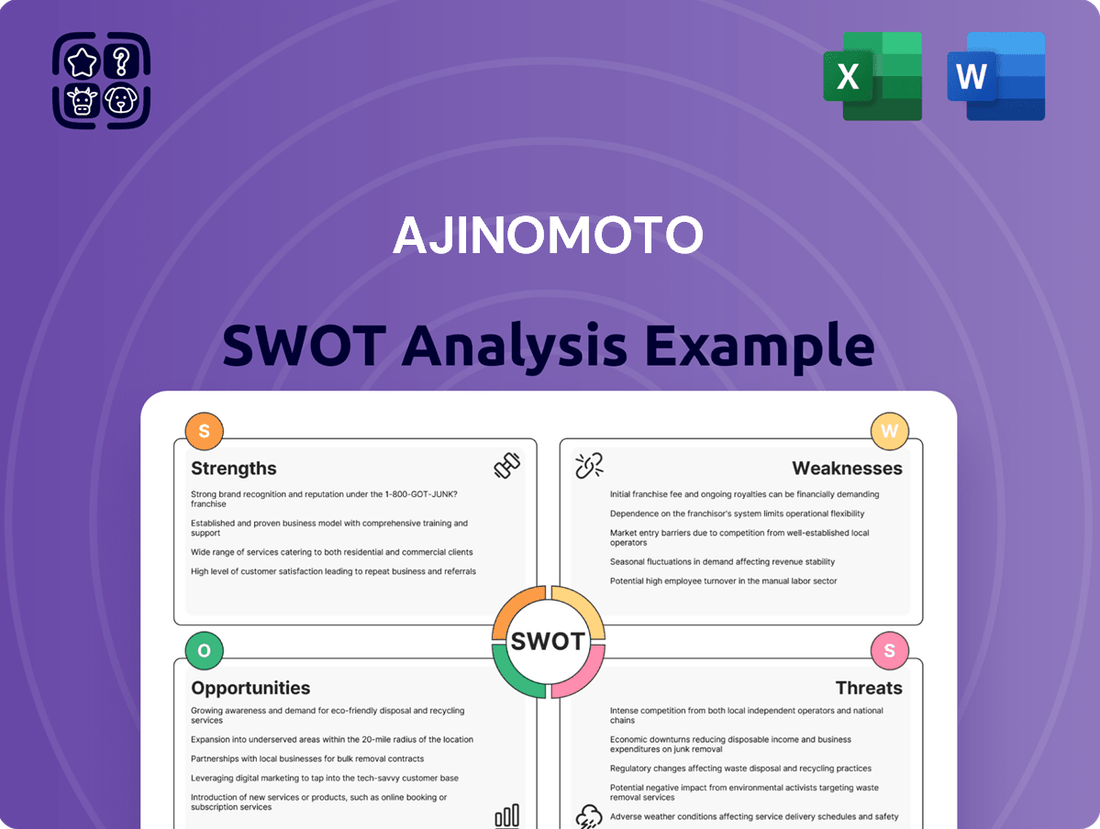

Ajinomoto SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

Ajinomoto's strengths lie in its established brand recognition and diverse product portfolio, particularly in seasonings and amino acids. However, it faces significant threats from intense competition and evolving consumer preferences towards healthier, natural ingredients. Understanding these dynamics is crucial for stakeholders.

Discover the complete picture behind Ajinomoto’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to navigate this complex landscape.

Strengths

Ajinomoto Co., Inc. benefits from exceptional global brand recognition, extending its operations to over 130 countries. This widespread presence underscores its significant market leadership, particularly in the umami seasoning sector where it commands a dominant share, especially across the Asia Pacific region. Its reputation for quality and innovation is a key driver of this strong competitive standing.

Ajinomoto's core strength lies in its sophisticated proprietary amino acid technologies, known as AminoScience. This deep scientific expertise enables the creation of a wide array of innovative products spanning food seasonings, healthcare, and even advanced materials like Ajinomoto Build-up Film (ABF) used in semiconductors.

