Ajinomoto Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

Curious about Ajinomoto's strategic product portfolio? Our preview offers a glimpse into how their offerings might be categorized within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

Understanding these placements is crucial for informed decision-making and resource allocation. This initial view sets the stage for a more comprehensive analysis.

To truly grasp Ajinomoto's competitive landscape and identify actionable strategies, you need the full picture.

Purchase the complete Ajinomoto BCG Matrix report for detailed quadrant placements, data-backed recommendations, and a clear roadmap to smart investment and product decisions.

Don't miss out on the insights that can drive your business forward.

Stars

Overseas Seasonings & Foods represents a significant Star within Ajinomoto's portfolio. This segment, encompassing popular brands like AJI-NO-MOTO, Ros Dee, and Sazón, is experiencing robust growth and holds a commanding market share, especially across the Asia Pacific region.

The company's strategic emphasis on emerging markets is a key driver for this segment's success. Aggressive pricing and volume expansion initiatives are effectively capitalizing on the increasing demand for these products in high-growth territories.

In 2024, Ajinomoto reported substantial growth in its Asia-Pacific food products business, largely attributed to the strong performance of its seasoning brands. For instance, sales in Southeast Asia saw double-digit increases, reflecting successful market penetration and brand loyalty.

The Bio-Pharma Services segment is a pivotal growth engine for Ajinomoto, harnessing its specialized AminoScience expertise to deliver premium services. This strategic move into gene therapy contract development and manufacturing (CDMO) through the acquisition of Forge Biologics in December 2023 underscores a significant commitment to a high-growth market.

Ajinomoto anticipates substantial profit increases from this segment, driven by consistent order expansion, especially from European and North American clients. The company's investment in Forge Biologics positions it to capitalize on the burgeoning demand for advanced biopharmaceutical manufacturing solutions.

Ajinomoto's Functional Materials division, prominently featuring electronic materials, has experienced robust sales growth, largely propelled by the resurgence of the semiconductor industry. This segment is a key growth driver for Ajinomoto, supplying critical, specialized components essential for a rapidly expanding technological sector.

The strategic importance of this business unit is underscored by its ability to leverage ongoing technological innovation and strong market demand. For example, in fiscal year 2023, Ajinomoto reported that its Functional Materials segment, which encompasses electronic materials, contributed significantly to overall company performance, reflecting the positive market trends in semiconductors and other high-tech applications.

New Health & Wellness Product Platforms

Ajinomoto is strategically expanding its presence in the burgeoning health and wellness sector, introducing innovative product platforms designed to meet evolving consumer needs. These new ventures are positioned to capture market share by offering science-backed solutions for healthier lifestyles.

The company launched 'Salt Answer' and 'Palate Perfect' in June 2025, directly addressing the significant consumer demand for reduced sodium intake and improved taste profiles in food products. This move is particularly relevant as global health organizations continue to emphasize the importance of lower sodium consumption, a trend projected to accelerate through 2025 and beyond.

Furthermore, Ajinomoto’s conscious brand, Atlr.72®, is making inroads into the sustainable food market with its Solein-powered products in Singapore. This initiative taps into the growing consumer preference for environmentally friendly and health-conscious food options, a market segment that saw a substantial increase in investment and consumer adoption in 2024.

- Market Focus: Health and wellness, sodium reduction, taste enhancement, sustainable food options.

- Key Launches (June 2025): 'Salt Answer' and 'Palate Perfect' platforms.

- Sustainable Initiative: Atlr.72® introducing Solein-powered products in Singapore.

- Consumer Trends: Directly addresses growing demand for healthier, lower-sodium, and sustainable food choices.

High-Value Amino Acids for Pharmaceuticals & Food

The high-value amino acids segment, targeting pharmaceuticals and specialized foods, is a key growth driver for Ajinomoto. This sector benefits from rising demand for advanced health and nutrition solutions. Ajinomoto's AminoScience expertise allows it to develop and supply these premium ingredients, which typically yield higher profit margins.

For instance, Ajinomoto's pharmaceutical-grade amino acids are crucial for parenteral nutrition and as active pharmaceutical ingredients (APIs). In 2024, the global pharmaceutical amino acids market was projected to reach approximately $3.8 billion, with a compound annual growth rate (CAGR) of around 6.5%. This demonstrates the significant value and expansion potential within this niche.

