Allianz Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allianz Bundle

Unlock the full strategic blueprint behind Allianz's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Allianz actively collaborates with a diverse range of financial institutions and banks to broaden the distribution of its insurance and asset management offerings. These strategic alliances enable Allianz to tap into the established customer relationships and extensive distribution channels of its partners, thereby enhancing market penetration and customer reach.

For instance, in 2024, Allianz UK continued its partnership with Sainsbury's Bank, a testament to the value derived from such collaborations in offering tailored home and motor insurance products to a wider audience.

Allianz actively partners with technology and digital solution providers to drive its digital transformation. These collaborations are crucial for improving customer experiences and making internal operations more efficient, for instance, by integrating AI and machine learning into claims processing and customer service functions.

A prime example of this strategy is the Allianz Accelerator program, which fosters innovation by supporting startups focused on areas like big data analytics and the Internet of Things (IoT). This proactive engagement with emerging technologies ensures Allianz remains at the forefront of digital advancements in the insurance sector.

Reinsurance companies are vital partners for Allianz, enabling the company to effectively manage and spread out risk, particularly for substantial or intricate insurance contracts. This strategic collaboration bolsters Allianz's capacity and financial resilience, empowering it to accept a wider array of risks. For instance, in 2024, Allianz entered into a 50:50 reinsurance joint venture with Jio Financial Services Limited, demonstrating a commitment to expanding its reach and risk-sharing capabilities in key markets.

Automotive and Mobility Partners

Allianz actively cultivates key partnerships within the dynamic automotive and mobility sectors. These strategic alliances include collaborations with major car manufacturers and emerging mobility service providers. For instance, in 2024, the company continued to explore and implement embedded insurance solutions directly within vehicle purchase or subscription models, aiming to capture a larger share of the connected car market. Such partnerships are crucial for developing innovative insurance products that cater to evolving transportation trends, including the significant growth in e-mobility and shared mobility services.

These collaborations extend beyond traditional automotive players. Allianz Partners, a segment of Allianz, has notably expanded its Fusion platform through strategic alliances with numerous airlines. This expansion, ongoing through 2024 and into early 2025, allows for the integration of travel insurance and assistance services, enhancing the overall travel experience for customers and creating new revenue streams for both Allianz and its airline partners.

- Automotive Manufacturer Collaborations: Focus on integrating insurance at the point of sale for new vehicles, particularly electric vehicles.

- Mobility Service Provider Alliances: Partnering with ride-sharing and car-sharing platforms to offer tailored insurance solutions for their fleets and users.

- Airline Partnerships for Travel Insurance: Expanding the reach of travel insurance products through airline booking platforms, as exemplified by the growth of Allianz Partners' Fusion platform.

Sports and Cultural Organizations

Allianz’s strategic alliances with major sports and cultural entities are a cornerstone of its brand building and market penetration. These collaborations, including extended commitments with the Olympic and Paralympic Movements through 2032, and significant ties with organizations like England Rugby and FC Bayern Munich, are crucial for amplifying brand recognition on a global scale. In 2023, Allianz’s investment in sponsorships contributed to significant increases in brand recall across key markets.

These partnerships are not merely about visibility; they are deeply integrated into Allianz's strategy to connect with communities and embody shared values. Aligning with the resilience and excellence demonstrated by top athletes and cultural institutions reinforces Allianz's brand promise. The financial impact of these partnerships is evident in enhanced customer acquisition and loyalty metrics, particularly among demographics that highly value sports and cultural engagement.

- Global Brand Visibility: Partnerships with entities like the Olympic and Paralympic Movements (extended to 2032) and FC Bayern Munich significantly boost Allianz's international brand presence.

- Community Engagement: These collaborations foster deeper connections with diverse communities, aligning the brand with shared values of excellence, teamwork, and resilience.

- Brand Value Enhancement: Association with prestigious sporting and cultural events strengthens Allianz’s brand equity and perceived reliability, as evidenced by improved brand perception studies in 2023.

- Market Differentiation: Strategic sports and cultural sponsorships help Allianz stand out in a competitive insurance and financial services landscape.

Allianz leverages key partnerships with financial institutions and banks to expand its product distribution, effectively tapping into their customer bases and established channels. Collaborations with technology providers are crucial for driving digital transformation, enhancing customer experience through AI and IoT integration, as seen with the Allianz Accelerator program. Reinsurance partners are vital for risk management, with a notable 2024 joint venture with Jio Financial Services Limited demonstrating expanded risk-sharing capabilities.

Strategic alliances within the automotive and mobility sectors, including partnerships with car manufacturers and mobility service providers, allow for embedded insurance solutions in connected cars. Allianz Partners' Fusion platform, through numerous airline alliances in 2024, integrates travel insurance, enhancing customer travel experiences and creating new revenue streams.

These diverse partnerships, from financial institutions to airlines and technology firms, are instrumental in broadening Allianz's market reach, driving innovation, and strengthening its operational efficiency. The integration of insurance within vehicle purchase models and travel bookings exemplifies the strategic value derived from these collaborations.

What is included in the product

A detailed breakdown of Allianz's operations, outlining its diverse customer segments, robust distribution channels, and multifaceted value propositions across insurance and asset management.

The Allianz Business Model Canvas provides a clear, structured framework that simplifies the complex task of visualizing and refining strategic initiatives, alleviating the pain of scattered information and unclear direction.

Activities

Allianz's core activities heavily revolve around underwriting and risk management across its diverse insurance offerings, from property and casualty to life and health. This necessitates advanced actuarial science and data modeling to accurately price policies and maintain financial stability. In 2023, Allianz reported a net profit attributable to shareholders of €6.7 billion, demonstrating the effectiveness of its risk assessment and pricing strategies.

A significant aspect of their risk management extends to strategic partnerships, where Allianz actively manages and mitigates risks for event organizers, participants, and spectators. This commitment to comprehensive protection underscores their role as a reliable insurer. For instance, their sponsorship of major sporting events involves intricate risk assessments to ensure coverage for a wide array of potential liabilities.

