AIXTRON PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIXTRON Bundle

Unlock the strategic advantages AIXTRON holds by understanding the political, economic, social, technological, environmental, and legal forces at play. Our comprehensive PESTLE analysis provides a deep dive into these critical external factors, offering actionable intelligence for your business planning. Don't miss out on crucial market insights—download the full AIXTRON PESTLE analysis now and gain a competitive edge.

Political factors

Global geopolitical tensions, especially between the US, EU, and China, directly impact the semiconductor sector. For instance, in 2023, the US continued to implement export controls on advanced chip technology to China, a move that significantly reshaped global supply chains and market dynamics for equipment manufacturers like AIXTRON.

These trade restrictions can limit AIXTRON's access to key markets or necessitate costly adaptations in its supply chain and sales approaches. The ongoing US-China tech rivalry, which intensified in 2022-2023, has forced many companies to re-evaluate their manufacturing and sales strategies to comply with evolving regulations.

Furthermore, such policies can spur onshoring and nearshoring initiatives in semiconductor manufacturing. The EU's Chips Act, aiming to double its market share in semiconductors by 2030, represents a significant opportunity for equipment suppliers like AIXTRON to tap into new regional demand, though it also presents challenges in navigating diverse regulatory landscapes.

Governments globally are actively promoting domestic semiconductor manufacturing through substantial subsidy programs and industrial policies. For instance, the US CHIPS Act and the EU Chips Act are channeling billions into bolstering local production capabilities, aiming to reduce dependence on foreign supply chains. This surge in government funding directly translates into increased capital expenditure for chip manufacturers, a significant tailwind for equipment suppliers like AIXTRON.

These industrial policies often target specific technological advancements and material processing, areas where AIXTRON's specialized deposition equipment holds a competitive edge. The EU, for example, has committed €43 billion to its Chips Act, with a significant portion earmarked for R&D and manufacturing infrastructure, creating direct opportunities for AIXTRON's advanced deposition systems.

The stability of international relations is a crucial factor for AIXTRON, directly influencing its global operations and market access. Favorable diplomatic ties can unlock new markets and streamline cross-border activities, essential for a company with a worldwide customer base. For instance, AIXTRON's reliance on exports means that trade agreements and geopolitical stability, such as those governing semiconductor equipment trade between major economic blocs, significantly shape its revenue streams.

Regulatory Environment for High-Tech Exports

AIXTRON, a key player in supplying technology for advanced electronics, navigates a challenging landscape of export control regulations. These rules, often influenced by national security priorities and global technological competition, directly impact AIXTRON's ability to access certain markets and export its specialized equipment. For instance, evolving U.S. export controls on semiconductor manufacturing equipment, particularly those impacting China, have created significant compliance hurdles for companies like AIXTRON. Staying abreast of and adhering to these dynamic regulations is paramount for maintaining its international operations and revenue streams.

The geopolitical climate significantly shapes the regulatory environment for high-tech exports, directly affecting companies like AIXTRON. For example, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to implement stringent export controls on advanced semiconductor technologies and equipment destined for China. These measures, aimed at limiting China's access to cutting-edge technology, directly impact AIXTRON's sales opportunities in that region, a critical market for semiconductor equipment manufacturers. The company's revenue from China, which has historically been a substantial portion of its sales, is therefore subject to considerable regulatory risk.

- Geopolitical Tensions: Heightened tensions, particularly between the U.S. and China, lead to more restrictive export controls on advanced technologies.

- National Security Concerns: Governments increasingly view advanced manufacturing equipment as critical for national security, leading to tighter regulations.

- Compliance Costs: AIXTRON incurs significant costs to ensure compliance with complex and frequently changing international export regulations.

- Market Access Limitations: Regulatory changes can abruptly restrict AIXTRON's access to key international markets, impacting its revenue and growth prospects.

Political Stability in Key Operating Regions

AIXTRON's operations are significantly influenced by the political stability of its key regions, including Germany, China, and the United States. Political stability ensures predictable regulatory environments and supports AIXTRON's ongoing investments in advanced manufacturing and research. For instance, Germany, a core operational hub, benefits from a stable democratic framework, fostering consistent economic policies. In 2023, Germany's political landscape remained largely stable, supporting its position as a leading industrial nation.

Sudden policy shifts or geopolitical tensions in major markets like China or the US can create operational hurdles. Disruptions to supply chains or changes in trade policies, such as tariffs or export controls, directly impact AIXTRON's ability to source materials and deliver equipment. For example, ongoing trade discussions between major economic blocs could introduce new compliance requirements or alter market access for AIXTRON's deposition equipment.

AIXTRON's long-term strategic planning, including the expansion of its production capacity and R&D initiatives, is inherently tied to the predictability of the political landscape. A stable environment encourages the substantial capital expenditures required for technological advancement and market growth. The company's continued focus on expanding its presence in Asia, a region with dynamic political considerations, underscores the importance of monitoring these factors closely.

