Aktia Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aktia Bank Bundle

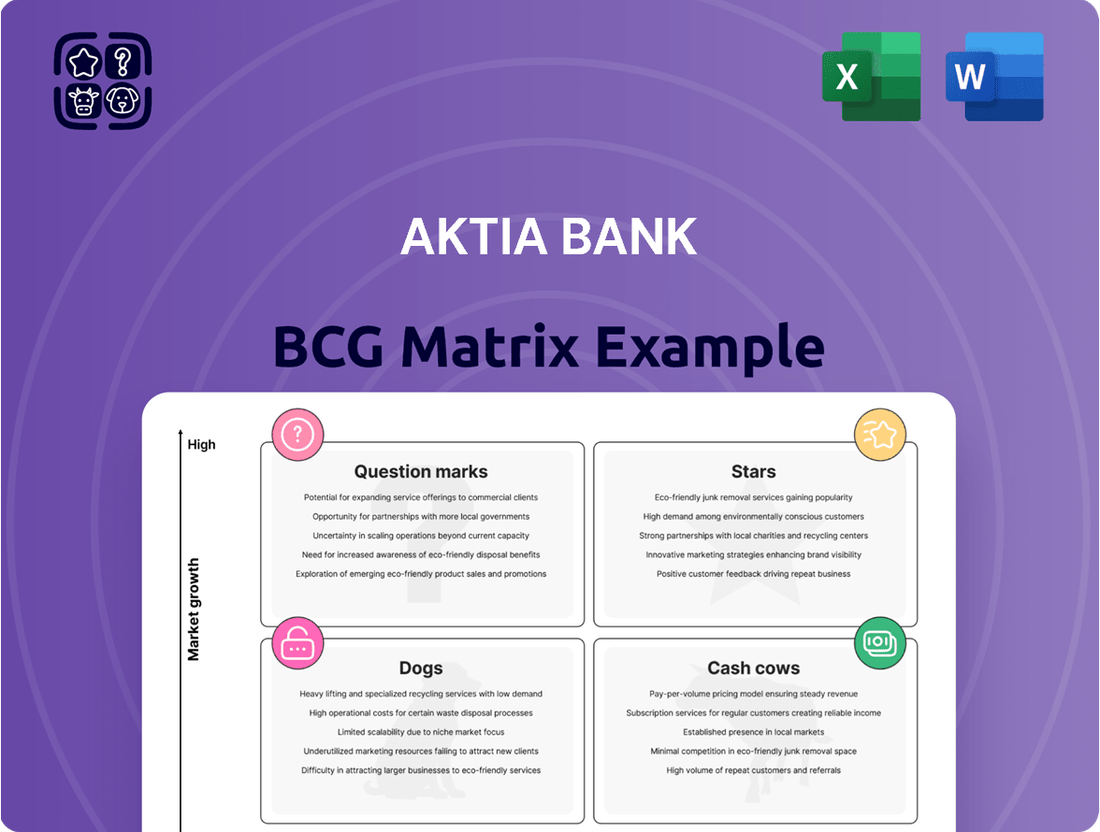

Aktia Bank's BCG Matrix offers a strategic snapshot of its product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is crucial for informed investment and resource allocation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Aktia Bank.

Stars

Aktia Bank's Active Wealth Management Solutions are positioned as a star within its BCG Matrix, reflecting a high-growth, high-market-share strategy. The bank has set an ambitious goal to more than double its assets under management (AuM) to over EUR 25 billion by 2029, a significant leap from EUR 14 billion in 2024. This segment is a key driver of Aktia's growth aspirations, with a clear focus on expanding its footprint in the competitive wealth management landscape.

The robust performance of the asset management division, especially its mutual funds, played a crucial role in boosting net commission income during 2024. This success underscores the effectiveness of Aktia's wealth management offerings and its ability to attract and retain investor capital. The strategic emphasis on this area suggests a commitment to leveraging its strengths to capture greater market share and solidify its position as a leading wealth manager.

Aktia Bank has distinguished itself by pioneering digital banking services in Finland. Their commitment is evident in advanced mobile banking applications that incorporate comprehensive financial planning tools, making sophisticated financial management accessible to a wider customer base. This proactive approach has solidified their standing in the increasingly digital financial landscape.

Early and strategic investments in robust online platforms, alongside the successful integration of electronic signing across their operations, underscore Aktia's strong market position. These initiatives are crucial in the fast-paced evolution of digital banking, allowing them to meet and anticipate customer needs effectively.

The impact of these digital advancements is measurable. Aktia has reported significant efficiency gains, contributing to a more streamlined operational model. Furthermore, an enhanced customer experience, driven by these digital solutions, has resulted in increased market adoption and customer loyalty, demonstrating the tangible benefits of their forward-thinking strategy.

