Air Liquide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

Navigate the complex external forces shaping Air Liquide's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, environmental regulations, and social trends present both challenges and opportunities for the industrial gas giant. Gain a critical edge by leveraging these expert-driven insights to refine your own market strategy and investment decisions. Download the full, actionable report now and unlock your competitive advantage.

Political factors

Governments globally are prioritizing decarbonization, with significant policy support for the energy transition, especially for low-carbon hydrogen. For instance, the European Union's Hydrogen Strategy aims to produce 10 million tonnes of renewable hydrogen by 2030, creating a substantial market opportunity.

Air Liquide is well-positioned to capitalize on this trend, benefiting from subsidies, grants, and favorable regulations for its low-carbon initiatives. The company's investments in green hydrogen production and carbon capture projects align directly with these governmental pushes, potentially unlocking substantial growth and market share in the coming years.

Geopolitical stability and evolving trade policies are critical for Air Liquide's global reach, influencing its supply chains and market access. For instance, ongoing trade tensions, such as those impacting the semiconductor industry in 2024, can directly affect demand for specialized gases and the cost of importing necessary equipment. Air Liquide's presence in approximately 60 countries means navigating a complex web of international relations, where shifts in trade agreements or the introduction of tariffs can significantly alter operational costs and customer service efficiency.

Healthcare policy and regulation are pivotal for Air Liquide's operations, particularly within its Healthcare segment. For instance, evolving regulations around the supply of medical gases, such as oxygen and nitrous oxide, directly impact Air Liquide's product offerings and distribution networks. In 2024, global healthcare spending is projected to reach over $10 trillion, with a significant portion allocated to medical supplies and services, underscoring the market's sensitivity to policy shifts.

Changes in reimbursement policies for home healthcare services, a key area for Air Liquide, can significantly affect revenue streams. For example, shifts in Medicare or national health insurance reimbursement rates in major markets like the US or France can create either tailwinds for growth or headwinds due to pricing pressures. Furthermore, stringent quality standards in pharmaceutical production necessitate continuous investment in compliance, influencing operational costs and market access.

Industrial Policy and Economic Stimulus

Government industrial policies, particularly those focused on boosting manufacturing, electronics, and energy sectors, directly influence the demand for Air Liquide's essential industrial gases. For instance, the European Union's Critical Raw Materials Act, aiming to secure supply chains for vital materials, could spur investment in manufacturing processes that rely on gases like nitrogen and oxygen.

Economic stimulus packages designed to invigorate specific industries often translate into increased capital expenditure on new production facilities and the expansion of existing ones. In 2024, many nations continued to implement such measures, with significant allocations towards green energy transitions and advanced manufacturing, creating a robust project pipeline for industrial gas suppliers like Air Liquide.

- Manufacturing Boost: Government incentives for domestic production, like those seen in the US semiconductor industry, increase the need for high-purity gases.

- Energy Transition: Subsidies and policies supporting renewable energy, such as hydrogen production, directly drive demand for hydrogen gas and related technologies.

- Infrastructure Investment: Stimulus funds directed towards infrastructure projects can indirectly boost demand for gases used in construction and materials processing.

Carbon Pricing and Emission Reduction Targets

Governments worldwide are increasingly implementing carbon pricing mechanisms, like carbon taxes and emissions trading systems, directly affecting industries such as industrial gases. For example, the European Union's Emissions Trading System (EU ETS) saw allowances trade around €80-€90 per tonne of CO2 in late 2023 and early 2024, a significant cost factor for energy-intensive operations. These policies compel companies like Air Liquide to factor in the cost of their carbon footprint, influencing investment decisions towards lower-emission technologies and operational efficiencies.

National emission reduction targets, such as the United States' goal to cut emissions by 50-52% below 2005 levels by 2030, also shape the market landscape. This regulatory push encourages Air Liquide to expand its offerings in decarbonization solutions, including carbon capture, utilization, and storage (CCUS) technologies, and hydrogen production. The company's strategic investments in these areas, like its commitment to developing large-scale hydrogen projects, directly respond to these evolving environmental mandates and the growing demand for sustainable industrial processes.

- Carbon Pricing Impact: EU ETS allowance prices averaged over €80/tonne in early 2024, increasing operational costs for emissions-intensive industries.

- Emission Targets Drive Innovation: National climate goals encourage investment in low-carbon technologies, such as hydrogen and CCUS, aligning with Air Liquide's sustainability strategy.

