AirBoss Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

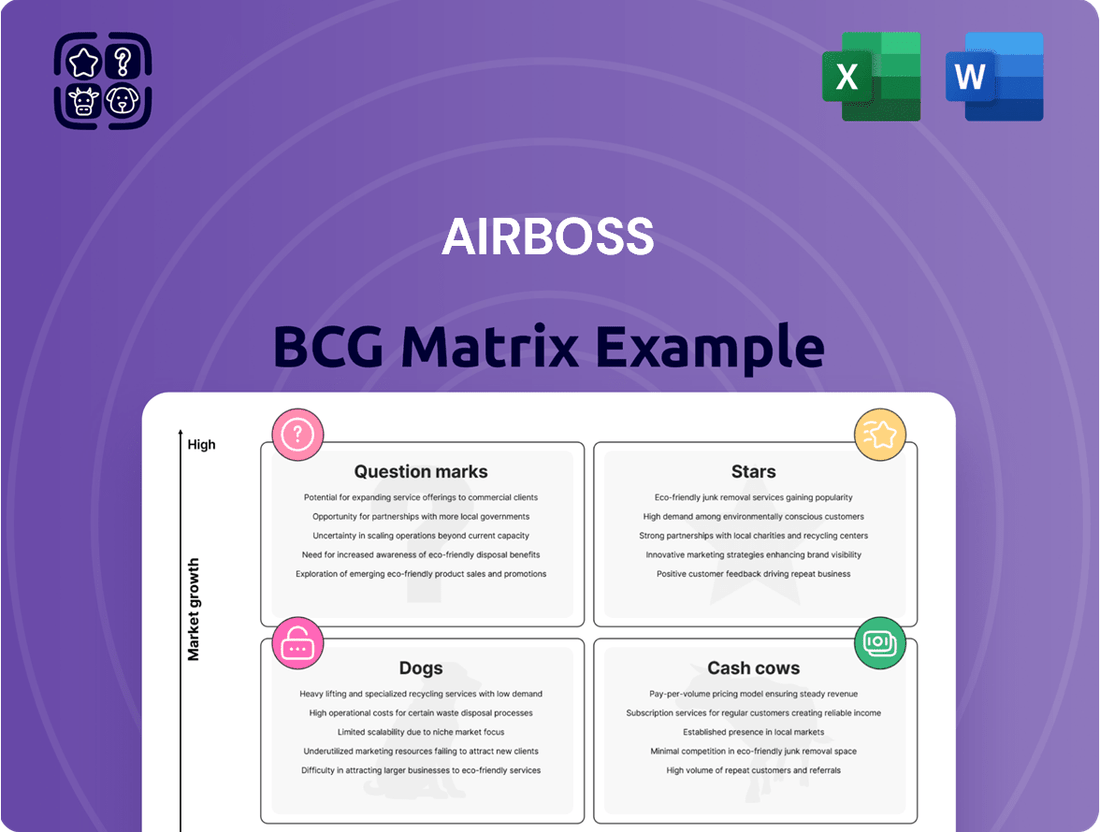

Unlock the secrets to this company's strategic product portfolio with our AirBoss BCG Matrix analysis. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

Ready to move beyond this snapshot? Purchase the full AirBoss BCG Matrix for a comprehensive breakdown, including detailed data, actionable recommendations, and a clear roadmap to optimize your investments and product strategy.

Stars

AirBoss Defense Group's (ADG) specialized CBRN protective equipment, including their Molded AirBoss Lightweight Overboots (MALOs) and Low Burden Masks (LBMs), are experiencing robust demand. The company recently secured an $82.3 million contract for MALOs from the U.S. Government, alongside additional orders totaling up to $15.6 million from Swiss Defense Forces and a partner nation, with deliveries beginning in Q2 2025. This strong order pipeline and the expanding CBRN defense market, which is anticipated to see substantial growth, highlight the strategic importance of these offerings.

The Molded AirBoss Lightweight Overboots (MALOs) represent a significant strength for AirBoss in the defense sector. This product has a long history of success, with AirBoss having supplied overboots to the United States for more than two decades.

To date, AirBoss has sold an impressive 6.1 million pairs of MALOs to over sixty countries, demonstrating their widespread adoption and reliability in military applications. This consistent demand underscores the product's established market position.

