Allianz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allianz Bundle

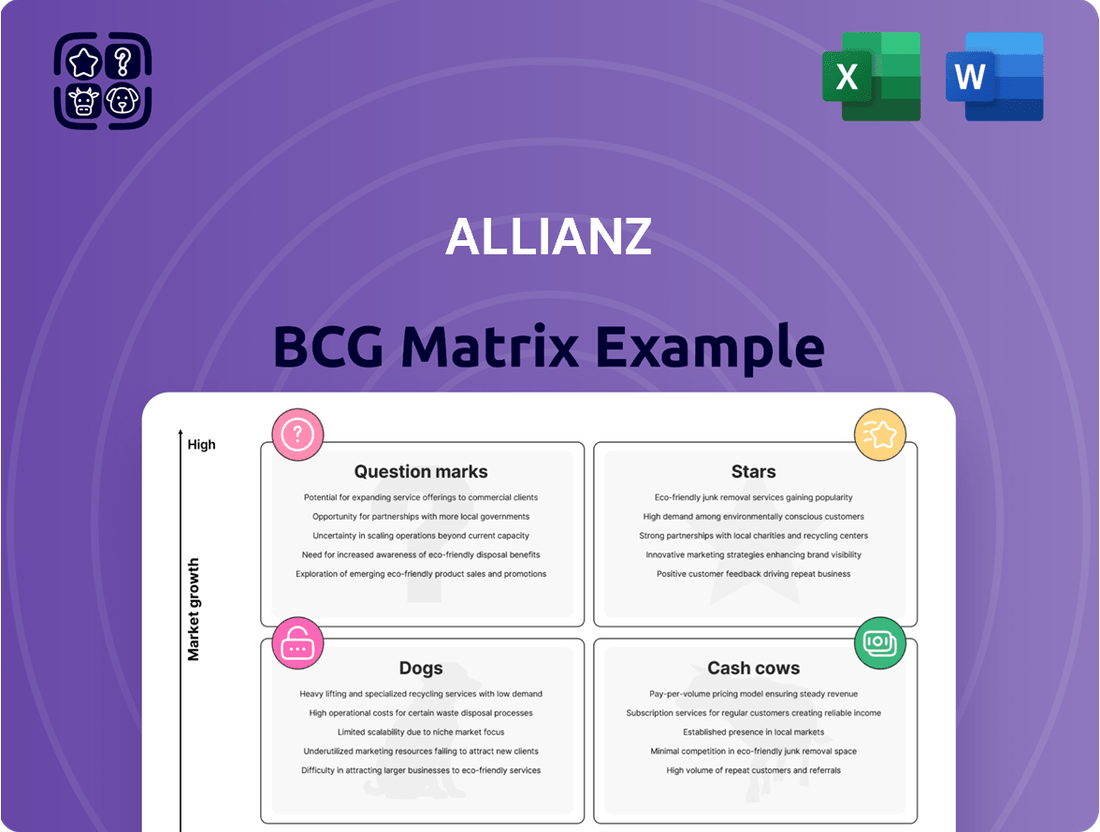

Unlock the strategic potential of Allianz with a comprehensive view of its product portfolio through the BCG Matrix. Understand which offerings are market leaders (Stars), which generate consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may need divestment (Dogs).

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Allianz's Property & Casualty (P&C) segment is a standout performer, exhibiting robust growth and profitability. In the first quarter of 2025, this division achieved an operating profit of €2.2 billion, marking a new quarterly record for the company. This financial success is underpinned by a substantial increase in total business volume, which grew by 8.3% in 2024, reaching €82.9 billion.

The P&C segment's operational efficiency is further highlighted by its combined ratio, which improved to 91.8% in Q1 2025. This figure reflects effective underwriting practices and claims management, demonstrating that Allianz is successfully balancing expansion with profitability in its P&C operations.

