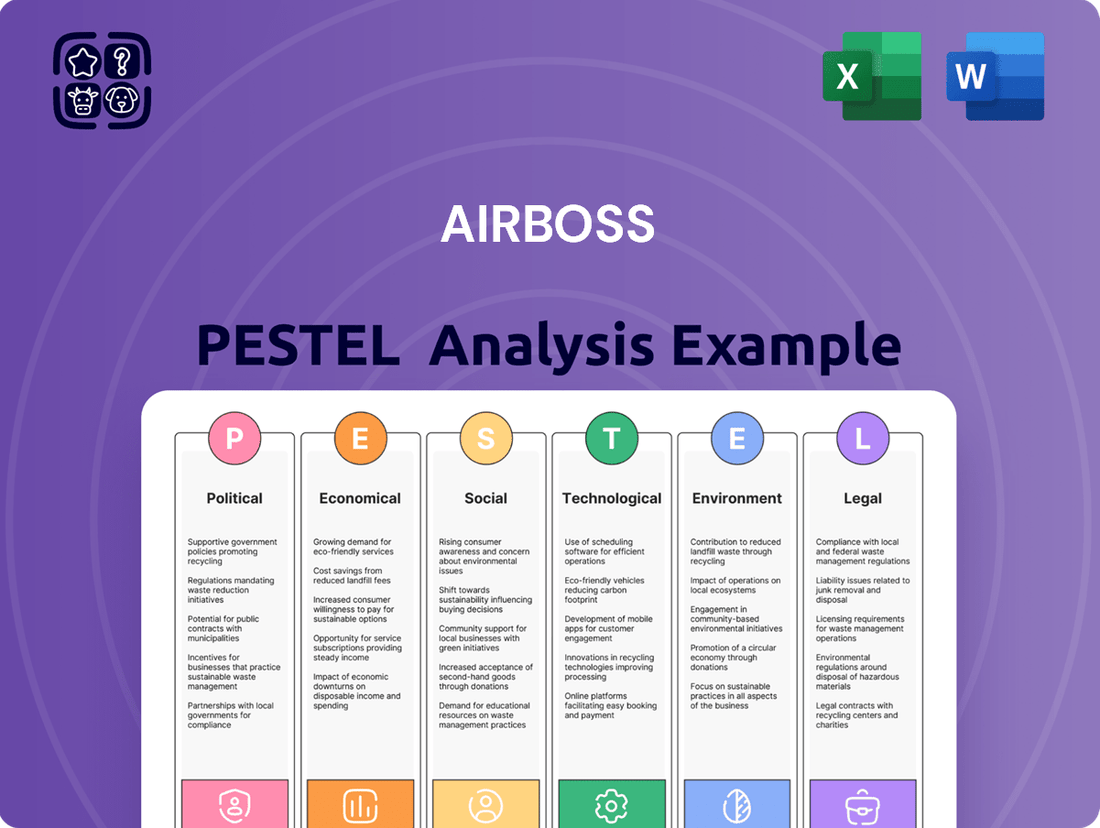

AirBoss PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping AirBoss's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full report to gain a strategic advantage and make informed decisions.

Political factors

Government defense spending is a critical factor for AirBoss's survivability division, as it heavily relies on defense contracts. For instance, the United States Department of Defense's budget for fiscal year 2024 was approximately $886 billion, signaling continued investment in defense capabilities, which could benefit AirBoss.

Changes in national defense budgets directly influence the demand for CBRN protection solutions. A sustained or increased defense budget, like the proposed $900 billion for FY2025, suggests potential for stable or growing revenue streams for AirBoss's specialized products.

Geopolitical priorities and international relations also play a significant role. As global tensions persist, such as those in Eastern Europe, governments may increase spending on protective equipment, directly impacting AirBoss's market opportunities and strategic planning for its survivability division.

Changes in international trade policies and tariffs directly impact AirBoss's ability to source components and sell its products globally. For instance, the imposition of new tariffs on materials imported from Asia could raise production costs for its defense and commercial products. Conversely, favorable trade agreements, like potential updates to the USMCA in 2024/2025, could open up new markets or reduce costs for its Canadian operations.

Government regulations significantly shape AirBoss's manufacturing and operational landscape. For instance, evolving environmental standards, such as those concerning emissions or waste management, may require substantial capital expenditures for new pollution control technologies or process modifications. In 2024, many industrial sectors faced increased scrutiny on sustainability reporting, potentially impacting AirBoss's supply chain and operational costs.

