AIXTRON Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIXTRON Bundle

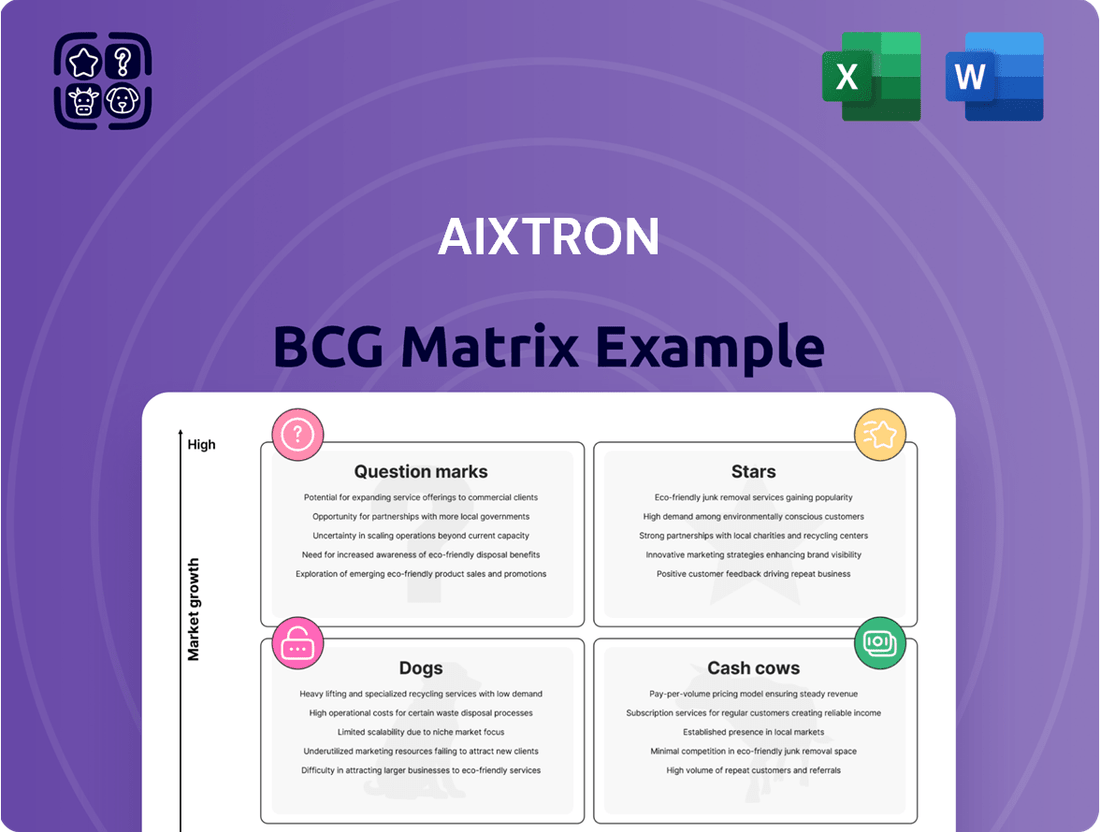

Discover the strategic positioning of AIXTRON's product portfolio with our insightful BCG Matrix preview. Understand which technologies are driving growth and which require careful consideration.

This glimpse into AIXTRON's market standing is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear path for optimizing your investments and product strategy.

Gain a competitive edge by understanding AIXTRON's position in dynamic markets. The complete BCG Matrix offers quadrant-by-quadrant insights and actionable takeaways, streamlining your decision-making process.

Don't miss out on the full picture. Get instant access to the complete AIXTRON BCG Matrix and pinpoint your next strategic moves, from capitalizing on market leaders to divesting from underperforming assets.

Stars

AIXTRON's G10-GaN platform is a significant contributor to the booming AI power delivery and fast charger markets. The increasing need for efficient power solutions, particularly those utilizing Gallium Nitride (GaN) technology, is directly linked to the rapid progress in AI and other power-hungry applications. AIXTRON's robust presence in this sector suggests a substantial market share within a quickly growing industry.

