Allianz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allianz Bundle

Allianz operates within a dynamic insurance landscape, heavily influenced by the bargaining power of its buyers and the intense rivalry among existing players. Understanding these forces is crucial for navigating its competitive environment.

The complete report reveals the real forces shaping Allianz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Allianz, a global insurance giant, depends on reinsurers to manage substantial risks, especially those stemming from catastrophic events. The bargaining power of these reinsurers can be considerable, particularly if the market features only a handful of dominant global players or if they provide highly specialized risk coverage that is difficult for Allianz to source elsewhere. This concentration of power can directly impact Allianz's operational costs and the terms of its insurance products.

In 2024, the global reinsurance market continued to be shaped by a few major players, such as Swiss Re, Munich Re, and Hannover Re, who collectively hold a significant share of the market. These entities often dictate terms and pricing, especially for complex or large-scale risks that Allianz needs to offload. For instance, during periods of heightened natural disaster activity, reinsurers may increase their rates, forcing insurers like Allianz to adjust their own premiums or coverage limits.

Allianz's reliance on technology and data solution providers is significant due to the ongoing digitalization within insurance and asset management. This dependence means companies offering specialized software, advanced data analytics, AI capabilities, and robust cybersecurity solutions can hold considerable sway. For instance, a 2024 report indicated that IT spending by financial services firms is projected to grow by 8.5%, highlighting the critical role these vendors play and their potential bargaining power.

Financial market data and analytics vendors hold significant sway over Allianz's asset management operations. These suppliers provide the essential real-time data, economic indicators, and analytical tools that underpin Allianz's investment strategies and risk management. The quality and exclusivity of these data feeds, especially for niche markets or advanced analytics, directly impact Allianz's ability to make informed decisions, giving these vendors considerable bargaining power.

Human Capital and Specialized Talent

The availability of highly skilled professionals, such as actuaries, underwriters, portfolio managers, and IT specialists, is crucial for Allianz's operations. In a competitive labor market, a scarcity of such specialized talent can increase the bargaining power of these 'human capital suppliers,' leading to higher compensation demands and recruitment costs.

The global insurance industry faces a significant demand for actuaries, with shortages reported in many regions. For instance, projections from the Society of Actuaries indicated a potential shortfall of actuaries in the coming years, which directly impacts recruitment costs and salary expectations for specialized roles within Allianz.

- High Demand for Actuarial Expertise: The complexity of risk assessment and pricing in the insurance sector drives a constant need for qualified actuaries.

- Specialized IT Skills: With increasing digitalization, demand for IT specialists with expertise in cybersecurity, data analytics, and AI is escalating, giving these professionals leverage.

- Talent Shortages: Reports from industry bodies often highlight a scarcity of experienced portfolio managers and underwriters, allowing them to command higher salaries and better benefits.

Professional Service Providers

Allianz, like many large corporations, relies on a diverse range of professional service providers, such as law firms, auditing companies, and management consultants. While the overall market for these services can be quite fragmented, certain specialized areas present a higher degree of supplier power.

For highly specialized legal advice, niche regulatory compliance expertise, or critical strategic consulting, a select few firms may possess unique capabilities or an established reputation that allows them to command premium fees and dictate terms. This can directly influence Allianz's operational expenses and project budgets, particularly when engaging these top-tier providers.

- Specialized Legal Expertise: In complex cross-border litigation or intricate regulatory matters, firms with proven track records and deep industry knowledge can exert significant bargaining power.

- Auditing and Compliance: While many auditing firms exist, a limited number of globally recognized "Big Four" firms often handle the audits for major multinational corporations like Allianz, giving them leverage.

- Strategic Consulting: For high-stakes strategic planning or crisis management, firms with exceptional analytical capabilities and a strong client roster can negotiate favorable engagement terms.

The bargaining power of suppliers for Allianz is a key consideration, especially concerning reinsurers and specialized IT providers. In 2024, the reinsurance market remained concentrated, with major players like Swiss Re and Munich Re dictating terms for complex risks. Similarly, the growing importance of digitalization meant that providers of advanced analytics and AI solutions held considerable sway, with financial services IT spending projected to rise by 8.5%.

