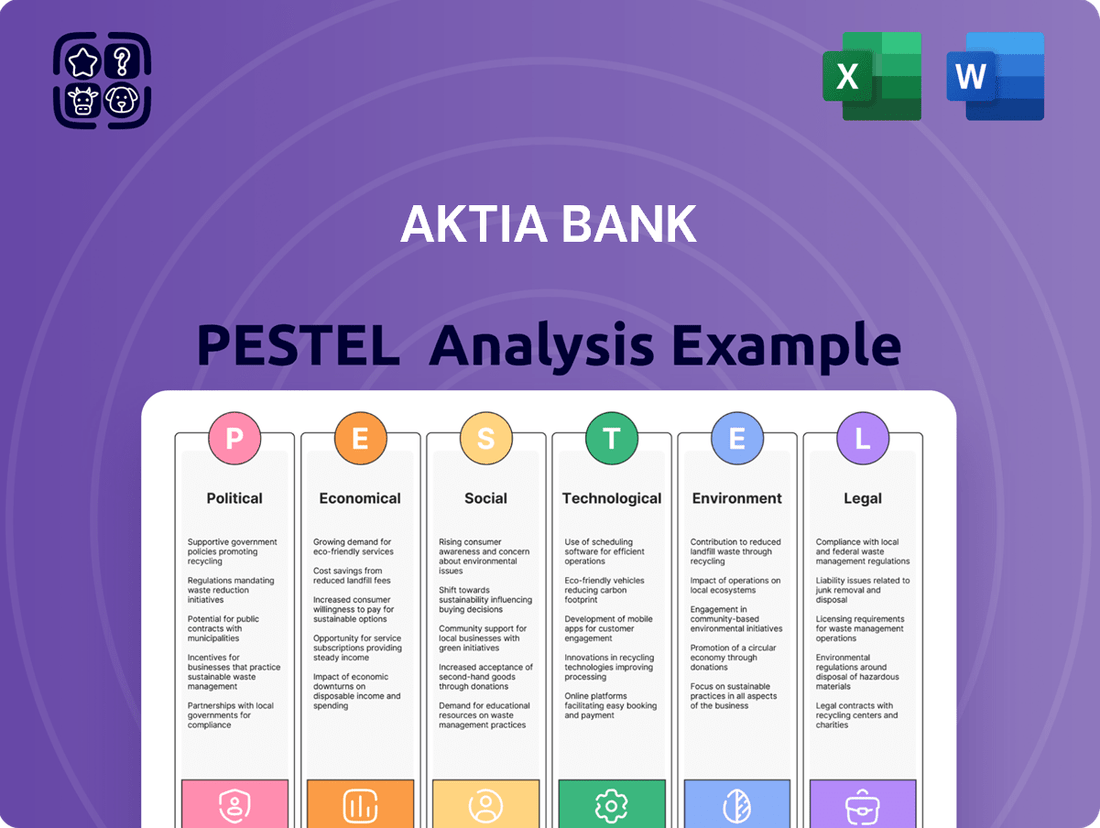

Aktia Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aktia Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Aktia Bank's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Download the full report to gain a competitive edge and make informed decisions for Aktia Bank's future success.

Political factors

The Finnish government, established in June 2023, is prioritizing the development of a robust growth strategy for its financial sector. This initiative includes a thorough review of existing financial market regulations.

A dedicated working group was formed in February 2024 to devise regulatory proposals, with a deadline set for May 2025. This demonstrates a clear political commitment to modernizing and potentially streamlining the framework governing Finnish banks like Aktia.

Finland, as an active EU member, navigates the complex landscape of EU financial regulations while seeking to preserve its national specificities. This involves a delicate balancing act to ensure that regulatory frameworks support, rather than hinder, domestic financial sector development.

Finance Finland, a key industry body, has voiced concerns about the potential for over-regulation at the EU level, arguing that excessive rules could undermine the competitiveness of Finnish financial institutions. They advocate for a regulatory approach that fosters innovation and growth, rather than stifling it.

