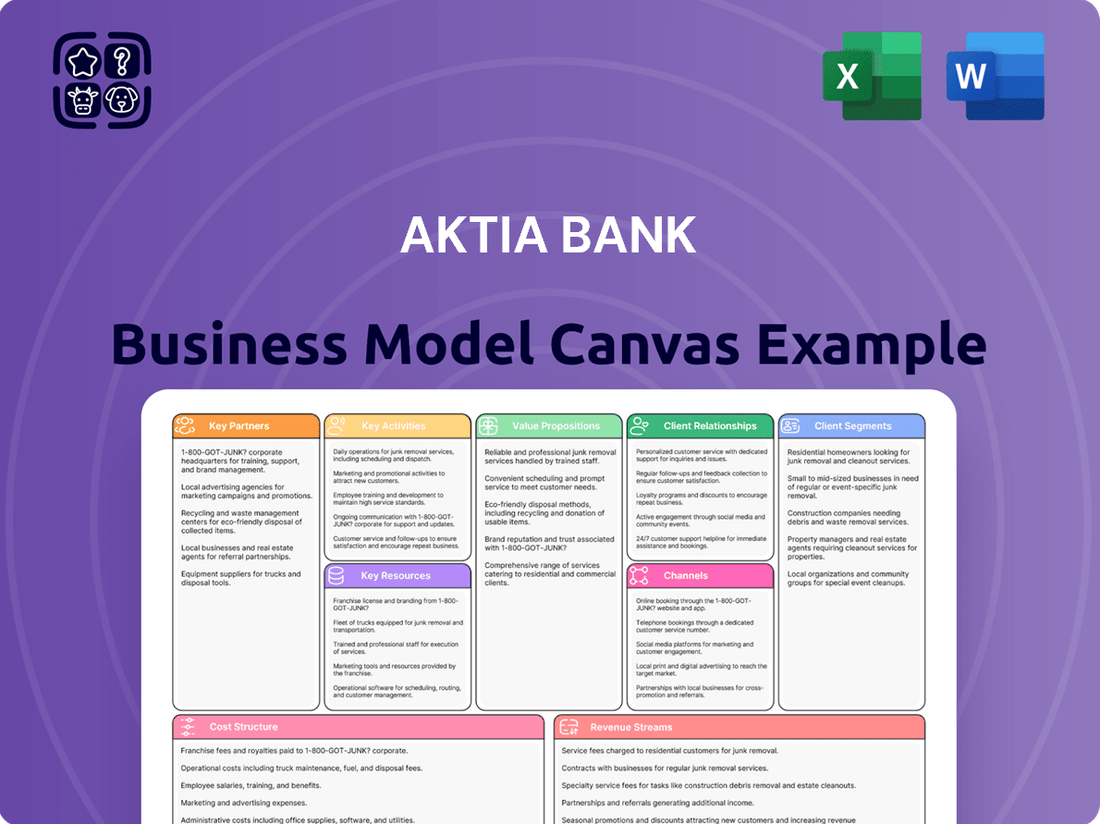

Aktia Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aktia Bank Bundle

Discover the strategic core of Aktia Bank's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Aktia Bank effectively serves its customer segments, delivers value, and manages its key resources and activities to achieve profitability. Uncover the secrets to their success and apply them to your own ventures.

Partnerships

Aktia's strategic banking alliances, notably its May 2024 partnership with Swedbank, are designed to significantly boost its service offerings for corporate clients, especially SMEs. This collaboration grants Aktia access to Swedbank's robust international services, including crucial foreign trade financing and interest rate hedging solutions, areas where Swedbank holds a strong position in the larger corporate segment.

This alliance is built on mutual benefit and complementary strengths, allowing Aktia to expand its capabilities without directly competing with Swedbank. It fosters a valuable environment for knowledge sharing and strengthens Nordic financial cooperation, ultimately enhancing the value proposition for Aktia's SME customer base.

Aktia Bank actively partners with key FinTech providers to bolster its digital capabilities and operational effectiveness. A prime example is its collaboration with Temenos, which supplies Aktia's core banking system and payments hub. This partnership is instrumental in facilitating faster payment processing, elevating customer service standards, and streamlining overall operational workflows.

Further strengthening its digital infrastructure, Aktia partners with Signicat, a provider of electronic signing and strong authentication solutions. This collaboration is a cornerstone of Aktia's digital transformation, significantly reducing reliance on paper-based procedures. By automating these processes, customer advisors gain valuable time, allowing them to focus on more strategic, value-adding client interactions.

Aktia Bank is enhancing its life insurance distribution by partnering with POP Bank, commencing November 2024. This collaboration allows Aktia Life Insurance to offer its investment insurance policies directly to POP Bank's customer base. This strategic move is expected to significantly expand Aktia's market presence in the life insurance segment.

The partnership with POP Bank provides Aktia with crucial new distribution channels for its investment-linked insurance products. This expansion is particularly impactful as it taps into POP Bank's established customer network, aiming to increase the volume of new business for Aktia's life insurance offerings. In 2023, the Finnish life insurance market saw continued growth, with investment-linked products remaining a popular choice for consumers seeking both protection and potential returns.

Asset Management Collaborations

Aktia's asset management arm actively engages in collaborations to extend the reach of its investment funds. These partnerships are crucial for distributing its award-winning fund products across international markets, tapping into distribution networks and platforms that complement its direct sales efforts.

These strategic alliances enable Aktia to access a broader spectrum of investors, significantly enhancing its global fund distribution capabilities. For instance, by partnering with international financial platforms, Aktia can make its investment solutions available to a wider audience, driving both asset growth and brand visibility.

- Global Distribution Networks: Aktia partners with various international platforms and distributors to sell its investment funds beyond its home market.

- Expanded Investor Reach: These collaborations allow Aktia to connect with a more diverse and global investor base, increasing fund AUM.