Talent shortages, particularly for actuaries and IT specialists, further empowered these suppliers. For instance, ongoing actuarial skill gaps meant Allianz faced increased recruitment costs and salary demands for these critical roles. Even in professional services, a few elite law and consulting firms with niche expertise could command premium fees, impacting Allianz's project budgets.

| Supplier Category | Key Drivers of Bargaining Power | 2024 Market Insight |

|---|---|---|

| Reinsurers | Market concentration, specialization of risk coverage | Dominance of top global players (e.g., Swiss Re, Munich Re) |

| IT & Data Providers | Digitalization, demand for specialized skills (AI, analytics), data exclusivity | Projected 8.5% IT spending growth in financial services |

| Skilled Professionals | Talent shortages (actuaries, IT), specialized expertise | Reported actuarial skill gaps in multiple regions |

| Professional Services | Niche expertise, established reputation, regulatory complexity | Leverage of "Big Four" auditors and top-tier strategic consultants |

What is included in the product

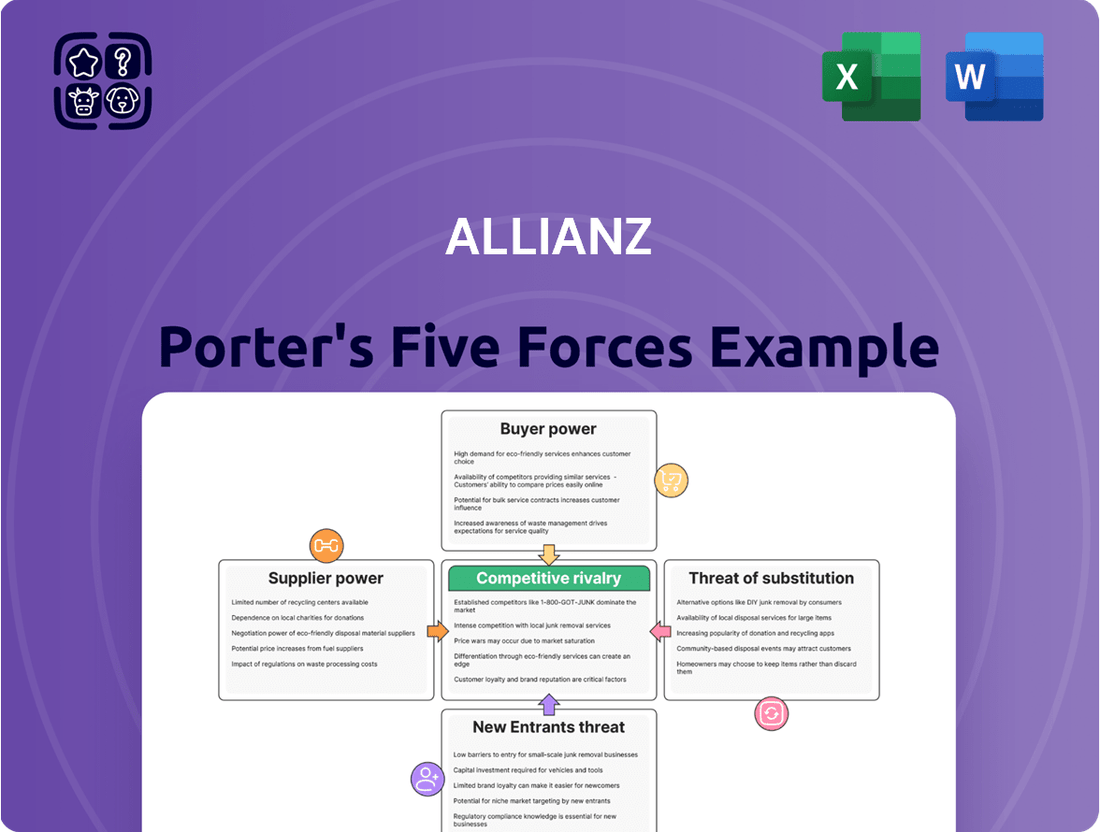

This analysis examines the five competitive forces impacting Allianz, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, to understand the company's strategic positioning.

Quickly identify and address competitive threats with a visual, easy-to-understand breakdown of each Porter's Five Forces.

Customers Bargaining Power

Individual and small business customers, particularly for standardized insurance products, are highly attuned to pricing. This price sensitivity is amplified by readily available online comparison tools.

