Ajinomoto Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

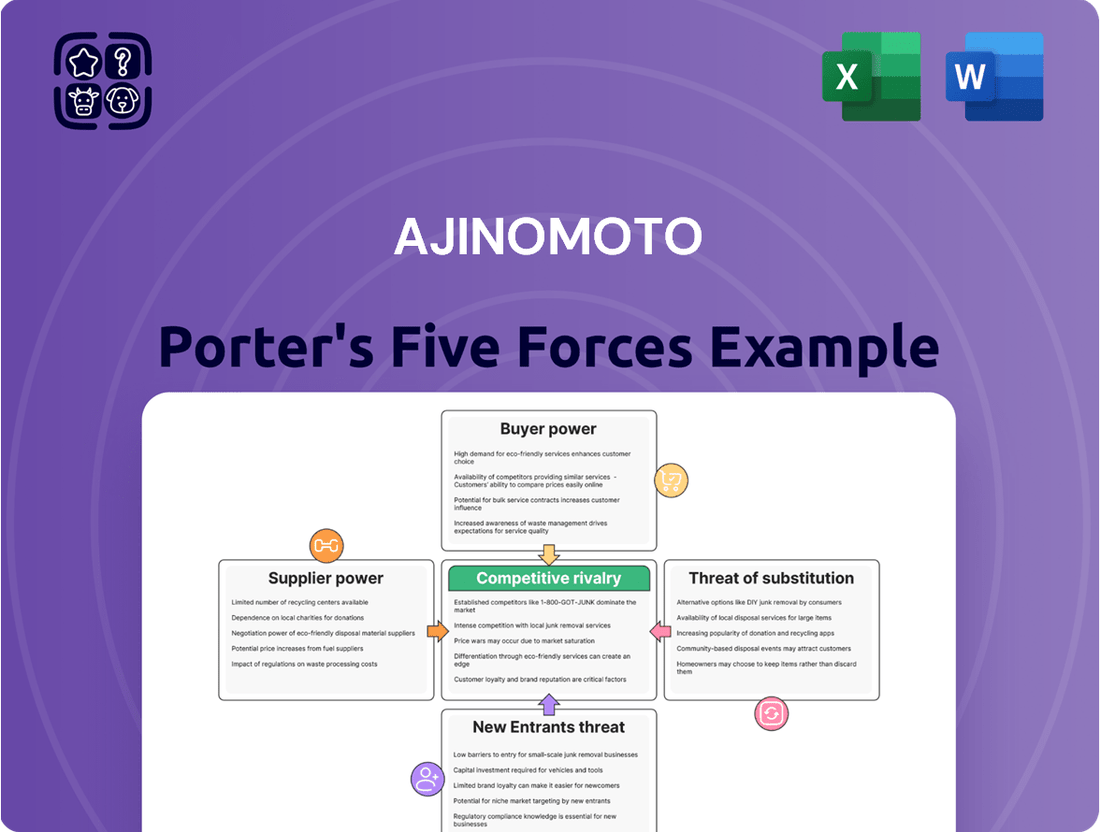

Ajinomoto navigates a complex global food and biotechnology landscape, where understanding competitive pressures is paramount. Our analysis reveals how buyer power, supplier leverage, and the threat of new entrants shape its market. We also examine the intensity of rivalry among existing competitors and the ever-present threat of substitute products. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Ajinomoto’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ajinomoto's reliance on a concentrated group of suppliers for key raw materials significantly influences supplier bargaining power. For instance, the agricultural sector, supplying essential ingredients for their vast seasoning and food product lines, can exert pressure if few dominant players control supply. Similarly, specialized chemical producers for amino acids and pharmaceutical intermediates represent a critical vulnerability.

While Ajinomoto's considerable global presence enables them to diversify sourcing and negotiate from a position of strength, the power of suppliers can escalate for highly specialized or proprietary inputs. For example, if a unique fermentation technology relies on a single chemical compound from a limited number of manufacturers, those suppliers gain substantial leverage, potentially impacting Ajinomoto's cost of goods sold and production stability.

Ajinomoto faces significant switching costs when changing ingredient suppliers. These costs include the expense and time required for re-validating new ingredients to ensure they meet stringent quality and taste profiles, which is crucial for their food and health product lines. For instance, the process of ensuring a new amino acid source meets the same exacting standards as their current suppliers can take months and involve extensive laboratory testing.

Logistical adjustments are another hurdle. Reconfiguring supply chains, updating inventory management systems, and potentially establishing new relationships with transportation providers add further complexity and cost. These operational shifts can disrupt production schedules, impacting Ajinomoto's ability to meet demand reliably.