- Award-Winning Fund Access: Partnerships facilitate the availability of Aktia's recognized investment products to a wider international audience.

Real Estate Agencies

Aktia Bank's integration of real estate agency services necessitates strong collaborations with various real estate agencies. These partnerships are crucial for offering a holistic financial and property transaction experience to their clientele. By aligning with established agencies, Aktia can streamline the process for customers looking for mortgages, property sales, and related financial advice.

These alliances allow Aktia to broaden its market reach and provide a more complete service suite. For instance, in 2024, the Finnish housing market saw continued activity, with approximately 60,000-70,000 residential transactions expected, highlighting the vibrant environment where such partnerships can thrive. Aktia's engagement with these agencies ensures clients have access to a wide selection of properties and expert guidance throughout their buying or selling journey.

The benefits of these key partnerships extend to both Aktia and its clients:

- Expanded Property Listings: Access to a broader inventory of properties through partner agencies.

- Streamlined Transactions: Facilitating smoother mortgage applications and property sales processes.

- Enhanced Client Value: Offering a one-stop solution for financial and real estate needs.

- Market Insights: Gaining valuable data on local property market trends through agency collaborations.

Aktia Bank's Key Partnerships are vital for expanding its service offerings and market reach. Collaborations with FinTechs like Temenos and Signicat enhance digital capabilities, improving payment processing and streamlining customer interactions. Strategic alliances, such as the one with Swedbank in May 2024, bolster corporate services, particularly for SMEs, by providing access to international trade finance and hedging solutions.

Further distribution channels are secured through partnerships like the one with POP Bank, commencing November 2024, to expand life insurance sales. Aktia also leverages global distribution networks for its asset management arm, increasing fund accessibility and assets under management. These partnerships are crucial for providing comprehensive financial and property transaction experiences by aligning with real estate agencies.

What is included in the product

Aktia Bank's Business Model Canvas focuses on providing a broad range of banking and wealth management services to private individuals and corporate clients, leveraging a digital-first approach alongside traditional branch networks.

It details customer relationships, key activities, and revenue streams, emphasizing personalized financial solutions and sustainable growth strategies.

Aktia Bank's Business Model Canvas acts as a pain point reliever by offering a structured, one-page snapshot of their core components, simplifying complex financial strategies for quick understanding and internal alignment.

Activities

Aktia Bank's key activities heavily feature wealth management and asset management, encompassing active wealth management, investment funds, and private banking. The bank is strategically pushing to become a premier wealth manager, prioritizing organic growth in this sector.

This focus translates into delivering highly personalized solutions and expert guidance across a diverse range of investment classes. For instance, in 2023, Aktia's asset management segment saw a net sales growth of 8% to €2.9 billion, demonstrating tangible progress in their strategic objective.

Aktia offers a comprehensive suite of banking services catering to individuals, businesses, and institutional clients. This encompasses everyday banking, savings accounts, and crucial financing options like mortgages and business loans, alongside efficient payment solutions.

The bank strategically targets customers focused on wealth accumulation, aiming to deliver integrated financial strategies. In 2024, Aktia continued to build on its strong customer relationships, with its banking segment reporting a net interest income of €348.5 million for the first nine months of the year, demonstrating robust performance in its core lending and deposit activities.

Aktia Bank's key activities include offering life insurance, disability, and severe illness insurance. These products are crucial for providing financial security to customers.

The life insurance segment consistently supports Aktia's financial results, driven by a robust demand for investment-linked insurance solutions. This highlights a core area of customer interest and business success.

Aktia is also committed to sustainable practices, exemplified by offerings like the Green Energy Loan. Furthermore, it integrates responsible investment principles directly into its insurance product development.

Digital Service Development and IT Enhancement

Aktia Bank is significantly investing in its IT infrastructure and digital service offerings to support growth and operational efficiency. This strategic focus includes enhancing digital customer interactions, rolling out electronic signature capabilities, and modernizing core banking systems to deliver quicker, more intuitive digital experiences.

These initiatives are designed to optimize internal operations and elevate the overall customer experience, reflecting a commitment to digital transformation. For instance, in 2023, Aktia reported a 17% increase in digital customer interactions compared to the previous year, underscoring the growing adoption and success of their digital service enhancements.

- IT Infrastructure Upgrades: Modernizing core banking systems and cloud migration efforts.

- Digital Customer Journeys: Streamlining onboarding, account management, and transaction processes online.

- Electronic Signing Implementation: Facilitating secure and efficient document management digitally.

- Data Analytics and AI: Leveraging data to personalize services and improve decision-making.

Customer Advisory and Personalized Service

Aktia Bank's core activities heavily feature delivering exceptional customer advisory and personalized service. This involves proactive engagement with clients to understand their unique financial situations and aspirations. For instance, in 2023, Aktia reported a strong focus on its premium segments, where personalized advisory is paramount to client retention and growth.

The bank actively fosters customer dialogue, ensuring advice is not generic but precisely tailored to individual needs. This approach is particularly evident in their Premium and Private Banking offerings, aiming to build long-term relationships. Aktia's commitment to this personalized touch serves as a significant competitive advantage, driving customer loyalty and satisfaction.

This dedication to bespoke service translates into tangible results. Aktia's strategy emphasizes understanding and responding to evolving customer financial goals, which is a critical driver of their business model. In 2024, the bank continued to invest in digital tools that enhance the advisory experience, allowing for more efficient and data-driven client interactions.

- Personalized Advisory: Aktia prioritizes high-quality, attentive advisory services, especially for Premium and Private Banking clients.

- Active Dialogue: The bank engages in active customer conversations to better understand and address financial needs.

- Tailored Solutions: Aktia focuses on creating customized financial solutions that align with individual client goals.

- Customer Satisfaction Driver: This commitment to personal service is a key differentiator and a significant factor in customer satisfaction and retention.