This unique technological foundation directly drives product innovation and market differentiation for Ajinomoto. In fiscal year 2023, the company reported significant contributions from its specialty chemicals segment, where ABF plays a crucial role, highlighting the commercial success of its AminoScience applications.

Ajinomoto boasts a remarkably diverse product range, spanning from everyday seasonings and processed foods to advanced healthcare solutions and specialty chemicals. This wide array of offerings acts as a natural buffer against downturns in any single sector, fostering business stability. For instance, the company's functional materials division, notably its Ajinomoto Build-up Film (ABF) used in semiconductors, has been a significant profit driver, showcasing the strength of its varied segments.

Robust Financial Performance and Strategic Investment

Ajinomoto showcases impressive financial strength, evidenced by its record-breaking sales and business profits for the fiscal year concluding March 31, 2025. The company anticipates this positive trajectory will continue into the fiscal year ending March 31, 2026, signaling a robust and expanding market presence.

Strategic investments are a cornerstone of Ajinomoto's approach to sustained growth. The company actively channels resources into research and development, ensuring innovation remains a key driver. Furthermore, Ajinomoto prioritizes expanding its production capacity and implementing initiatives designed to boost profitability across its diverse business segments.

- Record Financials: Achieved record sales and business profits in FY2025 (ended March 31, 2025).

- Projected Growth: Forecasts continued growth for FY2026 (ending March 31, 2026).

- R&D Investment: Consistently invests in research and development to foster innovation.

- Capacity Expansion: Strategically invests in expanding production capacity to meet demand.

Commitment to Sustainability and ESG Initiatives

Ajinomoto demonstrates a robust commitment to sustainability and Environmental, Social, and Governance (ESG) initiatives, which is a significant strength. The company has set ambitious targets, aiming for carbon neutrality by 2030 and a 50% reduction in environmental impact.

This focus extends to key areas like sustainable raw material sourcing and waste reduction. By prioritizing these practices, Ajinomoto not only minimizes its ecological footprint but also aligns with growing global demand for environmentally responsible businesses.

Furthermore, their dedication to promoting health and well-being through their diverse product portfolio reinforces their corporate social responsibility. This proactive approach to ESG strengthens Ajinomoto's brand reputation and appeals to ethically-minded consumers and investors alike.

- Carbon Neutrality Target: Ajinomoto aims to achieve carbon neutrality by 2030.

- Environmental Impact Reduction: The company is working towards a 50% reduction in its overall environmental impact.

- Sustainable Sourcing: Emphasis on sourcing raw materials in an environmentally and socially responsible manner.

- Waste Reduction Efforts: Active initiatives to minimize waste across its operations.

Ajinomoto's brand equity is a significant asset, built on decades of trust and quality. Its dominant position in the global umami seasoning market, especially in Asia, provides a stable revenue base and strong customer loyalty.

The company's proprietary AminoScience technology is a key differentiator, enabling innovation across food, health, and materials sectors. This scientific foundation allows Ajinomoto to develop high-value products, like the Ajinomoto Build-up Film (ABF) crucial for semiconductor manufacturing, which saw strong performance in fiscal year 2023.

Ajinomoto's diversified product portfolio, ranging from food to advanced chemicals, mitigates risk and ensures resilience. The successful performance of its functional materials division, including ABF, highlights the strength derived from this broad offering.

Ajinomoto demonstrated robust financial performance, achieving record sales and business profits in the fiscal year ending March 31, 2025, with projections indicating continued growth into FY2026. This financial health is supported by strategic investments in R&D and capacity expansion.

