Air Liquide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

Air Liquide operates in a dynamic industrial gas market, where the threat of new entrants is moderate due to high capital requirements but low switching costs for customers. Bargaining power of buyers is significant, especially for large industrial clients, while supplier power is relatively low given the diverse raw material sources.

The intensity of rivalry among existing competitors is high, driven by product differentiation and price competition. Furthermore, the threat of substitutes is limited, as industrial gases are critical to many manufacturing processes. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Air Liquide’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Air Liquide depends on a limited number of suppliers for critical inputs such as electricity for its air separation units and natural gas for hydrogen production. This concentration means these suppliers hold substantial leverage, potentially raising prices or restricting availability, which directly affects Air Liquide's expenses and earnings.

The industrial gas sector, a significant market, was valued at USD 118.9 billion in 2024 and is expected to grow to USD 125.7 billion by 2025. This expansion highlights the industry's scale, but the underlying supply chain for raw materials may still be concentrated, giving key suppliers considerable bargaining power.

For Air Liquide, switching suppliers for essential inputs like energy or highly specialized equipment presents significant challenges. These hurdles stem from existing long-term contracts, the intricate nature of integrated infrastructure, and the non-negotiable requirement for stringent quality control in its operations.

Consequently, these elevated switching costs inherently limit Air Liquide's ability to easily change suppliers. This situation directly amplifies the bargaining power of its current suppliers, as the cost and complexity of transitioning away are substantial deterrents.

Air Liquide benefits from this industry dynamic, as the high switching costs create a natural moat around its business. For instance, in 2023, Air Liquide's capital expenditures were €3.7 billion, reflecting significant investments in infrastructure that further embed its supplier relationships and increase switching costs for both parties.

The ability of raw material suppliers to integrate forward into industrial gas production represents a significant, albeit often low, threat to Air Liquide. If a supplier could effectively enter this capital-intensive market, they would directly compete, amplifying their leverage.

While the industrial gas sector demands substantial investment and complex technology, making forward integration by raw material suppliers generally unlikely, the threat isn't entirely absent. For specialized components or niche gases, the barrier to entry might be lower, potentially empowering those suppliers.

However, the inherent complexities and high capital expenditure associated with industrial gas manufacturing, including Air Liquide's significant investments in facilities and technology, typically serve as a strong deterrent for raw material providers considering such a strategic move.

Uniqueness of Supplier's Products/Services

While air itself is a plentiful resource, the specialized technology and deep expertise needed to separate, purify, and reliably deliver industrial and medical gases like oxygen and nitrogen are not. Companies possessing unique, proprietary equipment for air separation units (ASUs) or advanced purification systems wield considerable influence. This distinctiveness in their offerings, coupled with the critical nature of these gases for many industrial processes and healthcare, grants them significant leverage in negotiating prices and contract terms.

The bargaining power of suppliers in this segment is further amplified by the capital-intensive nature of gas production and the stringent quality and safety standards required. For instance, Air Liquide, a major player, relies on specialized suppliers for critical components of its air separation units. The development and manufacturing of these highly engineered systems, often protected by patents, represent a significant barrier to entry for alternative suppliers.

- Specialized Technology: Suppliers of proprietary ASU technology and advanced purification systems possess unique capabilities, granting them pricing power.

- Criticality of Gases: The essential nature of industrial and medical gases for various sectors underscores the importance of reliable, high-quality supply, strengthening supplier leverage.

- Capital Intensity & Standards: The high cost of specialized equipment and adherence to strict quality and safety regulations limit the supplier base, enhancing their bargaining position.

Limited Availability of Alternative Inputs

While atmospheric air, the primary feedstock for oxygen, nitrogen, and argon, is abundant and free, the bargaining power of suppliers for Air Liquide is influenced by other key inputs. For instance, natural gas is a crucial component in hydrogen production. Fluctuations in natural gas prices, as seen with a significant increase in European gas prices in late 2021 and 2022, can directly impact Air Liquide's production costs and therefore the bargaining power of natural gas suppliers.