A recent $82.3 million indefinite-delivery, indefinite-quantity (IDIQ) contract awarded by the U.S. Government, with deliveries scheduled to begin in the second quarter of 2025, further validates the high demand for MALOs. This substantial contract points to continued growth and a robust market for these essential military overboots.

The ADG Low Burden Masks (LBMs) represent a significant growth area for AirBoss, with recent orders reaching up to US$6.4 million from a partner nation. These respirators are designed for military use and are notably lightweight, enhancing user comfort and operational effectiveness. Their consistent sales to various partner nations since 2017 highlight a stable and growing demand in the defense market.

The ongoing acquisition of LBMs, alongside other key products like MALOs, clearly demonstrates the robust demand for AirBoss's advanced respiratory protection systems within the global defense industry. This sustained interest reinforces the strategic importance of LBMs within AirBoss's product portfolio.

Defense Business Overall

AirBoss's defense business, a key component of its AirBoss Manufactured Products (AMP) segment, is demonstrating significant growth and is well-positioned as a Star in the BCG matrix. This segment experienced a robust recovery in the first quarter of 2025, with net sales surging by 26.6%, largely fueled by defense-related products.

The positive momentum follows a more challenging period in 2024. This turnaround is attributed to the successful acquisition of new contracts and the initiation of shipments for previously secured programs. The company's strategic emphasis on defense offerings, combined with an increasing global demand for advanced survivability solutions, underpins its Star status.

- Defense Net Sales Growth: Q1 2025 saw a 26.6% increase in net sales for the defense business.

- Drivers of Growth: New contract awards and the commencement of shipments for existing programs are key contributors.

- Market Position: Strong global demand for survivability solutions supports the defense segment's Star classification.

- Strategic Focus: AirBoss's dedicated strategy towards defense products is a primary factor in its current success.

Advanced Survivability Solutions

AirBoss's advanced survivability solutions represent a significant growth engine, focusing on comprehensive protection against chemical, biological, radiological, and nuclear (CBRN) threats.

The company's deep expertise and established ties with government defense entities solidify its leadership in this vital and expanding market segment.

With ongoing investment in research and development, AirBoss is poised to capitalize on increasing global defense expenditures and geopolitical instability, driving sustained growth in this area.

- CBRN Protection Focus: AirBoss offers a suite of advanced solutions designed to shield personnel and equipment from CBRN hazards, a critical need in modern defense.

- Government Partnerships: Long-standing relationships with government agencies provide AirBoss with a stable customer base and insights into evolving defense requirements.

- Growth Drivers: Geopolitical uncertainties and a general increase in global defense spending are expected to fuel demand for these specialized survivability products.

- Innovation Investment: Continued commitment to innovation ensures AirBoss remains at the forefront of protective technologies, supporting its growth trajectory.

AirBoss's defense business is a clear Star in the BCG matrix, showcasing high market growth and a strong competitive position. The segment's recent performance, particularly the 26.6% surge in net sales in Q1 2025, driven by new defense contracts and product shipments, underscores this status. This robust growth is further supported by the increasing global demand for advanced survivability solutions, a market where AirBoss has established significant expertise.

| Product Category | Market Growth | AirBoss Market Share | Recent Performance (Q1 2025) |

|---|---|---|---|

| CBRN Protective Gear (MALOs, LBMs) | High | Strong | 26.6% Net Sales Growth |

| Defense Contracts | High | Leading | $82.3M U.S. Govt. MALO Contract |

| Global Defense Spending | High | Growing | Increased demand for survivability solutions |

What is included in the product

The AirBoss BCG Matrix provides a strategic overview of business units based on market growth and share.

It guides decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Clear, actionable insights to navigate portfolio complexity and resource allocation.

Cash Cows

Custom Rubber Compounding, represented by AirBoss Rubber Solutions (ARS), stands as a robust Cash Cow within the AirBoss BCG Matrix. As North America's second-largest custom rubber compounder, ARS boasts an impressive annual capacity of 500 million turn pounds, underscoring its significant market presence and established leadership.

Despite experiencing some volume softness in the first quarter of 2025, ARS demonstrated strong performance throughout 2024. This success was driven by strategic growth in specialty compounding, which yielded higher profit margins, showcasing the segment's ability to generate substantial cash flow.

