AirBoss Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

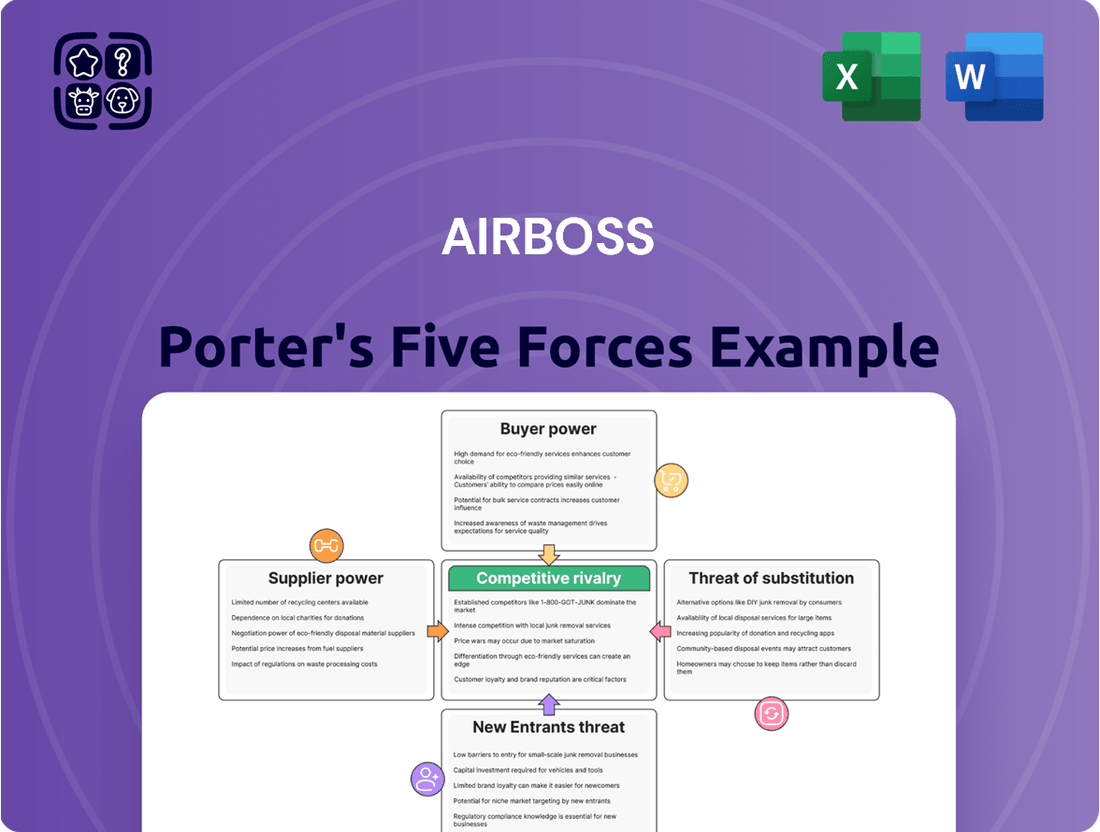

AirBoss faces moderate threats from new entrants and substitutes, while buyer and supplier power presents a significant challenge. Understanding these dynamics is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping AirBoss’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The price and availability of crucial raw materials like natural and synthetic rubber directly affect AirBoss's operational costs and profitability. For instance, in early 2025, natural rubber prices experienced notable volatility, driven by supply constraints stemming from aging rubber plantations and adverse weather conditions impacting harvests, directly increasing input expenses for AirBoss's rubber solutions segment.

AirBoss depends on a range of specialty chemicals for its rubber compounding processes. The global market for these chemicals is expanding, fueled by robust demand from industries like automotive and construction. This growth can potentially impact the pricing and consistent availability of these crucial inputs for AirBoss.

For highly specialized rubber compounds or unique survivability solutions, AirBoss may face a limited number of qualified suppliers. This scarcity directly enhances the bargaining power of these few suppliers, allowing them to potentially dictate terms and pricing. This situation is particularly acute in the defense sector, where stringent material specifications for survivability solutions leave little room for alternative sourcing.