- Germany's stable political environment supports AIXTRON's R&D and manufacturing base.

- Trade policy shifts in the US and China can impact AIXTRON's supply chain and market access.

- Geopolitical events can influence labor availability and operational costs in key AIXTRON operating regions.

- Predictable political conditions are crucial for AIXTRON's long-term investment decisions in new technologies.

Governments globally are increasingly leveraging industrial policies and subsidies to bolster domestic semiconductor production, directly benefiting equipment suppliers like AIXTRON. The EU's Chips Act, for instance, aims to double its market share by 2030, channeling billions into R&D and manufacturing infrastructure, creating substantial opportunities for AIXTRON's advanced deposition systems.

Geopolitical tensions, particularly between the US and China, continue to drive export controls on advanced chip technology. These restrictions, exemplified by ongoing US measures impacting China in 2023, necessitate AIXTRON to adapt its supply chain and sales strategies, highlighting the critical need for regulatory compliance and market diversification.

AIXTRON's operational stability hinges on predictable political environments in key regions like Germany, China, and the US. Stable political frameworks support consistent economic policies and R&D investments, whereas sudden policy shifts or trade disputes can disrupt supply chains and market access, impacting the company's revenue streams.

The political landscape directly influences AIXTRON's access to critical markets and its ability to conduct business globally. For example, the US CHIPS Act and similar initiatives in other regions create demand for semiconductor manufacturing equipment, presenting growth avenues for AIXTRON. However, navigating varying regulatory requirements across these regions remains a key challenge.

What is included in the product

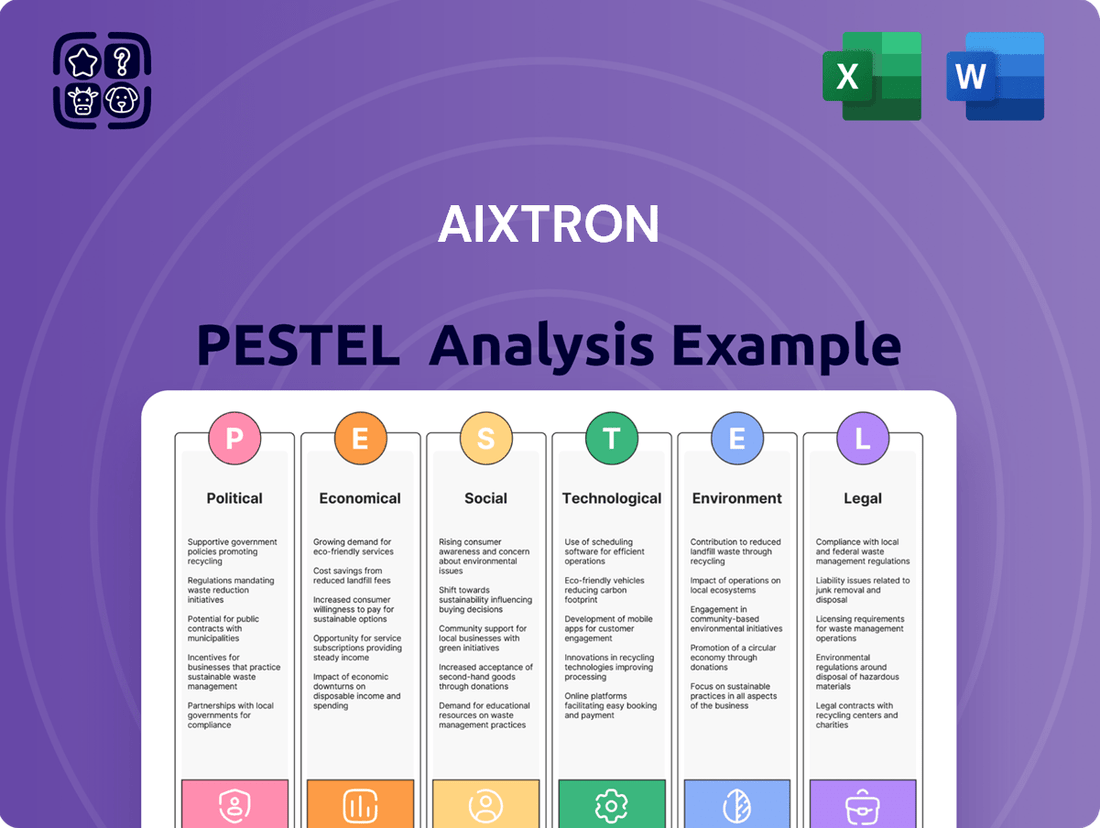

This AIXTRON PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operating landscape.