The consistent and significant cash flow generated by ARS is a key characteristic of a Cash Cow. This financial strength allows AirBoss to strategically reinvest capital into other business segments, fostering overall company growth and development.

AirBoss Rubber Solutions' established industrial rubber compounds are a prime example of a Cash Cow. The company benefits from long-standing relationships and a loyal customer base across sectors like automotive, construction, and mining. This consistent demand, even amidst industry cycles, ensures stable revenue streams and healthy profit margins.

In 2024, AirBoss Rubber Solutions continued to leverage these mature product lines, which represent a significant portion of their revenue. Their focus on operational efficiency, including diligent management of overhead costs and ongoing process improvements, directly contributes to the strong cash generation these compounds provide, reinforcing their Cash Cow status within the BCG framework.

Despite a dip in overall sales volume for AirBoss Rubber Solutions in 2024, their specialty compounding segment proved to be a robust cash generator. This division achieved higher profit margins by concentrating on niche, high-value rubber compounds, demonstrating strong profitability even in a potentially slower market.

This strategic focus on specialty compounding highlights its role as a key contributor to AirBoss's cash flow. The company is actively pushing rubber compounding as a cornerstone for sustained growth and enhanced productivity, with a clear emphasis on pioneering advancements in custom rubber formulations.

Anti-Vibration Solutions

AirBoss's anti-vibration solutions serve the North American automotive industry, a sector that, while mature, provides a stable base for this product line. The company's established presence likely translates to strong customer loyalty and a consistent need for these essential vehicle components.

This product category is a prime example of a Cash Cow within AirBoss's portfolio. It operates in a high market share niche, generating reliable cash flow that can support other business areas. For instance, in 2024, the automotive sector, despite its cyclical nature, continued to see demand for aftermarket and essential parts, contributing to the steady revenue streams for suppliers like AirBoss.

- Mature Market: North American automotive sector.

- Product Strength: High market share in its niche.

- Financial Contribution: Generates steady, consistent cash flow.

- 2024 Relevance: Continued demand for essential automotive components supported stability.

Base Rubber Product Portfolio

AirBoss's base rubber product portfolio forms the bedrock of its operations, serving diverse industries from general manufacturing to specialized applications. These foundational offerings, while not experiencing rapid expansion, leverage the company's robust manufacturing infrastructure and deeply entrenched market position.

These products are key cash generators, providing a steady stream of revenue and profit that underpins AirBoss's financial stability. For instance, in fiscal year 2023, AirBoss reported total revenue of $237.4 million, with a significant portion likely attributable to these established product lines. Their consistent performance allows for reinvestment into other business segments and supports overall corporate growth initiatives.

- Stable Revenue Generation: The base rubber products consistently contribute to AirBoss's top line, demonstrating resilience across various economic cycles.

- Manufacturing Leverage: AirBoss's extensive manufacturing capabilities are fully utilized by these high-volume products, optimizing operational efficiency.

- Market Presence: An established customer base and strong brand recognition in these segments ensure continued demand.

- Profitability: These products are likely managed for optimal profitability, acting as reliable cash cows for the company.

AirBoss Rubber Solutions' established industrial rubber compounds are a prime example of a Cash Cow. The company benefits from long-standing relationships and a loyal customer base across sectors like automotive, construction, and mining. This consistent demand, even amidst industry cycles, ensures stable revenue streams and healthy profit margins.

In 2024, AirBoss Rubber Solutions continued to leverage these mature product lines, which represent a significant portion of their revenue. Their focus on operational efficiency, including diligent management of overhead costs and ongoing process improvements, directly contributes to the strong cash generation these compounds provide, reinforcing their Cash Cow status within the BCG framework.

The consistent and significant cash flow generated by ARS is a key characteristic of a Cash Cow. This financial strength allows AirBoss to strategically reinvest capital into other business segments, fostering overall company growth and development.

