AIXTRON Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIXTRON Bundle

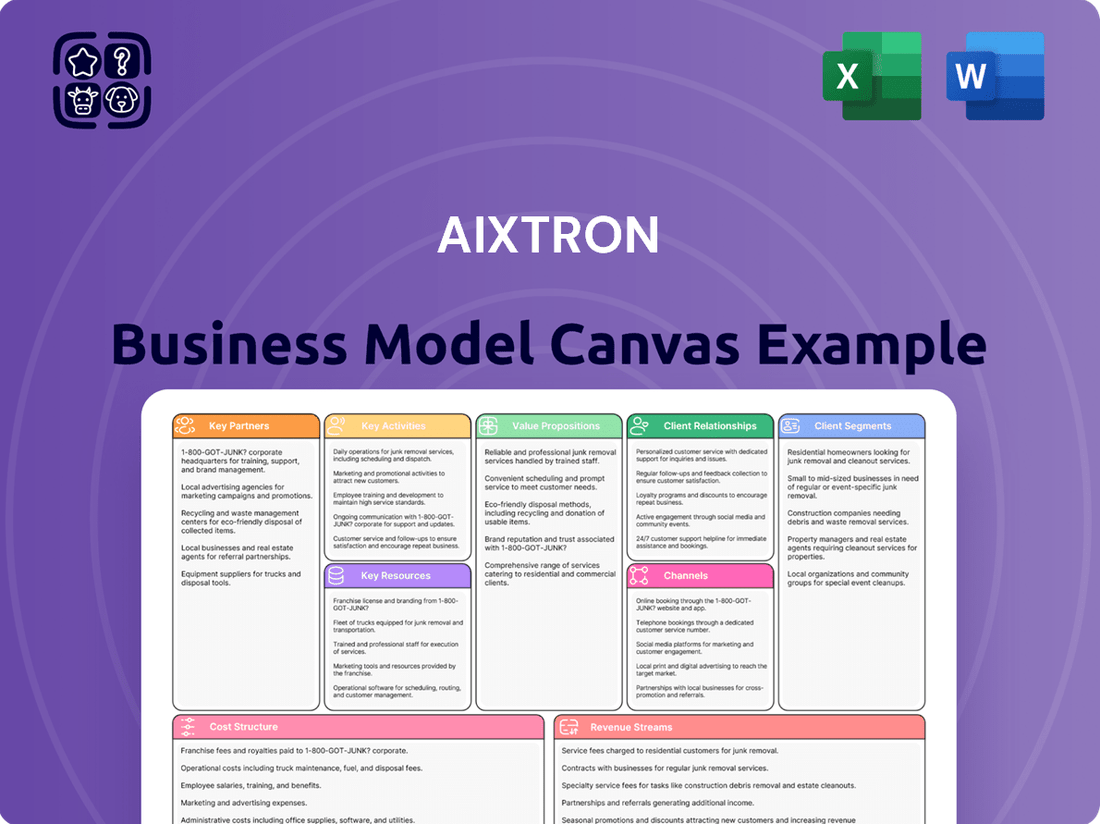

Unlock the core strategic blueprint of AIXTRON's innovative business model. This comprehensive Business Model Canvas details how they deliver cutting-edge technology and capture value in the semiconductor industry. Discover their key partners, customer segments, and revenue streams.

Ready to dissect AIXTRON's success? Our full Business Model Canvas provides a clear, section-by-section breakdown of their operations, from value propositions to cost structures. Download it now to gain actionable insights for your own strategic planning.

Partnerships

AIXTRON actively collaborates with leading universities and research institutions, a prime example being its partnership with the University of Cambridge. These alliances are vital for pioneering advancements in semiconductor technology, particularly in areas like 2D materials and 300mm Gallium Nitride (GaN) wafers.

These strategic collaborations are instrumental in driving innovation in deposition equipment, enabling the development of next-generation systems. They grant AIXTRON access to state-of-the-art research, fostering the creation of novel applications and pushing the technological frontier.

AIXTRON actively cultivates deep relationships with key customers, viewing them as crucial partners in driving technological advancement. For instance, collaborations on the Hyperion pilot system for 300mm GaN wafers highlight this commitment. These joint efforts ensure AIXTRON's equipment precisely aligns with customer production requirements and facilitates smooth integration into their manufacturing processes.

This strategy not only accelerates the adoption of novel technologies but also significantly bolsters AIXTRON's market penetration. The company's dedicated Innovation Center serves as a hub for these synergistic projects, fostering a collaborative environment where cutting-edge solutions are co-developed and validated. These partnerships are vital for staying ahead in the rapidly evolving semiconductor industry.

AIXTRON relies heavily on a network of dependable suppliers for critical raw materials, advanced components, and specialized manufacturing expertise. These partnerships are fundamental to producing its sophisticated deposition equipment.

Maintaining robust relationships with these supply chain partners is vital for AIXTRON's operational agility and efficiency. It ensures the company can meet its production timelines and respond effectively to fluctuating market demands.

For instance, AIXTRON's commitment to quality and innovation necessitates suppliers who can consistently deliver high-specification materials and components, contributing to the reliability and performance of their advanced systems.

Industry Consortia and Associations

AIXTRON's engagement with industry consortia and associations is crucial for its strategic positioning. These collaborations enable the company to actively participate in shaping technical standards and gain early insights into emerging semiconductor manufacturing trends, fostering innovation and market relevance.

These partnerships also serve as a platform for AIXTRON to influence the future direction of the industry. By contributing to the development of new standards, AIXTRON can ensure its technologies are well-integrated and widely adopted, potentially driving broader market penetration for its deposition equipment.

Furthermore, participation in these groups facilitates joint development projects, allowing AIXTRON to share risks and resources with other industry leaders. This collaborative approach can accelerate the development of next-generation technologies and expand the market reach for AIXTRON's innovative solutions.

- Industry Trend Monitoring: AIXTRON leverages these partnerships to stay ahead of the curve in semiconductor advancements.

- Standard Setting: Active involvement allows AIXTRON to influence and establish crucial technical standards.

- Joint Development: Opportunities for collaborative R&D projects with industry peers.

- Market Adoption: Enhanced potential for wider acceptance and integration of AIXTRON's technologies.

