Air Liquide Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

Curious about Air Liquide's product portfolio performance? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock strategic advantage and make informed decisions about resource allocation and future investments, you need the full picture. Purchase the complete Air Liquide BCG Matrix for a detailed, data-driven analysis and actionable insights that will guide your business forward.

Stars

Air Liquide is heavily investing in low-carbon and renewable hydrogen, recognizing its pivotal role in global decarbonization. The company is channeling substantial capital into expanding its production capabilities and supply networks for this cleaner fuel. This strategic focus is fueled by a growing demand for hydrogen across industrial applications and the transportation sector, aiming to reduce carbon footprints significantly.

Significant investments are being made in large-scale electrolyzer projects, which are key to producing green hydrogen. For instance, Air Liquide is a major player in projects like the Normand'hy facility in France, a significant step towards large-scale green hydrogen production. These initiatives underscore the company's commitment to building robust hydrogen mobility solutions, supporting the transition to cleaner transport options.

Air Liquide's Advanced Materials for Electronics segment is a strong performer, fueled by significant investments in semiconductor manufacturing. This includes crucial carrier gases and other advanced materials essential for creating the next generation of chips.

The electronics industry's relentless pursuit of faster, more powerful semiconductors directly benefits this division. Furthermore, the global trend of relocating and expanding semiconductor production facilities creates a consistent demand for Air Liquide's specialized products and expertise.

In 2024, the semiconductor industry is projected to see robust growth, with capital expenditures on new fabrication plants and equipment reaching hundreds of billions of dollars globally. Air Liquide is well-positioned to capture a significant share of this market, leveraging its technological leadership and established customer relationships.

Air Liquide's Large Industries segment in the Americas is experiencing robust expansion, driven by the successful launch of new Air Separation Units (ASUs). This growth is further bolstered by a healthy uptick in its hydrogen business, signaling a dominant position in a burgeoning regional market for essential industrial gases.

Home Healthcare Services

Home healthcare services represent a significant growth area for Air Liquide, driven by demographic shifts and a growing preference for care outside traditional hospital settings. This segment is a key component of Air Liquide's strategic portfolio, reflecting its commitment to evolving patient needs.

Air Liquide's performance in home healthcare is particularly robust, with notable strength in markets like the United States and Latin America. This strong market presence underscores the company's ability to capitalize on the expanding demand for these services.

- Market Growth: The global home healthcare market was valued at approximately USD 318.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030, according to Grand View Research.

- Patient Preference: A significant driver is the increasing patient comfort and preference for receiving medical care in familiar home environments, reducing hospital stays and associated costs.

- Air Liquide's Position: Air Liquide has established a strong foothold, particularly in regions experiencing rapid aging populations and a high adoption rate of home-based medical solutions.

- Strategic Importance: This segment aligns with Air Liquide's broader strategy of providing essential healthcare solutions, positioning it as a leader in a dynamic and expanding sector.

CO2 Capture and Decarbonization Technologies

Air Liquide is actively investing in CO2 capture and decarbonization technologies to help its industrial clients slash emissions, a move that directly supports worldwide climate targets. This strategic focus addresses a significant and expanding market demand for sustainable industrial operations.

The company is developing and deploying a range of solutions, including advanced CO2 capture systems and the production of low-carbon air gases. These offerings are crucial for industries looking to transition towards greener practices.

- Investment in CO2 Capture: Air Liquide is channeling significant capital into developing and scaling CO2 capture technologies, aiming to provide viable solutions for hard-to-abate sectors.

- Low-Carbon Air Gases: The company is also expanding its portfolio of low-carbon air gases, such as hydrogen produced with renewable energy or through carbon capture, to support decarbonization efforts.

- Market Growth: The global market for carbon capture, utilization, and storage (CCUS) is projected for substantial growth, with estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by regulatory pressures and corporate sustainability goals. For instance, in 2024, significant project announcements are expected to further bolster this market.

- Customer Focus: These initiatives are directly aligned with the needs of industrial customers who are increasingly seeking partners to help them achieve their net-zero commitments and navigate the complexities of decarbonization.