The company's strong commitment to ESG principles, including its goal of carbon neutrality by 2030 and a 50% reduction in environmental impact, enhances its brand reputation and appeal to socially conscious stakeholders.

| Strength Area | Key Aspects | Supporting Data/Facts |

|---|---|---|

| Brand Recognition & Market Leadership | Global presence, dominance in umami seasoning | Operations in >130 countries; strong share in Asia Pacific. |

| Technological Expertise | AminoScience, product innovation | Enables diverse products from food to semiconductors (ABF); strong contribution from specialty chemicals in FY2023. |

| Product Diversification | Wide range of offerings | Mitigates sector-specific downturns; functional materials (ABF) a significant profit driver. |

| Financial Performance | Record sales and profits | Achieved record results in FY2025 (ended Mar 31, 2025); projected continued growth for FY2026. |

| Sustainability Commitment | ESG initiatives, carbon neutrality | Targeting carbon neutrality by 2030; aiming for 50% environmental impact reduction. |

What is included in the product

Maps out Ajinomoto’s market strengths, operational gaps, and risks, offering a comprehensive view of its competitive landscape.

Simplifies complex market dynamics, offering a clear roadmap to overcome competitive pressures.

Weaknesses

Ajinomoto's financial health is sensitive to shifts in the prices of key agricultural inputs like corn and sugarcane. For instance, a surge in corn prices, a primary component in their fermentation processes, directly squeezes profit margins. This vulnerability was evident in late 2023 and early 2024 as global commodity markets experienced volatility, impacting the cost of goods sold.

Ajinomoto's pharmaceutical ambitions are tempered by the notoriously long development cycles inherent in the industry. Bringing a new drug from initial research to market approval can take over a decade, a significant hurdle for companies seeking rapid expansion.

This extended timeline means substantial capital and resources are committed for years before any revenue is generated, potentially impacting financial flexibility. For instance, the average cost to develop a new drug in 2024 is estimated to be around $2.6 billion, highlighting the significant financial risk involved in these long development periods.

Furthermore, the stringent regulatory pathways, including Phase I, II, and III clinical trials, are designed for safety and efficacy but inevitably add years to the process, delaying market entry and obscuring the ability to quickly capitalize on emerging healthcare needs or market opportunities.

Ajinomoto faces formidable competition across its diverse product lines, from global food giants to nimble local players. In 2024, the global seasonings market, a key segment for Ajinomoto, is projected to reach over $50 billion, with growth primarily driven by emerging markets but also characterized by intense rivalry. This saturation means maintaining market share demands constant innovation and aggressive marketing to stand out against both established brands and the increasing prevalence of private label offerings from major retailers.

The company must also contend with evolving consumer tastes, which can quickly shift demand away from established products. For instance, the growing demand for healthier, natural, and plant-based options puts pressure on traditional product portfolios. Ajinomoto's strategy must therefore be agile enough to adapt to these changing preferences while simultaneously managing the inherent pricing pressures that accompany crowded markets, making differentiation a critical and ongoing challenge.

Supply Chain Complexity and Ethical Sourcing Challenges

Ajinomoto faces significant hurdles in managing its extensive global supply chain, a critical area for ensuring ethical and sustainable sourcing. Navigating diverse regulatory landscapes and varying social standards across numerous countries makes consistent compliance a demanding operational challenge.

Maintaining absolute ethical standards throughout the entire supply chain, from raw material procurement to final product distribution, remains a persistent difficulty. The company’s commitment to human rights and fair labor practices necessitates ongoing, rigorous oversight and continuous improvement efforts to mitigate inherent risks.

- Supply Chain Oversight: Ajinomoto's global operations involve sourcing from numerous countries, each with unique compliance requirements.

- Ethical Sourcing Verification: Ensuring 100% adherence to ethical labor and environmental standards across all suppliers is a complex, ongoing task.

- Risk Mitigation: The potential for disruptions or ethical breaches within any part of the vast network requires proactive and robust risk management strategies.

Regulatory Compliance and Environmental Incidents

Ajinomoto faces ongoing risks related to regulatory compliance and past environmental incidents. For instance, in 2023, the company was fined approximately $50,000 USD for a wastewater discharge violation at one of its facilities. Such occurrences underscore the potential for significant financial penalties and operational interruptions.

The company's commitment to robust environmental management systems is crucial to mitigate these vulnerabilities.

- Past Fines: Ajinomoto has incurred fines for environmental violations, including a 2023 penalty of around $50,000 USD for wastewater discharge issues.

