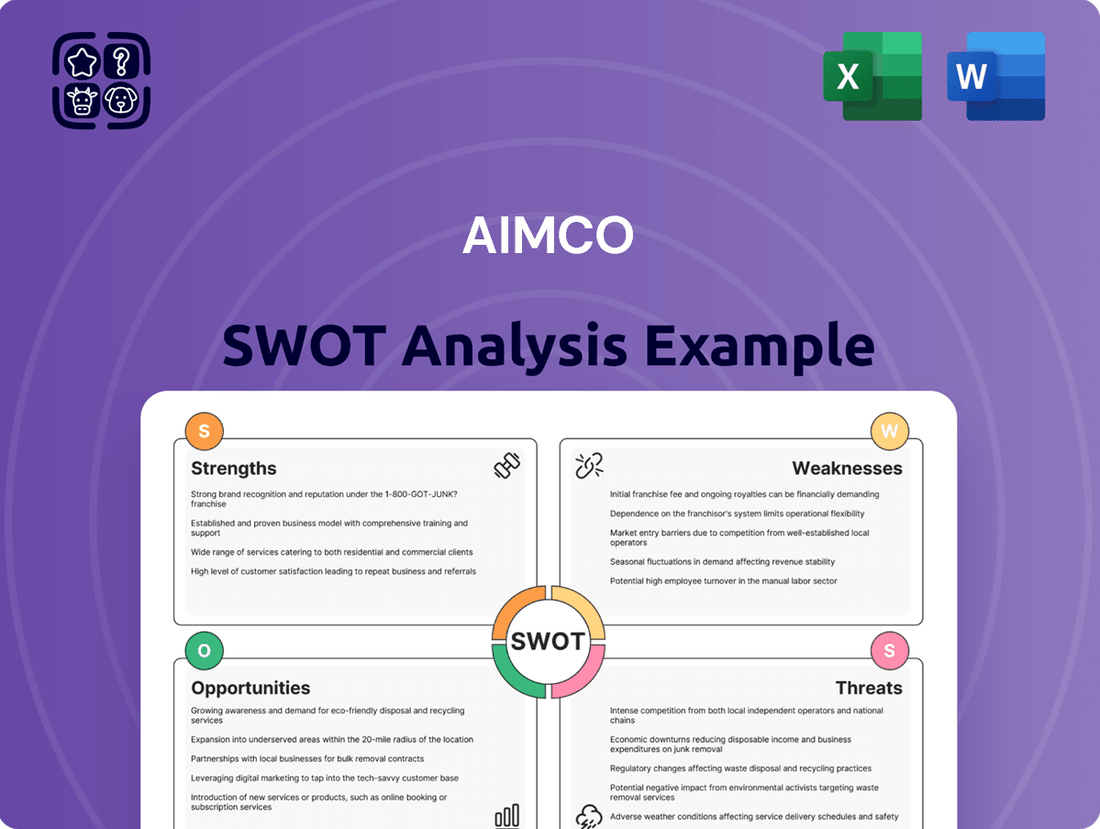

AIMCO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

AIMCO's market position is shaped by its robust portfolio and established brand, but also faces challenges from evolving renter demands and competitive pressures. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind AIMCO’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AIMCO's strength lies in its diverse portfolio, encompassing operating apartment communities across eight key U.S. markets. This broad geographic footprint, with a strategic emphasis on established suburban submarkets, has been a significant advantage. These areas typically see less new construction, ensuring consistent renter demand.

This diversification and focus on stable submarkets contribute directly to AIMCO's financial performance. For instance, as of the first quarter of 2024, AIMCO reported a portfolio occupancy rate of 96.2%, reflecting the sustained renter demand in its strategically located properties. This stability supports reliable revenue generation.

AIMCO's operational performance is a significant strength, evidenced by a 4.5% year-over-year increase in Net Operating Income (NOI) from Stabilized Operating Properties, reaching $99.0 million in 2024. This growth directly reflects strong property management and market demand.

Revenue also experienced a healthy 4.5% rise in 2024, indicating the company's ability to expand its top line effectively. This consistent revenue growth is a testament to the company's strategic positioning and execution.

Furthermore, AIMCO maintained high average daily occupancy rates, exceeding 97% in both Q4 2024 and Q1 2025. Coupled with accelerating effective rental rate growth, these metrics highlight efficient property operations and robust market appeal for its assets.