Provides a concise, actionable summary of AIXTRON's PESTLE analysis, enabling rapid identification of external opportunities and threats to inform strategic decisions.

Economic factors

Global economic growth is a critical driver for AIXTRON, as its semiconductor equipment sales are closely tied to the capital expenditure of chip manufacturers. In 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a slight uptick from the previous year, indicating a generally supportive environment for investment in advanced manufacturing technologies.

Periods of robust economic expansion, like the expected continued growth through early 2025, typically translate into higher consumer and enterprise spending on electronics, from smartphones to data centers. This increased demand for semiconductors directly prompts chipmakers to invest in expanding their fabrication capacity, thereby boosting AIXTRON's order book for deposition equipment.

Conversely, any significant global economic slowdown or recessionary pressures, as seen in historical downturns, can cause semiconductor companies to delay or scale back their capital investment plans. This would directly impact AIXTRON through reduced orders for its advanced deposition tools, highlighting the sensitivity of its business to macroeconomic trends.

Rising inflation presents a significant challenge for AIXTRON, directly impacting its operational expenses. For instance, the global inflation rate hovered around 5.9% in 2023, a figure that has continued to influence the cost of essential inputs like rare earth materials and energy crucial for semiconductor equipment manufacturing. This upward pressure on raw materials and energy can squeeze AIXTRON's profit margins if not effectively managed.

To counter these inflationary headwinds, AIXTRON needs robust supply chain strategies and potentially judicious price adjustments for its advanced deposition equipment. The company’s ability to secure stable and cost-effective raw material sourcing will be paramount. Furthermore, elevated inflation often correlates with higher interest rates, which can increase the cost of capital for AIXTRON and potentially dampen demand from its customers in the semiconductor industry who also face financing challenges.

Global supply chain disruptions, stemming from geopolitical tensions and events like the ongoing semiconductor shortage, directly impact AIXTRON's ability to procure essential components for its deposition equipment. These disruptions can lead to production delays and affect delivery schedules for customers worldwide.

To counter these challenges, AIXTRON likely employs strategies such as diversifying its supplier base and potentially increasing inventory levels for critical parts. However, these measures can lead to higher operational costs, as seen in the broader manufacturing sector where logistics expenses have seen significant increases; for instance, the Drewry World Container Index saw a substantial rise in 2024 compared to pre-pandemic levels.

Currency Exchange Rate Fluctuations

As a global player, AIXTRON's financial performance is directly impacted by currency exchange rate shifts. For example, a stronger Euro in early 2024 could increase the cost of AIXTRON's advanced deposition equipment for customers in the United States, potentially dampening demand. Conversely, a weaker Euro might make their components sourced from outside the Eurozone more affordable.

Managing these currency risks is crucial for AIXTRON's profitability and market competitiveness. The company likely employs sophisticated hedging techniques to mitigate the impact of volatile exchange rates on its revenue streams and operational expenses. This proactive approach helps ensure stable pricing and predictable financial outcomes amidst global economic uncertainties.

- Currency Exposure: AIXTRON's global operations mean its revenues and costs are denominated in various currencies, exposing it to exchange rate volatility.

- Impact on Pricing: A strong Euro can make AIXTRON's products more expensive for international buyers, potentially affecting sales volume.

- Hedging Importance: Effective currency hedging strategies are vital for AIXTRON to manage financial risks and maintain competitive pricing in international markets.

- 2024/2025 Outlook: With ongoing geopolitical events and varying inflation rates across regions, currency fluctuations are expected to remain a significant factor for AIXTRON's financial planning.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for companies like AIXTRON, which supply advanced equipment for semiconductor manufacturing. The semiconductor industry's relentless pursuit of smaller, faster, and more efficient chips necessitates continuous innovation in deposition technologies. For instance, the global semiconductor R&D spending was projected to reach approximately $100 billion in 2024, a significant increase reflecting the industry's commitment to future advancements.

Government initiatives and private sector strategies that prioritize R&D funding directly translate into demand for AIXTRON's sophisticated deposition tools. As new materials like advanced compound semiconductors and 2D materials gain traction, the need for specialized deposition equipment escalates. This trend is supported by data showing a steady rise in patent filings related to novel semiconductor manufacturing processes, indicating a robust pipeline of innovation that requires advanced equipment solutions.

Economic climates that foster long-term investment are crucial for AIXTRON's growth. Periods of strong economic expansion and favorable interest rates encourage companies to allocate more capital towards R&D, thereby boosting demand for AIXTRON's capital-intensive equipment. Conversely, economic downturns or uncertainty can lead to reduced R&D budgets, potentially impacting AIXTRON's order intake. The ongoing global push for technological sovereignty and advanced manufacturing capabilities, particularly in areas like AI and high-performance computing, is expected to sustain elevated R&D investments in the semiconductor sector through 2025 and beyond.