Air Liquide's strategic pivot towards low-carbon hydrogen introduces a new dynamic. This involves sourcing inputs like renewable electricity and purified water. The availability and pricing of these alternative inputs, particularly from renewable energy providers, will shape supplier power in this growing segment. For example, the cost of green hydrogen is heavily dependent on the price of renewable electricity, which has seen considerable volatility.

- Input Dependence: Natural gas is a key input for hydrogen, with prices impacting production costs.

- Renewable Sourcing: Investments in low-carbon hydrogen shift dependencies to renewable energy and water suppliers.

- Price Volatility: Fluctuations in natural gas and renewable electricity prices directly influence supplier bargaining power.

Suppliers of specialized technology for air separation units (ASUs) and advanced purification systems hold significant bargaining power due to their unique, often patented, capabilities. The critical nature of industrial and medical gases, coupled with the high capital intensity and stringent quality standards of the sector, further limits the supplier base, enhancing their leverage.

For Air Liquide, the bargaining power of suppliers is particularly evident in the cost of natural gas, a key input for hydrogen production, and increasingly, in the pricing of renewable electricity for its low-carbon initiatives. For instance, European natural gas prices saw substantial increases in late 2021 and 2022, directly impacting production costs.

| Key Input | Impact on Air Liquide | Supplier Bargaining Power Factor |

| Specialized ASU Technology | High reliance on proprietary equipment | Unique capabilities, patents |

| Natural Gas | Essential for hydrogen production | Price volatility, market concentration |

| Renewable Electricity | Growing importance for low-carbon hydrogen | Availability, pricing of green energy |