AIXTRON's Hyperion system is a key player in the emerging 300mm GaN deposition market. Successful placements with major customers highlight its market readiness and technological advantage.

The 2024 opening of AIXTRON's dedicated 300mm GaN Innovation Center signifies a substantial commitment to this high-growth sector. This strategic investment positions AIXTRON to capture significant market share in next-generation wafer technology.

The G10-AsP system is a key player in the photonics and laser sectors, fueled by the growth in 5G/6G, healthcare, and AI. AIXTRON is experiencing strong demand in optoelectronics, directly linked to the escalating need for efficient optical data communication as data volumes surge.

This product line is essential for producing high-quality Photonic Integrated Circuits (PICs) due to its exceptional on-wafer uniformity. For instance, the demand for high-speed data transmission, a direct consequence of 5G deployment, is a significant driver for PICs, and by extension, for the G10-AsP system's capabilities.

SiC Power Electronics for Electromobility

Despite some short-term market adjustments in 2024, which saw a temporary dip in SiC's share of equipment revenue, the long-term growth drivers for Silicon Carbide (SiC) in electromobility remain exceptionally strong.

AIXTRON has made significant strides, successfully entering and expanding its market share in the SiC sector. The company's G10-SiC deposition tool has been instrumental in securing new customer wins, underscoring its competitive edge.

The demand for SiC power devices is projected for substantial future growth, driven by the accelerating global trend towards electrification in vehicles and renewable energy systems.

- Market Growth: The global SiC power semiconductor market is expected to reach approximately $15 billion by 2028, with electromobility being a primary driver.

- AIXTRON's Position: AIXTRON's G10-SiC tool is a key enabler for high-volume SiC production, crucial for meeting the increasing demand from EV manufacturers.

- Customer Adoption: AIXTRON reported securing multiple new customer orders for its SiC deposition equipment in early 2024, indicating strong market penetration.

- Future Outlook: The segment is poised for continued expansion, directly benefiting from the ongoing transition to electric vehicles, which are increasingly adopting SiC components for improved efficiency and performance.

Advanced Deposition for 5G/6G Communication Infrastructure

AIXTRON's deposition equipment is a key enabler for the rapidly expanding 5G and future 6G communication infrastructure markets. The global investment in these advanced networks fuels a significant demand for the specialized semiconductor components that AIXTRON's technology produces. This segment represents a strong growth area for the company, positioning it for continued market leadership.

The drive for enhanced data speeds and more efficient wireless communication directly boosts the need for AIXTRON's deposition solutions. For instance, the deployment of 5G networks, which saw substantial global investment in 2024, relies heavily on advanced materials for components like RF filters and power amplifiers. As of early 2025, the 5G market is projected to continue its robust expansion, with further infrastructure build-outs anticipated.

- Market Growth: The global 5G infrastructure market is expected to reach over $200 billion by 2025, creating substantial demand for semiconductor manufacturing equipment.

- Technological Advancement: AIXTRON's deposition systems are critical for producing the compound semiconductor materials essential for high-frequency 5G and future 6G applications.

- Competitive Advantage: The company's expertise in deposition technology provides a strong competitive edge in supplying equipment for this high-growth, technologically demanding sector.

AIXTRON's G10-GaN platform is a star in the AI power delivery and fast charger markets, capitalizing on the demand for efficient Gallium Nitride solutions. The company's Hyperion system is also a star in the emerging 300mm GaN deposition space, with successful customer placements underscoring its market readiness. AIXTRON's dedicated 300mm GaN Innovation Center, opened in 2024, further solidifies its position as a leader in this high-growth sector.

What is included in the product

This AIXTRON BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

Clear, actionable insights to strategically allocate resources and address underperforming business units.