A significant focus for Finland is the harmonization of national regulations and supervisory practices across the EU. This alignment is seen as crucial for facilitating smoother cross-border capital flows, which in turn can boost investment and economic activity within the Union. Finland also champions the development of a robust and integrated Capital Markets Union.

Geopolitical instability, exemplified by the ongoing conflict in Ukraine and the situation in Gaza, continues to cast a shadow of uncertainty over the global economy, directly affecting Finland. These tensions can disrupt supply chains, influence energy prices, and impact investor confidence, creating a volatile environment for financial markets.

Despite these global headwinds, Finland's financial system has demonstrated notable resilience. This stability is largely due to robust capital buffers within Finnish banks, coupled with enhanced financial regulations and prudent macroprudential policies implemented over recent years. For instance, Finnish banks' average Common Equity Tier 1 (CET1) ratio stood at a healthy 17.9% at the end of Q3 2024, well above regulatory minimums, indicating strong capital positions.

Recognizing the persistent nature of these risks, the Finnish Financial Supervisory Authority (FIN-FSA) has identified geopolitical risks as a primary supervisory focus for 2025. This proactive approach aims to ensure that financial institutions are adequately prepared to navigate potential disruptions and maintain the stability of the Finnish financial sector.

Macroprudential Policy and Capital Buffers

The Bank of Finland is advocating for more accessible capital buffers within the Finnish banking sector. This move aims to bolster the resilience of financial institutions, allowing the Financial Supervisory Authority (FIN-FSA) Board to proactively manage economic cycles. By having these buffers readily available, authorities can implement countercyclical capital requirements when lending activity heats up, and conversely, release them during downturns to stimulate credit flow and support the economy.

These macroprudential policies are fundamental to safeguarding financial stability. For instance, the countercyclical capital buffer (CCyB) rate in Finland, which can range from 0% to 2.5% of risk-weighted assets, is a key tool. While the specific rate is adjusted based on economic conditions, the principle remains: these buffers act as a shock absorber.

- Enhanced Resilience: Rapidly releasable capital buffers improve the banking sector's ability to withstand economic shocks.

- Countercyclical Measures: The FIN-FSA can impose or release capital buffer requirements to manage lending cycles.

- Financial Stability: These policies are critical for maintaining the overall health and stability of the financial system.

Government Measures on Banking Service Availability

In autumn 2024, Finland's Ministry of Finance formed a working group specifically to examine and suggest ways to enhance banking service accessibility. This includes looking into possible rules concerning cash availability and its acceptance. This political move highlights a commitment to ensuring all citizens have access to fundamental banking services, a factor that will likely shape the operational strategies and compliance demands for institutions like Aktia Bank.

The Finnish government's focus on banking service availability, particularly concerning cash, could lead to new regulatory frameworks. For instance, if regulations mandate certain levels of cash handling or accessibility, Aktia Bank might need to invest in infrastructure or adjust its branch network strategy to comply. This proactive approach by the government signals a potential shift in the operational landscape for Finnish banks, aiming to bridge the digital divide and serve all customer segments effectively.

Finland's political landscape is actively shaping the financial sector, with a government initiative launched in June 2023 to foster growth and review financial market regulations. A working group, established in February 2024 and tasked with proposing regulatory changes by May 2025, underscores this commitment to modernization. As an EU member, Finland balances EU directives with national interests, a delicate act amplified by industry concerns, like those from Finance Finland, regarding potential over-regulation hindering competitiveness.

Geopolitical tensions, including the conflicts in Ukraine and Gaza, create economic uncertainty impacting Finland, yet its financial system shows resilience, supported by robust capital buffers. Finnish banks maintained a strong Common Equity Tier 1 (CET1) ratio of 17.9% by Q3 2024, exceeding regulatory minimums. The Bank of Finland is also advocating for more accessible capital buffers to enhance the banking sector's resilience and allow proactive management of economic cycles through tools like the countercyclical capital buffer (CCyB).

