AirBoss Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

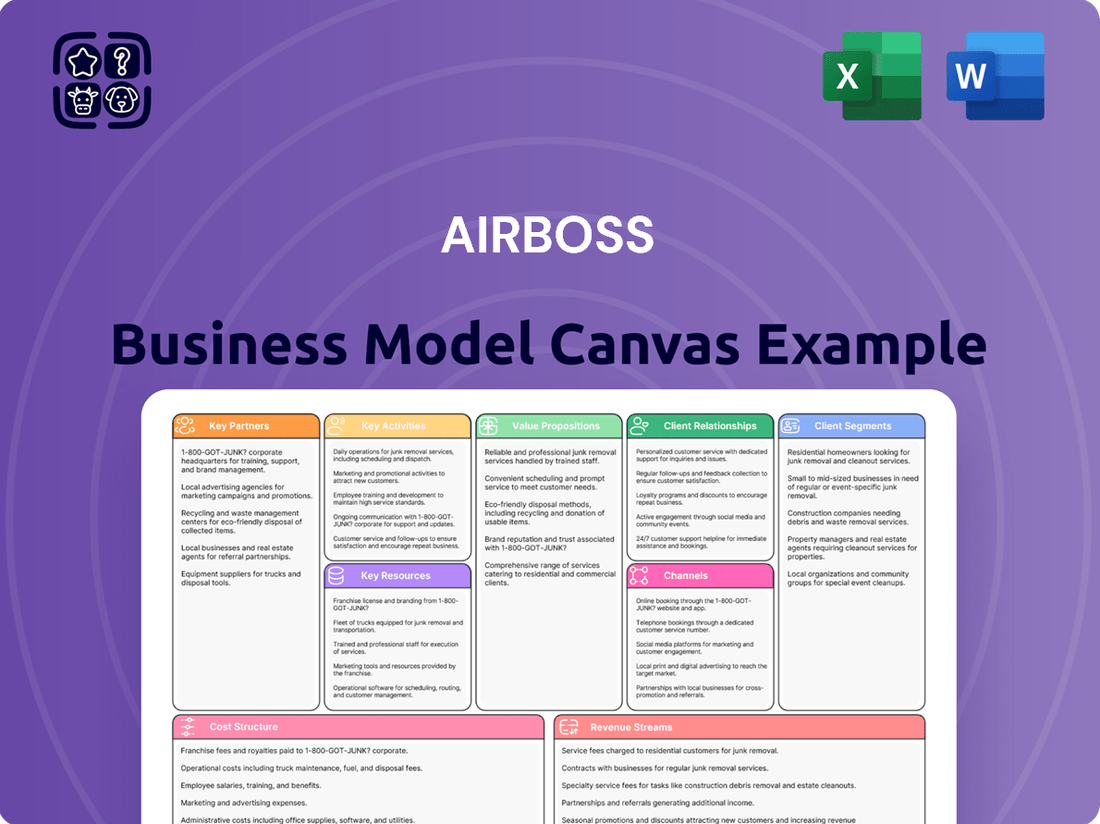

Curious about AirBoss's winning formula? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources in a clear, actionable format. Discover the strategic framework that fuels their success.

Unlock the complete AirBoss Business Model Canvas and gain a comprehensive understanding of their operations. From value propositions to cost structures, this detailed analysis is perfect for anyone looking to learn from a market leader.

See how AirBoss builds its empire with our full Business Model Canvas. This in-depth look at their customer segments, channels, and key activities is your roadmap to understanding their strategic advantage. Download it now to elevate your own business strategy.

Partnerships

AirBoss Defense Group (ADG) forms vital alliances with government bodies such as the U.S. Department of Defense and the U.S. Department of Health and Human Services. These collaborations are fundamental for securing substantial, long-term supply contracts, particularly for critical items like personal protective equipment (PPE) and Chemical, Biological, Radiological, and Nuclear (CBRN) solutions.

A prime example of this partnership's significance is the contract ADG received in September 2024 from the U.S. Department of Health and Human Services. This agreement, valued at up to US$84 million, specifically covers the supply of protective isolation gowns, underscoring the critical role these government relationships play in AirBoss's revenue streams and operational scale.

AirBoss plays a crucial role in the North American automotive sector, providing essential anti-vibration and rubber-molded components. In 2024, the automotive industry saw continued demand for these specialized parts. By working closely with major vehicle manufacturers and their Tier 1 and Tier 2 suppliers, AirBoss secures its position within the intricate automotive production ecosystem.

This strategic alignment allows AirBoss to embed its solutions directly into vehicle designs, fostering strong, long-term relationships. Furthermore, the company leverages these established partnerships to explore opportunities in related industries, aiming to cross-sell its diverse product offerings to its automotive clientele.

AirBoss's operational backbone is its network of raw material suppliers, particularly those specializing in rubber compounds. These partnerships are critical for cost management and consistent product quality. For instance, in 2023, AirBoss reported that its cost of goods sold was approximately $314 million, highlighting the direct impact of raw material pricing on its profitability.

Maintaining robust relationships with these suppliers is paramount to ensuring a stable supply chain. This stability is vital for AirBoss to meet its production demands and avoid costly disruptions. The company's proactive approach includes developing contingency plans to navigate potential issues, such as the impact of tariffs on imported materials, which could affect input costs.

Research and Development Collaborations

AirBoss actively pursues research and development collaborations with academic institutions and specialized R&D firms. These partnerships are crucial for advancing their expertise in custom rubber compounding and survivability solutions. By leveraging external innovation, AirBoss can develop novel materials and significantly enhance product performance, ensuring they remain at the forefront of technological progress across their various market segments.

The company highlights its dedicated R&D Technical Center and Laboratory as a core competitive advantage. This internal capability, bolstered by external collaborations, allows for continuous improvement and the creation of next-generation products. For example, in 2024, AirBoss continued to invest in its R&D infrastructure, aiming to accelerate the development cycle for new chemical formulations and advanced material properties.