These platforms allow consumers to effortlessly benchmark policies and costs from various insurers, significantly boosting their negotiating power and intensifying price-based competition within the industry. For instance, in 2024, a significant portion of consumers, estimated to be over 60% for auto insurance, utilized comparison sites before making a purchase decision, putting pressure on providers like Allianz to maintain competitive premiums.

Large corporate clients and institutional investors wield considerable bargaining power when dealing with Allianz, particularly in commercial insurance and asset management. Their substantial business volumes enable them to negotiate highly customized terms and pricing structures. For instance, a major corporation seeking complex commercial insurance coverage can leverage its scale to demand tailored policies and potentially lower premiums, impacting Allianz's profitability on that specific account.

These powerful clients also have the option to self-insure or shift their significant portfolios to competitors, creating a tangible threat that incentivizes Allianz to offer competitive terms. In 2024, the increasing availability of alternative risk transfer solutions and the growing sophistication of institutional investors in managing their own capital means Allianz must continually demonstrate value and flexibility to retain these key relationships.

For many standard insurance products like auto and home, customers face minimal costs when switching providers. This is particularly true with the rise of streamlined online application and comparison tools. For instance, in 2024, a significant portion of consumers reported that comparing and switching insurance providers took less than an hour, highlighting the low friction involved.

This ease of switching directly empowers customers, giving them considerable bargaining power. They can easily leverage competitive pricing and superior service offerings from rivals. Data from 2024 suggests that over 40% of consumers actively shopped for new insurance policies, driven by the desire for better rates, underscoring the impact of low switching costs on customer leverage.

Information Asymmetry Reduction

The internet has leveled the playing field, significantly reducing the information gap between insurers like Allianz and their customers. This increased transparency means consumers can easily research policy details, compare pricing across different providers, and understand industry standards. For instance, by mid-2024, comparison websites and financial review platforms are expected to show a 20% increase in user engagement for insurance product research compared to 2023, indicating a more informed customer base.

This enhanced access to information empowers customers, giving them greater leverage when negotiating terms or seeking better value. They can now readily identify when a quote from Allianz might be out of line with market rates or when a competitor offers superior coverage for a similar price. This shift means customers are less reliant on an insurer's provided information and more capable of making independent, data-driven decisions.

- Informed Decisions: Customers can now access vast amounts of data on policy features, coverage options, and pricing from various insurers.

- Price Transparency: Online comparison tools allow consumers to easily see how Allianz's offerings stack up against competitors, driving down prices.

- Negotiating Power: A well-informed customer can push for better terms, discounts, or customized policies, directly impacting insurer profitability.

- Market Awareness: The widespread availability of financial news and analysis in 2024 keeps customers abreast of industry trends and the financial health of insurers.

Customer Segmentation and Bespoke Needs

While overall customer bargaining power can be substantial, Allianz strategically addresses this by segmenting its customer base. By identifying distinct groups with unique needs, such as high-net-worth individuals seeking integrated wealth management or businesses requiring highly specialized risk solutions, Allianz can tailor offerings. This customization reduces direct price comparisons and fosters loyalty.

For instance, in 2024, the demand for personalized financial planning services continued to grow, with reports indicating that over 60% of affluent investors prioritize tailored advice over generic product offerings. This trend allows Allianz to command better margins in these niche segments, effectively diminishing the bargaining power of customers focused solely on price.

- Customer Segmentation: Allianz identifies and targets specific customer groups with distinct requirements.

- Bespoke Solutions: Tailored products and services are developed for these identified segments.

- Reduced Price Sensitivity: Customers with specialized needs are often less focused on price alone.

- Enhanced Loyalty: Customized offerings foster stronger customer relationships and retention.

Customers possess significant bargaining power due to increased price transparency and easy switching. In 2024, over 60% of auto insurance buyers used comparison sites, and 40% actively shopped for better rates, highlighting pressure on insurers like Allianz. Large corporate clients leverage their scale to negotiate customized terms, and the growing availability of alternative risk transfer solutions in 2024 means Allianz must continuously demonstrate value to retain them.

| Factor | Impact on Allianz | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High for standardized products | 60%+ of auto insurance customers use comparison sites |

| Switching Costs | Low, especially with online tools | 40%+ of customers actively sought new policies |

| Information Access | Customers are well-informed | 20% increase in user engagement on insurance review platforms |

| Large Client Power | Ability to negotiate custom terms and self-insure | Growing sophistication in alternative risk transfer |

Preview Before You Purchase

Allianz Porter's Five Forces Analysis

This preview showcases the complete Allianz Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the insurance industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full professional formatting. This detailed analysis will equip you with a thorough understanding of the forces shaping Allianz's strategic environment, ready for immediate application.