Product safety standards are also paramount, particularly in the automotive and defense sectors AirBoss serves. Non-compliance can lead to costly recalls, reputational damage, and loss of market access. As of early 2025, regulatory bodies continue to update safety protocols for advanced materials and manufacturing techniques, demanding ongoing vigilance and adaptation from companies like AirBoss.

Political Stability in Key Markets

The political stability of countries where AirBoss operates or sources materials significantly influences its business continuity and strategic investment decisions. For instance, geopolitical tensions in regions supplying critical components could disrupt production lines, as seen with supply chain vulnerabilities highlighted during the 2022-2023 period affecting global manufacturing. Unstable political environments can also introduce currency volatility, impacting AirBoss's international revenue streams and the cost of imported materials, with emerging markets often exhibiting higher fluctuations.

These risks can directly affect AirBoss's ability to conduct business efficiently and predictably. For example, a sudden change in trade policies or the imposition of sanctions in a key sourcing country could necessitate costly and time-consuming adjustments to its supply chain strategy. The company's 2024 outlook, like many in the defense and industrial sectors, is closely monitoring political developments in North America and Europe, given their importance to both sales and procurement.

- Impact on Supply Chain: Political instability in sourcing regions can lead to delays and increased costs for raw materials and components.

- Currency Fluctuations: Unstable political climates often correlate with volatile exchange rates, affecting AirBoss's profitability on international sales and the cost of goods.

- Operational Risks: Changes in regulations, security concerns, or civil unrest in operating countries can pose direct threats to AirBoss's facilities and personnel.

Public Procurement Policies

Public procurement policies significantly shape AirBoss's market access, especially for its protective equipment and defense offerings. Government purchasing decisions, often guided by transparency and competitive bidding, directly impact the company's potential to win large contracts. For instance, in 2023, the Canadian federal government's procurement spending reached over $22 billion, with a substantial portion allocated to defense and public safety, areas where AirBoss operates.

Navigating these policies requires AirBoss to adapt to various governmental requirements. Factors such as a preference for domestic suppliers, as seen in various national security initiatives, can create both opportunities and challenges. The company must also contend with the complexities of competitive bidding processes, ensuring its proposals meet stringent criteria to secure government tenders.

- Government spending on defense and protective gear is a key driver for companies like AirBoss.

- Transparency and competitive bidding are standard in public procurement, requiring robust proposal strategies.

- Domestic supplier preferences can influence contract awards, making local presence a potential advantage.

Government defense spending remains a primary revenue driver for AirBoss's survivability division. The US Department of Defense budget for FY2024 was approximately $886 billion, and projections for FY2025 suggest a continued robust investment, potentially exceeding $900 billion, which directly benefits companies securing defense contracts.

Geopolitical events continue to shape demand for protective equipment. Ongoing global tensions, particularly in Eastern Europe, are likely to sustain or increase government expenditure on CBRN protection, creating favorable market conditions for AirBoss's specialized offerings throughout 2024 and 2025.

Trade policies and tariffs directly influence AirBoss's operational costs and market access. For example, potential adjustments to trade agreements like the USMCA in 2024/2025 could impact component sourcing and sales channels, necessitating strategic adaptation to maintain competitive pricing and expand market reach.

| Factor | 2024/2025 Data/Projection | Impact on AirBoss |

|---|---|---|

| US Defense Budget | FY2024: ~$886 billion FY2025 Projection: >$900 billion |

Sustained demand for survivability products. |

| Geopolitical Tensions | Ongoing in Eastern Europe | Increased government spending on protective gear. |

| Trade Policy Outlook | Potential USMCA adjustments | Affects sourcing costs and market access. |

What is included in the product

This AirBoss PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive understanding of the external landscape.

AirBoss PESTLE Analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for efficient strategic decision-making.

Economic factors

Global economic growth is a critical factor for AirBoss, as it directly impacts demand across its key markets like automotive, industrial, and defense. A robust global economy generally translates to higher sales for rubber compounds and finished goods. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.1% in 2023, indicating a moderate but present demand environment.

AirBoss relies heavily on rubber and various chemicals, making it susceptible to global commodity market swings. For instance, natural rubber prices saw significant fluctuations in 2024, with key benchmarks like the SICOM TSR20 contract trading within a wide range, impacting production costs.