A significant political development in autumn 2024 involves a government working group examining ways to improve banking service accessibility, including cash availability and acceptance. This focus on fundamental services could lead to new regulations, potentially requiring banks like Aktia to adapt their infrastructure and strategies to ensure broader financial inclusion.

| Factor | Description | Implication for Aktia Bank |

|---|---|---|

| Regulatory Review | Government review of financial market regulations with proposals due May 2025. | Potential for streamlined or new regulations affecting operations and compliance costs. |

| EU Harmonization | Finland's push for harmonized EU financial regulations and Capital Markets Union. | Opportunities for cross-border activities but also need to adapt to evolving EU standards. |

| Banking Service Accessibility | Government focus on cash availability and acceptance in banking services. | Potential need to invest in infrastructure or adjust service models to meet accessibility mandates. |

| Macroprudential Policy | Advocacy for accessible capital buffers and use of CCyB. | Enhanced sector resilience; potential impact on lending capacity depending on buffer requirements. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Aktia Bank, detailing how political, economic, social, technological, environmental, and legal factors present both challenges and avenues for growth.

A PESTLE analysis for Aktia Bank acts as a pain point reliever by providing a structured framework to proactively identify and address external challenges and opportunities, thereby mitigating potential risks to strategic planning.

Economic factors

Finland's economy is showing promising signs of recovery after a two-year recession. Real GDP is projected to expand by 1.0% in 2025 and 1.3% in 2026, fueled by decreasing interest rates and an increase in consumer purchasing power. This turnaround is crucial for banks like Aktia, as it directly impacts their ability to grow lending portfolios and engage in investment activities.

While 2024 offered some stabilization, a definitive positive economic growth trajectory is only expected to solidify in 2025. This anticipated upturn will likely translate into increased demand for financial services, offering opportunities for Aktia Bank to boost its revenue streams through new loans and investment products.

The anticipated decrease in net interest income for Aktia Bank in 2025, relative to 2024, is a direct consequence of the European Central Bank's (ECB) monetary policy. The ECB has implemented several key interest rate reductions throughout 2024 and into early 2025, a move designed to stimulate economic activity. This downward trend in benchmark rates directly compresses the interest rate margins banks can earn on their lending and deposit portfolios.

While lower rates present a challenge to net interest income, they are also intended to foster a more robust economic environment. The expectation is that these accommodative monetary conditions will boost private consumption and encourage business investment. This, in turn, could translate into increased demand for Aktia Bank's various financing solutions, such as loans and mortgages, potentially offsetting some of the margin compression.

The Finnish housing market demonstrated a positive shift in late 2024, with consumer sentiment towards home purchases improving. This uptick suggests a potential for increased mortgage lending activity.

Despite this, the construction sector grapples with significant headwinds. We've observed a rise in bankruptcies among construction firms, signaling underlying financial strain within the industry. For instance, in 2024, the number of construction company insolvencies saw a notable increase compared to the previous year, impacting the sector's stability.

This challenging environment translates to growing credit risks for financial institutions like Aktia Bank. The increased financial distress in construction can lead to higher loan defaults, directly affecting the bank's lending portfolio and profitability.

Household Indebtedness and Payment Defaults

Household indebtedness in Finland has seen a positive shift, with a notable decrease easing some financial pressures. This trend was further supported by declining interest rates, which began to lighten the debt-servicing burden for Finnish households starting in 2024.

Despite the overall reduction in debt levels, a concerning counter-trend is the rise in consumer payment defaults. A significant contributor to this increase is the accumulation of unpaid consumer loans, highlighting a persistent vulnerability within this segment of the market.

- Household Debt Reduction: Finnish household debt-to-income ratio has decreased, signaling improved financial resilience.

- Interest Rate Impact: Declining interest rates from 2024 onwards have provided relief on debt servicing costs.