Allianz's key activity in asset management involves strategically managing extensive portfolios for its own insurance businesses and for external clients via PIMCO. This encompasses making smart investment choices, fine-tuning portfolios, and creating a variety of investment options to grow wealth and achieve returns.

The company focuses on optimizing investment strategies and wealth management for its diverse client base. In 2024, Allianz saw significant growth in its commitment to sustainability, with sustainable investments reaching €171.9 billion.

Allianz actively pursues continuous development of new and innovative insurance and financial products. This focus is crucial for addressing evolving customer needs and staying competitive in the market. For instance, in 2024, Allianz continued to expand its range of accumulation annuities, offering more options for long-term savings and investment growth.

Leveraging digital advancements and direct customer feedback is central to Allianz's product innovation strategy. This allows them to create more tailored and relevant solutions. In 2024, the company highlighted its commitment to sustainable offerings, integrating environmental, social, and governance (ESG) principles into new product designs, reflecting growing consumer demand for responsible investments.

The expansion of products available to consumers remains a key activity for Allianz. Throughout 2024, the company worked to broaden its product portfolio, making a wider array of financial tools and insurance solutions accessible to a diverse customer base, thereby enhancing its market reach and customer engagement.

Claims Processing and Customer Service

Allianz's key activities revolve around efficient claims processing and exceptional customer service, which are fundamental to building trust and loyalty. By streamlining the claims journey, they aim to reduce customer frustration and foster repeat business.

Leveraging advanced technologies is central to this strategy. For instance, Allianz has been investing in AI-powered tools to automate claim assessment and fraud detection, speeding up payouts. In 2024, the company reported a significant increase in digital claims submissions, indicating a successful shift towards online self-service options for customers.

- Streamlined Claims Handling: Implementing digital tools and AI for faster, more transparent claim settlements.

- Customer-Centric Approach: Prioritizing customer satisfaction through responsive and empathetic service throughout the claims process.

- Technological Integration: Utilizing AI and digital platforms to enhance efficiency and customer experience in claims management.

- Focus on Retention: Recognizing that excellent claims service is a key driver for customer retention and long-term growth.

Sales and Distribution

Allianz's sales and distribution strategy is multifaceted, employing a wide array of channels to connect with its global customer base. This includes leveraging digital platforms for direct engagement and sales, alongside a robust network of tied agents and independent brokers.

The company actively utilizes partnerships with banks, automotive manufacturers, and other financial institutions to embed its insurance and asset management offerings. This multi-channel approach is crucial for reaching diverse customer segments, from individual policyholders to large corporate clients, and for driving both new business acquisition and customer loyalty.

- Digital Channels: Allianz increasingly invests in its online presence and digital sales tools to streamline customer acquisition and service.

- Agent and Broker Networks: A significant portion of sales is generated through its extensive network of tied agents and independent brokers, providing personalized advice and solutions.

- Bancassurance and Partnerships: Collaborations with banks and other strategic partners allow Allianz to offer its products through established customer relationships, expanding reach.

- Customer Retention: Focus remains on enhancing customer experience and offering tailored solutions to foster long-term relationships and reduce churn.

Allianz's core activities center on underwriting and sophisticated risk management across its broad insurance spectrum. This involves meticulous actuarial analysis and data-driven pricing to ensure financial health. In 2023, Allianz achieved a net profit of €6.7 billion, underscoring the efficacy of its risk assessment and pricing models.

A crucial aspect of their operations involves managing and mitigating risks through strategic collaborations, ensuring comprehensive protection for all parties involved. Their engagement in major events, for example, requires detailed risk evaluations for extensive liability coverage.

Allianz's key activities also encompass robust asset management, where they strategically handle substantial investment portfolios for both their internal insurance operations and external clients via PIMCO. This includes optimizing investment choices and developing diverse investment vehicles to foster wealth growth.

The company is dedicated to refining investment strategies and wealth management for its varied clientele. In 2024, Allianz demonstrated a strong commitment to sustainability, with its sustainable investments growing to an impressive €171.9 billion.

Allianz actively develops innovative insurance and financial products to meet evolving customer demands and maintain market competitiveness. For instance, in 2024, they expanded their range of accumulation annuities, offering more avenues for long-term savings and investment growth.

Integrating digital advancements and customer feedback is vital to Allianz's product innovation, enabling the creation of more personalized solutions. In 2024, the company emphasized its dedication to sustainable offerings, embedding ESG principles into new product designs to align with growing consumer interest in responsible investing.

Expanding product accessibility for consumers is a primary focus for Allianz. Throughout 2024, the company worked to broaden its portfolio, making a wider array of financial tools and insurance solutions available to a diverse customer base, thereby enhancing market penetration and customer engagement.

Efficient claims processing and superior customer service are fundamental to Allianz's operations, building essential trust and loyalty. By streamlining the claims experience, they aim to reduce customer friction and encourage repeat business.

The company leverages advanced technologies to enhance claims management. For example, Allianz has been investing in AI for claim assessment and fraud detection to expedite payouts. In 2024, digital claims submissions saw a significant rise, indicating successful adoption of online self-service options.

| Key Activity | Description | Supporting Data/Examples (2023-2024) |

| Underwriting & Risk Management | Accurate pricing and financial stability through actuarial science and data modeling. | €6.7 billion net profit attributable to shareholders in 2023. |

| Asset Management | Strategic management of investment portfolios for internal and external clients. | €171.9 billion in sustainable investments by 2024. |

| Product Development & Innovation | Creating new and improved insurance and financial products. | Expansion of accumulation annuities in 2024; integration of ESG principles into new products. |

| Claims Processing & Customer Service | Efficient and customer-centric claims handling using technology. | Increased digital claims submissions in 2024; investment in AI for claim assessment. |

| Sales & Distribution | Multi-channel approach including digital, agents, brokers, and partnerships. | Continued investment in digital sales tools; leveraging bancassurance partnerships. |