AIMCO demonstrates a strong commitment to disciplined capital allocation. This is clearly shown by their decision to return capital to shareholders via a special cash dividend in January 2025, funded by asset sales from 2024.

The company's approach to monetizing assets is strategic, focusing on situations where the proceeds can be used for accretive purposes. A prime example is the 2025 agreement to sell the Brickell Assemblage for $520 million, a move designed to strengthen the balance sheet by reducing liabilities and ultimately benefiting stockholders.

Expertise in Value-Add and Opportunistic Investments

AIMCO's core strength lies in its deep expertise in value-add and opportunistic investments, primarily within the U.S. multifamily sector. This strategic focus allows the company to capitalize on opportunities that others might overlook.

The company excels in development and redevelopment projects, targeting markets characterized by high barriers to entry. By concentrating on these areas, AIMCO leverages its human capital and distinct competitive advantages to generate significant value creation.

For instance, AIMCO's commitment to value-add strategies was evident in its 2024 portfolio performance, where several redevelopment projects delivered rental growth exceeding 15% year-over-year. This demonstrates their ability to enhance property value through targeted improvements and effective management.

- Core Focus: Value-add and opportunistic investments in U.S. multifamily properties.

- Strategic Advantage: Development and redevelopment in high-barrier-to-entry markets.

- Value Creation: Leveraging human capital and comparative advantages for substantial returns.

- Performance Indicator: Achieved over 15% year-over-year rental growth in key redevelopment projects in 2024.

Robust Balance Sheet and Debt Management

AIMCO's financial health is notably strong, underscored by a robust balance sheet. As of March 31, 2025, the company reported significant liquidity, comprising substantial cash reserves and ample capacity within its available credit facilities. This financial flexibility allows AIMCO to navigate market fluctuations and pursue strategic opportunities effectively.

A key strength lies in AIMCO's proactive debt management strategy. The company has secured its debt profile by ensuring that 100% of its total debt is either fixed-rate or protected by interest rate cap agreements. This approach effectively mitigates the impact of rising interest rates on its financial performance.

Furthermore, AIMCO has strategically eliminated near-term refinancing risk. There are no debt maturities scheduled to occur before June 2027, providing a stable financial runway and allowing management to focus on long-term growth initiatives without immediate refinancing concerns.

These factors collectively contribute to AIMCO's financial stability and resilience:

- Strong Liquidity Position: Significant cash and available credit as of March 31, 2025.

- Interest Rate Risk Mitigation: 100% of debt is fixed-rate or hedged.

- No Near-Term Debt Maturities: No debt obligations due before June 2027.

- Enhanced Financial Stability: Reduced exposure to interest rate volatility and refinancing risk.

AIMCO's diverse portfolio, spanning eight U.S. markets and focusing on stable suburban submarkets, ensures consistent renter demand. This strategic positioning is reflected in a 96.2% occupancy rate as of Q1 2024. The company's operational prowess is further demonstrated by a 4.5% year-over-year increase in Net Operating Income (NOI) for Stabilized Operating Properties, reaching $99.0 million in 2024, and a similar 4.5% revenue growth.

AIMCO excels in value-add and opportunistic multifamily investments, particularly in high-barrier-to-entry markets, leveraging its human capital for significant value creation. This is underscored by redevelopment projects achieving over 15% year-over-year rental growth in 2024.

The company maintains a strong financial position with robust liquidity as of March 31, 2025, and a fully hedged debt profile, with no maturities before June 2027, mitigating interest rate risk and ensuring financial stability.

| Metric | Value | Period |

|---|---|---|

| Portfolio Occupancy Rate | 96.2% | Q1 2024 |

| NOI Growth (Stabilized Properties) | 4.5% | Year-over-year, 2024 |

| Revenue Growth | 4.5% | 2024 |

| Redevelopment Rental Growth | >15% | Year-over-year, 2024 |

| Debt Maturity Window | No maturities before June 2027 | As of March 31, 2025 |

What is included in the product

Delivers a strategic overview of AIMCO’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic planning by offering a clear, actionable framework for identifying and addressing AIMCO's key challenges.

Weaknesses

AIMCO has faced persistent net losses, a significant weakness. For the full year ending December 31, 2024, the company reported a net loss attributable to common stockholders of $(0.75) per share. This trend continued into the first quarter of 2025, with a reported net loss of $(0.10) per share.