What is included in the product

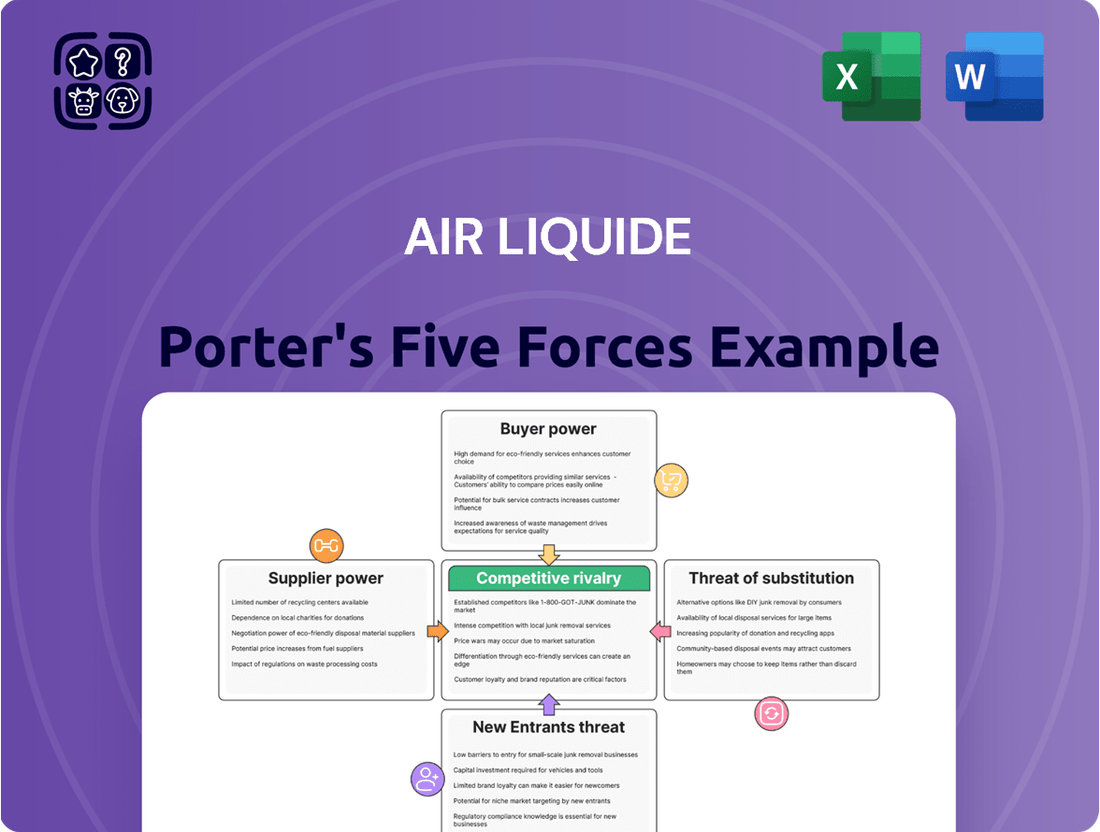

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Air Liquide, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Gain immediate clarity on competitive pressures with a visual, interactive model that highlights key threats and opportunities for Air Liquide.

Customers Bargaining Power

Air Liquide's customer base includes major sectors such as healthcare, manufacturing, electronics, and energy. Within these industries, customers frequently commit to substantial, long-term contracts for essential gases.

These significant volume purchases grant key clients considerable leverage. This allows them to negotiate advantageous pricing and contractual conditions with Air Liquide.

For instance, the manufacturing industry represents a substantial buyer of industrial gases, a segment where purchasing power directly influences supplier relationships and cost structures.

For common industrial gases like oxygen and nitrogen, the products are largely standardized. This means customers can often switch between major suppliers such as Air Liquide, Linde, and Air Products without facing significant operational disruptions. This ease of switching directly enhances customer bargaining power, as they can readily solicit competitive bids from various providers.

The competitive landscape is robust, with key players like Linde reporting substantial sales figures. For instance, Linde's 2024 sales reached $33 billion, underscoring the availability of choices for industrial gas consumers. This market dynamic allows customers to leverage the presence of multiple strong suppliers to negotiate more favorable terms and pricing.

Large industrial clients, such as major petrochemical or steel manufacturers, possess the potential to produce their own industrial gases if supplier costs become excessive or if they need highly specialized, localized gas production. For instance, a large refinery might evaluate the economics of building its own air separation unit if the price of oxygen or nitrogen from external providers exceeds a certain threshold, especially considering the substantial capital outlay and technical know-how involved.

The mere possibility of customers undertaking backward integration, even if not fully realized, significantly enhances their leverage in negotiations with gas suppliers like Air Liquide. This is because suppliers must consider the potential loss of significant volume if a major customer decides to self-supply, forcing them to offer more competitive pricing or terms to retain business.

Air Liquide actively counters this threat by offering advanced on-site generation solutions. These integrated systems provide tailored gas production directly at the customer's facility, effectively internalizing the supply chain for the client and reducing the incentive for them to build their own capacity. This strategy, which accounted for a significant portion of Air Liquide's revenue growth in recent years, demonstrates a proactive approach to managing customer bargaining power.

Price Sensitivity of Customers

The price sensitivity of customers for industrial gases like those supplied by Air Liquide can vary significantly. While in many industrial processes, the cost of gases might be a small fraction of overall production expenses, intense competition can amplify the importance of even minor cost reductions. This often leads customers to actively seek lower prices, thereby increasing their bargaining power.

For instance, in sectors like metal fabrication or food processing, where margins are often tight, customers are more inclined to shop around for the best gas prices. This pressure forces suppliers to be highly efficient and innovative. Air Liquide's focus on operational efficiency, including optimized logistics and production, directly addresses this customer price sensitivity by allowing them to offer competitive pricing without sacrificing profitability.

- Customer Price Sensitivity: In many industrial applications, the cost of industrial gases is a relatively small component of a customer's total production costs.

- Competitive Pressure: However, in highly competitive industries, even minor cost savings are crucial, making customers price-sensitive and inclined to negotiate for lower prices.