This price volatility directly affects AirBoss's manufacturing expenses and profit margins. If raw material costs rise unexpectedly, the company may need to adjust its pricing strategies, potentially affecting sales volume and competitiveness in the 2024-2025 period.

Managing this volatility is crucial, often requiring AirBoss to employ sophisticated hedging strategies or robust supply chain management to secure stable input costs and maintain predictable profitability.

Rising inflation in 2024 and projected into 2025 directly impacts AirBoss by increasing its operational expenses. For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.1% in early 2024, impacting the cost of raw materials, energy, and logistics for the company.

Higher interest rates, a response to inflation, pose a challenge for AirBoss's capital-intensive operations. The Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, making it more expensive for AirBoss to finance new equipment, facility upgrades, or potential acquisitions, thus potentially slowing expansion plans.

These economic pressures can significantly erode AirBoss's profit margins if not effectively managed through pricing strategies or cost-saving initiatives. The company's financial planning must account for these fluctuating costs and borrowing expenses, directly influencing its ability to invest in future growth and maintain competitive pricing.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant risk for AirBoss, given its international operations. Changes in the value of currencies like the US dollar, Euro, or Canadian dollar directly affect the reported value of international sales and the cost of goods purchased from overseas suppliers. For instance, a stronger Canadian dollar relative to the US dollar could reduce the translated value of US sales for AirBoss, while simultaneously making US-sourced raw materials cheaper.

These movements can impact profitability and the company's ability to compete globally. If AirBoss's products are priced in a weakening currency, their attractiveness to international buyers diminishes. Conversely, if raw materials are sourced in a strengthening currency, production costs rise, potentially squeezing profit margins. For example, in late 2024, the Canadian dollar experienced some volatility against the US dollar, which would have directly influenced AirBoss's financial reporting and pricing strategies for cross-border transactions.

- Impact on Revenue: A weaker foreign currency against the Canadian dollar reduces the repatriated value of international sales.

- Cost of Goods Sold: Fluctuations affect the cost of imported raw materials and components.

- Competitiveness: Exchange rates influence the pricing of AirBoss's products in foreign markets relative to local competitors.

- Financial Reporting: Translation of foreign subsidiary results into the parent company's reporting currency can lead to gains or losses.

Defense Spending Budgets

Government defense spending is a critical driver for companies like AirBoss, directly impacting the demand for their specialized survivability solutions, particularly in areas like CBRN protection. Fluctuations in these budgets can significantly alter the landscape of contract opportunities. For instance, a projected 3.4% increase in U.S. defense spending for fiscal year 2025, reaching an estimated $894 billion, signals continued robust demand. Conversely, budget cuts or reallocations can constrain growth.

The global defense market is expected to see continued expansion, with projections indicating a compound annual growth rate (CAGR) of around 4.5% between 2024 and 2029, reaching an estimated value of over $750 billion. This overall market health is positive for AirBoss. However, the specific allocation within these budgets towards protective equipment and advanced survivability technologies will be key.

- Increased global security concerns, particularly in Eastern Europe and the Middle East, are driving higher defense spending by NATO members and other allied nations.

- The U.S. Department of Defense's FY2025 budget request emphasizes modernization and readiness, including investments in chemical, biological, radiological, and nuclear (CBRN) defense capabilities.

- Canada's defense spending is also on an upward trajectory, with a commitment to increase defense investments by 70% over the next 20 years, which could benefit Canadian-based companies like AirBoss.

- The demand for advanced personal protective equipment (PPE) and collective protection systems remains high as nations prioritize the safety of their personnel in evolving threat environments.

Global economic growth influences AirBoss's demand across automotive, industrial, and defense sectors. The IMF projected 3.2% global growth for 2024, indicating a stable demand environment. Commodity price volatility, such as in natural rubber in 2024, directly impacts AirBoss's production costs and profit margins, necessitating effective hedging strategies.

Inflation and rising interest rates increase operational expenses and borrowing costs for AirBoss. For instance, US inflation was around 3.1% in early 2024, with the Federal Reserve holding rates at 5.25%-5.50%, making capital investments more expensive.

Currency fluctuations affect AirBoss's international revenue and costs. A stronger Canadian dollar, for example, could decrease the value of US sales for the company, impacting its global competitiveness and financial reporting.

Government defense spending, particularly in CBRN protection, is a key driver for AirBoss. The U.S. FY2025 defense budget request of $894 billion signals continued demand, with global defense markets projected for 4.5% CAGR through 2029.