Full Document Unlocks After Purchase

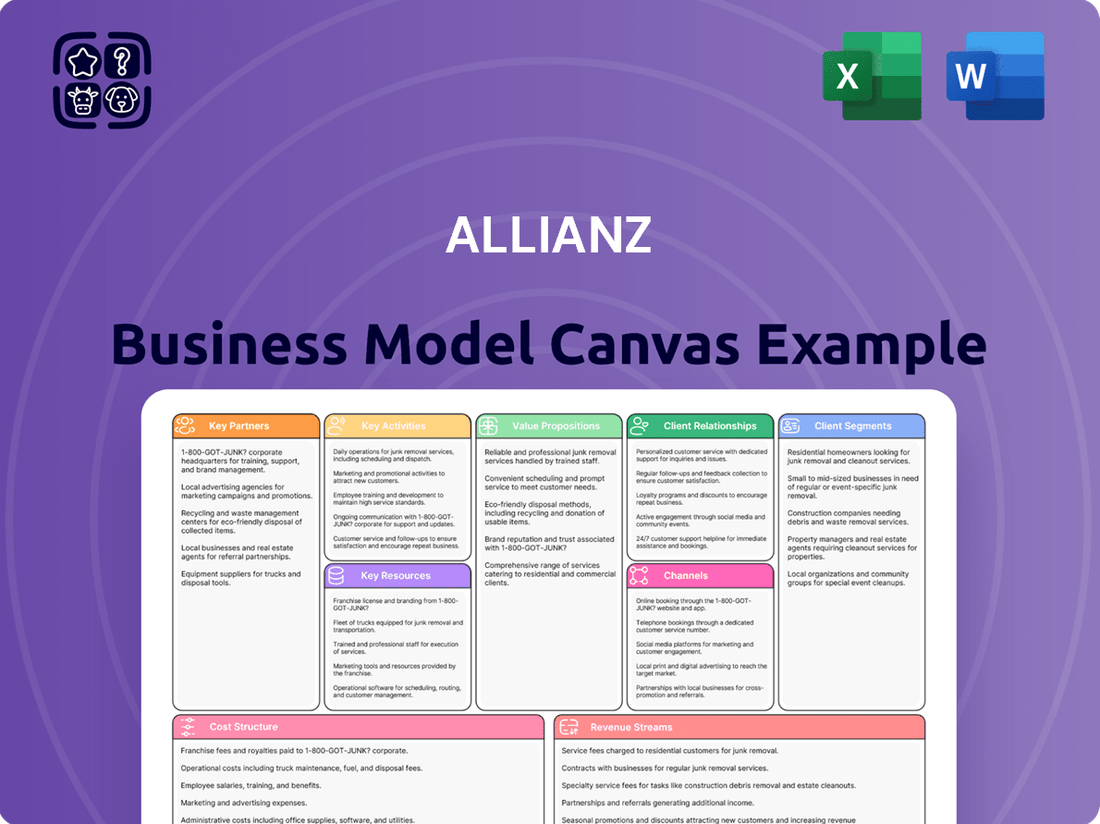

Business Model Canvas

The Allianz Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you are viewing a direct snapshot of the complete, ready-to-use file, ensuring there are no discrepancies or missing sections once your order is complete. You can trust that the structured content and professional formatting are exactly what you'll be working with.

Resources

Allianz's financial capital and reserves are its most critical resources. This robust foundation allows the company to handle significant risks, meet its obligations to policyholders, and pursue strategic growth initiatives. The company's financial strength is paramount to its core business of providing insurance and asset management services.

A key indicator of this strength is its Solvency II capitalization ratio. For 2024, Allianz reported a very healthy Solvency II ratio of 209%. This high ratio demonstrates Allianz's substantial capacity to absorb unexpected losses and maintain its financial stability, even under adverse market conditions.

Allianz's human capital is its bedrock, featuring actuaries, investment managers, risk analysts, IT specialists, and customer service experts. This deep well of talent fuels product development, robust risk management, and exceptional customer experiences.

In 2024, Allianz continued its commitment to employee growth, investing heavily in learning programs designed to keep its workforce at the cutting edge of financial services and technology.

Allianz's brand reputation and trust are cornerstones of its business model, acting as a powerful magnet for customers. This isn't just a feeling; it's backed by data. For six consecutive years, Allianz has held the top spot as the number one insurance brand globally, a testament to its consistent delivery of reliable services.

Furthermore, Allianz consistently ranks among the Top 30 most valuable global brands across all industries. This widespread recognition and high regard translate directly into customer loyalty, giving Allianz a significant competitive edge and reinforcing its market leadership in a crowded financial services landscape.

Technology Infrastructure and Data

Allianz's robust IT systems and digital platforms are the backbone of its operations, enabling personalized customer experiences and data-driven decision-making. These technological assets are fundamental to delivering efficient services and developing innovative insurance and financial products.

The company heavily invests in advanced data analytics, leveraging AI and machine learning across various functions, from risk assessment to customer service. This focus on sophisticated data utilization allows Allianz to extract valuable insights and optimize its business processes.

Allianz places a strong emphasis on data quality and management, recognizing its critical role in the effectiveness of its AI and analytics initiatives. The company's commitment to data integrity ensures reliable insights for strategic planning and operational improvements. In 2024, Allianz reported that its data value metric, which quantifies the financial impact of data projects, demonstrated significant positive contributions to profitability.

- IT Systems and Digital Platforms: Essential for operational efficiency and customer engagement.

- AI and Machine Learning: Utilized across operations for enhanced decision-making and product development.

- Data Quality and Management: A core focus to ensure the accuracy and reliability of analytics.

- Data Value Metric: Quantifies the financial impact of data-driven initiatives, showing positive returns in 2024.

Global Network and Distribution Channels

Allianz leverages an extensive global network, comprising subsidiaries, agents, and brokers, alongside robust digital platforms. This infrastructure ensures broad market reach and localized customer service, enabling the company to effectively serve a wide array of customer segments across numerous geographies.