- Air Liquide's Strategy: Air Liquide counters this by employing dynamic pricing models and achieving efficiency gains, ensuring profitability while meeting customer demands for cost-effectiveness.

Availability of Substitutes for Customers

The availability of substitutes for industrial gases, like those supplied by Air Liquide, can vary significantly by application. While direct substitutes are scarce for essential uses such as oxygen in healthcare or nitrogen in electronics manufacturing, technological shifts can introduce alternatives. For instance, advancements in energy efficiency or process redesign might lessen the demand for industrial gases in certain manufacturing sectors.

However, the fundamental nature of many industrial gas applications limits the practical availability of substitutes. For example, hydrogen's role in refining or ammonia production is difficult to replace with current technologies. Air Liquide's 2024 performance, with revenue growth driven by its large and diversified customer base, indicates that for many core industrial processes, direct substitution remains a low threat.

- Limited Direct Substitutes: In critical applications like medical oxygen or semiconductor manufacturing, direct substitutes are often non-existent or prohibitively expensive.

- Technological Advancements: Emerging technologies or process innovations could, in some niche areas, reduce the reliance on specific industrial gases, creating indirect substitute pressures.

- Energy Transition Impact: The broader energy transition might influence demand for gases like hydrogen, with potential for both increased use in new applications and reduced use in older, less efficient processes.

- Air Liquide's Market Position: The company's strong market share and integrated supply chain in 2024 suggest that customers face significant hurdles in finding readily available and cost-effective alternatives for many of their industrial gas needs.

The bargaining power of customers for industrial gases is significant due to the large volumes purchased and the standardized nature of many products, allowing for easy switching between suppliers. For example, Linde's 2024 sales of $33 billion highlight the scale of the market, giving major buyers considerable negotiation leverage.

Customers, particularly large industrial clients, can exert influence by threatening backward integration, though this is capital-intensive. Air Liquide mitigates this by offering on-site generation solutions, a strategy contributing to its recent revenue growth.

Price sensitivity varies; while gas costs are often a small part of total production, intense competition drives customers to seek lower prices, enhancing their bargaining power. Air Liquide addresses this through operational efficiencies and dynamic pricing.

The threat of substitutes is generally low for essential industrial gases, though technological shifts could impact demand in specific sectors. Air Liquide's strong 2024 market position indicates customers face challenges finding viable alternatives for many core needs.

Same Document Delivered

Air Liquide Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Air Liquide, detailing the competitive landscape within the industrial gases sector. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights into the industry's structure and Air Liquide's strategic positioning. You're looking at the actual document, ready for your immediate use and informed decision-making.

Rivalry Among Competitors

The industrial gas sector, where Air Liquide operates, is defined by substantial upfront investments in production facilities, such as air separation units, and the infrastructure needed for delivery. These high fixed costs create a strong incentive for players to maximize their operational output. For instance, Air Liquide's significant capital expenditures are geared towards building and maintaining these essential assets.

To offset these considerable fixed costs, companies like Air Liquide strive for high capacity utilization. This pursuit drives aggressive competition to secure and retain long-term customer agreements, as underutilized capacity directly impacts profitability. Air Liquide's strategic plan ADVANCE, targeting 2025, specifically highlights the importance of financial discipline and efficient use of capital resources to manage these cost structures.

The industrial gas market is characterized by fierce rivalry among a few dominant global players. Air Liquide, Linde, and Air Products are the primary competitors, each boasting substantial global reach, advanced technological expertise, and considerable financial muscle. This concentration of power intensifies competition for market share across numerous regions and industries.

Air Liquide, for instance, demonstrates its extensive global presence by operating in 60 countries and catering to over 4 million customers. This broad operational scope, coupled with significant investments in research and development, allows these major players to leverage economies of scale and offer comprehensive solutions, further escalating the competitive landscape.