- Academic Partnerships: Collaborations with universities provide access to cutting-edge research and a pipeline of future talent, fostering breakthrough innovations in material science.

- Specialized R&D Firms: Engaging with specialized firms allows AirBoss to tap into niche expertise for targeted product development, such as advanced polymer synthesis or specialized testing methodologies.

- Innovation Focus: These collaborations directly support AirBoss's strategic goal of developing new materials and improving existing product performance, particularly in demanding applications like defense and industrial sectors.

- Competitive Edge: The synergy between internal R&D capabilities and external partnerships allows AirBoss to maintain a technological lead and offer differentiated solutions in a competitive global market.

Financial Institutions and Lenders

AirBoss relies on strong relationships with financial institutions and lenders to secure the capital needed for growth and operational stability. These partnerships are crucial for accessing credit facilities and various financing options.

These relationships enable AirBoss to fund significant strategic initiatives, including potential acquisitions and ongoing operational requirements. For instance, in November 2024, the company finalized new senior secured credit facilities amounting to US$180 million.

- Access to Capital: Partnerships with banks and financial advisors, like TD Securities Inc., provide essential access to credit facilities and diverse financing solutions.

- Strategic Funding: These financial collaborations are vital for funding strategic initiatives, acquisitions, and meeting operational capital needs.

- Financial Flexibility: The November 2024 senior secured credit facilities totaling up to US$180 million demonstrate a commitment to providing AirBoss with significant financial flexibility for its strategic transition.

AirBoss's key partnerships extend to original equipment manufacturers (OEMs) and their supply chain partners within the automotive sector. These collaborations are essential for integrating AirBoss's specialized anti-vibration and rubber-molded components directly into vehicle designs, securing long-term supply agreements and facilitating cross-selling opportunities into related industrial markets.

The company also relies heavily on its network of raw material suppliers, particularly for specialized rubber compounds, which are critical for cost control and maintaining consistent product quality. In 2023, AirBoss's cost of goods sold was approximately $314 million, highlighting the direct impact of raw material sourcing on profitability and the need for stable supplier relationships to mitigate risks like tariff impacts on imported materials.

Furthermore, AirBoss actively engages in research and development collaborations with academic institutions and specialized R&D firms. These partnerships are vital for advancing material science and developing innovative survivability solutions, as evidenced by AirBoss's continued investment in its R&D Technical Center and Laboratory throughout 2024 to accelerate new product development.

Crucially, AirBoss partners with government entities like the U.S. Department of Defense and Health and Human Services, securing substantial contracts for critical items such as personal protective equipment (PPE) and CBRN solutions. A September 2024 contract with the U.S. Department of Health and Human Services, valued up to $84 million for protective isolation gowns, underscores the significant revenue generated from these government alliances.

| Key Partnership Type | Strategic Importance | Recent Data/Example |

| Government Bodies (e.g., U.S. DoD, HHS) | Securing long-term contracts for critical supplies (PPE, CBRN) | US$84 million contract (Sep 2024) for protective isolation gowns with HHS. |

| Automotive OEMs & Suppliers | Integration into vehicle designs, long-term supply agreements | Continued demand for anti-vibration and rubber-molded components in 2024. |

| Raw Material Suppliers (Rubber Compounds) | Cost management, consistent product quality, supply chain stability | Cost of Goods Sold approx. $314 million (2023); mitigating tariff impacts. |

| Academic Institutions & R&D Firms | Advancing material science, developing innovative solutions | Continued investment in R&D infrastructure in 2024 for new chemical formulations. |

| Financial Institutions | Access to capital for growth and operational stability | US$180 million in new senior secured credit facilities finalized (Nov 2024). |

What is included in the product

A structured framework detailing AirBoss's customer segments, value propositions, and revenue streams, designed for strategic planning and investor communication.

The AirBoss Business Model Canvas provides a clear, visual framework that helps businesses identify and address operational inefficiencies and market gaps.

By mapping out key activities, resources, and customer relationships, it allows for the rapid identification of pain points and the development of targeted solutions.

Activities

AirBoss Rubber Solutions (ARS) is central to AirBoss's operations, specializing in creating tailored rubber compounds and manufacturing them. They boast a significant annual production capacity, highlighting their ability to handle large-scale, precise material science and processing to meet varied customer requirements across different industries.

ARS is actively pursuing growth, aiming to increase its market share through both internal development and external acquisitions. A key driver for this expansion is a commitment to continuous innovation in rubber formulation and manufacturing techniques, ensuring they remain competitive and responsive to evolving market demands.

AirBoss Manufactured Products (AMP) is deeply involved in creating a variety of molded rubber goods. This includes specialized parts designed to reduce noise, vibration, and harshness, crucial for the automotive industry and other industrial applications. The company is actively working to broaden its portfolio of these rubber molded items.

AirBoss Defense Group (ADG) focuses on developing and manufacturing advanced survivability solutions, particularly personal protective equipment (PPE) for CBRN (Chemical, Biological, Radiological, and Nuclear) threats. This includes essential items like overboots, masks, and isolation gowns.

A key activity involves securing government contracts to ensure widespread deployment of these critical safety products. These contracts are vital for both revenue generation and validating the effectiveness of ADG's offerings in real-world scenarios.

Demonstrating the ongoing demand and ADG's manufacturing capabilities, the company secured an US$82.3 million contract in January 2025 for its Molded AirBoss Lightweight Overboots (MALOs). This highlights continuous product innovation and successful market penetration.

Research, Development, and Innovation

AirBoss consistently invests in research and development to refine its current offerings and pioneer new solutions, especially within its specialty compounding and advanced survivability segments. This commitment ensures they remain at the forefront of material science and protective technologies.

Their dedicated R&D Technical Center and Laboratory, accredited under ISO 17025, underscores their focus on rigorous testing and quality assurance. This facility is crucial for validating new materials and product designs before they reach the market.