The company's strategy includes actively expanding its distribution channels to capture a larger market share. This multi-channel approach is crucial for adapting to evolving customer preferences and market dynamics.

As of the first quarter of 2024, Allianz reported a significant global presence, with operations in over 70 countries. Its digital channels are increasingly important, with online sales contributing a growing percentage of new business premiums. In 2023, Allianz’s total revenue reached approximately €160 billion, underscoring the strength of its extensive distribution capabilities.

- Global Reach: Operations in over 70 countries as of Q1 2024.

- Distribution Mix: Utilizes subsidiaries, agents, brokers, and digital platforms.

- Digital Growth: Increasing contribution of online sales to new business.

- Financial Scale: €160 billion in total revenue for 2023, reflecting network strength.

Allianz's physical assets include its extensive network of branches, offices, and data centers worldwide. These physical locations are crucial for customer interaction, operational support, and housing critical IT infrastructure, ensuring the company's ability to deliver services efficiently.

The company's commitment to sustainability is also a key resource, influencing its operational practices and investment strategies. This focus not only aligns with global trends but also enhances its brand reputation and long-term resilience.

Allianz's intellectual property, including proprietary algorithms, insurance product designs, and research findings, represents a significant competitive advantage. These intangible assets drive innovation and differentiate Allianz in the market.

In 2024, Allianz continued to invest in R&D, with a notable focus on developing new parametric insurance products and advanced risk modeling techniques, further solidifying its intellectual capital.

Allianz's strategic partnerships and alliances are vital for expanding its market reach and enhancing its service offerings. Collaborations with technology providers, distribution partners, and other financial institutions allow Allianz to leverage external expertise and resources.

These partnerships are instrumental in developing innovative solutions and accessing new customer segments. For instance, in early 2024, Allianz announced a new strategic alliance with a leading fintech company to enhance its digital customer onboarding process.

| Resource Category | Key Components | 2024/Recent Data Points |

|---|---|---|

| Intellectual Property | Proprietary algorithms, product designs, research | Focus on parametric insurance and advanced risk modeling in 2024 R&D. |

| Strategic Partnerships | Fintech collaborations, distribution alliances | New fintech alliance announced early 2024 to improve digital customer onboarding. |

Value Propositions

Allianz provides a broad spectrum of insurance solutions, encompassing property-casualty, life, and health insurance. This extensive product range equips individuals and businesses with strong defenses against a multitude of financial uncertainties, aiming to secure their assets and overall financial well-being.

The company's offerings are designed to protect valuable assets, facilitate effective wealth management, and ultimately foster a sense of financial security for its diverse clientele. For instance, in 2024, Allianz's property-casualty segment continued to demonstrate resilience, with significant premium growth reported in key markets, underscoring the demand for robust asset protection.

Allianz's asset management arm offers advanced investment strategies designed to expand wealth for both institutional and individual investors. They provide a wide array of investment options and expert advice to assist clients in reaching their financial objectives.

In 2024, Allianz's asset management segment saw significant growth, reporting robust third-party net inflows. This indicates strong client confidence and successful capital deployment across their diverse investment products.

Allianz champions innovation and digital convenience, offering customers seamless self-service platforms and AI-powered solutions. This commitment is demonstrated by their impressive goal of resolving motor claims within 30 minutes using advanced AI and machine learning technologies.

Trust and Reliability

Allianz's value proposition of trust and reliability is deeply rooted in its extensive history and robust financial standing. Customers turn to Allianz knowing their commitments will be met, especially when economic conditions are volatile.

The company's commitment to its customers is reflected in its strong brand recognition and positive customer feedback. For instance, Allianz consistently ranks high in brand value surveys, underscoring its reputation for dependability.

- Strong Financial Performance: Allianz maintained a solid financial position, with its solvency capital ratio remaining robust, demonstrating its capacity to meet obligations.

- Customer Satisfaction: High customer satisfaction scores in key markets highlight Allianz's ability to deliver on its promises and build lasting relationships.

- Brand Reputation: Allianz's brand value, often cited among the top financial services companies globally, is a testament to decades of consistent and reliable service.

Sustainable and Responsible Solutions

Allianz is increasingly weaving sustainability into its core business, offering clients investment and insurance products that align with environmental and social objectives. This focus resonates strongly with a growing segment of customers who are keen on responsible investing and demonstrating strong corporate citizenship through their financial choices.

The demand for such offerings is clearly reflected in the market. By 2024, Allianz's sustainable investments had surged to an impressive €171.9 billion, underscoring the significant client appetite for solutions that contribute positively to society and the environment.

- Sustainable Investment Growth: Allianz's sustainable investments reached €171.9 billion in 2024.

- Client Alignment: Appeals to clients prioritizing responsible investing and corporate citizenship.

- Integrated Offerings: Includes sustainable investment options and insurance solutions.

- Environmental and Social Support: Products are designed to support environmental and social goals.

Allianz's value proposition centers on providing comprehensive protection through a wide array of insurance products and robust asset management services.

They offer innovative digital solutions and a trusted, reliable brand built on a strong financial foundation, ensuring customer security and wealth growth.

Furthermore, Allianz is committed to sustainability, offering investment and insurance products that align with environmental and social goals, meeting the growing demand for responsible finance.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Protection | Broad spectrum of insurance (property-casualty, life, health) and asset management. | Resilient property-casualty segment with significant premium growth. |

| Financial Security & Wealth Growth | Protecting assets, facilitating wealth management, and expanding wealth via investment strategies. | Robust third-party net inflows in asset management, indicating client confidence. |

| Innovation & Digital Convenience | Seamless self-service platforms and AI-powered solutions for efficient customer interaction. | Goal of resolving motor claims within 30 minutes using AI and machine learning. |

| Trust & Reliability | Extensive history, robust financial standing, and strong brand recognition. | Consistently ranks high in brand value surveys, underscoring dependability. |

| Sustainability | Investment and insurance products aligned with environmental and social objectives. | Sustainable investments surged to €171.9 billion. |

Customer Relationships

Allianz focuses on building enduring customer relationships by offering highly personalized service and expert financial advice. They tailor solutions specifically to the unique needs of both individual clients and corporations, ensuring a bespoke approach to financial planning and protection.

