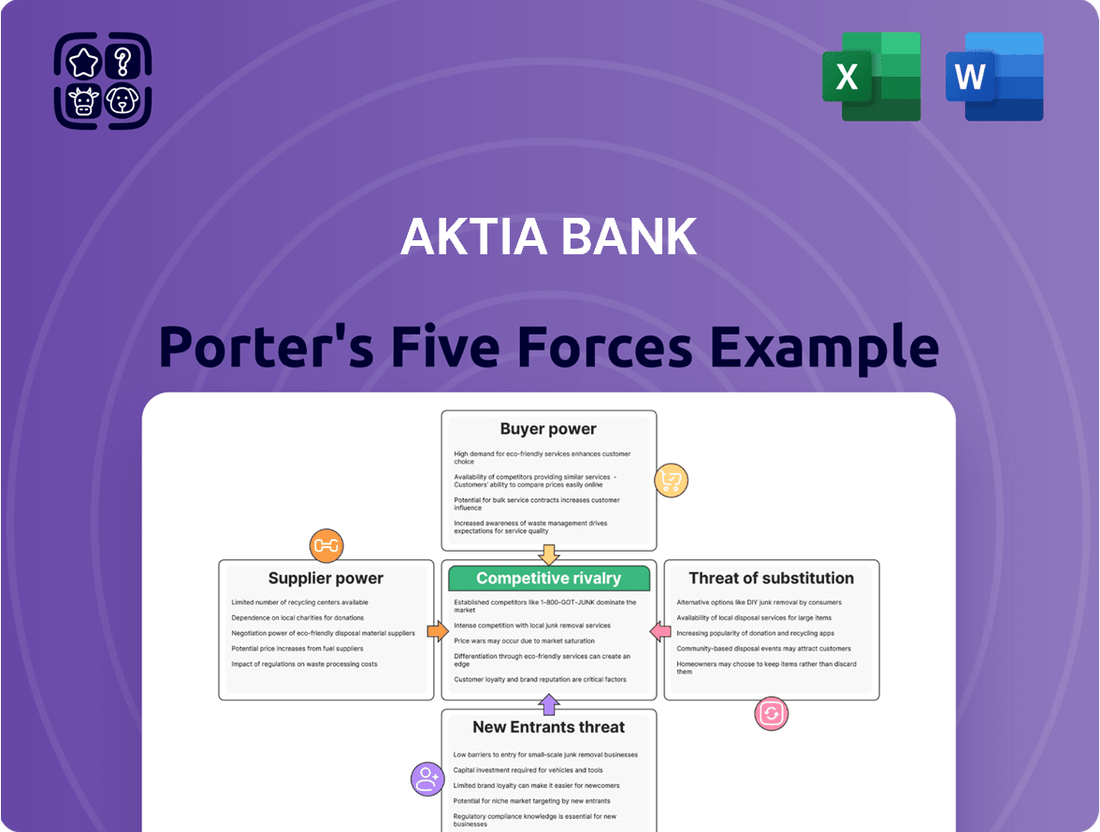

Aktia Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aktia Bank Bundle

Aktia Bank operates within a dynamic financial landscape, where understanding the interplay of competitive forces is crucial for strategic success. Our analysis reveals how buyer power and the threat of substitutes significantly shape Aktia's market position, while the intensity of rivalry and supplier influence present ongoing challenges.

The complete report reveals the real forces shaping Aktia Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aktia Bank's reliance on technology providers for its digital banking, core systems, and cybersecurity presents a significant factor in its operational landscape. The bargaining power of these suppliers can be substantial, particularly when dealing with specialized or deeply integrated technology solutions where the cost and complexity of switching are considerable.

The Finnish financial sector's ongoing commitment to IT and digital advancement, with substantial investments continuing through 2024 and projected into 2025, underscores the critical nature of these technology partnerships. For instance, the increasing demand for cloud-based banking solutions and advanced AI-driven analytics means that providers of these cutting-edge technologies often command greater leverage.