- Market Opportunities: The demand for decarbonization solutions is growing, creating new revenue streams for companies providing emissions reduction technologies and services.

- Competitive Advantage: Early adoption of sustainable practices and investment in green technologies can provide a competitive edge in a market increasingly focused on environmental performance.

Governmental focus on industrial reshoring and domestic manufacturing, particularly in sectors like semiconductors and advanced batteries, directly boosts demand for high-purity industrial gases. For example, the US CHIPS and Science Act, with its substantial funding, is driving significant investment in new fabrication plants, each requiring vast quantities of specialized gases.

The global push for energy transition, underscored by initiatives like the EU's €3 billion Hydrogen Strategy and the US Inflation Reduction Act (IRA), creates substantial opportunities for Air Liquide's low-carbon hydrogen production and related infrastructure. These policies often include direct subsidies and tax credits, making green hydrogen projects more economically viable and accelerating market adoption.

Regulatory frameworks surrounding healthcare, including medical gas supply chain security and home healthcare reimbursement policies, are crucial for Air Liquide's Healthcare segment. For instance, evolving national health insurance policies in 2024 and 2025 will continue to shape revenue streams and operational strategies within this vital business unit.

| Policy/Initiative | Target Area | Impact on Air Liquide | 2024/2025 Relevance |

|---|---|---|---|

| US CHIPS and Science Act | Semiconductor Manufacturing | Increased demand for high-purity gases | Drives significant investment in new fabrication plants |

| EU Hydrogen Strategy | Renewable Hydrogen Production | Growth in hydrogen supply and infrastructure | Supports Air Liquide's green hydrogen projects |

| US Inflation Reduction Act (IRA) | Clean Energy & Hydrogen | Tax credits and subsidies for low-carbon technologies | Enhances economic viability of hydrogen investments |

| Healthcare Reimbursement Policies | Medical Gas & Home Healthcare | Influences revenue and operational strategies | Key factor for Healthcare segment performance |

What is included in the product

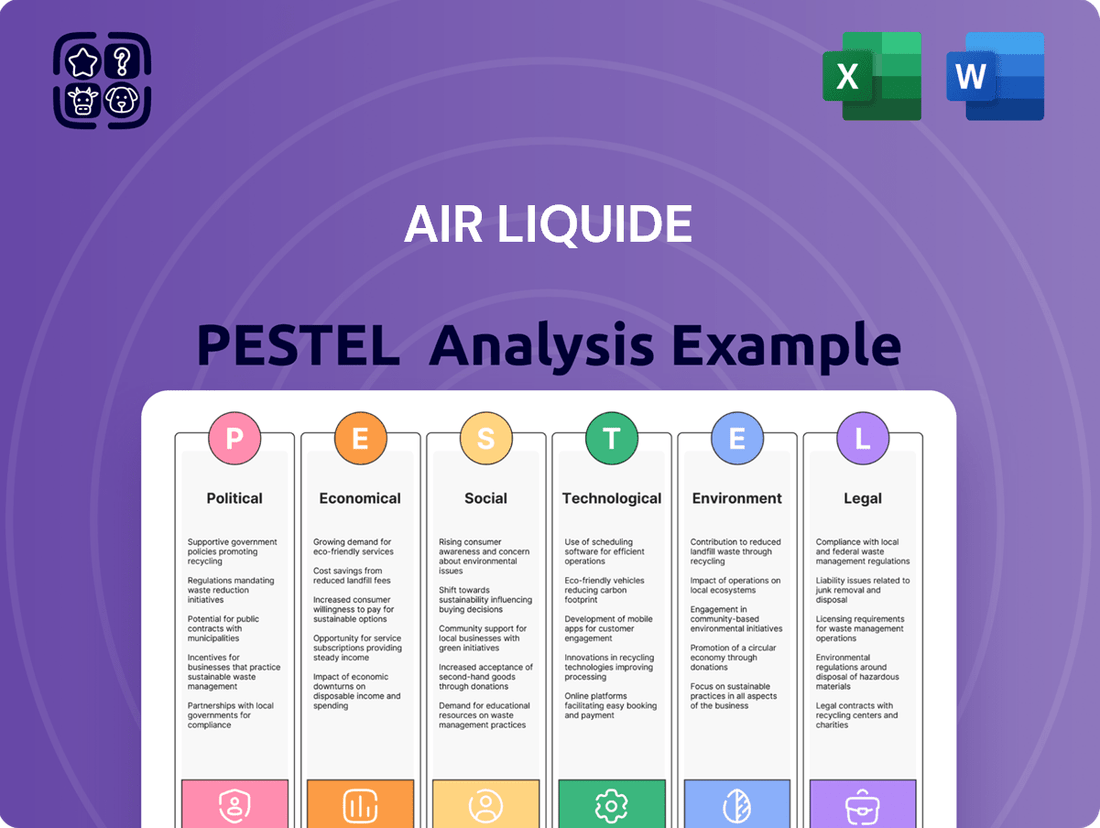

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Air Liquide, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within Air Liquide's operating landscape.