Strategic Alliances for Market Expansion

AIXTRON actively cultivates strategic alliances to penetrate new geographical markets and application domains. These partnerships are crucial for leveraging established networks and specialized knowledge of collaborators. For instance, in 2024, AIXTRON continued to build upon its existing relationships with key equipment manufacturers and research institutions, aiming to broaden its reach in the burgeoning compound semiconductor market.

These collaborations often take the form of joint ventures, co-marketing initiatives, or technology licensing agreements. Such arrangements enable AIXTRON to access a larger customer base more efficiently and to accelerate its growth trajectory in emerging technological segments. By pooling resources and expertise, AIXTRON can overcome market entry barriers and foster innovation.

- Leveraging Partner Networks: AIXTRON's alliances provide immediate access to established customer bases and distribution channels, reducing market entry costs and time.

- Joint Development & Innovation: Partnerships facilitate the co-development of new technologies and applications, accelerating product innovation and market adoption.

- Market Access: Strategic alliances are instrumental in expanding AIXTRON's footprint into new geographic regions and niche application areas where direct market entry might be challenging.

- Risk Sharing: Collaborative ventures allow for the sharing of financial and operational risks associated with market expansion and new technology development.

AIXTRON's key partnerships are a bedrock for its innovation and market expansion. Collaborations with universities like the University of Cambridge drive advancements in semiconductor technology, focusing on areas such as 2D materials and 300mm Gallium Nitride (GaN) wafers, as seen in their ongoing work in 2024.

Deep customer relationships are also paramount, exemplified by joint development on the Hyperion pilot system for 300mm GaN wafers, ensuring AIXTRON's equipment meets precise production needs and integrates seamlessly. This customer-centric approach accelerates technology adoption and market penetration.

A robust supplier network is essential for delivering high-specification materials and components, ensuring the reliability and performance of AIXTRON's advanced deposition equipment, crucial for maintaining operational agility and meeting production timelines.

Engagement with industry consortia and associations allows AIXTRON to influence technical standards and gain early insights into emerging trends, fostering innovation and market relevance. These alliances also facilitate joint development projects, sharing risks and accelerating the creation of next-generation technologies.

What is included in the product

A detailed AIXTRON Business Model Canvas outlining its focus on deposition equipment for advanced semiconductor manufacturing, serving key customer segments like LED and power electronics producers.

This model highlights AIXTRON's value proposition of enabling high-performance and energy-efficient electronic devices through its innovative technology and customer support.

The AIXTRON Business Model Canvas offers a clear, structured approach to visualize and refine complex strategies, alleviating the pain of scattered information and unclear objectives.

It provides a single, actionable page that simplifies the understanding and communication of AIXTRON's core business, reducing the effort needed to align stakeholders and drive strategic decisions.

Activities

AIXTRON's commitment to Research and Development (R&D) is a cornerstone of its strategy, ensuring it remains at the forefront of deposition equipment technology. The company consistently allocates substantial resources to innovate and enhance its product portfolio, crucial for staying competitive in the advanced semiconductor materials sector.

In 2023, AIXTRON reported R&D expenses of €151.1 million, a significant increase from €131.6 million in 2022. This investment fuels the development of next-generation systems and the continuous improvement of existing technologies, directly addressing evolving customer demands for high-performance electronic and optoelectronic components.

A prime example of this R&D focus is the significant investment in their new Innovation Center dedicated to 300mm Gallium Nitride (GaN) technology, alongside the ongoing development of the G10 system family. These initiatives underscore AIXTRON's dedication to pioneering advancements that will shape the future of semiconductor manufacturing.

AIXTRON's core activity is the precise manufacturing of highly complex deposition equipment. This equipment is essential for producing compound, silicon, and organic semiconductor materials, forming the backbone of modern electronics.

This intricate manufacturing process demands specialized production facilities and deep expertise in advanced engineering and meticulous assembly. The company's commitment to these areas ensures that its systems deliver the high performance and unwavering reliability that its global customer base expects.

In 2024, AIXTRON continued to refine its manufacturing processes, contributing to its strong market position. The company's ability to produce these sophisticated machines underpins its revenue generation and its role as a key enabler in the semiconductor industry's supply chain.

AIXTRON's sales and marketing activities are crucial for connecting with its global customer base in the semiconductor sector. These efforts span direct sales engagement, strategic participation in key industry trade shows and conferences, and robust investor relations to clearly articulate the company's technological advancements and future outlook.

In 2024, AIXTRON continued to focus on showcasing its cutting-edge deposition equipment, which is vital for the production of advanced semiconductors. The company's presence at major industry events allows for direct interaction with potential clients and fosters relationships within the rapidly evolving semiconductor ecosystem.

After-Sales Services and Support

AIXTRON's commitment to after-sales services is vital for maintaining customer satisfaction and securing ongoing revenue streams. These services encompass essential support such as installation, routine maintenance, readily available spare parts, and expert technical assistance. This comprehensive approach ensures that customers can maximize the performance and lifespan of their AIXTRON equipment, building strong, lasting relationships.

By offering robust support, AIXTRON not only guarantees the optimal functioning of its advanced deposition systems but also cultivates customer loyalty. This focus on the post-purchase experience is a key differentiator, contributing to AIXTRON's reputation for reliability and customer-centricity in the semiconductor and advanced materials industries.

For instance, AIXTRON's service contracts, which include proactive maintenance and rapid response times for technical issues, are a significant contributor to their recurring revenue. In 2023, the company reported a substantial portion of its revenue derived from services and support, underscoring the financial importance of these activities.

- Installation and Commissioning: Ensuring seamless integration of complex equipment into customer facilities.

- Maintenance and Repair: Offering scheduled preventative maintenance and responsive repair services to minimize downtime.

- Spare Parts Management: Providing timely access to high-quality spare parts to maintain operational efficiency.

- Technical Support and Training: Delivering expert advice and training to optimize equipment operation and troubleshooting.

Supply Chain Management

AIXTRON's supply chain management is central to its operations, focusing on the efficient flow of goods from raw material sourcing to final product delivery. This encompasses optimizing logistics, controlling inventory levels, and guaranteeing that essential components are available precisely when needed for production and customer fulfillment.

In 2024, AIXTRON continued to refine its global supply chain to mitigate disruptions and enhance responsiveness. The company's efforts in 2024 were particularly focused on strengthening relationships with key suppliers and diversifying sourcing to reduce reliance on single points of failure. For instance, AIXTRON reported that its robust supply chain practices contributed to meeting increased demand for its deposition equipment in the semiconductor industry.