Aktia Bank's bargaining power of suppliers is influenced by its access to liquidity and funding. Key suppliers include central banks, interbank markets, and depositors. In 2024, Finnish banks, including Aktia, generally maintained robust liquidity positions, but a greater reliance on short-term market funding could amplify supplier influence during periods of market stress.

The European Central Bank's monetary policy decisions directly impact funding costs and availability for banks like Aktia. Furthermore, regulatory frameworks such as Basel III standards dictate capital requirements, indirectly affecting how banks manage their funding and, consequently, the bargaining power of their funding suppliers.

The bargaining power of suppliers, particularly concerning human capital, is a significant factor for Aktia Bank. Skilled professionals in banking, wealth management, and IT are essential for the bank's operations and strategic growth.

A competitive labor market for financial expertise, especially in specialized areas like digital transformation and wealth management, can empower employees. This increased bargaining power for employees, particularly those with in-demand skills, can lead to higher salary demands and improved benefits, directly impacting Aktia's operational costs and ability to attract and retain top talent.

In 2024, the demand for IT professionals in the financial sector remained robust, with reports indicating salary increases of up to 15% for cybersecurity and cloud computing specialists. Similarly, the wealth management sector continued to see strong demand for experienced advisors, with many firms offering substantial signing bonuses to secure top performers, reflecting the heightened bargaining power of these skilled individuals.

Data and Information Providers

Aktia Bank's reliance on data and information providers means these suppliers wield significant bargaining power. Access to reliable market intelligence, credit ratings, and analytics is fundamental for Aktia's operational efficiency, robust risk management, and informed strategic choices. The critical nature of these data streams, coupled with potentially high switching costs due to complex integration processes, further strengthens the suppliers' position.

- Data Dependency: Aktia Bank's strategic and operational decisions are heavily reliant on the accuracy and timeliness of external data.

- High Switching Costs: Integrating new data providers can be costly and time-consuming, locking Aktia into existing relationships.

- Supplier Concentration: The market for specialized financial data often features a limited number of dominant players, increasing their leverage.

Real Estate and Infrastructure

Aktia Bank's reliance on physical branches means that landlords and infrastructure providers hold some bargaining power, especially in desirable urban areas. The cost of commercial real estate in Finland, where Aktia primarily operates, can fluctuate. For instance, in Helsinki, prime office space rental prices saw an increase in early 2024, impacting operating costs for banks with extensive physical networks.

While Aktia is expanding its digital services, which can mitigate the need for prime physical locations, the existing branch network still necessitates real estate agreements. Specialized infrastructure, such as data centers or secure facilities, can further concentrate bargaining power with a limited number of providers. The ability of Aktia to negotiate favorable lease terms is therefore influenced by market conditions and the availability of suitable properties.

- Real Estate Costs: In 2023, average commercial rental prices in Finland's major cities remained relatively stable, but specific prime locations experienced upward pressure.

- Digital Shift Impact: Aktia's investment in digital banking services, aiming for a significant portion of transactions to be digital by 2025, may reduce future reliance on extensive physical real estate.

- Infrastructure Dependence: The need for secure and reliable IT infrastructure, often provided by specialized third parties, grants these suppliers a degree of bargaining power.

Aktia Bank's reliance on technology providers for core systems and digital services grants these suppliers significant leverage, especially for specialized solutions. The Finnish financial sector's continued digital transformation in 2024, with substantial IT investments, amplifies the power of providers offering cutting-edge technologies like AI and cloud solutions.

The bank's dependence on external data and information providers, crucial for market intelligence and risk management, also strengthens supplier bargaining power. High switching costs associated with integrating these data streams further entrench existing relationships, highlighting a critical area of supplier influence for Aktia.

Human capital, particularly in specialized financial and IT roles, represents another key area where suppliers (employees) exert considerable influence. The competitive labor market in 2024 saw significant demand for IT professionals, with salary increases of up to 15% for cybersecurity experts, underscoring the bargaining power of skilled individuals.

| Supplier Type | Influence Factors | 2024/2025 Relevance |

| Technology Providers | Specialized solutions, high switching costs | Critical for digital banking, AI adoption |

| Data Providers | Data accuracy, integration complexity | Essential for risk management, strategic decisions |

| Skilled Labor (IT/Finance) | In-demand skills, competitive market | Key for digital transformation, talent retention |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Aktia Bank's unique position in the Finnish banking sector.