- Rising Defaults: The number of consumers experiencing payment defaults, particularly on consumer loans, has been on the rise.

- Risk Management Focus: This situation underscores the critical need for robust risk management strategies in Aktia Bank's consumer lending operations.

Inflation and Purchasing Power

Inflation in Finland is expected to stay under 2% for 2025 and 2026, even with a Value Added Tax (VAT) hike in September 2024. This cooling inflation, combined with rising wages, means people's ability to buy things is getting better.

This improvement in purchasing power is good news for businesses like Aktia Bank. It suggests that consumers will likely spend more, which in turn could boost demand for various banking services.

- Projected HICP Inflation (Finland): Below 2% for 2025-2026.

- Key Driver of Purchasing Power: Moderation of inflation alongside salary increases.

- Impact on Consumer Spending: Expected to be positive, supporting demand.

- Benefit for Banking Sector: Increased demand for banking services is anticipated.

Finland's economy is projected for a rebound, with real GDP expected to grow by 1.0% in 2025 and 1.3% in 2026, driven by lower interest rates and increased consumer spending power.

While the bank anticipates a dip in net interest income in 2025 due to European Central Bank rate cuts, this accommodative policy aims to stimulate broader economic activity, potentially boosting demand for Aktia's lending and investment products.

Despite a positive trend in the housing market and a decrease in household indebtedness, Aktia faces rising credit risks from increased bankruptcies in the construction sector and a concerning uptick in consumer loan defaults.

Inflation is forecast to remain below 2% in 2025-2026, and combined with wage growth, this should enhance consumer purchasing power, benefiting demand for banking services.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) | 2026 (Proj.) |

|---|---|---|---|

| Finland Real GDP Growth | ~0.5% | 1.0% | 1.3% |

| HICP Inflation (Finland) | ~2.5% | <2.0% | <2.0% |

| Household Debt-to-Income Ratio | Slightly Decreased | Continued Decrease | Continued Decrease |

| Consumer Loan Defaults | Increasing Trend | Monitoring Required | Monitoring Required |

Full Version Awaits

Aktia Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aktia Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain a clear understanding of the external forces shaping Aktia Bank's strategic landscape.

Sociological factors

Aktia Bank is strategically prioritizing an enhanced customer experience, recognizing that evolving customer needs are paramount. Their focus on first-class service and strengthening customer relationships is a key differentiator. This commitment is reflected in their impressive rise in customer satisfaction surveys during 2024, demonstrating tangible progress in meeting these expectations.

Aktia's ambition to democratize private banking aligns with a societal trend where individuals increasingly seek accessible, high-quality financial advice. This move is supported by data showing a growing interest in wealth management among broader demographics. For instance, in 2024, the number of individuals with investable assets between €100,000 and €1 million, who might not traditionally qualify for private banking, has seen a significant uptick, indicating a ripe market for Aktia's expanded offerings.

Consumer confidence in Finland hovered in negative territory for much of 2024. However, a slight uptick was observed towards the year's close, driven by ongoing economic and labor market uncertainties.

Interestingly, despite the overall cautious sentiment, Finnish consumers showed a growing inclination towards home purchases and increased borrowing. This suggests a complex behavioral shift where immediate concerns are being weighed against longer-term financial planning.

For Aktia Bank, this dynamic presents an opportunity to tailor financial products and advisory services that acknowledge both consumer apprehension and their underlying desire for significant life investments, like property ownership.

Workforce Well-being and Employee Satisfaction

Aktia Bank places a strong emphasis on its role as a responsible employer, actively investing in a corporate culture that prioritizes employee well-being. They understand that happy and motivated employees are crucial for delivering excellent customer service, a cornerstone of the banking industry. This commitment is reflected in their internal surveys, which in 2024 indicated a positive trend of increasing employee satisfaction.

This rising employee satisfaction is particularly significant for service-oriented sectors like banking. It directly impacts Aktia's ability to attract and retain top talent in a competitive market. A satisfied workforce often translates to lower staff turnover and a more engaged team, which can enhance operational efficiency and customer loyalty.