Switching Costs

Switching suppliers for custom rubber compounds presents a significant hurdle for AirBoss. The costs associated with re-tooling manufacturing equipment, re-validating product specifications, and adjusting quality control protocols can be substantial. These investments create a lock-in effect, making it economically unfeasible for AirBoss to frequently change its rubber compound suppliers, thereby strengthening the suppliers' bargaining power.

The intricate nature of custom rubber formulations means that a new supplier would need extensive testing and approval processes to ensure consistent performance and quality. This can extend lead times and introduce production uncertainties for AirBoss. For instance, if a supplier has developed a proprietary compound that perfectly meets AirBoss's unique application requirements, finding an equivalent from another source could take months and considerable R&D investment.

- High Re-tooling Costs: Upgrading or modifying machinery to accommodate new rubber compounds can cost tens of thousands, if not hundreds of thousands, of dollars.

- Certification and Compliance: New materials often require rigorous testing and certification, especially in industries like automotive or defense, adding significant time and expense.

- Quality Control Adjustments: Ensuring consistent batch-to-batch quality with a new supplier demands meticulous monitoring and potential recalibration of existing processes.

Supplier Concentration

Supplier concentration is a crucial factor for AirBoss. If a small number of suppliers control the essential materials or parts AirBoss relies on, these suppliers gain significant leverage. This means they can potentially dictate higher prices or more stringent terms, directly impacting AirBoss's profitability and operational flexibility.

For instance, if AirBoss sources specialized rubber compounds, and only two or three global manufacturers produce these to the required specifications, those manufacturers hold considerable bargaining power. AirBoss must closely examine the number of viable suppliers for its critical inputs to gauge this influence effectively. In 2024, industries heavily reliant on niche materials often saw price increases driven by such concentrated supplier bases.

- High supplier concentration allows dominant suppliers to command premium pricing.

- AirBoss's reliance on a few key suppliers can lead to supply chain vulnerabilities.

- Assessing supplier market share is vital for understanding their bargaining power.

The bargaining power of suppliers is a significant factor for AirBoss, particularly concerning specialized rubber compounds and chemicals. High switching costs, due to re-tooling and certification needs, strengthen supplier leverage. In 2024, the automotive sector, a key market for AirBoss, saw increased material costs, with some specialty chemical prices rising by 5-10% due to supply chain pressures and demand growth.

| Input Material | Supplier Concentration | Impact on AirBoss | 2024 Price Trend (Est.) |

|---|---|---|---|

| Natural Rubber | Moderate to High | Affects raw material cost | Up 3-7% |

| Specialty Chemicals | Moderate | Impacts compounding costs | Up 5-10% |

| Proprietary Rubber Compounds | Low | High switching costs, strong supplier power | Stable to Up 5% |

What is included in the product

This analysis unpacks the competitive intensity within AirBoss's operating environment, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly visualize competitive pressures across all five forces with a dynamic, interactive dashboard.

Easily adapt the analysis to changing market dynamics by simply updating input data.

Customers Bargaining Power

AirBoss's diverse customer base, spanning automotive, industrial, and defense sectors, significantly dilutes the bargaining power of any single customer. For instance, in 2024, the automotive sector, while a key market, represented only a portion of AirBoss's overall revenue. This broad industry exposure means that a downturn or concentrated demand from one segment is less likely to cripple the company, as other sectors can absorb production or maintain demand.

AirBoss's defense contracts often involve government entities and major defense contractors as customers. These clients possess significant bargaining power, driven by the sheer volume of their orders and the mission-critical nature of the products supplied. For instance, in 2024, AirBoss secured a substantial contract with the U.S. Department of Defense for its survivability solutions, highlighting the scale of these relationships.

Customers in the automotive industry, especially Original Equipment Manufacturers (OEMs), exert significant bargaining power on suppliers like AirBoss. These OEMs frequently demand highly competitive pricing for rubber molded products and anti-vibration solutions, directly impacting AirBoss's profitability. In 2024, the automotive sector continued its focus on cost optimization, with many manufacturers pushing for price reductions to maintain their own margins in a competitive global market.

