies are expected to climb by 10% in 2024.

- Regional Impact: The US and Western Europe are anticipated to see the most pronounced increases in insolvencies.

- Insurance Sector Effects: Higher insolvency rates lead to increased claims for credit insurance and reduced demand for other business insurance lines.

- Underlying Causes: This trend is driven by a broader slump in global demand and ongoing geopolitical instability.

Global economic growth is projected to be moderate in 2025, with advanced economies navigating inflation risks. While the IMF forecast global growth at 3.2% for both 2024 and 2025, some regions like Germany anticipate slower expansion, impacting Allianz's revenue streams through reduced consumer and corporate spending.

Interest rates remained elevated in early 2024, boosting Allianz's investment income, especially for annuities. However, potential rate cuts in 2025 could lower bond yields, necessitating strategic portfolio adjustments to maintain profitability.

Persistent inflation in 2024 and into 2025 increases claim severity for insurers like Allianz due to higher repair and medical costs. Despite some cooling, sustained elevated inflation requires careful premium adjustments to protect underwriting margins.

Global insolvencies are expected to rise by 10% in 2024, particularly in the US and Western Europe, leading to higher claims for credit insurers and reduced demand for other business insurance products.

| Economic Factor | 2024 Outlook | 2025 Outlook | Impact on Allianz |

|---|---|---|---|

| Global Growth | Resilient, moderate expansion | Moderate expansion | Influences premium income and asset management fees |

| Interest Rates | Elevated, boosting investment income | Potential for gradual easing | Affects investment returns and annuity demand |

| Inflation | Persistent, though moderating | Continued concern, though potentially slower | Increases claim severity, necessitates premium adjustments |

| Insolvencies | Projected 10% increase | Continued elevated levels | Increases credit insurance claims, reduces demand for business insurance |

What You See Is What You Get

Allianz PESTLE Analysis

The Allianz PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Allianz's operations.

You can trust that the detailed insights and structured presentation of this PESTLE analysis are precisely what you'll be working with immediately after your purchase.

Sociological factors

The global population is aging rapidly, with the proportion of people aged 65 and over expected to reach 16% by 2050, up from 10% in 2022. This demographic shift significantly impacts insurance providers like Allianz by increasing the dependency ratio – the number of non-working individuals (children and elderly) supported by each working-age person. This trend necessitates a strategic focus on products catering to senior needs, such as long-term care insurance and retirement solutions.

As the population ages, consumption patterns shift, with greater demand for healthcare services, pharmaceuticals, and specialized travel. Allianz must adapt its property and casualty (P&C) offerings to reflect changing transportation needs, potentially including more support for assistive technologies and adapted vehicles. The increasing number of older adults also presents opportunities in wealth management and estate planning services.

Consumer preferences are rapidly evolving, with younger demographics increasingly prioritizing experiences and services over traditional asset ownership. This shift necessitates that Allianz adapt its insurance products to offer greater flexibility and on-demand coverage options.

There's a growing demand for highly personalized insurance solutions, fueled by advancements in data analytics and artificial intelligence. For instance, in 2024, studies indicated that over 60% of consumers expect personalized product recommendations from service providers, a trend that will undoubtedly influence insurance offerings.

Seamless digital interactions are no longer a luxury but an expectation. Allianz must continue to invest in user-friendly digital platforms and AI-powered customer service to meet the demand for efficient and intuitive engagement, mirroring trends seen across the broader financial services sector where digital-first approaches are gaining traction.

Increasing urbanization means more properties and people are packed into cities, concentrating risks like fires or natural disasters. For instance, as of 2024, over 60% of the global population lives in urban areas, a figure projected to reach 68% by 2050, according to UN data.

This concentration, especially with an aging demographic leading to smaller, older households, makes these communities more susceptible to severe damage from catastrophic events. This necessitates a strategic shift in insurance, focusing on enhanced property coverage and localized support services for vulnerable urban populations.