Aktia Bank's key activities revolve around managing wealth and assets, offering investment funds, and private banking services. They are actively working to become a leading wealth manager, focusing on growing this area organically. This means providing tailored advice and solutions across various investment types.

The bank also delivers a full range of banking services, from daily banking and savings to essential financing like mortgages and business loans. They also provide efficient payment solutions for individuals, businesses, and institutions.

Aktia's operations include offering life, disability, and severe illness insurance, which are vital for customer financial security. Additionally, they are committed to sustainability, as seen with products like the Green Energy Loan, and integrate responsible investment principles into their insurance offerings.

A significant part of Aktia's strategy involves investing in IT and digital services to boost growth and efficiency. This includes enhancing digital customer interactions, implementing electronic signatures, and updating core banking systems for a smoother digital experience.

| Key Activity | Description | 2023/2024 Data/Insight |

| Wealth & Asset Management | Active wealth management, investment funds, private banking. Focus on organic growth. | Asset management net sales grew 8% to €2.9 billion in 2023. |

| Banking Services | Everyday banking, savings, mortgages, business loans, payment solutions. | Banking segment net interest income was €348.5 million for the first nine months of 2024. |

| Insurance Offerings | Life, disability, and severe illness insurance. | Insurance segment supports financial results, driven by investment-linked solutions. |

| Digital Transformation | IT infrastructure upgrades, digital customer journeys, electronic signing. | Digital customer interactions increased by 17% in 2023. |

Preview Before You Purchase

Business Model Canvas

The Aktia Bank Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, professionally structured Business Model Canvas, ready for your strategic planning needs.

Resources

Aktia Bank's approximately 850 employees are a cornerstone of its business model, bringing diverse expertise in financial advisory, asset management, and IT. This skilled workforce is critical for developing and delivering the bank's core financial products and services.

The deep knowledge of its financial advisors and asset managers in areas like wealth management, banking, and life insurance allows Aktia to offer highly personalized financial solutions. This expertise directly translates into meeting individual client needs and fostering strong, long-term relationships, a key differentiator in the competitive financial services landscape.

Furthermore, Aktia's IT professionals are indispensable for maintaining and innovating the bank's digital platforms and operational infrastructure. Their commitment ensures seamless service delivery and supports the bank's strategic goals for digital transformation, impacting efficiency and customer experience.

Aktia Bank's advanced technology and IT infrastructure are foundational to its business model, powering its digital banking services and ensuring operational efficiency. The core banking system, alongside robust digital platforms, allows for seamless customer interactions and transaction processing.

Significant ongoing investments in IT and data security are crucial for Aktia. For instance, in 2023, the bank continued to enhance its digital capabilities, focusing on areas like electronic signing and instant payment solutions to meet evolving customer expectations and maintain a competitive edge.

Aktia's financial capital, encompassing its balance sheet and assets under management (AuM), forms the bedrock of its business operations. As of December 31, 2024, Aktia reported a robust balance sheet total of EUR 11.9 billion, underscoring its financial stability.

The bank's Assets Under Management (AuM) reached EUR 14.0 billion by the end of 2024, demonstrating significant client trust and investment activity. Growing this AuM is a key strategic objective, with a clear target set to surpass EUR 25 billion by 2029, reflecting an ambitious growth trajectory.

Brand Reputation and Customer Trust

Aktia Bank's extensive 200-year history in Finland has cultivated a robust brand reputation, fostering deep customer trust and loyalty. This heritage, combined with a consistent focus on personal relationships and open communication, positions Aktia as a dependable financial ally for its clients.

Customer satisfaction remains a cornerstone of Aktia's success. In 2023, Aktia reported strong customer satisfaction scores, particularly highlighting the value customers place on the bank's personalized service and proactive engagement. This commitment to building trust through tangible interactions reinforces its market standing.

- Brand Heritage: Aktia boasts a 200-year legacy in Finnish banking.

- Customer Trust: This long history directly translates to high levels of customer trust.

- Customer Satisfaction: Aktia consistently achieves high customer satisfaction ratings, especially in personal service.

- Reliable Partner: The bank's active dialogue with customers solidifies its image as a trustworthy financial partner.

Physical Branch Network and Digital Channels

Aktia Bank utilizes a dual approach, combining its 14 physical branch offices strategically located across key Finnish regions like Helsinki, Turku, Tampere, Vaasa, and Oulu, with robust digital channels including internet and telephone services. This hybrid model ensures broad customer reach and caters to varied preferences for banking interactions. In 2024, Aktia continued to invest in enhancing its digital platforms, aiming to streamline customer journeys while maintaining the accessibility of its physical network for essential services and personalized advice.

This integrated strategy allows Aktia to serve a diverse customer base effectively, offering the convenience of digital banking alongside the personal touch of face-to-face interactions. The bank's commitment to both channels reflects a deep understanding of customer needs, ensuring accessibility and support across all touchpoints. For instance, customer feedback in early 2024 highlighted the importance of seamless transitions between online inquiries and in-branch consultations.

- Physical Presence: 14 branch offices in strategic Finnish locations.

- Digital Reach: Comprehensive internet and telephone banking services.

- Customer Focus: Hybrid approach serving diverse customer needs for both digital and in-person interactions.

Aktia Bank's key resources are its skilled employees, robust IT infrastructure, substantial financial capital, and a strong brand built on a 200-year history. These elements collectively enable the bank to deliver personalized financial services and maintain customer trust.