The potential impact on product quality and regulatory compliance is a major concern. Introducing a new supplier's ingredient might necessitate recertification processes, especially for products intended for pharmaceutical or specialized nutritional applications. Failure to maintain consistent quality or meet regulatory standards could lead to product recalls or loss of market trust, making suppliers with proven track records highly valuable.

These high switching costs effectively empower Ajinomoto's existing suppliers. It limits the company's flexibility to aggressively negotiate prices or seek out cheaper alternatives, as the cost and risk of switching often outweigh potential short-term savings. This leverage is amplified when suppliers provide unique or specialized amino acid inputs, or ingredients that meet pharmaceutical-grade specifications, where alternative sources are scarce.

The availability of substitute raw materials significantly impacts the bargaining power of Ajinomoto's suppliers. If Ajinomoto can readily source alternative inputs for its core products like seasonings and processed foods, the leverage held by any single supplier is reduced. For example, many common food ingredients have multiple global producers, making it easier for Ajinomoto to switch suppliers if pricing or terms become unfavorable.

However, Ajinomoto's reliance on proprietary amino acid technologies presents a different scenario. For these specialized inputs, the uniqueness and complexity of production can limit the availability of substitutes. In 2024, Ajinomoto's advanced fermentation technologies, particularly for specific high-value amino acids used in pharmaceuticals and specialized nutrition, meant that suppliers with exclusive or highly developed processes could command greater power due to the limited alternatives available.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Ajinomoto’s business presents a significant concern. Imagine a major agricultural producer, a key supplier of raw materials, deciding to start processing their own food products. Similarly, a chemical company could begin developing its own pharmaceutical ingredients, directly competing with Ajinomoto’s offerings. This potential for forward integration by suppliers directly amplifies their bargaining power.

This strategic move by suppliers creates a direct competitive challenge, forcing Ajinomoto to potentially face its own suppliers as rivals. While this threat might be less pronounced for suppliers of bulk, commoditized raw materials, it becomes a more substantial consideration when dealing with specialized inputs or proprietary technologies.

- Forward Integration Risk: Key suppliers may enter Ajinomoto's market, transforming from raw material providers to direct competitors.

- Increased Bargaining Power: This capability inherently strengthens suppliers' leverage in negotiations with Ajinomoto.

- Industry Impact: A supplier's entry can disrupt Ajinomoto's market share and pricing strategies.

- Specialized Inputs: The threat is more acute for suppliers of unique or technologically advanced components.

Importance of Ajinomoto to Suppliers

Ajinomoto's substantial purchasing volume significantly impacts its suppliers' bargaining power. For many, especially smaller or niche producers, Ajinomoto represents a major client, often accounting for a considerable percentage of their output. This reliance naturally diminishes their ability to dictate terms, as losing Ajinomoto's business could be detrimental.

Consider the agricultural sector, a key supplier base for Ajinomoto's core ingredients like tapioca and sugarcane. In 2024, global commodity prices for these staples experienced volatility. For instance, tapioca prices saw fluctuations due to weather patterns and changing demand in other industries. Suppliers heavily dependent on Ajinomoto's consistent orders found themselves with less leverage to push for higher prices, especially when faced with Ajinomoto’s scale.

Conversely, if Ajinomoto constitutes only a minor part of a very large, diversified supplier's overall revenue, its bargaining power is naturally reduced. Such suppliers, perhaps global chemical manufacturers or large-scale logistics providers, have multiple other customers and are less susceptible to Ajinomoto’s demands. Their scale and market position allow them to maintain stronger negotiating stances.

- Ajinomoto's substantial procurement volume: This makes it a critical customer for many suppliers, thereby reducing their individual bargaining power.

- Supplier dependency on Ajinomoto: For smaller or specialized suppliers, Ajinomoto's orders can represent a significant portion of their revenue, limiting their ability to negotiate favorable terms.

- Diversified suppliers: For very large suppliers where Ajinomoto is a small client, Ajinomoto's leverage is diminished due to the supplier's broader customer base.

- Commodity price impact: Fluctuations in raw material prices, as seen in agricultural commodities in 2024, can influence the negotiation dynamics between Ajinomoto and its suppliers.

Suppliers' bargaining power is a key factor for Ajinomoto, especially concerning specialized amino acids and agricultural inputs like tapioca and sugarcane. In 2024, fluctuations in agricultural commodity prices, such as tapioca, gave Ajinomoto leverage over suppliers heavily reliant on its consistent orders.

However, Ajinomoto's substantial purchasing volume can also empower suppliers if they are large and diversified, making Ajinomoto a smaller client. Conversely, for smaller suppliers, Ajinomoto's significant orders limit their ability to dictate terms.