A PESTLE analysis for Air Liquide offers a structured way to understand external forces, acting as a pain point reliever by proactively identifying potential challenges and opportunities in political, economic, social, technological, environmental, and legal landscapes.

Economic factors

Air Liquide's business is intrinsically linked to the health of the global economy and the pace of industrial activity. As a supplier of essential gases and services, its demand directly mirrors the output of sectors such as manufacturing, electronics, and energy. For instance, a strong global GDP growth forecast, such as the IMF's projection of 3.2% for both 2024 and 2025, generally signals increased industrial output and, consequently, higher demand for Air Liquide's offerings.

Conversely, economic downturns or a slowdown in industrial production can negatively impact Air Liquide. Reduced manufacturing activity, as experienced in certain regions during periods of economic uncertainty, can lead to lower consumption of industrial gases and delays in capital expenditure projects that require these products. This sensitivity means that global economic trends are a critical factor in assessing Air Liquide's revenue and growth potential.

Energy prices, especially for electricity and natural gas, are a major concern for Air Liquide. Manufacturing industrial gases like oxygen and nitrogen requires a lot of power, making these costs a direct hit to their bottom line. For instance, in 2023, European natural gas prices, while down from their 2022 peaks, remained a significant factor influencing operational expenses.

While Air Liquide has mechanisms to pass on these energy cost changes to its customers, extreme price swings can still squeeze profit margins. This volatility can also affect how competitive their products are compared to alternatives. The company's ability to manage these fluctuating energy costs is crucial for maintaining profitability and market position.

Air Liquide is strategically channeling significant capital into future growth markets, with a particular focus on electronics and the burgeoning energy transition sectors like hydrogen and carbon capture. These investments are pivotal for securing long-term revenue streams and maintaining a competitive edge.

The company boasts a record investment backlog, and a substantial portion of this capital is earmarked for these high-potential areas. This demonstrates a clear commitment to leveraging emerging economic opportunities. For instance, by the end of 2024, Air Liquide anticipated its investment backlog to reach €37 billion, with a notable emphasis on sustainable development and energy transition projects.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Air Liquide, a global player in 60 countries. These shifts can distort its reported financial performance, even when the core business is performing well.

For instance, a strong euro against other currencies can make Air Liquide's foreign earnings translate into fewer euros, negatively affecting reported revenue and net profit. In the first half of 2024, the company noted a negative currency impact. This highlights the sensitivity of its financial results to global currency movements.

- Negative Currency Impact: In H1 2024, currency fluctuations had a detrimental effect on Air Liquide's reported financials.

- Revenue and Profitability: Adverse currency movements can reduce reported revenue and net profit figures.

- Global Operations: Operating in 60 countries exposes Air Liquide to a wide range of currency risks.

- Underlying Performance: It's crucial to distinguish between currency effects and the actual operational health of the business.

Healthcare Market Dynamics

The healthcare market offers Air Liquide a robust and relatively insulated revenue stream, largely unaffected by typical industrial economic fluctuations. This stability is fueled by demographic shifts like aging populations and a growing preference for home-based medical care, both of which necessitate a consistent supply of medical gases and related services. For instance, the global healthcare market was valued at approximately $10 trillion in 2023 and is projected to reach over $13 trillion by 2027, indicating substantial ongoing demand.

Air Liquide's presence in this sector is critical, providing essential gases such as oxygen, nitrogen, and nitrous oxide to hospitals, clinics, and homecare patients. The company's ability to serve these diverse needs ensures a steady demand for its products, bolstering its economic resilience. The increasing prevalence of chronic diseases and the expansion of healthcare infrastructure, particularly in emerging economies, further amplify this consistent growth trajectory.