The bank's financial strength is evident in its balance sheet total of EUR 11.9 billion and Assets Under Management (AuM) reaching EUR 14.0 billion as of December 31, 2024. These figures underscore Aktia's stability and its capacity to manage significant client assets, with a strategic goal to grow AuM to over EUR 25 billion by 2029.

| Resource Category | Specific Resource | Key Metrics/Data (as of Dec 31, 2024) |

|---|---|---|

| Human Capital | Employees | Approx. 850 (diverse expertise in finance, IT) |

| Physical & Digital Infrastructure | IT Infrastructure | Advanced digital platforms, core banking system, ongoing investment in digital capabilities (e.g., electronic signing, instant payments) |

| Financial Capital | Balance Sheet Total | EUR 11.9 billion |

| Financial Capital | Assets Under Management (AuM) | EUR 14.0 billion (Target: > EUR 25 billion by 2029) |

| Brand & Reputation | Brand Heritage | 200-year history in Finnish banking, high customer trust and satisfaction |

Value Propositions

Aktia Bank distinguishes itself as a premier wealth manager, providing clients with unparalleled expertise across key investment areas. This includes deep knowledge in fixed income, strategic manager selection, navigating alternative investments, and optimizing asset allocation to meet diverse financial goals.

This value proposition is designed for individuals and families who prioritize sophisticated, high-quality solutions for wealth growth and preservation. Aktia's commitment to excellence in these specialized fields ensures clients receive tailored strategies that aim to maximize returns while managing risk effectively.

In 2024, Aktia Bank managed a significant portion of its clients' assets through these expert-driven wealth management services. For instance, their focus on fixed income in a fluctuating interest rate environment, coupled with a robust selection of alternative investments, demonstrated their capacity to adapt and deliver value amidst market volatility.

Aktia Bank's core value lies in offering highly personalized and attentive financial advisory. This approach aims to bring the benefits of private banking to a broader audience, moving beyond traditional high-net-worth exclusivity.

By focusing on tailored solutions, Aktia ensures that each client's unique financial needs and aspirations are addressed. This commitment to individualization is crucial in building long-term trust and delivering measurable value.

In 2024, Aktia Bank continued to emphasize its advisory strengths, with a significant portion of its client base benefiting from these personalized services. For instance, their wealth management segment saw continued growth, reflecting the market's demand for expert guidance in navigating complex financial landscapes.

Aktia Bank provides a complete financial ecosystem, bringing together banking, wealth management, life insurance, and real estate services. This integrated model simplifies financial management for customers by offering a single point of access for diverse needs.

In 2024, Aktia Bank continued to emphasize its comprehensive offering, aiming to be a one-stop shop for financial well-being. This strategy supports customer retention and cross-selling opportunities across its various business segments.

Digital Convenience and Efficiency

Aktia Bank's commitment to digital advancement translates into a seamless and efficient banking experience for its customers. By consistently investing in its digital platforms, including robust online banking portals and intuitive mobile applications, Aktia ensures that users can manage their finances with unparalleled ease and speed. This focus on digital convenience directly addresses the needs of modern consumers who prioritize quick access to services and streamlined transaction processes.

The bank's digital offerings extend to features like electronic signing, further simplifying administrative tasks and enhancing the overall customer journey. This dedication to digital efficiency is a core value proposition, attracting and retaining clients who expect modern, accessible financial solutions. For instance, in 2024, Aktia reported a significant increase in the adoption of its digital services, with mobile banking users growing by 15% year-over-year, underscoring the market's demand for such conveniences.

- Digital Convenience: Access banking services anytime, anywhere through online and mobile platforms.

- Efficiency in Transactions: Benefit from faster processing times for payments, transfers, and other financial operations.

- Streamlined Customer Journeys: Experience simplified processes, such as electronic signing for documents, reducing paperwork and waiting times.

- Continuous Investment: Aktia's ongoing commitment to digital development ensures services remain cutting-edge and user-friendly.

Sustainability and Responsible Investment

Aktia Bank's commitment to sustainability is a core value proposition, resonating with a growing segment of the market. The bank actively expands its green loan portfolio, exemplified by offerings like the Green Energy Loan, directly addressing customer demand for environmentally friendly financing options.

This focus on responsible investment principles attracts clients who wish to align their financial goals with their ethical and environmental values. By providing avenues for building sustainable wealth, Aktia positions itself as a partner for conscious consumers and investors.

- Green Loans: Aktia's Green Energy Loan is a prime example of its commitment to sustainable financing.

- Responsible Investment: The bank adheres to principles that guide investments towards environmentally and socially sound practices.

- Customer Appeal: This strategy attracts customers prioritizing ethical and eco-conscious financial solutions.

- Wealth Building: Aktia facilitates wealth creation for those seeking sustainable and responsible investment avenues.

Aktia Bank offers a comprehensive financial ecosystem, integrating banking, wealth management, life insurance, and real estate services. This holistic approach provides customers with a single, convenient point of access for all their financial needs, fostering loyalty and cross-selling opportunities.

In 2024, Aktia Bank continued to strengthen its position as a unified financial partner, aiming to simplify financial management for its clients. This strategy proved effective, as evidenced by continued growth in its wealth management segment and increased customer engagement across its diverse service offerings.

| Service Area | 2024 Focus | Customer Benefit |

|---|---|---|

| Banking | Digitalization and ease of access | Streamlined transactions, anytime/anywhere banking |

| Wealth Management | Expertise in fixed income, alternatives, and asset allocation | Tailored strategies for wealth growth and preservation |

| Life Insurance | Integrated financial planning | Comprehensive security and future planning |

| Real Estate | Holistic financial solutions | Simplified property financing and management |

Customer Relationships

Aktia Bank prioritizes personalized advisory and active customer dialogue, recognizing these as cornerstones for building enduring client trust. Their approach is built on skilled employees engaging closely with customers to deeply understand individual financial needs and aspirations, a strategy especially evident within their Premium and Private Banking segments.

This commitment translates into offering tailored financial solutions, fostering a sense of partnership rather than just a transactional relationship. For instance, in 2024, Aktia reported a significant increase in customer satisfaction scores directly linked to their enhanced advisory services, highlighting the tangible impact of this customer-centric model.