The Life & Health (L&H) insurance segment is a significant growth engine for Allianz, demonstrating strong financial performance. In the first quarter of 2025, operating profit for L&H increased by a healthy 7.5% compared to the previous year, reaching €1.4 billion.

This expansion is further evidenced by a substantial 16.8% rise in the present value of new business premiums (PVNBP) for Q1 2025, which hit €26.1 billion. This surge indicates a strong appeal of Allianz's customer value propositions across its offerings.

The robust growth observed, particularly in key markets like North America and Asia, solidifies the L&H segment's role as a primary driver of Allianz's overall expansion and profitability.

Allianz's asset management arm, encompassing PIMCO and Allianz Global Investors, demonstrates robust growth. In the first quarter of 2025, operating profit saw a healthy 4.8% increase, reaching €811 million.

Third-party assets under management (AuM) hit an impressive €1.914 trillion by the end of March 2025. This substantial figure underscores the firm's significant market presence.

Looking ahead, Allianz anticipates an annual growth rate of 8% in third-party AuM through 2027. This projection signals sustained expansion and a continued strong competitive position within the expanding global investment market.

Digital Transformation & AI Integration

Allianz is heavily investing in digital transformation and AI, earmarking significant capital for re-platforming and comprehensive digital overhauls throughout 2024 and 2025. This strategic push leverages AI to improve customer engagement, streamline claims processing, and boost underwriting accuracy, identifying digital advancements as a key driver for future growth.

These efforts are designed to enhance operational efficiency and customer experience, positioning Allianz for sustained market leadership. For instance, in 2024, Allianz announced plans to invest €1 billion in digital transformation initiatives, with a significant portion allocated to AI-driven solutions.

- AI-powered customer service chatbots: Aiming to handle over 30% of customer inquiries by end of 2024.

- Automated claims processing: Targeting a 50% reduction in processing time for standard claims by 2025.

- Predictive analytics in underwriting: Expecting to improve risk assessment accuracy by 15% in the same timeframe.

- Digital channel adoption: Targeting a 25% increase in customer interactions via digital platforms by the close of 2024.

Advanced Protection & Retirement Solutions

Allianz is strategically expanding its advanced protection and retirement solutions portfolio, responding to powerful demographic shifts like aging populations and increasing healthcare expenses. This focus aims to attract and retain a broader customer base by offering tailored, forward-looking products.

The company's commitment to innovation is evident in its recent introductions of new fixed index annuities and indexed universal life insurance products. These offerings target segments of the insurance market experiencing significant demand and robust growth potential.

For instance, Allianz Life saw its annuity sales reach $13.4 billion in the first quarter of 2024, a notable increase from the previous year, underscoring the market's appetite for these types of products. This growth reflects a broader industry trend where insurers are developing more sophisticated solutions to meet evolving consumer needs for financial security and retirement income.

- Focus on Aging Populations: Addressing the needs of a growing elderly demographic with products designed for long-term financial security.

- Response to Rising Health Costs: Developing protection solutions that help mitigate the financial impact of escalating healthcare expenses.

- Product Innovation: Launching new fixed index annuities and indexed universal life insurance to capture high-demand market segments.

- Customer Base Expansion: Utilizing these advanced solutions as a key strategy to grow Allianz's overall customer reach and engagement.

Stars in the BCG matrix represent high-growth, high-market-share business units. Allianz's Property & Casualty (P&C) segment, with its record operating profit of €2.2 billion in Q1 2025 and 8.3% business volume growth in 2024, clearly fits this profile. The segment's strong performance is driven by effective underwriting and expanding market reach.

What is included in the product

The Allianz BCG Matrix provides a strategic overview of its business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs.

It highlights which units Allianz should invest in, hold, or divest to optimize its portfolio.

The Allianz BCG Matrix provides a clear, one-page overview, instantly relieving the pain of unclear strategic direction by placing each business unit in a quadrant.