High switching costs, including re-validation of ingredients for quality and taste profiles, further strengthen the position of Ajinomoto's existing suppliers, particularly for unique or pharmaceutical-grade inputs where alternatives are scarce.

The threat of forward integration by suppliers, especially in specialized chemical or agricultural sectors, also increases their leverage, potentially turning them into direct competitors.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ajinomoto's global food and amino acid businesses.

Effortlessly analyze Ajinomoto's competitive landscape, revealing key threats and opportunities to guide strategic adjustments.

Customers Bargaining Power

Ajinomoto's customer base is diverse, spanning large industrial clients and individual consumers. For its business-to-business (B2B) segment, major food manufacturers and pharmaceutical companies that buy significant quantities of amino acids and other ingredients hold considerable sway. Their large order volumes and the feasibility of switching suppliers mean they can negotiate favorable terms.

While individual consumers in the business-to-consumer (B2C) market have limited individual power, this power is amplified when aggregated by large retail chains. These retailers, acting as intermediaries, can exert pressure on Ajinomoto by demanding better pricing or promotional support due to the sheer volume of goods they move.

In 2024, the global amino acid market, a key area for Ajinomoto, was projected to reach over $30 billion, with significant portions driven by large B2B purchases. This market size underscores the importance of these major clients, whose purchasing decisions can significantly impact Ajinomoto's revenue and pricing strategies.

The bargaining power of Ajinomoto's customers is significantly influenced by switching costs. For business-to-business clients, particularly those using specialized amino acids in pharmaceuticals or unique food formulations, these costs can be substantial. Consider the impact of reformulating a drug or a complex food product; this involves not only R&D expenses but also navigating rigorous regulatory re-approvals, making a switch from an established supplier like Ajinomoto a costly and time-consuming endeavor. This high switching cost inherently limits the power these B2B customers wield.

Conversely, for Ajinomoto's consumer-facing products, such as seasonings and processed foods, switching costs are typically very low. Consumers can easily opt for competing brands based on price, taste, or perceived health benefits. This ease of switching empowers individual consumers, allowing them to exert considerable pressure on Ajinomoto through their purchasing decisions. For instance, a minor price increase on a popular seasoning could lead to a swift migration to a competitor's offering, demonstrating the low switching costs and high customer power in this segment.

The bargaining power of Ajinomoto's customers is significantly influenced by the availability of substitute products. In the vast processed food and seasoning markets, consumers and businesses have a plethora of alternative brands and ingredients, granting them considerable leverage. This wide array of choices means customers can easily switch if they find prices too high or quality lacking.

However, Ajinomoto's specialized segments, such as certain amino acid-based solutions for pharmaceuticals or high-performance materials, present a different picture. In these niche areas, the availability of direct substitutes can be limited, thereby diminishing customer bargaining power. For instance, in the pharmaceutical ingredients sector, rigorous testing and regulatory approvals can make switching suppliers costly and time-consuming.

The global food ingredients market, where Ajinomoto operates extensively, is projected to reach USD 72.7 billion by 2025, according to Grand View Research, highlighting the competitive landscape. This broad market size underscores the constant pressure from substitutes in the more commoditized segments of Ajinomoto's business.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large B2B clients, can significantly bolster their bargaining power against suppliers like Ajinomoto. If a major food manufacturer, for instance, possesses the scale and financial muscle to develop its own flavor enhancers or other core ingredients, it lessens its reliance on external providers.

This potential for insourcing means customers can credibly threaten to produce these components themselves, forcing Ajinomoto to maintain competitive pricing and service levels. In 2024, for example, global food and beverage companies continue to invest heavily in R&D, with many exploring proprietary ingredient development to gain a competitive edge and control their supply chains.

- Increased Customer Leverage: Customers can leverage the threat of backward integration to negotiate better terms, including lower prices and more favorable contract conditions.

- Focus on Value Addition: Ajinomoto must continuously demonstrate its unique value proposition beyond just ingredient supply, perhaps through innovation, technical support, or customized solutions.

- Market Dynamics: The growing trend of vertical integration within the food industry, driven by a desire for greater control and cost efficiency, amplifies this threat.

- Strategic Implications: For Ajinomoto, this necessitates a proactive approach to customer relationship management and a keen understanding of client strategies to mitigate the risk of losing business to in-house production.

Price Sensitivity of Customers

Customer price sensitivity is a major driver of bargaining power, especially within the competitive food and beverage sector. For Ajinomoto, this is particularly relevant given the current economic climate and inflationary pressures impacting consumer spending. While the company offers premium and health-conscious options that can justify higher price points, a broader market trend towards value-seeking, especially in developing regions, can amplify customer demands for lower prices.

