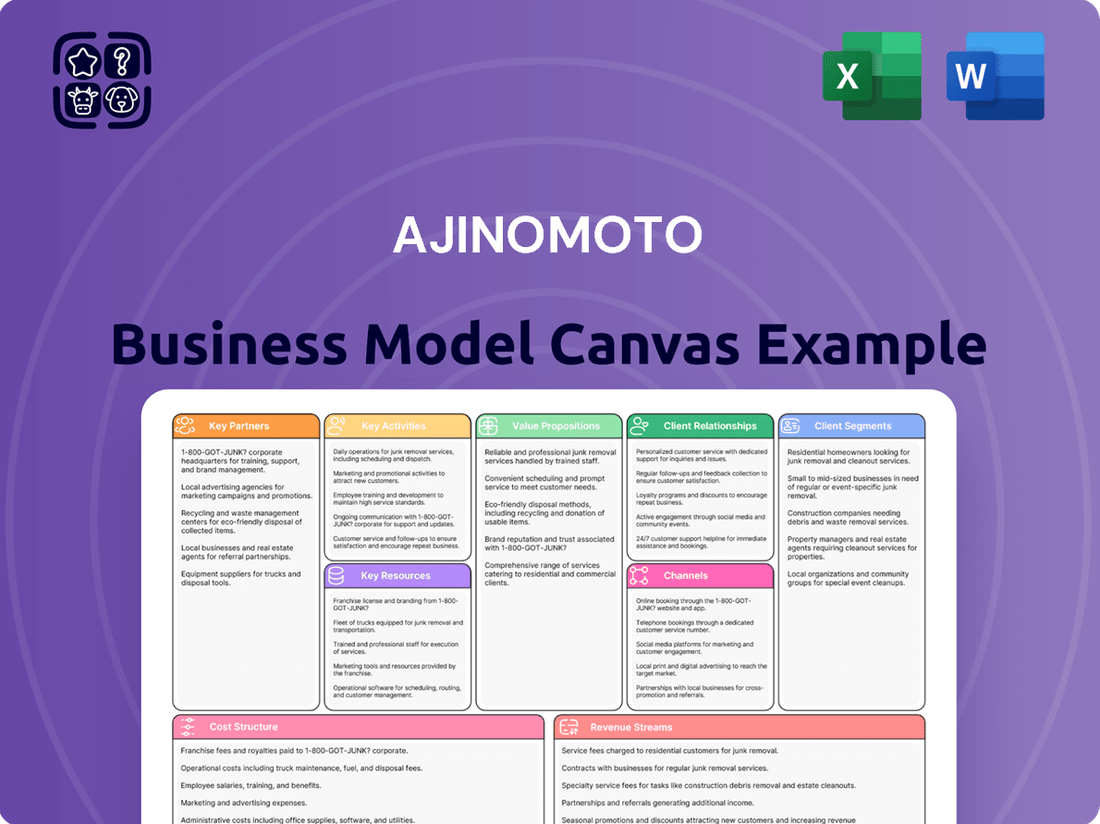

Ajinomoto Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

Unlock the full strategic blueprint behind Ajinomoto's business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse product portfolio and global reach, captures market share with strong brand recognition, and stays ahead in a competitive landscape by focusing on health and wellness. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a food industry giant.

Partnerships

Ajinomoto actively cultivates strategic alliances with leading research institutions and universities across the globe. These collaborations are vital for pushing the boundaries of amino acid technology and biotechnology. For instance, in 2024, Ajinomoto continued its ongoing research initiatives with institutions like the University of Tokyo and the University of California, Davis, focusing on novel applications of amino acids in areas such as functional foods and pharmaceuticals.

These partnerships are instrumental in accelerating scientific discovery and the development of next-generation products. They enable Ajinomoto to tap into specialized expertise and cutting-edge research facilities, ensuring a robust pipeline of innovative solutions in nutrition, health, and food science. The company's commitment to these alliances underpins its strategy for sustained growth and market leadership.

Ajinomoto's collaborations with key raw material suppliers are vital for maintaining a consistent and high-quality supply of ingredients for its broad product range, from food seasonings to amino acids.

These partnerships are crucial for ensuring the integrity of Ajinomoto's products, with a strong emphasis on rigorous quality assurance protocols at every stage of sourcing.

Ajinomoto actively works with suppliers to promote ethical sourcing practices and enhance environmental sustainability across its entire value chain, reflecting a commitment to responsible business operations.

For instance, in 2024, Ajinomoto continued its focus on sustainable sourcing of corn, a primary ingredient, aiming to reduce its environmental footprint by 30% by 2030 compared to 2015 levels.

Ajinomoto's success hinges on robust distribution and logistics networks, often built through strategic partnerships. Collaborating with established logistics providers ensures their diverse product portfolio, from seasonings to processed foods, reaches consumers efficiently across global markets. These alliances are crucial for managing complex supply chains and navigating varying regulatory landscapes.

In 2024, Ajinomoto continued to leverage these partnerships to enhance its reach. For instance, their collaboration with major shipping and warehousing companies worldwide allows for optimized inventory management and reduced transit times. This focus on supply chain efficiency directly impacts product availability and customer satisfaction, particularly in fast-moving consumer goods sectors.

These partnerships are not just about moving products; they are about building resilient supply chains. By working with logistics experts, Ajinomoto can better respond to market demands, minimize waste, and ensure product quality from production to point-of-sale. This operational excellence is a key factor in maintaining their competitive edge in the global food industry.

Joint Ventures in Emerging Markets

Ajinomoto actively forms joint ventures with local businesses in emerging markets. This strategy is key to its global expansion, allowing for tailored product development that resonates with regional palates. For instance, in 2024, Ajinomoto continued to focus on these collaborations in Southeast Asia and Africa, regions showing significant growth potential.

These partnerships are crucial for leveraging local knowledge and existing distribution channels. By teaming up with established players, Ajinomoto can quickly gain traction and build market share. This approach proved particularly effective in navigating regulatory landscapes and consumer preferences in markets like Vietnam and Nigeria during the past year.

Key benefits of these joint ventures include:

- Accelerated Market Entry: Local partners provide immediate access to established consumer bases and supply chains.

- Product Customization: Deep understanding of local tastes enables Ajinomoto to adapt its offerings effectively.

- Risk Mitigation: Sharing resources and responsibilities with local entities reduces financial and operational risks.

- Enhanced Brand Acceptance: Association with trusted local brands fosters consumer trust and brand loyalty.

Healthcare and Pharmaceutical Collaborations

Ajinomoto’s strategic alliances with pharmaceutical giants and healthcare networks are crucial for advancing its amino acid-based therapies. These collaborations are vital for both the research and development of innovative health solutions and for securing robust market penetration within the demanding healthcare landscape. For instance, by partnering with leading research institutions, Ajinomoto can accelerate the discovery and validation of new therapeutic applications for its amino acid technologies.