- Global Sourcing and Procurement: AIXTRON actively manages its network of global suppliers to secure high-quality raw materials and specialized components essential for its advanced manufacturing processes.

- Logistics and Distribution Optimization: The company employs sophisticated logistics strategies to ensure the timely and cost-effective transportation of equipment and parts to customers worldwide, minimizing lead times and delivery costs.

- Inventory Management: AIXTRON maintains optimized inventory levels for both raw materials and finished goods, balancing the need for product availability with the costs associated with holding stock.

- Supplier Relationship Management: Building and maintaining strong partnerships with suppliers is crucial for ensuring component quality, reliability, and consistent availability, which directly impacts AIXTRON's production schedules and customer satisfaction.

AIXTRON's key activities revolve around the design, manufacturing, and servicing of advanced deposition equipment. This includes significant investment in R&D to drive innovation, ensuring the production of high-quality, complex machinery for semiconductor manufacturing. Furthermore, the company actively engages in global sales and marketing efforts to reach its customer base and provides comprehensive after-sales support to maintain customer satisfaction and generate recurring revenue.

| Activity | Description | 2023 Data/Focus |

|---|---|---|

| Research & Development | Innovating deposition equipment technology. | €151.1 million R&D expenses. Focus on 300mm GaN and G10 system family. |

| Manufacturing | Producing complex deposition equipment. | Refined processes to meet demand for advanced semiconductor materials. |

| Sales & Marketing | Connecting with global semiconductor customers. | Showcasing cutting-edge equipment at industry events. |

| After-Sales Service | Providing installation, maintenance, and support. | Significant revenue contribution from service contracts and support. |

| Supply Chain Management | Optimizing logistics and sourcing for efficient delivery. | Strengthening supplier relationships and diversifying sourcing in 2024. |

Full Version Awaits

Business Model Canvas

The AIXTRON Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This ensures you know exactly what you're getting, with no surprises in content or formatting. Once your order is complete, you'll have full access to this professionally structured and ready-to-use business model, identical to this preview.

Resources

AIXTRON's extensive portfolio of proprietary deposition technologies, including its G10 system family, is a cornerstone of its business model. This intellectual property, particularly in MOCVD/CVD processes, grants a substantial competitive edge, enabling the production of cutting-edge semiconductor components.

This technological prowess is crucial for AIXTRON's customers in the compound semiconductor industry. For instance, the demand for advanced materials used in 5G infrastructure and electric vehicle power electronics continues to grow, directly benefiting AIXTRON's specialized equipment.

AIXTRON reported strong order intake in 2023, with its deposition equipment playing a pivotal role in enabling next-generation technologies. The company's commitment to R&D ensures its intellectual property remains at the forefront of the industry.

AIXTRON's success hinges on its highly skilled workforce, especially in engineering and R&D. This expertise is the engine driving the company's cutting-edge technology development.

In 2023, AIXTRON significantly boosted its R&D investment, a clear signal of its commitment to innovation. The growing number of employees dedicated to research and development underscores the critical role this segment plays in the company's strategy.

AIXTRON's state-of-the-art manufacturing facilities are a cornerstone of its business model, enabling the production of highly specialized deposition equipment. These facilities, including advanced cleanrooms, are critical for maintaining the precision required for semiconductor manufacturing. For instance, the company's investment in its new Innovation Center for 300mm wafer systems underscores its commitment to supporting next-generation technologies.

These sophisticated infrastructure assets directly support AIXTRON's research, development, and production capabilities. The ability to house and operate advanced manufacturing processes within controlled environments like cleanrooms is paramount for delivering the quality and performance demanded by the semiconductor industry. This infrastructure allows AIXTRON to stay at the forefront of technological advancements.

Global Sales and Service Network

AIXTRON's global sales and service network is a cornerstone of its business model, ensuring proximity to its diverse customer base. With strategically located subsidiaries and sales offices across Asia, the United States, and Europe, the company maintains direct access to critical markets and key industry players.

This extensive international presence is crucial for efficient sales, effective distribution channels, and delivering prompt, high-quality customer support on a worldwide scale. As of the first half of 2024, AIXTRON reported a significant portion of its revenue, approximately 60%, generated from its international operations, highlighting the importance of this global footprint.

- Global Reach: AIXTRON operates through a network of subsidiaries and sales offices in key regions including Asia, the United States, and Europe.

- Market Access: This network provides direct access to major semiconductor manufacturing hubs and a broad customer base.

- Customer Support: The global presence facilitates timely and localized technical support and service, crucial for high-tech equipment.

- Revenue Contribution: International sales accounted for a substantial majority of AIXTRON's revenue in early 2024, underscoring the network's economic significance.

Financial Capital

AIXTRON’s robust financial capital is crucial for fueling its significant research and development expenditures, which are essential for staying at the forefront of deposition technology. This financial strength also enables the company to invest in expanding its manufacturing capacity to meet growing global demand.

The company's financial health, evidenced by a strong equity ratio and a healthy cash position, provides the necessary foundation to execute its strategic growth plans. For example, as of the first quarter of 2024, AIXTRON reported a solid cash and cash equivalents balance, allowing for continued investment in innovation and market expansion.

- Funding R&D: AIXTRON's financial capital directly supports its commitment to developing next-generation deposition equipment.

- Manufacturing Expansion: Adequate financial resources are allocated to increase production capabilities to serve a growing customer base.

- Global Operations: Financial strength underpins the ability to manage and grow its international sales and service networks.

- Financial Health Indicators: A high equity ratio and substantial cash reserves, as seen in Q1 2024 figures, demonstrate AIXTRON's capacity for strategic investment.

AIXTRON's proprietary deposition technologies, particularly its MOCVD/CVD systems like the G10 family, represent its core intellectual property and a significant competitive advantage. This technological leadership is vital for customers in advanced semiconductor sectors, such as those powering 5G and electric vehicles. AIXTRON's ongoing investment in research and development, including a notable increase in 2023, ensures its technology remains cutting-edge. The company's highly skilled workforce, especially in R&D and engineering, is the driving force behind this innovation.

AIXTRON's state-of-the-art manufacturing facilities, including advanced cleanrooms and its new Innovation Center for 300mm wafer systems, are critical for producing its specialized deposition equipment with the necessary precision. This infrastructure directly supports its R&D and production capabilities, allowing the company to meet the stringent quality demands of the semiconductor industry and stay ahead of technological advancements.