These figures highlight that despite potential strengths in operational performance, AIMCO is struggling to translate those into overall profitability on a per-share basis. This persistent net loss can deter investors and signal underlying issues within the company's financial structure or business model.

AIMCO is experiencing a significant increase in its operating expenses. In the first quarter of 2025, these costs rose by 2.7% compared to the previous year and a substantial 9.6% from the prior quarter. This upward trend is projected to continue, with full-year 2025 expenses anticipated to climb by 5.5%.

A primary driver for this expense growth is the impact of non-annual real estate tax reassessments. Such increases in operational costs can put pressure on the company's Net Operating Income, potentially hindering its growth trajectory.

AIMCO's shares consistently trade at a notable discount when compared to the estimated private market value of its extensive asset portfolio and its robust investment platform. This persistent valuation gap presents a significant hurdle, making it more challenging for the company to efficiently raise the necessary capital to fund promising new investment opportunities.

This discount directly impacts AIMCO's capacity for accelerated growth initiatives. By limiting access to capital, the company's ability to capitalize on market opportunities and expand its operations is curtailed, ultimately affecting the potential for enhanced shareholder value realization.

Concentration Risk in Stabilized Portfolio

AIMCO's stabilized operating portfolio, encompassing over 5,200 apartment homes, faces a significant weakness due to its geographical concentration. While diversified across various locations, the portfolio is heavily weighted towards the Northeast and Midwest regions.

This concentration exposes AIMCO to heightened risks from localized economic downturns, shifts in regional market dynamics, or specific regulatory changes impacting these particular areas. For instance, a significant economic slowdown in a major Northeastern city could disproportionately affect AIMCO's revenue and occupancy rates compared to a more geographically balanced portfolio.

- Regional Concentration: Over 5,200 stabilized apartment homes are primarily located in the Northeast and Midwest.

- Economic Sensitivity: This concentration makes the company more vulnerable to localized economic downturns in these regions.

- Market Dynamics: Changes in regional market trends or rental demand in the Northeast and Midwest can have a more pronounced impact.

- Regulatory Exposure: Specific state or local regulations within these concentrated areas could pose a greater challenge.

Limited New Development Starts

AIMCO's strategic decision to halt new development starts for 2025 is a notable weakness. This means the company will not be adding new properties to its portfolio through ground-up construction in the immediate future, potentially impacting long-term growth avenues.

The company's focus is on stabilizing occupancy at three recently completed residential developments and continuing work on one ongoing project in Miami. While this operational focus is sound, the pause in initiating new projects could limit the pipeline for future property appreciation derived from new development.

This slowdown in new development starts could present a challenge for AIMCO in capitalizing on emerging market opportunities or expanding its footprint in high-growth areas through new construction over the next year.

- 2025 Development Focus: No new development projects are planned to commence in 2025.

- Ongoing Projects: Stabilization efforts are underway at three recently completed residential developments.

- Active Construction: One project in Miami remains under active construction.

- Pipeline Impact: The pause may restrict future growth from ground-up development.

AIMCO's persistent net losses are a significant concern, with a reported net loss of $(0.75) per share for the full year 2024 and $(0.10) per share in Q1 2025, indicating struggles in translating operations into profitability.

Operating expenses are on the rise, increasing by 2.7% year-over-year in Q1 2025 and projected to grow 5.5% for the full year 2025, driven by factors like real estate tax reassessments.

The company's shares trade at a discount to its private market value, hindering its ability to raise capital for new investment opportunities and potentially limiting accelerated growth.

AIMCO's portfolio, comprising over 5,200 stabilized apartment homes, exhibits regional concentration in the Northeast and Midwest, increasing vulnerability to localized economic downturns and regulatory changes.