This heightened sensitivity means customers are more likely to switch brands or seek cheaper alternatives if prices rise significantly. For instance, by mid-2024, many markets saw consumers actively trading down to private label goods or seeking out promotional offers, directly impacting sales volumes for branded products. This behavior forces companies like Ajinomoto to carefully balance premium positioning with competitive pricing strategies to retain market share.

- Price Sensitivity Impact: Increased consumer focus on price, particularly in emerging markets, empowers customers to negotiate or seek lower-cost alternatives.

- Economic Influence: Inflationary periods and economic downturns amplify price sensitivity, making consumers more receptive to discounts and value brands.

- Brand Loyalty vs. Price: While Ajinomoto's premium products may have some resilience, widespread value-seeking behavior can erode brand loyalty if price differentials become too large.

- Competitive Pressure: High customer price sensitivity intensifies competition, as rivals may leverage lower pricing to capture market share.

The bargaining power of Ajinomoto's customers is substantial, particularly among large B2B clients who purchase ingredients in bulk. These major buyers can leverage their significant order volumes and the relatively low switching costs in many ingredient categories to negotiate favorable pricing and terms. For instance, in 2024, the global amino acid market, a core area for Ajinomoto, continued to see intense competition among large suppliers and buyers, increasing buyer leverage.

| Customer Segment | Bargaining Power Level | Key Factors |

| Large Food Manufacturers (B2B) | High | Large order volumes, potential for backward integration, moderate switching costs for some ingredients. |

| Pharmaceutical Companies (B2B) | Moderate to High | High switching costs due to R&D and regulatory hurdles for specialized amino acids, but significant volume can still grant leverage. |

| Retail Chains (B2C Intermediaries) | High | Aggregated consumer demand, control over shelf space, ability to demand promotional support. |

| Individual Consumers (B2C) | Low (individually), High (collectively) | Low switching costs for consumer products, high price sensitivity, amplified power through collective purchasing decisions. |

Preview Before You Purchase

Ajinomoto Porter's Five Forces Analysis

This preview displays the complete Ajinomoto Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the food and biotechnology sectors. You're looking at the actual document, which includes detailed insights into supplier power, buyer bargaining power, threat of new entrants, threat of substitutes, and existing competitive rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

Ajinomoto operates in markets characterized by a significant number and diversity of competitors. Across its core segments like food, beverages, and amino acids, the company faces both large multinational corporations and smaller, specialized regional players. For instance, in the global food and beverage sector, Ajinomoto competes with giants such as Nestlé and Unilever, who boast extensive product portfolios and vast distribution networks.

The amino acid market, a key area for Ajinomoto, also features formidable competition. Companies like Ajinomoto itself are major producers, but the landscape includes other significant players in biotechnology and chemical manufacturing. This intense rivalry necessitates continuous innovation and strategic pricing to maintain market share. In 2024, the global amino acid market was valued in the tens of billions of dollars, highlighting the scale of competition and the opportunities within it.

The food and beverage industry's growth rate, while generally stable, significantly impacts competitive rivalry. In slower growth phases, companies are more inclined to fight aggressively for market share, intensifying competition. For instance, the global food and beverage market was projected to grow at a compound annual growth rate (CAGR) of around 5.4% from 2023 to 2028, according to Mordor Intelligence.

However, high-growth niches within the broader industry, such as plant-based alternatives and functional foods, are magnets for new entrants. Ajinomoto's focus on these innovative areas, like its plant-based protein products, attracts new competitors eager to capture emerging consumer demand. This dynamic means that even within a stable overall market, specific segments can experience heightened rivalry due to their rapid expansion and potential for future growth.

Ajinomoto leverages its proprietary AminoScience to differentiate products like its iconic MSG and umami seasonings, building strong brand recognition that lessens direct price wars. This scientific backing allows them to offer unique value propositions, setting them apart in a crowded market.

Despite this, in the fast-moving consumer packaged goods sector, brand loyalty isn't etched in stone. For instance, in 2024, while Ajinomoto holds a significant share in many Asian markets for seasonings, competitors are increasingly focusing on natural ingredients and health claims. Ajinomoto's continued success hinges on relentless innovation in taste, perceived health benefits, and demonstrable sustainability efforts to keep consumers engaged.