What You See Is What You Get

AirBoss PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This AirBoss PESTLE Analysis provides a comprehensive overview of the external factors influencing the business, ensuring you have all the necessary insights.

Sociological factors

The heightened global focus on health and safety, amplified by the COVID-19 pandemic, is a significant sociological driver. This increased awareness translates directly into a stronger demand for personal protective equipment (PPE) and sophisticated safety solutions across various industries.

For AirBoss, this evolving landscape is particularly beneficial for its survivability division, which specializes in protective products. The company's emphasis on advanced respiratory and chemical protection aligns perfectly with this growing market need, impacting its product development strategies and potential for market expansion.

In 2024, the global PPE market was valued at an estimated $70 billion, with projections indicating continued growth driven by these evolving safety consciousness trends. AirBoss's strategic positioning in this sector allows it to capitalize on this sustained demand.

Aging populations in developed nations, including Canada where AirBoss is headquartered, present a complex challenge for labor availability. This demographic trend can lead to a shrinking pool of experienced workers in manufacturing sectors, potentially increasing recruitment difficulties and driving up labor costs for specialized roles like rubber compounding. For instance, as of 2023, Canada's median age was around 41.7 years, a figure that has been steadily increasing, indicating a growing proportion of older workers who may be nearing retirement.

The availability of skilled labor is a critical factor for AirBoss's specialized manufacturing processes. A scarcity of qualified technicians and engineers with expertise in rubber compounding and advanced manufacturing techniques can directly constrain production capacity and necessitate higher wages to attract and retain talent. In 2024, reports indicated ongoing labor shortages in skilled trades across North America, impacting various industrial sectors.

Societal demand for sustainability is increasingly shaping consumer and industrial preferences, directly impacting companies like AirBoss. This trend is particularly evident in sectors where AirBoss operates, such as automotive and industrial manufacturing. For instance, a 2024 report indicated that 70% of consumers are more likely to purchase from brands committed to sustainability, a figure that has steadily climbed over the past few years.

Meeting these evolving expectations requires AirBoss to invest in greener manufacturing processes and explore the use of recycled materials. The automotive industry, a key market for AirBoss, is seeing significant shifts, with manufacturers prioritizing suppliers who demonstrate a strong environmental, social, and governance (ESG) profile. This push towards eco-conscious product development isn't just about compliance; it's becoming a competitive differentiator.

Public Perception of Defense and Security Needs

Public sentiment regarding national security and emergency preparedness significantly shapes government spending and the market acceptance of defense technologies. A strong societal belief in the necessity of protection, particularly against evolving threats like CBRN (Chemical, Biological, Radiological, and Nuclear) agents, directly correlates with increased demand for specialized survivability solutions. For instance, in 2024, global defense spending was projected to reach $2.4 trillion, reflecting a sustained emphasis on security. This heightened awareness can directly benefit companies like AirBoss, whose products are designed to enhance protection in such scenarios.

The perception of risk influences investment in defense capabilities. As global geopolitical tensions remain elevated, public and governmental focus on preparedness intensifies. This trend is evident in increased defense budgets in many NATO countries, with several nations exceeding their 2% GDP defense spending commitments in 2024. Such a climate fosters a more receptive environment for AirBoss's offerings, as governments and populations alike prioritize robust protective measures.

Key societal views impacting AirBoss include:

- Growing awareness of asymmetric warfare and terrorism: This drives demand for advanced protective gear and infrastructure.

- Increased public concern over natural disasters and pandemics: This broadens the market for CBRN protection beyond traditional military applications.

- Governmental focus on homeland security: This translates into funding for domestic preparedness initiatives, creating opportunities for suppliers of protective equipment.

- Public acceptance of technological solutions for safety: This supports the adoption of innovative survivability products.

Workplace Safety Standards and Culture

The increasing focus on workplace safety across sectors like automotive and industrial manufacturing directly fuels demand for advanced rubber products that improve operational security. AirBoss is well-positioned to capitalize on this by supplying robust and dependable components designed to mitigate workplace injuries.

This trend is supported by data showing a continuous effort to reduce workplace accidents. For instance, in 2023, the U.S. Bureau of Labor Statistics reported a continued decline in workplace injury and illness cases, underscoring the industry's commitment to safety enhancements.