Aktia Bank's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Aktia Bank caters to a broad client base, encompassing private individuals, corporate entities, and institutional investors. This diverse clientele, particularly in the Finnish market, experiences a growing ability to influence terms due to a wider array of banking choices, from established institutions to innovative fintech solutions.

The increasing availability of digital banking platforms and neobanks in Finland, for example, has significantly lowered switching costs for customers. This competitive landscape means clients can more easily compare offerings and demand better rates or services, directly impacting Aktia's pricing power.

To counter this heightened customer bargaining power, Aktia Bank emphasizes delivering highly personalized advisory services and fostering strong customer satisfaction. By building deeper relationships and offering tailored financial guidance, Aktia aims to differentiate itself beyond mere transactional banking, thereby retaining its client base and mitigating the pressure from competitors.

Wealth management clients, particularly high-net-worth individuals and institutional investors, wield considerable bargaining power. Their ability to shift substantial assets between wealth managers means they can negotiate for better fees and more tailored services. Aktia Bank's ambition to be a top wealth manager underscores the importance of addressing this client leverage.

The bargaining power of digital banking users in Finland is significant due to the ease of comparing and switching between online platforms. This accessibility allows customers to readily find better rates or services, putting pressure on banks like Aktia to remain competitive.

Aktia's strategic focus on digital banking is a direct response to this trend, aiming to enhance customer retention by offering intuitive interfaces and a broad spectrum of digital services. In 2023, digital transactions for Finnish banks saw continued growth, reflecting this user preference and the heightened bargaining power of digitally savvy consumers.

Price Sensitivity

Customers' sensitivity to interest rates, fees, and service charges significantly shapes their banking choices. In a highly competitive landscape, the potential for customers to switch providers for more favorable terms directly impacts Aktia Bank's revenue streams, particularly net interest income and commission income. These income categories experienced notable shifts throughout 2024 and are projected to continue this trend into 2025, reflecting ongoing customer price sensitivity.

- Price Sensitivity Impact: Customers actively compare interest rates on savings and loans, as well as fee structures for various banking services.

- Market Dynamics: In 2024, many banks, including competitors to Aktia, adjusted their deposit rates and loan pricing in response to central bank policy changes, directly influencing customer switching behavior.

- Revenue Streams: Aktia's net interest income, a key driver of profitability, is directly exposed to this sensitivity, as are its commission-based fees for services like account management and transactions.

- 2024/2025 Outlook: Fluctuations in these income lines during 2024 highlight the ongoing challenge Aktia faces in retaining customers purely on price, a trend expected to persist into 2025.

Demand for Tailored Solutions

Customers, especially in wealth management and corporate banking, are increasingly seeking highly personalized financial solutions. This trend means they have more leverage if a bank cannot meet their specific needs. For instance, in 2024, a significant portion of high-net-worth individuals in Finland expressed a preference for financial advisors who could offer bespoke investment strategies, rather than one-size-fits-all products.

Aktia Bank's strategic focus on delivering tailored financing and investment solutions is a key differentiator. By providing customized offerings, Aktia aims to build deeper customer loyalty. This approach can effectively mitigate the bargaining power of customers, as they become more invested in the relationship with a bank that truly understands and caters to their unique financial situations and goals.

- Demand for Customization: Clients in wealth management and corporate sectors actively seek bespoke financial products and services.

- Aktia's Differentiation: The bank's capacity to provide tailored financing and investment strategies sets it apart in a competitive market.

- Relationship Building: Customization fosters stronger client relationships, thereby reducing their inclination to switch providers based on price alone.

- Mitigating Bargaining Power: By meeting specific client needs, Aktia can lessen the leverage customers hold in negotiations.

Customers, particularly those with substantial assets or high transaction volumes, possess significant bargaining power due to their ability to switch providers. This is amplified by the increasing availability of digital banking and fintech alternatives in Finland, which lowers switching costs and increases price transparency. For example, in 2024, the ease of comparing loan rates and savings account yields online directly pressured banks like Aktia to offer competitive pricing.