Aktia Bank emphasizes dedicated relationship management for its strategic customer segments like Premium, Private Banking, SMEs, and institutions. This approach ensures these vital groups receive tailored attention and customized solutions, fostering stronger loyalty and driving business growth.

Aktia Bank actively enhances its digital self-service capabilities, enabling customers to manage accounts, execute transactions, and retrieve information seamlessly via online platforms and mobile apps. This digital-first approach offers significant flexibility, particularly appealing to a growing segment of the customer base that prefers independent, technology-driven banking interactions.

In 2023, Aktia reported a substantial increase in digital service adoption, with over 70% of all customer transactions conducted through digital channels. This trend is expected to continue, driven by ongoing investments in user-friendly interfaces and expanded functionalities within their digital ecosystem.

High Customer Satisfaction Focus

Aktia Bank places a strong emphasis on fostering high customer satisfaction, a core element of its business strategy. This dedication is demonstrably linked to improvements in its customer experience metrics.

For instance, Aktia saw a notable uplift in the EPSI Rating survey for Finnish private investors in 2024, signaling positive customer sentiment. This focus translates into tangible actions aimed at refining service delivery and actively incorporating customer input to elevate the overall banking experience.

- Improved Customer Satisfaction: Aktia Bank's commitment to customer satisfaction is reflected in its performance in the 2024 EPSI Rating survey for Finnish private investors, where it achieved a significant improvement.

- Service Quality Enhancement: The bank actively works to enhance the quality of its services, ensuring a more responsive and positive interaction for its clients.

- Feedback Integration: Aktia demonstrates a proactive approach by effectively responding to and integrating customer feedback into its operational improvements.

Community Engagement and Trust Building

Aktia Bank's deep roots and commitment to societal prosperity are cornerstones of its customer relationships, fostering trust through active community engagement. This long-standing dedication to building wealth and well-being for its customers and the broader society underpins a relationship built on reliability and shared values.

By consistently acting responsibly within the financial sector, Aktia cultivates a strong sense of community and shared purpose with its clientele. This approach is vital for maintaining long-term customer loyalty and attracting new customers who value ethical and community-focused banking practices.

- Long History: Aktia Bank has a history dating back to 1891, signifying a deep-seated commitment to its customers and communities.

- Societal Focus: The bank's mission to build wealth and well-being for society directly translates into customer-centric relationship building.

- Trust and Responsibility: Aktia's responsible financial stewardship reinforces trust, a critical element in customer relationships, especially in the banking sector.

- Community Engagement: Active participation in and support of local communities demonstrates a commitment beyond transactional banking, strengthening bonds.

Aktia Bank cultivates strong customer relationships through a blend of personalized advisory, digital self-service, and a deep commitment to societal well-being. This multifaceted approach, evident in their 2024 customer satisfaction improvements and high digital transaction rates, fosters loyalty and trust.

| Customer Relationship Aspect | Description | Key Data/Insight (2023-2024) |

|---|---|---|

| Personalized Advisory | Skilled employees engage closely to understand individual financial needs. | Increased customer satisfaction scores linked to enhanced advisory services in 2024. |

| Digital Self-Service | Online platforms and mobile apps for seamless account management and transactions. | Over 70% of customer transactions conducted digitally in 2023, with continued growth expected. |

| Dedicated Relationship Management | Tailored attention for strategic segments like Premium, Private Banking, SMEs, and institutions. | Fosters stronger loyalty and drives business growth within key customer groups. |

| Societal Commitment | Building wealth and well-being for customers and society, dating back to 1891. | Reinforces trust and community bonds through responsible financial stewardship and engagement. |

Channels

Aktia Bank maintains a physical presence with 14 branch offices strategically located across Finland's major economic hubs. These include prominent cities such as Helsinki, Turku, Tampere, Vaasa, and Oulu, ensuring accessibility for a broad customer base.

These branches serve as crucial touchpoints, offering personalized face-to-face financial advice and a comprehensive suite of services. Customers can engage with banking, asset management, and life insurance solutions directly through these physical locations.

For the first half of 2024, Aktia reported that its branch network continued to be a significant channel for customer interaction, particularly for advisory services and complex financial needs, complementing its digital offerings.

Aktia Bank's digital banking platforms, encompassing both online and mobile interfaces, serve as its core customer interaction channels. These digital avenues are designed for seamless everyday banking, investment management, and a broad spectrum of financial service access, underscoring Aktia's commitment to digital accessibility.

In 2023, Aktia reported that a significant portion of its customer transactions were conducted through digital channels. For instance, the bank saw a substantial increase in mobile banking usage, with over 70% of active customers utilizing the mobile app for their banking needs. This digital engagement is crucial for driving efficiency and meeting evolving customer expectations for convenience.

Aktia Bank leverages telephone and dedicated customer service centers as crucial channels for direct customer engagement, offering support and personalized advisory services. These centers ensure a high level of accessibility, allowing customers to receive assistance and guidance without the necessity of visiting a physical branch.

In 2024, Aktia reported a significant portion of customer inquiries being handled through these channels, reflecting a growing preference for remote service. This focus on telephone and customer service centers contributes to operational efficiency and customer satisfaction by providing timely and expert support.

External Partner Networks

Aktia leverages external partner networks to significantly expand its market reach and service offerings. For instance, a key partnership with Swedbank allows Aktia to provide specialized services to corporate clients, tapping into Swedbank's established business relationships. This collaboration is crucial for increasing Aktia's penetration in the corporate banking sector.

Further enhancing its product portfolio, Aktia partners with POP Bank to distribute life insurance products. This strategic alliance broadens Aktia's financial planning solutions for its customers, enabling them to access a more comprehensive suite of wealth management tools. Such partnerships are vital for offering integrated financial services.

These collaborations are not just about expanding reach; they are about creating a more robust and appealing value proposition for customers. By working with external partners, Aktia can offer specialized products and services it might not develop in-house, thereby increasing customer loyalty and market share. For example, in 2024, Aktia's focus on digital transformation also involved integrating partner services seamlessly into its own digital platforms, aiming to provide a unified customer experience.