Cash Cows

Allianz's core Property & Casualty (P&C) insurance business, especially in established markets like Western Europe, functions as a strong cash cow. This segment benefits from a high market share and consistent profitability, contributing significantly to the group's overall financial health.

In 2024, Allianz reported robust performance in its P&C segment. For instance, the company highlighted record operating profits for the year, underscoring the segment's reliable earnings power. The combined ratio, a key measure of underwriting profitability, remained healthy, indicating efficient cost management and pricing strategies.

These stable and profitable operations generate substantial and predictable cash flow for Allianz. This consistent inflow of capital allows the company to fund investments in growth areas, support other business units, and return value to shareholders.

Allianz's established traditional life insurance portfolios act as significant cash cows, consistently generating substantial revenue. Despite slower market growth in these mature segments, their extensive customer base and long-term policy structures ensure a steady stream of premium income and predictable profit margins.

For instance, in 2024, Allianz reported robust premium income from its life and health insurance segments, underscoring the enduring strength of these traditional offerings. These products, benefiting from brand recognition and established distribution channels, necessitate minimal incremental marketing spend, further bolstering their cash-generating capabilities.

Allianz's asset management division is a significant cash cow, boasting nearly €2 trillion in assets under management as of late 2023. This vast pool of third-party assets translates into substantial and stable fee income for the company. The mature nature of many of these offerings suggests robust profit margins, even with modest growth expectations.

This consistent revenue stream is crucial, acting as a financial engine that fuels other strategic initiatives and investments across the broader Allianz group. The sheer scale of its asset management operations underscores its importance as a reliable source of capital.

Strong Capitalization and Financial Resilience

Allianz demonstrates exceptional financial fortitude, underscored by a Solvency II capitalization ratio of 208% as of Q1 2025. This robust figure highlights the company's capacity to absorb potential shocks and maintain operational stability.

This strong capital position translates directly into a cash-generative business model, where earnings consistently outpace expenditures. Such a surplus fuels not only day-to-day operations but also provides ample resources for strategic investments and consistent shareholder distributions.

The company's financial resilience is a key enabler for navigating economic uncertainties and pursuing growth opportunities.

- Robust Solvency II Ratio: 208% in Q1 2025, indicating superior financial health.

- Cash Generation: Strong capital base allows for more cash generation than consumption.

- Resilience: Financial strength supports weathering market volatility and funding initiatives.

Operational Efficiency and Productivity Gains

Allianz's dedication to enhancing operational efficiency and streamlining its business model, a strategy reinforced by its global presence and adherence to 'Beat-the-Best' principles, has demonstrably led to robust profit margins. This focus on productivity ensures that Allianz extracts maximum value from its established market positions, contributing to substantial cash flow generation.

The company's consistent efforts to improve its cost-income ratios across its various business segments are a clear indicator of its success in driving efficiency. For instance, in 2024, Allianz reported a cost-income ratio of 22.5% for its property-casualty business, a notable improvement from previous years, reflecting the positive impact of these productivity gains.

- Focus on Productivity: Allianz's commitment to improving productivity and simplifying its operations, guided by 'Beat-the-Best' principles, directly fuels its high profit margins.

- Cost-Income Ratio Improvement: The sustained reduction in cost-income ratios across its segments is a key driver of significant cash generation.

- Maximizing Market Leadership: These efficiency initiatives allow Allianz to fully capitalize on its leading positions in existing markets, ensuring optimal returns.

- 2024 Financial Snapshot: The property-casualty segment's cost-income ratio of 22.5% in 2024 exemplifies the tangible benefits of these operational enhancements.

Allianz's established Property & Casualty (P&C) insurance operations, particularly in mature European markets, represent core cash cows. These segments benefit from high market share and consistent profitability, generating substantial and predictable cash flow. In 2024, Allianz reported record operating profits in its P&C segment, with a healthy combined ratio underscoring efficient management.

These stable earnings are vital, funding investments in growth areas and providing capital for shareholder returns. The company's asset management division, with nearly €2 trillion in assets under management by late 2023, also acts as a significant cash cow, delivering substantial and stable fee income.