Demand for Financial Security and Wealth Management

In an era marked by economic volatility and geopolitical shifts, the desire for financial security is paramount, driving a significant increase in demand for robust wealth management services. This trend, often termed a 'flight to trust,' directly benefits established financial institutions like Allianz, which can leverage its dual strengths in insurance and asset management to meet this growing need.

Allianz's strategic positioning allows it to offer a comprehensive suite of products designed to provide protection and facilitate long-term wealth accumulation. For instance, as of the first quarter of 2024, Allianz reported a solid performance across its insurance and asset management segments, indicating a strong market appetite for its offerings.

- Growing Demand: Global uncertainty fuels a heightened need for financial planning and protection.

- Allianz's Advantage: The company's integrated insurance and asset management model caters directly to this demand.

- Market Performance: Allianz's Q1 2024 results reflect strong customer engagement with its security and wealth-building solutions.

- Innovation Focus: Continued development of innovative retirement and protection products is key to capturing this market.

Employee Engagement and Workforce Evolution

Allianz faces the critical challenge of maintaining high employee engagement while navigating a rapidly changing workforce landscape. The insurance sector, in general, is experiencing a significant demographic shift, with a substantial portion of experienced employees approaching retirement age. This creates a need for robust succession planning and knowledge transfer initiatives to retain institutional expertise.

Simultaneously, the demand for tech-savvy professionals is escalating as Allianz embraces digital transformation and integrates artificial intelligence (AI) into its operations. This necessitates a proactive approach to talent acquisition and development, focusing on upskilling existing employees and attracting new talent with digital competencies. For instance, in 2024, many leading financial services firms, including those in insurance, reported investing heavily in reskilling programs to bridge the digital skills gap, with some allocating over 10% of their training budgets to AI and data analytics.

- Demographic Shift: A significant portion of the insurance workforce is nearing retirement, posing a risk to institutional knowledge.

- Digital Transformation: The increasing adoption of AI and digital technologies requires a workforce with advanced technical skills.

- Talent Strategy: Allianz must implement effective talent management strategies, including upskilling and reskilling programs, to meet future demands.

- Employee Expectations: Evolving employee expectations regarding flexibility, purpose, and career development must be addressed to foster engagement.

Societal attitudes towards risk and protection are evolving, with a growing emphasis on preventative health measures and well-being. This shift influences demand for health insurance products that cover wellness programs and preventative care, rather than just treatment. Allianz can capitalize on this by expanding its health and wellness offerings, aligning with a broader societal trend towards proactive health management.

Consumer trust is a critical sociological factor, especially in financial services. In 2024, surveys indicated that over 70% of consumers consider brand reputation and trustworthiness as key factors when choosing an insurance provider. Allianz's long-standing history and global presence contribute significantly to this trust, which is essential for retaining customers and attracting new ones in a competitive market.

The increasing awareness of social responsibility and ethical business practices influences consumer choices. Customers are more likely to engage with companies that demonstrate a commitment to sustainability and corporate social responsibility (CSR). Allianz's initiatives in these areas, such as its investments in renewable energy and community support programs, resonate with this growing societal expectation.

Changes in family structures, such as smaller household sizes and an increase in single-person households, impact insurance needs. These evolving demographics require flexible and adaptable insurance products, potentially including more tailored coverage for individuals rather than traditional family plans. Allianz must continue to innovate its product portfolio to cater to these diverse and changing household compositions.

Technological factors

The insurance industry, including Allianz, is experiencing a significant technological shift with the widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are transforming core operations, from initial risk assessment to customer interaction.

Allianz can harness AI for more precise and equitable underwriting, speeding up the process and reducing human bias. For instance, AI-powered analytics can process vast datasets to identify risk patterns more effectively than traditional methods, potentially leading to more accurate pricing and reduced adverse selection.

Furthermore, AI and ML are revolutionizing claims processing, enabling faster settlement and improved fraud detection. Chatbots and virtual assistants are also enhancing customer service by providing instant support and personalized policy recommendations, increasing customer satisfaction and operational efficiency. By mid-2024, many insurers reported significant improvements in claim resolution times due to AI integration.