Customer Switching Costs

Customer switching costs for AirBoss, especially in demanding industrial sectors, can be a significant factor. Developing custom rubber compounds often involves intricate specifications and rigorous performance testing, making a change to a new supplier a complex and potentially costly undertaking.

These costs aren't just about the price of the new product; they encompass re-qualification processes, potential adjustments to manufacturing equipment, and the risk of unforeseen performance issues. For instance, a customer relying on a specific AirBoss compound for a critical automotive component might face substantial engineering and validation expenses to switch to an alternative, even if the initial price is lower.

- Moderate to High Switching Costs: Customers in sectors like automotive or aerospace face significant hurdles in changing compound suppliers due to stringent performance and safety requirements.

- Product Specification Complexity: AirBoss's ability to produce custom compounds means that each product is tailored, increasing the effort and expertise needed for a competitor to replicate it.

- Supply Chain Integration: Established relationships and integrated supply chains mean that switching suppliers can disrupt a customer's production schedules and inventory management.

- Validation and Re-qualification: For critical applications, customers must invest time and resources to validate and re-qualify new materials, adding to the overall cost of switching.

Price Sensitivity in Industrial Markets

In certain industrial markets, particularly for more standardized rubber goods, customers can exhibit significant price sensitivity. This means that AirBoss might find itself in a position where it needs to compete fiercely on price to secure business, potentially squeezing its profit margins. For instance, if a large automotive manufacturer is sourcing a common rubber component, they will likely solicit bids from multiple suppliers and choose the most cost-effective option, putting pressure on AirBoss's pricing strategies.

This high price sensitivity directly impacts AirBoss's profitability. When customers have many alternatives or when the product is seen as a commodity, they have greater leverage to demand lower prices. This can force AirBoss to absorb higher input costs or operate with thinner margins, especially in segments where differentiation is difficult. For example, in 2023, the average price of synthetic rubber, a key input for many industrial products, saw fluctuations that could exacerbate this pressure if passed directly to customers.

- Price Sensitivity: Customers in industrial markets, especially for commoditized rubber products, can be highly sensitive to price changes.

- Competitive Pressure: This sensitivity forces companies like AirBoss to engage in aggressive price competition, potentially impacting profitability.

- Input Cost Impact: Fluctuations in raw material costs, such as synthetic rubber prices, can amplify the pressure on AirBoss to maintain competitive pricing.

AirBoss faces varying degrees of customer bargaining power across its diverse markets. While its broad customer base in sectors like automotive and industrial generally dilutes individual customer influence, specific segments, particularly defense, involve powerful buyers. The automotive sector, a significant market for AirBoss, continues to emphasize cost optimization, leading to pricing pressures from Original Equipment Manufacturers (OEMs).

Customers in specialized industrial applications often face high switching costs due to the complexity of custom rubber compound specifications and rigorous validation processes. This complexity, coupled with supply chain integration, can moderate customer bargaining power. However, in more commoditized industrial markets, price sensitivity is higher, forcing AirBoss into competitive pricing scenarios that can impact margins.

| Customer Segment | Bargaining Power Factor | Impact on AirBoss | 2024 Relevance |

| Automotive OEMs | Price Sensitivity, Cost Optimization Focus | Pressure on pricing, potential margin squeeze | Continued emphasis on cost reduction by manufacturers |

| Defense Contractors/Government | Volume of Orders, Mission Criticality | Significant leverage due to scale and importance of products | Large contracts secured, highlighting buyer scale |

| Industrial (Custom Compounds) | High Switching Costs, Product Complexity | Reduced bargaining power due to supplier integration and validation needs | Customization requirements create barriers to switching |

| Industrial (Standardized Products) | Price Sensitivity, Availability of Alternatives | Increased price competition, potential for lower margins | Commoditization can lead to focus on cost-effectiveness |

Full Version Awaits

AirBoss Porter's Five Forces Analysis

The preview you see is the exact AirBoss Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the aerospace and defense sector. This document details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes, all crucial for understanding AirBoss's strategic positioning. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The custom rubber compounding market, AirBoss Rubber Solutions' operational arena, is characterized by significant fragmentation. This means there are many companies vying for business, which naturally fuels intense price competition and can put a strain on profit margins for all involved.