- Enhanced Safety Features: AirBoss's products, such as specialized anti-vibration mounts and protective seals, directly contribute to reducing operator exposure to hazards.

- Regulatory Compliance: Adherence to stringent safety regulations, like those from OSHA, necessitates the use of high-quality, safety-certified materials.

- Industry Investment: Global spending on industrial safety equipment is projected to reach over $60 billion by 2026, indicating a strong market driver for safety-enhancing components.

Societal shifts toward prioritizing health, safety, and sustainability are profoundly influencing industries. This heightened awareness, particularly post-pandemic, drives demand for protective equipment and eco-friendly solutions. For AirBoss, this translates into increased opportunities for its survivability division and necessitates a focus on greener manufacturing practices to meet evolving consumer and industrial expectations. For example, the global PPE market reached an estimated $70 billion in 2024, with continued growth anticipated.

Demographic changes, such as aging populations in developed nations, present challenges in skilled labor availability for specialized manufacturing roles. This can lead to increased recruitment difficulties and higher labor costs, impacting production capacity. In 2023, Canada's median age was approximately 41.7 years, reflecting a trend of an aging workforce.

Public perception of national security and evolving threats like CBRN agents directly impacts government spending on defense and preparedness. This heightened focus, evidenced by global defense spending projected at $2.4 trillion in 2024, creates a receptive market for AirBoss's specialized survivability solutions.

| Sociological Factor | Impact on AirBoss | Supporting Data (2023-2025) |

|---|---|---|

| Increased Health & Safety Awareness | Boosts demand for PPE and protective solutions; benefits Survivability division. | Global PPE market valued at $70 billion (2024 est.). |

| Aging Population & Labor Shortages | Potential for recruitment challenges and increased labor costs in specialized manufacturing. | Canada's median age ~41.7 years (2023); ongoing skilled trades shortages in North America (2024). |

| Demand for Sustainability | Drives need for greener manufacturing and recycled materials; competitive differentiator. | 70% of consumers prefer sustainable brands (2024 report). |

| National Security & Preparedness Focus | Increases demand for CBRN protection and defense technologies. | Global defense spending projected at $2.4 trillion (2024); NATO nations exceeding 2% GDP defense spending (2024). |

Technological factors

Continuous innovation in polymer science and rubber compounding technologies is a significant technological factor for AirBoss. These advancements allow for the development of materials with enhanced properties, such as improved durability, greater chemical resistance, and increased flexibility. For instance, the development of advanced synthetic rubbers and novel additive packages can significantly extend product lifespan and performance in harsh environments.

These technological leaps empower AirBoss to create superior products across its diverse application areas, from automotive components to specialized industrial goods. This ability to engineer materials with specific, high-performance characteristics provides a distinct competitive edge in markets demanding advanced solutions. The 2024 market for specialized rubber compounds, driven by automotive and industrial sectors, is projected to see continued growth, with companies investing heavily in R&D for next-generation materials.

AirBoss's manufacturing operations are increasingly influenced by technological advancements, particularly in automation and smart manufacturing. The adoption of advanced robotics and AI-driven processes in their facilities, like those seen in the automotive sector, can significantly boost production efficiency and lower operational costs. For instance, companies investing in Industry 4.0 technologies are reporting up to a 20% increase in output and a 15% reduction in waste, according to recent industry surveys from 2024.

This technological shift is not just about efficiency; it's also about product quality and consistency. Smart manufacturing techniques allow for real-time monitoring and adjustments, minimizing defects and ensuring uniform product standards across all batches. AirBoss's commitment to integrating these innovations is vital for staying competitive in a global market where precision and reliability are paramount.

Ongoing research and development in materials science, especially for Chemical, Biological, Radiological, and Nuclear (CBRN) defense, is critical for AirBoss's survivability division. This focus ensures the company remains at the forefront of protection technology.

Developing advanced protective fabrics and compounds with enhanced barrier capabilities and improved wearer comfort is paramount. This allows AirBoss to effectively address emerging threats and strengthen its position in securing future defense contracts, a key driver for growth in the 2024-2025 period.

Digital Transformation and Data Analytics

AirBoss is increasingly leveraging digital transformation and data analytics to sharpen its operational edge. By integrating advanced digital tools into its supply chain management, production planning, and quality control processes, the company can achieve significant efficiencies. For instance, in 2024, many manufacturing firms reported that AI-driven predictive maintenance reduced unplanned downtime by up to 30%, a benefit AirBoss can also realize.