The insurance sector's digital shift, while improving efficiency, amplifies exposure to advanced cyber risks such as ransomware and phishing. Allianz's commitment to digital transformation necessitates substantial investment in cutting-edge security infrastructure to counter these evolving threats.

In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, underscoring the critical need for robust data protection. Allianz must bolster its defenses and potentially expand its cyber insurance offerings to mitigate these growing financial and operational risks.

Allianz is actively engaged in a significant digital transformation, a critical technological factor influencing its operations. The company is prioritizing a move away from complete legacy system overhauls, which have historically presented risks of failure, towards more agile and incremental modernization strategies. This approach allows for more controlled integration and reduces disruption.

To enhance efficiency and maintain competitiveness, Allianz is implementing targeted upgrades and the gradual integration of artificial intelligence (AI) into key operational areas. For instance, AI is being deployed in customer portals to improve user experience and in underwriting modules to streamline risk assessment processes. By 2024, the global IT spending for the insurance industry was projected to reach over $250 billion, highlighting the significant investment in digital advancements.

Advanced Data Analytics and Specialized Data Sources

The integration of advanced data analytics and specialized data sources is significantly improving risk assessment accuracy for insurers like Allianz. By moving beyond traditional data, Allianz can now incorporate diverse information streams for more granular insights.

This allows for more precise underwriting and the development of highly personalized insurance policies. For instance, the use of climate data can inform flood risk assessments, while wearable device data might help in evaluating individual health and lifestyle factors, leading to more accurate pricing and tailored product offerings.

Consider the impact of these advancements:

- Enhanced Risk Modeling: Advanced analytics, including AI and machine learning, process vast datasets to identify subtle risk patterns previously undetectable.

- New Data Integration: Allianz can leverage sources like satellite imagery for property risk assessment and IoT data from connected devices for usage-based insurance.

- Personalized Product Development: Granular data allows for the creation of bespoke insurance products that better match individual needs and risk profiles.

- Improved Claims Management: Real-time data analytics can expedite claims processing and fraud detection, leading to greater efficiency and customer satisfaction.

Automation and Operational Efficiency

Technological advancements are significantly boosting automation within Allianz's operations. This includes areas like damage assessments, where AI-powered tools can analyze images to expedite claims processing, and document management, where optical character recognition (OCR) streamlines the handling of policy documents. In 2024, the insurance industry saw a continued surge in AI adoption, with reports indicating that companies leveraging AI for claims processing experienced an average reduction in processing times by up to 30%.

This increased automation directly translates into reduced operational costs and enhanced efficiency. By minimizing manual intervention, Allianz can reallocate resources to more strategic initiatives and customer-facing activities. For instance, automated fraud detection systems, utilizing machine learning algorithms, can identify suspicious patterns more effectively than manual reviews, leading to substantial savings. A recent industry survey from late 2024 highlighted that insurers implementing advanced automation saw a 15-20% decrease in operational expenses related to back-office functions.

The streamlined workflows resulting from automation contribute to improved customer satisfaction. Faster claims settlements and more responsive customer service are key benefits. Furthermore, the ability to process a higher volume of transactions with greater accuracy allows Allianz to scale its operations effectively. By mid-2025, it's projected that over 60% of insurance customer interactions will be handled or augmented by AI, indicating a clear trend towards technology-driven efficiency and customer experience improvements.

Key impacts of automation on Allianz include:

- Reduced claims processing times: Leading to quicker payouts and happier customers.

- Lower operational costs: Through decreased reliance on manual labor and fewer errors.

- Enhanced fraud detection capabilities: Protecting the company and policyholders from financial losses.

- Improved scalability: Allowing for efficient handling of increased business volumes.

Technological factors are profoundly reshaping Allianz's operational landscape, driven by advancements in AI and data analytics. These innovations are crucial for enhancing risk assessment accuracy, personalizing product offerings, and streamlining claims management. The ongoing digital transformation, moving towards agile modernization rather than wholesale legacy system replacements, is central to Allianz's strategy for improved efficiency and market competitiveness.