These partnerships are instrumental in navigating the complex regulatory pathways and distribution channels inherent in the pharmaceutical industry. By leveraging the expertise and established networks of its healthcare partners, Ajinomoto can ensure its products reach patients efficiently and effectively. The company's focus on areas like sterile amino acid solutions for intravenous nutrition underscores the necessity of these deep industry connections.

- Pharmaceutical Company Alliances: Partnering with companies like Eisai Co., Ltd., to develop new drug delivery systems or co-market specialized amino acid-based treatments.

- Healthcare Provider Networks: Collaborating with major hospital systems and clinics to integrate amino acid therapies into patient care protocols and conduct real-world evidence studies.

- Clinical Research Organizations (CROs): Engaging CROs to manage and execute clinical trials, ensuring rigorous scientific validation of Ajinomoto's health products.

- Biotechnology Firms: Joint ventures with biotech companies to explore novel applications of amino acid science in areas such as regenerative medicine or personalized nutrition.

Ajinomoto's network of key partnerships extends to raw material suppliers, ensuring a stable and high-quality input stream for its diverse product lines. These relationships are critical for maintaining product integrity and adhering to stringent quality control measures throughout the supply chain. Furthermore, Ajinomoto actively collaborates with suppliers to advance sustainable sourcing practices, exemplified by its 2024 commitment to increase sustainable corn sourcing to reduce its environmental impact.

What is included in the product

The Ajinomoto Business Model Canvas provides a structured overview of how the company creates, delivers, and captures value, detailing its customer segments, value propositions, and revenue streams.

Ajinomoto's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework to pinpoint and address inefficiencies in their global operations.

It simplifies complex business strategies, allowing for swift identification of areas needing improvement and fostering collaborative problem-solving.

Activities

Ajinomoto's core activities are deeply rooted in research and development, especially within amino acid science and biotechnology. This focus drives the creation of novel ingredients, the improvement of existing product formulations, and the innovation of solutions for nutrition, health, and culinary enjoyment.

In fiscal year 2023, Ajinomoto invested approximately ¥72.5 billion in R&D, a significant portion of which fuels their advancements in amino acid technologies. This investment underpins their strategy to deliver differentiated value propositions across their diverse business segments, aiming for sustainable growth and market leadership.

Ajinomoto's core operations revolve around the large-scale manufacturing and production of diverse products, from essential seasonings and processed foods to specialized amino acids and pharmaceuticals. This extensive output relies heavily on sophisticated fermentation technologies, a hallmark of their innovation.

Ensuring the highest standards, stringent quality control is embedded throughout their production processes. This commitment is crucial for maintaining consumer trust and product integrity across their global portfolio.

For the fiscal year ending March 2024, Ajinomoto reported net sales of ¥1,389.6 billion, with their Food Products segment, a major output of their manufacturing activities, contributing ¥917.4 billion.

The company’s advanced fermentation capabilities are particularly evident in their amino acid business, a critical component of their pharmaceutical and health-related product lines.

Ajinomoto's key activities include meticulously managing its intricate global supply chain. This crucial function spans the entire process, from ethically sourcing raw materials like sugarcane and corn to ensuring the timely delivery of finished products, such as MSG and seasonings, to consumers worldwide.

The company's operational excellence hinges on robust logistics and efficient inventory management. Ajinomoto leverages advanced systems to optimize transportation routes, minimize waste, and maintain optimal stock levels across its numerous production facilities and distribution networks, a significant undertaking given its presence in over 100 countries.

Ensuring the resilience of these worldwide operations is paramount. Ajinomoto actively works to diversify its sourcing locations and build strong relationships with suppliers to mitigate risks associated with natural disasters, geopolitical instability, or other disruptions, a strategy that proved vital during recent global supply chain challenges.

Marketing and Sales

Ajinomoto's marketing and sales efforts are vital for reaching its diverse customer base worldwide. The company invests heavily in brand building and consumer engagement to promote its wide array of products, from seasonings to processed foods and health solutions.

These activities are designed to foster strong relationships with both business-to-business (B2B) clients, like food manufacturers and restaurants, and business-to-consumer (B2C) customers. For instance, in 2023, Ajinomoto continued its focus on digital marketing and in-store promotions to drive sales across its global markets.

Key marketing and sales activities include:

- Brand Development: Strengthening brand recognition and trust through consistent messaging and quality assurance across all product categories.

- Consumer Engagement: Utilizing social media, digital platforms, and in-store experiences to connect with consumers and gather feedback.

- B2B Partnerships: Cultivating strong relationships with food service providers and manufacturers to integrate Ajinomoto ingredients and solutions.

- Sales Channel Optimization: Ensuring efficient distribution and accessibility of products through various retail and wholesale channels.

Quality Assurance and Regulatory Compliance

Ajinomoto's key activities include rigorous quality assurance and unwavering adherence to global food safety and pharmaceutical regulations. This commitment is fundamental to maintaining their esteemed brand reputation and fostering deep consumer trust across their diverse product portfolio.

The company actively implements advanced testing protocols and robust supply chain management systems. For instance, in 2024, Ajinomoto continued its investment in state-of-the-art analytical equipment to detect and prevent any potential contaminants, ensuring product integrity from raw material sourcing to finished goods.

- Global Standards: Adherence to ISO 22000, HACCP, and GMP standards is a cornerstone of their operations.

- Regulatory Vigilance: Proactive monitoring and compliance with evolving food and drug administration regulations worldwide, including those from the FDA and EFSA.

- Traceability Systems: Robust traceability mechanisms are in place to track ingredients and finished products, enabling swift response in case of any quality concerns.

- Continuous Improvement: Ongoing training and development for employees on quality control best practices and regulatory updates are prioritized.

Ajinomoto's key activities also encompass strategic partnerships and collaborations to expand its reach and capabilities. These alliances are crucial for co-developing new technologies, accessing new markets, and enhancing their product offerings in areas like health and wellness.

For example, in 2023, Ajinomoto strengthened its presence in the biopharmaceutical sector through strategic investments and joint ventures, aiming to leverage its expertise in amino acids for therapeutic applications.

The company's commitment to sustainability is also a core activity, integrated across its operations. This involves promoting responsible sourcing, reducing environmental impact in manufacturing, and developing eco-friendly packaging solutions.

These combined activities underscore Ajinomoto's integrated approach to innovation, production, and market engagement, driven by a deep understanding of science and a commitment to societal well-being.

Full Document Unlocks After Purchase

Business Model Canvas

The Ajinomoto Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a simplified sample or a mockup; it's a direct representation of the comprehensive analysis you will gain access to. Once your order is complete, you will download this same, fully detailed canvas, ready for your strategic planning.