While many industrial gases can be seen as commodities, leading players like Air Liquide actively differentiate themselves. They achieve this through specialized gas mixtures tailored for specific industries, innovative application technologies that enhance customer processes, and robust service packages. This strategy is especially potent in high-margin sectors such as healthcare and advanced electronics.

Air Liquide's strategic emphasis on hydrogen, a key component in the growing clean energy sector, and advanced materials critical for semiconductor manufacturing, exemplifies this product differentiation. For instance, in 2024, the company continued to invest heavily in hydrogen infrastructure, aiming to capture a significant share of this expanding market, thereby moving beyond basic gas supply.

Strategic Investments in Future Markets

Competitive rivalry is intensifying as companies make significant strategic investments in future growth markets. This includes areas like low-carbon hydrogen, carbon capture technologies, and specialized materials crucial for the booming electronics sector. The race is on to gain early dominance and secure lucrative, long-term agreements in these high-potential segments.

Air Liquide, for instance, reported a substantial investment backlog of €4.6 billion as of the first half of 2025. A considerable portion, 40%, of these investments is specifically earmarked for projects focused on hydrogen and carbon capture, underscoring the strategic importance of these emerging industries.

- Strategic Investments: Companies are pouring capital into low-carbon hydrogen, carbon capture, and advanced materials for electronics.

- Early Leadership: The goal is to establish a leading position and secure long-term contracts in these high-growth areas.

- Air Liquide's Commitment: A record €4.6 billion investment backlog in H1 2025, with 40% allocated to hydrogen and carbon capture.

Mergers and Acquisitions as a Competitive Strategy

Mergers and acquisitions (M&A) are a significant force shaping competitive rivalry in the industrial gas sector. Consolidation through these deals can create larger, more formidable players with enhanced market presence and cost advantages, thereby intensifying competition for all participants.

This trend towards consolidation has been evident for years, leading to a more concentrated market where fewer, larger companies hold substantial market share. For instance, Air Liquide itself has been active in M&A, with its acquisition of Airgas in 2016 for approximately $13.4 billion being a landmark deal that significantly expanded its footprint in North America. Such moves often put increased pressure on smaller, regional players to either scale up or face being outcompeted.

- Consolidation creates larger players: Deals like Air Liquide's 2016 acquisition of Airgas for $13.4 billion demonstrate how M&A builds scale.

- Expanded market reach and cost efficiencies: Acquirers gain access to new geographies and customer segments, while also realizing synergies that lower costs.

- Intensified competitive pressure: Larger, more efficient entities can exert greater pricing power and service capabilities, challenging smaller competitors.

- Concentrated market dynamics: The industrial gas market has seen significant consolidation, leading to fewer, more dominant global players.

The industrial gas sector is dominated by a few large global players, including Air Liquide, Linde, and Air Products. These companies compete fiercely on price, innovation, and service, particularly in high-growth sectors like healthcare and electronics. Air Liquide's extensive global network and focus on differentiated offerings, such as specialized gas mixtures and advanced application technologies, allow it to maintain a strong competitive position.

Strategic investments in emerging areas like low-carbon hydrogen and carbon capture are intensifying rivalry, as companies race to secure early leadership. Air Liquide's significant investment backlog, with a substantial portion allocated to these future growth markets, highlights this aggressive competitive stance. For instance, a significant portion of its €4.6 billion investment backlog as of H1 2025 is directed towards hydrogen and carbon capture initiatives.

Market consolidation through mergers and acquisitions further fuels competitive intensity. Deals like Air Liquide's 2016 acquisition of Airgas for $13.4 billion demonstrate how companies are building scale and market reach. This consolidation creates larger, more efficient entities that can exert greater competitive pressure on smaller players, reshaping the market landscape.

| Competitor | Global Presence (Approx.) | Key Differentiators | Recent Strategic Focus |

|---|---|---|---|

| Air Liquide | 60+ countries, 4M+ customers | Specialized gases, application tech, hydrogen focus | Low-carbon hydrogen, carbon capture investments |

| Linde | 100+ countries | Broad product portfolio, engineering capabilities | Industrial digitalization, sustainability solutions |

| Air Products | 50+ countries | Industrial gases, gas technologies, hydrogen infrastructure | Hydrogen energy projects, clean energy transition |

SSubstitutes Threaten

For major industrial consumers, the main alternative to buying gases from Air Liquide is producing them directly at their own facilities. This approach requires substantial upfront capital expenditure, but it can lead to cost efficiencies and enhanced supply chain autonomy for businesses with extremely high gas consumption.