- Swedbank Partnership: Enhances corporate client services and market access.

- POP Bank Collaboration: Expands life insurance product distribution and wealth management offerings.

- Digital Integration: Aims to provide a unified customer experience by embedding partner services into Aktia's digital channels.

- Market Reach: Extends Aktia's ability to serve a broader customer base beyond its direct channels.

Real Estate Agency Offices

Aktia's real estate agency offices serve as a crucial physical touchpoint for customers seeking property transactions. These offices not only facilitate the buying and selling of real estate but also offer integrated financial advice, such as mortgage solutions and investment guidance, directly within the transaction process.

In 2024, the Finnish real estate market saw continued activity, with Aktia's agency offices playing a role in connecting buyers and sellers. For instance, the number of completed property transactions handled through such channels often correlates with broader market trends, providing a tangible link between real estate services and financial product uptake.

- Physical Presence: Dedicated offices offer a tangible, in-person experience for clients engaging in property sales or purchases.

- Integrated Services: These locations provide a seamless blend of real estate brokerage and financial advisory services, such as mortgage pre-approvals.

- Market Access: They act as hubs for local market knowledge, connecting potential buyers with available properties and sellers with interested parties.

Aktia Bank utilizes a multi-channel approach, blending physical branches, digital platforms, and telephone services to engage with its customer base. These channels cater to diverse customer needs, from in-person advisory for complex financial matters to convenient digital access for everyday banking. The bank's strategy emphasizes integrating these touchpoints to provide a cohesive and accessible customer experience.

In the first half of 2024, Aktia reported that its 14 physical branches, located in key Finnish cities, remained vital for advisory services, complementing the growing reliance on digital channels. The bank's digital platforms, including its mobile app, saw continued strong adoption, with over 70% of active customers using the mobile app for banking needs in 2023, highlighting a clear preference for digital engagement.

Telephone and customer service centers provide essential support and personalized advice, handling a significant portion of customer inquiries in 2024. Furthermore, Aktia leverages strategic partnerships, such as with Swedbank for corporate clients and POP Bank for life insurance, to broaden its service offerings and market reach, aiming for a unified customer experience across all touchpoints.

Customer Segments

Aktia Bank caters to private individuals, from the mass affluent to high-net-worth segments, who are actively seeking to grow their wealth. These clients value personalized guidance and sophisticated wealth management, which Aktia delivers through its dedicated Private Banking and Premium services.

In 2024, the demand for tailored financial advice among these demographic groups remained robust, with many actively seeking to optimize their investment portfolios and estate planning. Aktia's focus on these segments reflects a strategic understanding of their evolving financial needs and a commitment to providing specialized solutions.

Aktia Bank is actively focusing on expanding its reach within the Small and Medium-sized Enterprise (SME) sector, recognizing its crucial role in economic growth. The bank provides a suite of banking and financing solutions specifically designed to meet the diverse operational and developmental needs of these businesses.

To bolster its offerings for expanding corporate clients, Aktia has forged strategic partnerships, such as its collaboration with Swedbank. This alliance grants Finnish SMEs enhanced access to international banking services, facilitating cross-border transactions and global business expansion.

In 2024, the SME sector represented a significant portion of the Finnish economy, with over 300,000 SMEs contributing substantially to employment and GDP. Aktia's strategic push into this segment aims to capture a larger share of this vital market by offering specialized financial products and advisory services.

Aktia Bank extends its services beyond small and medium-sized enterprises to cater to larger corporate clients. These customers benefit from a full suite of banking, financing, and asset management solutions designed to meet complex financial needs.

A key strategic move for Aktia is its collaboration with Swedbank, a partnership specifically designed to enhance the offerings for corporate clients with international operations and cross-border requirements. This alliance aims to provide seamless global banking experiences.

Institutional Clients

Aktia Bank actively serves institutional clients by offering specialized asset management and tailored investment solutions. This segment encompasses a broad range of organizations, including pension funds, insurance companies, and corporations, all seeking expert guidance to professionally manage their financial assets.

These clients leverage Aktia's deep expertise across a diverse array of investment funds and sophisticated strategies designed to meet specific risk and return objectives. For instance, by the end of 2023, Aktia's asset management division reported managing €16.6 billion in assets under management, a significant portion of which is attributed to institutional mandates.

- Asset Management Expertise: Aktia provides professional management of assets for institutional entities.

- Diverse Investment Solutions: Offers a range of investment funds and strategies to meet client needs.

- Client Base: Includes pension funds, insurance companies, and corporations.

- Financial Performance: Aktia managed €16.6 billion in assets under management by the end of 2023, with institutional clients forming a key part of this.

Life Insurance Policyholders

Aktia Bank's life insurance policyholders represent a significant customer segment. This group includes individuals and families who have secured their future through Aktia's comprehensive life insurance offerings, which extend to disability and severe illness coverage. The bank also caters to those seeking investment-linked insurance solutions, blending protection with wealth accumulation. By the end of 2023, Aktia reported that its insurance operations contributed positively to its overall results, demonstrating the segment's importance.

Aktia reaches these policyholders through a multi-channel approach. This involves direct engagement via Aktia's own banking and insurance branches, as well as strategic partnerships that broaden accessibility. These collaborations allow Aktia to connect with a wider audience seeking reliable financial protection and investment opportunities. The bank's commitment to customer service across these channels underpins its strategy for this segment.

The value proposition for this segment centers on security, long-term financial planning, and tailored solutions. Aktia aims to provide peace of mind by offering products designed to meet diverse needs, from income replacement in case of disability to ensuring financial stability for beneficiaries. The integration of investment components within certain policies further appeals to those looking to grow their assets while being insured.

Key aspects of this customer segment include:

- Diverse Needs: Policyholders require coverage for life, disability, and critical illnesses, alongside investment-linked products.