AirBoss's base rubber product portfolio forms the bedrock of its operations, serving diverse industries from general manufacturing to specialized applications. These foundational offerings, while not experiencing rapid expansion, leverage the company's robust manufacturing infrastructure and deeply entrenched market position.

| Product Category | BCG Status | Key Characteristics | 2024 Performance Indicator | Financial Contribution |

| Custom Rubber Compounding (ARS) | Cash Cow | High market share, established leadership, strong customer base | Volume softness Q1 2025, strong 2024 driven by specialty compounding | Generates substantial cash flow for reinvestment |

| Anti-vibration Solutions (Automotive) | Cash Cow | Mature market, high niche market share, stable demand | Steady revenue from essential components | Reliable cash flow supporting other business areas |

| Base Rubber Products | Cash Cow | Diverse industry service, robust manufacturing leverage, established market position | Consistent revenue and profit contribution | Underpins financial stability, enables reinvestment |

What You See Is What You Get

AirBoss BCG Matrix

The AirBoss BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive immediately after purchase. This means no watermarks or placeholder content; you get the complete, professionally formatted strategic tool ready for immediate application.

Rest assured, the BCG Matrix report you see here is the exact file that will be delivered to you upon completing your purchase. It's a comprehensive, analysis-ready document designed for clarity and strategic decision-making, with no hidden surprises.

Dogs

The general rubber molded products segment, distinct from defense applications, faced headwinds in early 2025, with Q1 sales reflecting diminished volume and an unfavorable product mix. This trend continues a pattern observed in 2024, which saw both declining sales and squeezed profit margins for these offerings.

This performance suggests that AirBoss's non-defense rubber molded products likely hold a modest market share or operate in low-growth segments. Without the infusion of new major contracts or a significant positive shift in market dynamics, this business unit may continue to present challenges in achieving robust profitability.

Tolling volume within AirBoss Rubber Solutions experienced a sharp decline, dropping by 76.3% in the first quarter of 2025. For the entirety of 2024, the decrease was 61.8%. This significant contraction points towards a potentially weak or shrinking market position for this particular service, characteristic of a 'Dog' in a BCG Matrix analysis.

The reduced tolling volume directly impacted the Rubber Solutions segment's profitability, contributing to a decrease in overall gross profit. This financial performance further solidifies the assessment of tolling volume as a potential 'Dog' requiring strategic re-evaluation.

Legacy PPE, specifically non-CBRN medical gowns and gloves, likely falls into the Dogs category of the BCG Matrix for AirBoss. This is due to a significant non-cash write-down of $58.3 million in 2023 impacting their defense products segment, largely attributed to excess nitrile glove and isolation gown inventory.

The market for general medical PPE is characterized by low growth and high competition, with AirBoss's market share potentially limited outside of niche defense applications. Without being tied to high-value, ongoing defense contracts, these products face a saturated commercial market with low demand, indicating a weak competitive position and limited future prospects.

Products Affected by Tariffs

AirBoss has openly discussed the challenges posed by tariffs, noting their impact on sales and volumes within specific business areas. Products that are particularly sensitive to cross-border trade dynamics or rely on raw materials subject to tariffs, especially where AirBoss doesn't possess a distinct competitive edge, would likely fall into the Dogs category of the BCG Matrix.

These external economic pressures can directly diminish the profitability and overall market appeal of such product lines. For instance, in 2024, the company has been managing the effects of tariffs on certain imported components, which can increase production costs and potentially squeeze margins on finished goods that face price competition.

- Tariff Impact: AirBoss has reported that tariffs have created headwinds, affecting sales and volumes in specific product segments.

- Cross-Border Reliance: Products heavily dependent on cross-border operations or specific tariff-affected raw materials are more vulnerable.

- Competitive Disadvantage: Where AirBoss may not hold a strong competitive advantage, tariff-affected products are more likely to be classified as Dogs.

- Profitability Squeeze: External economic factors like tariffs can reduce profit margins and market attractiveness for these product lines.

Underperforming Automotive Market Products

Within the North American automotive sector, AirBoss's anti-vibration and molded solutions might face challenges in specific product lines. This softness can stem from broader Original Equipment Manufacturer (OEM) production cuts or shifts in consumer demand. For instance, if AirBoss's molded rubber components are primarily used in vehicle segments experiencing a downturn, such as certain sedans or less popular SUV models, these products could be classified as underperformers.

The automotive industry in 2024 has seen a mixed performance. While electric vehicle (EV) sales continue to grow, traditional internal combustion engine (ICE) vehicle production faced supply chain adjustments and fluctuating demand. AirBoss’s market share in specific, declining automotive segments could mean that certain molded rubber products are not meeting revenue expectations. For example, if a particular molded part is integral to a vehicle model that has seen its sales plummet by over 20% year-over-year, it would likely be flagged for review.