The strategic application of data analytics allows AirBoss to move beyond reactive problem-solving to proactive optimization. This translates into more accurate demand forecasting, a critical factor in minimizing waste and managing inventory effectively. By analyzing vast datasets, AirBoss can identify trends and patterns that inform better resource allocation and strategic planning across all its business segments, ultimately driving profitability.

- Enhanced Supply Chain Visibility: Digital platforms provide real-time tracking and data, improving inventory management and reducing lead times.

- Optimized Production Planning: Data analytics enables more precise scheduling, minimizing bottlenecks and maximizing throughput.

- Improved Quality Control: Sensor data and analytics can identify deviations early in the production process, reducing defects and rework.

- Data-Driven Decision Making: Insights from analytics support more informed strategic choices, from product development to market entry.

New Product Development and Application Diversification

Technological advancements are a key driver for AirBoss, enabling continuous innovation and the diversification of its product range beyond traditional rubber and polymer solutions. This allows the company to explore new applications for its core competencies.

By leveraging its expertise in rubber compounds and protective technologies, AirBoss can tap into emerging industries, thereby creating new revenue streams and mitigating risks associated with over-reliance on established markets. For instance, advancements in material science could lead to applications in areas like advanced filtration or specialized sealing solutions for the burgeoning electric vehicle sector.

- Innovation in Rubber Compounds: AirBoss's ongoing research and development in advanced rubber formulations allows for the creation of materials with enhanced durability, chemical resistance, and thermal properties, opening doors to new industrial applications.

- Protective Solutions for Emerging Markets: The company is exploring the application of its protective technologies in sectors such as renewable energy infrastructure, where durable and resilient materials are crucial for components exposed to harsh environmental conditions.

- Digitalization in Manufacturing: Implementing digital technologies in its production processes can lead to improved efficiency, quality control, and faster product development cycles, ultimately enhancing AirBoss's competitive edge.

Technological advancements in polymer science are directly fueling AirBoss's capacity for innovation, enabling the creation of materials with superior performance characteristics. This drive for enhanced durability and resistance is crucial for meeting the evolving demands of sectors like automotive and industrial manufacturing, which are projected to see significant investment in advanced materials through 2025.

The integration of automation and smart manufacturing technologies, including AI and robotics, is streamlining AirBoss's production, leading to increased efficiency and reduced operational costs. Industry reports from 2024 indicate that companies adopting Industry 4.0 principles can experience output increases of up to 20%, a tangible benefit for AirBoss's manufacturing output.

Digital transformation, particularly through data analytics and AI-driven insights, is optimizing AirBoss's operations from supply chain management to quality control. Predictive maintenance powered by AI, for instance, has been shown to reduce unplanned downtime by as much as 30% in manufacturing settings during 2024, a key area for AirBoss to leverage.

| Technological Factor | Impact on AirBoss | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Polymer Science Innovation | Enhanced material properties (durability, resistance) | Growth in specialized rubber compounds market driven by automotive and industrial sectors. |

| Automation & Smart Manufacturing | Increased production efficiency, reduced costs | Industry 4.0 adoption leading to up to 20% output increase and 15% waste reduction. |

| Digital Transformation & Data Analytics | Optimized operations, proactive decision-making | AI-driven predictive maintenance reducing unplanned downtime by up to 30%. |

Legal factors

AirBoss must navigate a complex web of product liability and safety regulations, especially given its critical defense and automotive applications. For instance, in 2024, the automotive industry saw ongoing scrutiny regarding component safety, with recalls often costing manufacturers millions. Failure to meet these standards, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US, can result in substantial fines and mandatory product recalls, impacting AirBoss's financial performance and brand image.

AirBoss's manufacturing facilities must comply with stringent environmental laws concerning air emissions, wastewater, and hazardous waste. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act, which sets limits on pollutants. Failure to meet these standards can result in significant fines, potentially impacting profitability and operational continuity.

Protecting AirBoss's proprietary rubber formulations, manufacturing processes, and specialized product designs through patents and trademarks is essential for maintaining its competitive advantage. For instance, in 2024, companies globally spent an estimated $200 billion on R&D, highlighting the critical need for IP protection to recoup these investments.

Legal frameworks for intellectual property enforcement are vital to prevent unauthorized replication and safeguard innovation. In 2023, IP infringement lawsuits in the manufacturing sector saw an average settlement of $1.5 million, underscoring the financial risks associated with weak IP protection.