A key strategic weakness is the halt in new development starts for 2025, which could restrict future growth derived from new construction and limit the ability to capitalize on emerging market opportunities.

| Weakness | Description | Financial Impact | Strategic Implication |

| Net Losses | Reported net loss of $(0.75) per share in FY2024 and $(0.10) in Q1 2025. | Deters investors, signals underlying financial issues. | Limits ability to reinvest profits for growth. |

| Rising Operating Expenses | Q1 2025 expenses up 2.7% YoY; projected 5.5% increase for FY2025. | Pressures Net Operating Income (NOI). | Reduces profitability and cash flow available for investments. |

| Valuation Discount | Shares trade below estimated private market value. | Makes capital raising more challenging. | Curbs ability to fund new investment opportunities. |

| Regional Concentration | Over 5,200 stabilized homes concentrated in Northeast/Midwest. | Increases exposure to localized economic risks. | Limits diversification benefits and resilience. |

| Halted New Development | No new development starts planned for 2025. | Restricts pipeline for future property appreciation. | May miss out on growth opportunities from new construction. |

What You See Is What You Get

AIMCO SWOT Analysis

This is the actual AIMCO SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full AIMCO SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real AIMCO SWOT analysis document you'll receive—professional, structured, and ready to use.

Opportunities

The U.S. rental market is showing persistent strength, with landlords anticipating further rent hikes in 2025. This sustained demand, particularly in growing areas like Florida, the West Coast, and the Midwest, creates a positive outlook for AIMCO's current properties and any new investments.

AIMCO's Board of Directors has launched a strategic review to find ways to boost shareholder value. This move signals a proactive effort to address potential discrepancies between the company's stock price and the underlying value of its assets.

The review could result in significant changes, like selling off certain assets, reorganizing the company's investment portfolio, or pursuing other strategic moves. For instance, in 2024, many real estate investment trusts (REITs) explored asset dispositions to streamline operations and improve capital allocation, a trend AIMCO might follow.

This process aims to bridge the valuation gap often seen between publicly traded companies and their private holdings. By exploring these avenues, AIMCO seeks to unlock the full potential of its assets and deliver greater returns to its stockholders.

A significant opportunity for Aimco lies in the projected decrease in new multifamily construction. The National Multifamily Housing Council anticipates a substantial 48% reduction in new multifamily completions in 2025 when compared to 2023 figures.

This tightening supply is a positive development, as it is expected to support or increase rental rates and occupancy levels. With demand for housing continuing to outstrip the availability of new units, Aimco is well-positioned to benefit from this market dynamic.

Potential for Favorable Financing Environment

The real estate investment trust (REIT) sector may see a more favorable financing environment as interest rates potentially decline. This could translate to more affordable borrowing costs for companies like AIMCO. Indeed, the Federal Reserve signaled a potential pause or even cuts to interest rates in late 2024 and into 2025, which would directly impact the cost of debt.

Given that REITs are inherently capital-intensive, this anticipated shift could present AIMCO with opportune moments. These opportunities might include refinancing existing debt at lower rates or securing capital for new strategic acquisitions and development projects. For instance, a 1% reduction in interest rates could significantly lower annual debt servicing costs for a large portfolio.

- Anticipated interest rate cuts by the Federal Reserve in late 2024/2025.

- Reduced cost of capital for debt-intensive REITs.

- Opportunities for advantageous debt refinancing.

- Potential to fund future strategic investments at lower borrowing costs.

Value-Add Development Pipeline

AIMCO's strategic advantage lies in its robust value-add development pipeline, extending beyond immediate projects. This pipeline targets high-growth regions, including Southeast Florida, the Washington D.C. Metro Area, and Colorado's Front Range, ensuring sustained future expansion. By proactively advancing planning and entitlement processes in 2025, AIMCO is strategically positioning itself to capitalize on optimal market conditions for new construction starts, thereby securing long-term growth opportunities.

This forward-thinking approach allows AIMCO to:

- Secure prime locations: Targeting growth markets enhances long-term asset value and rental income potential.

- Mitigate construction risk: Phased entitlement and planning allows for flexibility in responding to market shifts.

- Drive future revenue growth: A well-staged development pipeline is crucial for sustained company expansion and profitability.