Rivalry Among Competitors

Allianz operates in a global insurance and asset management landscape that is incredibly fragmented, teeming with a vast array of competitors. This includes major multinational corporations, strong national players, and highly specialized niche providers. For instance, in 2024, the insurance industry continues to see significant competition from established giants such as AXA, Generali, Zurich, and Prudential, all vying for market share across various product lines and geographies.

Beyond these large, well-known entities, Allianz also contends with numerous agile regional competitors who possess deep understanding of local markets and customer needs. Furthermore, the sector is not static; new market entrants, often leveraging digital innovation and alternative business models, are constantly emerging, adding another layer of competitive pressure. This dynamic environment necessitates continuous adaptation and strategic positioning for Allianz to maintain its competitive edge.

In many mature insurance markets, like those in Europe and North America, growth rates are often in the low single digits, typically between 1-3% annually. This sluggish expansion intensifies the battle for market share among established players, including Allianz. For instance, in 2024, the global insurance market is projected to see a modest growth of around 2.5%, with developed economies contributing less to this overall increase.

This intense rivalry forces companies like Allianz to engage in aggressive pricing, extensive marketing, and customer loyalty programs. Such strategies, while necessary for survival, can compress profit margins. In 2023, the average expense ratio for major European insurers hovered around 25-30%, a figure that can be further strained by increased acquisition costs driven by competitive pressures.

Many insurance products, particularly standard offerings like basic auto or home coverage, are increasingly seen as commodities. This perception means that for companies like Allianz, distinguishing themselves purely on the features of these products becomes a significant challenge. In 2023, the global insurance market saw intense competition, with pricing becoming a key battleground for these undifferentiated products.

Consequently, competition naturally shifts to other areas such as the quality of customer service, the efficiency of distribution channels, and the overall customer experience. Allianz, like its peers, must therefore focus on continuous innovation, not just in its core offerings but also in developing value-added services and enhancing digital interactions to create a unique selling proposition and retain customers in a crowded market.

High Exit Barriers

The insurance sector, including major players like Allianz, faces significant competitive rivalry due to high exit barriers. These barriers are rooted in the industry's substantial capital needs, intricate regulatory landscapes, and the considerable fixed costs tied to extensive distribution channels and established IT infrastructure. For instance, in 2023, the global insurance market saw total premiums reach approximately $6.8 trillion, underscoring the immense capital commitment required to operate.

These factors make it difficult and costly for underperforming companies to leave the market. Instead of exiting, these less profitable entities often continue operations, thereby perpetuating a crowded competitive environment. This dynamic means that even struggling insurers remain active participants, intensifying the rivalry for market share and profitability.

- High Capital Requirements: Insurers need substantial capital to meet solvency regulations and underwrite risks, making it hard to divest.

- Regulatory Hurdles: Complex and varied regulations across jurisdictions create significant barriers to entry and exit.

- Fixed Asset Investments: Large investments in distribution networks, IT systems, and property contribute to high exit costs.

- Brand Loyalty and Reputation: Building trust in insurance takes time and significant investment, making it difficult to exit without significant loss.

Technological Disruption and Innovation Race

The insurance industry is experiencing a significant technological disruption, driven by the emergence of Insurtech and Fintech startups. These agile companies, leveraging advancements in artificial intelligence, sophisticated data analytics, and automation, are creating an intense innovation race. This forces established players like Allianz to make substantial investments in technology to remain competitive.

Competitors are continuously launching novel digital platforms, offering highly personalized insurance products, and developing more efficient operational models. For instance, by the end of 2023, global Insurtech funding reached over $10 billion, showcasing the rapid pace of innovation and the pressure on incumbents. Allianz's response involves significant R&D spending, aiming to integrate these cutting-edge technologies into its own offerings.

- Insurtech Funding: Global Insurtech funding exceeded $10 billion in 2023, highlighting the competitive pressure from new entrants.

- AI Adoption: Companies are investing in AI for claims processing and customer service, with projections suggesting AI in insurance could save the industry billions annually by 2025.

- Digital Platforms: The development of user-friendly digital interfaces and mobile applications is becoming a key differentiator.