Labor Laws and Employment Regulations

AirBoss must navigate a complex web of labor laws and employment regulations to ensure fair treatment and operational stability. This includes strict adherence to wage and hour laws, such as minimum wage requirements which, as of 2024, vary significantly by jurisdiction, impacting payroll costs. Compliance also extends to maintaining safe working conditions, with OSHA standards setting benchmarks for workplace safety that directly influence operational procedures and potential liabilities.

The company's human resources strategy must also account for evolving regulations concerning employee benefits, leave policies, and anti-discrimination laws. For instance, the Family and Medical Leave Act (FMLA) in the United States mandates unpaid, job-protected leave for specific family and medical reasons, requiring careful management of workforce availability. Furthermore, understanding and managing relations with labor unions, where applicable, is crucial to avoid work stoppages and ensure productive employee engagement.

- Minimum Wage Compliance: Adhering to federal, state, and local minimum wage laws, which saw an average increase across several US states in early 2024, directly impacting labor costs.

- Workplace Safety Standards: Implementing and maintaining robust health and safety protocols in line with OSHA guidelines to prevent accidents and associated penalties, which can range from hundreds to thousands of dollars per violation.

- Union Relations and Collective Bargaining: Managing agreements and negotiations with unionized workforces to foster positive labor relations and prevent disruptions, with the potential for significant financial impact if disputes arise.

- Employee Benefits and Leave Policies: Ensuring compliance with regulations like the FMLA and state-specific paid sick leave laws, which affect employee retention and operational planning.

International Trade and Sanctions Laws

AirBoss, as a global player, must meticulously adhere to international trade regulations and sanctions. These legal frameworks govern the import and export of goods, ensuring compliance with customs procedures and avoiding penalties for non-adherence. For instance, in 2024, the global trade landscape continues to be shaped by evolving sanctions regimes, impacting supply chains and market access for manufacturers like AirBoss.

Navigating these complexities is crucial for seamless cross-border operations. Failure to comply can lead to significant legal repercussions, including fines and the disruption of business activities. The International Trade Administration reported that in 2023, export control violations resulted in over $1.2 billion in penalties, highlighting the financial risks involved.

- Global Trade Compliance: AirBoss must stay updated on trade agreements and tariffs affecting its key markets.

- Sanctions Adherence: Strict adherence to economic sanctions imposed by countries like the United States and the European Union is paramount.

- Customs Regulations: Understanding and complying with diverse customs documentation and procedures in different countries is essential for smooth logistics.

- Export Controls: Ensuring all exported products meet the specific export control regulations of originating and destination countries is vital.

AirBoss's commitment to intellectual property protection is paramount, especially with significant R&D investments. In 2024, the global expenditure on research and development neared $2.5 trillion, underscoring the value of safeguarding innovations through patents and trademarks. Failure to protect proprietary rubber formulations and manufacturing processes can lead to competitors replicating designs, eroding market share and profitability.

Environmental factors

AirBoss's dependence on natural and synthetic rubber for its diverse product lines, including tire components and industrial hoses, highlights the critical need for sustainable sourcing. In 2024, the global rubber market faced ongoing volatility, with natural rubber prices fluctuating significantly due to weather patterns and geopolitical events impacting key producing regions like Southeast Asia. This underscores AirBoss's vulnerability to supply chain disruptions and the imperative to adopt robust sustainability practices to ensure consistent raw material availability.

The increasing demand for ethically and environmentally sourced materials directly influences AirBoss's supplier selection and operational transparency. Consumers and business partners are increasingly scrutinizing supply chains, pushing companies like AirBoss to demonstrate commitment to fair labor practices and reduced environmental footprints in their raw material procurement. By 2025, regulatory frameworks and investor expectations are anticipated to further emphasize these demands, making sustainable sourcing a key competitive differentiator.

AirBoss's manufacturing operations inherently create waste, necessitating robust management strategies focused on reduction, reuse, and recycling. For instance, in 2024, companies in the industrial manufacturing sector reported an average of 15% of their raw material inputs being converted into waste, highlighting the scale of this challenge.

Compliance with evolving waste disposal regulations is paramount, with many jurisdictions implementing stricter landfill bans and extended producer responsibility schemes. AirBoss's commitment to circular economy principles, aiming to keep materials in use for as long as possible, is a critical environmental consideration that can also lead to cost savings and enhanced brand reputation.