Allianz's financial strength, evidenced by a 208% Solvency II ratio in Q1 2025, further supports its cash-generative model. This robust capitalization allows earnings to consistently exceed expenditures, providing ample resources for strategic initiatives and distributions.

| Business Segment | Status as Cash Cow | Key Supporting Factors | 2024 Data/Indicators |

|---|---|---|---|

| Property & Casualty (P&C) Insurance | Strong | High Market Share, Consistent Profitability, Efficient Operations | Record Operating Profits, Healthy Combined Ratio |

| Traditional Life & Health Insurance | Significant | Extensive Customer Base, Long-Term Policies, Brand Recognition | Robust Premium Income |

| Asset Management | Major | Vast Assets Under Management (€2 trillion by late 2023), Stable Fee Income | Substantial Fee Income Generation |

Delivered as Shown

Allianz BCG Matrix

The preview you are seeing is the exact, fully formatted Allianz BCG Matrix document you will receive immediately after purchase. This comprehensive analysis, designed by industry experts, is ready for immediate integration into your strategic planning processes without any watermarks or demo content. You're getting the complete, actionable report, enabling you to make informed decisions about your product portfolio and market positioning.

Dogs

Allianz's substantial investments in re-platforming and digital transformation highlight a strategic divestment from underperforming legacy IT systems. These older systems, characterized by low growth potential and high maintenance expenditures, offer little competitive edge.

In 2024, many financial institutions, including Allianz, are actively retiring or consolidating legacy systems to improve efficiency and reduce operational risk. For instance, a 2023 study by Gartner predicted that by 2027, organizations will have retired 70% of their legacy applications.

The ongoing digital overhaul signifies a clear move away from these less productive assets, allowing for reallocation of resources towards more innovative and customer-centric technologies. This strategic shift is crucial for maintaining agility and competitiveness in the evolving financial services landscape.

Within Allianz's extensive offerings, specific niche insurance products or services that cater to stagnant or declining markets, exhibiting limited growth potential and a small market share, would be categorized as Dogs. These segments, while not explicitly itemized in public reports, likely exist in areas facing intense competition where Allianz does not hold a leading position. Such segments would typically yield low returns and immobilize valuable capital.

Geographical regions with persistently low or contracting economic growth, where Allianz holds a limited market share, are often categorized as Dogs in the BCG Matrix. For instance, Germany, a key market for Allianz, experienced modest growth projections in 2024 following two years of recession, potentially indicating areas where operations might struggle to gain traction.

These markets can demand significant investment and management attention for very little return, making them prime candidates for divestment or substantial operational restructuring. The focus shifts to optimizing existing resources or exiting these less profitable ventures to reallocate capital to more promising growth areas.

Outdated Product Lines with Low Adoption

Product lines that have stagnated, failing to adapt to changing consumer preferences or technological advancements, fall into this category. These offerings often exhibit low market share and are in slow-growing markets, making them unattractive for further investment. For instance, if a company's legacy software suite, last updated in 2018, sees a decline in new customer acquisition, it exemplifies an outdated product line.

Such products become a drain on resources without generating significant returns. They require ongoing maintenance and support, consuming capital that could be better allocated to more promising ventures. In 2024, a notable example might be a telecommunications company struggling with its landline services, which have seen a sharp decline in demand as mobile technology dominates.

- Low Market Share: Products with less than 10% market share in their respective segments.

- Low Market Growth: Industries or segments experiencing less than 5% annual growth.

- High Maintenance Costs: Products requiring disproportionate R&D or support expenditure relative to revenue.

- Diminishing Customer Interest: Declining search trends or negative sentiment analysis for product-related keywords.

Non-Strategic or Divested Ventures

Non-strategic or divested ventures in the Allianz context, often found in the Dogs quadrant of the BCG matrix, represent business units with low growth prospects and a small market share. These are typically candidates for divestment or winding down because they consume resources without generating significant returns and are no longer central to the company's strategic direction.