Companies like Air Liquide recognize this competitive pressure and often provide their own on-site generation solutions, thereby integrating this substitute into their service offerings. For instance, in 2023, Air Liquide continued to expand its on-site production capabilities, particularly for major clients in sectors like electronics and refining, reflecting a strategic response to the threat of self-generation.

Technological advancements in customer industries can indeed present a threat by reducing the need for Air Liquide's core products. For example, innovations in manufacturing processes might lessen the reliance on inert gases for welding or other applications. Similarly, breakthroughs in healthcare could shift demand for certain medical gases.

However, for many fundamental uses, such as providing oxygen for medical patients or gases for essential industrial processes like steelmaking, direct substitutes remain scarce. This limited substitutability is a key factor in maintaining the strength of Air Liquide's market position in these areas.

The global shift towards renewable energy sources like solar and wind power presents a significant threat of substitution for traditional fossil fuel-based energy. This transition could reduce demand for industrial gases used in oil and gas extraction and processing, impacting Air Liquide's existing markets.

However, this energy evolution also creates a substantial opportunity. The demand for green hydrogen, produced using renewable electricity, is surging. Projections indicate the global green hydrogen market could expand from approximately $2.5 billion in 2024 to over $40 billion by 2034, offering a strong growth avenue for Air Liquide.

Recycling and Reuse Technologies

Advances in recycling and reuse technologies for certain industrial gases present a potential threat by reducing the need for newly produced gases. While this is more likely to impact specialty gases, it could still affect the volume sales of more common gases. For instance, the growing circular economy initiatives are encouraging the recovery and purification of gases like helium, which is a high-value specialty gas.

However, the continuous and often non-recoverable consumption in many critical applications, such as medical oxygen or welding gases, significantly limits the widespread impact of recycling on Air Liquide's core business. The inherent nature of many gas applications means that reuse is often impractical or impossible, thereby mitigating the threat of substitutes in these areas.

- Recycling Impact: Potential reduction in demand for newly produced gases, particularly specialty gases.

- Application Limitations: Continuous consumption in key sectors like healthcare and manufacturing limits the scope of substitution.

- Helium Example: Growing interest in helium recycling highlights the threat for high-value, albeit niche, gas markets.

Changes in Product Design or Material Science

Innovations in product design or material science by Air Liquide's customers could indeed lead to a decreased reliance on industrial gases. For instance, if a customer develops a new manufacturing process that uses a different catalyst or requires fewer steps, the demand for specific gases like hydrogen or nitrogen might diminish. This is a constant consideration, especially as industries push for greater efficiency and sustainability.

Consider the semiconductor industry, a major consumer of high-purity gases. A breakthrough in solid-state cooling technology, for example, could reduce the need for cryogens like liquid nitrogen in certain chip manufacturing stages. While such specific shifts are possible, the fundamental role of gases in many chemical and physical processes makes a complete substitution across the board unlikely for a broad range of applications.

The threat of substitutes is particularly relevant when looking at energy-intensive processes. As of 2024, global efforts to decarbonize are driving innovation in alternative energy sources and production methods. For example, advancements in electrolysis for hydrogen production could potentially reduce the reliance on traditional steam methane reforming, which uses natural gas. However, even with these shifts, industrial gases remain integral to sectors like healthcare (oxygen), food and beverage (carbon dioxide), and metallurgy.