AirBoss itself holds the position of the second-largest custom rubber compounder in North America. This ranking underscores the highly competitive nature of the industry, where market share is hard-won and maintaining an edge requires constant strategic focus.

The competitive rivalry within the specialized defense market, particularly in the Chemical, Biological, Radiological, and Nuclear (CBRN) sector where AirBoss Defense Group operates, is intense. This segment is characterized by sophisticated technologies and high barriers to entry.

Established global players such as 3M Company, Avon Protection Systems, and Smiths Detection are significant competitors. These companies possess strong brand recognition, extensive research and development capabilities, and established relationships with defense ministries worldwide, offering a range of advanced detection, protection, and decontamination solutions.

The market's growth, driven by increasing global security concerns and military modernization programs, attracts new entrants and encourages existing players to innovate. For instance, in 2023, global defense spending reached an estimated $2.4 trillion, with a notable portion allocated to advanced protective equipment and detection systems, highlighting the significant market opportunity and the competitive pressure to capture market share.

AirBoss distinguishes itself by developing proprietary rubber compounds and advanced survivability technologies. This focus on unique, high-performance offerings, like their Molded AirBoss Lightweight Overboots (MALOs), directly challenges competitors who might rely on price alone. For instance, in 2024, AirBoss continued to invest in R&D, aiming to maintain its edge in specialized defense and industrial footwear.

Global and Regional Players

AirBoss operates in markets with a mix of global and regional competitors. This broad competitive landscape, including large chemical conglomerates, intensifies rivalry across its product lines.

The company contends with established international players who often possess significant scale and resources. For instance, in the rubber compounding sector, major global chemical firms can leverage their extensive supply chains and R&D capabilities, directly impacting AirBoss's market position.

- Global Competitors: Companies like Lanxess and Eastman Chemical are significant players in related chemical and material sectors, often competing for similar customer bases or raw material inputs.

- Regional Manufacturers: In specific geographic markets, smaller, agile regional players can offer localized solutions and pricing advantages, adding another layer of competitive pressure.

- Industry Consolidation: The broader industrial materials market has seen consolidation, with larger entities acquiring smaller firms, potentially increasing the competitive threat to independent players like AirBoss.

Economic Headwinds and Market Softness

Challenging economic conditions and market softness, as experienced by AirBoss in 2024, can intensify competitive rivalry. When the overall market shrinks, companies often fight harder for each available contract or sale. This dynamic can lead to increased price competition, reduced margins, and a greater focus on retaining existing customers.

For instance, if the industrial sector, a key market for AirBoss, experiences a slowdown, companies like AirBoss will likely face more aggressive bidding from competitors. This intensified competition puts direct pressure on sales volumes and overall profitability as companies strive to secure business in a more constrained environment.

- Intensified Competition: Economic headwinds in 2024 led to a more aggressive competitive landscape for AirBoss.

- Market Softness Impact: A softer market meant fewer opportunities, forcing companies to compete more fiercely for existing business.

- Margin Pressure: This increased rivalry often translates into downward pressure on pricing and, consequently, profit margins.

- Customer Retention Focus: Companies are likely prioritizing retaining their current customer base due to the difficulty of acquiring new business.

Competitive rivalry is a significant factor for AirBoss, operating in both fragmented custom rubber compounding and specialized defense markets. In the defense sector, established global players like 3M and Smiths Detection compete fiercely, particularly in the high-tech CBRN segment, where global defense spending reached an estimated $2.4 trillion in 2023. AirBoss differentiates itself through proprietary technologies and specialized products, like its MALOs, to counter this intense competition. The company also faces rivalry from large chemical conglomerates and regional manufacturers, with industry consolidation adding further pressure, especially during challenging economic conditions like the market softness experienced in 2024, which intensifies competition for contracts and can compress profit margins.