- Market Growth: Demand for specialized amino acids in pharmaceuticals and high-end food products is increasing, driving segment expansion.

- Ajinomoto's Role: The company utilizes its AminoScience expertise to innovate and supply these high-margin ingredients.

- Profitability: These specialized amino acids contribute significantly to Ajinomoto's overall business growth due to their premium pricing and demand.

- Industry Data: The pharmaceutical amino acids market is a substantial and growing sector, indicating strong potential for companies like Ajinomoto.

Ajinomoto's Stars represent high-growth, high-market-share segments. The Overseas Seasonings & Foods division, particularly strong in Asia, is a prime example, with double-digit sales increases in Southeast Asia during 2024. The Bio-Pharma Services, boosted by the Forge Biologics acquisition, is another star, capitalizing on the growing gene therapy market.

The Functional Materials segment, driven by the semiconductor industry's resurgence, also shines. Ajinomoto's strategic expansion into health and wellness, with launches like 'Salt Answer' and 'Palate Perfect' in June 2025, further solidifies its Star status by addressing key consumer trends.

Finally, high-value amino acids for pharmaceuticals and specialized foods are a significant Star. This segment benefits from robust demand in a market projected to reach approximately $3.8 billion in 2024, with Ajinomoto leveraging its AminoScience expertise for premium, high-margin products.

| Segment | Growth Rate | Market Share | 2024/2025 Relevance |

|---|---|---|---|

| Overseas Seasonings & Foods | High | High (Asia Pacific) | Double-digit growth in Southeast Asia (2024) |

| Bio-Pharma Services | High | Growing | Capitalizing on gene therapy market via Forge Biologics |

| Functional Materials | High | Strong | Driven by semiconductor industry demand |

| Health & Wellness | High | Emerging/Growing | New product launches in June 2025 |

| High-Value Amino Acids | High | Niche/Growing | Pharmaceutical amino acids market ~$3.8bn (2024 proj.) |