- Personalized Products: Data analytics enables the creation of tailored insurance policies, moving away from one-size-fits-all solutions.

Competitive rivalry within the insurance sector is fierce, with Allianz facing pressure from a broad spectrum of global and regional players. This dynamic is amplified by the fact that many insurance products, particularly standard ones, are increasingly viewed as commodities, intensifying competition on price and customer experience. For example, in 2024, the global insurance market's projected modest growth of around 2.5% means companies must fight harder for every customer.

The intensity of this rivalry forces companies like Allianz to invest heavily in marketing, customer retention, and operational efficiency, which can impact profit margins. In 2023, the average expense ratio for major European insurers was around 25-30%, a figure that can be squeezed further by the costs associated with aggressive customer acquisition strategies driven by competition.

Technological advancements, particularly from Insurtech startups, are further escalating competitive pressures. These new entrants are leveraging AI and data analytics to offer innovative, personalized products and streamlined services. Global Insurtech funding exceeding $10 billion in 2023 underscores the rapid pace of this disruption and the need for established firms like Allianz to continuously adapt and invest in technology to maintain their market position.

SSubstitutes Threaten

Large corporations increasingly utilize self-insurance or establish captive insurance companies, directly substituting traditional commercial insurance. This allows them to retain risk internally, potentially lowering premium expenses and enhancing control over their risk management. For instance, in 2023, the global captive insurance market was valued at approximately $70 billion, demonstrating significant adoption.

Government-provided social security and welfare programs represent a significant threat of substitutes for private insurance providers. In many developed nations, robust state-sponsored systems offer a safety net for citizens, covering aspects like retirement income, unemployment support, and healthcare. For instance, in 2024, the U.S. Social Security Administration projected that its Old-Age and Survivors Insurance (OASI) Trust Fund reserves are projected to be depleted by 2034, but even then, it would still be able to pay about 80% of scheduled benefits, indicating a continued, albeit potentially reduced, government safety net.

The breadth and accessibility of these public programs can directly diminish the demand for comparable private insurance products. When individuals perceive that the government will provide a baseline level of financial security or healthcare access, their willingness to purchase private life, health, or disability insurance may decrease. This is particularly true for lower and middle-income individuals who rely more heavily on these state provisions.

Alternative investment vehicles like private equity, venture capital, and real estate pose a significant threat to Allianz's managed funds. For instance, the global private equity market was valued at approximately $12.4 trillion in 2023, offering investors compelling returns outside traditional stock and bond markets. Furthermore, the increasing accessibility of direct investing platforms empowers both individual and institutional investors to bypass traditional asset managers, managing their portfolios independently or through specialized, non-traditional advisors.

Risk Management Consulting and Loss Prevention Services

Businesses increasingly invest in in-house risk management teams and advanced loss prevention technologies. This proactive approach aims to directly reduce potential losses, thereby decreasing the reliance on traditional insurance products. For instance, the adoption of AI-powered fraud detection systems in the financial sector, which saw a significant increase in investment throughout 2024, serves as a direct substitute for certain insurance coverages.

The growing availability of specialized risk consulting services also presents a viable alternative. These firms offer expertise in areas like cybersecurity, operational efficiency, and compliance, enabling companies to build robust internal defenses. This can lessen the perceived need for comprehensive insurance policies, as businesses feel more equipped to manage their own exposures.

The threat of substitutes for risk management consulting and loss prevention services is substantial. Consider these factors:

- Internal Expertise Development: Companies are prioritizing building strong internal risk management departments, reducing the need for external consultants.

- Technological Solutions: Investments in loss prevention technologies, such as advanced surveillance and predictive analytics, directly mitigate risks, diminishing the role of insurance as a primary risk transfer mechanism.

- Self-Insurance Strategies: Larger corporations may opt for self-insurance or captive insurance arrangements, effectively substituting external risk management services and traditional insurance policies.

- Focus on Prevention: A shift towards a culture of prevention, driven by regulatory pressures and a desire for operational resilience, encourages direct investment in mitigating risks rather than relying on post-loss compensation.

Peer-to-Peer (P2P) Insurance and Microinsurance Models

The rise of peer-to-peer (P2P) insurance and microinsurance models presents a growing threat of substitutes for traditional insurers like Allianz. These innovative approaches offer alternative ways for individuals and communities to manage risk, particularly in niche markets or developing economies.