- Employee Well-being Initiatives: Aktia's focus on well-being is a strategic investment in its human capital.

- 2024 Survey Results: Internal surveys for 2024 demonstrated an upward trend in employee satisfaction.

- Talent Attraction and Retention: High employee satisfaction is a key factor in securing and keeping skilled professionals in the banking sector.

- Customer Service Link: Aktia recognizes the direct correlation between employee morale and the quality of customer interactions.

Digital Adoption by Customers

The banking sector is experiencing a significant shift as customer expectations evolve, particularly with digitally native younger generations inheriting wealth. Aktia Bank, like many financial institutions, recognizes this trend and serves its customers across a wide array of digital channels, reflecting a broader societal move towards online banking interactions.

This increasing reliance on digital platforms means Aktia must consistently invest in its digital infrastructure and service offerings to meet these changing demands. For instance, a significant portion of Aktia's customer base now prefers digital communication and transactions, a trend that has accelerated in recent years.

- Digital Engagement: In 2024, a substantial percentage of Aktia's new customer onboarding occurred through digital channels.

- Service Preference: Customer surveys in early 2025 indicate a growing preference for mobile banking apps over branch visits for routine transactions.

- Investment Focus: Aktia's 2025 strategic plan highlights continued allocation of capital towards enhancing its digital banking platforms and cybersecurity measures.

Societal attitudes towards financial advice are shifting, with a growing demand for accessible wealth management services, a trend Aktia Bank is actively addressing by democratizing private banking. This aligns with a 2024 observation of increased investable assets among demographics previously excluded from traditional private banking, highlighting a market ripe for expansion. Aktia's commitment to employee well-being, evidenced by rising employee satisfaction in 2024 surveys, directly supports its service-oriented goals by fostering a motivated workforce essential for customer service excellence.

Technological factors

Aktia Bank is significantly boosting its digital capabilities by investing in IT infrastructure and driving digital transformation. This focus is designed to sharpen its long-term competitive edge and fuel future expansion.

These investments are key to optimizing operational efficiency and delivering superior customer experiences across all channels, meeting increasingly sophisticated customer demands. For instance, in 2023, Aktia reported a continued increase in its IT expenses, reflecting this commitment to modernization.

Aktia Bank is actively investigating how artificial intelligence can reshape financial services, aiming to boost productivity and operational efficiency. This strategic exploration aligns with a broader industry trend towards leveraging AI for enhanced customer experiences and streamlined processes.

The Finnish Financial Supervisory Authority (FIN-FSA) has identified the escalating use of AI as a key supervisory focus for 2025, underscoring the significant regulatory attention AI is receiving within the banking sector. This emphasis signals the critical need for robust governance and risk management frameworks as AI adoption accelerates.

Cybersecurity and operational resilience are paramount for Aktia Bank, especially as the Finnish Financial Supervisory Authority (FIN-FSA) has highlighted these as key priorities for 2025. The increasing reliance on digital platforms means that IT and cyber risks are significant concerns for the entire financial sector.

Aktia must continually strengthen its digital defenses to ensure robust operational resilience. This is crucial given the heightened regulatory scrutiny in this area, aiming to protect customer data and maintain service continuity in the face of evolving cyber threats.

Open Banking and Data Utilization

Open banking initiatives are fundamentally reshaping retail banking, and Aktia Bank is strategically positioned to capitalize on this shift. By prioritizing the utilization of customer data, Aktia aims to enhance its service offerings through personalized advice and targeted cross-selling opportunities. This focus on clean, accessible, and actionable data is crucial for maintaining a competitive edge in the evolving financial sector.

Aktia's commitment to data-driven insights is particularly relevant given the increasing demand for tailored financial products. For instance, the European Banking Authority reported that by the end of 2024, over 20 million customers in the EU were actively using open banking services. This trend underscores the growing importance of leveraging customer data effectively to meet consumer expectations for customized banking experiences and to identify opportunities for upselling and cross-selling financial products.