Key drivers within the healthcare market impacting Air Liquide include:

- Aging Demographics: Globally, the proportion of individuals aged 65 and over is rising, increasing the demand for healthcare services and medical gases. By 2050, the number of people aged 65 or over is projected to more than double from 771 million in 2020 to 1.6 billion.

- Home Healthcare Growth: A significant trend is the shift towards home-based medical care, which requires reliable delivery of medical gases and equipment directly to patients' residences. The global home healthcare market size was valued at USD 328.2 billion in 2023 and is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030.

- Technological Advancements: Innovations in medical treatments and diagnostic procedures often rely on specialized gases and advanced delivery systems, creating new avenues for Air Liquide's offerings.

- Increased Healthcare Spending: Many governments are prioritizing healthcare expenditure, leading to expanded facilities and greater access to medical treatments, which directly benefits gas suppliers like Air Liquide.

Economic growth directly fuels demand for Air Liquide's industrial gases, with global GDP projected at 3.2% for both 2024 and 2025, signaling increased manufacturing activity. However, energy costs, particularly natural gas and electricity, significantly impact operational expenses, as seen with European natural gas prices remaining a key factor in 2023. Air Liquide is strategically investing in high-growth sectors like electronics and hydrogen, aiming to leverage emerging economic opportunities, evidenced by a projected investment backlog of €37 billion by the end of 2024.

| Economic Factor | Impact on Air Liquide | Relevant Data/Observation |

|---|---|---|

| Global GDP Growth | Drives demand for industrial gases | IMF projects 3.2% growth for 2024 and 2025 |

| Energy Prices (Natural Gas, Electricity) | Affects operational costs and profitability | European natural gas prices remained a significant factor in 2023 |

| Investment in Growth Markets | Secures future revenue streams | Investment backlog expected to reach €37 billion by end of 2024, focusing on electronics and energy transition |

| Currency Fluctuations | Impacts reported financial performance | Negative currency impact noted in H1 2024 |

What You See Is What You Get

Air Liquide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Air Liquide delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed examination of the external forces shaping Air Liquide's market landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into opportunities and threats, empowering you to navigate the complexities of the global industrial gas sector.

Sociological factors

The global population is aging rapidly, with projections indicating that by 2050, over 1.5 billion people will be aged 65 and over. This demographic shift directly fuels a growing demand for healthcare services, including medical gases and respiratory care, which are core to Air Liquide's business. The increasing prevalence of chronic diseases often associated with aging, such as COPD and cardiovascular conditions, further amplifies the need for these essential medical supplies and related home healthcare solutions.

Growing public awareness and demand for sustainable practices are significantly shaping industrial strategies. Consumers and investors alike are increasingly prioritizing environmental, social, and governance (ESG) factors, pushing companies to actively reduce their carbon footprint. This societal shift directly benefits Air Liquide, as it fuels demand for its decarbonization solutions, including low-carbon hydrogen production and CO2 capture technologies. For instance, by 2024, the global green hydrogen market is projected to reach $15.6 billion, a testament to this growing demand.

Societal expectations are increasingly pushing companies like Air Liquide to prioritize workforce diversity and inclusion. This means creating an environment where everyone feels valued and has equal opportunities, regardless of their background.

Air Liquide has been actively working on this, reporting that in 2023, women held 32% of management positions globally, up from 29% in 2020. This reflects a tangible commitment to building a more representative leadership team.

Employee Engagement and Well-being

Societal expectations increasingly focus on how companies treat their employees, making employee engagement and well-being a significant sociological factor. Air Liquide recognizes this, striving to foster a positive corporate culture that directly impacts productivity and innovation.

The company's commitment extends to offering global volunteering opportunities, allowing employees to contribute to their communities. This initiative aligns with the growing demand for corporate social responsibility and strengthens employee morale.

Furthermore, Air Liquide is dedicated to ensuring common basic care coverage for all its employees worldwide. This approach addresses fundamental human needs and reflects a commitment to equitable treatment across its diverse workforce, a key aspect of modern sociological considerations for employers.

In 2023, Air Liquide reported high levels of employee engagement, with over 80% of employees participating in its annual survey, indicating a strong connection to the company's mission and values. The company also invested significantly in training and development programs, aiming to enhance employee skills and career progression.

Access to Healthcare in Developing Regions

Air Liquide's mission to provide medical oxygen and healthcare services in developing regions addresses a critical societal need. Many low and middle-income countries face significant challenges in ensuring adequate healthcare access, particularly for oxygen therapy, which is vital for treating respiratory illnesses. For instance, the World Health Organization (WHO) estimates that millions of deaths annually could be averted with improved access to oxygen, especially for conditions like pneumonia and malaria.