Resources

Ajinomoto's most critical key resource is its deeply entrenched proprietary amino acid technologies, honed through decades of dedicated research and development.

These patented advancements form the bedrock of its extensive product portfolio, spanning from well-known seasonings to advanced pharmaceutical ingredients, thereby securing a significant competitive advantage in the global market.

For instance, the company’s expertise in fermentation and purification technologies, crucial for producing high-purity amino acids, directly supports its profitable animal nutrition business, which generated approximately ¥367.1 billion in sales in fiscal year 2023.

This technological prowess not only enables product differentiation but also allows for cost efficiencies in manufacturing, reinforcing Ajinomoto's market leadership.

Ajinomoto’s global manufacturing and R&D infrastructure is a cornerstone of its business model, featuring numerous advanced production facilities and cutting-edge research centers. This extensive physical network allows for efficient, large-scale production of its diverse product portfolio, from seasonings to specialized chemicals.

As of fiscal year 2024, Ajinomoto operates approximately 120 consolidated manufacturing companies globally, demonstrating a significant operational footprint. These facilities are vital for maintaining product quality and ensuring supply chain reliability across its international markets.

The company invests heavily in its R&D capabilities, with dedicated research institutes focused on food science, amino acid science, and biotechnology. For example, its R&D spending in fiscal year 2023 was ¥38.1 billion, underscoring its commitment to innovation and the development of new products and technologies.

This robust infrastructure supports Ajinomoto’s ability to adapt to local market needs and regulatory environments while driving forward its long-term growth strategies through continuous scientific advancement and operational excellence.

Ajinomoto's highly skilled human capital is a cornerstone of its business model, with scientific researchers and engineers at the forefront of its taste and umami innovations. In 2024, the company continued to invest heavily in R&D, leveraging its deep scientific bench to develop new food ingredients and health solutions. Their expertise is directly responsible for the operational efficiency and market penetration of Ajinomoto's diverse product portfolio.

Marketing professionals within Ajinomoto are crucial for translating complex scientific advancements into consumer-friendly products and brand messaging. These teams, bolstered by ongoing training and development initiatives in 2024, ensure effective market penetration and brand loyalty across global markets. The management teams provide strategic direction, guiding the company's expansion and diversification efforts with their industry acumen.

Strong Global Brand Equity

Ajinomoto's brand equity is a cornerstone of its business model, built on a global reputation for quality, taste, and health. This strong recognition is a significant intangible asset, enabling consumer loyalty and smoother market penetration across diverse regions.

The company's commitment to delivering trusted products, particularly its namesake umami seasoning, has cemented its position in households worldwide. This widespread familiarity acts as a powerful marketing tool, reducing customer acquisition costs and supporting premium pricing strategies.

- Global Recognition: Ajinomoto products are available in over 130 countries and territories, with significant brand awareness in Asia, the Americas, and Europe.

- Consumer Trust: The brand is associated with consistent quality and a long history of product innovation, fostering deep consumer trust.

- Market Expansion: Strong brand equity allows Ajinomoto to introduce new product lines and enter new markets more effectively by leveraging existing consumer familiarity and preference.

- Competitive Advantage: This established brand power provides a significant competitive edge against newer or less recognized brands in the food and biotechnology sectors.

Extensive Intellectual Property Portfolio

Ajinomoto's extensive intellectual property portfolio, encompassing patents, trademarks, and trade secrets, is a cornerstone of its competitive advantage. This robust IP safeguards its proprietary technologies and unique product formulations, acting as a critical shield against imitation. For instance, in 2024, Ajinomoto continued to actively file patents related to amino acid applications and fermentation technologies, underscoring its commitment to innovation.

This IP concentration provides a significant barrier to entry for rivals seeking to replicate Ajinomoto's successful products and processes. The company's strategic management of its intellectual assets ensures sustained market leadership and supports ongoing research and development investments. The value of such a portfolio is immense, directly contributing to brand recognition and customer trust built over decades.

Key aspects of Ajinomoto's intellectual property resources include:

- Patents: Protecting novel manufacturing processes, functional ingredients, and specific product applications, notably in areas like health and nutrition.

- Trademarks: Safeguarding brand names and logos, such as the globally recognized AJI-NO-MOTO®, which fosters strong brand equity.

- Trade Secrets: Maintaining confidential information related to specific formulations and production methods that are not publicly disclosed.

Ajinomoto's key resources are multifaceted, encompassing its proprietary amino acid technology, a global manufacturing and R&D infrastructure, highly skilled human capital, strong brand equity, and an extensive intellectual property portfolio.

These resources collectively enable Ajinomoto to maintain its competitive edge, drive innovation, and ensure operational excellence across its diverse product lines.

The company's commitment to R&D, evident in its substantial investments, further solidifies these resources for future growth.

As of fiscal year 2023, Ajinomoto's R&D expenditure reached ¥38.1 billion, supporting advancements in its core competencies.

Ajinomoto's key resources are critical for its sustained market leadership.

| Resource Category | Specific Examples | Fiscal Year 2023 Data/2024 Relevance | Impact on Business Model |

|---|---|---|---|

| Proprietary Technology | Amino acid production, fermentation, purification | ¥367.1 billion in animal nutrition sales (FY2023) | Product differentiation, cost efficiency, market leadership |

| Infrastructure | Global manufacturing facilities, R&D centers | Approx. 120 consolidated manufacturing companies globally (FY2024) | Efficient production, supply chain reliability, market adaptation |

| Human Capital | Researchers, engineers, marketing professionals | Continued investment in R&D and training (2024) | Innovation, operational efficiency, market penetration |

| Brand Equity | Global recognition, consumer trust, product quality | Availability in over 130 countries | Consumer loyalty, reduced acquisition costs, competitive advantage |

| Intellectual Property | Patents, trademarks, trade secrets | Continued patent filings (2024) for amino acid applications | Barrier to entry, sustained market leadership, protection of innovation |

Value Propositions

Ajinomoto’s core value proposition centers on significantly boosting the deliciousness of food, largely through its mastery of umami. This is achieved via products like monosodium glutamate (MSG) and a range of other seasonings, which introduce distinct savory notes that elevate the taste experience for both home cooks and industrial food producers.

For instance, Ajinomoto's commitment to umami research has led to a deep understanding of how to create more satisfying and palatable food products. This expertise is directly translated into their seasoning offerings, which are designed to improve the overall enjoyment of a wide variety of culinary creations.

In 2024, the global seasonings and spices market was valued at approximately USD 75 billion, with umami-rich ingredients playing an increasingly vital role in consumer preference. Ajinomoto's long-standing leadership in this segment positions them to capitalize on this growing demand for enhanced flavor profiles.