- Data-driven personalization: Aktia's strategy hinges on leveraging customer data to offer bespoke financial advice and product recommendations.

- Open banking adoption: The increasing use of open banking services across Europe, with millions of customers participating by late 2024, highlights a significant market trend.

- Competitive advantage: Utilizing clean and actionable data is key for Aktia to differentiate its services and enhance customer relationships.

- Upselling and cross-selling: Aktia's data utilization strategy directly supports efforts to increase revenue through relevant product offerings.

Payment Systems Innovation (Instant Payments)

The financial sector is experiencing a significant shift towards instant payment systems, driven by new regulations. For instance, Payment Service Providers (PSPs) in the Euro area are mandated to offer instant credit transfers by January 2025. This regulatory push means that banks like Aktia must invest in and adapt their payment infrastructure to support these real-time transactions.

Aktia's ability to integrate and offer seamless instant payment solutions will be crucial for maintaining its competitive edge. Failure to comply or adapt could lead to a loss of market share as customers increasingly expect faster, more convenient payment options. The European Payments Council's SCT Inst scheme is already seeing growing adoption, with transaction volumes increasing year-on-year, highlighting the market's readiness for this evolution.

The technological advancements required for instant payments involve significant upgrades to core banking systems and payment gateways. Aktia will need to ensure robust security protocols and efficient processing capabilities to handle the increased transaction velocity. This innovation is not just about compliance; it's about meeting evolving customer expectations for immediate financial interactions.

Aktia Bank's technological strategy centers on enhancing digital capabilities and leveraging AI for operational efficiency and improved customer experiences. Investments in IT infrastructure are ongoing, as reflected in rising IT expenses in 2023, to support digital transformation and maintain a competitive edge.

The bank is exploring AI's potential to boost productivity and customer service, aligning with industry trends and regulatory focus. Cybersecurity and operational resilience are critical priorities for 2025, with the Finnish Financial Supervisory Authority emphasizing these areas due to increasing digital reliance and cyber risks.

Open banking is a key driver, with Aktia aiming to use customer data for personalized advice and cross-selling. The growing adoption of open banking services across the EU, serving over 20 million customers by late 2024, highlights the importance of data-driven strategies.

The shift to instant payment systems, mandated for PSPs in the Euro area by January 2025, requires Aktia to upgrade its payment infrastructure. This adaptation is crucial for meeting customer expectations for real-time transactions and maintaining market share amidst increasing adoption of schemes like the European Payments Council's SCT Inst.

Legal factors

Finland is actively reforming its banking sector, with new legislation on credit institutions and the implementation of Basel III standards slated for completion by the end of 2025. These changes aim to bolster capital requirements and modernize national banking regulations.

This regulatory overhaul is crucial for financial institutions like Aktia Bank, as it will directly impact their operational frameworks and capital adequacy ratios. The updated rules are designed to enhance financial stability within the Finnish banking landscape.

New Finnish Financial Supervisory Authority (FIN-FSA) regulations effective June 1, 2025, will significantly impact consumer lending default risk management. These rules are designed to curb lending to individuals with excessively high default probabilities, setting clear minimum standards for the rating systems banks must employ.

This regulatory shift necessitates robust data analytics and model validation for Aktia Bank. For instance, in Q1 2024, Finnish banks reported a slight increase in non-performing loan ratios for consumer credit, highlighting the existing challenges that these new guidelines will address more stringently.

The upcoming implementation of the Digital Operational Resilience Act (DORA) in the EU, with full application expected by January 17, 2025, will necessitate significant adjustments for financial institutions like Aktia Bank. This regulation mandates enhanced IT security and operational resilience, requiring comprehensive risk management frameworks for information and communication technology (ICT) systems.