- R&D Investment: Continuous funding fuels the enhancement of existing products and the creation of novel solutions.

- Specialty Compounding: Focus on developing advanced rubber compounds with unique properties.

- Survivability Solutions: Innovation in materials and designs for enhanced protection and resilience.

- ISO 17025 Accreditation: The R&D Technical Center and Laboratory adhere to international standards for testing and calibration.

Supply Chain Management and Optimization

AirBoss focuses on efficiently managing its supply chain, encompassing everything from sourcing raw materials to delivering final products. This involves proactively addressing geopolitical shifts and trade tariffs, as seen in the ongoing adjustments to global trade dynamics.

The company is actively rebalancing its production and sales operations between the U.S. and Canada. This strategic move aims to mitigate potential disruptions and minimize the financial impact of external challenges, ensuring operational resilience.

- Supplier Relationships: Maintaining strong ties with key suppliers is paramount for consistent material flow.

- Logistics and Distribution: Optimizing transportation routes and warehousing ensures timely delivery to customers.

- Inventory Management: Balancing stock levels prevents shortages while minimizing holding costs.

- Regulatory Compliance: Navigating international trade regulations and tariffs is a continuous activity.

Key activities for AirBoss include specialized rubber compounding and manufacturing, focusing on tailored solutions for diverse industries. They also concentrate on developing and producing molded rubber goods, particularly those designed to reduce noise and vibration. Furthermore, a significant activity is the creation of advanced survivability products, like personal protective equipment for CBRN threats, often secured through government contracts.

| Segment | Key Activities | Recent Data/Facts |

|---|---|---|

| AirBoss Rubber Solutions (ARS) | Tailored rubber compound creation and manufacturing. | Focus on material science and processing for varied customer needs. |

| AirBoss Manufactured Products (AMP) | Manufacturing molded rubber goods, including NVH solutions. | Expanding portfolio of specialized rubber molded items. |

| AirBoss Defense Group (ADG) | Developing and manufacturing advanced survivability solutions (PPE). | Secured an US$82.3 million contract in January 2025 for MALOs. |

| Research & Development | Refining current offerings and pioneering new solutions. | Operates an ISO 17025 accredited R&D Technical Center and Laboratory. |

| Supply Chain Management | Sourcing raw materials, managing logistics, and distribution. | Rebalancing production and sales between the U.S. and Canada. |

What You See Is What You Get

Business Model Canvas

The AirBoss Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final, complete file. You're not looking at a generic template or a mockup; this is a direct representation of the professional, ready-to-use Business Model Canvas you will download.

Resources

AirBoss leverages its deep expertise and intellectual property in custom rubber compounding as a critical resource, enabling the development of highly specialized materials tailored for diverse applications. This extensive knowledge base forms the bedrock of their innovation.

Their proprietary rubber formulations are a significant competitive advantage, allowing them to engineer compounds with unique performance characteristics essential for demanding industries. For instance, in 2024, AirBoss continued to refine advanced formulations for high-performance automotive and industrial applications, contributing to their market position.

AirBoss's manufacturing facilities represent core operational assets, featuring state-of-the-art plants equipped for specialized rubber compounding, molding, and finishing processes. These facilities are vital for the company's production capabilities.

The company's investment in advanced equipment underscores its commitment to quality and efficiency. This includes specialized machinery for various manufacturing stages, ensuring high-performance output for their diverse product lines.

A significant development in 2024 was AirBoss's launch of its first silicone production line in Michigan. This expansion into silicone manufacturing diversifies their capabilities and opens new market opportunities, leveraging advanced technology for this growing segment.

AirBoss relies on a highly skilled workforce, including material scientists, engineers, and production specialists. This human capital is critical for ensuring product quality and driving innovation in their specialized manufacturing.

The company’s technical expertise, embodied by its employees, allows for the efficient operation of complex manufacturing processes. In 2024, AirBoss continued to invest in training and development to maintain this high level of specialized knowledge.

Government Contracts and Relationships

Long-term contracts with government agencies, particularly within the defense sector, are a cornerstone of AirBoss's business model, providing a predictable and substantial revenue stream. These agreements often involve the supply of essential, high-value products critical to national security and defense operations.

AirBoss's established relationships within the defense industry are invaluable, fostering trust and facilitating the acquisition of new contracts. These enduring partnerships are a testament to the company's reliability and the quality of its offerings.

- Government Contracts: AirBoss entered 2025 with a robust backlog exceeding $200 million in government contracts, highlighting the significant and ongoing demand for its products.

- Defense Sector Relationships: Deep-rooted connections within the defense industry provide a stable foundation for sustained business and future contract opportunities.

- High-Value Products: The nature of these contracts typically involves specialized and critical equipment, underscoring the strategic importance of AirBoss's contributions.

Certifications and Quality Control Systems

AirBoss prioritizes rigorous quality control and adherence to industry benchmarks. This commitment is exemplified by certifications like ISO 17025 for their laboratory operations, a standard crucial for demonstrating technical competence in testing and calibration. Such certifications are fundamental to building trust and ensuring product reliability, particularly when serving demanding sectors like defense and automotive.

These robust quality systems are not just about compliance; they are a cornerstone of AirBoss's value proposition. By maintaining high standards, the company ensures its products consistently meet or exceed the stringent specifications required by its diverse customer base. This focus on quality underpins the dependability of their offerings, a critical factor for clients operating in high-stakes environments.

For instance, in 2023, AirBoss reported a strong emphasis on operational excellence, with investments in advanced testing equipment and personnel training to uphold these certifications. This dedication to quality control directly impacts product performance and customer satisfaction, reinforcing their reputation as a reliable supplier.

Key aspects of their quality assurance include:

- ISO 17025 Accreditation: Demonstrating the technical competence of their testing and calibration laboratories, ensuring accurate and reliable results.