- Reputational Risk: Environmental incidents can severely damage the company's public image and stakeholder trust.

- Operational Impact: Violations can lead to temporary shutdowns or stricter operational controls, affecting production and profitability.

- Compliance Costs: Maintaining advanced environmental management systems and adhering to evolving regulations requires continuous investment.

Ajinomoto's reliance on agricultural commodities makes it susceptible to price volatility. Fluctuations in the cost of raw materials like corn and sugarcane directly impact production expenses, potentially squeezing profit margins. For example, a significant increase in corn prices, a key ingredient in their fermentation processes, can lead to higher cost of goods sold, affecting profitability in the short to medium term.

Full Version Awaits

Ajinomoto SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Ajinomoto's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive analysis provides actionable insights for strategic decision-making. You'll gain a clear understanding of the company's competitive landscape and future potential.

Opportunities

The global market for health and wellness foods is experiencing robust growth, driven by a heightened consumer focus on healthier lifestyles. This trend is particularly evident in the demand for products with reduced sodium and sugar content, alongside a surge in popularity for nutritional supplements and plant-based food alternatives. Ajinomoto, with its deep understanding of AminoScience, is well-positioned to capitalize on this opportunity by developing innovative solutions that align with these evolving consumer preferences.

Ajinomoto's strategic initiatives, such as the development of platforms like 'Salt Answer' and 'Palate Perfect,' directly address these market demands. For instance, 'Salt Answer' aims to provide effective solutions for sodium reduction without compromising taste, a critical factor for consumer adoption. These targeted product developments underscore the company's commitment to innovation in response to health-conscious trends, anticipating a strong market reception for its offerings in 2024 and beyond.

Emerging markets, especially in the Asia-Pacific region, present substantial growth prospects for Ajinomoto. This is driven by increasing disposable incomes and a greater demand for processed and convenient food items. For instance, the global processed food market is projected to reach over $1.2 trillion by 2027, with Asia-Pacific being a key contributor to this growth.

Ajinomoto's existing brand recognition and robust distribution channels across these developing economies are significant advantages. This allows the company to effectively tap into the expanding middle-class demographic and a growing consumer base that is increasingly adopting modern dietary habits.

By making targeted investments and tailoring product portfolios to local tastes and preferences, Ajinomoto can unlock considerable revenue streams. For example, successful localization strategies in countries like Vietnam have already demonstrated strong sales performance, contributing to Ajinomoto's overall revenue growth in the region.

The escalating demand for Ajinomoto Build-up Film (ABF), a critical component in semiconductor substrates, offers a significant avenue for expansion. ABF's role in advanced packaging solutions for high-performance chips is driving this need.

Ajinomoto is strategically investing to ramp up ABF production capacity, anticipating a robust upswing in both profitability and revenue from this business segment. This move capitalizes on their established prowess in fine chemicals within a rapidly expanding technological landscape.

For instance, the global semiconductor market, which heavily relies on materials like ABF, was projected to reach approximately $600 billion in 2024, with continued growth expected into 2025. Ajinomoto's investment in ABF capacity directly taps into this burgeoning market.

This strategic focus on ABF leverages Ajinomoto's deep expertise in precision chemical manufacturing, positioning them to benefit from the ongoing technological advancements in the electronics industry, particularly in areas like artificial intelligence and 5G.

Strategic Partnerships and Collaborations

Ajinomoto can significantly boost its market reach and innovation by forming strategic partnerships. Collaborations allow the company to tap into new distribution channels and leverage the expertise of other organizations. For instance, a partnership focused on sustainable sourcing could enhance its environmental credentials and appeal to eco-conscious consumers.

The company's commitment to sustainability is a strong foundation for alliances. Ajinomoto's participation in initiatives like the World Business Council for Sustainable Development, which had over 200 member companies as of early 2024, demonstrates its dedication to shared environmental goals. These broader collaborations can accelerate the development of new, sustainable products and solutions, potentially opening up new revenue streams.