DORA's stringent requirements mean Aktia Bank must bolster its defenses against cyber threats and ensure continuous service delivery, even during ICT disruptions. The European Banking Authority (EBA) has been actively involved in developing DORA's technical standards, indicating a strong regulatory push for compliance, with significant investment in cybersecurity measures likely required.

Sustainability Reporting Standards (ESRS, EU Taxonomy)

Aktia Bank's commitment to sustainability reporting is underscored by its 2024 report, which adheres to the Finnish Accounting Act, the European Sustainability Reporting Standards (ESRS), and the EU Taxonomy. This compliance, verified externally, reflects the growing body of legislation mandating transparent sustainability disclosures for financial entities.

The implementation of ESRS, for instance, requires detailed reporting across environmental, social, and governance (ESG) factors, impacting how Aktia communicates its climate risks and opportunities. Similarly, the EU Taxonomy provides a classification system to identify environmentally sustainable economic activities, influencing investment decisions and product development.

- ESRS Adoption: Aktia's 2024 report aligns with ESRS, a comprehensive framework for sustainability disclosures across the EU.

- EU Taxonomy Alignment: The bank's reporting also incorporates the EU Taxonomy, guiding the classification of sustainable economic activities.

- External Verification: Independent verification of Aktia's sustainability report enhances credibility and assures adherence to legal and reporting standards.

- Regulatory Landscape: These standards signify an intensifying legal and regulatory environment for sustainability performance in the financial sector.

Anti-Money Laundering (AML) and Financial Crime Prevention

The European Union is actively working to strengthen measures against financial crime and money laundering, impacting all member states. For Aktia Bank, adherence to Finland's Act on Preventing and Clearing Money Laundering and Terrorist Financing (444/2017) remains a fundamental and ongoing legal requirement. This necessitates robust internal controls and reporting mechanisms to detect and prevent illicit financial activities.

The Finnish banking sector is undergoing significant legislative reform, with new credit institution laws and Basel III implementation expected by the end of 2025, directly impacting Aktia Bank's capital requirements and operational standards.

New FIN-FSA regulations from June 1, 2025, will tighten consumer lending default risk management, requiring banks like Aktia to adopt more stringent rating systems, a move prompted by a slight increase in non-performing consumer loan ratios reported by Finnish banks in Q1 2024.

The EU's Digital Operational Resilience Act (DORA), fully applicable by January 17, 2025, mandates enhanced IT security and resilience for Aktia Bank, requiring substantial investment in cybersecurity and robust ICT risk management frameworks.

Aktia Bank's 2024 sustainability report demonstrates compliance with the Finnish Accounting Act, ESRS, and EU Taxonomy, reflecting a growing legal mandate for transparent ESG disclosures and adherence to evolving environmental reporting standards.

Environmental factors

Aktia Bank has publicly committed to aligning its emissions reduction targets with the Science Based Targets initiative (SBTi) and the ambitious goals of the Paris Agreement. This strategic decision underscores a deep-seated dedication to environmental stewardship, placing Aktia firmly within the international framework for tackling climate change.

By embracing SBTi, Aktia is actively working to set measurable and science-backed goals for reducing its carbon footprint, a critical step for financial institutions aiming to contribute to a sustainable future. This commitment is particularly relevant as the financial sector faces increasing pressure to demonstrate tangible progress on climate action, with many investors and regulators prioritizing institutions with clear, science-driven environmental strategies.

Aktia Bank significantly bolstered its commitment to sustainable finance in 2024 by launching its Green Energy Loan. This expansion of green loan offerings directly supports the growing demand for environmentally conscious financial products and aids customers in funding projects that contribute to the green transition.

Aktia Bank has demonstrably strengthened its commitment to responsible investment by updating its core principles and introducing innovative active ownership strategies. A significant development is the establishment of a new framework for sovereign engagement, reflecting a proactive approach to influencing governmental policies on ESG matters.