- Channel Preference: They are served through Aktia's direct channels and an established network of partners.

- Financial Goals: This segment seeks both protection for dependents and opportunities for wealth growth.

- Market Presence: Aktia's insurance business demonstrated a solid performance in 2023, underscoring the segment's contribution.

Aktia Bank's customer base is strategically segmented to address diverse financial needs, ranging from individual wealth growth to corporate and institutional asset management. This multi-faceted approach ensures tailored services for each demographic.

In 2024, the bank continued to focus on private individuals, particularly the mass affluent and high-net-worth segments, who seek personalized wealth management. Simultaneously, Aktia is expanding its services to Small and Medium-sized Enterprises (SMEs) and larger corporations, recognizing the vital role these businesses play in economic development.

Furthermore, Aktia actively serves institutional clients, offering specialized asset management and investment solutions. The bank also caters to its life insurance policyholders, providing protection and investment-linked products through various channels.

| Customer Segment | Key Characteristics | 2024 Focus/Data Points |

|---|---|---|

| Private Individuals (Mass Affluent to High-Net-Worth) | Seeking wealth growth, personalized guidance, sophisticated wealth management. | Demand for tailored financial advice remained robust; focus on investment optimization and estate planning. |

| Small and Medium-sized Enterprises (SMEs) | Require banking and financing for operations and development; international access. | Significant portion of the Finnish economy; Aktia aims to capture market share with specialized products and advisory. |

| Corporate Clients | Complex financial needs, international operations, cross-border requirements. | Partnership with Swedbank enhances international banking services for these clients. |

| Institutional Clients | Pension funds, insurance companies, corporations seeking asset management and investment solutions. | Managed €16.6 billion in assets under management by end of 2023, with institutional mandates forming a key part. |

| Life Insurance Policyholders | Require life, disability, critical illness coverage; investment-linked solutions. | Insurance operations contributed positively to results in 2023; served via direct channels and partnerships. |

Cost Structure

Personnel costs represent a substantial segment of Aktia Bank's operating expenses, encompassing salaries, benefits, and other employee-related outlays for its workforce of approximately 850 individuals. In 2023, personnel expenses amounted to €104.5 million, reflecting a slight increase from the previous year, partly due to a rise in the full-time equivalent (FTE) employee count.

Aktia Bank faces significant IT expenses, a key component of its cost structure. These include substantial investments in digital development, essential for modernizing its services and staying competitive. For instance, in 2023, Aktia continued its strategic investments in technology, aiming to enhance customer experience and operational efficiency through digital channels.

Maintaining the core banking system represents another major cost. This ensures the stability and reliability of all banking operations. Furthermore, continuous upgrades and enhancements to data security are paramount, reflecting the increasing need to protect customer information and comply with stringent regulations, a trend that has only intensified in 2024.

Depreciation of tangible assets like branch network infrastructure and intangible assets such as core banking software and IT systems represents a significant component of Aktia Bank's cost structure. These non-cash expenses reflect the gradual reduction in the value of these assets over their useful lives.

In 2024, Aktia Bank's depreciation and amortization expenses amounted to €46.1 million. This figure underscores the ongoing investment in and maintenance of the bank's physical and digital operational backbone. A potential reassessment of the carrying value of IT systems, perhaps due to technological obsolescence or changes in usage, could lead to increased impairment charges, further impacting profitability.

Operating Expenses (Marketing, Purchased Services, Rent)

Aktia Bank's operating expenses are significantly influenced by marketing and advertising efforts, crucial for customer acquisition and brand visibility. These costs can fluctuate depending on the intensity of specific campaigns and market conditions. For instance, in 2024, increased digital marketing spend aimed at attracting younger demographics was a notable factor.

Purchased services represent another key component, encompassing fees paid to external partners for specialized functions. This includes technology providers like Signicat for digital identity verification, a critical service for a modern bank. The scale of these services often scales with transaction volumes and regulatory requirements.

Rent for office spaces, including branches and administrative headquarters, forms a stable but substantial part of the cost structure. Aktia Bank manages its real estate portfolio to optimize costs, considering factors like location and facility utilization.

- Marketing and Advertising: Costs vary with campaign intensity.

- Purchased Services: Fees for external partners like Signicat.

- Rent: For office spaces and branches.

- Administrative Overheads: General operational costs.

Credit Losses and Impairments

Aktia Bank’s cost structure incorporates provisions for credit losses and impairments on its loan portfolio and other commitments. These costs are a crucial element of managing financial risk within the banking operations.

Historically, Aktia has maintained these provisions at a moderate level, reflecting a generally high quality within its loan book. This suggests a robust credit risk management framework and a portfolio less susceptible to widespread defaults.

However, these provisions can see an uptick. Factors such as deteriorating market conditions or specific, localized impairments, particularly within the corporate loan segment, can necessitate higher provisioning. For instance, in 2023, while specific figures for credit loss provisions are part of detailed financial reporting, the banking sector globally experienced increased sensitivity to economic slowdowns, which can translate to higher impairment charges.

- Provisions for Credit Losses: Costs set aside to cover potential defaults on loans and other financial obligations.

- Loan Book Quality: Aktia generally benefits from a strong credit quality in its lending activities, keeping these costs manageable.

- Impact of Market Conditions: Economic downturns or sector-specific issues can lead to increased impairment charges, affecting profitability.

- Corporate Loan Book Sensitivity: The corporate segment can be more prone to fluctuations and specific impairments compared to retail lending.

Aktia Bank's cost structure is heavily influenced by personnel expenses, with salaries and benefits for its workforce representing a significant outlay. IT expenses are also substantial, driven by ongoing investments in digital development to enhance customer experience and operational efficiency. Furthermore, the maintenance of core banking systems and robust data security measures are critical, albeit costly, components.