| Competitor Type | Key Players Example | Competitive Action | Market Impact |

|---|---|---|---|

| Global Defense Suppliers | 3M Company, Smiths Detection | Advanced technology, R&D investment, established relationships | High barriers to entry, intense competition for defense contracts |

| Global Chemical Conglomerates | Lanxess, Eastman Chemical | Scale, extensive supply chains, R&D capabilities | Pressure on raw material sourcing and pricing |

| Regional Manufacturers | Various smaller, agile firms | Localized solutions, pricing advantages | Fragmented market, increased competition for specific contracts |

SSubstitutes Threaten

The threat of substitutes for traditional rubber products is significant, with materials like advanced plastics, metals, and composites increasingly offering comparable or even enhanced performance. For instance, in the automotive sector, high-performance polymers are replacing rubber in seals and hoses due to their superior resistance to heat and chemicals. By 2024, the global plastics market alone was valued at over $1 trillion, demonstrating the scale of these alternatives.

While rubber is vital for automotive anti-vibration, the automotive industry is exploring alternatives. For instance, advancements in polyurethane and thermoplastic elastomers (TPEs) offer comparable or even superior performance in certain applications, potentially displacing traditional rubber. The global market for TPEs in automotive was projected to reach over $6 billion in 2024, highlighting a significant shift.

In the CBRN defense sector, AirBoss faces a threat from emerging technologies that could bypass traditional rubberized protective gear. Innovations in advanced materials, such as self-healing polymers or bio-integrated defenses, might offer superior protection or decontamination capabilities. For instance, research into novel chemical agents that neutralize threats instantly, rather than relying on physical barriers, could significantly alter the market landscape.

In-house Production by Customers

Large customers in sectors like automotive or industrial manufacturing might explore in-house production if the economics shift favorably, directly impacting AirBoss's custom rubber compounding and product manufacturing services.

This threat is amplified as companies increasingly seek greater control over their supply chains and production costs. For instance, a significant automotive OEM could potentially justify the capital expenditure for rubber compounding equipment if the volume of their needs reaches a certain threshold, making it cheaper than outsourcing. In 2024, the ongoing volatility in raw material prices for rubber compounds could further incentivize such vertical integration for major players seeking cost stability.

- Potential for vertical integration by large customers in automotive and industrial sectors.

- Economic viability of in-house production as a key driver for substitution.

- Supply chain control and cost reduction as motivations for customers to produce internally.

Durability and Lifespan of Products

The inherent durability and long lifespan of some of AirBoss's finished rubber products, like those used in industrial applications or defense, can paradoxically act as a subtle form of substitution threat. This is because a product that lasts for many years naturally reduces the frequency with which customers need to purchase replacements. For instance, if a critical component in a heavy-duty vehicle has an expected lifespan of 15 years, the demand for new units of that specific component will be significantly lower compared to a product with a 3-year lifespan.

This extended product life directly impacts the potential for new entrants or existing competitors to gain market share by offering superior longevity. If AirBoss's products are already perceived as highly durable, it makes it harder for competitors to differentiate on this factor. However, if a competitor were to develop a significantly longer-lasting alternative, it could disrupt the market by capturing customers who prioritize extended service life. For example, in the tire industry, which shares some material science with AirBoss's offerings, innovations in tread compounds and construction have led to tires lasting much longer, impacting the replacement cycle.

Consider the implications for AirBoss's revenue streams. A longer product lifespan means fewer repeat purchases within a given period. This necessitates a strategic focus on innovation, new product development, and potentially exploring service-based revenue models to maintain consistent sales growth. While durability is a positive attribute, its extreme manifestation can limit the velocity of market penetration for new offerings if the core product remains functional for an extended duration.

- Reduced Replacement Cycles: Products with lifespans exceeding a decade inherently lower the demand for new units, impacting sales volume.

- Competitive Differentiation: Competitors may struggle to gain traction if AirBoss's products are already perceived as exceptionally durable.

- Strategic Revenue Planning: Companies must account for extended product lifespans when forecasting sales and planning for new product introductions.