This commitment is realized through dedicated advisors who act as trusted partners, fostering loyalty via consistent, customer-centric communication. Allianz prioritizes understanding diverse client segments, crafting messages that resonate and build confidence.

In 2024, Allianz reported a significant increase in customer satisfaction scores, directly linked to their enhanced advisory services and personalized outreach programs. This focus on tailored advice and proactive engagement is a cornerstone of their strategy to maintain high retention rates.

Allianz heavily invests in digital self-service, enabling customers to manage policies, file claims, and access account details through their online portals and mobile app. This digital-first approach boosts operational efficiency and offers round-the-clock customer convenience.

In 2024, Allianz reported a significant increase in digital customer interactions, with over 80% of policy adjustments and claims submissions occurring through digital channels. Their platforms allow for seamless policy purchase, management, and modification, catering to evolving customer expectations for speed and accessibility.

Allianz cultivates strong customer bonds by actively participating in communities and sponsoring major sporting and cultural events. This engagement goes beyond insurance, fostering a deeper, emotional connection with their customer base and enhancing brand loyalty. For instance, in 2024, Allianz continued its long-standing partnership with the Olympic and Paralympic Games, showcasing a commitment to global athletic excellence and community spirit.

The company's dedication to recognizing positive impact is exemplified by initiatives like the Allianz Unity Awards. These awards celebrate individuals who leverage sports to drive meaningful social change, further solidifying relationships by aligning with customer values and inspiring a sense of shared purpose.

Proactive Communication and Education

Allianz actively communicates with its customers, providing updates on their policies, relevant market shifts, and new products. This proactive approach is designed to keep clients well-informed and confident in their financial choices.

The company also focuses on educating its customer base, offering insights and resources to help them navigate the complexities of financial planning. This commitment to education empowers individuals to make smarter decisions for their future.

A prime example of this proactive engagement occurred in November 2024, when Allianz issued an early weather warning to its customers in Valencia, demonstrating their dedication to customer safety and well-being.

- Proactive Policy Updates: Keeping policyholders informed about coverage details and changes.

- Market Insights: Sharing relevant financial market developments that may impact customers.

- New Offering Announcements: Educating customers on new products and services that could benefit them.

- Customer Empowerment: Providing educational content to foster informed financial decision-making.

- Crisis Communication: Issuing timely alerts, such as the November 2024 severe weather warning in Valencia.

Customer Feedback and Continuous Improvement

Allianz places a strong emphasis on gathering customer feedback through various avenues, including regular surveys and direct communication channels. This proactive approach allows them to identify areas for enhancement and ensure their insurance products and services consistently meet and exceed customer expectations. This dedication to a customer-centric model is a cornerstone of their strategy.

The company's commitment to improvement is reflected in its performance metrics. For instance, in 2024, Allianz reported that 72% of its business segments demonstrated superior performance compared to their respective local markets, a testament to the effectiveness of their customer-focused strategies.

- Customer Feedback Mechanisms: Allianz utilizes surveys, direct feedback channels, and digital platforms to solicit customer input.

- Continuous Improvement Cycle: Feedback is systematically analyzed to drive enhancements in product design, service delivery, and overall customer experience.

- Market Outperformance: In 2024, 72% of Allianz's segments outperformed their local markets, underscoring the success of their customer-centric approach.

- Customer-Centricity as a Core Value: The company's operations are built around understanding and responding to evolving customer needs and expectations.

Allianz fosters deep customer loyalty through personalized advice and proactive communication, acting as a trusted financial partner. Their commitment to understanding individual needs is evident in tailored solutions and consistent engagement, as highlighted by a significant rise in customer satisfaction scores in 2024. This customer-centric approach extends to robust digital self-service options, with over 80% of policy adjustments and claims handled digitally in 2024, reflecting a drive for efficiency and convenience.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Advice & Support | Dedicated advisors, tailored solutions | Increased customer satisfaction scores |

| Digital Engagement | Online portals, mobile app, self-service | 80% of policy adjustments/claims via digital channels |

| Community & Value Alignment | Event sponsorships (Olympics), social impact awards | Enhanced brand loyalty and emotional connection |

| Proactive Communication & Education | Policy updates, market insights, crisis alerts (Valencia weather warning) | Informed customer base, improved decision-making |

| Feedback & Continuous Improvement | Surveys, direct feedback, market outperformance | 72% of segments outperformed local markets |

Channels

Allianz leverages a substantial direct sales force and a broad network of independent agents to connect with customers. This approach facilitates personalized advice and the sale of insurance and asset management products, fostering deep customer relationships through in-depth consultations.

In 2023, Allianz's direct sales and agency channels were instrumental in its strong performance. For instance, the company reported a total revenue of €150.8 billion for the fiscal year 2023, with a significant portion attributed to sales generated through these direct customer engagement methods.

Looking ahead, Allianz aims to expand its customer reach by focusing on advanced protection and retirement solutions. This strategy is supported by ongoing investments in training and technology for its sales professionals and agents, ensuring they can effectively communicate the value of these complex offerings.

Allianz leverages its extensive digital ecosystem, encompassing its corporate website, mobile apps, and customer portals, to facilitate direct sales, policy management, and claims processing. This digital-first approach ensures unparalleled convenience and accessibility for its global customer base.

In 2024, Allianz reported a significant increase in digital engagement, with over 60% of new policy sales originating through its online channels. The company's mobile app alone saw a 25% surge in active users, handling millions of policy inquiries and service requests annually.

These digital platforms are more than just information hubs; they are fully functional insurance marketplaces where customers can seamlessly purchase, customize, and manage their insurance products. This includes features like real-time policy adjustments and instant claims submission, streamlining the customer journey.