Depreciation and amortization, totaling €46.1 million in 2024, reflect the wear and tear on tangible assets like branches and intangible assets such as IT systems. Marketing and advertising costs fluctuate based on campaign intensity, with a notable increase in digital spend in 2024 targeting younger demographics. Purchased services, including fees for external technology providers like Signicat, and rent for office spaces also contribute to the overall expense base.

| Cost Category | 2023 (EUR Million) | 2024 (EUR Million) | Key Drivers |

|---|---|---|---|

| Personnel Costs | 104.5 | N/A* | Salaries, benefits, FTE count |

| Depreciation & Amortization | N/A* | 46.1 | IT systems, branch infrastructure |

| IT Expenses | Significant Investment | Continued Investment | Digital development, modernization |

| Marketing & Advertising | Fluctuating | Increased Digital Spend | Brand visibility, customer acquisition |

*Specific figures for 2023 Depreciation & Amortization and 2024 Personnel Costs are not detailed in the provided text.

Revenue Streams

Net Interest Income (NII) is a cornerstone of Aktia Bank's revenue, stemming from the spread between interest earned on its loan portfolio and investments, and interest paid on customer deposits and wholesale funding. In 2024, Aktia Bank reported a robust NII performance, a testament to favorable interest rate environments.

However, projections for 2025 indicate a potential moderation in NII growth. This anticipated shift is largely attributed to the expected decline in prevailing interest rates, which will naturally compress the net interest margin.

Aktia Bank generates net commission income from a variety of financial services. These include fees and commissions earned from asset management, the sale of investment funds, card services, and other core banking operations. This diversified approach helps stabilize revenue.

Looking ahead to 2025, Aktia Bank anticipates a slight increase in its net commission income. This growth is projected to be fueled by positive developments in key areas, particularly the card business and the expansion of assets under management. For instance, in 2023, Aktia's commission income from banking operations, excluding insurance, was €107.3 million, showcasing the significance of these revenue streams.

Aktia Bank generates revenue from its life insurance operations through premiums collected on policies, income from investment-linked products, and various other insurance-related services. This segment has demonstrated steady growth and robust demand, making a reliable contribution to the bank's overall earnings.

In 2024, the life insurance sector continued to be a significant contributor to Aktia's financial performance, reflecting a consistent demand for these products. The net income from this segment underscores its stability and importance within Aktia's diversified revenue streams.

Asset Management Fees

Asset management fees are a cornerstone of Aktia Bank's revenue, generated by expertly managing client portfolios, including mutual funds and other managed capital. This fee structure directly links the bank's success to the growth of its assets under management (AUM). Aktia actively pursues strategies to expand its AUM, recognizing that each additional euro managed translates into higher fee income.

For instance, in 2024, Aktia Bank reported a notable increase in its AUM, which directly boosted its commission income. The bank's commitment to offering diverse and attractive investment products underpins this growth.

- Asset Management Fees: Revenue generated from managing customer assets, including mutual funds and managed capital.

- Growth Correlation: Aktia's asset management fees are directly proportional to the growth in its assets under management (AUM).

- 2024 Performance: Aktia Bank experienced a significant increase in AUM in 2024, leading to a corresponding rise in commission income from asset management.

Other Operating Income

Aktia Bank’s Other Operating Income encompasses a diverse range of revenue streams beyond its core banking activities. This includes profits generated from the sale or revaluation of financial instruments, such as securities and derivatives, reflecting active treasury management. For instance, in 2023, Aktia reported gains from financial instruments that contributed to this segment.

Furthermore, the bank earns commissions from its real estate agency services, leveraging its customer base and brand recognition to facilitate property transactions. This diversification into ancillary services adds a valuable layer to its revenue model. In the first half of 2024, Aktia’s real estate operations showed continued activity, contributing to this income stream.

Other miscellaneous operational revenues also fall under this category, which can include income from various partnerships, service fees not directly tied to lending or deposit-taking, and other non-core operational gains. These varied sources collectively bolster Aktia’s overall financial performance.

- Gains from Financial Instruments: Profits realized from trading and managing a portfolio of securities and other financial assets.

- Real Estate Agency Commissions: Revenue earned from facilitating property sales and related services.

- Miscellaneous Operational Revenues: Income from various other non-core banking activities and service agreements.

Aktia Bank's revenue streams are multifaceted, extending beyond traditional banking to encompass insurance and asset management. Net interest income, derived from lending and deposit activities, remains a primary driver, though its growth is sensitive to interest rate fluctuations. Commission income from services like asset management and card operations provides a more stable and growing revenue base.

The bank's life insurance segment contributes steadily through premiums and investment-linked product income. Furthermore, gains from financial instruments and real estate agency commissions add to other operating income, demonstrating a diversified approach to revenue generation. For instance, Aktia's commission income from banking operations, excluding insurance, was €107.3 million in 2023, highlighting the importance of these fee-based services.

| Revenue Stream | Description | 2023 Data (EUR millions) | 2024 Outlook |

|---|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits | (Not specified for 2023) | Potential moderation due to expected rate declines |

| Net Commission Income | Fees from asset management, card services, etc. | 107.3 (Banking operations excl. insurance) | Slight increase expected, driven by card business and AUM growth |

| Life Insurance Income | Premiums and investment income from insurance policies | (Not specified for 2023) | Continued steady growth and demand |

| Asset Management Fees | Fees for managing client assets and mutual funds | (Included in Net Commission Income) | Directly correlated with AUM growth; significant increase in 2024 |

| Other Operating Income | Gains from financial instruments, real estate commissions, etc. | (Gains from financial instruments reported in 2023) | Continued activity in real estate operations in H1 2024 |

Business Model Canvas Data Sources

The Aktia Bank Business Model Canvas is built upon a foundation of comprehensive financial statements, internal operational data, and extensive market research. These sources ensure each element of the canvas accurately reflects Aktia's current strategic position and future potential.