Air Liquide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

Unlock the strategic blueprint of Air Liquide's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how they deliver essential gases and services, manage key partnerships, and generate revenue across diverse industries. Discover the core elements that drive their global operations and market leadership.

Ready to gain a competitive edge? Download the full Air Liquide Business Model Canvas to explore their customer relationships, cost structure, and key resources. This actionable document is perfect for strategic planning, competitive analysis, or investor pitches, offering a clear roadmap to understanding their thriving business.

Partnerships

Air Liquide actively cultivates strategic alliances with major energy firms and industrial leaders to expedite the shift towards a low-carbon economy. These partnerships are instrumental in driving forward large-scale projects centered on renewable and low-carbon hydrogen production, a key component of their decarbonization strategy.

A prime illustration of this collaborative approach is their joint venture with Siemens Energy, aimed at developing and manufacturing industrial-scale electrolyzers. This collaboration is crucial for scaling up hydrogen production technologies, with significant investments planned to boost capacity and efficiency in the coming years, supporting the global energy transition.

Air Liquide actively fosters innovation through a broad network of collaborations, partnering with universities, industry leaders, and emerging startups. These strategic alliances are crucial for advancing research and development in critical sectors like the energy transition and healthcare.

In 2024 alone, Air Liquide reported engaging in over 350 such partnerships. This extensive network fuels progress in deep technologies and supports the company's commitment to sustainable growth and technological advancement.

Air Liquide’s key partnerships often involve long-term industrial supply contracts, which are crucial for stabilizing demand. These agreements lock in customers for extended periods, providing predictable revenue streams for the company’s diverse range of gases and related services.

A prime example of this strategy is Air Liquide's significant investment of over $250 million in a new industrial gas plant in Idaho. This facility is specifically designed to meet the needs of Micron Technology, Inc., under a long-term contract to supply high-purity gases essential for advanced memory chip manufacturing.

Healthcare Provider Partnerships

Air Liquide's healthcare provider partnerships are crucial for delivering essential medical gases and services. They work closely with hospitals and clinics to enhance patient care and streamline healthcare operations.

These collaborations are widespread, with Air Liquide serving around 20,000 hospitals and clinics globally. This extensive network underscores their commitment to supporting the healthcare ecosystem.

- Hospitals and Clinics: Direct provision of medical gases like oxygen, nitrous oxide, and medical air, alongside equipment and maintenance services.

- Healthcare Professionals: Collaboration with doctors, nurses, and respiratory therapists to ensure safe and effective gas delivery and therapy.

- Medical Institutions: Partnering to optimize gas supply systems, improve patient safety protocols, and introduce innovative respiratory care solutions.

Hydrogen Mobility Ecosystem Collaborations

Air Liquide is actively building a robust hydrogen mobility ecosystem through strategic partnerships. A prime example is their collaboration with HysetCo, a joint venture focused on developing hydrogen refueling stations and fueling vehicle fleets, particularly in France. This initiative directly supports the deployment of hydrogen-powered vehicles.

Further strengthening its commitment, Air Liquide participates in key industry alliances such as the Global Hydrogen Mobility Alliance. These alliances bring together various stakeholders to accelerate the adoption of hydrogen as a clean energy solution for transportation worldwide. By pooling resources and expertise, these collaborations aim to overcome market barriers and drive innovation.

These partnerships are crucial for Air Liquide's strategy to scale up hydrogen production and distribution infrastructure. For instance, their involvement in projects like the European Clean Hydrogen Alliance underscores their dedication to creating a seamless hydrogen value chain. By 2024, Air Liquide is projected to have invested significantly in expanding its hydrogen production capacity to meet growing demand.

- HysetCo Collaboration: Focused on fueling vehicle fleets and developing hydrogen infrastructure in France.

- Global Hydrogen Mobility Alliance: Accelerating hydrogen adoption in transportation through industry-wide cooperation.

- European Clean Hydrogen Alliance: Contributing to the development of a comprehensive hydrogen value chain across Europe.

Air Liquide's strategic partnerships are the bedrock of its expansion and innovation, particularly in the burgeoning hydrogen sector and critical healthcare services. These alliances are not merely transactional; they represent a shared vision for decarbonization and enhanced patient care.

The company's 2024 engagement in over 350 diverse partnerships highlights a proactive approach to fostering technological advancement and market penetration. These collaborations range from joint ventures with industrial giants to deep tech research with academic institutions, all aimed at accelerating the energy transition and improving healthcare outcomes.

Long-term industrial supply contracts, such as the one with Micron Technology, Inc., provide substantial revenue stability and demonstrate the critical role of these partnerships in securing future growth. This approach ensures predictable demand for Air Liquide's essential products and services.

Air Liquide's commitment to building a hydrogen mobility ecosystem is evident in collaborations like HysetCo and its participation in the Global Hydrogen Mobility Alliance, driving the adoption of clean transportation solutions.

| Partner Type | Focus Area | Example | Impact |

|---|---|---|---|

| Energy & Industrial Leaders | Low-carbon hydrogen production | Siemens Energy (Electrolyzer manufacturing) | Scaling up hydrogen technology, supporting energy transition |

| Technology Companies & Startups | R&D, Deep Tech | Various industry leaders and emerging startups | Advancing innovation in energy and healthcare |

| Industrial Customers | Long-term supply contracts | Micron Technology, Inc. (Idaho plant) | Securing predictable revenue, meeting advanced manufacturing needs |

| Healthcare Providers | Medical gas supply & services | ~20,000 hospitals and clinics globally | Enhancing patient care, streamlining operations |

| Mobility Sector Stakeholders | Hydrogen mobility infrastructure | HysetCo, Global Hydrogen Mobility Alliance | Accelerating hydrogen adoption in transportation |