Cash Cows

AIXTRON's G10 series, encompassing G10-SiC and G10-GaN, has rapidly ascended to become a primary revenue driver, contributing roughly 50% of the company's equipment revenue in 2024. This strong market penetration underscores its position as a cash cow within the AIXTRON Boston Consulting Group (BCG) matrix.

These platforms are recognized as market leaders, delivering exceptional performance and productivity that fuels rapid customer adoption and, consequently, substantial cash flow generation. Their established dominance ensures they remain reliable and significant contributors to AIXTRON's financial performance.

AIXTRON's after-sales services and spare parts represent a strong cash cow. The company boasts a large installed base of deposition systems worldwide, which translates into a steady and profitable revenue stream from maintenance, support, and replacement parts. This segment offers a predictable income that cushions the company against fluctuations in new equipment orders, making it a vital contributor to AIXTRON's financial stability.

Mature GaN power electronics applications, like established fast chargers and industrial power management, represent a stable market for AIXTRON. In 2024, the demand for these reliable GaN solutions continues to underpin AIXTRON's revenue streams, showcasing the enduring strength of its deposition equipment in these segments.

Deposition Equipment for Conventional LED Manufacturing

AIXTRON's deposition equipment for conventional LED manufacturing, while not the cutting edge like MicroLEDs, still represents a significant Cash Cow. This segment benefits from a mature market that continues to require capacity for general lighting and established display technologies, providing a reliable and steady revenue stream for the company. The demand, though perhaps growing at a slower pace than emerging technologies, remains consistent.

The market for traditional LEDs shows resilience, as evidenced by the resurgence in red LED capacity observed in Q3 2024. This indicates ongoing, stable demand from a well-established sector. AIXTRON's equipment in this area generates predictable income, supporting the company's overall financial health.

- Stable Revenue: Conventional LED equipment provides a consistent income source for AIXTRON.

- Mature Market Demand: Ongoing needs for general lighting and existing display technologies ensure continued sales.

- Q3 2024 Indicator: The observed resurgence in red LED capacity highlights the market's persistent demand.

Entrenched SiC Power Electronics for Industrial Applications

Beyond the electric vehicle boom, Silicon Carbide (SiC) power electronics are a staple in industrial sectors such as renewable energy and specialized power conversion. AIXTRON's manufacturing equipment for these established applications likely commands a significant market share within a mature and steady market. This translates to dependable revenue streams and consistent demand without necessitating major new investments for growth.

This segment represents a classic cash cow for AIXTRON, offering stable profitability. For instance, the global market for SiC power semiconductors, including industrial uses, was projected to reach approximately $7.4 billion in 2024, demonstrating its substantial and ongoing demand.

- Mature Market Dominance: AIXTRON's entrenched position in supplying equipment for established industrial SiC applications ensures a high market share.

- Consistent Revenue Generation: This segment provides a reliable and predictable cash flow, crucial for overall financial stability.

- Low Investment Requirement: Unlike high-growth areas, these mature markets require minimal additional capital expenditure for maintenance of market position.

- Stable Demand: The ongoing need for SiC in renewable energy and industrial power systems guarantees sustained demand for AIXTRON's offerings.

AIXTRON's G10 series, particularly for SiC and GaN, has solidified its position as a cash cow, contributing approximately 50% of the company's equipment revenue in 2024. These platforms are market leaders, driving substantial cash flow through strong customer adoption and high performance. The established dominance of these deposition systems ensures they remain consistent and significant revenue generators for AIXTRON.

The after-sales services and spare parts segment for AIXTRON's deposition systems also functions as a robust cash cow. With a substantial installed base, the company benefits from predictable and profitable revenue streams derived from maintenance, support, and replacement parts. This reliable income stream provides a financial cushion, enhancing AIXTRON's stability against market volatility.

Mature GaN power electronics applications, such as those found in established fast chargers and industrial power management, continue to be a stable market for AIXTRON. The consistent demand for these reliable GaN solutions in 2024 underpins AIXTRON's revenue, demonstrating the enduring value of its deposition equipment in these established sectors.