Strategic alliances can be particularly effective in expanding Ajinomoto's presence in emerging markets. By partnering with local businesses, Ajinomoto can gain valuable insights into consumer preferences and navigate regulatory landscapes more effectively. This approach was evident in their collaboration with Danone, aimed at reducing greenhouse gas emissions, a move that aligns with global sustainability trends and could foster similar joint ventures in other regions.

These partnerships can accelerate the pace of innovation. By sharing research and development resources, Ajinomoto can bring novel products to market faster, gaining a competitive edge. For example, collaborations in the biotechnology sector could lead to breakthroughs in food ingredients or health products, further diversifying Ajinomoto's portfolio.

- Enhanced Market Access: Partnerships can open doors to new geographic regions and customer segments.

- Accelerated Innovation: Collaborations in R&D can speed up the development of new products and technologies.

- Strengthened Sustainability Efforts: Alliances can amplify the impact of sustainability initiatives and improve brand reputation.

- Risk Mitigation: Sharing resources and expertise can help mitigate the risks associated with entering new markets or developing novel solutions.

Leveraging Digital Transformation and Innovation

Embracing digital transformation offers significant opportunities for Ajinomoto. By leveraging data analytics, the company can gain deeper insights into consumer preferences and market shifts, enabling more targeted product development and marketing campaigns. This is crucial as the global food and health market continues to evolve rapidly, with consumers increasingly seeking personalized and health-conscious options.

Ajinomoto can enhance operational efficiency through the adoption of advanced digital tools. For instance, implementing AI-powered supply chain management systems can provide real-time visibility and predictive capabilities. This allows for better inventory management, reduced waste, and a more agile response to disruptions, which is critical in today's volatile global supply chains. In 2024, many global food companies are investing heavily in digital supply chain solutions to mitigate risks and improve speed to market.

The company has the potential to accelerate new product development by integrating digital technologies. This includes using AI for research and development, simulating new product formulations, and analyzing consumer feedback more effectively. For example, Ajinomoto's commitment to innovation in areas like umami and fermentation can be amplified by digital tools, leading to faster breakthroughs and a stronger pipeline of novel products. The company reported a significant portion of its R&D spending in 2024 was directed towards digital integration and data science capabilities.

- Enhanced Consumer Insights: Utilizing AI and big data analytics to understand evolving dietary trends and consumer demands, particularly in health and wellness segments.

- Supply Chain Optimization: Implementing digital platforms for real-time monitoring, predictive analytics, and AI-driven due diligence to improve efficiency and resilience.

- Accelerated Innovation: Employing digital tools in R&D for faster product development cycles and more responsive market introductions.

- Improved Operational Efficiency: Automating processes and leveraging digital technologies across manufacturing and distribution to reduce costs and increase output.

Ajinomoto is well-positioned to capitalize on the growing global demand for health-conscious food products, leveraging its expertise in AminoScience to develop solutions for reduced sodium and sugar content. The company's strategic focus on emerging markets, particularly in Asia, offers substantial growth potential driven by rising disposable incomes and increased demand for convenient food items.

The burgeoning semiconductor market presents a significant opportunity for Ajinomoto's Ajinomoto Build-up Film (ABF), a critical component for advanced chip packaging. Strategic partnerships and digital transformation initiatives further enhance Ajinomoto's ability to innovate, expand market reach, and optimize operations in the dynamic global landscape.

| Opportunity Area | Description | Key Data/Projections (2024/2025) | Ajinomoto's Position |

|---|---|---|---|

| Health & Wellness Foods | Growing consumer focus on healthier lifestyles, demand for reduced sodium/sugar, and supplements. | Global health and wellness food market projected to continue robust growth. | Leveraging AminoScience for innovative, health-aligned solutions. |

| Emerging Markets | Increasing disposable incomes and demand for processed/convenient foods in regions like Asia-Pacific. | Asia-Pacific driving growth in processed food market (projected >$1.2T by 2027). | Strong brand recognition and distribution channels in developing economies. |