What is included in the product

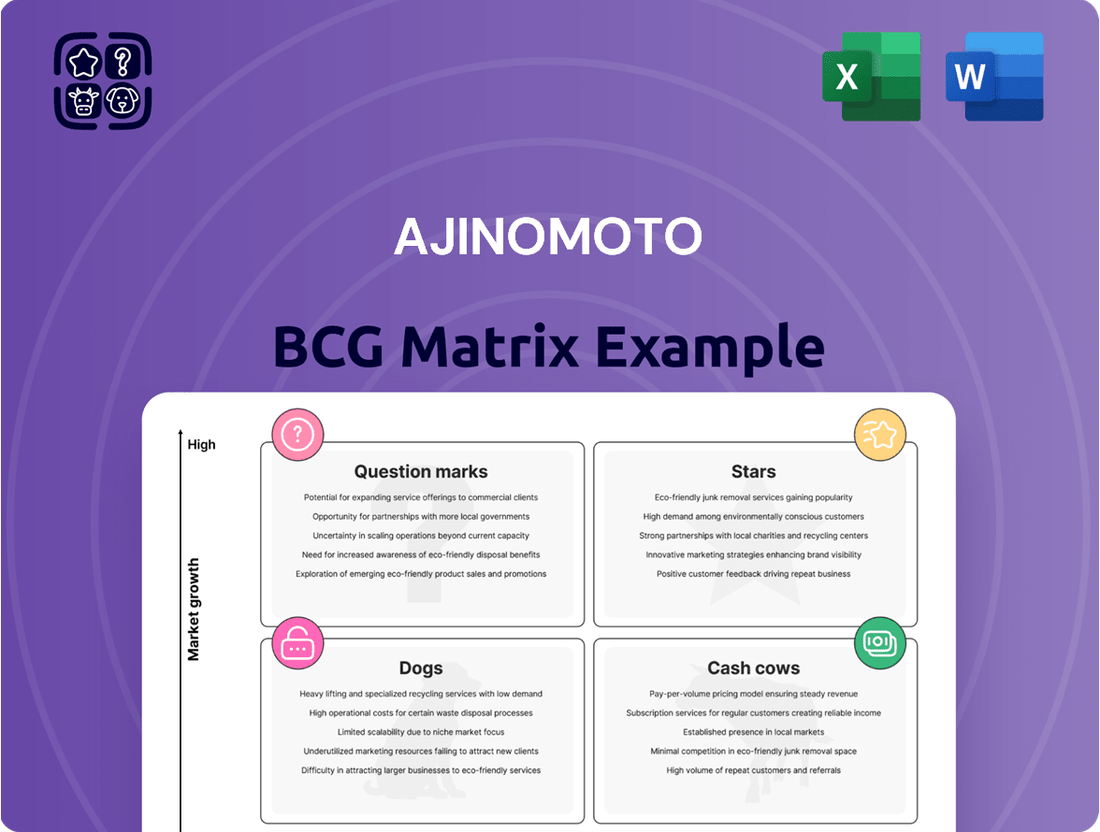

The Ajinomoto BCG Matrix analyzes its business units based on market share and growth, identifying Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, holding, or divestment for each Ajinomoto product category.

Quickly identify underperforming products with a visual overview, easing strategic decision-making.

Cash Cows

The flagship AJI-NO-MOTO seasoning and other core seasonings in the Japanese domestic market are undeniable cash cows for Ajinomoto. These products command a significant market share, a testament to their enduring brand recognition and deep-rooted consumer loyalty. This allows them to generate substantial and consistent cash flow, even in a mature market.

While specific product segments, like Aji-no-moto in Malaysia, have experienced minor volume dips, Ajinomoto's overall domestic seasoning business remains a strong performer. This stability is crucial for funding growth initiatives in other business areas.

Ajinomoto's traditional processed foods in Japan, such as seasonings and instant meals, represent a significant Cash Cow within its portfolio. This segment benefits from a deeply entrenched market presence and a loyal consumer base, ensuring consistent sales and profitability in a mature market. For instance, in the fiscal year ending March 2024, Ajinomoto reported steady performance in its Japan business, with its seasoned food products contributing reliably to the company's overall financial health.

These products require relatively low investment to maintain their market share due to established brand recognition and efficient distribution channels built over decades. This stability allows Ajinomoto to generate substantial cash flow, which is crucial for funding research and development in emerging markets or investing in its Stars and Question Marks. The consistent earnings from these Cash Cows underpin the company's ability to pursue strategic growth initiatives.

Ajinomoto's industrial amino acids business operates as a classic Cash Cow within its BCG matrix. This segment holds a high market share in the global supply of amino acids for general industrial and food processing applications, a market characterized by low growth.

The company's strong position allows it to generate substantial and consistent cash flow from these foundational products. For instance, Ajinomoto is a key player in the production of monosodium glutamate (MSG), a widely used food additive, which contributes significantly to its revenue stream.

The stability inherent in this business, driven by consistent demand from diverse sectors like food, pharmaceuticals, and animal feed, ensures reliable cash generation for Ajinomoto. In 2024, the global amino acid market, valued at over $25 billion, is projected to see steady, albeit modest, growth, underscoring the mature and stable nature of Ajinomoto's operations in this space.

Japan's Frozen Foods

Japan's frozen foods segment, despite a dip in profit during Q1 2025, continues to be a foundational element within Ajinomoto's portfolio, functioning as a classic cash cow.

This established market holds a considerable share, consistently contributing a significant portion to the company's total revenue. Even with recent profit declines, its sheer scale and market penetration underscore its importance as a reliable income generator that needs careful nurturing.

- Market Position: Dominant player in the Japanese frozen food sector.

- Revenue Contribution: Remains a substantial revenue driver for Ajinomoto.

- Profitability Trend: Experienced a profit decrease in Q1 2025.

- Strategic Importance: Vital for consistent cash flow generation despite market pressures.

Traditional Coffee Beverages (Japan)

Ajinomoto's traditional coffee beverages in Japan, including popular brands like Blendy and Birdy, represent a significant Cash Cow. This segment commands a leading share in the Japanese home-use coffee market, benefiting from strong brand recognition and deeply ingrained consumer purchasing habits.

Despite a modest dip in overall domestic coffee segment profits, the sheer volume of sales and established market position ensure a reliable and substantial cash flow. For instance, in fiscal year 2023, Ajinomoto reported that its coffee business continued to be a stable contributor, even as it navigated evolving consumer preferences.

- Market Dominance: Ajinomoto leads the Japanese home-use coffee market, ensuring consistent sales volume.