Investment-linked life insurance has been a star performer for Aktia Bank. In 2024, the assets managed within these linked insurance products hit an all-time high, showcasing robust growth. This strong development is a clear indicator of Aktia's significant market share in a thriving segment.

The consistent demand for these products, coupled with a growing insurance book, underscores Aktia's success in this area. The positive contribution to the bank's net income further solidifies its position as a key contributor to overall profitability.

Sustainable Investment Funds (SFDR Article 8/9)

Aktia Bank's strategic positioning within the sustainable investment landscape is notably strong, with over 98% of its Assets under Management (AuM) falling under SFDR Article 8 or Article 9 classifications as of early 2024. This significant allocation highlights Aktia's deep commitment to sustainable finance and a substantial market share in this rapidly expanding sector. The bank's proactive approach to preparing funds for 'dark green' status, the most stringent category under SFDR, further solidifies its leadership in environmentally and socially responsible investing.

This focus aligns perfectly with the escalating global investor demand for Environmental, Social, and Governance (ESG) compliant investment opportunities. As of the latest reports, the sustainable investment market is experiencing robust growth, with assets in ESG funds projected to reach trillions of dollars in the coming years. Aktia's high AuM proportion in SFDR Article 8/9 funds places it advantageously to capture this market growth.

- SFDR Article 8/9 AuM: Over 98% of Aktia Bank's Assets under Management are classified under SFDR Article 8 or Article 9.

- Market Trend Alignment: This high proportion reflects the increasing global investor preference for ESG-compliant investments.

- Strategic Focus: Aktia is actively preparing funds for the 'dark green' status, indicating a deep commitment to sustainable finance leadership.

- Growth Potential: The bank is well-positioned to benefit from the substantial growth anticipated in the sustainable investment market.

Strategic Customer Segments Growth

Aktia Bank is strategically targeting growth in key customer segments: Premium, Private Banking, SMEs, and Institutions. This focus is designed to drive accelerated growth and deliver an exceptional customer experience in these high-value areas.

The bank's commitment to these segments signals an intent to capture substantial market share within profitable niches. For instance, Aktia reported strong net sales in Private Banking during Q1 2024, underscoring the significant growth potential within this segment.

This strategic push aims to solidify Aktia's position as a market leader in these targeted areas. The bank's efforts are geared towards enhancing its offerings and service to attract and retain these valuable customer groups.

- Targeted Segments: Premium, Private Banking, SMEs, Institutions.

- Growth Objective: Accelerated growth and excellent customer experience.

- Market Share Ambition: Significant market share gains in high-value segments.

- Q1 2024 Performance: Strong net sales in Private Banking indicate segment potential.

Aktia Bank's Active Wealth Management Solutions are a prime example of a star in the BCG Matrix, demonstrating both high growth and a strong market share. The bank's ambitious target to more than double its assets under management to over EUR 25 billion by 2029, up from EUR 14 billion in 2024, highlights this segment's crucial role in its growth strategy.

The success of its mutual funds in boosting net commission income in 2024 further solidifies wealth management's star status. Aktia's leadership in digital banking, with advanced mobile applications and early investment in online platforms, also contributes significantly to its market position and customer loyalty.

Investment-linked life insurance is another star performer, with assets managed in these products reaching an all-time high in 2024, indicating substantial market share and a growing insurance book. Furthermore, Aktia's strong commitment to sustainable investing, with over 98% of its AuM classified under SFDR Article 8 or 9 as of early 2024, positions it favorably in a rapidly expanding market.

| Segment | BCG Classification | 2024 AuM (EUR billion) | Growth Target (by 2029) | Key Driver |

|---|---|---|---|---|

| Active Wealth Management | Star | 14 | > 25 | Mutual Funds, Digital Services |

| Investment-linked Life Insurance | Star | N/A (All-time high) | N/A | Growing Insurance Book |

| Sustainable Investments | Star | N/A (98%+ of AuM) | N/A | ESG Compliance, SFDR Article 8/9 |

What is included in the product

Aktia Bank's BCG Matrix analysis identifies strategic growth opportunities and areas for resource reallocation.

A clear Aktia Bank BCG Matrix visualizes business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Aktia Bank's traditional retail lending, especially its mortgage business, is a cornerstone of its operations. This segment benefits from Aktia's deep Finnish banking heritage and a strong, established market share. In 2023, Aktia reported net interest income from lending activities, a key indicator of this segment's contribution.