AI and automation are significantly reducing processing times and operational costs. For example, AI-driven claims processing can cut resolution times by up to 30%, as observed in 2024 industry trends. Furthermore, the projected global cost of cybercrime reaching $10.5 trillion annually by 2024 highlights the critical need for robust cybersecurity investments to protect against escalating digital threats.

| Technological Factor | Impact on Allianz | Key Data/Trend (2024-2025) |

| AI & Machine Learning | Enhanced underwriting, fraud detection, customer service | AI adoption in claims processing reduced times by up to 30% (2024) |

| Digital Transformation | Agile modernization, improved efficiency, customer experience | Global IT spending in insurance projected over $250 billion (2024) |

| Cybersecurity | Mitigation of advanced cyber risks, data protection | Global cybercrime cost projected at $10.5 trillion annually (2024) |

| Data Analytics | Precise risk modeling, personalized products | Increased use of diverse data sources for granular insights |

Legal factors

The insurance sector operates within a dynamic web of regulations, both at home and abroad. Allianz, for instance, must adapt to stringent rules like the UK's Consumer Duty, which mandates a higher standard of customer care and product fairness. This evolving landscape also includes data security mandates, such as the US NAIC's Insurance Data Security Model Law, requiring robust protection of sensitive customer information.

Stricter data privacy and protection laws are a significant factor for insurers like Allianz. For example, the UK's post-Brexit data protection framework and the NAIC's new privacy protections model law place considerable responsibilities on companies handling customer information. Allianz must prioritize transparency in how data is used, actively identify vulnerable customers within its data processes, and maintain rigorous oversight of any third parties involved in data handling.

As artificial intelligence becomes more integrated into insurance operations, regulatory bodies are increasingly focusing on legal and ethical frameworks. New directives are emerging to ensure fairness and prevent bias in AI-driven decision-making, particularly impacting how Allianz uses AI for underwriting and claims processing.

These evolving regulations may mandate greater algorithmic transparency, requiring insurers to provide clearer explanations for AI outputs. For instance, the European Union's AI Act, expected to be fully implemented by 2025, categorizes AI systems based on risk, with high-risk applications, such as those in insurance, facing stringent compliance requirements for data quality, oversight, and transparency.

Solvency and Capital Requirements

Changes to solvency regimes, like the full rollout of Solvency UK reforms, are geared towards simplifying regulations and offering more adaptability. These shifts are designed to make capital management more efficient for insurers.

Allianz must consistently uphold robust capital reserves and sophisticated risk management practices to adhere to these evolving solvency ratios. Meeting these requirements is crucial for unlocking capital that can be strategically deployed for future investments and business growth.

For instance, as of the first quarter of 2024, Allianz reported a Solvency II ratio of 212%, demonstrating a strong capital position above regulatory minimums. This healthy ratio provides a solid foundation for navigating regulatory changes and pursuing growth opportunities.

- Solvency UK Reforms: Aim to streamline and introduce flexibility into regulatory requirements for insurers.

- Capital Reserves: Allianz must maintain strong capital to meet evolving solvency ratios.

- Risk Management: Effective risk management is key to navigating regulatory changes and ensuring solvency.

- Q1 2024 Solvency Ratio: Allianz reported a Solvency II ratio of 212%, indicating robust capital adequacy.

Anti-Greenwashing Regulations and ESG Disclosure

Governments worldwide are intensifying scrutiny on environmental, social, and governance (ESG) claims, introducing stricter anti-greenwashing regulations. This means companies like Allianz must substantiate their sustainability marketing with verifiable data, avoiding misleading statements about their environmental or social impact. Failure to comply can result in significant penalties and reputational damage.

The Corporate Sustainability Reporting Directive (CSRD) in Europe, for instance, mandates comprehensive ESG disclosures for a broad range of companies, including Allianz. This directive, along with the accompanying European Sustainability Reporting Standards (ESRS), requires detailed reporting on a company's environmental, social, and governance performance, ensuring greater transparency and comparability for investors and stakeholders.

Allianz's adherence to these evolving legal frameworks is crucial for maintaining trust and investor confidence. For example, the ESRS framework, which began its phased implementation in 2024, sets specific requirements for reporting on topics such as climate change mitigation and biodiversity, directly impacting how Allianz communicates its ESG initiatives.