What is included in the product

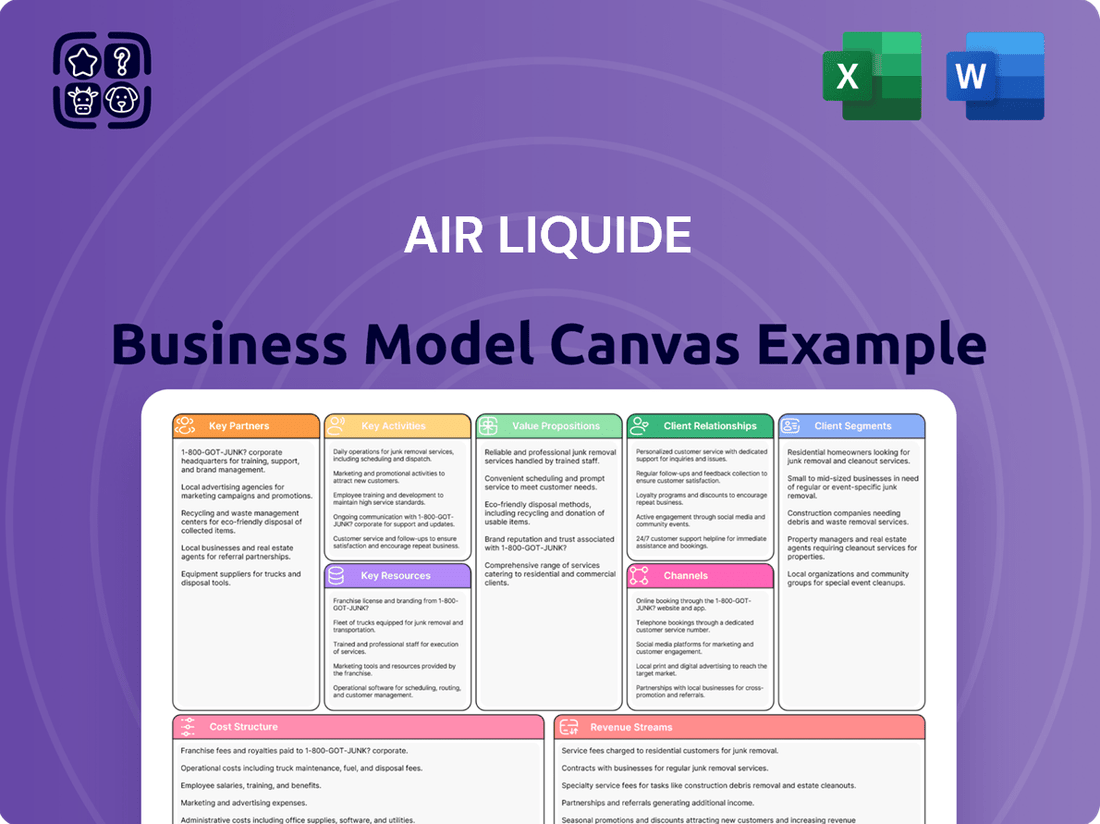

This Air Liquide Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions to reflect real-world operations.

It is organized into 9 classic BMC blocks, offering full narrative and insights designed to help entrepreneurs and analysts make informed decisions.

Air Liquide's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their complex operations, allowing for quick identification of inefficiencies and potential areas for improvement in gas production and distribution.

Activities

Air Liquide's core activities revolve around the large-scale production and global distribution of industrial and medical gases like oxygen, nitrogen, and hydrogen. This necessitates operating an extensive network of production facilities and pipelines to cater to a wide array of industries.

A significant focus is on supplying ultra-pure gases, such as nitrogen, to the burgeoning semiconductor industry. In 2024, Air Liquide continued its strategic investments in this area, recognizing the critical need for high-purity gases in advanced manufacturing processes.

Air Liquide actively provides comprehensive home healthcare services, delivering essential medical equipment and personalized care to individuals managing chronic conditions directly in their residences. This focus on in-home support aims to significantly enhance patient quality of life through tailored care plans and advanced remote monitoring technologies.

The company's commitment to home healthcare is substantial, evidenced by its care for approximately 2.1 million patients across more than 30 countries. This global reach underscores Air Liquide's role as a key facilitator in making advanced medical support accessible and convenient for a vast number of individuals.

Air Liquide's core activity involves the meticulous engineering and construction of gas production plants. This encompasses designing, building, and operating their own sophisticated facilities, such as air gas separation units and hydrogen production plants, ensuring internal efficiency and technological advancement.

Beyond internal operations, Air Liquide Engineering & Construction extends its expertise globally, offering proprietary technology and process solutions to external clients. A prime example is the 200 MW ELYgator electrolyzer project in Rotterdam, showcasing their capability in delivering large-scale, advanced industrial solutions.

Research, Development, and Innovation

Air Liquide's commitment to Research, Development, and Innovation is a cornerstone of its business strategy, driving the creation of cutting-edge solutions. This dedication ensures the company remains at the forefront of technological advancements and process enhancements across its diverse markets. In 2024, Air Liquide allocated €309 million towards its innovation initiatives, underscoring the significant investment in future growth and competitive advantage.

The company strategically directs its innovation efforts towards pivotal sectors critical for global progress. These include the energy transition, where new technologies are vital for decarbonization and sustainable energy solutions, and the healthcare sector, focusing on advancements in medical gases and related services. Furthermore, Air Liquide is heavily involved in developing advanced materials essential for high-tech industries, such as electronics and aerospace.

- Continuous R&D Investment: Air Liquide consistently invests in research and development to pioneer new technologies and refine existing operational processes.

- Strategic Innovation Focus: Innovation efforts are concentrated on key growth areas including energy transition, healthcare advancements, and specialized materials for high-tech applications.

- 2024 Innovation Expenditure: The company's commitment is demonstrated by its €309 million investment in innovation activities during 2024.

Development of Decarbonization Solutions

Air Liquide is deeply involved in creating and deploying ways for both its clients and its own operations to lower CO2 emissions. This commitment involves leading the way in CO2 capture technologies, manufacturing hydrogen with a low carbon footprint, and providing energy-efficient options to back the worldwide shift towards cleaner energy sources.