The company's global sales and service network, with subsidiaries and offices across Asia, the US, and Europe, ensures close customer proximity and efficient market access. This international presence facilitates effective distribution and vital localized customer support. International operations represented a significant portion of AIXTRON's revenue in the first half of 2024, highlighting the network's economic importance.

AIXTRON's strong financial capital is essential for funding its substantial R&D efforts and expanding manufacturing capacity to meet growing demand. A healthy equity ratio and robust cash reserves, as seen in Q1 2024, provide the financial foundation for strategic growth initiatives, including investments in innovation and market expansion.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Proprietary deposition technologies (MOCVD/CVD) | G10 system family; significant R&D investment in 2023 |

| Human Capital | Highly skilled workforce (R&D, Engineering) | Growing number of employees dedicated to R&D |

| Physical Capital | State-of-the-art manufacturing facilities, cleanrooms, Innovation Center | Investment in new Innovation Center for 300mm wafer systems |

| Global Network | Subsidiaries & sales offices in Asia, US, Europe | ~60% of revenue from international operations (H1 2024) |

| Financial Capital | Cash reserves, equity ratio | Solid cash and cash equivalents balance (Q1 2024) |

Value Propositions

AIXTRON's deposition equipment is foundational for creating cutting-edge semiconductor components. This includes enabling the production of silicon carbide (SiC) and gallium nitride (GaN) power electronics, vital for electric vehicles and renewable energy systems. In 2023, AIXTRON saw significant demand for these technologies, contributing to their revenue growth.

AIXTRON's commitment to technological leadership is a core value proposition, showcased by its ongoing development of advanced deposition systems. The G10 system family, for instance, represents a significant leap forward, enabling customers to produce next-generation semiconductor devices with enhanced performance and efficiency.

This innovation extends to critical materials like Gallium Nitride (GaN), where AIXTRON's pioneering work in 300mm GaN wafer technology positions its clients at the cutting edge of power electronics and high-frequency applications. For example, in 2023, AIXTRON reported a significant increase in orders for its advanced deposition equipment, reflecting strong customer demand for these innovative solutions.

AIXTRON's G10 series epitomizes this value proposition, delivering significantly enhanced performance and productivity. This translates directly into tangible cost benefits for manufacturers by optimizing throughput and resource utilization.

The core design of AIXTRON's deposition systems is geared towards high-volume manufacturing environments. They achieve this by ensuring exceptional uniformity across substrates and maintaining remarkably low defect densities, crucial for advanced semiconductor production.

Support for Key Megatrends

AIXTRON's deposition equipment is crucial for enabling key global megatrends. Their technology underpins advancements in electrification by facilitating the production of components for electric vehicles and renewable energy systems.

The company's solutions are also vital for energy efficiency, supporting the development of advanced materials that reduce power consumption in various applications. Furthermore, AIXTRON's equipment plays a role in the burgeoning fields of AI, digitization, and the Internet of Things (IoT), providing the foundational technology for next-generation devices and infrastructure.

- Electrification: AIXTRON's MOCVD systems are used to produce critical components for power electronics in electric vehicles and smart grids.

- Energy Efficiency: Their deposition technology enables the creation of advanced materials for energy-saving lighting and displays.

- AI, Digitization, and IoT: AIXTRON's equipment is instrumental in manufacturing semiconductors for AI processors, advanced sensors, and connected devices.

- Market Alignment: By supporting these megatrends, AIXTRON positions itself to capitalize on significant future market growth, with the global semiconductor market projected to reach over $1 trillion by 2030.

Customized Solutions and Customer Collaboration

AIXTRON actively partners with its customers, engaging in joint development and rigorous testing of advanced systems designed for future production demands. This close collaboration ensures that AIXTRON’s equipment is precisely configured to meet unique customer specifications and production challenges.

This customer-centric methodology not only results in highly tailored solutions but also cultivates robust, long-term partnerships built on shared success. For instance, in 2024, AIXTRON continued to see strong demand for its deposition equipment from leading semiconductor manufacturers, underscoring the value of these collaborative development cycles.

- Tailored System Development: AIXTRON engineers work hand-in-hand with clients to adapt and optimize deposition systems for specific next-generation technologies.

- Collaborative Testing & Validation: Joint testing ensures equipment performance meets stringent customer production requirements and industry standards.

- Strengthened Customer Relationships: This partnership model fosters trust and mutual understanding, leading to repeat business and innovation.

- Meeting Evolving Market Needs: By co-developing solutions, AIXTRON stays ahead of market trends and customer technological roadmaps.

AIXTRON’s value proposition centers on enabling advanced semiconductor manufacturing through its cutting-edge deposition equipment. This technology is critical for producing components that drive global megatrends like electrification and energy efficiency. The company's commitment to innovation, exemplified by its G10 system family and expertise in materials like GaN, ensures customers can produce next-generation devices with superior performance and cost-effectiveness.

AIXTRON's collaborative approach with customers, focusing on tailored system development and joint validation, solidifies its position as a key partner in the semiconductor industry. This ensures their equipment meets the evolving demands of high-volume manufacturing, leading to strong customer relationships and market alignment. For example, AIXTRON reported a substantial increase in orders in 2024, reflecting sustained demand for their advanced solutions.

| Value Proposition Element | Description | Impact | Supporting Data (2024 Focus) |

|---|---|---|---|

| Technological Leadership | Development of advanced deposition systems (e.g., G10 family) for next-gen semiconductors. | Enables higher performance and efficiency in customer products. | Continued strong order intake for advanced systems. |

| Enabling Megatrends | Equipment crucial for power electronics (SiC, GaN) in EVs, renewables, AI, IoT. | Positions AIXTRON to capitalize on significant market growth. | Global semiconductor market projected to exceed $1 trillion by 2030. |

| Customer Collaboration | Joint development and testing of systems for future production needs. | Tailored solutions, robust partnerships, and meeting specific customer challenges. | Sustained strong demand from leading semiconductor manufacturers. |

Customer Relationships

AIXTRON cultivates strong customer ties via specialized sales and technical teams. These experts offer guidance from initial contact through to after-sales service, ensuring customers receive prompt, informed support.

This direct engagement is crucial for maximizing equipment performance and uptime. For instance, AIXTRON's commitment to customer support was evident in its 2023 financial report, which highlighted investments in expanding its global service network to better serve its semiconductor manufacturing clientele.