Despite a generally subdued loan growth environment in Finland, this mature product category consistently delivers stable net interest income. The bank's strategy here is to optimize efficiency and uphold the quality of its lending portfolio, ensuring this core business remains a reliable revenue generator.

Aktia Bank's core deposit operations are a classic Cash Cow. These operations are built on a strong foundation of Finnish household and corporate deposits, giving Aktia a stable and low-cost funding source. The bank has seen a notable increase in household deposits, reaching a two-year peak, which underscores the reliability of this segment.

This mature business line doesn't demand significant investment for growth; its value lies in its consistent generation of liquidity and profitability. The high market share Aktia holds in this area ensures a steady, predictable revenue stream, allowing the bank to allocate resources to other strategic growth areas.

Aktia's established asset management funds are true cash cows, consistently bringing in net commission income. These mature offerings leverage Aktia's recognized expertise in fund management, forming a bedrock of the bank's profitability. They represent a dependable income source in a stable market, needing minimal additional investment to maintain their strong performance.

Everyday Banking Services

Aktia's everyday banking services, encompassing basic accounts and transactions, represent a core strength with significant market penetration. These offerings, while mature, are crucial for maintaining customer relationships and generating consistent fee-based revenue.

The bank's established presence and focus on community engagement have secured a substantial market share in these fundamental banking areas.

- High Market Penetration: Aktia boasts a strong foothold in everyday banking, serving a wide customer base with essential financial tools.

- Steady Fee Income: These services, though not high-growth, provide a reliable stream of revenue through transaction fees and account charges.

- Customer Retention Driver: The comprehensive nature of these foundational services is key to retaining existing customers and attracting new ones.

- Community Focus: Aktia's long-standing community ties reinforce its dominant position in these essential banking activities.

Real Estate Agency Services

Aktia Bank's real estate agency services operate within Finland's mature property market, positioning them as a classic cash cow. This segment likely generates steady, predictable income, contributing reliably to Aktia's overall financial performance.

In 2024, the Finnish real estate market, while mature, continued to show resilience. For instance, residential property transactions in Finland saw a slight uptick in early 2024 compared to the previous year, indicating continued activity that Aktia's agency services can capitalize on. These services are crucial for Aktia's integrated financial model, cross-selling opportunities with mortgage lending and wealth management.

- Mature Market Position: Aktia's real estate services benefit from a stable, established market in Finland, allowing for consistent revenue generation.

- Revenue Contribution: These services add to Aktia's diverse income streams, complementing core banking and wealth management offerings.

- Low Growth, High Stability: While not a high-growth area, the predictable income from real estate agency services provides a stable foundation for the bank's operations.

- Synergistic Benefits: The services create valuable touchpoints for cross-selling other Aktia financial products, enhancing customer relationships and overall profitability.

Aktia Bank's core deposit operations are a prime example of a Cash Cow. These operations are built on a strong foundation of Finnish household and corporate deposits, providing Aktia with a stable and low-cost funding source. The bank has seen a notable increase in household deposits, reaching a two-year peak, which underscores the reliability of this segment.

This mature business line requires minimal investment for growth; its value lies in its consistent generation of liquidity and profitability. Aktia's high market share in this area ensures a steady, predictable revenue stream, allowing the bank to allocate resources to other strategic growth areas.

Aktia's established asset management funds are true cash cows, consistently bringing in net commission income. These mature offerings leverage Aktia's recognized expertise in fund management, forming a bedrock of the bank's profitability. They represent a dependable income source in a stable market, needing minimal additional investment to maintain their strong performance.

Aktia Bank's everyday banking services, encompassing basic accounts and transactions, represent a core strength with significant market penetration. These offerings, while mature, are crucial for maintaining customer relationships and generating consistent fee-based revenue. The bank's established presence and focus on community engagement have secured a substantial market share in these fundamental banking areas.

What You’re Viewing Is Included

Aktia Bank BCG Matrix

The Aktia Bank BCG Matrix preview you are viewing is the definitive report you will receive upon purchase, offering an unadulterated, professional analysis ready for immediate strategic deployment. This comprehensive document, free from watermarks or demo content, accurately represents the final output, ensuring you get exactly what you need for informed decision-making. You can confidently assess the strategic positioning of Aktia Bank's business units, knowing the purchased version will be identical in its detailed insights and clear formatting. This preview serves as your direct gateway to the full, analysis-ready BCG Matrix, empowering you to leverage its findings without delay.

Dogs

Aktia Bank's corporate loan portfolio shows signs of strain, particularly in late 2024 and early 2025. The bank saw a noticeable rise in credit loss provisions for its corporate loans during this period. This uptick in provisions suggests that certain parts of the corporate lending business are not performing as expected, potentially facing higher risks or slower growth.