The company has made significant strides, achieving an 11% reduction in its Scope 1 and 2 CO2 emissions when compared to 2020 levels. This progress underscores their dedication to environmental responsibility and their active role in the energy transition.

- Pioneering CO2 Capture Technologies: Developing advanced methods to trap carbon dioxide at its source.

- Low-Carbon Hydrogen Production: Investing in and scaling up the creation of hydrogen with minimal greenhouse gas emissions.

- Energy Efficiency Solutions: Offering technologies and services that help customers reduce their energy consumption and carbon output.

- Commitment to Emission Reduction: Successfully lowered Scope 1 & 2 CO2 emissions by 11% since 2020.

Air Liquide's key activities encompass the production and global distribution of industrial and medical gases, requiring extensive infrastructure. They also focus on supplying ultra-pure gases, particularly for the semiconductor industry, with strategic investments in 2024. Furthermore, the company is a major provider of home healthcare services, supporting millions of patients worldwide with essential medical equipment and personalized care.

The company also designs, builds, and operates its own gas production facilities and offers engineering and construction services to external clients, as seen with their involvement in the Rotterdam electrolyzer project. A significant portion of their activity is dedicated to Research, Development, and Innovation, with a €309 million investment in 2024 supporting advancements in energy transition, healthcare, and advanced materials.

Finally, Air Liquide actively develops and implements solutions to reduce CO2 emissions for both its clients and its own operations, including CO2 capture and low-carbon hydrogen production. This commitment is reflected in their 11% reduction in Scope 1 and 2 CO2 emissions since 2020.

Full Version Awaits

Business Model Canvas

The Air Liquide Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you'll get the complete, professionally formatted canvas with all sections intact, ready for your strategic planning. No mockups or altered samples, just the real deal to help you understand and optimize Air Liquide's operations.

Resources

Air Liquide operates an extensive global production and distribution infrastructure, encompassing a vast network of production sites, pipelines, and logistics assets strategically located across 60 countries. This robust infrastructure is a cornerstone of their business, ensuring the efficient and reliable supply of essential gases to a diverse customer base. In 2024, the company continued to bolster this network, making significant investments in new facilities to further enhance its reach and capacity.

This expansive footprint allows Air Liquide to serve over 4 million customers and patients worldwide, from industrial giants to individual healthcare recipients. The company's commitment to maintaining and growing this infrastructure is evident in its ongoing capital expenditures, which are crucial for meeting the increasing demand for industrial and medical gases and for maintaining their competitive edge in the global market.

Air Liquide's proprietary technologies are the bedrock of its operations, particularly in gas production, purification, and application. These advanced capabilities allow them to offer highly specialized solutions across diverse sectors.

The company's expertise extends to unique equipment designed for industrial processes, critical healthcare needs, and environmental sustainability initiatives. This technological edge is a key differentiator.

Air Liquide Engineering & Construction exemplifies this, not only building the Group's sophisticated production units but also delivering bespoke technology solutions to external clients, showcasing the commercial value of their innovations.

Air Liquide's human capital, numbering around 66,500 employees globally, is a cornerstone of its business model. A significant portion, over 3,000 employees, are specifically focused on research and development, showcasing a strong commitment to innovation.

These dedicated R&D teams possess specialized knowledge in fields such as materials science, process engineering, and cryogenics. This deep expertise is crucial for creating advanced solutions and applications that meet evolving industry needs.

This highly skilled workforce directly fuels Air Liquide's ability to develop cutting-edge technologies and maintain a competitive edge in the industrial gas and services market.

Robust Intellectual Property and Patents

Air Liquide's dedication to pioneering new solutions is evident in its robust intellectual property, particularly its extensive patent portfolio. This strong foundation in patents protects its innovative technologies and reinforces its market leadership across diverse sectors.

In 2024 alone, Air Liquide secured 366 new patents. This significant number underscores the company's continuous investment in research and development, ensuring its competitive advantage by safeguarding its technological breakthroughs.

- Innovation Driver: Patents are central to Air Liquide's strategy, protecting its advancements in gas production, distribution, and application technologies.

- Competitive Edge: The 366 new patents filed in 2024 bolster Air Liquide's position against competitors by shielding its proprietary processes and products.

- Future Growth: This intellectual property is a key resource for future revenue streams and market expansion, enabling the company to license technologies or maintain exclusivity.

Secure Low-Carbon Energy Supply

Access to competitive and sustainable energy sources is a fundamental resource for Air Liquide, particularly given the energy-intensive nature of industrial gas production. This access directly impacts operational costs and the company's environmental footprint.

Air Liquide's commitment to a secure low-carbon energy supply is demonstrated through significant investments in renewable energy. In 2024, the company secured over 2,500 GWh of low-carbon and renewable electricity. This substantial volume was primarily achieved through Power Purchase Agreements (PPAs).

These PPAs are strategically vital for Air Liquide. They not only ensure a stable and cost-effective power supply for its extensive existing infrastructure but also provide the necessary clean energy to support future growth initiatives. Crucially, these agreements are a cornerstone of their strategy to significantly reduce CO2 emissions across their operations.

- Secured 2,500+ GWh of low-carbon/renewable electricity in 2024

- Utilized Power Purchase Agreements (PPAs) for energy procurement

- Ensures energy for existing operations and future growth

- Supports CO2 emission reduction targets

Air Liquide's key resources include its extensive global infrastructure, proprietary technologies, skilled workforce, robust patent portfolio, and access to competitive, sustainable energy. These elements are critical for its operational efficiency, innovation, and market leadership.

The company's vast production and distribution network, spanning 60 countries, ensures reliable gas supply to over 4 million customers. Its 66,500 employees, with over 3,000 in R&D, drive technological advancements, protected by a significant patent portfolio, including 366 new patents in 2024.