Allianz leverages a robust network of brokers and partners to distribute its insurance and financial products. This includes a vast array of insurance brokers and independent financial advisors who act as crucial intermediaries, reaching diverse customer segments. In 2023, the broker channel remained a significant contributor to premium growth across the insurance industry.

Strategic alliances with entities like banks and automotive manufacturers further amplify Allianz's market penetration. These collaborations allow Allianz to offer tailored insurance solutions through established customer bases. For instance, Allianz UK’s partnership with Sainsbury's Bank provides home and motor insurance, demonstrating a successful integration of financial services within a retail environment.

Call Centers and Customer Service Hubs

Allianz's dedicated call centers and customer service hubs are crucial for providing direct customer support, managing inquiries, processing requests, and aiding in claims. These channels offer a vital human interaction point for those who prefer speaking with a representative.

Beyond traditional phone support, Allianz is increasingly integrating AI-powered solutions like chatbots and voicebots. These digital assistants help customers with common queries and tasks, offering a faster, more accessible service. For instance, in 2024, Allianz reported a significant increase in digital self-service adoption, with AI-driven tools handling a growing percentage of customer interactions.

- Human Touchpoint: Essential for complex issues and building customer relationships.

- AI Integration: Chatbots and voicebots enhance efficiency and availability.

- Digital Adoption: Growing reliance on self-service options for routine tasks.

Marketing and Advertising Campaigns

Allianz utilizes a comprehensive media strategy, encompassing traditional advertising like television and print, alongside robust digital marketing efforts. This includes search engine optimization, pay-per-click advertising, and targeted online display ads to capture attention and generate interest in their diverse financial products and services.

Social media platforms and influencer collaborations are key components, allowing Allianz to engage with a wider audience and build relatable brand narratives. In 2024, Allianz continued to invest heavily in digital channels, with social media engagement metrics showing a steady increase in customer interaction and brand recall across platforms like LinkedIn and X.

Strategic sponsorships, such as their involvement with major sporting events and cultural initiatives, further amplify brand visibility and reinforce Allianz's commitment to community and excellence. These campaigns are designed not only to build brand awareness but also to directly drive customer acquisition by guiding them to appropriate sales channels, whether online or through their extensive network of advisors.

- Broad Media Mix: Traditional (TV, print), Digital (SEO, PPC, display), Social Media, Influencer Marketing, Sponsorships.

- Campaign Objectives: Drive demand for financial products and services.

- Customer Guidance: Directing potential customers towards various sales channels.

- 2024 Focus: Continued investment in digital channels and social media engagement.

Allianz's channels are multifaceted, combining direct sales forces and extensive broker networks with a growing digital presence. These channels are crucial for product distribution and customer engagement, supported by robust marketing and customer service operations.

In 2023, Allianz reported €150.8 billion in total revenue, with significant contributions from its direct sales, agency, and broker networks. By 2024, over 60% of new policies were sold via digital channels, highlighting a strong shift towards online engagement.

| Channel Type | Key Activities | 2023/2024 Data/Focus |

|---|---|---|

| Direct Sales & Agencies | Personalized advice, product sales, customer relationship building | Instrumental in 2023 performance; focus on advanced solutions |

| Digital Channels | Online sales, policy management, claims processing, customer self-service | Over 60% of new policies in 2024; 25% surge in mobile app users |

| Brokers & Partners | Market penetration via intermediaries, strategic alliances (e.g., banks, retailers) | Significant contributor to premium growth; partnerships expand reach |

| Customer Service (Call Centers, AI) | Direct support, inquiry management, claims assistance, AI chatbots | Growing adoption of AI for efficiency; increased digital self-service |

| Media & Marketing | Brand awareness, demand generation, customer acquisition | Heavy investment in digital/social media; sponsorships for visibility |

Customer Segments

Individual retail clients represent a vast and varied customer base for Allianz, encompassing everyone from young professionals starting their financial journey to retirees seeking secure income streams. This segment actively seeks a wide array of products, including essential property-casualty coverage like car and home insurance, alongside life insurance for protection and health insurance for well-being.

Beyond immediate protection, these individuals also look to Allianz for long-term financial security, specifically in retirement planning and wealth management services. The company's reach within this segment is global, serving diverse age groups, income brackets, and geographic locations, demonstrating a commitment to broad market accessibility.

In 2024, Allianz continued to see strong engagement from younger demographics, particularly those in their late 20s and 30s, who are increasingly prioritizing financial planning and insurance as they advance in their careers. This trend is supported by data showing a growing demand for digital-first insurance solutions and personalized financial advice among this demographic.

Allianz provides Small and Medium-sized Enterprises (SMEs) with specialized insurance products designed to safeguard their operations, property, and workforce. These businesses frequently need adaptable and expandable risk management tools to suit their evolving needs.

The company is focused on enhancing efficiency within its mid-corporate offerings, which includes a significant portion of the SME market. In 2024, the SME sector continued to be a vital engine for economic growth, with many businesses actively seeking robust insurance to mitigate potential disruptions.

Large corporations and multinational clients represent a significant customer segment for Allianz, demanding sophisticated and integrated risk management solutions. These businesses, often operating across diverse geographies and industries, require comprehensive global insurance programs tailored to their complex operational landscapes. For instance, in 2024, Allianz Global Corporate & Specialty (AGCS) reported a strong performance, serving a vast array of large industrial clients with specialized coverages.

Allianz's value proposition for this segment centers on providing robust asset protection and proactive risk mitigation strategies. By leveraging deep industry expertise and a global network, Allianz helps these entities navigate intricate regulatory environments and minimize potential financial disruptions. The company's commitment to innovation in risk assessment and claims management is crucial for maintaining the trust of these high-value clients.

Institutional Investors

Institutional investors represent a cornerstone for Allianz, primarily through its subsidiary PIMCO. These sophisticated clients, including pension funds, sovereign wealth funds, endowments, and foundations, rely on Allianz's asset management arm for advanced investment strategies and comprehensive wealth management solutions. As of the first quarter of 2024, PIMCO managed approximately $1.9 trillion in assets, a significant portion of which comes from these institutional mandates.