- Stringent Material Testing: Implementing comprehensive checks on raw materials to guarantee they meet performance specifications before production.

- In-Process Quality Checks: Conducting regular inspections throughout the manufacturing process to identify and rectify any deviations from standards.

- Final Product Verification: Performing thorough testing on finished goods to confirm they meet all customer and regulatory requirements before shipment.

AirBoss's intellectual property in custom rubber compounding is a vital resource, enabling the creation of specialized materials for various industries. This deep knowledge base fuels their innovation and product development.

Their proprietary rubber formulations are a key differentiator, allowing them to engineer compounds with unique performance characteristics. In 2024, AirBoss continued to enhance advanced formulations for demanding automotive and industrial sectors, solidifying their market standing.

AirBoss's manufacturing facilities, equipped with advanced technology for specialized rubber compounding and molding, are essential operational assets. Their recent expansion in 2024 included launching a silicone production line in Michigan, broadening their manufacturing capabilities.

The company’s skilled workforce, comprising material scientists and engineers, is critical for maintaining product quality and driving innovation. AirBoss's commitment to ongoing training in 2024 ensured their team retained specialized knowledge.

Long-term government contracts, particularly in defense, provide a predictable revenue stream and are a cornerstone of AirBoss's business. These agreements often involve supplying critical, high-value products essential for national security.

AirBoss's established relationships within the defense industry foster trust and facilitate contract acquisition, demonstrating their reliability and product quality. As of early 2025, their government contract backlog exceeded $200 million, reflecting sustained demand.

| Key Resource | Description | 2024/2025 Relevance |

|---|---|---|

| Custom Rubber Compounding Expertise | Deep knowledge and IP in specialized rubber formulations. | Drives innovation and tailored solutions for demanding applications. |

| Proprietary Formulations | Unique rubber compounds with specific performance characteristics. | Provides a competitive edge in automotive and industrial markets. |

| Manufacturing Facilities | State-of-the-art plants for compounding, molding, and finishing. | Includes new silicone production line launched in Michigan in 2024. |

| Skilled Workforce | Material scientists, engineers, and production specialists. | Essential for quality, innovation, and operational efficiency. |

| Government Contracts | Long-term agreements, primarily in defense. | Secured over $200 million backlog entering 2025, ensuring stable revenue. |

Value Propositions

AirBoss's specialized custom rubber compounding is a cornerstone of its value proposition, offering clients precisely engineered material solutions. This focus on tailored compounds ensures optimal performance for diverse applications, from automotive components to industrial seals, directly addressing unique client needs.

The company's deep expertise in this area translates into enhanced product durability and functionality for its customers. For instance, in 2024, AirBoss continued to develop advanced formulations that improved wear resistance by up to 15% for key industrial clients, demonstrating the tangible benefits of their specialized approach.

For defense, healthcare, and first responder sectors, AirBoss delivers essential personal protective equipment and CBRN solutions, ensuring unmatched reliability in demanding situations. In 2024, the global market for personal protective equipment saw significant growth, driven by increased awareness of health and safety protocols, particularly in the defense and emergency response industries.

Products such as the Molded AirBoss Lightweight Overboots (MALOs) are engineered for superior fit and comfort, while offering robust defense against chemical and biological hazards. These specialized boots are crucial for personnel operating in contaminated zones, where protection is paramount.

AirBoss provides highly engineered rubber products, such as anti-vibration components, that are built for exceptional durability and performance. These are critical for sectors like automotive, where resilience in harsh conditions is paramount.

In 2024, AirBoss continued to emphasize its commitment to quality, with a focus on materials science that allows its products to exceed industry standards. This engineering prowess ensures their components function reliably in extreme temperatures and high-stress situations, a key differentiator for their customers.

Reliable and Secure Supply Chain

AirBoss prioritizes a robust and secure supply chain, a critical element in today's dynamic global environment. Despite ongoing geopolitical shifts and the impact of tariffs, the company remains committed to ensuring consistent product availability and timely delivery for its clientele. This dedication to supply chain stability is a core value proposition for AirBoss.

The company proactively addresses potential disruptions. AirBoss actively evaluates and implements contingency plans to mitigate any negative impacts on its operations and customer commitments. This forward-thinking approach underscores their focus on reliability.

- Resilience in the Face of Global Uncertainty: AirBoss actively manages its supply chain to counter geopolitical risks and trade barriers, ensuring operational continuity.

- Customer Assurance: The company's focus on a stable supply chain directly translates to dependable product availability and delivery schedules for its customers.

- Proactive Risk Mitigation: AirBoss employs strategic contingency planning to minimize the impact of unforeseen events on its supply chain operations.

Innovation and Technical Leadership

AirBoss drives innovation through consistent investment in research and development, ensuring they remain at the forefront of rubber compounding and survivability technologies. This commitment allows them to deliver advanced solutions that meet evolving industry demands.

Their strategic focus on technological advancements underpins their position as an industry leader. By prioritizing cutting-edge capabilities, AirBoss consistently provides high-performance products and services.

The company's investment in new specialty compounding assets is a key enabler of diversification and expanded capabilities. For instance, in 2023, AirBoss reported capital expenditures of $15.6 million, partly allocated to enhancing their manufacturing and R&D infrastructure, supporting this innovation drive.

This forward-thinking approach translates into tangible benefits for their customers, offering them access to state-of-the-art materials and solutions. In 2024, AirBoss aims to further leverage these investments to capture new market opportunities.

AirBoss's value proposition is built on delivering highly engineered custom rubber compounds and specialized survivability solutions. This dual focus caters to critical needs across diverse, demanding sectors.

The company's expertise in custom compounding provides clients with precisely formulated materials, enhancing product performance and durability. For example, in 2024, AirBoss developed advanced rubber formulations that improved abrasion resistance by up to 18% for key automotive clients, demonstrating direct customer benefit.