Air Liquide's investments in renewable and low-carbon hydrogen, alongside its strong position in the electronics materials sector, represent its 'Stars' in the BCG Matrix. These areas exhibit high growth potential and strong market positions, driven by global decarbonization trends and the booming semiconductor industry.

The company's significant capital allocation towards green hydrogen production, exemplified by projects like Normand'hy, positions it to capture the expanding demand for cleaner fuels. Similarly, its advanced materials for electronics cater to the robust growth in semiconductor manufacturing, a market projected for substantial investment in 2024.

The home healthcare segment also shines as a 'Star,' benefiting from demographic shifts and increasing patient preference for in-home care. With the global home healthcare market valued at approximately USD 318.4 billion in 2023 and projected to grow at a CAGR of 7.8% from 2024 to 2030, Air Liquide's strong presence in key markets like the US and Latin America solidifies its star status.

Furthermore, the company's focus on CO2 capture and decarbonization technologies addresses a critical need for industrial clients, aligning with escalating sustainability goals and regulatory pressures. The CCUS market's projected substantial growth underscores the strategic importance and high-growth trajectory of this segment for Air Liquide.

| Segment | Growth Potential | Market Position | Key Drivers |

|---|---|---|---|

| Hydrogen (Low-Carbon/Renewable) | High | Strong | Decarbonization, Industrial demand, Mobility transition |

| Advanced Materials for Electronics | High | Strong | Semiconductor industry growth, Chip manufacturing expansion |

| Home Healthcare | High | Strong | Demographic shifts, Patient preference for home care |

| CO2 Capture & Decarbonization | High | Developing/Strong | Climate targets, Industrial sustainability needs |