These institutions require specialized expertise and a deep understanding of global financial markets to meet their long-term objectives. Allianz, via PIMCO, offers a broad spectrum of investment products and services tailored to the unique needs and risk appetites of these large-scale investors.

- PIMCO's Asset Under Management (AUM): Approximately $1.9 trillion as of Q1 2024.

- Key Institutional Client Types: Pension funds, sovereign wealth funds, endowments, foundations.

- Services Offered: Sophisticated investment strategies, wealth management, tailored investment solutions.

- Strategic Importance: These clients are critical for Allianz's asset management revenue and market presence.

Affluent and High-Net-Worth Individuals

Affluent and high-net-worth individuals represent a key customer segment for Allianz, demanding sophisticated wealth management, advanced life insurance, and bespoke investment strategies focused on capital preservation and long-term growth. Allianz directly addresses the intricate financial planning needs of this demographic through specialized offerings.

- Tailored Investment Portfolios: Allianz provides customized investment solutions, including access to alternative investments and private equity, designed to meet the specific risk appetites and return objectives of high-net-worth clients.

- Advanced Life Insurance Solutions: Products like universal life insurance and variable universal life insurance are offered, providing tax-deferred growth, death benefit protection, and estate planning benefits crucial for wealth transfer.

- Retirement Planning Expansion: In 2024, Allianz continued to broaden its retirement accumulation options, enhancing tools and products to assist a wider range of individuals, including the affluent, in securing their financial future.

Allianz serves a diverse clientele, from individual retail customers seeking basic insurance and savings products to affluent individuals requiring complex wealth management and advanced life insurance. The company also caters to small and medium-sized enterprises (SMEs) with adaptable risk management solutions and large corporations and multinational clients demanding integrated global insurance programs.

Institutional investors, managed through PIMCO, form a crucial segment, with PIMCO overseeing approximately $1.9 trillion in assets as of Q1 2024, primarily from pension funds, sovereign wealth funds, and endowments. In 2024, Allianz observed a growing interest from younger demographics in digital insurance solutions and personalized financial advice, indicating an evolving customer preference.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Individual Retail Clients | Property-casualty, life, health insurance, retirement planning, wealth management | Growing demand for digital-first solutions and personalized advice from younger demographics. |

| Small and Medium-sized Enterprises (SMEs) | Operational, property, and workforce protection; adaptable risk management | Vital engine for economic growth, actively seeking robust insurance to mitigate disruptions. |

| Large Corporations & Multinational Clients | Sophisticated, integrated global risk management, asset protection | AGCS reported strong performance, serving diverse industrial clients with specialized coverages. |

| Institutional Investors (via PIMCO) | Advanced investment strategies, wealth management | PIMCO managed ~ $1.9 trillion in AUM as of Q1 2024, serving pension funds, sovereign wealth funds, etc. |

| Affluent & High-Net-Worth Individuals | Wealth management, advanced life insurance, bespoke investment strategies | Broadening retirement accumulation options and offering advanced life insurance for wealth transfer. |

Cost Structure

Claims and Benefit Payouts represent the most substantial expense for an insurer like Allianz. These are the funds disbursed to policyholders when an insured event occurs or benefits are due. The total amount paid out is heavily dependent on how often claims are filed and how severe those claims are, along with the specific coverage outlined in each policy.

For instance, Allianz reported a notable rise in claims stemming from natural catastrophes in the first quarter of 2025 when contrasted with the same period in 2024. This trend directly impacts the cost structure, as more frequent and severe weather events necessitate larger payouts.

Allianz's operating expenses, encompassing administrative and sales functions, are a critical component of its cost structure. These costs include significant investments in employee compensation, marketing campaigns to reach a broad customer base, and the maintenance of extensive office infrastructure across its global operations. For instance, in 2023, Allianz reported administrative expenses of €13.8 billion, reflecting the scale of its global support functions.

The company actively pursues efficiency measures to optimize these expenditures and enhance productivity. Initiatives focused on digital transformation and process automation are key to streamlining administrative tasks and reducing overhead. Allianz's commitment to improving operational efficiency aims to translate into better cost management, ultimately supporting its profitability targets.

Allianz incurs significant expenses in its underwriting and risk assessment processes. These costs encompass actuarial analysis, the acquisition and management of vast datasets, and the compensation for skilled underwriters and risk management professionals. For instance, in 2024, the insurance industry, including major players like Allianz, continued to invest heavily in advanced analytics and AI to refine risk pricing, with some estimates suggesting operational costs for underwriting can range from 5% to 15% of gross written premiums depending on complexity.

Technology and Digital Transformation Investments

Allianz's cost structure heavily features significant investments in technology and digital transformation. This includes substantial spending on IT infrastructure, software development, and robust cybersecurity measures. These outlays are essential for maintaining operational efficiency and improving customer interactions in today's digital landscape.

The company is actively embracing artificial intelligence and machine learning to drive innovation and streamline processes. For instance, in 2023, Allianz reported capital expenditures of €2.8 billion, a portion of which was allocated to these technological advancements, reflecting a commitment to modernizing its operations.

- IT Infrastructure Upgrades: Ongoing investment in cloud computing, data centers, and network capabilities.

- Software Development: Creation and enhancement of proprietary platforms for underwriting, claims processing, and customer relationship management.

- Cybersecurity: Significant budget allocation to protect sensitive customer data and maintain system integrity against evolving threats.

- AI & Automation: Development and deployment of AI-driven tools for fraud detection, personalized customer service, and process automation, with a focus on enhancing efficiency and customer experience.

Investment Management Costs

Investment management costs are a critical component of Allianz's operational expenses. These include the fees paid to manage investment portfolios, such as fund management charges and expenses incurred from trading securities. The compensation for skilled asset managers and financial analysts who drive investment performance also falls into this category.