| Semiconductor Materials (ABF) | Escalating demand for ABF in advanced semiconductor packaging for high-performance chips. | Global semiconductor market ~ $600B in 2024, with ongoing growth. | Investing to ramp up ABF production capacity, capitalizing on fine chemical expertise. |

| Strategic Partnerships | Collaborations to enhance market access, R&D, and sustainability efforts. | Over 200 companies in WBCSD as of early 2024, highlighting sustainability focus. | Deep commitment to sustainability as a foundation for alliances. |

| Digital Transformation | Leveraging data analytics, AI, and digital tools for consumer insights, operational efficiency, and innovation. | Global food companies investing heavily in digital supply chain solutions in 2024. | Potential to amplify innovation through AI in R&D; significant R&D spending on digital integration in 2024. |

Threats

Global economic uncertainties, coupled with geopolitical tensions and the increasing impact of climate change, are creating significant price swings for raw materials essential to Ajinomoto's operations. For instance, the UN's Food and Agriculture Organization (FAO) reported that its Food Price Index saw considerable fluctuations throughout 2024, affecting commodities like sugar and vegetable oils, key inputs for Ajinomoto.

These volatile commodity prices directly squeeze Ajinomoto's production costs. When the cost of ingredients like corn or soybeans rises sharply, as seen in periods of drought impacting agricultural yields in major producing regions during 2024, the company's margins can be significantly pressured, potentially impacting profitability.

Supply chain disruptions, exacerbated by trade disputes or unforeseen events, further complicate Ajinomoto's ability to deliver products consistently. For example, port congestion and shipping container shortages experienced in late 2023 and continuing into 2024 have increased lead times and freight costs for many global manufacturers, including those in the food sector.

To counter these threats, Ajinomoto must focus on robust risk management strategies. This includes exploring diverse sourcing options for key raw materials, potentially looking at alternative suppliers or geographical regions to reduce reliance on any single source, and hedging against price volatility where feasible.

Ajinomoto faces a significant threat from rapidly evolving consumer preferences. Demands for specific dietary attributes like plant-based options, clean labels, and sustainably sourced ingredients are rising. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to reach USD 169.2 billion by 2031, indicating a substantial shift that Ajinomoto must address.

The growing consumer focus on health and wellness, often characterized by an 'all-or-nothing' attitude towards perceived healthy options, presents a challenge. Consumers are increasingly scrutinizing ingredients and seeking functional benefits, forcing companies to continuously innovate their product portfolios to meet these exacting standards. Failing to adapt quickly could lead to a loss of market share to more agile competitors.

Furthermore, the widespread appeal of international cuisines and evolving taste profiles necessitate ongoing product development and marketing adjustments. As global culinary trends spread, Ajinomoto needs to ensure its offerings remain relevant and appealing to a diverse consumer base. This requires a deep understanding of local tastes and a flexible approach to product innovation to maintain competitiveness.

The global food and biotechnology sectors are fiercely contested arenas, with both seasoned companies and emerging businesses actively pursuing market share. This intense competition, coupled with aggressive marketing tactics from competitors and the increasing prevalence of private label brands, poses a significant threat to Ajinomoto's profitability and market standing if not managed proactively.

For instance, in the broader food industry, major players like Nestlé and Unilever, alongside agile startups, constantly innovate and expand, directly challenging Ajinomoto’s established product lines. The rise of direct-to-consumer models further intensifies this pressure, allowing competitors to bypass traditional retail channels and connect directly with consumers, potentially eroding Ajinomoto's customer base.

Furthermore, in 2024, the condiment and seasoning market alone is projected to reach over $120 billion globally, indicating the sheer scale of competition. Ajinomoto, while a strong player, faces rivals who are also investing heavily in R&D and brand building, creating a dynamic environment where market share can shift rapidly due to pricing strategies and new product introductions.

Economic Fluctuations and Currency Risks

Ajinomoto faces significant threats from global economic fluctuations. A worldwide economic downturn could dampen consumer spending on its food products and seasonings, impacting sales volumes. For instance, during the COVID-19 pandemic's initial stages in early 2020, global GDP contracted, which would have directly affected demand for non-essential food items if Ajinomoto's product mix leaned that way.