What is included in the product

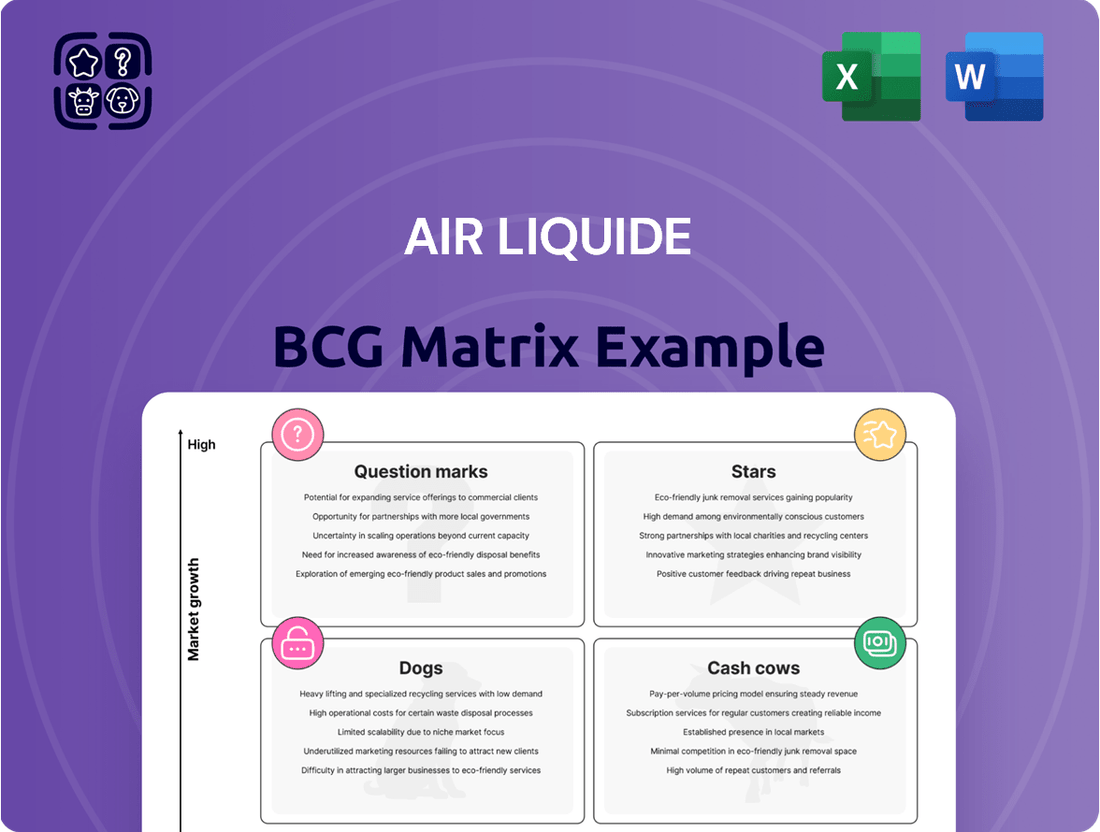

The Air Liquide BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear, one-page BCG Matrix overview for Air Liquide helps prioritize investments by visually categorizing business units, alleviating the pain of resource allocation uncertainty.

Cash Cows

Air Liquide's traditional industrial gases, particularly oxygen and nitrogen, represent its classic cash cows. These essential products are the backbone of numerous mature industries, including manufacturing, healthcare, and chemicals, ensuring a steady and substantial revenue stream. The company's strong market presence and the critical nature of these gases for industrial operations translate into predictable and robust cash flow generation.

In 2024, Air Liquide continued to demonstrate the resilience of its industrial gas segment. For instance, the company reported that its Large Industries segment, which heavily relies on oxygen and nitrogen supply to sectors like refining and chemicals, maintained strong operational performance. This stability is underpinned by long-term contracts, providing a reliable foundation for cash generation and supporting the company's overall financial health.

Air Liquide's medical oxygen and hospital gases segment functions as a classic Cash Cow within its BCG Matrix. The company holds a substantial market share in this essential and stable sector, ensuring consistent revenue streams.

While the growth rate for medical gases might not be as explosive as some newer markets, the unwavering demand from hospitals and healthcare facilities globally translates into predictable and reliable cash generation for Air Liquide. This stability is a hallmark of a Cash Cow.

In 2024, the global medical gases market, including oxygen, was valued at approximately $25 billion, with projections indicating steady, albeit moderate, growth. Air Liquide's strong position in this segment directly contributes to its robust financial performance and ability to fund other ventures.

Air Liquide's Industrial Merchant business in established regions functions as a cash cow. This segment focuses on selling industrial gases like oxygen, nitrogen, and hydrogen in smaller volumes to a diverse customer base across mature markets. Its strength lies in consistent revenue generation, fueled by a robust pricing strategy and resilient gas demand, ensuring stable cash flows for the company.

In 2024, the Industrial Merchant segment continued to demonstrate its stability. For instance, Air Liquide reported that its Large Industries and Healthcare segments, which often overlap with industrial merchant activities in terms of infrastructure and customer relationships, saw revenue growth driven by both volume and pricing. This indicates the enduring demand for essential industrial gases even in developed economies.

On-site Gas Production for Large Industries (Mature Contracts)

Air Liquide's on-site gas production for large industries, often secured by long-term contracts, represents a classic cash cow. Once these production facilities are built and operational, they generate consistent and significant cash flows. The initial capital expenditure is high, but after that, the ongoing investment required to maintain these operations is relatively low, especially as the contracts are in mature industrial sectors.

These mature contracts, typically spanning 10-20 years, offer a stable revenue stream. For instance, Air Liquide has secured numerous agreements with major players in sectors like refining, chemicals, and metallurgy, ensuring a predictable demand for their gases. The predictability of these cash flows allows for substantial returns on the initial investment.

- Predictable Revenue: Long-term contracts provide a stable and reliable income stream, insulating against market volatility.

- Low Ongoing Investment: Mature facilities require minimal additional capital expenditure, maximizing cash generation.

- Mature Industrial Sectors: Operations are typically in established industries with consistent demand for industrial gases.

- High Initial Capital: While cash cows, the initial setup of on-site production facilities involves significant upfront investment.

Gas & Services Segment Overall

Air Liquide's Gas & Services segment is a quintessential cash cow, representing 95% of the company's total revenue. This segment enjoys a dominant market share in the stable, mature global market for industrial and medical gases, consistently generating substantial profits. The robust cash flow from Gas & Services is crucial, enabling Air Liquide to invest in growth areas and other strategic ventures.