For the first quarter of 2025, Allianz's Asset Management division reported a cost-income ratio that remained largely consistent. This ratio stood at 61.3% during Q1 2025, indicating the efficiency with which the company manages its operational expenses relative to its income generation in this segment.

- Fund Management Fees: Direct charges for overseeing investment assets.

- Trading Expenses: Costs associated with buying and selling securities.

- Personnel Costs: Salaries and benefits for investment professionals.

- Cost-Income Ratio (Asset Management): 61.3% in Q1 2025, reflecting operational efficiency.

Allianz's cost structure is dominated by claims and benefit payouts, reflecting the core business of insurance. Operating expenses, including personnel and marketing, also represent a significant outlay. Investments in technology and underwriting are crucial for risk management and operational efficiency.

| Cost Component | Description | 2023/2024/2025 Data |

| Claims & Benefit Payouts | Funds disbursed to policyholders for insured events. | Increased in Q1 2025 due to natural catastrophes. |

| Operating Expenses | Includes administrative, sales, and marketing costs. | €13.8 billion in administrative expenses (2023). |

| Underwriting & Risk Assessment | Costs for actuarial analysis, data management, and personnel. | Industry estimates: 5%-15% of GWP for underwriting. |

| Technology & Digital Transformation | Investments in IT infrastructure, software, and cybersecurity. | €2.8 billion in capital expenditures (2023), partly for tech. |

| Investment Management | Fees for managing investment portfolios and personnel. | Cost-income ratio of 61.3% in Asset Management (Q1 2025). |

Revenue Streams

Insurance premiums form the bedrock of Allianz's revenue generation, stemming from the sale of a wide array of insurance products. These include essential property-casualty, life, and health insurance policies, representing the consistent payments policyholders make for their coverage.

This core revenue stream saw significant growth, with Allianz reporting a total business volume increase of 11.2% in 2024, reaching €179.8 billion. This substantial rise underscores the continued demand for Allianz's insurance offerings and the effectiveness of its premium collection strategy.

Allianz generates significant revenue through asset management fees, primarily from its division PIMCO. These fees are usually calculated as a percentage of the total assets managed for clients, or sometimes based on the investment performance achieved.

In 2024, Allianz's asset management arm saw its third-party assets under management climb to an impressive €1.9 trillion. This substantial AUM directly translates into substantial fee income, forming a core part of Allianz's overall revenue structure.

Allianz's investment income is a cornerstone of its profitability, stemming from earnings like interest, dividends, and capital gains generated by its substantial proprietary investment portfolio. This diverse array of financial instruments forms a critical part of their business model.

For 2024, Allianz continued to see robust returns from its investments, though the company has signaled expectations for slightly lower investment results in 2025. This anticipated moderation is attributed to factors such as higher interest accretion, which can impact the valuation and yield of certain assets within their portfolio.

Commissions and Fees from Financial Services

Allianz generates significant revenue from commissions and fees earned by facilitating the sale of various financial products, extending beyond its core insurance offerings. This includes commissions from brokering investments like mutual funds and securities, as well as fees for personalized financial planning and advisory services. For instance, in 2024, Allianz Global Investors, a key asset management arm, reported managing assets worth over €500 billion, a substantial portion of which would have generated fee-based income.

These revenue streams are crucial for diversifying Allianz's income base and capturing value across the broader financial services spectrum. The company leverages its extensive client network and trusted brand to cross-sell these additional financial products and services.

- Commissions on investment products: Earned when clients purchase mutual funds, stocks, bonds, and other investment vehicles through Allianz advisors or platforms.

- Advisory fees: Charged for personalized financial planning, wealth management, and investment strategy consultations.

- Brokerage fees: Applied to transactions executed on behalf of clients, such as buying or selling securities.

- Asset management fees: A percentage of the assets under management, generating recurring revenue from investment portfolios.

Reinsurance Income

Allianz generates income by taking on a portion of the risks from other insurance companies, a practice known as reinsurance. This not only helps spread out potential losses but also creates an additional revenue stream for Allianz. For instance, in 2024, Allianz announced a significant move, forming a 50:50 reinsurance joint venture with Jio Financial Services Limited in India.

This strategic partnership is designed to leverage both companies' strengths. Allianz brings its extensive global reinsurance expertise, while Jio Financial Services offers deep market penetration and a robust digital platform in India. The venture aims to capitalize on the growing insurance market in India, with reinsurance playing a crucial role in managing the increased risk associated with this expansion.

- Income from assuming risks from other insurers.

- Diversifies Allianz's risk exposure.

- Generates additional revenue streams.

- Example: 50:50 reinsurance joint venture with Jio Financial Services Limited in 2024.

Allianz's revenue streams are robust and diversified, encompassing insurance premiums, asset management fees, investment income, commissions, and reinsurance. These diverse income sources ensure financial stability and growth across its global operations.

The company's total business volume reached €179.8 billion in 2024, a notable 11.2% increase, highlighting strong performance in its core insurance segments. Furthermore, its asset management division managed €1.9 trillion in third-party assets under management in 2024, contributing significantly to fee-based income.

| Revenue Stream | Description | 2024 Data/Key Highlight |

|---|---|---|

| Insurance Premiums | Revenue from policyholders for coverage. | 11.2% increase in total business volume to €179.8 billion. |

| Asset Management Fees | Fees earned from managing client assets (e.g., PIMCO). | €1.9 trillion in third-party assets under management. |

| Investment Income | Earnings from Allianz's proprietary investment portfolio. | Robust returns, with expectations for slight moderation in 2025. |

| Commissions & Fees | Income from selling financial products and advisory services. | Allianz Global Investors managed over €500 billion in assets. |

| Reinsurance | Income from assuming risks from other insurance companies. | Formation of a 50:50 reinsurance joint venture with Jio Financial Services Limited in India. |

Business Model Canvas Data Sources

The Allianz Business Model Canvas is built using a combination of internal financial reports, customer feedback surveys, and extensive market research. These data sources are critical for accurately defining customer segments, value propositions, and revenue streams.