Developing scalable and accessible solutions is key to supporting global health initiatives. Air Liquide is uniquely positioned to contribute by leveraging its expertise in gas production and distribution. The company's focus on innovation aims to create cost-effective technologies suitable for diverse environments, thereby improving patient outcomes in underserved areas.

- Healthcare Infrastructure Gaps: Many developing regions lack robust healthcare infrastructure, including reliable power for oxygen concentrators and trained personnel.

- Oxygen Affordability: The cost of medical oxygen and related equipment remains a barrier for many patients and healthcare facilities in low-income settings.

- Disease Burden: High prevalence of respiratory diseases, such as pneumonia and tuberculosis, drives a substantial demand for medical oxygen in these regions.

Societal expectations continue to evolve, with a growing emphasis on corporate responsibility and ethical business practices. Air Liquide's commitment to providing essential medical gases, particularly in underserved regions, directly addresses critical global health needs. The company's investments in decarbonization technologies also align with increasing public demand for environmental sustainability.

The demographic shift towards an aging global population, with projections showing over 1.5 billion people aged 65+ by 2050, significantly boosts demand for healthcare services, including medical gases. This trend is further amplified by the rising incidence of chronic respiratory diseases, a core area for Air Liquide's offerings.

Air Liquide's focus on diversity and inclusion is also a key sociological factor, with women holding 32% of management positions globally in 2023. Employee well-being and engagement are also prioritized, as evidenced by over 80% employee participation in its 2023 engagement survey.

The company's efforts to improve access to medical oxygen in developing countries are crucial, as millions of deaths annually could be averted with better oxygen therapy. This addresses a significant global health challenge, particularly for respiratory illnesses prevalent in low and middle-income countries.

| Sociological Factor | Impact on Air Liquide | Supporting Data |

| Aging Population & Healthcare Demand | Increased demand for medical gases and respiratory care solutions. | By 2050, over 1.5 billion people will be aged 65+. |

| Sustainability Awareness | Drives demand for decarbonization solutions (e.g., low-carbon hydrogen). | Global green hydrogen market projected to reach $15.6 billion by 2024. |

| Diversity & Inclusion | Enhances corporate reputation and talent acquisition. | Women held 32% of management positions globally in 2023. |

| Employee Engagement & Well-being | Boosts productivity and innovation. | Over 80% employee participation in 2023 engagement survey. |

Technological factors

Technological advancements in hydrogen production, especially green hydrogen via electrolysis, are a cornerstone of Air Liquide's strategy. This focus on clean hydrogen directly supports the global energy transition, a critical market for the company.

Air Liquide is making substantial investments in these burgeoning technologies, aiming to boost its hydrogen revenue significantly. By 2030, the company targets a substantial increase in its hydrogen-related turnover, reflecting the growing demand for sustainable energy solutions.

The company is also expanding its electrolysis capacity, a key enabler for green hydrogen production. This expansion is crucial for meeting the projected demand and solidifying Air Liquide's position as a leader in the hydrogen economy.

Innovation in carbon capture and utilization (CCUS) is a significant technological driver for Air Liquide, positioning the company to provide essential decarbonization solutions to industries. This focus allows them to address the growing global demand for emission reduction technologies.

Air Liquide is actively securing substantial funding and partnerships for its CCUS initiatives, demonstrating a strong commitment to developing and deploying these pioneering technologies. For instance, in early 2024, the company announced a significant investment in a large-scale CCUS project in the United States, projected to capture over 5 million tons of CO2 annually.

The relentless pursuit of enhanced semiconductor performance, exemplified by advancements in chip density and processing power, directly fuels Air Liquide's demand for high-purity gases and specialized materials. This technological race, coupled with the global redistribution of fabrication facilities, necessitates continuous innovation in gas purification and delivery systems.

Air Liquide is bolstering its footprint in this critical industry by investing in new industrial capacities and pioneering technological solutions. For instance, their commitment to meeting the escalating demand for advanced electronics is evident in their ongoing expansion projects and research into next-generation materials.

Digitalization and Automation in Operations

The increasing integration of digitalization and automation is a significant technological driver for Air Liquide. These advancements are revolutionizing industrial processes by boosting efficiency, enhancing safety protocols, and enabling greater customization in the production and distribution of gases. For instance, in 2024, Air Liquide continued to invest heavily in digital solutions, aiming to improve its operational excellence and customer service by leveraging data analytics and AI for predictive maintenance and optimized supply chains.