- Semiconductor R&D Spending: Global R&D investment in semiconductors was on track to approach $100 billion in 2024.

- Demand for Advanced Equipment: The introduction of new materials and complex chip architectures directly fuels demand for AIXTRON's deposition technologies.

- Economic Influence: Favorable economic conditions encouraging long-term R&D spending are vital for AIXTRON's growth prospects.

- Innovation Trends: Increasing patent filings for novel semiconductor processes highlight the continuous need for cutting-edge manufacturing equipment.

Global economic growth significantly influences AIXTRON's sales, as chip manufacturers' capital expenditure directly correlates with its equipment orders. The IMF projected global growth at 3.2% for 2024, indicating a generally favorable environment for AIXTRON's advanced manufacturing technology investments. This growth trend is expected to continue into early 2025, driving demand for semiconductors and, consequently, AIXTRON's deposition equipment.

What You See Is What You Get

AIXTRON PESTLE Analysis

The AIXTRON PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting AIXTRON.

The content and structure shown in the preview is the same AIXTRON PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

The increasing appetite for advanced electronics like smartphones, electric vehicles, and AI hardware is a significant tailwind for the semiconductor industry. This trend directly fuels the demand for AIXTRON's deposition equipment, essential for producing the sophisticated chips powering these devices. For instance, the global market for semiconductors, which AIXTRON serves, was projected to reach over $600 billion in 2024, highlighting the scale of this consumer-driven demand.

Societal shifts towards greater digitalization across all aspects of life further amplify this demand for cutting-edge electronics. As more services and interactions move online, the need for powerful and efficient computing, driven by advanced semiconductors, continues to grow. This pervasive digitalization creates a sustained market for the high-performance chips that AIXTRON's equipment helps manufacture.

AIXTRON's reliance on a highly skilled workforce, especially in engineering and specialized technical roles, is paramount for its continued innovation in deposition equipment. The global competition for these professionals intensified in 2024, with demand outstripping supply in key high-tech hubs.

Demographic shifts present a dual challenge: an aging engineering population in some established markets necessitates knowledge transfer, while rapidly growing economies create intense competition for emerging talent. For instance, by 2025, the global shortage of semiconductor engineers is projected to reach over 1 million, impacting companies like AIXTRON.

To counter these trends, AIXTRON's strategy likely involves robust investment in internal talent development programs and offering competitive compensation and benefits packages to attract and retain top-tier engineers and technicians in the dynamic 2024-2025 period.

Societal focus on digital transformation is a powerful driver for AIXTRON. As industries, healthcare, and education increasingly adopt digital solutions, the demand for sophisticated semiconductor components surges. AIXTRON's deposition equipment is crucial for manufacturing the advanced chips powering this shift, including those essential for next-generation communication networks like 5G and 6G, and the vast data centers that underpin our digital lives.

This widespread embrace of digital technologies translates directly into a robust and expanding market for semiconductors. For instance, the global semiconductor market was projected to reach over $600 billion in 2024, with continued growth anticipated as digital integration deepens across all facets of society. AIXTRON is well-positioned to capitalize on this sustained trend, supplying the foundational technology for innovation.

Adoption of Sustainable Lifestyles and Technologies

Growing public consciousness around environmental impact is a significant driver for sustainable living and technology adoption. This shift directly impacts industries like semiconductor manufacturing, where AIXTRON's deposition equipment plays a crucial role. For instance, their tools are essential for producing energy-saving LED lighting, a market projected to reach over $100 billion globally by 2027, and components for electric vehicles, which saw a 35% increase in global sales in 2023 compared to 2022.

AIXTRON's technology directly supports this trend by enabling the production of components vital for energy efficiency. Their systems facilitate the manufacturing of power electronics for electric vehicles and advanced LED solutions. This alignment positions AIXTRON favorably as demand for greener technologies escalates.

- Growing demand for energy-efficient technologies: AIXTRON's equipment supports the production of LEDs and EV components, key areas in the sustainability push.

- Societal pressure for sustainable operations: Companies are increasingly scrutinized for their environmental footprint throughout their value chain.

- Market growth in sustainable sectors: The increasing adoption of EVs and energy-efficient lighting directly translates to demand for AIXTRON's advanced manufacturing solutions.

Education and Skill Development Initiatives

The caliber and direction of educational systems in regions where AIXTRON operates significantly influence the availability of skilled personnel for both the company and its clientele. For instance, in 2024, Germany, a key AIXTRON market, continued its focus on vocational training and dual education systems, aiming to bolster its manufacturing workforce, which directly benefits the semiconductor sector.

Government and industry-driven programs promoting Science, Technology, Engineering, and Mathematics (STEM) education, alongside specialized semiconductor manufacturing training, are crucial. In the US, initiatives like the CHIPS and Science Act of 2022 included provisions for workforce development, allocating funds to educational institutions to create semiconductor-focused curricula, underscoring the importance of a prepared talent pool.