- Stable Cash Flow: The mature nature of the segment generates predictable and steady revenue streams.

- Low Investment Needs: Reduced need for significant growth-oriented investments allows for capital redirection.

- Brand Loyalty: Established brands like Blendy and Birdy foster strong customer loyalty, underpinning consistent demand.

Ajinomoto's processed foods, particularly in Japan, act as significant cash cows. These products, benefiting from decades of brand building and established distribution, consistently generate substantial profits. For example, in the fiscal year ending March 2024, Ajinomoto's Japan business reported stable performance, with seasoned foods contributing reliably to overall financial health, requiring minimal new investment to maintain their strong market position.

| Product Category | Market Position | Cash Flow Generation | Investment Needs |

| Core Seasonings (Japan) | Dominant | High and consistent | Low (maintenance) |

| Industrial Amino Acids | High global share | Substantial and stable | Low (mature market) |

| Traditional Coffee Beverages (Japan) | Leading share | Predictable and steady | Low (brand loyalty) |

Delivered as Shown

Ajinomoto BCG Matrix

The Ajinomoto BCG Matrix preview you are currently viewing is the complete, unadulterated document you will receive immediately after your purchase. This means you'll get the fully detailed analysis, including all strategic insights and visual representations, without any watermarks or trial limitations.

Rest assured, the Ajinomoto BCG Matrix report you see here is the identical file that will be delivered to you upon completing your purchase. It is a professionally formatted and comprehensive tool, ready for immediate integration into your strategic planning processes.

What you are previewing is the exact Ajinomoto BCG Matrix document that will be sent to you after purchase. You can expect a fully functional, analysis-ready report that requires no further editing or preparation, allowing for instant strategic application.

This preview accurately represents the final Ajinomoto BCG Matrix report you will acquire. Upon purchase, you gain access to this detailed strategic framework, enabling you to effectively evaluate and manage Ajinomoto's diverse product portfolio.

Dogs

Within Ajinomoto's portfolio, certain older or less differentiated processed food products in the domestic Japanese market are considered Dogs. These items often face declining sales volumes, indicating a shrinking market share in a low-growth environment.

For instance, by the end of fiscal year 2023, a segment of Ajinomoto's processed foods, particularly those with long histories and minimal innovation, showed a stagnation in growth, contributing to their classification as Dogs. These products are typically cash traps, demanding resources without generating substantial returns or showing significant potential for market resurgence.

Commodity-grade feed-use amino acids, historically a part of Ajinomoto's portfolio, are now largely viewed as Question Marks or Dogs within a BCG Matrix framework. Ajinomoto has actively divested from these low-margin, high-competition segments, such as its 2019 sale of its European animal nutrition business. These products face slow market growth and intense price pressure, making significant investment unattractive.

Certain nutritional supplements within Ajinomoto's healthcare segment are currently classified as Dogs. These products are experiencing challenges due to escalating ingredient costs and a dip in consumer interest, resulting in profits that are not meeting expectations.

These specific supplements likely hold a small share of their respective niche markets and contribute little to the company's overall financial performance. For instance, in the competitive dietary supplement market, where key raw material costs for some vitamins saw increases of up to 15% in early 2024, these products are struggling to gain traction.

Their limited market presence and modest profit contribution align with the characteristics of a Dog in the BCG matrix, suggesting they may require a strategic review for potential divestment or repositioning within the broader Ajinomoto portfolio. The overall healthcare division, while strong, contains these specific underperformers that dilute its aggregate success.

Japanese Domestic Coffee Segment

Within Ajinomoto's portfolio, the Japanese domestic coffee segment is identified as a 'dog'. This classification stems from observations of a slight profit decline in this specific market.

This suggests a mature, low-growth environment where Ajinomoto's market share may be challenged, leading to difficulties in sustaining profitability.

For instance, the Japanese coffee market, while large, has seen increased competition from both domestic and international brands, alongside evolving consumer tastes favoring specialty or ready-to-drink options.

In 2024, the overall beverage market in Japan experienced moderate growth, but the traditional packaged coffee segment faced headwinds, impacting companies like Ajinomoto.

- Low Profitability: The Japanese domestic coffee segment shows a slight decrease in profit.

- Low Market Growth: The segment operates within a low-growth market.