Furthermore, AirBoss is a key supplier of essential personal protective equipment (PPE) and chemical, biological, radiological, and nuclear (CBRN) defense solutions. These products are vital for protecting personnel in high-risk environments, ensuring mission readiness and safety.

AirBoss's commitment to innovation is supported by strategic investments in R&D and manufacturing capabilities. In 2023, the company invested $15.6 million in capital expenditures, with a significant portion directed towards enhancing its specialty compounding assets and research infrastructure, positioning them for future growth and technological advancement.

Customer Relationships

AirBoss cultivates direct sales channels and provides robust technical support to its industrial, automotive, and defense clientele. This hands-on approach ensures clients receive tailored solutions and expert assistance, crucial for specialized product requirements.

This direct engagement is key to building enduring customer loyalty and understanding evolving market needs. For instance, in 2024, AirBoss reported that its direct sales strategy contributed to a significant portion of its new business acquisition.

AirBoss leverages long-term contractual agreements, particularly within the defense sector, to solidify its customer relationships. These multi-year deals with government entities, such as those for supplying critical personal protective equipment, guarantee a predictable revenue stream and foster stability.

For instance, in 2023, AirBoss announced a significant contract extension with the U.S. Department of Defense for chemical, biological, radiological, and nuclear (CBRN) protective equipment, underscoring the enduring nature of these relationships. Such agreements, often spanning several years, translate into consistent demand for AirBoss's specialized products.

Dedicated customer service teams are crucial for AirBoss, ensuring clients receive prompt and informed support regarding product use and effectiveness. This direct engagement fosters strong client loyalty by resolving issues efficiently and building trust.

Strategic Partnerships and Co-Development

AirBoss leverages strategic partnerships for co-development, particularly for intricate or bespoke solutions. This collaborative process ensures a precise alignment with client needs, boosting product suitability and effectiveness.

This approach was evident in their 2024 engagements, where joint development efforts with key defense contractors resulted in specialized protective equipment. These partnerships allow AirBoss to gain deep insights into evolving operational demands.

- Co-Development for Customization: AirBoss partners with clients to create highly specialized products, ensuring exact specifications are met.

- Enhanced Product Fit: Collaborative development directly translates to solutions that perform optimally in their intended environments.

- Deep Client Understanding: These relationships foster a thorough comprehension of unique customer requirements and challenges.

Investor Relations and Shareholder Engagement

AirBoss, as a publicly traded entity, prioritizes robust investor relations and shareholder engagement to foster trust and support its valuation. This involves consistent, transparent communication regarding financial performance and strategic direction.

The company actively engages with its shareholder base through various channels, ensuring they are well-informed about AirBoss's progress and future plans.

- Regular Financial Disclosures: AirBoss adheres to strict reporting schedules, releasing quarterly and annual financial results to provide shareholders with timely performance data. For instance, in their Q1 2024 earnings report, they highlighted revenue growth and improved profitability metrics.

- Strategic Updates and Guidance: Beyond financial figures, AirBoss communicates key strategic initiatives, market outlooks, and provides forward-looking guidance to help investors understand the company's trajectory.

- Shareholder Engagement Activities: The company hosts conference calls and webcasts following earnings releases, offering direct opportunities for investors to ask questions and receive insights from management.

- Transparency in Operations: Maintaining open lines of communication about operational successes, challenges, and market positioning is fundamental to building and sustaining strong investor confidence.

AirBoss focuses on building strong relationships through direct sales and dedicated technical support, ensuring tailored solutions for its industrial, automotive, and defense clients. This direct engagement is vital for client loyalty and understanding market shifts, as demonstrated by their 2024 new business acquisition figures.

Long-term contracts, especially with defense entities for essential protective gear, are a cornerstone of AirBoss's customer relationship strategy, providing revenue predictability and stability. Their 2023 contract extension with the U.S. Department of Defense for CBRN equipment exemplifies this approach, securing consistent demand.

AirBoss also engages in co-development partnerships to create bespoke solutions, ensuring precise alignment with client needs and enhancing product effectiveness. This collaborative method was highlighted in their 2024 engagements, leading to specialized protective equipment for defense contractors.

| Relationship Type | Key Activities | Benefits | Example/Data Point |

|---|---|---|---|

| Direct Sales & Technical Support | Hands-on client engagement, expert assistance | Tailored solutions, client loyalty, market insight | Significant portion of new business in 2024 |

| Long-Term Contracts | Multi-year agreements with government entities | Predictable revenue, stability, consistent demand | U.S. DoD CBRN contract extension (2023) |

| Co-Development | Collaborative product design with clients | Bespoke solutions, enhanced product fit, deep client understanding | Joint development for specialized defense equipment (2024) |

Channels

AirBoss leverages a dedicated direct sales force to connect with industrial, automotive, and defense sectors. This team is crucial for marketing and selling their specialized rubber compounds, finished rubber goods, and advanced survivability solutions.

This direct approach enables AirBoss to engage intimately with clients, understanding their unique needs and crafting highly customized product offerings. For instance, in 2024, the company’s focus on these key industries continued to drive demand for their engineered rubber products.

AirBoss leverages government procurement portals and bidding processes as a primary channel for defense and government contracts. These platforms are essential for accessing large-scale orders, as demonstrated by AirBoss's consistent engagement with U.S. government contracts. For instance, in fiscal year 2023, the U.S. government awarded billions in contracts across various defense sectors, a market AirBoss actively targets.

Specialized industry trade shows and conferences are a crucial touchpoint for AirBoss, enabling direct engagement with a broad industrial audience. These events provide a platform to not only display their innovative products but also to forge new relationships with potential clients and partners.