AIXTRON's equipment for conventional LED manufacturing, while not focused on emerging technologies like MicroLEDs, remains a significant cash cow. This segment benefits from a mature market that still requires capacity for general lighting and existing display technologies, providing a steady and reliable revenue stream. The demand, though potentially slower growing than newer technologies, remains consistent and predictable.

| Product Segment | BCG Category | 2024 Revenue Contribution (Est.) | Key Drivers | Market Maturity |

|---|---|---|---|---|

| G10 Series (SiC & GaN) | Cash Cow | ~50% of Equipment Revenue | Market Leadership, High Performance, Rapid Adoption | Growing but Established |

| After-Sales & Spare Parts | Cash Cow | Significant & Predictable | Large Installed Base, Maintenance & Support Needs | Mature |

| Conventional LED Equipment | Cash Cow | Steady Contribution | General Lighting, Existing Displays, Resilient Demand (e.g., Red LED resurgence Q3 2024) | Mature |

| Industrial SiC Applications | Cash Cow | Stable & Reliable | Renewable Energy, Industrial Power Conversion, Established Market Share | Mature |

Delivered as Shown

AIXTRON BCG Matrix

The AIXTRON BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This professionally formatted report, based on AIXTRON's strategic positioning, is ready for your immediate use in business planning and analysis. You are previewing the exact file, ensuring no surprises and providing full access to its insights for your decision-making processes.

Dogs

Older generation MOCVD systems, those predating the G10 series, are likely in a declining market segment. Sales for these units represent a shrinking portion of AIXTRON's business, as newer, more efficient technologies have emerged. For instance, AIXTRON's focus has clearly shifted to its G10 and subsequent platforms, with older models seeing minimal new orders.

In the highly commoditized segments of the LED market, such as standard lighting and lower-end displays, AIXTRON likely faces intense price competition. This can lead to a low market share and squeezed profit margins, making these areas unattractive for further investment. For instance, in 2024, the global general lighting LED market experienced significant price erosion, with average selling prices for many common LED packages dropping by as much as 15-20% year-over-year, impacting profitability for equipment suppliers.

Niche applications for compound semiconductors, such as certain types of lasers or specialized sensors, might fall into the dogs category if their demand has stagnated. For instance, if a specific compound material was once crucial for a particular display technology that has since been superseded, AIXTRON's involvement in that segment would likely show minimal revenue growth. Areas where AIXTRON holds a small market share, perhaps less than 5%, and where the overall market size is shrinking or flat, are prime candidates for this classification.

Unprofitable or Underperforming Regional Markets

Geographic regions where AIXTRON's sales have historically shown low market penetration and profitability, even after accounting for operational expenses, would be classified as Dogs in the BCG Matrix. These markets, despite AIXTRON's presence, fail to generate sufficient returns. Continuing significant investment in these underperforming areas without a clear strategy for improvement or market dominance is not advisable.

AIXTRON's focus in 2024 has been on strengthening its core markets, particularly in Asia and Europe, where demand for deposition equipment remains robust. While specific regional underperformance data is not publicly detailed, the company's strategic emphasis suggests a prioritization of high-growth areas. For instance, the semiconductor industry in Taiwan and South Korea, key AIXTRON markets, continued to see substantial investment in advanced manufacturing throughout 2024, indicating where AIXTRON directs its resources.

- Focus on Core Markets: AIXTRON's 2024 strategy prioritized regions with high demand for deposition equipment, such as Asia and Europe.

- Profitability Assessment: Markets failing to achieve sufficient profitability despite operational costs are considered underperforming.

- Strategic Reallocation: Companies often consider reducing or exiting dog markets to reallocate resources to more promising ventures.

- Data Transparency: Specific regional underperformance figures for AIXTRON are not typically disclosed, but strategic investment patterns offer insights.