These P2P and microinsurance platforms, often leveraging digital technology, allow groups of people to pool their premiums to cover specific risks, bypassing traditional intermediaries. For instance, some P2P platforms in 2024 focus on specialized coverage like cyber risk for small businesses or event cancellation, areas where traditional insurance might be less agile or cost-effective.

- P2P Insurance Growth: While specific global figures for P2P insurance penetration in 2024 are still emerging, early indicators suggest increasing adoption, especially among younger, tech-savvy demographics seeking more personalized and transparent risk solutions.

- Microinsurance Impact: Microinsurance, particularly in emerging markets, aims to provide affordable coverage for low-income populations. In 2023, the microinsurance market in Africa saw continued growth, with initiatives reaching millions of previously unbanked individuals, demonstrating a viable alternative for basic protection.

- Potential Disruption: As these models mature and gain scale, they could attract significant customer segments away from traditional insurers by offering lower administrative costs and more tailored products, thereby posing a tangible threat to Allianz's market share in certain segments.

Alternative investment vehicles like private equity and venture capital offer investors potentially higher returns than traditional insurance products, attracting capital that might otherwise be invested through Allianz's managed funds. The global private equity market's substantial valuation, reaching approximately $12.4 trillion in 2023, underscores this trend.

Businesses are increasingly investing in internal risk management teams and loss prevention technologies, directly reducing their need for traditional insurance. For example, the significant increase in investment in AI-powered fraud detection systems in 2024 highlights this shift toward proactive risk mitigation.

Peer-to-peer (P2P) insurance and microinsurance models offer specialized and often lower-cost alternatives to traditional insurance. While precise 2024 global P2P insurance figures are still developing, the growth in microinsurance, particularly in Africa where it reached millions in 2023, demonstrates a clear substitute for basic protection.

| Substitute Category | Key Characteristic | Market Indicator/Example |

|---|---|---|

| Self-Insurance/Captives | Internal risk retention, cost control | Global captive insurance market valued at ~$70 billion (2023) |

| Government Programs | Social safety nets (retirement, health) | US Social Security OASI Trust Fund projected to pay 80% of benefits even after depletion (2034) |

| Alternative Investments | Higher potential returns outside traditional markets | Global private equity market valued at ~$12.4 trillion (2023) |

| In-house Risk Management & Tech | Proactive loss prevention, direct risk mitigation | Increased investment in AI fraud detection (2024) |

| P2P & Microinsurance | Niche, lower-cost, technology-driven coverage | Microinsurance reaching millions in Africa (2023) |

Entrants Threaten

The insurance industry, including major players like Allianz, faces significant barriers to entry due to high capital requirements. In 2024, solvency regulations, such as Solvency II in Europe, necessitate substantial capital reserves to ensure insurers can meet their obligations. These stringent financial demands make it exceedingly challenging for new companies to enter the market and compete with established, well-capitalized firms.

In the insurance and asset management sectors, brand recognition and customer trust are incredibly important. Companies like Allianz have spent many years building a strong reputation. New companies entering the market find it very hard to gain this same level of trust, which makes it tough for them to attract and keep customers.

The financial services industry, including insurance giants like Allianz, faces a formidable threat from new entrants due to its complex regulatory landscape and the associated compliance costs. Navigating the intricate and constantly evolving rules across multiple jurisdictions is a significant barrier. For instance, in 2024, the European Union's Solvency II directive continues to impose stringent capital requirements and risk management standards on insurers, demanding substantial investment in compliance infrastructure and expertise.

These high costs for licensing, legal adherence, and ongoing reporting can be prohibitive for startups looking to enter the market. Incumbent firms, like Allianz, already possess established regulatory teams and processes, giving them a distinct advantage. The sheer expense of meeting these requirements, which can run into millions of euros annually for larger operations, deters many potential new players from even attempting to compete.

Building Extensive Distribution Networks

Building extensive distribution networks is a significant hurdle for new entrants trying to compete with established players like Allianz. This involves substantial upfront investment in setting up and nurturing relationships with agents, brokers, and developing robust digital platforms to reach a broad customer base. Allianz, with its global presence, already benefits from well-established and widespread distribution channels, making it difficult for newcomers to achieve similar reach and market penetration.