- Competitive Pressures: Increased competition and changing consumer preferences impact profitability.

- Strategic Review: This segment may require a strategic re-evaluation or divestment.

Remaining Non-Core Bulk Products

Remaining non-core bulk products within Ajinomoto's portfolio, following earlier strategic realignments to move away from commodity goods, represent the dogs in their BCG matrix. These are items that have not been successfully divested or transformed, leaving them with minimal growth prospects and a small slice of their respective markets.

These specific products, often characterized by low margins and limited competitive advantage, consume valuable resources, including capital and management attention, without generating substantial returns. For instance, if Ajinomoto had a line of basic industrial salts that were not central to their advanced food or pharmaceutical ventures, these could be categorized as dogs.

- Low Market Share: These products typically hold a very small percentage of their market.

- Low Growth Potential: The markets for these remaining bulk items are not expected to expand significantly.

- Resource Drain: They require investment and operational effort without commensurate financial reward.

- Strategic Burden: Their continued existence can hinder focus on more profitable, high-growth areas.

Ajinomoto's "Dogs" represent products or business units with low market share in low-growth industries. These often include older processed food items in mature domestic markets, or commodity feed-use amino acids where competition is fierce and margins are thin.

For example, by the end of fiscal year 2023, certain legacy processed foods in Japan, with minimal innovation, showed stagnant growth, characteristic of Dogs. These segments consume resources without generating significant returns, such as commodity amino acids, which Ajinomoto has strategically exited, evidenced by the 2019 sale of its European animal nutrition business.

These underperformers, like some nutritional supplements facing rising ingredient costs and waning consumer interest, as seen with up to a 15% increase in certain vitamin raw material costs in early 2024, contribute little to overall financial performance and may require divestment.

| Category | Market Growth | Market Share | Profitability | Strategic Outlook |

| Legacy Processed Foods (Japan) | Low | Low | Stagnant/Declining | Review for divestment or repositioning |

| Commodity Feed Amino Acids | Low | Low | Low Margin | Divested/Exited |

| Certain Nutritional Supplements | Low to Moderate | Low | Below Expectations | Strategic review, potential exit |

| Japanese Domestic Coffee | Low | Low | Slight Decline | Strategic re-evaluation |

Question Marks

Ajinomoto's strategic acquisition of Forge Biologics positions them within the burgeoning gene therapy Contract Development and Manufacturing Organization (CDMO) sector. This move signifies Ajinomoto's ambition to capture a share of a market projected for substantial expansion, driven by advancements in genetic medicine. For 2024, the global gene therapy market is estimated to be valued at approximately $10 billion and is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years.

Currently, Ajinomoto's presence in this specialized CDMO space can be characterized as a Question Mark on the BCG matrix. While Forge Biologics brings valuable expertise, Ajinomoto's market share is nascent as they focus on integration and capacity building. The gene therapy CDMO landscape is competitive, with established players and emerging companies vying for market dominance.

Significant capital investment will be crucial for Ajinomoto to scale its gene therapy CDMO operations effectively. This includes expanding manufacturing capacity, investing in advanced technologies, and strengthening its service offerings to attract and retain key clients in a highly demanding industry. The success of this venture hinges on Ajinomoto’s ability to navigate regulatory complexities and demonstrate robust manufacturing capabilities to support the pipeline of innovative gene therapies.

Ajinomoto views alternative proteins, encompassing plant-based and cultivated meat, as a key growth area, evidenced by their dedicated R&D efforts and strategic investments in promising startups. The global alternative protein market is projected for substantial expansion, with some estimates suggesting it could reach over $160 billion by 2030, showcasing significant potential. However, Ajinomoto's current market share in these emerging segments remains relatively small, characteristic of a "question mark" in the BCG matrix.

Significant capital is being channeled into developing proprietary technologies and scaling production for these novel food sources. This intensive investment is crucial for Ajinomoto to differentiate its offerings and secure a meaningful market position. Failure to achieve this could relegate these ventures to the "dog" category, demanding a re-evaluation of resource allocation.

Ajinomoto's AI Well-being Platform, 'i-LiveWell', marks a strategic entry into the burgeoning digital health sector. This new application taps into a high-growth market fueled by technological innovation and a growing consumer demand for personalized wellness solutions.