- Technological Advancements: New materials or processes that eliminate the need for specific industrial gases pose a direct threat.

- Efficiency Gains: Customer innovations that reduce the volume of gas required per unit of output can also impact demand.

- Sustainability Drivers: The push for greener manufacturing may lead to the adoption of alternative technologies that bypass traditional gas applications.

- Broad Applicability: Despite potential shifts, the diverse and fundamental uses of industrial gases across many sectors limit the overall substitutability.

The threat of substitutes for Air Liquide's products is multifaceted. For large industrial users, on-site gas generation presents a direct alternative, though it requires significant capital investment. Air Liquide itself offers these solutions, effectively integrating this substitute. For example, in 2023, the company expanded its on-site production for major clients in electronics and refining, acknowledging this competitive dynamic.

Technological shifts within customer industries can also reduce the need for specific gases. Innovations in manufacturing or healthcare might lessen reliance on inert or medical gases respectively. However, for fundamental applications like medical oxygen or gases for steelmaking, direct substitutes remain scarce, bolstering Air Liquide's market position.

The transition to renewable energy, while creating opportunities in areas like green hydrogen, could reduce demand for gases used in fossil fuel extraction. The global green hydrogen market is projected to grow from about $2.5 billion in 2024 to over $40 billion by 2034, showcasing this dual impact.

Advances in gas recycling, particularly for high-value gases like helium, pose a threat to new gas sales. However, the continuous and often non-recoverable consumption in critical sectors such as healthcare and welding limits the overall impact of recycling on Air Liquide's core business.

Customer innovations in product design or material science can also decrease gas dependency. For instance, a new semiconductor cooling technology could reduce the need for liquid nitrogen. While such specific shifts are possible, the fundamental role of gases in many processes makes broad substitution unlikely.

| Threat of Substitution | Description | Impact on Air Liquide | Mitigation Strategies | Example (2024 Data) |

| On-site Generation | Customers producing gases themselves. | Reduces demand for Air Liquide's bulk supply. | Offering on-site solutions; integrated services. | Expansion of on-site production for electronics/refining clients. |

| Technological Advancements | Customer process innovations reducing gas needs. | Lower volume requirements for specific gases. | Focus on high-purity and specialized gas applications. | Potential reduction in cryogen demand in semiconductor manufacturing. |

| Alternative Energy | Shift away from fossil fuels. | Decreased demand for gases in oil & gas sector. | Capitalizing on growth in green hydrogen. | Green hydrogen market projected to reach $40B+ by 2034. |

| Recycling & Reuse | Recovering and purifying existing gases. | Impacts demand for new specialty gas production. | Focus on non-recoverable applications; core business resilience. | Growing interest in helium recycling. |

Entrants Threaten

The industrial gas sector demands massive upfront investment. Building air separation units, liquefaction plants, and extensive distribution networks requires billions. This significant capital intensity acts as a formidable barrier, deterring many potential new entrants from even attempting to enter the market.

For instance, Air Liquide's commitment to capital expenditures, with investments reaching 2.3 billion euros in the first half of 2025, underscores the sheer scale of financial resources needed to establish a competitive presence. Such substantial outlays make it incredibly difficult for smaller or less capitalized companies to compete.

Established players like Air Liquide leverage massive economies of scale in production, distribution, and R&D, making it difficult for newcomers to match their cost efficiencies. For instance, Air Liquide's extensive global network of production facilities and distribution pipelines allows for optimized logistics and lower per-unit costs. A new entrant would require immense capital investment to build a comparable infrastructure, facing a steep learning curve to achieve operational excellence and cost competitiveness.

Air Liquide’s significant investment in proprietary technology and a robust patent portfolio acts as a formidable barrier to new entrants. These innovations in gas production, purification, and application require substantial upfront R&D expenditure for any competitor seeking to enter the market. For instance, the company's ADVANCE strategic plan places a strong emphasis on continued technological innovation, ensuring its leading edge.