A highly educated and proficient workforce is indispensable for fostering innovation and sustaining technological superiority in the intricate semiconductor industry. By 2025, it's projected that the global demand for semiconductor engineers will continue to outpace supply, highlighting the critical need for robust educational pipelines to meet this demand and ensure AIXTRON's continued success.

- AIXTRON's reliance on a skilled workforce is directly tied to educational output in key markets.

- Government funding for STEM and specialized training, like the CHIPS Act, directly impacts talent availability.

- The semiconductor industry faces a projected global talent shortage, emphasizing the importance of educational initiatives.

Societal trends toward digitalization and automation are profoundly shaping the demand for AIXTRON's advanced deposition equipment. As industries increasingly integrate AI and IoT technologies, the need for sophisticated semiconductors escalates, directly benefiting AIXTRON's market position. The global semiconductor market was projected to exceed $600 billion in 2024, a testament to this pervasive digital shift.

The growing emphasis on sustainability and energy efficiency also plays a crucial role. AIXTRON's technology is instrumental in producing components for electric vehicles and energy-saving LEDs, sectors experiencing significant growth. For example, EV sales saw a substantial increase in 2023, driving demand for the underlying semiconductor technology that AIXTRON helps enable.

Furthermore, the availability of a highly skilled workforce, particularly in engineering and specialized technical fields, remains a critical factor. The global shortage of semiconductor engineers, projected to reach over 1 million by 2025, underscores the importance of educational systems and talent development for companies like AIXTRON.

Technological factors

The relentless progress in semiconductor materials, including Gallium Nitride (GaN) and Silicon Carbide (SiC), is a significant technological driver. These advanced materials are essential for powering high-efficiency electronics, from electric vehicles to 5G infrastructure. AIXTRON's deposition equipment is at the forefront of enabling the widespread adoption of these next-generation materials.

The semiconductor industry's relentless pursuit of miniaturization and performance enhancement drives constant innovation in deposition technologies. AIXTRON's expertise in Metal Organic Chemical Vapor Deposition (MOCVD) and Atomic Layer Deposition (ALD) is crucial for fabricating next-generation devices. For instance, MOCVD is fundamental to producing the precise material layers required for high-efficiency micro-LED displays, a market projected to reach $16.2 billion by 2028, according to some market estimates.

AIXTRON's ongoing research and development in deposition processes directly impacts its competitive edge. Innovations in MOCVD systems, such as improved uniformity and throughput, enable manufacturers to produce more advanced chips, including those for silicon photonics and cutting-edge logic applications. The company's commitment to R&D ensures its ability to meet the evolving demands of these high-growth sectors, where even incremental improvements in deposition quality can translate to significant performance gains and cost efficiencies.

The proliferation of groundbreaking applications like 5G/6G networks, AI accelerators, and quantum computing is creating a significant surge in demand for highly specialized semiconductor components. AIXTRON's deposition equipment is crucial for manufacturing the advanced chips that power these emerging technologies, directly linking the company's success to the expansion of these innovative fields.

For instance, the global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to grow substantially by 2030. Similarly, the AI hardware market is experiencing rapid expansion, with revenues expected to reach hundreds of billions in the coming years. These trends highlight the direct impact of new applications on the need for AIXTRON's core technologies.

Furthermore, the industry's move toward heterogeneous integration, where different types of chips are combined, necessitates new equipment capabilities. AIXTRON's ability to adapt and provide solutions for these evolving device architectures will be a key determinant of its market position and growth in the coming years.

Competitive Landscape and Innovation Pace

The semiconductor equipment market is intensely competitive, with rivals like Applied Materials and ASML consistently pushing technological boundaries. AIXTRON's ability to maintain a rapid innovation pace, evidenced by its significant R&D expenditure, is paramount. In 2023, AIXTRON reported R&D expenses of €178.6 million, underscoring its commitment to developing next-generation deposition tools that offer enhanced performance and efficiency to meet evolving customer demands and industry standards.

AIXTRON must continue to invest heavily in research and development to offer superior performance, throughput, and cost-efficiency in its deposition tools. This focus on innovation is critical for maintaining market leadership in a sector where technological obsolescence is a constant threat. The company's strategic investments are geared towards enabling the production of advanced semiconductor devices, a demand driven by sectors like AI and high-performance computing.

- R&D Investment: AIXTRON's R&D spending was €178.6 million in 2023, a key indicator of its commitment to innovation.

- Competitive Pressure: Major competitors like Applied Materials and ASML are also investing heavily in new technologies.

- Market Demand: The need for advanced deposition tools is fueled by growth in AI, 5G, and automotive electronics.

- Adaptability: Quickly integrating new industry standards and customer specifications is vital for AIXTRON's market position.