- Dominant Market Share: The Gas & Services segment holds a leading position in the global industrial and medical gases market.

- High Revenue Contribution: This segment accounts for approximately 95% of Air Liquide's overall revenue.

- Consistent Profitability: It exhibits strong and reliable profitability due to its established market presence and mature industry.

- Cash Generation: The segment acts as a significant source of cash, funding the company's investments and strategic initiatives.

Air Liquide's Gas & Services segment, which includes its core industrial and medical gases, is a prime example of a cash cow. This division consistently generates significant profits due to its dominant market share in stable, mature global markets. The substantial and predictable cash flow from this segment is vital for funding the company's investments in new technologies and expansion into emerging markets.

In 2024, Air Liquide's Gas & Services segment continued to be the primary revenue driver, accounting for a substantial portion of the company's overall sales. This segment's stability is bolstered by long-term contracts and the essential nature of its products for a wide array of industries, from healthcare to manufacturing.

The consistent performance of this segment highlights its role as a reliable generator of cash, enabling Air Liquide to maintain financial flexibility and pursue strategic growth opportunities.

Air Liquide's mature industrial gas operations, particularly in established regions, function as cash cows. These businesses benefit from consistent demand in sectors like manufacturing and chemicals, supported by long-term contracts and efficient operations.

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Gas & Services | Cash Cow | Dominant market share, high revenue contribution (approx. 95%), consistent profitability, stable cash generation. | Remains the primary revenue driver, underpinning financial stability and investment capacity. |

| Industrial Gases (Oxygen, Nitrogen) | Cash Cow | Essential for mature industries, steady revenue streams, strong market presence, predictable cash flow. | Continued strong operational performance in Large Industries segment, supported by long-term contracts. |

| Medical Gases | Cash Cow | Unwavering demand from healthcare, substantial market share, predictable and reliable cash generation. | Global medical gases market valued around $25 billion in 2024, showing steady growth, with Air Liquide holding a strong position. |

Preview = Final Product

Air Liquide BCG Matrix

The Air Liquide BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted to provide strategic insights, will be delivered directly to you without any watermarks or demo content. You can be confident that the professional-grade report, ready for immediate application in your business planning, is exactly what you are seeing now.

Dogs

Air Liquide strategically divests non-core or underperforming assets to sharpen its focus on high-growth areas. This process ensures capital is reallocated to businesses with stronger market positions and future potential. For instance, in 2024, the company continued its portfolio optimization efforts, although specific divestment figures for non-core assets are often integrated into broader financial reporting rather than isolated.

Air Liquide's legacy technologies with declining demand, often categorized as Dogs in the BCG matrix, likely represent older production methods or specialized gas applications that are being superseded. These could include certain less efficient air separation unit technologies or niche industrial gases that have seen their market shrink considerably due to technological advancements or shifts in customer needs. For instance, if Air Liquide still operates older, energy-intensive cryogenic distillation plants for air separation that are less competitive than newer membrane or PSA technologies, these would fit this category.

These Dog segments would be characterized by a low market share within their specific niche and operate in markets experiencing a secular decline. Think of older industrial processes that are being phased out globally, leading to a reduced need for the specific gases or services associated with them. For example, the demand for certain gases used in legacy manufacturing processes that are no longer prevalent could place them in this category. In 2023, Air Liquide's overall revenue reached €27.6 billion, but specific segments within legacy technologies would represent a small fraction of this, likely showing negative or stagnant growth.

Within Air Liquide's diverse portfolio, certain niche regional businesses or specialized product lines can be categorized as 'dogs' in the BCG matrix. These are typically operations with a low market share in a low-growth industry. For instance, some of their legacy industrial gas operations in specific, mature European markets have experienced stagnant demand.

These segments, while perhaps stable, contribute minimally to overall growth. For example, in 2024, revenue from certain industrial gas applications in some parts of the Middle East and Africa showed only marginal year-over-year increases, indicating a low-growth environment for those specific offerings.