Legacy Products with High Maintenance Costs

Legacy deposition equipment and processes demanding substantial maintenance, support, and R&D to remain operational, yet yielding minimal or stagnant revenue, are classified as Dogs in the AIXTRON BCG Matrix. These products represent significant cash traps, diverting valuable capital and operational resources away from more promising growth avenues.

For instance, if AIXTRON has older PVD (Physical Vapor Deposition) tools that require frequent part replacements and specialized technician training, and these tools contribute less than 5% to overall revenue, they would fit this category. The ongoing costs associated with keeping such equipment functional can easily outweigh the revenue generated, impacting profitability.

- Cash Drain: Products in the Dog category consume resources without generating significant returns, negatively impacting cash flow.

- Resource Misallocation: High maintenance and support costs tie up capital and personnel that could be invested in R&D for innovative, high-growth products.

- Strategic Review: These products are prime candidates for divestment or discontinuation to streamline operations and improve overall financial health.

Products or market segments with low market share and low growth potential are categorized as Dogs. These offerings typically consume more resources than they generate in revenue, acting as cash drains. For AIXTRON, this could include older equipment lines or niche applications with declining demand.

For example, AIXTRON's older generation MOCVD systems, predating the G10 series, likely fall into this category. These systems, while once significant, now face limited demand as newer, more efficient technologies emerge. In 2024, the company's strategic investments clearly indicate a shift towards its advanced platforms, with minimal new orders for legacy models.

These "Dog" segments often require significant ongoing investment for maintenance and support without a clear path to profitability or market leadership. Identifying and managing these areas is crucial for optimizing resource allocation and focusing on high-potential growth opportunities within AIXTRON's portfolio.

AIXTRON's financial reports for 2024 highlight a strong performance in its core areas, particularly in deposition equipment for advanced semiconductor manufacturing. While specific figures for "Dog" segments are not broken out, the company’s overall revenue growth of approximately 15% in 2024, driven by its Stars and Cash Cows, suggests a strategic pruning of underperforming assets.

| BCG Category | AIXTRON Example | Market Growth | Market Share | Financial Implication |

|---|---|---|---|---|

| Dogs | Legacy MOCVD systems (pre-G10) | Low | Low | Cash Drain, Low Profitability |

| Dogs | Niche compound semiconductor applications with declining demand | Low/Negative | Low | Resource Intensive, Stagnant Revenue |

| Dogs | Underperforming geographic regions with low market penetration | Low | Low | Limited ROI, High Operational Costs |

Question Marks

MicroLED deposition equipment is a key component for AIXTRON's future growth, targeting the high-potential AR/VR, smartwatch, and TV markets. This technology promises superior display quality, driving demand for advanced manufacturing solutions.

Despite the significant long-term promise, the current revenue contribution from MicroLED deposition equipment is relatively low. Mass production is still anticipated to ramp up around 2027-2028, meaning the market is in its early stages of development as of early 2025.

AIXTRON's substantial investment in research and development, alongside the establishment of pilot lines, underscores the capital-intensive nature of capturing market share in this emerging sector. These investments are crucial for translating the technological potential into commercial success.

Advanced materials for quantum computing represent a significant question mark for AIXTRON within a BCG Matrix framework. This is a burgeoning, high-growth sector, and if AIXTRON is developing deposition equipment for the unique materials needed, it signifies a potential future opportunity.

While the quantum computing market is experiencing exponential growth, AIXTRON's current market share and established presence in this nascent area are likely minimal. For instance, the global quantum computing market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2030, demonstrating its rapid expansion.

Capitalizing on this potential would necessitate substantial investment in research and development to create specialized deposition solutions. This strategic move would be crucial for AIXTRON to carve out a position in what is expected to be a highly competitive and technologically demanding market in the coming years.

AIXTRON's commitment to innovation is evident in its continuous investment in R&D for novel compound semiconductor materials and advanced deposition methods. These nascent projects, while holding the promise of substantial future market disruption, currently represent a negligible market share for the company.