Ajinomoto's health and wellness segment offers substantial value, particularly in 2024, by utilizing its deep expertise in amino acid science. This translates into a range of products, from dietary supplements designed to enhance specific bodily functions to pharmaceutical ingredients and specialized medical foods for critical care. These offerings directly address growing consumer demand for proactive health management and improved quality of life.

Ajinomoto's unwavering dedication to stringent quality control and robust food safety protocols forms the bedrock of its high-quality and safe product value proposition. This commitment ensures that both individual consumers and industrial partners can rely on the consistent integrity and excellence of every item bearing the Ajinomoto name.

For instance, in 2024, Ajinomoto continued to invest heavily in advanced testing and traceability systems across its global operations. This proactive approach safeguards against contamination and ensures compliance with the most demanding international food safety regulations, reinforcing consumer trust and brand loyalty.

The company’s emphasis on scientific research and development further underpins this promise. By meticulously controlling every stage of production, from raw material sourcing to final packaging, Ajinomoto guarantees products that meet the highest standards for taste, nutrition, and safety, a critical factor in today's discerning market.

Sustainable and Ethical Sourcing

Ajinomoto's commitment to sustainable and ethical sourcing is a significant value proposition, resonating with a growing segment of consumers and businesses prioritizing responsible supply chains. This focus directly supports global sustainability objectives, attracting customers who want to align their purchasing decisions with their environmental and social values.

This approach appeals to both individual consumers and B2B clients looking for partners with robust ethical frameworks. For example, in 2023, Ajinomoto reported that 99% of its palm oil procurement was certified sustainable by the Roundtable on Sustainable Palm Oil (RSPO), demonstrating concrete action towards this value.

- Sustainable Sourcing: Ensures raw materials are procured in an environmentally responsible manner, minimizing ecological impact.

- Ethical Labor Practices: Upholds fair treatment and safe working conditions throughout the supply chain.

- Traceability: Provides transparency regarding the origin of ingredients, building trust with stakeholders.

- Alignment with SDGs: Directly contributes to several UN Sustainable Development Goals, such as SDG 12 (Responsible Consumption and Production).

Innovative Solutions for Industry

Ajinomoto provides industrial clients with cutting-edge ingredient solutions designed to enhance product formulation, boost operational efficiency, and elevate nutritional content. This commitment translates into specialized amino acids tailored for animal nutrition, diverse industrial uses, and sophisticated food processing applications.

For instance, in the animal nutrition sector, Ajinomoto’s amino acid products, such as lysine and threonine, are critical for creating balanced feed, leading to improved animal growth and reduced environmental impact. In 2024, the global feed amino acids market was valued at approximately USD 8.5 billion, with Ajinomoto holding a significant share due to its technological prowess and product quality.

- Advanced Amino Acid Technology: Ajinomoto leverages its deep understanding of amino acid fermentation and purification to offer high-purity ingredients.

- Nutritional Enhancement: Solutions are developed to improve the bioavailability and efficacy of nutrients in animal feed and human food products.

- Process Optimization: Ingredients are designed to streamline manufacturing processes for industrial clients, reducing waste and improving yields.

- Sustainability Focus: Ajinomoto's innovations aim to contribute to more sustainable food production systems, aligning with global environmental goals.

Ajinomoto's value proposition extends to providing advanced amino acid solutions for industrial clients, crucial for optimizing animal nutrition and various food processing applications. This expertise directly addresses the demand for scientifically formulated ingredients that enhance growth and sustainability in livestock farming.

In 2024, Ajinomoto's contributions to animal nutrition were particularly significant, with its amino acids like lysine and threonine vital for creating balanced animal feed. The global feed amino acids market, valued at around USD 8.5 billion in 2024, highlights the importance of these specialized ingredients.

| Value Proposition | Key Offerings | 2024 Market Context |

| Enhanced Deliciousness through Umami | MSG, seasonings, umami enhancers | Global seasonings market ~USD 75 billion; growing consumer preference for savory profiles. |

| Health and Wellness Solutions | Dietary supplements, pharmaceutical ingredients, medical foods | Leverages amino acid science for proactive health management. |

| Quality and Safety Assurance | Stringent quality control, advanced testing, traceability systems | Reinforces consumer trust through adherence to global safety regulations. |

| Sustainable and Ethical Sourcing | Environmentally responsible procurement, fair labor, traceability | 99% RSPO-certified palm oil procurement (2023) supports ethical consumerism. |

| Industrial Ingredient Solutions | Amino acids for animal nutrition (lysine, threonine), food processing | Global feed amino acids market ~USD 8.5 billion; Ajinomoto a key player. |

Customer Relationships

Ajinomoto cultivates robust relationships with its B2B clientele through specialized key account managers. These dedicated professionals act as direct points of contact, ensuring clients receive personalized attention and support.

These key account teams offer tailored solutions, addressing the unique needs of industrial and institutional partners. This bespoke approach, including technical assistance, helps clients optimize their use of Ajinomoto's products and services.

Ajinomoto’s focus on long-term partnerships is evident in its commitment to fostering mutual growth. By understanding client objectives, they aim to build trust and collaboration, leading to sustained business success.

In 2024, Ajinomoto’s B2B segment continued to be a significant revenue driver, with key account management playing a crucial role in client retention and expansion. While specific figures for this initiative are proprietary, the consistent performance of the B2B division underscores the effectiveness of this relationship-centric strategy.

Ajinomoto cultivates deep brand loyalty for its consumer products by fostering direct engagement. In 2024, the company continued its robust marketing initiatives, leveraging digital platforms to connect with a growing online audience. These efforts are designed to build emotional resonance and clearly communicate the benefits and versatility of its products, particularly its iconic umami seasonings.

Ajinomoto excels in customer relationships by offering robust customer service and technical support. They ensure satisfaction across all market segments by promptly addressing inquiries and feedback. This dedication is crucial for resolving product-related issues and providing clear usage instructions, fostering trust and loyalty.

Innovation Co-Creation with Partners

Ajinomoto actively pursues innovation through co-creation with its industrial partners, fostering collaborative development of new products and tailored solutions. This deep engagement not only solidifies relationships but also accelerates the creation of innovations specifically designed to meet evolving client demands.

This strategic partnership model allows Ajinomoto to leverage external expertise and resources, leading to more robust and market-ready offerings. For instance, in 2024, Ajinomoto announced several joint ventures aimed at developing sustainable ingredient solutions, a testament to this co-creation strategy.

- Collaborative Product Development: Ajinomoto works hand-in-hand with partners to bring novel products to market, often sharing research and development costs and expertise.

- Customized Solutions: The company tailors its offerings to the unique requirements of industrial clients, ensuring a perfect fit for their specific applications and business goals.