- Mandatory ESG Disclosure: Regulations like the CSRD are compelling companies to provide standardized and detailed ESG information, moving beyond voluntary reporting.

- Anti-Greenwashing Enforcement: Regulatory bodies are actively investigating and penalizing companies for exaggerated or unsubstantiated sustainability claims, impacting marketing and product development.

- Increased Transparency: The push for clearer ESG data empowers investors and consumers to make more informed decisions, holding companies accountable for their stated sustainability goals.

- Alignment with Global Standards: Companies are increasingly aligning their reporting with international frameworks to meet the expectations of a global investor base and regulatory bodies.

The insurance industry faces a complex and ever-changing legal landscape, demanding constant adaptation from companies like Allianz. New regulations focus on enhanced customer protection, such as the UK's Consumer Duty, and robust data security, exemplified by the NAIC's Insurance Data Security Model Law in the US. These legal frameworks necessitate greater transparency in operations and stricter oversight of data handling, especially with the increasing use of AI in underwriting and claims.

The EU's AI Act, with phased implementation continuing into 2025, categorizes AI systems by risk, imposing stringent compliance for high-risk applications in insurance, including requirements for data quality and algorithmic transparency. Furthermore, reforms like Solvency UK aim to simplify capital management and offer greater flexibility, requiring insurers to maintain strong capital reserves and risk management practices.

Allianz's Q1 2024 Solvency II ratio stood at a robust 212%, well above regulatory minimums, providing a solid base for navigating these legal shifts. Simultaneously, intensified scrutiny on Environmental, Social, and Governance (ESG) claims, driven by regulations like Europe's CSRD and the accompanying ESRS, mandates detailed and verifiable ESG disclosures, impacting corporate reporting and marketing strategies significantly.

| Regulatory Focus | Implication for Allianz | Example/Data Point |

|---|---|---|

| Customer Protection & Data Security | Higher standards for customer care, product fairness, and data protection. | UK Consumer Duty, NAIC Insurance Data Security Model Law. |

| AI & Algorithmic Transparency | Ensuring fairness and preventing bias in AI-driven decisions. | EU AI Act (phased implementation into 2025) categorizes insurance AI as high-risk. |

| Solvency & Capital Management | Streamlined regulations and increased capital management flexibility. | Allianz Q1 2024 Solvency II ratio: 212%. |

| ESG Disclosure & Anti-Greenwashing | Mandatory, verifiable ESG reporting and stricter enforcement against misleading claims. | EU CSRD and ESRS framework (phased implementation from 2024). |

Environmental factors

Climate change is a significant environmental factor, driving an increase in severe weather events such as floods and wildfires. These events directly impact Allianz's property and casualty insurance operations by escalating claims and the overall cost of doing business.

The year 2024 proved to be the third costliest on record for the insurance industry due to natural catastrophes. This trend necessitates continuous adaptation of Allianz's risk assessment models, underwriting strategies, and the management of its capital reserves to maintain financial stability and profitability.

The increasing focus on Environmental, Social, and Governance (ESG) factors is significantly shaping Allianz's investment strategies and how it develops new products. This means sustainability is becoming a core part of how they do business.

Allianz is actively embedding sustainability throughout its operations, which includes a notable rise in its sustainable investments. For example, by the end of 2023, Allianz Global Investors had €79.1 billion in ESG-focused assets under management, showing a clear commitment to this area.

The company is also introducing innovative sustainable solutions, such as its Surety Green2Green offering. This move aligns with a wider shift in the financial services sector, where there's a growing demand for sustainable finance products and a move towards nature-positive business practices.

Beyond just carbon footprints, the health of our planet's ecosystems is increasingly central to ESG considerations. Allianz recognizes this, identifying biodiversity impacts and associated risks as a significant issue for its investment and property & casualty portfolios.

The company is actively engaged in pilot assessments and is integrating frameworks such as the Taskforce for Nature-related Financial Disclosures (TNFD) into its reporting practices. This proactive approach reflects a growing understanding that nature-related risks can have tangible financial consequences.