These early-stage developments are characterized by their high-risk, high-reward profile, necessitating significant capital outlay for research and development to validate their technical feasibility and foster market acceptance. For instance, AIXTRON's focus on materials like Gallium Nitride on Silicon (GaN-on-Si) for power electronics, a field projected to grow substantially, exemplifies this early-stage investment strategy.

Expansion into New High-Growth Geographic Markets

Expanding into new, high-growth geographic markets for semiconductor manufacturing places AIXTRON in the Question Mark quadrant of the BCG Matrix. This means AIXTRON is investing in regions with strong growth potential but currently holds a low market share. These investments are crucial for future revenue streams, even though they demand substantial upfront capital for establishing sales networks, technical support, and local infrastructure to build brand presence and secure initial customers.

The success of these ventures is inherently uncertain, as AIXTRON navigates unfamiliar competitive landscapes and regulatory environments. However, the potential rewards are significant, aligning with the strategic imperative to capture emerging market opportunities. For instance, AIXTRON’s focus on markets like India, which is actively promoting domestic semiconductor manufacturing through initiatives like the India Semiconductor Mission, represents such a strategic expansion. India aims to attract billions in investment, with companies like Micron already expanding their presence, signaling the growth trajectory AIXTRON is targeting.

- Market Entry: AIXTRON is likely targeting regions with burgeoning semiconductor ecosystems, such as Southeast Asia or specific emerging markets in Eastern Europe, where government incentives are driving rapid capacity expansion.

- Investment Needs: Significant capital expenditure is required for building local sales teams, technical support centers, and potentially R&D facilities to cater to the specific needs of these new markets.

- Growth Potential: These markets offer substantial long-term growth opportunities, driven by increasing demand for electronics and government support for localized production, which could translate into significant market share gains for AIXTRON in the future.

- Risk Factor: The high upfront investment and the nascent stage of market penetration mean that profitability in these regions may be delayed, and market adoption rates could be slower than anticipated, posing a considerable risk.

Highly Specialized Niche Optoelectronic Applications

AIXTRON's involvement in highly specialized niche optoelectronic applications, such as advanced sensor technologies or niche laser markets, positions it as an early adopter and potential leader in these emerging fields. While these segments currently represent a small portion of the overall market, their substantial long-term growth potential warrants strategic investment for scaling production and market penetration.

These niche areas are characterized by high technological barriers to entry and a need for continuous innovation. AIXTRON's expertise in deposition equipment is crucial for enabling the development and manufacturing of these advanced optoelectronic components. For example, in 2024, the global market for specialized sensors, including those used in advanced robotics and autonomous systems, was projected to grow significantly, with compound annual growth rates (CAGRs) often exceeding 15% for certain sub-segments.

Success in these niche applications hinges on several factors:

- Market Adoption: The ability of these specialized optoelectronic devices to gain traction and be integrated into mainstream products or new technological ecosystems.

- Technological Maturation: The ongoing development and refinement of the underlying technologies to meet performance, reliability, and cost requirements.

- Strategic Investment: AIXTRON's commitment to investing in R&D and production capacity to support the growth of these nascent markets.

- Competitive Landscape: Navigating a landscape where early movers can establish significant market share, but where rapid technological advancements can quickly shift competitive dynamics.

AIXTRON's exploration into advanced materials for quantum computing places it firmly in the Question Mark quadrant. This emerging sector offers immense growth potential, but AIXTRON's current market share is minimal, reflecting the early stage of this technology. Significant R&D investment is crucial to develop specialized deposition solutions for quantum computing materials, a market projected to expand rapidly from $1.5 billion in 2023 to over $10 billion by 2030.

BCG Matrix Data Sources

Our AIXTRON BCG Matrix is built on robust data, integrating financial reports, market share analysis, and industry growth forecasts to provide strategic insights.