Integration of AI and Automation in Manufacturing

The manufacturing sector, particularly semiconductor fabrication, is rapidly embracing Industry 4.0 principles, driving a significant demand for highly automated and data-driven equipment. AIXTRON's deposition systems must align with this trend, offering capabilities for real-time process monitoring and predictive maintenance to enhance efficiency and yield for their customers.

The integration of AI and automation is crucial for AIXTRON to remain competitive as semiconductor manufacturers increasingly seek smart factory solutions. This includes enabling autonomous operation of deposition tools, a key requirement for advanced fabs aiming to optimize throughput and reduce operational costs.

- Industry 4.0 adoption: Global spending on Industry 4.0 technologies, including automation and AI in manufacturing, was projected to reach $150 billion in 2024, with continued strong growth expected.

- Semiconductor automation demand: The semiconductor equipment market is heavily influenced by the need for advanced automation, with companies like ASML reporting significant order backlogs driven by demand for highly sophisticated lithography systems.

- AI in process optimization: AI algorithms are increasingly used to fine-tune deposition processes, potentially improving wafer yield by several percentage points, a critical factor in the high-cost semiconductor industry.

The rapid advancement in semiconductor materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) is a key technological factor, directly benefiting AIXTRON's deposition equipment. These materials are vital for high-efficiency electronics in electric vehicles and 5G networks. The ongoing push for miniaturization and enhanced performance in semiconductors necessitates continuous innovation in deposition technologies, with AIXTRON's MOCVD and ALD expertise being crucial for next-generation devices.

| Technology Area | Impact on AIXTRON | Market Relevance (2024/2025 Projections) |

|---|---|---|

| Advanced Materials (GaN, SiC) | Drives demand for AIXTRON's deposition tools | Electric Vehicles: Significant growth expected in 2024-2025. 5G Infrastructure: Continued expansion driving component demand. |

| Miniaturization & Performance | Requires advanced MOCVD & ALD capabilities | Micro-LED Displays: Market projected to grow substantially by 2028. Silicon Photonics: Emerging demand for precise layer deposition. |

| AI & Automation (Industry 4.0) | Need for smart, automated deposition systems | Global Industry 4.0 Spending: Projected to exceed $150 billion in 2024. AI in Process Optimization: Potential for yield improvements in semiconductor fabs. |

Legal factors

AIXTRON's commitment to innovation is underscored by its substantial investments in research and development, making the protection of its intellectual property (IP) absolutely critical. The company relies on a strong portfolio of patents to shield its proprietary deposition technologies from being copied by rivals, which is key to maintaining its market advantage.

For instance, AIXTRON actively manages and defends its patent rights. While specific infringement case details are often confidential, the company's financial reports typically allocate resources for legal expenses, reflecting the ongoing need to protect its technological innovations. Challenges to these patents could lead to significant financial penalties or loss of market exclusivity, highlighting the importance of robust legal strategies.

AIXTRON's operations are heavily influenced by export control regulations, especially for its advanced deposition equipment which can be classified as dual-use technology. Failure to comply with international frameworks like the Wassenaar Arrangement and national laws, such as those enforced by the U.S. Department of Commerce, can lead to severe fines and loss of export privileges. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to update its Entity List and export control measures, impacting the availability of certain technologies to specific countries.

AIXTRON must navigate a complex web of environmental, health, and safety (EHS) regulations globally. These rules govern everything from chemical handling and waste management in its manufacturing facilities to ensuring the well-being of its workforce. For instance, compliance with directives like REACH and RoHS in Europe is critical for market access and operational continuity.

Failure to adhere to these EHS standards can result in substantial penalties, including significant fines and operational shutdowns, as seen in various industrial sectors. For example, in 2024, several manufacturing companies faced millions in fines for environmental violations. AIXTRON's commitment to robust EHS management systems is therefore paramount to mitigate these risks and maintain its reputation.

International Trade Laws and Tariffs

AIXTRON’s global operations are significantly shaped by international trade laws and tariffs. For instance, the European Union, where AIXTRON is headquartered, has various trade agreements that facilitate commerce, but also imposes tariffs on certain goods. In 2023, the EU’s trade surplus with China in goods reached €213 billion, highlighting the complex trade flows that AIXTRON navigates.

Changes in these trade policies can directly affect AIXTRON's cost of goods sold and pricing. For example, a sudden imposition of tariffs on semiconductor manufacturing equipment components imported into a key market could increase production costs. Navigating these regulations requires robust legal expertise to ensure compliance and maintain competitive pricing strategies.

- Trade Agreements: AIXTRON benefits from trade agreements that reduce or eliminate tariffs on its equipment in key markets like the US and China, though these can be subject to change.