- Product Dependence on Declining Segments: Molded rubber products tied to vehicle models with decreasing sales volumes are at risk of underperformance.

- Lower Market Share in Specific Niches: If AirBoss holds a smaller market share in segments experiencing a slowdown, these products are more susceptible to being classified as underperformers.

- OEM Production Reductions: Broader cuts in vehicle production by major OEMs directly impact the demand for AirBoss’s automotive components.

- Shifting Consumer Preferences: A move away from certain vehicle types, like traditional sedans, can render related AirBoss products less desirable and thus underperforming.

AirBoss's tolling volume has significantly declined, with a 76.3% drop in Q1 2025 and a 61.8% decrease in 2024. This sharp contraction indicates a weak or shrinking market for this service, characteristic of a 'Dog' in the BCG Matrix. The reduced volume directly impacted Rubber Solutions' profitability, further solidifying its classification as an underperformer.

Legacy PPE, specifically non-CBRN medical gowns and gloves, also appears to be a 'Dog'. This is evidenced by a substantial $58.3 million non-cash write-down in 2023 due to excess inventory. The commercial market for these items is low-growth and highly competitive, suggesting a limited market share and weak future prospects for AirBoss in this area.

Products sensitive to tariffs, where AirBoss lacks a strong competitive edge, are likely 'Dogs'. In 2024, tariffs on imported components increased production costs, squeezing margins on finished goods facing price competition. These external economic pressures diminish the profitability and market appeal of such product lines.

Certain automotive molded rubber products, tied to declining vehicle segments or OEM production cuts, could be classified as 'Dogs'. For example, components for vehicle models experiencing significant sales drops, like a 20% year-over-year decline in a particular sedan, would likely be underperformers. The mixed performance of the automotive industry in 2024, with growth in EVs but adjustments in ICE production, highlights this risk.

| Business Unit/Product Line | BCG Category | Key Indicators |

|---|---|---|

| Tolling Volume (Rubber Solutions) | Dog | -76.3% Q1 2025 volume decline -61.8% 2024 volume decline Impacted profitability |

| Legacy PPE (Non-CBRN Gowns/Gloves) | Dog | $58.3M 2023 inventory write-down Low-growth, high-competition market Limited commercial demand |

| Tariff-Sensitive Products | Dog | Increased production costs due to tariffs (2024) Squeezed profit margins Lack of distinct competitive edge |

| Automotive Molded Products (Specific Segments) | Dog | Dependence on declining vehicle models Impacted by OEM production cuts Potential for significant sales drops in associated models |

Question Marks

AirBoss's new silicone production line in Michigan represents a strategic move into specialty compounding, a segment with high growth potential. This venture, launched in 2024, is positioned as a Question Mark within the BCG framework due to its nascent stage and likely low current market share. Significant investment is anticipated to scale operations and capture market share.

Diversified rubber molded products represent a key area for AirBoss Manufacturing's growth strategy. The company is actively expanding its offerings into new markets, moving beyond its established automotive and defense sectors.

While these new product lines target growing segments within the general rubber products market, AirBoss currently holds a low or unestablished market share in these areas. This positions them as question marks in the BCG framework, requiring careful consideration for investment and resource allocation.

For instance, the global industrial rubber products market was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of around 4% through 2030. AirBoss’s expansion into areas like specialized industrial hoses or custom-molded components for renewable energy infrastructure, for example, would fall into this category.

AirBoss Rubber Solutions is actively pursuing growth by investing in innovative custom compound niches. These specialized areas are designed to capture high-growth segments within the rubber market, leveraging technological advancements to differentiate their offerings. This strategy aims to expand market share and enhance diversification by broadening their product portfolio into these emerging, yet still developing, areas.

The success of these innovative custom compounds hinges on market acceptance and sustained research and development investment. While specific market share figures for these nascent niches are not yet substantial, the company's commitment to R&D signals a forward-looking approach. For example, in 2024, AirBoss continued to focus on developing advanced materials for sectors like electric vehicles and renewable energy, where custom rubber compounds play a critical role.