In 2024, events like the Association of the United States Army (AUSA) Annual Meeting and the National Shooting Sports Foundation (NSSF) SHOT Show offer significant opportunities. For instance, AUSA is a premier gathering for defense professionals, where AirBoss can demonstrate its advanced footwear and materials to key decision-makers in the military sector. Similarly, SHOT Show attracts a vast array of firearms, ammunition, and law enforcement gear manufacturers and distributors, perfect for showcasing AirBoss's specialized polymer and rubber solutions.

Participation allows AirBoss to gather real-time market intelligence, understanding emerging trends and competitive landscapes. This direct feedback loop is invaluable for product development and strategic planning, ensuring AirBoss remains at the forefront of its specialized markets.

Online Presence and Corporate Website

AirBoss leverages its corporate website as a crucial hub for global outreach, offering comprehensive product information, investor relations updates, and timely company news. This digital platform ensures broad accessibility for stakeholders worldwide.

The website is a key channel for transparency, providing access to essential financial reports and press releases, which are vital for informed decision-making by investors and analysts. For instance, in their 2024 investor presentations, the company highlighted the website's role in disseminating quarterly earnings reports and strategic updates.

- Website Functionality: Serves as a primary source for product catalogs, investor relations materials, and company news.

- Information Accessibility: Provides global access to financial reports and press releases, enhancing transparency.

- Investor Engagement: Facilitates communication with shareholders and potential investors through dedicated sections.

- Brand Representation: Acts as a digital storefront, showcasing AirBoss's capabilities and market position.

Distributors and Resellers (Limited for Specialized Products)

While AirBoss primarily focuses on direct sales for many of its specialized rubber products, it strategically utilizes a network of distributors and resellers to enhance market penetration, particularly in international arenas or for less customized finished goods. This approach allows for broader reach and leverages existing logistical expertise.

In 2023, AirBoss reported total revenue of approximately $235.9 million, with a portion of this revenue likely attributable to sales facilitated through these indirect channels, supporting its global footprint.

- Market Reach Expansion: Distributors and resellers provide access to markets where direct presence might be cost-prohibitive or logistically complex.

- Logistical Efficiency: These partners often possess established distribution networks, streamlining the delivery of products to end-users.

- Product Specialization: The use of specialized distributors is particularly relevant for niche or highly technical rubber products requiring specific sales expertise.

- Revenue Diversification: This channel can contribute to revenue streams by reaching customer segments that prefer or require intermediary purchasing.

AirBoss utilizes a direct sales force for industrial, automotive, and defense sectors, fostering deep client relationships and customized solutions. This approach was a key driver of demand for their engineered rubber products throughout 2024.

Government procurement portals are a vital channel for defense contracts, enabling access to large-scale orders. AirBoss actively participates in these processes, building on the billions in defense contracts awarded annually by the U.S. government.

Trade shows and conferences, such as the 2024 AUSA Annual Meeting and SHOT Show, are critical for engagement with industrial audiences, showcasing innovations and building new partnerships. These events also provide invaluable market intelligence.

The corporate website serves as a global information hub, offering product details, investor relations, and company news, enhancing transparency and accessibility for stakeholders worldwide. In 2024, the company continued to highlight the website's role in disseminating financial reports.

Distributors and resellers expand AirBoss's market reach, especially internationally, and improve logistical efficiency for specialized rubber products. In 2023, approximately $235.9 million in revenue was generated, with a portion likely coming from these indirect channels.

Customer Segments

Defense and military organizations worldwide represent a crucial customer segment for AirBoss Defense Group (ADG). These entities, including national defense departments and various military branches, have a persistent need for advanced Chemical, Biological, Radiological, and Nuclear (CBRN) protective equipment and other survivability solutions. ADG's established relationships and proven track record make it a significant supplier to major defense forces.

In 2024, the global defense spending is projected to reach approximately $2.2 trillion, underscoring the substantial market for specialized equipment. ADG's role as a key supplier to the U.S. Department of Defense, which accounts for a significant portion of this global expenditure, highlights its strategic importance. Furthermore, ADG's engagement with other international military forces demonstrates its broad reach and the universal demand for its protective technologies.

Automotive industry manufacturers, encompassing both vehicle makers and their critical Tier 1 and Tier 2 suppliers, represent a cornerstone customer segment for AirBoss. These companies depend on AirBoss for specialized anti-vibration and other molded rubber components that are fundamental to the assembly and performance of modern vehicles.

This segment is particularly vital for AirBoss's Manufactured Products division, driving a substantial portion of its revenue. For instance, in 2024, the automotive sector's resilience and ongoing demand for advanced materials continued to bolster AirBoss's performance, reflecting the segment's strategic importance.

The General Industrial Sector is a foundational customer segment for AirBoss, encompassing diverse industries that rely on specialized rubber solutions. This includes heavy industry, mining, construction, transportation, and the critical oil and gas sectors. These businesses often require custom-engineered rubber compounds and finished products designed for demanding environments and specific performance criteria.

For instance, in 2024, the global mining industry continued to invest heavily in infrastructure and equipment, driving demand for durable rubber components like conveyor belts and wear-resistant linings. Similarly, the construction sector's ongoing projects, especially in infrastructure development, necessitate robust rubber seals, hoses, and vibration dampeners. The transportation industry, from heavy-duty trucking to specialized rail applications, also represents a significant portion of this segment's needs for reliable rubber parts.

Healthcare and First Responders

This customer segment encompasses crucial entities like hospitals, emergency medical services, and public health organizations. These institutions have a consistent and urgent need for personal protective equipment (PPE), including isolation gowns and respiratory protection, particularly during public health crises. AirBoss has a proven track record of supplying vital PPE to these frontline responders and healthcare facilities.

AirBoss's commitment to this segment is underscored by its role in providing essential safety gear. For instance, during the COVID-19 pandemic, the demand for PPE surged dramatically. In 2020 alone, the global market for medical PPE was valued at approximately $82.5 billion, highlighting the critical nature of AirBoss's offerings to healthcare and first responders.

- Hospitals: Require consistent supply of isolation gowns, masks, and other protective wear for staff and patient safety.