- Tariff Impact: A hypothetical 5% tariff on a critical component imported for deposition equipment could add millions to AIXTRON's cost base if not mitigated.

- Regulatory Compliance: AIXTRON must adhere to export control regulations, such as those managed by the Bureau of Industry and Security (BIS) in the United States, which can impact sales to certain countries.

Data Privacy and Cybersecurity Laws

AIXTRON operates in a landscape increasingly shaped by stringent data privacy and cybersecurity laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose significant obligations regarding the collection, processing, and storage of personal data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

The company’s reliance on digital platforms and the handling of sensitive customer and operational data necessitate robust cybersecurity frameworks. Protecting proprietary information and customer data is paramount to maintaining trust and operational integrity, especially given AIXTRON's global partnerships and customer base. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial and reputational risks associated with inadequate security measures.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA Compliance: California's stringent rules on consumer data rights.

- Cybersecurity Investment: The need for continuous investment in advanced security protocols.

- Global Data Standards: Navigating diverse international data protection requirements.

AIXTRON's intellectual property (IP) is a cornerstone of its competitive advantage, necessitating vigilant protection through patents for its advanced deposition technologies. The company's financial reports reflect ongoing legal expenses dedicated to defending this IP, as challenges could lead to significant financial repercussions and loss of market exclusivity.

The company must also navigate stringent export control regulations, particularly for its dual-use deposition equipment, adhering to international frameworks and national laws like those from the U.S. Department of Commerce. Non-compliance, as evidenced by ongoing updates to entity lists and control measures in 2023, can result in severe penalties and the loss of export privileges.

Furthermore, AIXTRON is subject to a complex array of global environmental, health, and safety (EHS) regulations, covering everything from chemical handling to worker well-being. Compliance with directives such as REACH and RoHS is crucial for market access and operational continuity, with violations potentially leading to substantial fines and operational halts, as seen in other manufacturing sectors in 2024.

| Legal Factor | Description | Impact on AIXTRON | Example/Data Point (2023-2025) |

| Intellectual Property Protection | Safeguarding patents for deposition technologies. | Maintains market advantage, prevents imitation. | Ongoing legal expenses allocated in financial reports for IP defense. |

| Export Controls | Adherence to regulations for dual-use equipment. | Affects sales to specific countries, risk of fines. | U.S. BIS Entity List updates impacting technology access (ongoing). |

| EHS Regulations | Compliance with environmental, health, and safety standards. | Ensures market access, avoids operational shutdowns and fines. | Potential fines for environmental violations in manufacturing sectors (millions in 2024). |

| Trade Laws & Tariffs | Navigating international trade agreements and tariffs. | Impacts cost of goods sold, pricing strategies. | EU trade surplus with China in goods was €213 billion in 2023. |

| Data Privacy & Cybersecurity | Complying with GDPR, CCPA, and data protection laws. | Mitigates risk of substantial fines, maintains customer trust. | GDPR penalties up to 4% of global annual revenue; global average data breach cost $4.45 million in 2023. |

Environmental factors

The global drive for sustainability significantly boosts the demand for energy-efficient technologies, a core area for AIXTRON. Its deposition equipment is vital for manufacturing components like LEDs, which reduce energy consumption in lighting, and power electronics essential for electric vehicles. For instance, the global LED lighting market was projected to reach over $100 billion by 2024, highlighting the scale of this demand.

This societal and regulatory push for reduced carbon footprints directly benefits AIXTRON, as its technology facilitates the production of devices critical for a greener economy. Furthermore, AIXTRON can leverage the energy efficiency of its own manufacturing equipment as a selling point, aligning its operational practices with the environmental goals it helps its customers achieve.

AIXTRON faces increasing scrutiny regarding hazardous substances and waste management, directly influencing its manufacturing and product lifecycle. For instance, the global e-waste generation was projected to reach 74 million metric tons by 2030, highlighting the growing challenge of responsible disposal. Compliance with regulations like the EU's Restriction of Hazardous Substances (RoHS) directive necessitates meticulous material sourcing and product design to limit specific chemicals, impacting production costs and innovation pathways.

The Waste Electrical and Electronic Equipment (WEEE) directive in Europe, along with similar international frameworks, mandates producer responsibility for product take-back and recycling. This requires AIXTRON to develop robust systems for managing end-of-life products, adding operational complexity and potential financial liabilities. For example, the European Environment Agency reported that in 2020, only 35% of WEEE was collected and treated correctly in the EU, underscoring the regulatory pressure for improved management.

AIXTRON, like many global corporations, faces mounting pressure from investors and the public to showcase robust Environmental, Social, and Governance (ESG) performance. This scrutiny directly impacts how the company operates and communicates its sustainability efforts.

Comprehensive ESG reporting is no longer a mere formality; it’s a critical tool for attracting capital and safeguarding brand reputation. Investors are increasingly looking at metrics such as AIXTRON's energy consumption, greenhouse gas emissions, and the sustainability of its supply chain to inform their investment decisions.