Exit Barriers for Competitors

High exit barriers significantly shape competitive rivalry within the food and biotechnology sectors where Ajinomoto operates. These barriers include substantial capital investments in specialized manufacturing facilities and ongoing R&D, which make it difficult for struggling companies to simply shut down operations. For instance, the biotechnology sector often requires multi-million dollar investments in sterile labs and advanced processing equipment, creating a sunk cost that discourages exits. This can result in unprofitable competitors remaining active, leading to intensified competition and potential price wars, especially in established product categories.

The presence of these exit barriers can perpetuate overcapacity in certain market segments. When companies cannot easily leave the market, even if they are not profitable, they may continue to produce goods, flooding the market. This situation was observed in some segments of the processed food market in 2024, where increased production capacity from both established players and those with high exit barriers led to tighter margins for all involved.

Ajinomoto, like its peers, faces this dynamic. The need for specialized fermentation technology, complex ingredient blending, and extensive distribution networks are all factors that increase the cost and difficulty of exiting the market. This means that even if a competitor’s product line is underperforming, they may continue to operate, forcing Ajinomoto to remain competitive on price and innovation to maintain market share.

- High Capital Investment: The food and biotech industries require substantial upfront investment in specialized manufacturing plants and R&D facilities, creating a significant barrier to exit.

- Specialized Capabilities: Unique technological expertise, such as advanced fermentation processes or proprietary ingredient formulations, makes it hard for companies to pivot or divest easily.

- Established Supply Chains: Long-term contracts with suppliers and distributors, along with established logistics networks, represent further sunk costs that complicate market departure.

- Market Overcapacity: When unprofitable firms cannot exit, they contribute to market overcapacity, intensifying price competition and reducing profitability across the industry.

Strategic Stakes of Competitors

The food and health sectors are incredibly important for Ajinomoto and its competitors. This high strategic stake naturally drives aggressive competition, with companies readily investing significant capital to capture or maintain their market share. For instance, in 2024, major players in the global food and beverage industry, including those directly competing with Ajinomoto, continued to see substantial investment in research and development, with some allocating upwards of 5% of their revenue to innovation.

Given that many of Ajinomoto's rivals possess long-term strategic outlooks and operate diversified business portfolios, they are deeply committed to protecting their existing market positions. This commitment translates into relentless competitive pressure and a constant push for innovation across product lines and markets. This dynamic ensures that the rivalry remains intense and sustained, as seen in the ongoing product launches and market expansions by companies like Nestlé and Unilever throughout 2024.

- Strategic Importance: Both Ajinomoto and its rivals recognize the significant long-term value and growth potential in the global food and health markets, driving substantial investment.

- Aggressive Competition: Companies are willing to invest heavily to gain or defend market share, leading to intense price competition and marketing efforts.

- Long-Term Vision: Competitors' diversified portfolios and strategic planning mean they are committed to protecting their market positions, ensuring sustained competitive pressure.

- Continuous Innovation: The need to stay ahead fuels continuous innovation in product development, manufacturing processes, and market reach among rivals.

Competitive rivalry is a defining characteristic for Ajinomoto, stemming from numerous global and regional players across its diverse product segments. In the food and beverage arena, giants like Nestlé and Unilever present significant competition, while the amino acid market sees intense battles among biotechnology and chemical manufacturers. This dynamic forces Ajinomoto into constant innovation and strategic pricing to retain its market standing.

The intensity of rivalry is further amplified by high exit barriers in the food and biotechnology sectors, where substantial capital investments in specialized manufacturing and R&D make market departure costly. This often leads to overcapacity, as unprofitable firms remain active, intensifying price competition. Ajinomoto must therefore continuously innovate in taste, perceived health benefits, and sustainability to maintain consumer engagement and market share.

| Key Competitors | Primary Markets | Competitive Strategy Examples | 2024 Market Presence Highlight |

| Nestlé | Food & Beverages | Extensive product portfolio, vast distribution | Strong global brand recognition and market share in diverse food categories. |

| Unilever | Food & Beverages | Brand loyalty, innovation in consumer trends | Significant presence in packaged foods and seasonings, competing on convenience and taste. |

| ADM (Archer Daniels Midland) | Amino Acids, Food Ingredients | Biotechnology, large-scale production | Major global supplier of amino acids for animal feed and food applications. |

| Ajinomoto | Amino Acids, Food, Health | Proprietary AminoScience, umami expertise | Leader in MSG and seasonings, expanding into health and wellness solutions. |

SSubstitutes Threaten

The appeal of substitute products hinges on their price-performance balance. For Ajinomoto's seasoning products, natural spices or alternative flavor enhancers can be strong contenders, particularly if they can deliver comparable taste experiences at a more economical price point. For instance, a shift towards simpler, less processed food ingredients by consumers could reduce demand for complex seasoning blends.