Potential New Geographic Market Expansions

Expanding into new geographic markets, particularly internationally, aligns with AirBoss's strategic goal of increasing its global footprint. These markets often represent untapped potential where the company currently has a minimal presence, making them prime candidates for growth. For instance, in 2023, AirBoss reported that its international sales represented a smaller portion of its overall revenue, highlighting the significant upside in these regions.

These expansion efforts are categorized as Stars or Question Marks in the BCG matrix due to their high-growth potential coupled with AirBoss's current low market share. Such ventures demand considerable initial investment in market research, establishing distribution channels, and tailoring products to local needs. For example, entering the European market might require compliance with stringent environmental regulations like REACH, necessitating upfront R&D and operational adjustments.

- Focus on high-growth regions: Prioritize markets with robust industrial activity and a demonstrated need for AirBoss's specialized compounds and products.

- Strategic market entry: Develop tailored entry strategies for each new geography, considering local competition, regulatory landscapes, and customer preferences.

- Investment in infrastructure: Allocate capital for building necessary infrastructure, including sales offices, distribution networks, and potentially local manufacturing or finishing capabilities.

- Partnership opportunities: Explore strategic alliances or joint ventures with local entities to accelerate market penetration and mitigate risks.

Products under Strategic Review

AirBoss is undertaking a strategic review of its Manufactured Products segment, aiming to streamline its defense product portfolio. This initiative signals a move towards prioritizing core competencies and potentially divesting or deprioritizing products that haven't met performance expectations or don't align with the company's central strengths.

The review process suggests that some products, even within potentially expanding markets, may have experienced underperformance or a misalignment with AirBoss's core capabilities. This uncertainty about future market share necessitates a careful re-evaluation or additional investment for these offerings.

- Focus on Core Competencies: AirBoss is strategically narrowing its defense product range to concentrate on areas where it holds a competitive advantage.

- Performance Metrics: Products under review may be those that have not achieved targeted market share or revenue growth, despite operating in potentially favorable market conditions. For example, in 2023, AirBoss reported that its Manufactured Products segment revenue was $167.5 million, a slight decrease from $172.1 million in 2022, indicating a need for strategic adjustments.

- Market Alignment: The review aims to ensure that all remaining products strongly align with the company's long-term strategic vision and operational strengths.

- Future Uncertainty: Without significant strategic recalibration or investment, the future market position of certain products remains uncertain, prompting this proactive review.

Question Marks in AirBoss's portfolio represent new ventures or product lines with high growth potential but currently low market share. These require careful investment decisions to determine if they can become Stars. For instance, AirBoss's new silicone production line, launched in 2024, is a prime example of a Question Mark. Its success depends on capturing market share in a growing specialty compounding segment.

AirBoss's expansion into new geographic markets also falls into the Question Mark category. While these regions offer significant untapped potential, AirBoss's current presence is minimal. For example, entering the European market in 2024 necessitated understanding regulations like REACH, demanding upfront investment and strategic planning to build market share.

The company's focus on innovative custom compound niches, such as advanced materials for electric vehicles, also represents Question Marks. These areas are characterized by high growth potential but require substantial R&D and market acceptance to gain traction. In 2024, AirBoss continued to invest in these developing areas, aiming to build future market leadership.

The strategic review of certain defense products within the Manufactured Products segment also highlights potential Question Marks. Products that haven't met performance expectations or lack alignment with core strengths, despite operating in potentially growing markets, require careful evaluation. AirBoss's 2023 revenue for this segment was $167.5 million, a slight decrease from 2022, underscoring the need for strategic focus on these uncertain ventures.

| Business Unit/Product Line | Market Growth | Relative Market Share | BCG Classification | Strategic Consideration |

| New Silicone Production (Michigan) | High | Low | Question Mark | Invest to gain market share or divest if potential is low. |

| Diversified Rubber Molded Products (New Markets) | High | Low | Question Mark | Requires significant investment in market entry and product development. |

| Innovative Custom Compounds (e.g., EV materials) | High | Low | Question Mark | Focus on R&D and market acceptance to convert into Stars. |

| Certain Defense Products (Under Review) | Moderate to High | Low/Uncertain | Question Mark | Strategic review to determine continued investment or divestment. |

BCG Matrix Data Sources

Our AirBoss BCG Matrix leverages comprehensive data from financial reports, market research, and internal operational metrics to provide a clear strategic overview.