For instance, in 2023, the global sustainable investment market reached an estimated $37.4 trillion, a testament to the growing investor demand for companies with strong ESG credentials. This trend means AIXTRON's operational strategies and public disclosures must actively reflect a commitment to environmental stewardship and social responsibility to remain competitive.

Supply Chain Sustainability and Transparency

The demand for sustainable and transparent supply chains is intensifying, pushing companies like AIXTRON to scrutinize their entire value chain. This includes ensuring that raw materials are sourced ethically and that partners adhere to environmentally sound practices.

AIXTRON must actively assess and reduce environmental risks embedded within its supplier network. This proactive approach is crucial for building resilience and meeting evolving regulatory and consumer expectations. For instance, in 2024, many semiconductor industry suppliers faced increased scrutiny over their carbon footprints and water usage, impacting their ability to secure contracts with major equipment manufacturers.

- Growing Stakeholder Demand: Customers and investors increasingly prioritize companies demonstrating robust supply chain sustainability, influencing purchasing decisions and investment strategies.

- Regulatory Scrutiny: Upcoming environmental regulations, particularly in the EU, will likely mandate greater transparency and accountability for supply chain emissions and resource management.

- Risk Mitigation: Proactively addressing environmental risks in the supply chain, such as those related to rare earth mineral sourcing or hazardous waste disposal, can prevent costly disruptions and reputational damage.

- Competitive Advantage: Companies that lead in supply chain transparency and sustainability can differentiate themselves, attracting environmentally conscious clients and talent.

Climate Change Mitigation and Adaptation

Global initiatives aimed at achieving carbon neutrality by 2050 and significantly cutting greenhouse gas emissions are reshaping industrial operations. AIXTRON, as a provider of deposition equipment, faces increasing scrutiny regarding its own carbon footprint and the energy efficiency of its products. For instance, the European Union's Green Deal aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, directly impacting manufacturing sectors AIXTRON serves.

This regulatory landscape compels AIXTRON to explore investments in renewable energy sources for its facilities and to innovate equipment that enables its customers to adopt lower-emission manufacturing processes. The demand for energy-efficient semiconductor manufacturing tools, crucial for technologies like advanced displays and power electronics, is on the rise. In 2024, the global semiconductor market is projected to see substantial growth, with a particular emphasis on sustainable production methods.

Furthermore, AIXTRON must proactively address potential disruptions to its supply chains stemming from climate-related events. Extreme weather patterns can impact raw material availability and logistics, necessitating robust adaptation strategies. Building resilience into supply networks, perhaps through diversified sourcing or regionalized production, becomes a critical consideration for maintaining operational continuity and meeting customer demand in an increasingly unpredictable climate.

- Carbon Neutrality Targets: Many nations, including those in the EU and UK, have set legally binding targets for net-zero emissions by 2050.

- Renewable Energy Adoption: AIXTRON's customers in sectors like automotive and consumer electronics are increasingly demanding components manufactured using renewable energy.

- Supply Chain Resilience: The increasing frequency of climate-related disruptions, such as floods and droughts, poses risks to global manufacturing supply chains.

- Energy Efficiency in Manufacturing: Equipment that reduces energy consumption during deposition processes is becoming a key differentiator in the market.

AIXTRON's business is intrinsically linked to the global push for sustainability and reduced environmental impact. The demand for energy-efficient technologies, a cornerstone of AIXTRON's product offerings, is projected to continue its upward trajectory. For instance, the global market for energy-efficient lighting, a key application for AIXTRON's LED deposition equipment, was expected to exceed $100 billion by 2024.

The company must also navigate increasing regulatory pressures concerning hazardous substances and waste management, with global e-waste projected to reach 74 million metric tons by 2030. Compliance with directives like RoHS necessitates careful material selection and product design, impacting production costs. Furthermore, the WEEE directive mandates producer responsibility for end-of-life products, requiring AIXTRON to implement robust recycling and disposal systems.

AIXTRON faces significant stakeholder scrutiny regarding its Environmental, Social, and Governance (ESG) performance, with sustainable investments reaching an estimated $37.4 trillion globally in 2023. This trend underscores the need for AIXTRON to demonstrate a strong commitment to environmental stewardship across its operations and supply chain to attract capital and maintain its competitive edge.

The company's supply chain is also under increasing pressure for transparency and sustainability, with many semiconductor suppliers facing scrutiny over their carbon footprints and water usage in 2024. AIXTRON must actively assess and mitigate environmental risks within its supplier network to ensure resilience and meet evolving regulatory and consumer expectations.

PESTLE Analysis Data Sources

Our AIXTRON PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, leading industry analyst reports, and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting AIXTRON.