Furthermore, Air Liquide secured over 2,500 GWh of low-carbon electricity in 2024 via PPAs, vital for cost management and emissions reduction.

| Resource Category | Key Assets | 2024 Data/Notes |

|---|---|---|

| Infrastructure | Global production sites, pipelines, logistics | Operates in 60 countries, serving 4M+ customers |

| Technology | Proprietary gas production, purification, application tech | Engineering & Construction division builds and licenses tech |

| Human Capital | Skilled workforce, R&D specialists | Approx. 66,500 employees globally; 3,000+ in R&D |

| Intellectual Property | Extensive patent portfolio | 366 new patents filed in 2024 |

| Energy | Access to competitive & sustainable energy | Secured 2,500+ GWh low-carbon/renewable electricity via PPAs |

Value Propositions

Air Liquide ensures a dependable flow of industrial and medical gases, vital for keeping customer operations running smoothly. This consistent supply is a cornerstone for businesses relying on uninterrupted processes.

The company's commitment to ultra-high purity gases is paramount, particularly for demanding sectors like semiconductor manufacturing, where even minute impurities can cause significant issues. This focus on purity is a critical factor for their clientele.

In 2024, Air Liquide's dedication to reliability and purity was underscored by its role in supplying essential gases for advanced manufacturing, contributing to the sector's growth. For instance, their gas solutions are integral to the production of advanced microchips, a market that saw significant investment and expansion in 2024.

Air Liquide goes beyond mere gas supply, offering bespoke technology and process solutions designed to fine-tune industrial operations. These tailored approaches boost efficiency and maximize resource use for clients.

The company's expertise extends to innovative plant designs and comprehensive, integrated gas solutions, particularly beneficial for large-scale industrial complexes. For instance, in 2024, Air Liquide continued its focus on advanced solutions for sectors like electronics and healthcare, aiming for significant operational improvements.

These concrete solutions directly contribute to societal progress by enabling industries to operate more sustainably and productively. Air Liquide's commitment in 2024 to developing greener technologies underscores this value, aligning industrial optimization with broader environmental goals.

Air Liquide significantly enhances patient quality of life, especially for those managing chronic conditions at home. Their approach combines personalized care, innovative medical equipment, and digital tools to support patients, particularly those with diabetes, in managing their health more effectively and improving their daily living.

This focus on patient well-being directly contributes to a more efficient and sustainable healthcare ecosystem. For instance, Air Liquide's commitment to simplifying diabetes management aims to reduce hospital readmissions and optimize resource allocation within healthcare systems.

Commitment to Decarbonization and Sustainability

Air Liquide actively supports customer decarbonization through innovative solutions like low-carbon hydrogen and CO2 capture technologies. These offerings directly help clients reduce their environmental impact and meet sustainability targets.

The company is also deeply committed to its own sustainability journey, targeting carbon neutrality by 2050. This dual focus on enabling customers and transforming its own operations underscores a robust value proposition in the environmental space.

- Enabling Customer Decarbonization: Providing low-carbon hydrogen and CO2 capture technologies.

- Energy Efficiency Solutions: Offering processes designed to minimize energy consumption for clients.

- Corporate Carbon Neutrality Goal: Aiming for carbon neutrality by 2050, demonstrating leadership.

- Sustainable Growth: Aligning business strategy with environmental responsibility for long-term value.

Innovation-Driven Technological Advancement

Air Liquide's commitment to innovation fuels its technological advancement, ensuring customers benefit from leading-edge solutions. The company's significant investment in research and development, coupled with a collaborative open innovation approach, allows it to translate novel ideas into tangible, market-ready technologies. This focus is evident in their pioneering work across several key sectors.

The company's dedication to R&D is substantial. For instance, Air Liquide reported €968 million in R&D expenses in 2023, a clear indicator of their strategic focus on future growth and technological leadership. This investment directly translates into customer value by providing access to advanced solutions designed for evolving market needs.

- Hydrogen Energy: Air Liquide is a major player in developing and deploying hydrogen technologies, crucial for decarbonization efforts.

- Advanced Materials: The company supplies essential, high-purity gases and materials vital for the semiconductor industry's continuous technological progress.

- Digital Healthcare: They are also innovating in digital healthcare, offering advanced solutions that improve patient care and operational efficiency.

Air Liquide provides essential industrial and medical gases, ensuring operational continuity for a diverse customer base. Their unwavering commitment to reliability is a critical factor for industries where uninterrupted processes are paramount.

The company's focus on ultra-high purity gases is particularly vital for sectors like semiconductor manufacturing, where even minor impurities can have significant consequences. This dedication to purity is a key differentiator for their clients.

In 2024, Air Liquide's role in supplying critical gases for advanced manufacturing, including the semiconductor sector which saw substantial investment, highlighted their commitment to reliability and purity. Their solutions are integral to producing advanced microchips.

Air Liquide also offers tailored technology and process solutions, enhancing industrial efficiency and resource optimization for their customers. These bespoke approaches are designed to improve client operations significantly.

Their expertise in designing innovative plants and providing integrated gas solutions is especially valuable for large industrial complexes. For example, in 2024, Air Liquide continued to deliver advanced solutions to the electronics and healthcare sectors, aiming for major operational improvements.

These solutions contribute to societal progress by enabling more sustainable and productive industrial operations. Air Liquide's 2024 focus on greener technologies aligns industrial optimization with environmental objectives.

Air Liquide enhances patient quality of life, particularly for those with chronic conditions at home, through personalized care, innovative equipment, and digital tools. Their approach aids patients, especially those with diabetes, in better health management.

This patient-centric focus contributes to a more efficient healthcare system, aiming to reduce readmissions and optimize resource use, as seen in their efforts to simplify diabetes management.

Air Liquide actively supports customer decarbonization with solutions like low-carbon hydrogen and CO2 capture technologies. These offerings help clients meet sustainability targets and reduce their environmental footprint.

The company is committed to its own sustainability goals, targeting carbon neutrality by 2050, which reinforces its value proposition in environmental solutions.