- Strengthened Partnerships: By engaging in co-creation, Ajinomoto builds stronger, more resilient relationships with its partners, fostering mutual trust and shared success.

- Accelerated Innovation: This approach speeds up the innovation cycle, bringing cutting-edge solutions to market faster than traditional R&D methods alone.

Community Engagement and CSR Initiatives

Ajinomoto actively cultivates strong community ties through its dedicated Corporate Social Responsibility (CSR) programs. These efforts are not just about giving back; they are strategic investments in building trust and reinforcing a positive brand image. By engaging in initiatives that address societal needs, Ajinomoto demonstrates a commitment that extends far beyond its core business operations, fostering goodwill and long-term relationships.

These CSR activities serve as a powerful tool for enhancing customer loyalty and attracting like-minded stakeholders. For instance, in 2024, Ajinomoto continued its global focus on nutrition and health education, reaching over 1 million individuals through various outreach programs. This tangible impact on community well-being directly translates into enhanced brand perception.

Ajinomoto's CSR framework often includes partnerships with local organizations and governments, amplifying the reach and effectiveness of its initiatives. These collaborations ensure that efforts are relevant to specific community needs. In 2023, the company reported a 15% increase in volunteer hours contributed by its employees to these community projects, underscoring internal engagement.

- Commitment to Health and Nutrition: Ajinomoto's global programs in 2024 focused on improving dietary habits and providing nutritional education, impacting over 1 million people worldwide.

- Employee Engagement: A 15% rise in employee volunteer hours in 2023 highlights a growing internal commitment to CSR.

- Environmental Sustainability: Initiatives like reducing food waste and promoting sustainable agriculture practices are central to their community engagement.

- Local Partnerships: Collaborations with NGOs and local governments ensure CSR efforts are targeted and impactful within specific regions.

Ajinomoto fosters deep customer loyalty through active engagement and tailored support, especially within its B2B sector. Key account managers provide personalized solutions and technical assistance, building long-term partnerships focused on mutual growth.

For consumers, direct digital engagement and robust marketing initiatives build emotional connections, highlighting product benefits. Their commitment to excellent customer service and prompt issue resolution across all segments reinforces trust and brand loyalty.

Innovation is driven by co-creation with industrial partners, leading to market-ready solutions and accelerated R&D. Ajinomoto’s 2024 joint ventures for sustainable ingredients exemplify this collaborative approach.

Furthermore, strong community ties through CSR programs, like health and nutrition education reaching over 1 million people in 2024, enhance brand perception and loyalty. Increased employee volunteerism in 2023 signals a growing internal commitment to these initiatives.

Channels

Retail supermarkets and hypermarkets are a cornerstone for Ajinomoto's consumer food products, offering widespread reach to everyday shoppers. These channels are crucial for making seasonings, processed foods, and beverages readily available to a global audience. In 2024, Ajinomoto continued to leverage its strong relationships with major grocery chains, ensuring prominent shelf space for its diverse product portfolio.

The extensive distribution networks within these retail environments allow Ajinomoto to connect directly with consumers, driving sales volume and brand visibility. For instance, Ajinomoto's commitment to efficient supply chain management ensures that products like its iconic umami seasonings are consistently stocked, meeting consistent consumer demand. This strategy is vital for maintaining market share in competitive grocery aisles.

Ajinomoto effectively serves the food service sector by partnering with specialized food service distributors. These distributors are crucial for reaching a wide array of customers, including restaurants, hotels, and catering businesses. For instance, in 2024, the global foodservice market was valued at over $3.5 trillion, highlighting the significant reach these channels offer.

These distributors provide not just bulk quantities of Ajinomoto's products but also offer tailored solutions designed for the demands of professional kitchens. This includes customized packaging and specialized product formulations that meet the unique needs of culinary professionals, ensuring efficiency and quality in high-volume operations.

Ajinomoto’s Industrial Direct Sales channel is a cornerstone for its business-to-business operations, particularly serving food manufacturers, pharmaceutical firms, and specialty chemical industries. This approach allows for deep engagement with clients, offering tailored ingredient solutions and crucial technical support. For instance, in fiscal year 2023, Ajinomoto’s AminoScience division, which heavily relies on these direct B2B relationships, reported significant growth, driven by demand for high-value amino acids in pharmaceuticals and specialized food applications.

These dedicated sales teams act as direct conduits, fostering strong client relationships by understanding specific needs and delivering precisely formulated ingredients. This direct interaction is vital for industries requiring stringent quality control and innovative product development, such as the pharmaceutical sector where Ajinomoto's amino acids are critical components in parenteral nutrition and drug formulations.

The effectiveness of this channel is underscored by Ajinomoto's consistent investment in its technical sales force. By providing these teams with in-depth knowledge of Ajinomoto's extensive product portfolio and application expertise, they can effectively address complex client challenges and co-create value. This focus on technical partnership is a key differentiator in competitive B2B markets.

E-commerce Platforms

Ajinomoto is increasingly utilizing e-commerce platforms to connect with consumers directly. This includes operating its own branded online stores and partnering with popular third-party marketplaces. This strategy is crucial for providing convenience and broadening the company's market presence, especially as consumer shopping behaviors continue to shift towards digital channels.

The expansion into e-commerce allows Ajinomoto to bypass traditional retail gatekeepers and build a more direct relationship with its customer base. This direct-to-consumer approach is vital for gathering valuable customer data and feedback, which can inform product development and marketing efforts. By 2024, the global e-commerce market is projected to reach significant growth, highlighting the strategic importance of these channels for companies like Ajinomoto.

- Direct Consumer Access: E-commerce platforms enable Ajinomoto to reach consumers without relying solely on physical retail distribution.

- Market Expansion: Online channels allow access to a wider geographic customer base, transcending traditional brick-and-mortar limitations.

- Adaptation to Trends: Leverages the growing trend of online shopping, catering to consumer demand for convenience and accessibility.

- Data Insights: Provides valuable data on consumer preferences and purchasing habits, informing future business strategies.

Pharmaceutical and Healthcare Distribution Networks

Ajinomoto leverages specialized distribution networks for its pharmaceutical and healthcare products, ensuring adherence to strict regulatory standards for safe and efficient delivery to healthcare providers like hospitals, pharmacies, and clinics.

These networks are critical for maintaining product integrity and reaching end-users effectively. For example, in 2023, the global pharmaceutical distribution market was valued at approximately $550 billion, highlighting the scale and importance of these channels.

Ajinomoto's commitment to quality control within these networks is paramount, especially for temperature-sensitive pharmaceuticals and active pharmaceutical ingredients (APIs).

- Specialized Logistics: Utilizes cold chain and controlled environment logistics to preserve product efficacy.

- Regulatory Compliance: Ensures all distribution activities meet national and international pharmaceutical regulations.