The threat of substitutes for traditional rubber products is significant, with materials like advanced plastics, metals, and composites increasingly offering comparable or even enhanced performance. For instance, in the automotive sector, high-performance polymers are replacing rubber in seals and hoses due to their superior resistance to heat and chemicals. By 2024, the global plastics market alone was valued at over $1 trillion, demonstrating the scale of these alternatives.

While rubber is vital for automotive anti-vibration, the automotive industry is exploring alternatives. For instance, advancements in polyurethane and thermoplastic elastomers (TPEs) offer comparable or even superior performance in certain applications, potentially displacing traditional rubber. The global market for TPEs in automotive was projected to reach over $6 billion in 2024, highlighting a significant shift.

In the CBRN defense sector, AirBoss faces a threat from emerging technologies that could bypass traditional rubberized protective gear. Innovations in advanced materials, such as self-healing polymers or bio-integrated defenses, might offer superior protection or decontamination capabilities. For instance, research into novel chemical agents that neutralize threats instantly, rather than relying on physical barriers, could significantly alter the market landscape.

Large customers in sectors like automotive or industrial manufacturing might explore in-house production if the economics shift favorably, directly impacting AirBoss's custom rubber compounding and product manufacturing services. This threat is amplified as companies increasingly seek greater control over their supply chains and production costs. For instance, a significant automotive OEM could potentially justify the capital expenditure for rubber compounding equipment if the volume of their needs reaches a certain threshold, making it cheaper than outsourcing. In 2024, the ongoing volatility in raw material prices for rubber compounds could further incentivize such vertical integration for major players seeking cost stability.

The inherent durability and long lifespan of some of AirBoss's finished rubber products, like those used in industrial applications or defense, can paradoxically act as a subtle form of substitution threat. This is because a product that lasts for many years naturally reduces the frequency with which customers need to purchase replacements. For instance, if a critical component in a heavy-duty vehicle has an expected lifespan of 15 years, the demand for new units of that specific component will be significantly lower compared to a product with a 3-year lifespan.

| Threat of Substitutes | Key Factors | Impact on AirBoss | 2024 Market Data/Trends |

| Material Substitution (e.g., Plastics, Composites, TPEs) | Superior performance (heat/chemical resistance), cost-effectiveness, technological advancements. | Loss of market share in specific applications, pressure on pricing. | Global plastics market > $1 trillion in 2024; Automotive TPE market projected > $6 billion in 2024. |

| Technological Advancements (e.g., Advanced materials in defense) | Novel protection mechanisms, enhanced decontamination, bypassing physical barriers. | Obsolescence of existing product lines, need for R&D investment. | Ongoing research into self-healing polymers and bio-integrated defenses. |

| Customer Vertical Integration | Desire for supply chain control, cost reduction, stable raw material pricing. | Reduced demand for AirBoss's compounding and manufacturing services. | Volatility in raw material prices in 2024 incentivizes vertical integration for large OEMs. |

| Product Longevity | Extended product lifespans reduce replacement frequency. | Lower repeat purchase rates, need for strategic revenue planning and innovation. | Tire industry innovations leading to longer lifespans impacting replacement cycles. |

Entrants Threaten

The rubber compounding and specialized rubber product manufacturing sectors demand substantial upfront capital. This includes acquiring advanced machinery, setting up production facilities, and investing in research and development to meet stringent quality and performance standards. For instance, setting up a modern rubber compounding plant can easily cost tens of millions of dollars.

AirBoss's deep investment in proprietary rubber compounding technology and advanced survivability solutions creates a significant barrier to entry. Developing these specialized formulations and the associated manufacturing expertise requires substantial time and capital, making it difficult for newcomers to compete effectively.

Building deep, trust-based relationships with existing customers is a significant barrier. For instance, AirBoss, a leader in specialized rubber products for defense and automotive sectors, has cultivated long-standing partnerships that are difficult for newcomers to replicate. These relationships often involve custom solutions and a proven track record of reliability.