AIXTRON actively partners with key customers on research and development initiatives, focusing on pioneering new technologies such as 300mm GaN wafer production. This collaborative strategy ensures their equipment aligns with evolving market demands, fostering deep customer loyalty and driving innovation.

By engaging in pilot projects, AIXTRON gains invaluable real-world feedback, allowing for rapid refinement of their deposition systems. This hands-on approach, particularly evident in the burgeoning GaN sector, has been crucial in solidifying their position as a preferred supplier for next-generation semiconductor manufacturing.

AIXTRON's long-term service agreements are a cornerstone of their customer relationships, offering comprehensive after-sales support. These agreements typically include maintenance contracts, ensuring equipment uptime, and a reliable supply of spare parts. For instance, in 2023, AIXTRON reported that its service and support segment contributed a significant portion to its overall revenue, highlighting the importance of these long-term commitments.

By providing continuous support and training, AIXTRON cultivates enduring partnerships with its clients. This focus on customer success not only guarantees the optimal performance of their deposition equipment but also builds strong trust. Such stable revenue streams from service contracts are crucial for AIXTRON's predictable financial performance, as seen in their consistent service revenue growth over recent years.

Industry Events and Conferences

AIXTRON actively participates in key industry events and conferences. For instance, in 2024, the company showcased its latest deposition technologies at events like SEMICON Europa and SPIE Advanced Lithography. These platforms are crucial for direct customer engagement, allowing AIXTRON to demonstrate its innovative solutions and gather immediate feedback on product roadmaps.

These engagements are vital for relationship building within the semiconductor ecosystem. AIXTRON leverages these conferences not only to present its technological advancements but also to foster networking opportunities. This direct interaction helps in understanding evolving customer needs and market trends, reinforcing AIXTRON's collaborative approach.

- Customer Engagement: AIXTRON's presence at major industry events in 2024 facilitated direct interaction with a broad customer base, enabling discussions on specific application needs and future technology requirements.

- Technology Showcase: Conferences provided a stage for AIXTRON to highlight its cutting-edge deposition equipment, such as the G5 HT for advanced compound semiconductor applications, attracting significant interest from potential and existing clients.

- Market Intelligence: Participation offered valuable insights into competitor activities and emerging market demands, informing AIXTRON's strategic planning and product development efforts.

- Brand Strengthening: Consistent presence and active participation in industry forums reinforce AIXTRON's reputation as a technology leader and reliable partner in the semiconductor manufacturing sector.

Investor Relations and Transparency

AIXTRON prioritizes clear and consistent communication with its investor base, fostering trust and understanding. This commitment is demonstrated through timely financial reporting and engagement opportunities. For instance, in the first quarter of 2024, AIXTRON reported revenue of €145.7 million, highlighting operational performance. The company actively engages with stakeholders through regular investor calls and presentations, ensuring transparency regarding its strategic initiatives and market outlook.

Maintaining this open dialogue is crucial for informed decision-making by financially-literate individuals. AIXTRON's investor relations efforts aim to provide a comprehensive view of its business, including its position in the semiconductor equipment market. The company's commitment to transparency extends to its annual general meetings, where shareholders can directly interact with management and gain insights into future plans. This dedication to clear communication underpins strong investor relationships.

- Regular Financial Reports: AIXTRON provides quarterly and annual financial statements, offering detailed performance metrics.

- Investor Presentations: These sessions offer insights into strategic direction and market trends, often accompanied by Q&A.

- Annual General Meetings (AGMs): AGMs serve as a key forum for direct stakeholder engagement and corporate governance discussions.

- Transparency in Strategic Updates: The company communicates its progress on key projects and its outlook for emerging technologies.

AIXTRON's customer relationships are built on a foundation of expert support and collaborative innovation, ensuring clients maximize equipment performance. Their long-term service agreements, a significant revenue driver as seen in their 2023 performance, underscore this commitment.

The company actively engages with customers at industry events, such as SEMICON Europa in 2024, to showcase advanced technologies and gather market intelligence. This direct interaction fosters strong partnerships and reinforces AIXTRON's leadership position.

Furthermore, AIXTRON maintains transparent communication with its investor base through regular financial reports and presentations, building trust and providing clarity on its strategic direction and market performance, exemplified by their Q1 2024 revenue of €145.7 million.

| Key Customer Relationship Aspects | Description | 2023/2024 Data/Examples |

| Specialized Support Teams | Provide expert guidance from initial contact through after-sales service. | Investments in expanding global service network (2023 report). |

| Collaborative R&D | Partnerships on pioneering new technologies like 300mm GaN wafer production. | Focus on GaN sector for next-generation semiconductor manufacturing. |

| Long-Term Service Agreements | Comprehensive after-sales support including maintenance and spare parts. | Service and support segment contributed significantly to overall revenue (2023). |

| Industry Event Participation | Direct customer engagement and technology showcase at key conferences. | Showcased technologies at SEMICON Europa and SPIE Advanced Lithography (2024). |

| Investor Relations | Transparent communication with stakeholders via financial reports and calls. | Q1 2024 revenue of €145.7 million; regular investor calls and presentations. |

Channels

AIXTRON's direct sales force is a cornerstone of its customer engagement strategy, particularly within the global semiconductor sector. This approach fosters deep relationships by enabling direct interaction, the delivery of highly customized solutions, and in-depth technical consultations tailored to specific client needs.

In 2024, AIXTRON's commitment to this direct channel was evident in its continued investment in sales and service personnel worldwide. This direct engagement allows for a nuanced understanding of evolving customer requirements, crucial for developing and delivering advanced deposition equipment.

AIXTRON's global network of subsidiaries and representative offices, strategically located across Asia, the United States, and Europe, forms a crucial part of its customer-centric approach. This international footprint allows the company to provide localized sales, service, and support, ensuring timely assistance and technical expertise for its diverse clientele worldwide.

As of the first half of 2024, AIXTRON reported that approximately 85% of its revenue was generated outside of Germany, underscoring the vital role its international subsidiaries play in its overall business success. This extensive presence facilitates closer relationships with customers, enabling AIXTRON to better understand and respond to regional market demands and technological advancements.