Air Liquide actively harnesses these evolving technologies to streamline its operations and elevate its service offerings. By automating key processes, the company can ensure more reliable gas supply and develop innovative solutions tailored to specific client needs. This strategic adoption of digital tools is crucial for maintaining a competitive edge and driving growth in a rapidly evolving market.

Key impacts of digitalization and automation for Air Liquide include:

- Enhanced Operational Efficiency: Automation reduces manual intervention, leading to faster production cycles and lower operational costs.

- Improved Safety Standards: Digital monitoring and automated safety systems minimize risks in hazardous environments.

- Greater Customization: Data-driven insights allow for more precise tailoring of gas products and delivery services to individual customer requirements.

- Development of Advanced Solutions: Technologies like AI and IoT are enabling Air Liquide to create new, value-added services for its clients, such as remote monitoring and optimization of gas usage.

Development of Advanced Medical Technologies

The rapid advancement of medical technologies, particularly in areas like telehealth and remote patient monitoring, is significantly shaping Air Liquide's healthcare business. These innovations enable more personalized and efficient patient care outside traditional hospital settings.

This technological evolution is driving a notable shift towards home healthcare solutions, a sector where Air Liquide is actively expanding its footprint. The company is investing in developing and delivering innovative services and equipment to support this growing demand.

For instance, Air Liquide's focus on home healthcare is evident in its efforts to provide advanced respiratory care and other medical services directly to patients' homes. This strategy aligns with global healthcare trends aiming for greater patient convenience and cost-effectiveness.

- Telehealth Growth: The global telehealth market was valued at approximately $117.7 billion in 2023 and is projected to reach $396.5 billion by 2030, indicating a strong trend towards remote care.

- Home Healthcare Expansion: Air Liquide aims to capitalize on this by enhancing its home healthcare services, focusing on respiratory support and chronic disease management.

- Digital Health Integration: The company is integrating digital tools to improve patient monitoring and adherence to treatment plans, a key component of advanced medical technology adoption.

Air Liquide is heavily invested in technological advancements, particularly in green hydrogen production through electrolysis, which is central to its strategy for the energy transition. The company is also focusing on innovation in carbon capture and utilization (CCUS) to offer decarbonization solutions.

The demand for high-purity gases in the semiconductor industry, driven by advancements in chip technology, is a key area for Air Liquide, necessitating continuous innovation in purification and delivery systems.

Digitalization and automation are enhancing Air Liquide's operational efficiency, safety, and customization capabilities, with significant investments in AI and data analytics for predictive maintenance and optimized supply chains in 2024.

The company is also expanding its presence in the healthcare sector, driven by the growth of telehealth and home healthcare, investing in advanced respiratory care and digital patient monitoring solutions.

Legal factors

Stricter environmental regulations, particularly those targeting CO2 emissions, directly influence Air Liquide's operational costs and investment strategies. For instance, the European Union's Emissions Trading System (ETS) mandates the purchase of allowances for greenhouse gas emissions, impacting industrial gas production. This regulatory pressure is a significant driver for Air Liquide's substantial investments in developing and deploying low-carbon technologies and solutions.

The healthcare sector operates under a stringent regulatory framework, demanding rigorous compliance with standards for medical gas quality, safety protocols, and distribution networks. Air Liquide's Healthcare division must meticulously navigate these national and international regulations, which cover medical devices, pharmaceuticals, and home healthcare provisions, to maintain market access and operational integrity.

Air Liquide operates in a market often characterized by a few major players, making adherence to anti-trust and competition laws paramount. These regulations, enforced by bodies like the European Commission and the U.S. Federal Trade Commission, aim to prevent monopolistic practices and ensure fair competition. For instance, the European Commission fined several industrial gas suppliers a total of €274 million in 2011 for cartel activities, highlighting the strict oversight.

International Trade Laws and Sanctions

International trade laws and sanctions significantly impact Air Liquide's global operations. For instance, evolving trade agreements and potential tariffs, such as those discussed between major economic blocs in 2024 and projected into 2025, can alter the cost of importing raw materials like natural gas or exporting specialized gases and technologies. Navigating these complex regulations requires constant vigilance to ensure compliance and avoid disruptions.