Air Liquide's innovation, backed by substantial R&D investment, ensures customers benefit from cutting-edge solutions. Their 2023 R&D expenses of €968 million underscore their commitment to technological leadership and future growth.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Reliable Gas Supply | Ensures uninterrupted operations for industrial and medical clients. | Crucial for sectors like advanced manufacturing and healthcare. |

| Ultra-High Purity Gases | Meets stringent requirements in demanding industries like semiconductors. | Essential for producing advanced microchips and other high-tech components. |

| Bespoke Technology & Process Solutions | Optimizes industrial operations for efficiency and resource utilization. | Drives improvements in sectors like electronics and healthcare. |

| Decarbonization Support | Offers low-carbon hydrogen and CO2 capture to reduce client environmental impact. | Aligns with growing global demand for sustainable industrial practices. |

| Innovation and R&D | Delivers leading-edge solutions through significant investment in research. | Fuels advancements in hydrogen energy, advanced materials, and digital healthcare. |

Customer Relationships

Air Liquide cultivates enduring, strategic alliances with its major industrial clientele, frequently securing multi-year agreements for gas provision and the management of on-site production facilities. These collaborations are founded on mutual trust and a joint dedication to peak operational efficiency and environmental responsibility.

The company's commitment extends to providing sustained support for customers across critical industrial domains. For instance, in 2023, Air Liquide's revenue from large industries, which relies heavily on these long-term relationships, saw robust growth, demonstrating the value and stability these partnerships provide.

Air Liquide's commitment to its industrial clients is evident through its dedicated account management and technical support teams. These experts provide continuous assistance, helping customers resolve any operational challenges and ensuring their gas supply systems function at peak efficiency. This focus on robust support is key to maintaining high customer satisfaction and uninterrupted operations.

For instance, in 2024, Air Liquide's proactive approach to customer service, including its specialized technical support, contributed to a strong performance in its industrial gas segment, which saw significant revenue growth, underscoring the value placed on these relationships by their clientele.

Furthermore, Air Liquide Engineering & Construction extends these efficient customer services on a global scale, demonstrating a consistent strategy to support clients across diverse international markets and industries.

Air Liquide's commitment to personalized patient care is a cornerstone of its customer relationships in home healthcare. Multidisciplinary teams craft tailored care plans and offer ongoing support, recognizing that each patient's journey with illness is unique. This patient-centric model is designed to boost treatment adherence and enhance overall quality of life.

Collaborative Innovation and Co-Development

Air Liquide actively involves its customers and partners in co-creation initiatives, focusing on developing innovative solutions tailored to specific industry challenges and future requirements. This collaborative method ensures that the developed solutions are highly relevant and seamlessly integrated into the operational workflows of their clients.

The company's commitment to collaborative innovation is evident in its R&D efforts, where dedicated teams work closely with a network of scientific and industrial partners. For instance, in 2023, Air Liquide announced collaborations focused on advancing hydrogen mobility solutions, a testament to their strategy of building innovation ecosystems.

- Customer-centric innovation: Developing solutions that directly address client-specific challenges and future needs.

- Co-development partnerships: Engaging customers and industrial partners in joint innovation projects.

- R&D integration: Air Liquide's research teams collaborate with external scientific and industrial entities to foster technological advancements.

- Market relevance: Ensuring solutions are practical and integrated into customer operations for maximum impact.

Emphasis on Value-Based Outcomes

Air Liquide is increasingly focusing on value-based outcomes, particularly within the healthcare sector. This means their customer relationships are built around demonstrating tangible improvements in patient health and achieving greater cost-effectiveness for healthcare providers. For instance, in 2023, the company highlighted its commitment to home healthcare services, aiming to improve patient quality of life and reduce hospital readmissions, a clear indicator of this value-driven approach.

This strategic shift involves tailoring services to meet specific patient needs and ensuring resources are utilized efficiently. The goal is to deliver superior quality of care rather than simply providing a high volume of services. This customer relationship strategy emphasizes partnership and shared success, aligning Air Liquide's offerings with the ultimate health and financial goals of their clients.

- Focus on Measurable Health Outcomes: Air Liquide aims to prove the effectiveness of its solutions through quantifiable patient improvements.

- Cost Efficiency for Healthcare Systems: The company seeks to demonstrate how its services contribute to reducing overall healthcare expenditures.

- Patient-Centric Service Design: Relationships are strengthened by aligning services directly with the needs and well-being of patients.

- Quality of Care Over Quantity: The emphasis is on delivering excellent medical support and outcomes, not just service volume.

Air Liquide fosters deep, long-term relationships with its industrial clients through multi-year contracts and on-site facility management, emphasizing operational efficiency and sustainability. These partnerships are built on trust and a shared commitment to excellence, as demonstrated by strong revenue growth in its large industries segment in 2023.

The company's dedication to customer success is further exemplified by its specialized technical support teams, ensuring seamless operations and high client satisfaction. This proactive support was a key factor in the industrial gas segment's significant revenue increase in 2024.

Moreover, Air Liquide actively engages in co-creation and co-development with customers and partners, driving innovation tailored to specific industry needs, such as advancements in hydrogen mobility highlighted in 2023 collaborations.

In healthcare, relationships are patient-centric, with tailored care plans and ongoing support designed to improve quality of life and treatment adherence, reflecting a value-based approach focused on measurable health outcomes and cost efficiency for providers.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Strategic Alliances (Industrial) | Multi-year agreements, on-site management, focus on efficiency & sustainability. | Robust growth in Large Industries revenue (2023). |

| Dedicated Support | Specialized technical teams, continuous assistance, problem resolution. | Key to industrial gas segment revenue growth (2024). |

| Co-creation & Co-development | Joint innovation with clients and partners for tailored solutions. | Hydrogen mobility collaborations (2023). |

| Value-Based Healthcare | Patient-centric care, focus on outcomes and cost-efficiency. | Improving patient quality of life in home healthcare. |

Channels

Air Liquide leverages a dedicated direct sales force and specialized key account teams to cultivate deep relationships with major industrial clients. These teams are instrumental in managing complex, long-term contracts, ensuring a thorough understanding of each customer's unique operational requirements and enabling the delivery of highly customized solutions.