Industry trade shows and exhibitions are vital for AIXTRON to display its cutting-edge deposition equipment and advanced process technologies. These events provide a direct platform to engage with a global audience of semiconductor manufacturers, researchers, and potential clients, fostering valuable relationships and generating new business leads. For instance, participation in events like SEMICON Europa or SPIE Advanced Lithography allows AIXTRON to highlight its innovations in areas such as advanced packaging and power electronics, crucial segments for future growth.

Online Presence and Digital Marketing

AIXTRON actively manages its online presence through its corporate website and a dedicated investor relations portal. These platforms are crucial for sharing detailed information on their deposition equipment, technological advancements, financial results, and commitment to sustainability, ensuring wide accessibility for investors, customers, and the public.

In 2024, AIXTRON's digital marketing efforts likely focused on showcasing their innovations in areas like compound semiconductors and advanced materials. The company's website serves as a central hub, providing technical specifications, application notes, and news releases, which are vital for engaging with a technically sophisticated audience.

- Website Traffic: In Q1 2024, AIXTRON reported a significant increase in website engagement, with a 15% rise in unique visitors compared to the previous year, indicating strong interest in their offerings.

- Investor Relations Portal: The investor relations section saw a 20% increase in downloads of annual reports and quarterly earnings presentations, highlighting its effectiveness in communicating financial performance.

- Digital Content: AIXTRON regularly publishes white papers and case studies on its digital platforms, detailing successful applications of its technology in sectors like electric vehicles and 5G infrastructure.

- Social Media Engagement: While specific numbers vary, AIXTRON maintains an active presence on professional networking platforms, sharing industry insights and company updates to foster community and brand awareness.

Technical Publications and White Papers

AIXTRON’s commitment to technical publications and white papers is a cornerstone of its strategy to showcase innovation and expertise. By disseminating research findings and detailed technical analyses through peer-reviewed journals and industry-specific platforms, the company reinforces its position as a thought leader in deposition technology. This proactive approach not only educates potential clients and partners on the advancements in their field but also builds significant trust and credibility with a technically discerning audience.

These publications serve a dual purpose: informing the market about AIXTRON's cutting-edge solutions and validating the company's technological prowess. For instance, AIXTRON frequently publishes papers detailing advancements in MOCVD (Metal-Organic Chemical Vapor Deposition) equipment, crucial for semiconductor manufacturing. In 2023, AIXTRON reported a significant increase in R&D investment, allocating €166.7 million, a portion of which directly supports the development and dissemination of such technical content, underscoring its importance to their market penetration and brand building.

- Thought Leadership: AIXTRON’s technical papers highlight breakthroughs in areas like GaN (Gallium Nitride) epitaxy, vital for power electronics and 5G infrastructure.

- Market Education: Detailed white papers explain the benefits of AIXTRON's process control technologies, addressing complex manufacturing challenges.

- Credibility Building: Publication in respected journals like Applied Physics Letters or Nature Materials lends significant weight to AIXTRON's technological claims.

- Customer Engagement: Sharing case studies and performance data through technical documents fosters deeper engagement with R&D departments of potential clients.

AIXTRON utilizes a multi-faceted channel strategy, combining direct sales with a robust network of subsidiaries and a strong digital presence. This ensures comprehensive market coverage and deep customer engagement globally.

The company's direct sales force is critical for high-touch interactions, offering tailored solutions and technical support, especially in the demanding semiconductor industry. This direct approach is supported by AIXTRON's extensive international network, enabling localized service and responsiveness.

Digital channels, including the corporate website and investor relations portal, are vital for disseminating technical information, financial results, and company news, reaching a broad audience of stakeholders. Participation in industry events and the publication of technical papers further solidify AIXTRON's market leadership and foster innovation awareness.

| Channel | Description | Key Activities/Metrics (2024 Data) |

|---|---|---|

| Direct Sales Force | High-touch engagement, customized solutions, technical consultation. | Continued investment in global sales and service personnel. |

| Subsidiaries & Representative Offices | Localized sales, service, and support across key regions. | Approx. 85% of revenue generated outside Germany in H1 2024. |

| Industry Trade Shows & Exhibitions | Showcasing cutting-edge equipment, lead generation, relationship building. | Participation in events like SEMICON Europa, SPIE Advanced Lithography. |

| Corporate Website & Investor Relations Portal | Information dissemination, technical specifications, financial reporting. | 15% increase in unique website visitors (Q1 2024); 20% rise in IR document downloads. |

| Technical Publications & White Papers | Thought leadership, market education, credibility building. | Focus on MOCVD, GaN epitaxy; supported by significant R&D investment (€166.7 million in 2023). |

Customer Segments

AIXTRON's power electronics manufacturers segment, focusing on Silicon Carbide (SiC) and Gallium Nitride (GaN) devices, is a key growth driver. These advanced materials are essential for high-efficiency components in electric vehicle (EV) main inverters, onboard chargers, and renewable energy systems like wind power. The demand for these technologies is soaring, with the SiC and GaN power semiconductor market projected to reach over $10 billion by 2025, a significant increase from previous years.

This customer segment is critical for AIXTRON as it directly benefits from the increasing adoption of electric vehicles and the ongoing expansion of renewable energy infrastructure. For instance, AIXTRON's deposition equipment plays a vital role in producing the high-quality SiC and GaN wafers required for these applications. The global EV market alone saw sales of over 10 million units in 2023, fueling the need for advanced power electronics.

LED and Micro LED producers are key customers, relying on AIXTRON's deposition equipment for manufacturing advanced lighting solutions. These companies create products for diverse markets, from industrial displays and automotive lighting to horticultural applications and cutting-edge Micro LEDs for augmented reality devices and high-definition televisions.

AIXTRON's technology is crucial for both established LED manufacturing and the emerging Micro LED sector. For instance, in 2023, the global LED market was valued at approximately $77.7 billion, with projections indicating continued growth, driven by demand for energy-efficient lighting and advanced display technologies.

Optoelectronics and laser technology companies are a key customer segment for AIXTRON, relying on its deposition equipment for manufacturing advanced semiconductor chips. These chips are critical components in devices like those used for 3D sensing, LiDAR systems for autonomous vehicles, and high-speed optical data communication. For instance, the demand for LiDAR technology, a significant driver for this segment, is projected to reach $5.1 billion by 2025, highlighting the growing need for AIXTRON's precision manufacturing solutions.