Hardgoods Sales in Industrial Merchant (e.g., US)

Sales of hardgoods, which include essential equipment and installations for industrial clients, have experienced a downturn in key markets like the United States. This segment of Air Liquide's Industrial Merchant business faces challenges that could lead to its classification as a dog in the BCG matrix if current conditions persist.

For instance, in 2024, the industrial equipment sector in the US saw a contraction, with some reports indicating a year-over-year decline in capital expenditures for machinery and related installations. This directly impacts hardgoods sales for companies like Air Liquide.

- Declining Sales: Hardgoods sales in the US Industrial Merchant sector have shown a downward trend.

- Market Share Concerns: If this segment also holds a low market share, it strengthens the case for a dog classification.

- 2024 Impact: The broader economic environment in 2024, marked by cautious industrial spending, has likely exacerbated this decline.

- Strategic Review: Such performance necessitates a strategic review to either divest or find a turnaround strategy.

Helium Sales (Impacted by Market Volatility)

Helium sales within Air Liquide's portfolio have faced significant headwinds, particularly due to market volatility. For instance, the Chinese market, a key consumer, saw a decline in helium demand in early 2024, impacting overall sales figures for the company.

While helium is a niche product, its current market standing, characterized by sluggish growth and regional sales dips, places it in a precarious position within the BCG matrix. This situation is exacerbated by broader economic factors affecting industrial gas demand.

- Market Volatility: Global helium prices and demand have fluctuated, influenced by supply chain disruptions and geopolitical events in 2023 and early 2024.

- Regional Declines: Specific markets, like China, experienced a contraction in helium consumption, directly affecting Air Liquide's regional revenue streams.

- Low Growth Potential: Despite its specialized applications, the overall market growth for helium has been modest, making it challenging to achieve significant market share gains.

- Competitive Landscape: The specialized nature of helium production and distribution means that while competition exists, the barriers to entry are high, yet market dynamics are currently unfavorable.

Air Liquide's 'Dogs' are business segments with low market share in low-growth industries. These often include legacy technologies or niche products facing declining demand or market saturation. For example, certain older industrial gas applications or specialized equipment sales in mature markets can fall into this category.

These segments, while potentially stable, contribute little to overall growth and may require significant investment to maintain. In 2024, Air Liquide continued its portfolio optimization, which often involves assessing and potentially divesting such 'Dog' assets to reallocate resources to more promising areas.

Segments like hardgoods sales in the US Industrial Merchant sector, experiencing a downturn due to cautious industrial spending in 2024, exemplify this. Similarly, challenges in the helium market, marked by volatility and regional demand dips in early 2024, also point to potential 'Dog' characteristics.

The company's overall revenue in 2023 was €27.6 billion, but the specific contribution of these 'Dog' segments would represent a small, likely stagnant or declining, portion of this total.

Question Marks

Air Liquide's commitment to hydrogen mobility infrastructure, encompassing fueling stations and supply chains, positions it as a key player in a nascent but rapidly expanding sector. While the potential for growth is substantial, the current market penetration of hydrogen-powered vehicles remains limited, classifying this segment as a question mark within the BCG matrix. Significant capital outlay is necessary to overcome adoption hurdles and establish a robust hydrogen ecosystem for transportation.

Air Liquide is actively pursuing new industrial applications for hydrogen, particularly in decarbonizing sectors like steel and glass production. These emerging markets represent significant future growth potential as industries strive to reduce their carbon footprint. For instance, the global green hydrogen market is projected to reach $115.1 billion by 2030, indicating substantial investment and adoption opportunities.

Air Liquide's recent transfer of Biogas and Maritime activities to its Industrial Merchant segment suggests these are developing areas with significant future promise. These sectors are increasingly driven by global sustainability initiatives, creating a fertile ground for growth.

While specific market share data for these transferred segments within Air Liquide's broader portfolio isn't publicly detailed, the strategic shift implies they represent opportunities for expansion. The focus is likely on scaling these operations to capture a larger portion of a growing market, particularly as environmental regulations and demand for cleaner energy solutions intensify in both the biogas and maritime industries.