Consider the sheer scale of Allianz's distribution. In 2023, Allianz reported total revenues of €150.8 billion, a testament to its ability to reach a vast customer pool through its existing networks. New entrants would need to replicate this extensive infrastructure, a costly and time-consuming endeavor.

- High Capital Outlay: Establishing a comparable distribution network to Allianz requires significant financial resources for licensing, agent recruitment, training, and technology infrastructure.

- Brand Recognition and Trust: Allianz leverages decades of brand building and customer trust, which new entrants must painstakingly develop to gain market acceptance.

- Time to Market: Building a comprehensive distribution system can take years, during which Allianz can continue to strengthen its market position.

- Regulatory Compliance: Navigating diverse regulatory landscapes across different regions adds complexity and cost for new entrants seeking to establish distribution.

Data and Expertise Accumulation

The insurance and asset management industries, where Allianz operates, are heavily reliant on the accumulation of data and specialized expertise. Newcomers face a significant hurdle in replicating the vast historical datasets and actuarial skills that established players like Allianz have honed over decades. For instance, in 2024, the insurance sector continued to leverage sophisticated data analytics for risk modeling, with companies investing billions in AI and machine learning to refine underwriting and pricing. Similarly, successful asset management hinges on deep market understanding and seasoned investment talent, areas where incumbents possess a distinct advantage.

New entrants find it challenging to match the sheer volume of data and the depth of specialized knowledge that established firms like Allianz have cultivated. This data and expertise accumulation acts as a substantial barrier, making it difficult for new companies to compete effectively on risk assessment and investment performance.

- Data Volume: Incumbents possess decades of granular customer and claims data, crucial for accurate risk pricing.

- Actuarial Expertise: Deeply ingrained actuarial knowledge is essential for underwriting and product development.

- Market Insights: Years of market participation build invaluable insights for asset management strategies.

- Talent Acquisition: Attracting and retaining top-tier investment talent is easier for established, reputable firms.

The threat of new entrants for Allianz is generally considered moderate to low, primarily due to the substantial barriers to entry within the insurance and asset management sectors. These barriers include significant capital requirements, stringent regulatory compliance, the need for established brand trust, and the difficulty in replicating extensive distribution networks and accumulated data expertise. For example, in 2024, the ongoing implementation of capital adequacy rules like Solvency II in Europe continues to demand considerable financial reserves from all insurers, making it a costly endeavor for newcomers to establish a foothold.

New companies entering the insurance market face immense challenges in building the brand recognition and customer trust that established players like Allianz have cultivated over many years. This trust is crucial for customer acquisition and retention, as clients often prefer to deal with reputable and financially stable institutions. The sheer difficulty in overcoming this trust deficit, coupled with the need for substantial investment in marketing and customer service, significantly limits the threat posed by new entrants.

The regulatory environment in financial services presents a formidable barrier to new entrants. Companies must navigate complex and evolving compliance requirements, which demand significant investment in legal expertise and infrastructure. For instance, in 2024, the continuous updates and interpretations of regulations like the EU's Solvency II directive mean that new entrants must not only meet initial capital requirements but also adapt to ongoing compliance demands, a costly and resource-intensive process that established firms like Allianz are better equipped to handle.

Building and maintaining extensive distribution networks is another significant hurdle for new entrants. Allianz, with its global reach, benefits from well-established relationships with agents and brokers, as well as robust digital platforms. Replicating this infrastructure requires substantial upfront investment and time, making it difficult for new companies to achieve comparable market penetration. In 2023, Allianz's total revenues of €150.8 billion underscore the effectiveness of its established distribution channels.

| Barrier to Entry | Impact on New Entrants | Relevance to Allianz |

|---|---|---|

| Capital Requirements | High; requires substantial financial reserves. | Established financial strength provides a competitive advantage. |

| Regulatory Compliance | Complex and costly; demands expertise and ongoing investment. | Incumbent advantage due to existing compliance infrastructure. |

| Brand Recognition & Trust | Difficult to build; takes years of consistent performance. | Decades of operation foster strong customer loyalty. |

| Distribution Networks | Requires significant investment in infrastructure and relationships. | Extensive global networks facilitate broad market access. |

| Data & Expertise | Challenging to replicate accumulated data and actuarial skills. | Possesses vast historical data and specialized talent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Allianz's annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry research firms and financial news outlets to provide a comprehensive view of the competitive landscape.