Aktia Bank addresses this by focusing on personalized service and tailored solutions, especially in wealth management and corporate banking, where clients demand bespoke strategies. This differentiation beyond price is crucial, as customers’ sensitivity to interest rates and fees directly impacts bank revenues. In 2023, digital transaction growth continued, highlighting the influence of digitally savvy consumers who readily switch for better terms.

| Customer Segment | Bargaining Power Driver | Impact on Aktia Bank | 2024 Trend Example |

|---|---|---|---|

| Wealth Management Clients | Ability to shift large assets; demand for tailored strategies | Negotiate lower fees; require specialized services | High-net-worth individuals sought bespoke investment plans |

| Digital Banking Users | Low switching costs; price transparency; access to alternatives | Pressure on interest rates and fees; need for competitive digital offerings | Continued growth in digital transactions, favoring user-friendly platforms |

| Corporate Clients | Volume of business; need for integrated financial solutions | Negotiate pricing for loans, treasury services; demand for efficiency | Increased focus on digital corporate banking solutions |

Preview the Actual Deliverable

Aktia Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Aktia Bank, detailing the competitive landscape and strategic positioning of the institution. The document you see here is the exact, fully formatted analysis you will receive immediately upon purchase, offering actionable insights without any placeholders or sample content. You're looking at the actual document, which is ready for download and immediate use the moment you complete your purchase, providing a complete and professionally written strategic overview.

Rivalry Among Competitors

Competitive rivalry in the Finnish banking sector is fierce, primarily driven by the dominance of a few major players. Established institutions such as Nordea and OP Financial Group significantly shape the market landscape. Aktia Bank contends with these giants across a broad spectrum of financial services, from basic banking to sophisticated wealth management and lending.

The Finnish market sees increasing competition from digital banks and agile fintech startups. Companies like Saldo Bank are carving out niches, particularly in digital lending and payment services, directly challenging traditional players. This trend is amplified by Finland's robust fintech ecosystem, which maintained a stable presence of approximately 210 companies in 2024, indicating a dynamic and innovative competitive landscape.

The wealth management sector in Finland is intensely competitive, featuring a crowded field of both local institutions and global financial firms actively seeking to grow their assets under management. This dynamic environment means that any player, including Aktia Bank, must consistently deliver superior investment performance and innovative client solutions to stand out and capture market share.

Aktia Bank's strategic objective to be a frontrunner in wealth management necessitates a proactive approach to client acquisition and retention. For instance, as of the first quarter of 2024, the Finnish banking sector saw continued competition for deposits, with interest rates on savings accounts rising, reflecting the pressure on banks to attract and hold customer funds, which directly impacts wealth management growth.

Product and Service Differentiation

Aktia Bank actively differentiates itself through a commitment to superior customer service and innovative product offerings. This focus on personal banking experiences aims to build loyalty in a competitive landscape. The bank's dedication to enhancing customer satisfaction is a cornerstone of its strategy, evident in its positive performance within the 2024 EPSI customer satisfaction survey.

This emphasis on customer experience acts as a significant differentiator for Aktia Bank. By prioritizing personalized interactions and actively seeking to improve client satisfaction, Aktia aims to stand out from competitors who may rely more heavily on price or broader product suites. The bank's strong showing in the 2024 EPSI survey underscores the effectiveness of this approach.

- Product Innovation: Aktia consistently introduces new financial products and digital tools to meet evolving customer needs.

- Service Quality: The bank places a high value on personalized customer interactions and efficient service delivery.

- Customer Experience: Aktia's strategy centers on creating positive and memorable experiences for its clients.

- Customer Satisfaction: Strong performance in the 2024 EPSI survey highlights Aktia's success in meeting and exceeding customer expectations.

Regulatory Environment and Consolidation

The Finnish banking sector operates under a stringent regulatory framework, primarily guided by the Financial Supervisory Authority (FIN-FSA) and the European Central Bank (ECB). These bodies impose strict capital requirements and operational standards, which can act as a barrier to entry for new players and influence the competitive intensity among existing ones. For instance, the Basel III framework, which mandates higher capital buffers, directly impacts how banks manage their risk and allocate resources, shaping their competitive strategies.