The rubber industry, including AirBoss's operations, is inherently energy-intensive due to processes like compounding and vulcanization. This leads to significant scrutiny regarding energy consumption and greenhouse gas emissions, with the sector often facing pressure to decarbonize.

In 2023, global industrial energy consumption accounted for about 37% of total final energy consumption, highlighting the sector's substantial energy footprint. AirBoss's commitment to improving energy efficiency and exploring renewable energy sources, such as solar or wind power for its manufacturing facilities, is vital for mitigating its environmental impact and aligning with increasingly stringent sustainability regulations and stakeholder expectations.

Climate Change Impacts and Adaptation

Climate change presents significant environmental challenges for AirBoss, potentially disrupting operations through extreme weather. For instance, increased frequency of severe storms in manufacturing regions could impact logistics and the availability of key raw materials, a concern as global supply chain disruptions remain a factor in 2024. Furthermore, evolving environmental regulations aimed at mitigating climate change could lead to increased compliance costs or require investments in more sustainable practices.

Adapting to these climate-related risks is crucial for AirBoss's long-term resilience and business continuity. The company should actively assess its vulnerability to climate impacts and develop strategies to mitigate these risks. This includes diversifying supply chains to reduce reliance on weather-vulnerable regions and exploring alternative, more sustainable materials.

- Supply Chain Disruption: Extreme weather events, such as hurricanes or prolonged droughts, can impede transportation networks and damage production facilities, impacting AirBoss's ability to source materials and deliver finished goods.

- Raw Material Availability: Changes in climate patterns can affect the availability and cost of natural resources used in manufacturing, potentially leading to price volatility or shortages.

- Regulatory Pressure: Growing global emphasis on climate action may result in stricter environmental regulations, carbon pricing mechanisms, or mandates for renewable energy adoption, influencing AirBoss's operational costs and strategic planning.

Product End-of-Life and Circularity

The environmental impact of rubber products, particularly at their end-of-life, is a growing concern for consumers and regulators alike. The biodegradability and recyclability of these materials directly influence landfill burden and resource depletion. For instance, in 2024, the global rubber waste generated was estimated to be over 15 million metric tons, with a significant portion ending up in landfills.

AirBoss, like many manufacturers in the sector, may encounter increasing pressure to innovate towards more sustainable product lifecycles. This could involve developing rubber compounds that are more readily recyclable or establishing robust take-back programs. Such initiatives are crucial for enhancing product circularity and actively reducing the volume of waste sent to landfills, aligning with broader environmental stewardship goals.

- Growing Rubber Waste: Global rubber waste reached over 15 million metric tons in 2024, highlighting landfill challenges.

- Recycling Imperative: The industry faces pressure to improve the recyclability of rubber products.

- Circularity Initiatives: AirBoss may need to explore take-back schemes to close the loop on product lifecycles.

- Landfill Reduction: Enhancing circularity directly contributes to minimizing environmental impact and waste.

AirBoss's environmental footprint is significantly shaped by its reliance on raw materials and energy consumption. In 2024, the global rubber market experienced price volatility, impacting sourcing costs and underscoring the need for sustainable procurement. The manufacturing processes are energy-intensive, contributing to greenhouse gas emissions, with industrial sectors accounting for a substantial portion of global energy use.

The company must manage waste effectively, as manufacturing often generates byproducts. In 2024, industrial waste levels were considerable, emphasizing the importance of reduction and recycling strategies. Furthermore, the end-of-life disposal of rubber products poses a challenge, with growing global rubber waste volumes necessitating a focus on product circularity and recyclability.

| Environmental Factor | Impact on AirBoss | 2024/2025 Data/Trend |

| Raw Material Sourcing | Supply chain vulnerability, cost fluctuations | Natural rubber prices volatile due to weather and geopolitics in Southeast Asia. |

| Energy Consumption | Greenhouse gas emissions, operational costs | Industrial sector's significant energy footprint; pressure to decarbonize operations. |

| Waste Management | Operational efficiency, regulatory compliance | Average 15% of raw material inputs converted to waste in manufacturing; stricter disposal regulations. |

| Product Lifecycle | Environmental impact, brand reputation | Over 15 million metric tons of global rubber waste in 2024; increasing demand for recyclability. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AirBoss is built upon a robust foundation of data from reputable sources including government publications, industry-specific market research, and international economic reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the aerospace and defense sector.