This direct engagement model is crucial for Air Liquide's strategy, particularly in projects like the comprehensive carrier gas solutions tailored for large-scale industrial operations. For instance, in 2024, Air Liquide reported significant growth in its industrial gas segment, driven by these strong customer relationships and the ability to offer integrated solutions that enhance efficiency and reliability for their partners.

Air Liquide's extensive pipeline networks are a critical component for supplying large volumes of industrial gases directly to customer facilities. This infrastructure ensures a highly efficient and dependable flow of essential products, forming a core part of their value proposition for major industrial clients.

This network is a significant asset, enabling Air Liquide to serve industries requiring continuous and substantial gas supply. For instance, the company is actively expanding its hydrogen infrastructure, connecting a 200 MW electrolyzer to its hydrogen pipeline network in Normandy, underscoring the strategic importance of these assets for future growth and sustainability initiatives.

Air Liquide's on-site production facilities represent a core channel, allowing them to build, own, and operate gas production units directly at or near major customer facilities. This approach guarantees a reliable and efficient supply of industrial gases, minimizing transportation costs and energy consumption for clients.

This integrated model offers significant advantages, such as enhanced supply chain security and optimized operational efficiency for customers. For instance, Air Liquide's commitment to this channel is exemplified by their plan to construct and manage a new industrial gas production facility in Idaho, underscoring their ongoing investment in this direct customer engagement strategy.

Home Healthcare Agencies and Clinics

Air Liquide's Home Healthcare Agencies and Clinics segment is a crucial customer segment, directly engaging with patients needing medical gases and related services. This channel facilitates the delivery of essential equipment, like oxygen concentrators and ventilators, right to patients' homes, ensuring continuity of care and comfort. In 2024, Air Liquide continued to bolster this segment through strategic acquisitions, notably strengthening its presence in Germany, a key European market for home healthcare.

This direct-to-patient approach is supported by a robust network of specialized agencies and collaborations with healthcare providers. These partnerships are vital for patient onboarding, training, and ongoing technical support, ensuring safe and effective use of medical devices. Air Liquide's commitment to this segment is underscored by its continuous investment in infrastructure and personnel to meet the growing demand for home-based medical care.

Key aspects of this channel include:

- Direct Patient Engagement: Facilitates personalized care and service delivery for individuals requiring home medical support.

- Equipment Logistics: Manages the efficient delivery, setup, and maintenance of medical gas equipment and devices.

- Partnership Integration: Leverages clinic relationships for referrals, patient management, and clinical oversight.

- Strategic Expansion: Focuses on growth through acquisitions, as seen with recent moves in the German market to enhance service reach.

Digital Platforms and Remote Monitoring Systems

Air Liquide leverages digital platforms and remote monitoring systems to streamline customer interactions and optimize service delivery. These digital channels facilitate everything from order placement to the real-time tracking of gas deliveries and equipment performance.

These systems are crucial for enhancing operational efficiency and providing proactive customer support. For instance, remote monitoring allows Air Liquide to anticipate potential issues with customer equipment, such as oxygen concentrators for home healthcare patients, enabling timely maintenance before a problem arises.

- Enhanced Customer Engagement: Digital portals and apps offer customers 24/7 access to account information, order tracking, and support, improving overall satisfaction.

- Real-time Data for Efficiency: Remote monitoring systems provide valuable data on equipment status and consumption, allowing for optimized logistics and predictive maintenance.

- Proactive Service Delivery: By analyzing real-time data, Air Liquide can identify and address potential service disruptions before they impact customers, ensuring greater reliability.

- Value for Local Customers: These digital solutions translate into tangible benefits for local clients, such as improved reliability of supply and more efficient project execution due to better data-driven insights.

Air Liquide's channels are multifaceted, encompassing direct sales for industrial giants, extensive pipeline networks, and on-site production facilities for reliable, high-volume supply. For healthcare, dedicated agencies and clinics ensure direct patient engagement and equipment delivery. Digital platforms and remote monitoring further enhance customer interaction and service efficiency across all segments.

These channels are crucial for delivering tailored solutions, from carrier gas for industrial processes to home oxygen therapy. In 2024, Air Liquide's strategic investments, such as expanding its hydrogen pipeline network and bolstering its home healthcare presence in Germany, highlight the ongoing importance of these direct and integrated customer engagement strategies.

The company's commitment to optimizing these channels is evident in its infrastructure development and digital integration. For example, the expansion of its hydrogen pipeline network, including connecting a 200 MW electrolyzer in Normandy, exemplifies the scale and strategic importance of its physical distribution channels.

| Channel Type | Description | Key Customer Segment | 2024 Focus/Example | Impact on Value Proposition |

|---|---|---|---|---|

| Direct Sales & Key Accounts | Dedicated sales force for complex, long-term contracts. | Large Industrial Clients | Growth in industrial gas segment driven by strong relationships. | Highly customized solutions, enhanced efficiency & reliability. |

| Pipeline Networks | Extensive infrastructure for direct, high-volume supply. | Industries needing continuous gas flow (e.g., refining, chemicals) | Expansion of hydrogen pipeline network in Normandy. | Efficient, dependable flow of essential products, cost optimization. |

| On-Site Production | Building, owning, and operating gas units at customer sites. | Major Industrial Clients requiring dedicated supply | New industrial gas facility planned in Idaho. | Guaranteed reliable supply, minimized transportation costs & energy use. |

| Home Healthcare Agencies & Clinics | Direct engagement with patients for medical gases and services. | Home Healthcare Patients | Strategic acquisitions to strengthen presence in Germany. | Continuity of care, comfort, safe and effective device use. |

| Digital Platforms & Remote Monitoring | Online portals, apps, and IoT for interaction and tracking. | All Customer Segments | Proactive maintenance of equipment like oxygen concentrators. | Streamlined interactions, optimized logistics, proactive support, improved satisfaction. |

Customer Segments

Large industrial clients, primarily from the chemicals, refining, steel, and energy sectors, represent a cornerstone for Air Liquide. These clients depend on significant volumes of industrial gases for their fundamental operations. The company's Large Industries segment demonstrated robust performance, achieving strong growth in the third quarter of 2024.