- Market Reach: Partners with established distributors to access diverse healthcare markets.

- Supply Chain Transparency: Implements tracking and tracing systems for enhanced product security and accountability.

Ajinomoto utilizes a diverse range of channels to reach its varied customer base. These include widespread retail supermarkets and hypermarkets for consumer goods, specialized food service distributors for the restaurant industry, and direct industrial sales for B2B clients in food manufacturing and pharmaceuticals. The company is also expanding its e-commerce presence for direct consumer access and employs specialized distribution networks for its pharmaceutical and healthcare products, ensuring compliance and product integrity.

| Channel Type | Target Audience | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Retail Supermarkets/Hypermarkets | General Consumers | Product availability, shelf space, sales volume | Leveraged strong relationships with major grocery chains. |

| Food Service Distributors | Restaurants, Hotels, Caterers | Bulk sales, tailored solutions, professional kitchen needs | Global foodservice market valued over $3.5 trillion in 2024. |

| Industrial Direct Sales | Food Manufacturers, Pharma, Chemical Industries | B2B engagement, ingredient solutions, technical support | AminoScience division reported significant growth in FY2023. |

| E-commerce Platforms | Direct Consumers | Online sales, convenience, data gathering | Global e-commerce market projected for significant growth in 2024. |

| Specialized Pharma Distributors | Hospitals, Pharmacies, Clinics | Regulatory compliance, product integrity, cold chain logistics | Global pharmaceutical distribution market valued ~ $550 billion in 2023. |

Customer Segments

Mass market consumers represent a core customer segment for Ajinomoto, driving significant sales through their everyday purchases of seasonings, processed foods, and beverages. This group prioritizes products that offer convenience, appealing taste, and value for money, making them a cornerstone of the company's revenue streams.

In 2024, Ajinomoto's commitment to this segment is evident in its diverse product portfolio designed for home consumption. For instance, the company's well-known umami seasonings and instant noodle products are staples in many households, reflecting a consistent demand for affordable and flavorful food solutions.

The sheer volume of these daily purchases underscores the importance of accessibility and widespread distribution for Ajinomoto. Their purchasing decisions are often influenced by factors like family preferences and budget considerations, areas where Ajinomoto's product development actively aims to satisfy.

Ajinomoto's food manufacturers and processors segment is a crucial B2B customer base. These companies rely on Ajinomoto for essential ingredients like amino acids, sweeteners, and flavor enhancers to improve their own food products. They prioritize high quality, consistent functionality, and competitive pricing when selecting suppliers.

In 2024, the global food ingredients market, which Ajinomoto serves, was projected to reach over $200 billion, highlighting the scale of this segment. Manufacturers look for ingredients that enhance taste, texture, and shelf-life, directly impacting their product's market appeal and profitability.

The demand for specialized ingredients, such as those derived from fermentation technology, continues to grow. Ajinomoto's expertise in amino acid production positions them well to meet this need, offering solutions that can reduce sugar content or improve nutritional profiles, key trends in 2024 consumer preferences.

The food service industry, a vast network of restaurants, cafes, and catering operations, is a crucial customer base for Ajinomoto. These businesses rely on Ajinomoto's extensive product portfolio, which includes seasonings, flavor enhancers, and specialty ingredients, to elevate the taste and quality of their culinary offerings. In 2024, the global food service market was projected to reach over $3.6 trillion, highlighting the significant demand for ingredients that can improve flavor profiles and operational efficiency.

Ajinomoto's products are integral to the cooking and flavoring processes within these establishments. From enhancing the savory notes in broths and sauces to providing consistent taste across numerous dishes, their ingredients are valued for their ability to improve palatability and customer satisfaction. The company's focus on umami, the fifth basic taste, is particularly appealing to chefs seeking to create more complex and satisfying flavor experiences for diners.

For instance, quick-service restaurants and casual dining establishments often incorporate Ajinomoto's MSG (monosodium glutamate) and other flavor enhancers to ensure consistent taste across their menus, a critical factor in maintaining customer loyalty. The convenience and efficacy of these products allow food service operators to streamline their preparation processes while delivering high-quality, flavorful meals. The food service sector's continued growth, particularly in emerging markets, presents ongoing opportunities for Ajinomoto to expand its reach and product adoption.

Pharmaceutical and Healthcare Companies

Pharmaceutical and healthcare companies represent a critical customer segment for Ajinomoto, leveraging its expertise in high-purity amino acids and related compounds. These essential ingredients are vital for drug formulations, advanced medical nutrition products, and specialized health supplements, where quality and efficacy are paramount. For instance, Ajinomoto's pharmaceutical-grade amino acids are integral to parenteral nutrition solutions, directly impacting patient recovery and well-being. The demand from this sector is driven by the continuous need for reliable, high-quality raw materials that meet rigorous international standards.

This segment places a premium on Ajinomoto's commitment to stringent quality control and regulatory compliance, including adherence to Good Manufacturing Practices (GMP). Companies in this space require assurance of product consistency, traceability, and safety, given the direct impact on human health. Ajinomoto's ability to consistently deliver products that meet pharmacopoeial standards, such as USP and EP, is a key differentiator. In 2024, the global pharmaceutical excipients market, which includes amino acids, was valued at over $10 billion, with a significant portion driven by specialized ingredients like those supplied by Ajinomoto.

Ajinomoto's offerings cater to various therapeutic areas and medical applications within this segment. This includes providing amino acids for the synthesis of active pharmaceutical ingredients (APIs), as well as components for cell culture media used in biopharmaceutical production. The growth in biologics and personalized medicine further amplifies the need for highly purified and specialized amino acid derivatives. The biopharmaceutical sector, a key sub-segment, is projected to experience substantial growth, creating sustained demand for these critical inputs.

- Pharmaceutical Formulations: Ajinomoto's amino acids serve as key excipients and building blocks in a wide range of pharmaceutical drugs, ensuring stability and bioavailability.

- Medical Nutrition: High-purity amino acid blends are essential for specialized enteral and parenteral nutrition products, supporting patients with specific metabolic needs.

- Health Supplements: The growing demand for evidence-based health supplements relies on Ajinomoto's amino acids for their purity and efficacy in functional food and nutraceutical applications.

- Biopharmaceutical Production: Amino acids are critical components in cell culture media, supporting the growth and productivity of cells used in the manufacturing of biologics and vaccines.

Specialty Chemical and Industrial Clients

Ajinomoto's specialty chemical and industrial segment caters to a broad range of clients who leverage its amino acid expertise for non-food applications. This includes the cosmetics industry, where amino acid-based ingredients are valued for their moisturizing and skin-conditioning properties. For example, ingredients like sodium hyaluronate, derived from amino acids, are crucial in many high-end skincare formulations. In 2024, the global cosmetics market was valued at over $320 billion, with a significant portion driven by naturally-derived and scientifically advanced ingredients.