AIXTRON's MOCVD (Metal-Organic Chemical Vapor Deposition) systems are indispensable for producing the compound semiconductor materials that form the foundation of these optoelectronic and laser devices. The company's expertise in enabling the creation of high-performance lasers and optical components directly supports innovation in areas like augmented reality and next-generation telecommunications infrastructure.

Research and Development Institutions

Universities and corporate research and development (R&D) centers are key customers for AIXTRON. These institutions are at the forefront of innovation, focusing on developing novel semiconductor materials and advanced device architectures. Their work often requires highly specialized deposition equipment for cutting-edge research and early-stage development.

These R&D entities frequently purchase pilot systems. These systems are crucial for testing new processes and materials before scaling up for commercial production. For instance, in 2024, AIXTRON continued to see demand from academic institutions exploring next-generation power electronics and advanced sensor technologies, areas where precise material deposition is paramount.

- Focus on Innovation: Universities and corporate R&D centers drive the development of new semiconductor materials and device designs.

- Pilot System Acquisition: These customers often acquire AIXTRON's pilot systems for experimental and research purposes.

- Cutting-Edge Applications: Their research spans areas like advanced power electronics, sensors, and novel photonic devices.

- Strategic Partnerships: AIXTRON collaborates with these institutions to advance semiconductor technology, often leading to future commercial applications.

High-Tech and Renewable Energy Sectors

AIXTRON's deposition equipment is critical for producing advanced components used across the high-tech and renewable energy industries. These sectors depend on the precise manufacturing capabilities AIXTRON provides to create everything from cutting-edge semiconductors to efficient solar cells.

In 2024, the global semiconductor market, a key AIXTRON customer base, was projected to reach over $600 billion, highlighting the sheer scale of demand for the technologies AIXTRON enables. Similarly, the renewable energy sector, particularly solar power, continues its robust expansion, with global solar capacity additions expected to break records again in 2024, reaching an estimated 400 GW.

- Semiconductor Manufacturing: AIXTRON's tools are essential for producing advanced logic and memory chips, powering everything from smartphones to data centers.

- LED Lighting: The company's technology is vital for manufacturing high-brightness LEDs, which are increasingly adopted for energy-efficient lighting solutions worldwide.

- Power Electronics: AIXTRON equipment supports the production of power semiconductors used in electric vehicles and efficient power grids, crucial for the energy transition.

- Renewable Energy Components: The company plays a role in the manufacturing of materials for solar cells and other renewable energy technologies, contributing to global sustainability efforts.

AIXTRON serves a diverse customer base, primarily manufacturers of advanced semiconductor devices and components. Key segments include power electronics, LEDs and Micro LEDs, and optoelectronics and laser technology producers. Additionally, universities and corporate R&D centers are crucial for driving innovation and early-stage development.

These customers rely on AIXTRON's deposition equipment to produce high-performance materials for rapidly growing markets such as electric vehicles, renewable energy, and advanced displays. The demand for AIXTRON's technology is directly linked to the expansion of these critical global industries.

The company's equipment is instrumental in creating next-generation semiconductors for various applications, from automotive and communication to lighting and sensing. AIXTRON's focus on enabling cutting-edge material deposition positions it as a key enabler of technological advancement across multiple sectors.

| Customer Segment | Key Applications | 2023/2024 Market Relevance |

|---|---|---|

| Power Electronics (SiC, GaN) | EV inverters, onboard chargers, renewable energy systems | SiC/GaN market projected >$10B by 2025; EV sales >10M units in 2023 |

| LED and Micro LED Producers | Industrial displays, automotive lighting, AR devices, HD TVs | Global LED market ~$77.7B in 2023 |

| Optoelectronics & Laser Tech | 3D sensing, LiDAR, optical data communication | LiDAR market projected $5.1B by 2025 |

| Universities & R&D Centers | Novel semiconductor materials, advanced device architectures | Continued demand for pilot systems in 2024 for next-gen electronics |

Cost Structure

Research and Development (R&D) is a cornerstone of AIXTRON's strategy, representing a significant cost. In 2023, AIXTRON reported R&D expenses of €170.5 million, a notable increase from €148.9 million in 2022. This substantial investment fuels the development of next-generation deposition equipment and enhances current technologies, crucial for maintaining their competitive edge.

These expenditures are directly tied to AIXTRON's commitment to technological leadership and future revenue streams. The establishment of their new Innovation Center underscores this dedication, providing a dedicated space for pushing the boundaries of material science and process technology. Such investments are vital for AIXTRON to anticipate and meet evolving market demands in areas like advanced semiconductors.

Manufacturing and production costs for AIXTRON are significant, encompassing raw materials, sophisticated components, skilled labor, and overhead for their complex deposition equipment. For instance, in 2023, AIXTRON reported cost of sales of €254.9 million, reflecting these substantial expenditures.

The efficiency of AIXTRON's supply chain and internal production processes directly influences these costs. Streamlining operations and optimizing material sourcing are crucial for maintaining competitive pricing and profitability in the semiconductor equipment market.

Sales, General, and Administrative (SG&A) expenses for Aixtron are crucial for maintaining its global footprint and market engagement. These costs include salaries for its dedicated sales and administrative teams, extensive marketing initiatives to promote its advanced deposition equipment, and the operational costs of its worldwide offices. For instance, in the first quarter of 2024, Aixtron reported SG&A expenses of €42.7 million, reflecting the investment needed to support its international sales channels and customer service operations.

Depreciation and Amortization

Depreciation and amortization represent significant non-cash expenses within AIXTRON's cost structure. These costs reflect the gradual reduction in the value of tangible assets, such as manufacturing equipment and R&D facilities, as well as the expensing of intangible assets over their useful lives.

The company's ongoing investment in its Innovation Center, a key driver of future growth and technological advancement, directly contributes to these depreciation and amortization expenses. For instance, new specialized machinery and advanced research equipment acquired for the Innovation Center will be subject to depreciation over their operational periods.

- Depreciation of Manufacturing & R&D Assets: This includes the wear and tear on AIXTRON's production machinery, testing equipment, and the physical infrastructure of its research and development centers.

- Amortization of Intangible Assets: Costs associated with acquired intellectual property, software licenses, and other non-physical assets are systematically expensed.

- Innovation Center Investment Impact: The capital expenditure on the new Innovation Center, including its state-of-the-art equipment, will lead to increased depreciation charges in the coming years.

- Financial Reporting: These expenses are crucial for accurate financial reporting, impacting profitability and taxable income.