In the realm of processed foods, the threat of substitutes is amplified by increasing consumer health consciousness and a desire for greater perceived value. Home cooking using fresh, unprocessed ingredients is a significant substitute, offering consumers control over ingredients and often a lower cost per serving. This trend was evident in 2024 as global inflation continued to pressure household budgets, encouraging more home meal preparation.

The threat of substitutes is significant for Ajinomoto, particularly in its consumer-focused food and beverage divisions. For instance, in the competitive frozen food market, consumers can readily opt for numerous other brands offering similar convenience and taste profiles. This ease of switching means Ajinomoto must continually innovate and maintain strong brand loyalty to counter the appeal of alternatives.

While Ajinomoto leverages its deep expertise in amino acid science to differentiate its products, many consumer needs can be met by a vast array of competing goods. For example, in the beverage sector, consumers have a wide selection of juices, teas, and other flavored drinks that serve the same basic purpose as Ajinomoto's offerings. The availability of these direct and indirect substitutes puts pressure on pricing and market share.

In 2023, the global market for processed foods, a key area for Ajinomoto, was valued at over $800 billion, highlighting the intense competition and the sheer volume of substitute products available. Similarly, the global beverage market, exceeding $1.5 trillion in 2023, presents a broad landscape where consumers can easily find alternatives to Ajinomoto's brands, making product differentiation and perceived value crucial for sustained success.

Customer willingness to switch to alternatives for Ajinomoto's products is shaped by evolving health consciousness and dietary trends. For instance, a growing preference for plant-based diets and a focus on natural ingredients could lead consumers to opt for plant-derived alternatives or less processed whole foods, impacting demand for Ajinomoto's offerings.

Economic pressures also play a role; if consumers face tighter budgets, they might seek out cheaper, generic versions of flavor enhancers or processed foods, increasing their propensity to substitute. This dynamic is particularly relevant in emerging markets where price sensitivity is often higher.

Ajinomoto's own research in 2024 highlights a significant shift in consumer perception regarding MSG. While the company continues to promote its safety and functionality, a segment of consumers remains wary, actively seeking out MSG-free products, thus demonstrating a clear propensity to substitute based on ingredient concerns.

Technological Advancements in Substitute Industries

Technological advancements in industries creating substitute products pose a significant threat to Ajinomoto. Innovations such as precision fermentation for alternative proteins or breakthroughs in synthetic biology can yield substitutes that are both highly effective and more cost-competitive than Ajinomoto's current offerings, particularly in the amino acid market. For instance, the alternative protein sector, where Ajinomoto is actively investing through partnerships, is seeing rapid development that could directly challenge its established product lines. This technological push means that new, potentially disruptive solutions can emerge rapidly, demanding continuous innovation and adaptation from Ajinomoto.

Ajinomoto is proactively addressing this threat by engaging directly with these emerging technologies. Their strategic partnerships and investments in the alternative protein space, for example, are designed to not only understand but also influence the development of these substitutes. By participating in this evolving landscape, Ajinomoto aims to mitigate the risk of being outmaneuvered by new technologies and to potentially leverage these advancements for its own growth. The company recognizes that staying ahead requires a deep understanding of technological trajectories in related industries.

Key areas of technological advancement impacting substitutes include:

- Precision Fermentation: Enabling the production of specific proteins and ingredients, potentially replicating the functionality of amino acids at a lower cost.

- Synthetic Biology: Offering novel ways to engineer microorganisms for producing complex compounds, including amino acids and other nutritional ingredients.

- Biotechnology Innovations: Advancements in genetic engineering and metabolic pathway optimization can lead to more efficient and sustainable production of bio-based chemicals.

- Plant-Based Ingredient Development: Continued innovation in creating high-quality, functional ingredients from plant sources that can serve as alternatives in food and other applications.

Regulatory and Health Trends Favoring Substitutes

Shifting regulatory environments and public health initiatives are increasingly highlighting concerns around sodium and sugar content, as well as promoting natural and organic ingredients. This trend directly enhances the attractiveness of alternative products that align with these evolving consumer preferences, potentially impacting demand for some of Ajinomoto's traditional offerings.

Ajinomoto is proactively addressing these shifts by investing in the development and expansion of its product portfolio. This includes a strategic focus on creating reduced-sodium alternatives and a growing range of plant-based options, aiming to capture market share within these burgeoning substitute categories.

- Regulatory Scrutiny: Increased government regulations globally are pushing for lower sodium and sugar content in processed foods, making naturally lower-salt or sugar-free alternatives more appealing.