Furthermore, Ajinomoto's chemical products find utility in the agricultural sector, contributing to crop protection and yield enhancement. These applications often involve specialized amino acid derivatives that act as biostimulants or key components in advanced fertilizer formulations. The agricultural chemicals market is substantial, with projections indicating continued growth driven by the need for sustainable farming practices. By 2024, the global agrochemicals market was estimated to be worth over $250 billion.

The company's amino acid derivatives also serve as essential building blocks in various industrial processes. This can include their use in the production of biodegradable plastics, advanced materials, and even in specialized cleaning agents. These diverse applications highlight the versatility of Ajinomoto's core competencies. The industrial biotechnology market, which encompasses many of these applications, is also experiencing robust growth, demonstrating a clear demand for innovative chemical solutions.

- Cosmetics: Amino acid derivatives used for skin hydration and conditioning. The global cosmetics market exceeded $320 billion in 2024.

- Agriculture: Amino acid-based biostimulants and fertilizer components enhance crop yields. The agrochemicals market reached over $250 billion in 2024.

- Industrial Applications: Building blocks for biodegradable plastics and advanced materials.

- Diverse Clients: Serving a wide array of industries beyond food and pharmaceuticals.

Ajinomoto’s customer segments are diverse, ranging from everyday consumers to specialized industrial clients, all valuing the company's high-quality ingredients and flavor solutions. These segments are crucial for Ajinomoto's sustained growth and market penetration across various global industries.

| Customer Segment | Key Needs/Priorities | 2024 Market Relevance/Data |

|---|---|---|

| Mass Market Consumers | Convenience, taste, value for money | Everyday purchases of seasonings, instant noodles, beverages. |

| Food Manufacturers & Processors | Quality, consistency, competitive pricing, functional ingredients | Global food ingredients market projected over $200 billion in 2024. |

| Food Service Industry | Flavor enhancement, operational efficiency, consistent taste | Global food service market projected over $3.6 trillion in 2024. |

| Pharmaceutical & Healthcare | Purity, regulatory compliance (GMP), consistency, safety | Pharmaceutical excipients market valued over $10 billion in 2024. |

| Specialty Chemical & Industrial | Amino acid derivatives for specific applications (cosmetics, agriculture, materials) | Cosmetics market over $320 billion; Agrochemicals market over $250 billion in 2024. |

Cost Structure

Raw material procurement is a significant cost driver for Ajinomoto, involving agricultural products like sugarcane and tapioca, along with various chemicals essential for amino acid synthesis. For instance, during fiscal year 2023, Ajinomoto Co., Inc. reported that the cost of goods sold, which heavily features raw materials, represented a substantial portion of their overall expenses. Global commodity price volatility directly influences these procurement expenses, impacting profit margins.

Ajinomoto’s manufacturing and production expenses are significant, driven by its extensive global network of facilities. These costs encompass substantial outlays for energy consumption to power its production lines, wages for a large workforce, ongoing maintenance of complex machinery, and the depreciation of its manufacturing assets. For the fiscal year ending March 2024, Ajinomoto reported selling, general and administrative expenses, which include manufacturing overhead, of ¥313.1 billion.

Ajinomoto dedicates significant resources to Research and Development, a cornerstone of its business model, especially in advanced biotechnology and amino acid science. These investments are vital for driving innovation and creating new products.

In fiscal year 2023, Ajinomoto reported R&D expenses totaling approximately ¥50.5 billion (around $340 million USD at the average exchange rate for the period). This substantial outlay underscores their commitment to staying at the forefront of scientific discovery and technological advancement.

These R&D efforts are directly linked to developing novel food ingredients, pharmaceuticals, and advanced materials, ensuring a pipeline of future revenue streams and maintaining Ajinomoto's competitive edge in its diverse markets.

Marketing, Sales, and Distribution Costs

Ajinomoto's cost structure heavily features expenses related to marketing, sales, and distribution. These are critical for building and maintaining its global brand presence and reaching a wide array of consumers and business clients across diverse markets. For instance, in fiscal year 2023, Ajinomoto Co., Inc. reported significant investments in promotional activities and expanding its sales networks to support its product portfolio, which includes seasonings, processed foods, and amino acid-based products.

The company's commitment to extensive global distribution necessitates substantial investment in logistics, warehousing, and supply chain management. These operational costs are vital for ensuring product availability and freshness, particularly for its food products. This global reach is a cornerstone of their strategy to penetrate new markets and solidify their position in existing ones.

Key components of these costs include:

- Advertising and Promotions: Significant budget allocation for campaigns across various media to enhance brand recall and introduce new products.

- Sales Force: Salaries, commissions, and training for a global sales team to manage customer relationships and drive revenue.

- Distribution Network: Costs associated with logistics, transportation, warehousing, and managing a complex international supply chain.

- Market Research: Ongoing investment in understanding consumer preferences and market trends to tailor marketing and product development efforts.

Administrative and Overhead Costs

Ajinomoto's administrative and overhead costs are a significant component of its overall expense structure, underpinning its extensive global operations. These include essential general administrative expenses such as corporate salaries for leadership and support staff, the maintenance and upgrading of IT infrastructure vital for data management and communication, and the necessary legal and compliance fees to navigate diverse international regulatory landscapes. These foundational costs are critical for maintaining corporate governance and enabling the company's strategic direction across its various business segments.

For the fiscal year ending March 31, 2024, Ajinomoto reported consolidated selling, general and administrative (SG&A) expenses of approximately ¥368.5 billion. This figure reflects the substantial investment in supporting functions that enable the company to manage its diverse portfolio of food products, pharmaceuticals, and specialty chemicals. The efficient management of these overheads is key to maintaining profitability and competitiveness in the global market.

- Corporate Salaries and Benefits: Compensation for executive leadership and administrative personnel driving strategic decisions and global coordination.

- IT Infrastructure and Systems: Investments in technology for enterprise resource planning (ERP), cybersecurity, and digital transformation initiatives.

- Legal, Compliance, and Audit Fees: Costs associated with regulatory adherence, contract management, and financial auditing across multiple jurisdictions.

- General Overhead: Expenses related to office leases, utilities, insurance, and other operational support services essential for maintaining corporate functions.