Furthermore, obtaining critical industry certifications, such as those required for military specifications or automotive safety standards, is a lengthy and resource-intensive process. These certifications act as a de facto barrier, as new entrants must invest heavily in compliance and validation before they can even bid on contracts, let alone secure them.

Regulatory Hurdles and Compliance

The defense and specialized chemical industries, where AirBoss operates, face formidable regulatory barriers. New entrants must navigate complex compliance protocols, including export controls, environmental standards, and safety certifications. For instance, the International Traffic in Arms Regulations (ITAR) in the US, which governs defense articles and services, imposes significant costs and administrative burdens. Companies lacking established compliance departments and experience can find these requirements prohibitive.

These regulatory demands translate into substantial upfront investment and ongoing operational costs. New companies must dedicate resources to understanding and adhering to a multitude of national and international regulations. Failure to comply can result in severe penalties, including fines and loss of operating licenses, making the cost of entry exceptionally high.

The strict oversight in these sectors also limits the speed at which new players can enter the market. Obtaining necessary approvals and certifications can be a lengthy process, often taking years. This extended lead time provides an advantage to established firms like AirBoss, which have already invested in and proven their ability to meet these stringent requirements.

- ITAR Compliance: Defense sector companies must adhere to regulations like ITAR, impacting product development and sales.

- Environmental Regulations: Specialized chemical production faces strict EPA and equivalent global standards.

- Safety Certifications: Meeting rigorous safety standards for materials and manufacturing processes is mandatory.

- Long Approval Cycles: Gaining necessary government and industry certifications can take several years.

Supply Chain Complexity

The intricate nature of supply chains poses a significant barrier for new companies entering the specialized industrial products market. Establishing robust relationships with suppliers for diverse raw materials, many of which may have specific quality or sourcing requirements, is a substantial undertaking. For instance, companies in sectors like advanced manufacturing or specialized chemicals often rely on a global network of suppliers, each with its own lead times, quality control processes, and potential geopolitical risks. In 2024, global supply chain disruptions, including port congestion and labor shortages, continued to impact companies, underscoring the difficulty for new entrants to navigate these complexities efficiently and cost-effectively.

Distributing specialized products across a wide array of industries, each with unique logistical needs and regulatory environments, further complicates market entry. New players must develop efficient distribution networks, manage inventory across different channels, and ensure timely delivery of often critical components. The cost associated with building and maintaining such a sophisticated distribution infrastructure can be prohibitive, especially when competing against established players who benefit from economies of scale and existing partnerships. The ongoing evolution of logistics technology and sustainability mandates also add layers of complexity that new entrants must address from the outset.

- Supply Chain Setup Costs: New entrants face substantial upfront investment in securing reliable raw material sources and building distribution networks.

- Supplier Dependency: Reliance on a limited number of specialized suppliers can create vulnerabilities for new market participants.

- Logistical Expertise: The need for specialized knowledge in handling and distributing diverse industrial products adds to the operational challenge.

- Market Access: Gaining access to established distribution channels and customer bases is a gradual and often costly process for new entrants.

The threat of new entrants for AirBoss is relatively low due to significant capital requirements, proprietary technology, and established customer relationships. For example, the specialized rubber compounding sector demands substantial upfront investment in advanced machinery, easily reaching tens of millions of dollars for a modern plant.

Moreover, developing unique rubber formulations and securing necessary industry certifications, such as those for defense or automotive sectors, represents a considerable hurdle. These certifications can take years to obtain, creating a prolonged lead time that favors established players like AirBoss.

The complex regulatory landscape, including ITAR compliance in the defense industry, further deters new entrants by imposing significant costs and administrative burdens. Navigating these stringent requirements necessitates established compliance departments and experience, which newcomers typically lack.

Finally, building robust supply chains and efficient distribution networks for specialized industrial products is a costly and time-consuming endeavor. In 2024, ongoing global supply chain disruptions highlighted the difficulty for new entrants to manage these complexities effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AirBoss leverages a comprehensive dataset including company annual reports, investor presentations, and industry-specific market research from firms like IBISWorld. We also incorporate data from financial news outlets and government regulatory filings to provide a robust understanding of the competitive landscape.