Despite regulatory hurdles, the Finnish fintech landscape has seen a notable trend towards consolidation. This is evident as larger, established financial institutions acquire or merge with innovative fintech startups to enhance their service offerings and market reach. For example, in 2023, several smaller Finnish fintech companies announced strategic partnerships or acquisitions, reflecting a drive for scale and efficiency in a competitive market.

- Regulatory Oversight: FIN-FSA and ECB set capital adequacy ratios and operational guidelines, influencing competitive strategy.

- Consolidation Trend: Increased mergers and acquisitions within the Finnish fintech sector are reshaping the competitive landscape.

- Impact on Rivalry: Consolidation can lead to fewer, larger players, potentially intensifying rivalry through economies of scale and broader service portfolios.

Competitive rivalry in Finland's banking sector is intense, marked by the presence of dominant established banks and a growing number of agile fintechs. Aktia Bank faces competition across all its service lines, from everyday banking to specialized wealth management, from both traditional rivals and newer digital entrants. This dynamic environment requires continuous innovation and a strong focus on customer experience to maintain and grow market share.

The Finnish market is characterized by a strong emphasis on customer service and digital offerings, pushing all players to adapt. Aktia's strategy to differentiate through superior client experiences and innovative products, as evidenced by its positive performance in the 2024 EPSI customer satisfaction survey, aims to counter the pressures from competitors. For instance, the ongoing competition for deposits in early 2024, with rising savings account rates, highlights the need for banks to attract and retain customer funds effectively.

While regulatory frameworks from FIN-FSA and the ECB create barriers to entry, they also shape competitive strategies, particularly concerning capital requirements under Basel III. The Finnish fintech sector's trend toward consolidation, with acquisitions and mergers occurring throughout 2023, suggests a move towards larger entities with broader capabilities, potentially intensifying rivalry for established players like Aktia.

SSubstitutes Threaten

The burgeoning fintech sector presents a substantial threat to traditional banks like Aktia. Specialized fintech firms are increasingly offering direct substitutes for core banking services, including payments, peer-to-peer lending, and robo-advisory platforms. This innovation allows customers to bypass traditional channels, seeking more convenient or cost-effective alternatives.

Finnish fintech companies alone generated EUR 2 billion in revenue in 2023, underscoring the market's growth and the competitive pressure these solutions exert. As these platforms mature and expand their offerings, they erode the market share and customer loyalty that incumbent banks have historically enjoyed.

Alternative investment platforms, such as online brokers and robo-advisors, present a significant threat to Aktia Bank's wealth management services. These platforms, including popular options like Nordnet and Degiro, often boast lower fee structures, with some offering commission-free trading on certain assets. This cost advantage, coupled with enhanced digital accessibility and user-friendly interfaces, attracts a growing segment of investors, particularly younger demographics, away from traditional banking models.

Non-bank financial service providers pose a significant threat of substitution for Aktia Bank. Credit unions, for instance, offer competitive savings and loan products, directly challenging Aktia's retail banking operations. In 2024, credit unions in Finland continued to grow their deposit base, providing an alternative funding source for consumers and small businesses.

Insurance companies that offer investment-linked products, such as unit-linked life insurance, also serve as substitutes by attracting capital that might otherwise be deposited or invested through Aktia's wealth management services. Aktia's own offering of life insurance products means it competes with these very entities, highlighting the blurred lines in the financial services landscape.

Specialized lending firms, focusing on niche markets like small business loans or specific types of consumer credit, can also divert customers from Aktia's traditional financing solutions. These firms often operate with lower overheads, allowing them to offer more attractive rates or flexible terms, thereby presenting a compelling alternative for borrowers.

Cryptocurrencies and Digital Wallets

Emerging technologies like cryptocurrencies and digital wallets present a growing threat of substitution for traditional banking services. These digital assets offer alternative avenues for storing value and conducting transactions, potentially bypassing conventional financial institutions. For instance, the global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating a significant shift in how value is perceived and exchanged.