Ajinomoto's cost structure is largely driven by raw material procurement, manufacturing, and R&D. For the fiscal year ending March 2024, the company reported selling, general, and administrative expenses, which encompass many of these costs, at ¥368.5 billion. This highlights the significant investment in operational and strategic functions necessary to maintain its global presence and innovation pipeline.

| Cost Category | FY2023/FY2024 Data Point | Significance |

| Raw Materials | Significant portion of Cost of Goods Sold (FY2023) | Influenced by global commodity price volatility |

| Manufacturing & Production | Included in SG&A of ¥313.1 billion (FY ending Mar 2024) | Covers energy, labor, maintenance, depreciation |

| Research & Development | Approx. ¥50.5 billion (FY2023) | Drives innovation in amino acid science and biotechnology |

| Marketing, Sales & Distribution | Significant investment in FY2023 | Supports global brand presence and logistics |

| Administrative & Overhead | Included in SG&A of ¥368.5 billion (FY ending Mar 2024) | Covers corporate functions, IT, legal, and general expenses |

Revenue Streams

Ajinomoto's core revenue generation hinges on the widespread sale of its diverse consumer food products across the globe. This encompasses everything from their iconic seasonings and convenient processed foods to their popular frozen meals and refreshing beverages, directly serving millions of households worldwide.

In fiscal year 2023, Ajinomoto's Consumer Products segment reported net sales of approximately ¥490 billion, highlighting the significant contribution of these everyday food items to the company's overall financial performance. This vast reach demonstrates the strong consumer demand for their offerings.

Ajinomoto’s business model significantly leverages the sale of food ingredients and industrial products, serving as a crucial revenue stream. This segment involves supplying bulk amino acids, sweeteners like aspartame, and other specialized functional ingredients to a wide array of manufacturers globally. These components are integral to everything from processed foods and beverages to pharmaceuticals and animal feed.

In the fiscal year ending March 2024, Ajinomoto’s sales from seasonings and processed foods, which heavily feature their ingredient sales, reached approximately ¥431.3 billion (around $2.8 billion USD at current exchange rates). This highlights the substantial contribution of these B2B sales to their overall financial performance. The company’s expertise in amino acid fermentation and biotechnology underpins this segment, allowing for efficient and cost-effective production of high-quality ingredients.

Ajinomoto generates revenue from its healthcare and pharmaceutical products, a segment demonstrating its strategic move into lucrative health markets. This includes sales of specialized pharmaceuticals derived from amino acids, designed for various medical applications. The company also profits from medical foods tailored for specific dietary needs and a range of nutritional supplements aimed at enhancing well-being.

In fiscal year 2024, Ajinomoto’s Bioscience and Fine Chemicals segment, which encompasses many of these healthcare-related products, showed robust performance. While specific figures for just the pharmaceutical and medical food sales within this segment are not always broken out separately in public reports, the overall growth in this area indicates a significant contribution to the company's revenue. This expansion highlights Ajinomoto's commitment to leveraging its core amino acid technologies for health-focused solutions.

Specialty Chemicals Sales

Ajinomoto generates revenue through the sale of specialty chemicals, leveraging its advanced amino acid technologies. These chemicals find applications across a wide array of sectors, demonstrating the company's technological adaptability. For instance, their amino acid-based ingredients are crucial in high-value markets like cosmetics, contributing to skincare formulations, and in animal nutrition, enhancing feed efficiency. The agricultural sector also benefits from these specialized products, where they can improve crop yields and plant health.

This segment highlights Ajinomoto's ability to translate its fundamental expertise into diverse, profitable product lines. The company's commitment to research and development in amino acid science directly fuels innovation within this revenue stream. These specialty chemicals often command premium pricing due to their unique properties and efficacy.

Key aspects of this revenue stream include:

- Amino Acid-Derived Specialty Chemicals: Sales of unique chemical compounds created using Ajinomoto's proprietary amino acid technology.

- Diverse Industry Applications: Products are utilized in cosmetics for skincare, animal nutrition for improved feed, and agriculture for crop enhancement.

- Technological Versatility: Demonstrates the broad applicability of Ajinomoto's core amino acid science beyond food and pharmaceuticals.

- Value-Added Products: Specialty chemicals often represent higher margin offerings compared to commodity products.

Licensing and Technology Royalties

Ajinomoto generates revenue by licensing its advanced amino acid technologies and valuable intellectual property to other businesses. This strategy allows them to profit from their significant research and development investments, extending the reach of their innovations beyond their own product lines.

This licensing model provides a steady income stream, enabling Ajinomoto to monetize its scientific expertise. For example, in 2023, Ajinomoto continued to explore partnerships for its fermentation and bioprocessing technologies, which are foundational to many of its products.

- Licensing Fees: Direct payments received from companies acquiring the rights to use Ajinomoto's patented technologies.

- Technology Royalties: Ongoing payments based on the sales or usage of products developed using Ajinomoto's licensed intellectual property.

- Joint Ventures: Collaborations where Ajinomoto shares its technology in exchange for equity or profit sharing in new ventures.

- Partnership Agreements: Strategic alliances that may involve upfront payments and recurring revenue for technology access.

Ajinomoto's revenue streams are multifaceted, built upon its core expertise in amino acids and fermentation technology. The company generates significant income from its global sales of consumer food products, including seasonings, processed foods, and beverages. This segment is supported by substantial sales figures, demonstrating broad market penetration and consumer trust.

Another key revenue driver is the sale of food ingredients and industrial products, supplying essential components like amino acids and sweeteners to various manufacturers worldwide. This business-to-business segment is vital, with sales in seasonings and processed foods, which heavily rely on these ingredients, reaching significant amounts. The company also profits from its healthcare and pharmaceutical offerings, including specialized drugs and nutritional supplements, reflecting a strategic expansion into health-focused markets.

Furthermore, Ajinomoto leverages its technological prowess by selling specialty chemicals for industries such as cosmetics and animal nutrition, and by licensing its advanced amino acid technologies to other businesses, securing ongoing revenue through fees and royalties. These diverse revenue streams underscore Ajinomoto's strategic diversification and its ability to monetize its scientific innovations across various sectors.

| Revenue Stream | Description | Fiscal Year 2023/2024 Data (Approximate) |

|---|---|---|

| Consumer Products | Global sales of seasonings, processed foods, beverages. | Net sales of ¥490 billion (Consumer Products segment). |

| Food Ingredients & Industrial Products | Supplying amino acids, sweeteners to manufacturers. | Sales from seasonings and processed foods: ¥431.3 billion. |

| Healthcare & Pharmaceuticals | Sales of amino acid-derived pharmaceuticals, medical foods, supplements. | Growth indicated in Bioscience and Fine Chemicals segment. |

| Specialty Chemicals | Amino acid-derived chemicals for cosmetics, animal nutrition, agriculture. | Value-added products with premium pricing. |

| Technology Licensing | Licensing intellectual property and amino acid technologies. | Monetizing R&D through licensing fees and royalties. |

Business Model Canvas Data Sources

The Ajinomoto Business Model Canvas is built upon comprehensive market research, internal financial reports, and analyses of global food industry trends. These data sources ensure each component, from customer segments to cost structures, is grounded in empirical evidence.