- Health Campaigns: Public health campaigns in 2024 continue to emphasize the benefits of reduced sodium and sugar intake, driving consumer choices towards healthier options.

- Natural and Organic Demand: The market for natural and organic food products, often perceived as healthier substitutes, saw a significant growth trajectory leading into 2024.

- Ajinomoto's Response: Ajinomoto's introduction of products like "AJI-NO-MOTO PLUS" with reduced sodium and its expansion into plant-based ingredients demonstrate a clear strategy to counter the threat of substitutes.

The threat of substitutes for Ajinomoto is substantial, especially in consumer-facing food and beverage segments where direct alternatives are plentiful. Consumers can easily switch to other brands of seasonings, processed foods, or beverages that offer similar taste profiles or convenience. This ease of substitution is amplified by factors like price sensitivity, evolving health consciousness, and the growing appeal of home-cooked meals using fresh ingredients, a trend particularly pronounced in 2024 due to ongoing economic pressures.

For instance, the vast global processed food market, valued at over $800 billion in 2023, is saturated with competing products. Similarly, the beverage sector, exceeding $1.5 trillion in 2023, presents a wide array of choices that fulfill the same basic consumer needs. Ajinomoto's own research in 2024 indicated consumer wariness towards MSG, pushing them towards MSG-free alternatives. This highlights how ingredient perception and dietary trends directly encourage substitution, forcing Ajinomoto to focus on product differentiation and perceived value to maintain its market position.

Technological advancements in areas like precision fermentation and synthetic biology also introduce potent substitutes, particularly in the amino acid market, by enabling cost-competitive production of similar functional ingredients. Ajinomoto's strategic investments in alternative proteins reflect an awareness of this disruptive potential. Furthermore, regulatory shifts and public health initiatives promoting reduced sodium and sugar, alongside a demand for natural ingredients, bolster the appeal of healthier substitutes, prompting Ajinomoto to develop reduced-sodium and plant-based options to counter this trend.

| Market Segment | Estimated Market Value (2023) | Key Substitute Drivers | Ajinomoto's Response Examples |

|---|---|---|---|

| Processed Foods | >$800 Billion | Health consciousness, Home cooking, Price sensitivity | Reduced sodium products, Plant-based ingredients |

| Beverages | >$1.5 Trillion | Wide variety of choices, Taste preference, Health trends | New flavor profiles, Functional beverages |

| Amino Acids | N/A (Component Market) | Technological innovation (fermentation), Cost-efficiency | Investment in alternative proteins, R&D in bio-production |

Entrants Threaten

Entering Ajinomoto's established markets, particularly in advanced areas like amino acid production and sophisticated food processing, demands a significant upfront capital outlay. Think about building state-of-the-art research and development centers, constructing large-scale manufacturing plants, and establishing robust global supply chains. These are not small investments; they are substantial financial commitments that can easily run into hundreds of millions or even billions of dollars.

For instance, establishing a new amino acid production facility with advanced fermentation technology and purification processes can cost upwards of $200 million to $500 million or more, depending on the scale and sophistication. Similarly, developing and launching new pharmaceutical products, a growing area for Ajinomoto, involves immense R&D expenditure, often exceeding $1 billion per successful drug. These high initial capital requirements significantly deter new players from attempting to enter these competitive sectors, effectively creating a substantial barrier to entry.

Ajinomoto enjoys substantial economies of scale across its operations. This means they can buy raw materials in massive quantities, run their factories more efficiently, and ship products more cost-effectively than a newcomer. For instance, in 2024, Ajinomoto's global procurement power allows them to negotiate better prices for key ingredients like molasses and corn starch, directly impacting their cost of goods sold.

These cost advantages create a significant barrier for potential new entrants. A new company would need to invest heavily to achieve similar production volumes and efficiency levels, a feat that is both capital-intensive and time-consuming. Without the ability to match Ajinomoto's lower average production costs, new businesses would find it extremely challenging to compete on price in the global MSG and seasoning market.

Ajinomoto's formidable strength in AminoScience, built over decades, acts as a significant deterrent to new competitors. Their proprietary technologies for amino acid production and innovative applications are not easily replicated.

The substantial investment in research and development, a hallmark of Ajinomoto's strategy, has cultivated unique intellectual property. This deep scientific expertise and accumulated knowledge represent a formidable barrier, making it incredibly challenging for newcomers to match their capabilities and market position.

Brand Identity and Customer Loyalty

Building a strong brand identity and fostering customer loyalty is a significant barrier to entry, especially in the competitive consumer food sector. Ajinomoto's decades of operation have solidified its reputation and created a deep connection with consumers.