This trend challenges banks by offering decentralized and often faster payment rails, as well as new investment vehicles. Digital wallets, integrated with these technologies, further simplify peer-to-peer transfers and online purchases, diminishing the necessity for traditional bank accounts for certain user segments.

The long-term impact is an evolving threat as adoption rates climb and regulatory frameworks mature. By mid-2024, several major financial institutions were exploring or implementing blockchain technology and digital currency solutions, acknowledging the competitive pressure and potential for innovation within this space.

- Alternative Transaction Methods: Cryptocurrencies and digital wallets provide direct peer-to-peer transactions, bypassing traditional banking intermediaries.

- Value Storage: Digital assets offer an alternative store of value, potentially diverting funds from traditional savings and investment accounts.

- Market Growth: The global cryptocurrency market cap exceeded $2.5 trillion in early 2024, signaling substantial user adoption and capital allocation.

- Digital Wallet Integration: The increasing prevalence of user-friendly digital wallets facilitates the adoption of these alternative financial tools.

In-house Corporate Finance

Large corporations increasingly establish sophisticated in-house treasury and finance departments, directly competing with banks like Aktia. This trend allows them to manage foreign exchange, hedging, and even some forms of short-term financing internally, bypassing traditional banking services. For instance, in 2024, many multinational corporations expanded their treasury operations to gain greater control over liquidity and reduce transaction costs, directly impacting the demand for external corporate finance solutions.

This internal capability acts as a significant substitute, particularly for routine cash management and basic financing needs. Companies can leverage internal expertise and technology to perform functions previously outsourced to banks. For example, a significant portion of corporate treasury departments now handle their own intercompany lending and foreign currency exposure management, reducing their reliance on external financial institutions for these core services.

- Internal Treasury Functions: Corporations are building robust in-house teams to manage treasury operations, including cash pooling, payments, and foreign exchange.

- Reduced Reliance on Banks: This internal capacity directly substitutes for services traditionally offered by banks, such as trade finance and working capital solutions.

- Cost Efficiency Drive: The push for cost savings in 2024 has accelerated the adoption of in-house solutions, as companies seek to reduce fees and gain better control over financial processes.

- Technological Advancements: Improved treasury management systems (TMS) and automation technologies enable companies to perform complex financial tasks internally, further diminishing the need for external banking support.

The threat of substitutes for Aktia Bank is significant, stemming from a diverse range of non-traditional financial service providers and evolving consumer behaviors. Fintech companies, alternative investment platforms, credit unions, insurance firms offering investment products, specialized lenders, cryptocurrencies, digital wallets, and even large corporations managing their own treasury functions all present viable alternatives to traditional banking services. These substitutes often compete on factors like cost, convenience, specialization, and technological innovation, directly impacting Aktia's market share and customer loyalty.

| Substitute Category | Key Offerings | Impact on Aktia Bank | 2023/2024 Data Point |

|---|---|---|---|

| Fintechs | Payments, P2P lending, robo-advisory | Erodes market share, challenges customer loyalty | Finnish fintech revenue reached EUR 2 billion in 2023. |

| Alternative Investment Platforms | Online brokers, robo-advisors | Diverts wealth management clients, offers lower fees | Platforms like Nordnet and Degiro offer commission-free trading. |

| Credit Unions | Savings, loans | Competes for retail banking customers and deposits | Credit unions continued deposit base growth in Finland in 2024. |

| Cryptocurrencies & Digital Wallets | Alternative transactions, value storage | Bypasses traditional payment rails, offers new investment vehicles | Global crypto market cap exceeded $2.5 trillion in early 2024. |

| Corporate Treasury | In-house FX, hedging, financing | Reduces demand for corporate finance solutions | Corporations expanded treasury operations in 2024 for cost savings. |

Entrants Threaten

The Finnish banking sector presents significant regulatory hurdles for potential new entrants. These include substantial capital requirements, complex licensing processes, and adherence to a comprehensive suite of financial regulations, such as the Basel III framework. For instance, in 2024, the Financial Supervisory Authority of Finland (FIN-FSA) specifically highlighted its supervisory focus on financial and operational risks, alongside sound governance practices, further solidifying these entry barriers.