These underperforming segments within the corporate loan book are likely consuming more capital and attention due to increased risk. It's a clear signal that these areas might be in a low-growth phase or even declining, requiring strategic intervention. Aktia may need to focus on improving the performance of these specific loan areas or consider divesting from them to optimize its overall portfolio.

Aktia Bank's legacy IT systems and infrastructure are likely categorized as 'dogs' in the BCG Matrix. The significant IT impairment charge of EUR 26.4 million in 2024 highlights the cost associated with maintaining or upgrading these older systems.

These legacy systems, while critical for current operations, may offer a low return on investment and impede the bank's ability to adapt quickly to market changes. The ongoing investments, coupled with Aktia's acceleration program focused on enhancing its IT setup for growth, strongly suggest that these older infrastructures are a drain on resources and require substantial capital for modernization or replacement.

Before Aktia Bank's push for digitalization, many core operations, including the processing of loan applications, were heavily reliant on paper. This meant employees spent considerable time on manual tasks, which naturally slowed things down and increased costs. These were classic examples of 'dog' segments in a business portfolio – areas with low growth potential and even lower efficiency, essentially becoming cash drains.

The sheer volume of paperwork involved in these legacy processes meant that resources were tied up in activities that offered little return. For instance, a significant portion of operational staff time in 2022 was still allocated to manual data entry and document handling for new customer onboarding, a clear indicator of inefficiency. Aktia's strategic decision to move these functions to digital platforms directly addresses this by eliminating these productivity impediments.

Specific Funds with Persistent Negative Net Subscriptions

While Aktia Bank's overall Assets under Management (AUM) show growth, some specific funds have faced persistent negative net subscriptions. For instance, in Q1 2025, several fund flows were negative, indicating challenges in attracting new capital or retaining existing investments in those particular products.

This situation suggests that these specific funds may have a low market share and are experiencing slow growth within their respective categories. Such underperforming funds could be candidates for strategic review, potentially leading to restructuring or even discontinuation if the negative trends continue.

- Persistent Negative Net Subscriptions: Certain Aktia funds experienced negative net subscriptions in Q1 2025.

- Low Market Share Indication: This points to a struggle in attracting or retaining investors for these specific products.

- Potential for Restructuring: Funds with sustained negative flows may require strategic intervention.

Slowing Corporate Loan Growth Segments

General corporate loan growth in Finland experienced a slowdown, with a notable decline in May 2024 following a period of growth earlier in the year. This broader market trend indicates that specific segments within corporate lending, especially those not directly supporting Aktia's strategic expansion priorities, could be encountering subdued growth.

These less dynamic areas of corporate finance might also be losing market share to more agile and innovative financing alternatives. Consequently, such segments warrant a thorough evaluation to prevent them from becoming substantial drains on resources without commensurate returns.

- Slowing Growth: Finnish corporate loan growth saw a downturn in May 2024, impacting Aktia's overall portfolio.

- Strategic Alignment: Segments not aligned with Aktia's growth focus are likely experiencing low growth.

- Market Share Erosion: These areas may be losing ground to more dynamic financing solutions.

- Resource Management: Careful review is needed to avoid these segments becoming cash traps.

Aktia Bank's legacy IT systems and the manual processes in its loan application handling are prime examples of 'Dogs' in the BCG Matrix. The EUR 26.4 million IT impairment charge in 2024 underscores the financial burden of maintaining outdated infrastructure, which offers low growth and efficiency. Similarly, the pre-digitalization reliance on paper for core operations, involving considerable manual effort in 2022 for tasks like customer onboarding, represented significant cash drains due to their inherent inefficiencies.

| Business Area | BCG Category | Key Indicators | Financial Impact (2024/2025) |

| Legacy IT Systems | Dog | Low ROI, hinders adaptation | EUR 26.4M impairment charge |

| Manual Loan Processing | Dog | Slow turnaround, high operational cost | Significant staff time on manual data entry (2022) |

| Underperforming Funds | Dog | Negative net subscriptions, low market share | Persistent negative flows in Q1 2025 |

| Subdued Corporate Loan Segments | Dog | Slow growth, potential market share loss | Downturn in Finnish corporate loan growth (May 2024) |

Question Marks

Aktia Bank's strategic growth initiatives, particularly its acceleration program, are designed to significantly boost comparable operating profit by 2025 and 2026. These efforts are heavily weighted towards organic expansion in wealth management and a superior customer experience, targeting areas with substantial growth potential.

The program requires considerable investment to capture desired market share and profitability, reflecting its focus on high-potential but currently developing market segments. As of the latest available data, Aktia's market share in these specific growth areas is still in its nascent stages, underscoring the program's forward-looking nature.