The electronics and semiconductor manufacturing sector represents a vital and expanding customer base for Air Liquide. These manufacturers require exceptionally pure gases and sophisticated materials to ensure the precision and reliability of their intricate production lines.

Air Liquide's commitment to this segment is underscored by its significant investment in Dresden, Germany, which is its largest ever in Europe. This substantial capital expenditure, amounting to €2 billion, is specifically aimed at bolstering the supply chain for the burgeoning European electronics industry, particularly for advanced semiconductor fabrication.

Healthcare institutions, including over 20,000 hospitals and clinics globally, represent a core customer segment for Air Liquide. These facilities depend on Air Liquide for a consistent and reliable supply of essential medical gases such as oxygen, nitrous oxide, and medical air, which are critical for patient care and life support.

Beyond gas supply, Air Liquide provides these institutions with specialized equipment, delivery systems, and comprehensive services. This includes installation, maintenance, and technical support for gas management, ensuring patient safety and operational efficiency within the healthcare setting.

Home Healthcare Patients

Home healthcare patients represent a crucial segment for Air Liquide, encompassing individuals managing chronic conditions like respiratory diseases, sleep apnea, diabetes, and those needing at-home infusion and nutrition therapies. This segment relies on reliable, continuous support for their well-being. In 2024, Air Liquide continued to serve a vast network of these patients, reinforcing its commitment to improving quality of life through accessible healthcare solutions.

Air Liquide's dedication to this market is underscored by its global reach, supporting over 2 million chronic patients at home worldwide. This extensive network highlights the company's capacity to deliver essential medical gases and services directly to individuals, enabling them to manage their health effectively within the comfort of their own residences. The focus remains on providing personalized care and advanced technologies to meet diverse patient needs.

- Patient Needs: Management of chronic respiratory conditions, sleep apnea, diabetes, and home-based infusion/nutrition therapies.

- Global Reach: Air Liquide supports over 2 million chronic patients at home globally.

- Service Focus: Delivery of essential medical gases and services for continuous home-based care.

- Impact: Enabling patients to manage health effectively and improve quality of life at home.

Emerging Energy Transition and Mobility Players

This segment comprises businesses and projects actively driving the shift towards a low-carbon economy, with a particular emphasis on green hydrogen production and its application in transportation. These players are crucial for Air Liquide's strategy in the evolving energy landscape.

Air Liquide is making substantial investments to build out the hydrogen mobility supply chain, recognizing its potential to decarbonize sectors like heavy-duty transport. This includes developing infrastructure and production capabilities to support this growing market.

- Focus on Decarbonization: Companies in this segment are developing and implementing solutions to reduce carbon emissions, with green hydrogen being a key enabler.

- Green Hydrogen Production: Initiatives like Air Liquide's Normand'Hy project in France are central to this segment, aiming to produce significant volumes of low-carbon hydrogen.

- Hydrogen Mobility Solutions: This includes the development of hydrogen fuel cell vehicles and the necessary refueling infrastructure to support their adoption.

- Strategic Investments: Air Liquide's commitment to hydrogen mobility underscores the importance of this segment for future growth and sustainability.

Air Liquide serves a broad spectrum of customers, from massive industrial complexes to individual patients receiving care at home. The company's reach extends across critical sectors like chemicals, refining, steel, energy, and the highly specialized electronics industry, all of which rely on industrial gases for their core operations. Furthermore, the healthcare sector, encompassing hospitals, clinics, and homecare patients, forms another significant pillar of Air Liquide's customer base, highlighting its diverse market engagement.

Cost Structure

Energy and raw materials represent a significant portion of Air Liquide's expenses, primarily for the production of industrial gases. For instance, in 2023, the cost of goods sold was €21.9 billion, with energy being a key component.

Air Liquide mitigates these volatile costs by securing long-term energy supply contracts and increasingly investing in renewable and low-carbon energy sources. This strategy helps stabilize expenses and aligns with their sustainability goals.

The company often adjusts its pricing to reflect changes in energy market prices, ensuring that fluctuations in electricity and natural gas costs are largely passed on to its customers. This mechanism is crucial for maintaining profitability amidst market volatility.

Air Liquide's cost structure heavily features capital expenditures (CAPEX) for its vast infrastructure. This includes building, enhancing, and maintaining its extensive network of production facilities, pipelines, and distribution systems, which are crucial for its operations.

In 2024, the company demonstrated a strong commitment to its infrastructure by reaching a record level of investment, with CAPEX decisions amounting to €4.4 billion. This significant outlay underscores the ongoing need to support and expand its global operational capabilities.

Air Liquide's commitment to innovation is evident in its significant Research and Development (R&D) investments. These expenditures are crucial for developing cutting-edge gas technologies, exploring novel applications, and pioneering sustainable solutions. In 2024 alone, the company allocated €309 million towards innovation, underscoring its dedication to maintaining technological leadership and uncovering new avenues for growth.

Operational and Logistics Costs

Operational and logistics costs are a major component of Air Liquide's business model. These expenses encompass the daily running of production facilities, essential maintenance to ensure uptime, and the complex transportation of gases to a diverse customer base. For instance, in 2023, Air Liquide invested heavily in its infrastructure, with capital expenditures reaching €3.7 billion, a significant portion of which directly addresses these operational and logistical needs.