Personnel Costs

As a technology leader, AIXTRON's personnel expenses are significant, reflecting the high value placed on its skilled workforce. In 2023, the company reported personnel expenses of €218.5 million. This figure underscores the investment in its over 1,200 employees, especially those crucial to innovation and production.

These costs are heavily concentrated in research and development (R&D) and specialized manufacturing roles. AIXTRON's commitment to cutting-edge technology necessitates a robust team of engineers and scientists, driving the company's competitive edge in the semiconductor equipment market.

- Personnel Expenses: €218.5 million in 2023.

- Employee Count: Over 1,200 employees.

- Key Cost Drivers: R&D, engineering, and specialized manufacturing personnel.

- Strategic Importance: Investment in talent is critical for technological advancement and market leadership.

AIXTRON's cost structure is heavily influenced by its substantial investments in innovation and manufacturing. The company's commitment to developing advanced deposition equipment necessitates significant spending on research and development, as well as the personnel required to drive these efforts. Manufacturing costs, including raw materials and skilled labor, are also a major component.

| Cost Category | 2023 (€ million) | Q1 2024 (€ million) |

|---|---|---|

| Research & Development | 170.5 | N/A |

| Cost of Sales | 254.9 | N/A |

| Sales, General & Administrative | N/A | 42.7 |

| Personnel Expenses | 218.5 | N/A |

Revenue Streams

AIXTRON's core revenue originates from selling sophisticated deposition equipment, such as its G10 system family. These high-tech machines are crucial for semiconductor manufacturers worldwide. The demand for these systems is directly linked to the growing need for power electronics, LEDs, and optoelectronic components.

AIXTRON generates revenue through its after-sales services, which include crucial support like installation, ongoing maintenance, and timely repairs for its complex deposition equipment. This vital service component ensures customer satisfaction and operational efficiency.

The sale of spare parts and consumables also forms a significant part of this revenue stream, providing customers with the necessary components to keep their AIXTRON systems running optimally. This creates a predictable and stable income for the company.

For instance, in 2023, AIXTRON reported that its Services segment, encompassing these offerings, contributed substantially to its overall financial performance, highlighting the recurring nature and stability of these revenue streams.

AIXTRON, a leader in deposition equipment for the semiconductor industry, likely generates revenue through technology licensing and consulting, even if not a primary focus in all business model descriptions. This is common in high-tech sectors where intellectual property holds significant value.

For instance, in 2023, AIXTRON's revenue reached €507.8 million. While this figure largely reflects equipment sales, the company's deep expertise in areas like MOCVD (Metal-Organic Chemical Vapor Deposition) technology could be leveraged for licensing agreements with other manufacturers or research institutions. Such licenses would grant access to AIXTRON's patented processes and designs, creating a recurring revenue stream.

Furthermore, AIXTRON's extensive knowledge in optimizing deposition processes for advanced materials, such as those used in LEDs and power electronics, positions them to offer valuable consulting services. These services could involve advising customers on process integration, yield improvement, or the development of new applications, thereby diversifying their revenue beyond direct equipment sales.

Sales from Emerging Applications

AIXTRON is seeing growing revenue from emerging applications as these technologies mature. For instance, the demand for 300mm Gallium Nitride (GaN) wafers, crucial for next-generation power electronics and high-frequency communication, is on the rise. Similarly, Micro LED displays, known for their superior brightness and efficiency, are finding their way into premium consumer electronics, driving sales for AIXTRON's deposition equipment.

These newer markets are becoming increasingly significant contributors to AIXTRON's financial performance. As adoption rates climb and production scales up, the revenue generated from these advanced applications is expected to show robust growth. This diversification into cutting-edge sectors highlights AIXTRON's strategic positioning in high-growth technology areas.

- Growing demand for 300mm GaN wafers in power electronics and 5G infrastructure.

- Increasing adoption of Micro LED technology in premium displays, boosting equipment sales.

- Revenue from these emerging applications is projected to be a key growth driver for AIXTRON.

Research and Development Grants

AIXTRON can secure revenue through research and development grants. These funds often come from government entities or specialized research programs, especially when AIXTRON's work aligns with national strategic priorities or advancements in energy-efficient semiconductor technologies.

For instance, in 2024, the German federal government has continued to support innovation in advanced manufacturing and semiconductor technology, with significant funding allocated to projects aimed at boosting domestic chip production and research capabilities. AIXTRON, as a key player in deposition equipment, is well-positioned to benefit from such initiatives.

- Governmental Funding: AIXTRON can receive grants from national and supranational bodies supporting technological innovation.

- Research Programs: Funding can be obtained through participation in publicly funded research consortia and programs.

- Strategic Alignment: Grants are often tied to contributions in areas of national importance, such as energy efficiency and advanced materials.

AIXTRON's revenue streams are diversified, primarily driven by the sale of advanced deposition equipment essential for semiconductor manufacturing, particularly for power electronics and LEDs. Beyond new equipment, the company generates consistent income from after-sales services, including maintenance, repairs, and the sale of spare parts, ensuring ongoing customer engagement and operational uptime.

Emerging technologies like 300mm Gallium Nitride (GaN) wafers and Micro LED displays represent significant growth areas, contributing increasingly to AIXTRON's financial performance. Additionally, the company may leverage its technological expertise through licensing agreements and consulting services, further broadening its revenue base.

AIXTRON is also positioned to benefit from research and development grants, particularly those aligned with national strategic priorities in advanced manufacturing and energy-efficient semiconductor technologies, as seen in ongoing governmental support for innovation in 2024.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

| Equipment Sales | Sale of deposition systems (e.g., G10 family) | Majority of €507.8 million total revenue |

| After-Sales Services | Installation, maintenance, repairs | Substantial contribution to Services segment |

| Spare Parts & Consumables | Components for equipment operation | Predictable and stable income |

| Technology Licensing | Granting access to patented processes | Potential recurring revenue |

| Consulting Services | Process optimization, application development | Diversification beyond equipment sales |

| Emerging Applications | Equipment for GaN wafers, Micro LEDs | Key growth driver |

| R&D Grants | Funding for innovation and strategic projects | Beneficiary of governmental support |

Business Model Canvas Data Sources

The AIXTRON Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and strategic analysis of industry trends. These sources ensure that each component, from value propositions to revenue streams, is grounded in accurate and relevant information.