Extensive Distribution Network and Infrastructure

The extensive distribution network and infrastructure within the industrial gas sector present a significant hurdle for new entrants. Building out a comparable system, which includes pipelines, cryogenic tanks, and a vast cylinder fleet, demands immense capital and considerable time. For instance, Air Liquide's substantial investments in its global supply chain, encompassing over 1,500 miles of pipelines in the US alone, underscore the scale of this barrier.

This established infrastructure, a hallmark of incumbents like Air Liquide, creates a formidable entry barrier. New players would find it exceedingly difficult to replicate the reach, efficiency, and reliability that existing companies have cultivated over years of operation. The industrial gas market's reliance on diverse distribution methods, from large-scale on-site production to packaged and cylinder supply, further complicates matters for any newcomer attempting to establish a competitive presence.

- Substantial Capital Investment: Developing a comprehensive distribution network, including pipelines and cryogenic storage, requires billions in upfront capital.

- Logistical Complexity: Managing a fleet of specialized vehicles and ensuring timely delivery across diverse geographies is operationally intensive.

- Incumbent Advantage: Established players benefit from existing, optimized routes and customer relationships built over decades, making it hard for new entrants to compete on cost and service.

Regulatory Hurdles and Safety Standards

The production, storage, and transport of industrial and medical gases are heavily regulated due to inherent safety and environmental concerns. New companies entering this market must navigate a complex web of national and international compliance standards, significantly increasing their initial capital expenditure and time to market.

For example, the medical gas sector demands adherence to rigorous quality control and certification processes, such as those overseen by the FDA in the United States. This creates a substantial barrier for potential entrants who lack the established infrastructure and expertise to meet these exacting requirements. In 2024, companies investing in new gas production facilities often faced multi-million dollar compliance costs before even beginning operations.

- Stringent Safety Regulations: Compliance with safety protocols for handling high-pressure gases is paramount.

- Environmental Standards: Adherence to emissions and waste disposal regulations adds to operational complexity.

- Medical Gas Certification: Meeting specific quality and purity standards for medical applications is a significant hurdle.

- Capital Investment: The cost of building compliant production and distribution infrastructure is substantial.

The threat of new entrants in the industrial gas market, particularly for companies like Air Liquide, is significantly mitigated by several key factors. The sheer scale of capital required to establish a competitive presence is a primary deterrent. Building the necessary production facilities, liquefaction plants, and extensive distribution networks demands billions of dollars in upfront investment.

Furthermore, established players benefit from considerable economies of scale, which newcomers struggle to match. Air Liquide's existing infrastructure and optimized logistics allow for cost efficiencies that are difficult for new entrants to replicate without massive investment and a steep learning curve. For instance, in 2024, the cost of building a new, medium-sized air separation unit could easily run into hundreds of millions of dollars.

Proprietary technology and robust patent portfolios also serve as significant barriers. Air Liquide's continuous investment in R&D, as highlighted by its ADVANCE strategic plan, ensures a technological edge that new entrants would find challenging and costly to overcome. The stringent regulatory environment, especially for medical gases, adds another layer of complexity and cost, requiring substantial adherence to safety and quality standards, with compliance costs in 2024 often reaching millions for new facilities.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Massive upfront investment required for production and distribution infrastructure. | High; deters most potential entrants. |

| Economies of Scale | Established players benefit from lower per-unit costs due to large-scale operations. | Significant; new entrants struggle to compete on price. |

| Technology & Patents | Proprietary processes and intellectual property create a competitive advantage. | High; requires substantial R&D investment to match. |

| Regulatory Compliance | Strict safety, environmental, and quality standards, especially for medical gases. | Substantial; increases time to market and initial costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Air Liquide leverages a comprehensive dataset including Air Liquide's annual reports, investor presentations, and competitor financial filings. We also incorporate industry-specific market research reports from firms like IHS Markit and Bloomberg, alongside data from regulatory bodies and trade associations.