For instance, the World Economic Forum's 2024 Global Risks Report highlighted that over half of the world's GDP is moderately or highly dependent on nature. This underscores the financial imperative for companies like Allianz to address biodiversity loss and integrate nature-related disclosures into their strategic planning.

Energy Transition and Green Investments

The global shift towards cleaner energy sources is creating new avenues for growth and potential challenges for Allianz. As countries and corporations commit to reducing carbon emissions, the demand for sustainable financing solutions is surging.

Allianz is actively participating in this energy transition by increasing its investments in green projects and creating insurance and investment products tailored to support the development of renewable energy infrastructure. This strategic move positions the company to benefit from the expanding market for sustainable finance, which saw global green bond issuance reach an estimated $1 trillion in 2024, a significant increase from previous years.

The company's focus on green investments is not just about financial returns; it's also about aligning with global efforts to combat climate change. This includes supporting both mitigation strategies, like renewable energy deployment, and adaptation measures, such as building more resilient infrastructure. By doing so, Allianz is contributing to a more sustainable financial ecosystem.

- Increased Green Investment: Allianz has committed to significant increases in its investments in renewable energy and sustainable infrastructure, aiming to allocate billions of euros by 2025.

- Product Development: The company is launching new insurance products designed to cover risks associated with green energy projects, such as solar farms and wind turbines, facilitating their development.

- Market Momentum: The global sustainable finance market is experiencing robust growth, with assets under management in ESG (Environmental, Social, and Governance) funds projected to exceed $50 trillion by 2025, presenting a substantial opportunity for Allianz.

- Climate Risk Management: Allianz is integrating climate risk assessment into its investment and underwriting processes, recognizing the financial implications of climate change for its business and clients.

Environmental Reporting and Transparency

Allianz is navigating a landscape where regulators and investors increasingly expect clear reporting on environmental impact and transparency. This trend is significantly shaping how companies, including Allianz, communicate their sustainability efforts.

Demonstrating this commitment, Allianz released its inaugural annual report adhering to the Corporate Sustainability Reporting Directive (CSRD). This report sets a high standard for openness, detailing progress on crucial sustainability goals. For instance, the company is actively tracking its targets for reducing emissions and growing its portfolio of sustainable investments, providing concrete data for stakeholders.

Key aspects of Allianz's environmental reporting and transparency include:

- CSRD Compliance: Allianz's first CSRD-compliant report signifies a move towards standardized and robust environmental disclosure.

- Emissions Reduction Targets: The company is actively monitoring and reporting on its progress towards specific emissions reduction goals.

- Sustainable Investment Growth: Transparency extends to the expansion of Allianz's sustainable investment portfolio, a key area of focus for environmentally conscious investors.

The escalating frequency and severity of natural disasters, exemplified by 2024 being the third costliest year for the insurance industry due to catastrophes, directly impact Allianz's claims and operational costs. This necessitates robust climate risk management and adaptation in underwriting and capital allocation.

Allianz is actively integrating sustainability into its core strategies, evidenced by a substantial increase in ESG-focused assets, reaching €79.1 billion managed by Allianz Global Investors by the end of 2023. This commitment extends to developing innovative green financial products like Surety Green2Green, aligning with the growing market demand for sustainable finance solutions.

The company is also proactively addressing nature-related risks, integrating frameworks like the Taskforce for Nature-related Financial Disclosures (TNFD) into its reporting. This reflects the understanding that biodiversity loss, which impacts over half of global GDP according to the World Economic Forum's 2024 Global Risks Report, poses tangible financial risks.

Allianz is strategically increasing investments in green projects and developing tailored insurance and investment products for renewable energy infrastructure, capitalizing on the surging demand for sustainable finance. Global green bond issuance was estimated to reach $1 trillion in 2024, highlighting the significant market momentum.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Allianz is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside comprehensive market research from firms such as Statista and Euromonitor. We also incorporate regulatory updates from government bodies and industry-specific reports to ensure a holistic view.