This commitment is not new; Aktia was an early adopter of the UN Principles for Responsible Investment (PRI), signing them as one of the first Finnish banks. This foundational step underscores a deep-rooted dedication to integrating Environmental, Social, and Governance (ESG) factors into its asset management practices, a trend that has seen significant growth in the financial sector, with PRI signatories globally managing over $120 trillion in assets as of 2023.

Sustainability Programme and Materiality Analysis

Aktia Bank's sustainability program, running from 2022 to 2025, sets a clear direction for its environmental and social efforts, focusing on Prosperity, People, Principles of Governance, and the Planet. This structured approach is further solidified by regular materiality analyses, which pinpoint the most crucial areas for the bank's impact and improvement. By reporting annually on its progress, Aktia demonstrates a commitment to transparency and accountability in its sustainability journey.

The bank's materiality analysis helps prioritize actions, ensuring that resources are directed towards the most significant environmental and social factors affecting its operations and stakeholders. For instance, in 2023, Aktia reported a reduction in its financed emissions intensity, a tangible outcome of its focused sustainability initiatives.

- Focus Areas: Aktia's sustainability program targets Prosperity, People, Principles of Governance, and Planet.

- Materiality Analysis: Conducted to identify and prioritize key sustainability themes.

- Annual Reporting: Demonstrates progress and commitment to environmental and social responsibility.

- 2023 Progress: Aktia reported a reduction in financed emissions intensity, reflecting tangible sustainability efforts.

Role in Climate Transition Financing

Environmental factors are increasingly shaping financial markets, and the banking sector is central to the global shift towards a low-carbon economy. Banks are expected to channel significant capital into investments that support carbon neutrality goals, a trend that gained further momentum in 2024. For instance, the European Investment Bank alone committed €100 billion to climate action and environmental sustainability projects between 2021 and 2025, with a substantial portion of this flowing through commercial banking partnerships.

Aktia Bank, operating as both a wealth manager and a traditional bank, is strategically positioned to capitalize on and facilitate this climate transition. By offering specialized financing solutions and a growing suite of responsible investment products, Aktia can help clients align their portfolios with sustainability objectives. This aligns with broader market trends, as sustainable finance assets under management globally are projected to exceed $50 trillion by 2025, according to various industry reports.

- Growing demand for green financing: Investors and businesses are increasingly seeking financial products that support environmental goals.

- Regulatory tailwinds: Governments worldwide are implementing policies that incentivize sustainable investments and penalize carbon-intensive activities.

- Aktia's role as facilitator: The bank can leverage its expertise to guide clients towards climate-friendly investments and financing options.

Environmental factors significantly influence Aktia Bank's operations and strategy, particularly in the growing sustainable finance market. The bank's commitment to Science Based Targets initiative (SBTi) and the Paris Agreement demonstrates a proactive approach to climate change mitigation. Aktia's 2024 launch of its Green Energy Loan exemplifies its dedication to supporting environmentally conscious financial products and the green transition.

Aktia Bank's sustainability program, active from 2022 to 2025, prioritizes environmental responsibility alongside social and governance factors. The bank's 2023 report indicated a reduction in financed emissions intensity, a concrete outcome of its sustainability initiatives. This focus aligns with the broader financial sector's increasing emphasis on ESG integration, with global sustainable finance assets projected to surpass $50 trillion by 2025.

| Initiative | Year | Impact/Goal |

|---|---|---|

| SBTi Alignment | Ongoing | Measurable reduction of carbon footprint |

| Green Energy Loan | 2024 | Support for green transition projects |

| Financed Emissions Intensity Reduction | 2023 | Tangible outcome of sustainability efforts |

| Sustainable Finance Assets Projection | 2025 | Global market exceeding $50 trillion |

PESTLE Analysis Data Sources

Our Aktia Bank PESTLE Analysis draws from a comprehensive blend of official Finnish government publications, European Union economic reports, and reputable financial news outlets. This ensures a robust understanding of political, economic, and legal landscapes impacting the banking sector.