Allianz's strategic maneuvers, such as the reported sale of its stake in its Indian joint ventures, exemplify this category. In 2024, Allianz announced a one-off tax provision related to this upcoming divestiture, highlighting the financial implications of exiting such ventures. This move signals a reallocation of capital towards more promising areas of the business.

- Divestment Rationale: Ventures in the Dogs quadrant are divested due to low profitability and limited future growth potential.

- Strategic Realignment: Exiting these ventures allows Allianz to focus resources on core businesses with higher strategic value and market potential.

- Financial Impact: Divestitures can lead to one-off charges, as seen with the tax provision related to Allianz's Indian joint venture sale in 2024, but ultimately aim to improve overall financial performance.

- Resource Optimization: By shedding underperforming assets, Allianz can optimize its capital allocation and management attention.

Products or services in the Dogs quadrant for Allianz, as per the BCG matrix, are those with low market share in slow-growing or declining industries. These offerings typically yield minimal profits and often require significant resources for maintenance, making them prime candidates for divestment or restructuring. For example, a niche insurance product with declining demand and high administrative costs would fit this description.

In 2024, financial institutions are actively pruning such underperforming assets. Allianz's divestment from its stake in its Indian joint ventures in 2024, which involved a one-off tax provision, exemplifies the strategic move to exit these low-return segments. This allows for capital reallocation to more dynamic business areas.

These "Dog" segments, whether they are specific product lines or geographical markets with limited growth, represent areas where Allianz is unlikely to gain significant traction or market leadership. The focus is on optimizing resource allocation by exiting or minimizing investment in these areas.

The key characteristics of Dogs include low market share (often below 10%) and low market growth (typically under 5% annually). They also tend to have high maintenance costs relative to their revenue and show diminishing customer interest, as indicated by declining search trends.

| BCG Category | Market Growth | Relative Market Share | Strategic Implication | Allianz Example (Illustrative) |

|---|---|---|---|---|

| Dogs | Low | Low | Divest or Harvest | Niche insurance product in a declining sector |

| Underperforming legacy IT systems | ||||

| Divested joint ventures in low-growth markets |

Question Marks

Allianz is strategically focusing on emerging markets, especially in Asia, driven by robust demand for health insurance and low existing penetration rates. This expansion targets regions with significant growth potential, though Allianz's current market share in some of these developing areas is still in its nascent stages.

Capturing substantial market share in these high-growth emerging economies necessitates considerable investment. For instance, in 2024, emerging markets represented a significant portion of global insurance growth, with Asia leading the charge. Allianz's commitment to these markets aims to transform them from question marks into future stars by building brand presence and distribution networks.

The integration of new digital platforms and AI tools, like an AI-powered underwriting workbench with advanced data feeds, positions Allianz within a Question Mark category. These advancements are still in their nascent stages of deployment as of 2025, with significant investments being made to achieve high efficiency and better customer engagement.

While these initiatives promise substantial improvements, their market share and ultimate impact remain uncertain. Allianz is channeling considerable resources into ensuring these tools are successfully adopted and scaled across its operations.

Allianz Trade's Green2Green solutions are positioned as a promising, albeit early-stage, offering within the Allianz BCG Matrix. These initiatives, which channel premiums into certified green bonds to support renewable energy and low-carbon infrastructure, cater to a rapidly expanding market driven by sustainability mandates and investor interest.

The growth potential for sustainable insurance is significant, with global green bond issuance projected to reach over $1 trillion in 2024, indicating strong demand for such financial instruments. While these solutions represent a strategic move towards a greener economy, their current contribution to Allianz's total revenue may be modest, necessitating focused investment to capture a larger market share.