As a recently launched product, 'i-LiveWell' currently possesses a limited market share. This positions it within the 'Question Marks' category of the BCG Matrix, indicating significant potential but also requiring substantial investment in marketing and ongoing development to capture market share and achieve profitability.

For example, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, highlighting the immense opportunity for platforms like 'i-LiveWell'.

D2C Solutions in Food & Wellness

Ajinomoto is actively pursuing direct-to-consumer (D2C) strategies within its Food & Wellness division, specifically aiming to capture segments of the small and middle-mass markets. This approach leverages the potential for high growth by fostering direct relationships with consumers and delivering tailored product experiences.

The D2C model promises significant upside by cutting out intermediaries, allowing for greater control over the customer journey and product innovation. For instance, the global D2C e-commerce market was projected to reach over $1.7 trillion by 2024, highlighting the substantial opportunity.

- High Growth Potential: D2C allows for direct customer feedback and personalized offerings, crucial for the evolving wellness market.

- Market Entry Challenges: Building brand awareness and customer loyalty in a crowded D2C space from a nascent position demands significant capital and agile operations.

- Strategic Investment: Ajinomoto's commitment to this segment will likely involve substantial investment in digital infrastructure, marketing, and supply chain optimization to compete effectively.

- Personalization Focus: The wellness sector thrives on customization; D2C enables Ajinomoto to offer bespoke solutions, from dietary supplements to meal kits, catering to individual health needs.

Food as a Service (FaaS) Businesses

Ajinomoto is actively exploring Food as a Service (FaaS) models, signifying a strategic pivot from traditional food product sales to subscription-based or on-demand culinary solutions. This represents a move into an emerging, high-growth sector that fundamentally alters how consumers access and consume food.

While the FaaS market is experiencing rapid expansion, Ajinomoto's current market penetration in this specific area is minimal. For instance, the global meal kit delivery market, a subset of FaaS, was valued at approximately USD 15 billion in 2023 and is projected to grow significantly, indicating substantial opportunity but also intense competition.

Developing successful FaaS ventures requires substantial investment in technology, logistics, and customer acquisition, alongside continuous innovation. Ajinomoto's commitment to this segment positions its FaaS businesses as potential Stars or Question Marks within the BCG matrix, depending on their future growth trajectory and investment needs.

- FaaS represents a strategic shift for Ajinomoto, moving beyond product sales to service-oriented models.

- The FaaS market, including areas like meal kits, shows strong growth potential, with the global market valued around USD 15 billion in 2023.

- Ajinomoto's current market share in FaaS is low, reflecting its early stage in this innovative sector.

- Significant capital investment and ongoing innovation are critical for scaling FaaS operations and achieving profitability.

Ajinomoto's AI Well-being Platform, 'i-LiveWell', is a new venture in the rapidly expanding digital health sector. This platform is positioned as a Question Mark on the BCG matrix due to its recent launch and limited market share, despite the sector's strong growth trajectory.

The global digital health market was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial opportunity for 'i-LiveWell'. Significant investment in marketing and ongoing development is required for Ajinomoto to increase its market share and achieve profitability in this competitive landscape.

The success of 'i-LiveWell' hinges on its ability to attract and retain users by offering personalized wellness solutions and demonstrating clear value in a market driven by technological innovation and consumer demand.

Ajinomoto's direct-to-consumer (D2C) food and wellness initiatives are also categorized as Question Marks. These ventures aim to tap into high-growth markets by building direct customer relationships.

The global D2C e-commerce market was projected to exceed $1.7 trillion by 2024. This presents a significant opportunity for Ajinomoto, but challenges in building brand awareness and customer loyalty in a crowded D2C space are substantial, necessitating considerable investment in digital infrastructure and marketing.

Ajinomoto's ventures into Food as a Service (FaaS), including meal kit delivery, are also considered Question Marks. While the sector is expanding rapidly, Ajinomoto's current market share is minimal.

The global meal kit delivery market, a segment of FaaS, was valued at approximately USD 15 billion in 2023. Success in FaaS requires significant investment in technology, logistics, and customer acquisition, with ongoing innovation being key to achieving profitability and market leadership.

BCG Matrix Data Sources

Our Ajinomoto BCG Matrix is constructed using comprehensive market research, internal sales data, and competitor analysis to provide a clear strategic overview.