New entrants in banking face formidable capital requirements. Establishing a new bank or financial institution demands significant upfront investment to meet stringent regulatory capital adequacy ratios and operational costs. For instance, in 2023, Aktia Bank maintained a strong Common Equity Tier 1 (CET1) capital ratio of 16.3%, comfortably above its target range, illustrating the substantial financial foundation required to compete effectively.

Established financial institutions like Aktia Bank leverage a significant advantage through their deeply ingrained brand reputation and the trust they've cultivated over many years. This is a substantial hurdle for any new player attempting to enter the market, as building comparable credibility takes considerable time and consistent positive customer experiences.

Aktia's long history, spanning nearly 200 years, has allowed it to foster strong relationships and a reliable image. This heritage, combined with a persistent focus on customer satisfaction, creates a powerful barrier that new entrants must overcome, making it challenging to attract and retain customers who value stability and proven service.

Economies of Scale and Scope

Existing financial institutions like Aktia Bank have a significant advantage due to established economies of scale. This means they can spread their fixed costs over a larger volume of business, leading to lower per-unit costs in areas like IT infrastructure, marketing campaigns, and regulatory compliance. For instance, in 2023, Aktia Bank reported operating expenses of €330.5 million, a figure that would be challenging for a new entrant to match while achieving comparable efficiency.

New entrants face substantial hurdles in replicating these cost efficiencies. Building a customer base large enough to justify the necessary investments in technology and operational capacity takes time and considerable capital. Without the benefit of a diversified product portfolio, a new bank would also struggle to achieve economies of scope, which arise from offering multiple related products and services, thereby sharing resources and reducing overall costs.

- Economies of Scale: Aktia Bank benefits from lower per-unit costs due to its large operational volume.

- Customer Acquisition Costs: New entrants face higher costs to attract customers compared to established players.

- Technological Investment: Significant upfront investment in technology is required, which is more manageable for incumbents.

- Diversified Offerings: Aktia’s ability to offer a broad range of financial products creates cost synergies not easily replicated by new entrants.

Access to Distribution Channels and Talent

New entrants to the banking sector, like Aktia, often struggle with building robust distribution networks, both physical branches and digital platforms. Attracting and retaining skilled talent is another significant hurdle, especially in the competitive Finnish financial services landscape. For instance, in 2024, the demand for specialized financial professionals, particularly in areas like cybersecurity and digital transformation, remained exceptionally high, driving up recruitment costs.

Aktia Bank benefits from its established and widespread distribution channels across Finland, which new players find difficult and expensive to replicate. Furthermore, Aktia's focus on employee satisfaction, a key factor in talent retention, provides a competitive edge. Data from 2023 indicated that employee turnover rates in the Finnish banking sector were around 10-15%, with companies prioritizing employee well-being often seeing lower figures.

- Distribution Network Challenges: New banks need substantial capital investment to establish a comparable physical and digital presence to Aktia's existing network.

- Talent Acquisition Costs: The competition for experienced financial professionals in Finland drives up salaries and benefits, making it costly for new entrants to build a strong team.

- Aktia's Advantage: Aktia's long-standing reputation and established infrastructure in Finland reduce the threat of new entrants by creating high barriers to entry in terms of network and talent.

The threat of new entrants into the Finnish banking sector, where Aktia operates, is significantly mitigated by high regulatory barriers and substantial capital requirements. These factors, coupled with the established brand loyalty and economies of scale enjoyed by incumbents like Aktia, make market entry exceptionally challenging and costly for newcomers. For instance, in 2024, the Finnish Financial Supervisory Authority (FIN-FSA) continued its stringent oversight, emphasizing robust governance and risk management, which demands considerable resources from any aspiring bank.

Porter's Five Forces Analysis Data Sources

Our Aktia Bank Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Aktia's annual reports, investor presentations, and regulatory filings with the Finnish Financial Supervisory Authority. We also incorporate industry-specific market research from reputable sources like Statista and IBISWorld, alongside macroeconomic data from the European Central Bank to provide a thorough competitive landscape assessment.