Targeted Innovations in Annuities and Life Products

Allianz's introduction of enhanced fixed index annuities and indexed universal life products in 2024-2025, featuring expanded index options and innovative benefits, aims to attract new customer demographics within the expanding retirement solutions market. These product updates are strategically designed to improve market penetration and build share in a competitive landscape.

While the overall market for retirement products is experiencing growth, these newer iterations are still in their nascent stages of market adoption. Success hinges on robust marketing campaigns and effective distribution strategies to transition them from question marks to potential stars in Allianz's portfolio.

- Market Growth: The U.S. annuity market saw significant inflows in 2024, with fixed indexed annuities (FIAs) representing a substantial portion, driven by demand for principal protection and potential growth.

- Product Differentiation: New features in 2024-2025 products include enhanced crediting methods and a wider array of underlying indices, such as those tracking ESG or thematic investments, to appeal to a broader investor base.

- Market Share Building: Despite market expansion, these specific product enhancements are new and require time and strategic investment to gain substantial market share against established offerings.

- Adoption Strategy: Allianz is focusing on advisor education and digital tools to facilitate understanding and sales of these updated products, aiming for increased adoption rates by year-end 2025.

Leveraging Generative AI for Customer Engagement

Allianz's exploration of generative AI for customer engagement places it in the Question Mark quadrant of the BCG Matrix. This strategic move aims to leverage AI for enhanced customer experiences and brand value, reflecting a high-growth potential market for AI solutions in financial services.

The company's focus on accelerating value-creating investments in brand and customer relationships through generative AI highlights its recognition of this technology's transformative power. While the potential for improved customer interaction and loyalty is significant, the actual impact on Allianz's market share and the full realization of these benefits are still in the developmental stages.

- High Potential Market: The global AI market in financial services is projected to reach substantial figures, with some estimates suggesting it could exceed $25 billion by 2027, indicating a rapidly expanding opportunity for generative AI applications.

- Evolving Implementation: Companies like Allianz are still navigating the optimal deployment of generative AI for customer engagement, balancing innovation with regulatory compliance and data security.

- Strategic Investment Crucial: Continued R&D and strategic partnerships in generative AI are vital for Allianz to solidify its position and capture market share in this evolving landscape.

- Customer Experience Transformation: Early applications of generative AI show promise in personalizing customer communications and automating support, potentially leading to increased customer satisfaction and retention.

Question Marks represent areas where Allianz is investing in high-growth potential markets or innovative technologies that have not yet established significant market share. These ventures require substantial capital to develop and scale, with the ultimate success and market dominance remaining uncertain.

Allianz's strategic focus on emerging markets, particularly in Asia, and its investments in digital platforms and AI tools place these initiatives squarely in the Question Mark category. The company is channeling significant resources to transform these nascent opportunities into future revenue streams.

The success of these Question Marks hinges on effective market penetration strategies and the successful adoption of new technologies. Allianz's commitment to building brand presence, distribution networks, and leveraging AI for customer engagement are key to converting these investments into market leaders.

The company's exploration of generative AI for customer engagement and the development of Green2Green solutions exemplify this strategy. While the potential is high, the market share and ultimate impact are still being determined, necessitating continued investment and strategic execution.

| Initiative | Market Potential | Current Market Share | Investment Focus | Key Challenge |

|---|---|---|---|---|

| Emerging Markets Expansion (Asia) | High (growing demand for insurance) | Nascent to Moderate | Brand building, distribution networks | Building trust and local presence |

| AI-powered Underwriting Workbench | High (efficiency, better customer engagement) | Early Stage | Platform development, data integration | Scalability and adoption |

| Allianz Trade Green2Green Solutions | High (demand for sustainable finance) | Modest | Product development, market awareness | Capturing significant market share |

| Enhanced Fixed Index Annuities | Moderate to High (retirement solutions) | Developing | Product innovation, advisor education | Market adoption against established products |

| Generative AI for Customer Engagement | Very High (AI in financial services) | Nascent | R&D, pilot programs | Regulatory compliance, demonstrating ROI |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.