Early-Stage Advanced Technologies (e.g., Subleem™ for semiconductors)

Air Liquide's development of advanced technologies like Subleem™ for semiconductors places them in the question marks category of the BCG matrix. These are innovative solutions targeting a high-growth sector, but their current market share is minimal due to their novelty and the substantial investment needed for broad market penetration.

Subleem™ represents a significant R&D effort by Air Liquide, aiming to address critical needs in the semiconductor industry. For instance, the semiconductor market itself is projected to reach $1 trillion by 2030, highlighting the immense potential for disruptive technologies.

- High Growth Potential: The semiconductor industry is experiencing rapid expansion, driven by demand for AI, 5G, and advanced computing.

- Low Market Share: As new technologies, Subleem™ and similar innovations have yet to capture significant market share.

- High Investment Needs: Developing and scaling these advanced technologies requires substantial capital expenditure.

- Strategic Importance: Air Liquide’s investment in these areas positions them for future leadership in a crucial technological domain.

Carbon Capture and Storage (CCS) Projects (Early Adopters)

Large-scale Carbon Capture and Storage (CCS) projects, particularly those in their initial development phases or with limited market uptake, can be categorized as question marks within the Air Liquide BCG Matrix. These ventures are positioned in a high-growth sector focused on decarbonization, yet they demand significant capital expenditure and market maturation to secure substantial market share.

While CO2 capture solutions are a Star, the extensive upfront investment and the need for regulatory and infrastructure development for CCS projects place them in a position of uncertainty. For instance, projects like the Northern Lights initiative in Norway, a significant CCS endeavor, are still in their early stages, demonstrating the nascent market adoption.

- High Growth Potential: The global CCS market is projected to grow significantly, driven by climate targets. Estimates suggest the market could reach hundreds of billions of dollars by 2050.

- Substantial Investment Needs: Building CCS infrastructure, including capture facilities, transport pipelines, and storage sites, requires massive capital. A single large-scale CCS plant can cost upwards of $1 billion.

- Market Development Required: Widespread adoption of CCS depends on policy support, technological advancements, and the establishment of robust CO2 transport and storage networks.

- Early Adopter Challenges: Companies investing in early CCS projects face risks associated with unproven technologies at scale, uncertain long-term operational costs, and evolving regulatory frameworks.

Air Liquide's ventures into emerging hydrogen mobility and new industrial decarbonization sectors, such as green steel production, are currently classified as question marks. These areas show immense future growth potential, but require substantial investment and face limited current market adoption, necessitating strategic development to achieve significant market share.

The company's focus on advanced semiconductor technologies like Subleem™ and large-scale Carbon Capture and Storage (CCS) projects also falls into the question mark category. While these sectors are poised for significant expansion, driven by technological advancements and climate goals respectively, they demand considerable capital and market maturation before realizing their full potential.

Air Liquide's strategic repositioning of Biogas and Maritime activities suggests these are also developing areas with future promise, fitting the question mark profile. The growth in these segments is tied to global sustainability trends, indicating a need for scaling operations to capture a larger market share as environmental regulations and demand for cleaner solutions increase.

| Business Area | BCG Category | Key Characteristics | Market Potential (Illustrative) | Investment Needs |

| Hydrogen Mobility | Question Mark | Nascent market, high growth potential, low current penetration | Global hydrogen fuel cell vehicle market projected to grow significantly | High capital for infrastructure development |

| Industrial Hydrogen Decarbonization | Question Mark | Emerging applications in steel, glass; strong sustainability drivers | Green hydrogen market projected to reach $115.1 billion by 2030 | Significant R&D and operational investment |

| Advanced Semiconductor Tech (e.g., Subleem™) | Question Mark | High-growth sector, innovative but low current market share | Semiconductor market projected to reach $1 trillion by 2030 | Substantial R&D and scaling investment |

| Large-Scale CCS Projects | Question Mark | High growth potential, early stage development, requires market maturation | Global CCS market potentially hundreds of billions by 2050 | Massive capital for infrastructure; policy dependent |

| Biogas & Maritime Activities | Question Mark | Developing sectors driven by sustainability, strategic focus for growth | Increasing demand for cleaner maritime fuels and biogas | Investment for scaling operations and market capture |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitor analysis, to accurately assess business unit performance.