The company's strategic focus on advanced facility design directly targets the reduction of these significant costs. By engineering new plants with greater energy efficiency and optimized distribution networks, Air Liquide aims to lower both its energy consumption and the expenses tied to transporting its products. This forward-thinking approach is crucial for maintaining competitiveness in the industrial gas market.

- Facility Operations: Costs related to running production plants, including utilities and personnel.

- Maintenance: Expenses for upkeep and repair of equipment to ensure reliability.

- Logistics & Distribution: Costs for transporting gases via pipelines, trucks, and other methods.

- Energy Efficiency Investments: Capital allocated to improve energy consumption in operations.

Personnel and Administrative Expenses

Personnel and administrative expenses are a significant component of Air Liquide's cost structure, reflecting its global operational scale. As of 2024, the company employs approximately 66,500 individuals worldwide.

These costs encompass salaries, comprehensive benefits packages, and ongoing training and development programs essential for maintaining a skilled workforce. The administrative overhead required to manage such a large, international organization also contributes substantially to this expense category.

- Global Workforce: Air Liquide's approximately 66,500 employees represent a major cost driver.

- Employee Compensation: Salaries and benefits are a core part of personnel expenses.

- Training and Development: Investment in employee skills is crucial for operational excellence.

- Administrative Overheads: The costs associated with managing a global enterprise are significant.

Air Liquide's cost structure is heavily influenced by its substantial investments in infrastructure and innovation. The company's commitment to expanding its operational capabilities is highlighted by its record CAPEX decisions of €4.4 billion in 2024, alongside €309 million allocated to R&D for technological advancement.

| Cost Category | 2023 (in € billion) | 2024 (in € billion) | Key Drivers |

| Cost of Goods Sold (incl. Energy) | 21.9 | N/A | Energy prices, raw material costs |

| Capital Expenditures (CAPEX) | 3.7 | 4.4 | Infrastructure development, new facilities |

| Research & Development (R&D) | N/A | 0.309 | Innovation, new technologies |

| Personnel & Administration | N/A | N/A | Global workforce (approx. 66,500 employees) |

Revenue Streams

Air Liquide's core revenue generation stems from the sale of essential industrial gases like oxygen, nitrogen, and hydrogen. These gases are critical inputs for a vast array of sectors, including manufacturing, healthcare, and electronics.

The company's Large Industries segment, a key contributor to this revenue stream, demonstrated robust performance. In the third quarter of 2024, revenue from this segment experienced significant growth, underscoring the ongoing demand for Air Liquide's industrial gas solutions in large-scale operations.

Air Liquide's Healthcare Services generate revenue by supplying essential medical gases to hospitals and clinics. This core offering is complemented by extensive home healthcare services, catering to individuals managing chronic illnesses and requiring ongoing support.

The Healthcare segment demonstrated robust performance, with solid sales growth reported in the third quarter of 2024. This positive momentum continued into the first half of 2025, where sales saw a significant increase, underscoring the growing demand for their specialized medical solutions.

Air Liquide’s Engineering & Construction segment is a significant revenue driver, focusing on designing, building, and selling specialized technologies and production units to a broad range of industrial clients. This division leverages the company's deep expertise in gas production and handling to create custom solutions.

In the first half of 2024, the Engineering & Construction division demonstrated robust performance, with order intake reaching €416 million. This figure reflects both internal Group projects and substantial business secured from external, third-party customers, highlighting the division's market competitiveness.

Sales of Advanced Materials and Equipment

Air Liquide generates revenue through the sale of advanced materials and specialized equipment. This segment is particularly crucial for the electronics sector, which relies on high-purity substances and tailored gas application systems. In the first half of 2024, the company saw positive performance in this area.

- Sales of Carrier Gases: Experienced growth, supporting the semiconductor manufacturing process.

- Equipment & Installations in Electronics: Also contributed to revenue growth, reflecting increased demand for gas solutions in the electronics industry.

Long-Term Supply Contracts and Service Fees

A significant portion of Air Liquide's revenue is secured through long-term supply contracts with major industrial clients, providing a stable and predictable income. These agreements, often spanning many years, ensure consistent demand for their gases and related services.

These contracts frequently incorporate service fees covering the maintenance, operation, and technical support of gas production and delivery infrastructure. This creates a recurring revenue stream that extends beyond the initial product supply, reinforcing client loyalty and revenue stability.

As of early 2024, Air Liquide reported a record investment backlog, highlighting a strong pipeline of future projects and expansions. This backlog, valued at €3.8 billion as of December 31, 2023, directly translates into anticipated future revenue from new and existing contracts.

- Long-Term Contracts: Secure predictable income from major industrial customers.

- Service Fees: Generate recurring revenue through maintenance and operational support.

- Investment Backlog: Record €3.8 billion backlog as of end-2023 signals future growth.

Air Liquide's revenue streams are diverse, encompassing the sale of industrial and medical gases, healthcare services, and engineering and construction projects. Long-term contracts with major clients provide a stable revenue base, often including service fees for infrastructure maintenance and support.

The company also generates income from advanced materials and specialized equipment, particularly for the electronics sector. This multifaceted approach ensures resilience and growth across various economic cycles.

In the first half of 2024, Air Liquide reported €11.2 billion in sales, with a significant portion driven by its Large Industries and Healthcare segments. The company's robust investment backlog of €3.8 billion as of December 31, 2023, further illustrates the strong pipeline of future revenue.

| Revenue Segment | Key Activities | First Half 2024 Sales (Approx.) | Key Driver |

|---|---|---|---|

| Industrial Gas & Services | Sale of O2, N2, H2; large-scale supply | €8.5 billion | Long-term contracts, industrial demand |

| Healthcare | Medical gases, home healthcare | €2.0 billion | Hospital supply, chronic illness support |

| Engineering & Construction | Design & build of gas units | €0.7 billion | Order intake (€416m H1 2024) |

Business Model Canvas Data Sources

The Air Liquide Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the industrial gas sector, and strategic analyses of global economic trends. These diverse sources ensure a comprehensive and accurate representation of the company's operational framework and market positioning.