Geopolitical tensions and the imposition of sanctions by countries or international bodies directly affect Air Liquide's market access and supply chains. For example, sanctions on specific nations can restrict the company's ability to sell its products or invest in new facilities, as seen with past sanctions impacting energy and technology sectors. Air Liquide must actively monitor and adapt to these evolving legal landscapes to mitigate risks and maintain its competitive edge.

- Trade Policy Shifts: Anticipated changes in trade policies and potential tariffs in 2024-2025 could influence Air Liquide's import costs for key raw materials and the competitiveness of its exports.

- Sanctions Compliance: Adherence to international sanctions regimes is critical, as violations can lead to significant financial penalties and reputational damage, impacting Air Liquide's ability to operate in affected regions.

- Regulatory Complexity: The intricate web of international trade laws requires robust compliance frameworks to manage cross-border transactions, technology transfers, and international investments effectively.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are increasingly vital for Air Liquide, especially with its growing digital operations. Laws like the General Data Protection Regulation (GDPR) mandate strict handling of customer and operational data. Failure to comply can lead to significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Adhering to these regulations is crucial for maintaining customer trust and preventing costly data breaches. Air Liquide's commitment to data security directly impacts its reputation and the secure functioning of its increasingly digital infrastructure. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial imperative for robust cybersecurity measures.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- Global Data Breach Costs: Averaged $4.45 million in 2023.

- Regulatory Focus: Increasing scrutiny on data protection and cybersecurity practices across industries.

Air Liquide must navigate a complex legal landscape, from environmental mandates like the EU Emissions Trading System to stringent healthcare regulations for medical gases. Compliance with anti-trust laws is critical to prevent penalties, as demonstrated by past cartel fines in the industrial gas sector. Evolving international trade policies and sanctions, particularly those impacting energy and technology, necessitate constant vigilance to manage supply chains and market access effectively.

| Legal Factor | Impact on Air Liquide | Relevant Data/Examples |

|---|---|---|

| Environmental Regulations | Increased operational costs, drives investment in low-carbon tech. | EU Emissions Trading System (ETS) mandates allowances for CO2 emissions. |

| Healthcare Compliance | Requires rigorous adherence to quality, safety, and distribution standards. | Regulations cover medical devices, pharmaceuticals, and home healthcare. |

| Competition Law | Ensures fair market practices, prevents monopolistic behavior. | EU fined industrial gas suppliers €274 million in 2011 for cartel activities. |

| International Trade & Sanctions | Affects import costs, export competitiveness, and market access. | Potential tariffs and sanctions in 2024-2025 require active monitoring. |

| Data Privacy & Cybersecurity | Mandates strict data handling, risks significant fines for breaches. | GDPR fines up to 4% of global revenue; 2023 data breach cost averaged $4.45M. |

Environmental factors

Governments worldwide are intensifying efforts to combat climate change, leading to stricter regulations and carbon pricing mechanisms. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will impact industries with significant carbon footprints, creating both challenges and opportunities for companies like Air Liquide that provide decarbonization solutions.

Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, pushing companies to demonstrate tangible progress in reducing their environmental impact. In 2024, a significant portion of global institutional capital is allocated to ESG-aligned investments, compelling Air Liquide to highlight its commitment to achieving carbon neutrality by 2050 and its investments in low-carbon hydrogen production, which reached €8 billion by the end of 2023.

Customers are also demanding more sustainable products and services, driving demand for decarbonization solutions. Air Liquide's strategic focus on supporting customer decarbonization, offering technologies like carbon capture and storage, positions it to capitalize on this trend. The company's revenue from these sustainable offerings saw a notable increase in 2024, reflecting growing market acceptance.

The growing global awareness of resource scarcity, especially concerning water and energy, directly impacts Air Liquide's strategic planning. This heightened focus necessitates a commitment to sustainable sourcing, influencing how the company manages its supply chain and production processes.

Air Liquide is actively addressing these environmental pressures by accelerating its procurement of low-carbon electricity. For instance, as of the first half of 2024, the company had secured a significant portion of its electricity needs from renewable sources, demonstrating a tangible step towards reducing its carbon footprint and dependence on fossil fuels.

Furthermore, the company is implementing robust water management plans, particularly in regions identified as high-stress water areas. These initiatives are crucial for enhancing environmental stewardship and ensuring operational resilience in the face of increasing water scarcity, a critical factor for many industrial processes.