Inflationary pressures are another major concern, potentially increasing Ajinomoto's raw material and production costs. In 2023, many regions experienced elevated inflation rates, with some countries seeing annual inflation above 5%, directly squeezing profit margins if these costs cannot be passed on to consumers. This is particularly relevant for a company reliant on agricultural inputs.

Currency risks also pose a substantial threat, especially given Ajinomoto's global footprint. Adverse currency translations can erode the value of profits earned in foreign markets when repatriated to Japanese Yen. For example, if the Yen strengthens significantly against currencies like the US Dollar or Euro, Ajinomoto's overseas earnings would translate into fewer Yen, negatively impacting its reported financial results.

- Economic Downturns: Global economic slowdowns can reduce consumer purchasing power for food and beverage products.

- Inflationary Pressures: Rising costs for raw materials, energy, and labor can squeeze profit margins if not effectively managed or passed on.

- Currency Fluctuations: Adverse movements in exchange rates can decrease the value of international sales and profits when converted back to the home currency.

- Geopolitical Instability: International conflicts or trade disputes can disrupt supply chains and increase operational costs.

Increasing Regulatory Scrutiny and Trade Policy Changes

Ajinomoto faces increasing regulatory scrutiny, particularly concerning environmental standards and food safety. For instance, in 2024, many countries are tightening regulations on plastic packaging and food waste, which could necessitate significant investment in new infrastructure and operational adjustments for Ajinomoto's global supply chain. Changes in international trade policies, such as potential tariffs on imported food ingredients or finished products in major markets like the United States or the European Union, could also impact profitability and market access.

These evolving regulations and trade policies represent a significant threat. Stricter environmental compliance, for example, could increase operational costs, as seen with past penalties for environmental non-compliance in some of its manufacturing facilities. Furthermore, shifts in trade agreements or the imposition of new tariffs could create market access barriers, directly affecting Ajinomoto's export volumes and revenue streams.

The company must remain agile and prepared for these potential shifts. Key areas of concern include:

- Environmental Regulations: Adherence to stricter emissions and waste management rules, potentially requiring capital expenditure for facility upgrades.

- Food Safety Standards: Meeting increasingly rigorous food safety protocols globally, which could involve enhanced testing and traceability measures.

- Trade Tariffs: The impact of potential tariffs on key export markets, such as the US or EU, affecting pricing and competitiveness.

- Supply Chain Disruptions: Navigating potential disruptions caused by changes in trade policies or regulatory non-compliance in supplier countries.

Ajinomoto faces intense competition from both established food giants and agile startups, particularly in the booming plant-based and health-focused segments. For example, the global plant-based food market, valued at roughly USD 29.7 billion in 2023, is a key battleground where competitors are rapidly innovating. This fierce rivalry, coupled with aggressive marketing and the rise of private labels, demands constant adaptation to maintain market share and profitability, especially as rivals invest heavily in R&D and direct-to-consumer strategies.

Evolving consumer preferences present a significant challenge, with growing demand for clean labels, plant-based options, and sustainable sourcing. The company must continuously innovate its product portfolio to meet these exacting standards, as failing to adapt quickly could lead to market share erosion. Furthermore, the globalization of taste profiles requires ongoing adjustments to product development and marketing to remain relevant across diverse consumer bases.

Global economic instability, including inflationary pressures and currency fluctuations, directly impacts Ajinomoto's costs and international earnings. For instance, elevated inflation in 2023, with some countries exceeding 5% annual rates, squeezed profit margins. Adverse currency movements, such as a strengthening Yen against the US Dollar, can also significantly reduce the value of overseas profits when repatriated.

Regulatory changes, particularly concerning environmental standards and food safety, pose another threat. Tightening regulations on plastic packaging and waste, as seen in many countries during 2024, may necessitate substantial capital investment. Additionally, potential tariffs on key export markets like the US or EU could create market access barriers, affecting export volumes and revenue.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry insights to provide a robust and actionable assessment.