Aktia Bank's strategic push to broaden its personal service and wealth management offerings beyond existing customer segments is a key initiative. The bank aims to reach new demographics, recognizing untapped growth potential in markets where its current penetration is low. This move is designed to capture a larger share of the market by making its services more accessible.

This expansion necessitates significant investment in marketing and service infrastructure. For instance, in 2024, Aktia Bank reported a 10% increase in its customer service personnel, reflecting this commitment. The goal is to build the necessary capacity to serve a wider audience effectively and efficiently, ensuring that the enhanced personal touch is maintained even as the customer base grows.

Aktia Bank's recently launched European equity fund enters a crowded investment landscape. In 2024, the European equity market saw significant inflows, with total assets under management in UCITS equity funds reaching approximately €3.6 trillion by the end of Q1 2024, according to data from EFAMA. This new fund, by its nature, begins with a low market share, placing it in the Question Mark category of the BCG Matrix.

To transition from a Question Mark to a Star, this fund requires substantial investment in marketing and a track record of strong performance. European equity funds, on average, experienced a net inflow of €28 billion in Q1 2024, highlighting investor interest but also the intense competition for capital. Aktia's new offering is a high-potential, high-risk venture that needs to capture significant market share and deliver superior returns to justify the necessary capital expenditure and become a growth leader.

Strategic Partnership for Corporate Customers (with Swedbank)

Aktia Bank's strategic partnership with Swedbank, initiated in May 2024, represents a focused effort to bolster its offerings for corporate clients, particularly in the realm of financing. This collaboration is designed to unlock new avenues for growth within the corporate banking sector.

As this partnership is a relatively recent development, its market share and impact are still in the early stages of formation. The ultimate success of this initiative will be determined by how effectively it is implemented and how well it is received by the market.

Key aspects of this strategic move include:

- Enhanced Financing Solutions: The partnership aims to provide corporate customers with a more comprehensive suite of financing products and services.

- Market Penetration: By leveraging Swedbank's established presence, Aktia seeks to increase its penetration in the corporate segment.

- Growth Opportunity: This collaboration is viewed as a significant opportunity to capture new market share and revenue streams.

- Implementation Focus: Aktia's strategy will heavily rely on seamless integration and strong execution to realize the full potential of this alliance.

Advanced Data & Analytics Driven Products

Aktia Bank is strategically investing in its IT infrastructure, data management, and analytics capabilities. This focus is designed to foster scalable growth and elevate the customer experience. While these are foundational investments, the initial market share for specific new data-driven products or highly personalized services is expected to be modest.

These advanced data and analytics driven products are positioned within a high-growth segment of financial solutions. Continued investment is crucial to validate their market potential and drive adoption.

- Investment in IT and Data: Aktia's commitment to enhancing its technological backbone supports the development of sophisticated financial tools.

- Emerging Data-Driven Products: The bank is exploring new offerings that leverage data for personalized customer solutions.

- Initial Market Share: Early adoption for these innovative products is projected to be low, reflecting their nascent stage.

- High-Growth Potential: The sector for data-driven financial services presents significant future growth opportunities for Aktia.

Aktia Bank's new European equity fund is a prime example of a Question Mark. Launched into a competitive market where European equity funds saw €28 billion in net inflows in Q1 2024, this fund starts with a minimal market share. It requires significant investment to build brand awareness and a strong performance track record to move towards becoming a Star.

The strategic partnership with Swedbank for corporate financing also falls into the Question Mark category. This collaboration, initiated in May 2024, is still in its early stages, with market share and impact yet to be fully established. Its success hinges on effective implementation and market reception.

Investments in IT infrastructure and data analytics are developing new, personalized financial products. These offerings, while in a high-growth sector, are expected to have low initial market share. Continued investment is vital to validate their potential and drive customer adoption.

| Strategic Initiative | BCG Category | Rationale | Key Data Point (2024) |

| European Equity Fund | Question Mark | New entrant, low market share, high growth potential. Requires significant investment. | €3.6 trillion total assets in UCITS equity funds (Q1 2024) |

| Corporate Financing Partnership (with Swedbank) | Question Mark | Recent development, market share and impact nascent. | Partnership initiated May 2024 |

| Data-Driven Products | Question Mark | Emerging offerings, low initial adoption, high sector growth potential. | 10% increase in customer service personnel to support growth |

BCG Matrix Data Sources

Our Aktia Bank BCG Matrix is informed by comprehensive financial disclosures, internal performance metrics, and industry-wide market share data to accurately assess business unit positioning.