The global push for decarbonization is accelerating the demand for low-carbon hydrogen, encompassing both green hydrogen produced via electrolysis powered by renewables and blue hydrogen derived from natural gas with carbon capture. This environmental imperative is a major catalyst for Air Liquide, driving significant investment in production facilities and innovative technologies. For example, in 2024, the company announced a €5 billion investment plan for low-carbon hydrogen in Germany, highlighting its commitment to this burgeoning market.

Industries like steel, chemicals, and heavy transport are increasingly looking to hydrogen as a viable solution to slash their greenhouse gas emissions, creating substantial growth avenues for Air Liquide. By 2030, the International Energy Agency projects that clean hydrogen could meet up to 10% of global energy needs, a significant increase from current levels, directly benefiting companies like Air Liquide that are at the forefront of this energy transition.

Circular Economy Principles

The increasing emphasis on circular economy principles, aiming to minimize waste and optimize resource use, is a significant environmental trend. Air Liquide's commitment to CO2 capture and utilization technologies directly supports this by converting waste streams into valuable products, such as sustainable fuels or chemicals.

This approach not only reduces environmental impact but also creates new revenue opportunities. For instance, Air Liquide's investments in hydrogen production from renewable sources align with circularity by utilizing byproducts and reducing reliance on virgin fossil fuels.

- Waste Reduction: Air Liquide's focus on CO2 capture and utilization transforms industrial emissions, a major waste product, into valuable feedstocks.

- Resource Efficiency: By developing technologies that recycle and reuse materials, the company enhances overall resource efficiency within its operations and for its clients.

- Sustainable Feedstocks: Air Liquide's exploration of bio-based and recycled feedstocks for chemical production further embeds circular economy principles into its value chain.

Biodiversity Preservation and Water Management

Growing concerns over biodiversity preservation and the critical need for responsible water management are increasingly shaping industrial operations globally. These environmental factors directly impact companies like Air Liquide, influencing how they conduct business and manage their resources.

Air Liquide is proactively integrating biodiversity assessment criteria into its investment processes, aiming to minimize its ecological footprint. Furthermore, the company is actively developing comprehensive water management plans to mitigate its environmental impact, recognizing water as a precious and finite resource.

- Biodiversity Integration: Air Liquide incorporates biodiversity impact assessments into its capital expenditure decisions for new projects.

- Water Stewardship: The company is implementing water efficiency measures across its facilities, targeting reductions in water withdrawal and consumption.

- Regulatory Landscape: Evolving environmental regulations, particularly concerning water usage and habitat protection, necessitate adaptive strategies.

- Stakeholder Expectations: Investors and communities are placing greater emphasis on corporate responsibility regarding environmental stewardship, including biodiversity and water.

The global drive towards decarbonization is a primary environmental factor, significantly boosting demand for low-carbon hydrogen solutions. Air Liquide's substantial investments, like the €5 billion plan in Germany for low-carbon hydrogen announced in 2024, underscore its strategic alignment with this trend.

Stricter environmental regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM) effective 2026, create both challenges and opportunities, pushing for sustainable practices and rewarding companies offering decarbonization technologies.

Investor focus on ESG criteria is intensifying, with a large portion of global capital in 2024 allocated to ESG-aligned investments, compelling Air Liquide to highlight its 2050 carbon neutrality goal and its €8 billion investment in low-carbon hydrogen by the end of 2023.

Customer demand for sustainable products and services is growing, driving the need for decarbonization solutions. Air Liquide's revenue from these offerings saw a notable increase in 2024, reflecting market acceptance of its carbon capture and storage technologies.

| Environmental Factor | Impact on Air Liquide | Key Data/Initiative |

|---|---|---|

| Decarbonization Push | Increased demand for low-carbon hydrogen | €5 billion investment in German low-carbon hydrogen (2024); €8 billion invested in low-carbon hydrogen (by end of 2023) |

| Regulatory Landscape | Opportunities in decarbonization solutions, compliance needs | EU CBAM implementation (2026) |

| ESG Investor Focus | Need to demonstrate environmental progress | Carbon neutrality by 2050 goal; increased revenue from sustainable offerings (2024) |

| Customer Sustainability Demands | Growth in demand for eco-friendly technologies | Focus on carbon capture and storage solutions |

PESTLE Analysis Data Sources

Our PESTLE analysis for Air Liquide is meticulously constructed using data from reputable sources including the International Energy Agency (IEA), national regulatory bodies, and leading financial news outlets. This ensures a comprehensive understanding of political, economic, and environmental factors impacting the industrial gas sector.