New entrants face the arduous task of not only introducing products but also convincing consumers to switch from established, trusted brands. This requires substantial investment in marketing and brand building, often proving cost-prohibitive for newcomers.

For instance, in 2024, the global food and beverage market saw continued consolidation, with established players leveraging their brand equity to maintain market share. Ajinomoto's success in retaining loyal customers across its diverse product lines, from seasonings to processed foods, underscores the difficulty new companies face in carving out a niche.

- Brand Recognition: Ajinomoto brands like AJI-NO-MOTO® have achieved widespread recognition and trust over many years.

- Customer Loyalty Programs: While not always explicit, the consistent quality and taste of Ajinomoto products foster repeat purchases.

- Marketing Investment: New entrants must allocate significant capital to marketing campaigns to even approach Ajinomoto's level of brand awareness.

- Distribution Networks: Established brands benefit from extensive and efficient distribution channels, another hurdle for new competitors.

Access to Distribution Channels

Newcomers often struggle to gain traction with established distribution networks, a significant hurdle for entering markets like food service or pharmaceuticals. These established channels, like major grocery chains or specialized distributors, are crucial for reaching consumers efficiently.

Ajinomoto's deep-rooted global distribution system, built over decades, presents a formidable barrier. Securing shelf space or distribution agreements with key players is exceptionally challenging for new companies attempting to enter the market. For instance, in 2024, the grocery retail sector continued to consolidate, with larger chains exerting even more influence over product placement, making it harder for unproven brands to secure access.

- Limited Shelf Space: Major retailers in 2024 typically allocate limited shelf space, making it difficult for new entrants to secure prominent positions.

- Established Relationships: Ajinomoto benefits from long-standing partnerships with distributors, providing preferential treatment and access that newcomers lack.

- High Slotting Fees: The cost of gaining access to prime shelf space in major retail outlets can be prohibitively expensive for emerging companies.

- Brand Recognition: Consumers often gravitate towards familiar brands, which Ajinomoto possesses, making it harder for new entrants to drive initial sales through distribution channels.

The threat of new entrants into Ajinomoto's core markets remains relatively low due to significant capital requirements and established economies of scale. For example, establishing a new amino acid production facility can cost hundreds of millions of dollars, a substantial hurdle. Furthermore, Ajinomoto's global procurement power in 2024, allowing for better pricing on key ingredients like molasses, creates cost advantages that are difficult for newcomers to match.

Ajinomoto's deep expertise in AminoScience, protected by proprietary technologies and extensive R&D investment, presents another formidable barrier. This scientific knowledge is not easily replicated, and the company's consistent brand building efforts have cultivated strong customer loyalty. In 2024, the consolidation of the food and beverage market further solidified the challenges for new entrants attempting to gain consumer trust and market share against established brands.

Access to established distribution networks poses a significant challenge for new companies. Securing shelf space in major retail outlets, which often have limited capacity and preferential arrangements with established players like Ajinomoto, is costly and difficult. In 2024, the increasing influence of larger grocery chains on product placement amplified this barrier, making it harder for unproven brands to gain visibility and traction.

New entrants face considerable challenges in matching Ajinomoto's brand recognition and fostering customer loyalty. The company's long-standing presence and consistent product quality, evident in its diverse product lines from seasonings to processed foods, have built deep consumer trust. Newcomers must invest heavily in marketing to even approach this level of brand awareness, a task made more difficult by the continuing consolidation within the global food and beverage market as observed in 2024.

| Barrier Type | Description | Impact on New Entrants | Ajinomoto's Advantage | 2024 Relevance |

| Capital Requirements | High cost of R&D, manufacturing, and supply chain setup. | Significant financial hurdle. | Decades of investment and scale. | Continued high investment for advanced production. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Difficulty competing on price. | Massive procurement and operational efficiency. | Stronger negotiating power for raw materials. |

| Proprietary Technology & R&D | Unique production methods and product innovations. | Inability to replicate advanced capabilities. | Substantial R&D investment and patents. | Focus on advanced AminoScience applications. |

| Brand Equity & Loyalty | Strong consumer recognition and trust in established brands. | Challenge in shifting consumer preference. | Long history of quality and marketing. | Consolidation favors established brands. |

| Distribution Networks | Established relationships and access to retail channels. | Difficulty securing shelf space and reaching consumers. | Extensive global distribution system. | Retail consolidation increases access barriers. |

Porter's Five Forces Analysis Data Sources

Our Ajinomoto Porter's Five Forces analysis leverages data from financial reports, industry-specific market research, and competitor disclosures to provide a comprehensive view of the competitive landscape.