- Emergency Services: Need durable and reliable respiratory protection and protective suits for paramedics and firefighters.

- Public Health Agencies: Procure PPE for distribution during outbreaks and for maintaining public health infrastructure.

- AirBoss's role: Providing specialized protective solutions tailored to the demanding environments faced by these critical services.

Specialty Product Manufacturers

Specialty product manufacturers represent a key customer segment for AirBoss, particularly those needing highly customized rubber compounds. These businesses rely on AirBoss's advanced compounding technology and significant research and development capabilities to create unique formulations tailored to their specific product requirements and manufacturing processes. For instance, in 2024, AirBoss continued to serve niche markets demanding bespoke material solutions, underscoring its role as a critical partner in innovation for these clients.

These manufacturers often operate in industries where material performance is paramount, such as aerospace, defense, and specialized industrial equipment. AirBoss's ability to engineer rubber compounds with specific properties like extreme temperature resistance, chemical inertness, or enhanced durability directly addresses these demanding applications. The company’s focus on R&D ensures that it can meet evolving industry standards and customer needs for cutting-edge material science.

- Customization: Companies requiring unique rubber compound formulations for proprietary products.

- Performance Demands: Clients in sectors like aerospace and defense needing materials with specific, high-performance characteristics.

- R&D Collaboration: Businesses that partner with AirBoss for material innovation and development.

AirBoss serves a diversified customer base, with defense and military organizations worldwide forming a critical segment for its Chemical, Biological, Radiological, and Nuclear (CBRN) protective gear. The automotive industry, including major manufacturers and suppliers, relies on AirBoss for essential anti-vibration and molded rubber components, a key revenue driver for its Manufactured Products division.

The General Industrial Sector, encompassing mining, construction, and transportation, also represents a foundational customer base, requiring robust, custom-engineered rubber solutions for demanding environments. Furthermore, healthcare institutions and emergency services depend on AirBoss for vital personal protective equipment (PPE), especially during public health emergencies.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Defense & Military | CBRN protection, survivability solutions | Global defense spending projected ~$2.2 trillion; ADG is a key supplier to the U.S. DoD. |

| Automotive | Anti-vibration, molded rubber components | Automotive sector resilience continued to bolster AirBoss performance in 2024. |

| General Industrial | Durable, custom rubber for mining, construction, transport | Mining investment drove demand for components; construction sector needs robust seals and dampeners. |

| Healthcare & Emergency Services | PPE, respiratory protection | Global medical PPE market valued at ~$82.5 billion in 2020, highlighting critical demand. |

Cost Structure

Raw material procurement is a major cost driver for AirBoss, with significant outlays for rubber, chemicals, and other compounding agents. For instance, in 2024, the company likely faced fluctuating prices for synthetic rubber, a key component, influenced by global petrochemical market dynamics.

This price volatility directly impacts AirBoss's profitability. Fluctuations in the cost of natural rubber, often tied to agricultural yields and global demand, also present a challenge that requires careful management of supplier relationships and inventory.

Manufacturing and Production Expenses are a significant component of AirBoss's cost structure. These encompass direct labor wages for the skilled workforce operating production lines, the substantial energy consumption required to power advanced manufacturing machinery, and ongoing maintenance costs to ensure the optimal functioning of their production facilities. For instance, in 2023, AirBoss reported that its cost of goods sold, which largely reflects these manufacturing expenses, was approximately $200 million, highlighting the scale of these operational outlays.

Managing these costs effectively is paramount to AirBoss's profitability. The company actively pursues strategies to optimize its production processes, seeking to streamline workflows and reduce waste. Furthermore, driving operational efficiencies through technological upgrades and lean manufacturing principles is a continuous focus, aiming to lower per-unit production costs and enhance overall competitiveness in the market.

AirBoss dedicates significant resources to its Research and Development Technical Center and Laboratory, a crucial element for staying ahead in advanced materials and survivability solutions. This ongoing investment covers personnel, state-of-the-art laboratory equipment, and rigorous testing protocols, all vital for driving innovation.

In 2023, AirBoss reported R&D expenses amounting to $6.5 million, representing approximately 3.5% of its total revenue for the year. This commitment underscores the company's strategy to continuously improve existing products and develop next-generation technologies to maintain its competitive advantage.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for AirBoss are crucial for supporting its operations and market presence. These costs cover everything from the salaries of the sales and marketing teams to the overhead of corporate functions and the administrative staff that keeps the business running smoothly. Efficient management of these expenses is key to maintaining profitability and operational effectiveness.

In 2024, AirBoss's SG&A expenses are projected to reflect continued investment in market expansion and operational efficiency. For example, companies in similar industrial sectors often allocate between 15% to 25% of their revenue to SG&A. AirBoss's specific allocation will be detailed in its upcoming financial reports, but it's expected to be managed to support growth initiatives without becoming a drag on performance.

- Sales & Marketing: Costs associated with promoting and selling AirBoss's diverse product lines, including advertising, commissions, and trade show participation.

- General & Administrative: Includes executive salaries, legal fees, accounting services, and other corporate overhead necessary for business management.

- Operational Support: Expenses related to human resources, IT infrastructure, and other back-office functions that enable day-to-day operations.

- Focus on Efficiency: AirBoss aims to optimize SG&A spending, ensuring that investments in these areas directly contribute to revenue generation and long-term business sustainability.

Logistics and Distribution Costs

AirBoss's cost structure is significantly influenced by logistics and distribution. These costs encompass everything from shipping products to customers worldwide, to managing inventory in warehouses. For example, in 2024, global shipping rates saw fluctuations, impacting the overall expense of moving goods across borders. Managing these international movements also involves navigating complex customs procedures and potential tariffs.

The company is proactively addressing the financial implications of international trade policies. AirBoss is actively evaluating contingency plans to mitigate the impact of potential tariffs on its distribution network and product pricing. This strategic foresight is crucial for maintaining competitive pricing and ensuring supply chain resilience in an evolving global economic landscape.

- Global Shipping Expenses: Costs associated with transporting finished goods from manufacturing facilities to customers.

- Warehousing and Inventory Management: Expenses related to storing products, managing stock levels, and order fulfillment.

- Cross-Border Logistics: Costs incurred for international shipping, including freight, insurance, and customs brokerage fees.

- Tariff Mitigation Strategies: Investments in planning and potentially adjusting sourcing or distribution to counter the impact of import duties.

AirBoss's cost structure is heavily weighted towards manufacturing and raw materials. In 2023, the cost of goods sold, largely reflecting manufacturing expenses, was approximately $200 million. This highlights the significant outlays for direct labor, energy consumption, and machinery maintenance necessary for their advanced production processes. The company actively pursues operational efficiencies and lean manufacturing principles to manage these substantial costs effectively.

| Cost Category | 2023 Data (Approximate) | Key Drivers |

| Raw Materials | Significant portion of COGS | Rubber, chemicals, compounding agents, price volatility |

| Manufacturing & Production | ~$200 million (COGS) | Direct labor, energy, maintenance, operational efficiency |

| R&D | $6.5 million (3.5% of revenue) | Personnel, equipment, testing for innovation |

| SG&A | Projected 15-25% of revenue (industry average) | Sales, marketing, administrative overhead, operational support |

| Logistics & Distribution | Influenced by global shipping rates and tariffs | Freight, warehousing, customs, tariff mitigation planning |

Revenue Streams

AirBoss generates substantial revenue through the sale of custom rubber compounds. These specialized formulations are tailored for diverse industrial applications, serving key sectors like automotive, mining, and construction. This product line is a cornerstone of their AirBoss Rubber Solutions segment.

In 2024, AirBoss continued to see strong demand for these custom compounds. For instance, the automotive industry's ongoing need for durable and specialized rubber components for vehicles, from seals to engine mounts, directly fuels this revenue stream. Similarly, the mining sector relies on these compounds for heavy-duty equipment parts that can withstand harsh conditions.

AirBoss generates significant income from selling finished rubber products. These include specialized items like anti-vibration components and other molded goods. The automotive sector and general industrial markets are the primary customers for these manufactured rubber items, making this a core revenue stream for AirBoss Manufactured Products.

AirBoss generates significant revenue by selling survivability and protective equipment, primarily through contracts with government agencies and defense organizations. These agreements cover essential items like personal protective equipment (PPE) and chemical, biological, radiological, and nuclear (CBRN) defense solutions. The company's offerings include specialized overboots, masks, and isolation gowns designed for high-threat environments.

The company has a strong track record of securing substantial government contracts, underscoring its critical role in national security and public health preparedness. For instance, in 2024, AirBoss continued to fulfill its long-standing contracts for CBRN protective equipment, demonstrating consistent demand for its specialized products.

Long-Term Supply Agreements

Long-term supply agreements provide AirBoss with a predictable and steady income stream. These contracts, especially with defense and government entities, often span multiple years, ensuring consistent demand for their products. As of the beginning of 2025, AirBoss had secured over $200 million in government contracts, highlighting the stability offered by these arrangements.

- Stable Revenue: Multi-year commitments from clients, particularly in the defense sector, generate reliable and recurring income.

- Contract Value: AirBoss entered 2025 with more than $200 million in government contracts, underscoring the significance of this revenue stream.

- Predictability: These agreements reduce revenue volatility and allow for better financial planning and resource allocation.

Licensing and Technology Transfer (Potential)

While not a current primary revenue source, AirBoss's proprietary compounds and advanced manufacturing technologies present a potential avenue for future income through licensing and technology transfer. This strategy leverages their innovative capabilities, allowing other companies to utilize their specialized knowledge or processes.

For instance, in 2024, the specialty chemicals sector saw significant growth in technology licensing deals, with many companies actively seeking to acquire or license novel material science advancements. AirBoss’s ongoing investment in research and development, particularly in areas like advanced rubber compounds and specialized polymers, positions them to capitalize on this trend.

- Potential Licensing: AirBoss's unique formulations for protective equipment and industrial applications could be licensed to manufacturers in related or new markets.

- Technology Transfer: Sharing their proprietary manufacturing processes or material science breakthroughs could generate revenue through technology transfer agreements.

- Market Opportunity: The global market for chemical and material science licensing is robust, with opportunities for companies holding unique intellectual property.

AirBoss's revenue streams are diverse, primarily driven by the sale of custom rubber compounds and finished rubber products. Additionally, significant income is generated through contracts for survivability and protective equipment, often with government entities.

In 2024, the company continued to benefit from strong demand in the automotive and mining sectors for its custom rubber compounds, essential for vehicle components and heavy-duty equipment. The sale of finished rubber products, such as anti-vibration parts, also remained a core revenue generator for their manufactured products segment.

Government contracts represent a crucial and stable revenue source, particularly for their specialized protective equipment, including CBRN solutions. As of early 2025, AirBoss held over $200 million in such contracts, highlighting the predictable income these long-term agreements provide.

| Revenue Stream | Key Products/Services | Primary Customers | 2024/2025 Relevance |

| Custom Rubber Compounds | Specialized rubber formulations | Automotive, Mining, Construction | Strong demand, essential for industrial applications |

| Finished Rubber Products | Molded rubber goods, anti-vibration components | Automotive, General Industrial | Core revenue for manufactured products |

| Survivability & Protective Equipment | PPE, CBRN defense solutions, overboots, masks | Government Agencies, Defense Organizations | Over $200M in contracts entering 2025, stable income |

Business Model Canvas Data Sources

The AirBoss Business Model Canvas is informed by a blend of internal financial data, extensive market research, and operational insights. This multifaceted approach ensures each component accurately reflects the company's strategic direction and market position.