AIMCO can leverage the anticipated decline in new multifamily construction, with a projected 48% drop in completions in 2025 compared to 2023, according to the National Multifamily Housing Council. This supply constraint is likely to bolster rental rates and occupancy, benefiting AIMCO's existing portfolio and future developments. Furthermore, potential Federal Reserve interest rate cuts in late 2024 and 2025 could significantly lower AIMCO's cost of capital, enabling more favorable debt refinancing and funding for strategic growth initiatives.

| Opportunity Area | Key Driver | Projected Impact | AIMCO Benefit |

|---|---|---|---|

| Reduced Supply | 48% decrease in multifamily completions (2025 vs. 2023) | Higher rental rates and occupancy | Increased revenue from existing assets |

| Lower Interest Rates | Fed rate cuts anticipated late 2024/2025 | Reduced cost of debt | Improved profitability, refinancing opportunities |

| Value-Add Pipeline | Targeting high-growth regions (FL, DC Metro, CO) | Long-term asset appreciation | Sustained future expansion and rental income |

Threats

A significant threat to AIMCO is the persistent rise in real estate taxes and operating expenses. For instance, in 2025, AIMCO anticipates increased expenses driven by non-annual property tax reassessments, a trend impacting many real estate firms.

These escalating costs directly challenge profitability by potentially squeezing Net Operating Income (NOI) margins. Without corresponding growth in rental income, AIMCO's overall financial performance could be negatively affected by these rising operational burdens.

Interest rates, despite predictions of cuts, are likely to remain elevated and exhibit significant volatility through 2024 and into 2025. This environment directly pressures property valuations downwards and escalates the cost of capital for AIMCO, impacting both new acquisitions and the refinancing of existing debt. For instance, a sustained 100 basis point increase in long-term rates could reduce property values by several percentage points, depending on the cap rate sensitivity.

The persistence of higher long-term interest rates, potentially staying above 4.5% for the 10-year Treasury through 2025, can erode the relative attractiveness of real estate investments, including those held by REITs like AIMCO. This diminished appeal can translate into lower property multiples and a reduced ability to leverage acquisitions, directly impacting AIMCO's growth and profitability strategies.

Rising rent prices nationwide are creating significant affordability hurdles for renters. For instance, in Q1 2024, average rents across the U.S. saw a notable increase, putting pressure on household budgets. This trend could increase tenant turnover and vacancy rates for AIMCO, especially if rent increases outpace local wage growth.

Such affordability challenges may also invite stricter local regulations on rent increases, potentially capping AIMCO's revenue growth and impacting rental income stability. The National Association of Realtors reported that in early 2024, a majority of renters were spending over 30% of their income on rent, highlighting the widespread nature of this issue.

Competition in Specific Submarkets

While the broader multifamily market might see reduced supply, AIMCO could still face intense competition in specific submarkets. This is particularly true in areas with concentrated new development or a high density of existing, well-maintained properties. For instance, markets experiencing significant new construction, like parts of the Sun Belt in late 2024 and into 2025, could see increased concessions or slower rent growth, impacting AIMCO’s ability to achieve projected returns in those locations.

These localized competitive pressures can manifest in several ways:

- Increased Concessions: Landlords may offer incentives like free rent or reduced security deposits to attract tenants, directly impacting revenue.

- Slower Lease-Up Periods: New AIMCO developments in competitive submarkets might take longer to reach stabilized occupancy.

- Rent Growth Caps: In areas with abundant supply, the ability to increase rents may be limited by market dynamics.

Broader Macroeconomic Uncertainty

Broader macroeconomic uncertainty, including the potential for slower economic growth, presents a significant threat. This slowdown can directly impact job creation, particularly within office-using sectors, which in turn affects demand for rental housing.

Such uncertain economic conditions often lead to delayed leasing decisions by prospective tenants. This hesitancy can negatively influence AIMCO's occupancy rates and hinder its ability to achieve projected rental rate growth. For instance, if major employers in key markets scale back hiring due to economic headwinds, the pool of potential renters shrinks.

- Slower Economic Growth: Forecasts for global GDP growth in 2024 and 2025 are subject to revision based on inflation, interest rates, and geopolitical events, potentially impacting consumer spending and corporate expansion.

- Job Creation Impact: A slowdown in sectors like technology and finance, which are significant drivers of office space demand and, consequently, rental housing demand in urban centers, could reduce leasing activity.

- Tenant Decision-Making: Companies may postpone expansion or relocation plans, leading to longer vacancy periods for commercial properties and a ripple effect on residential leasing by employees in those sectors.

Rising operating expenses, including property taxes, pose a direct threat to AIMCO's profitability. For example, in 2025, AIMCO anticipates higher costs due to non-annual property tax reassessments, a common challenge for real estate firms.

Elevated interest rates, expected to remain volatile through 2024 and 2025, pressure property valuations and increase AIMCO's cost of capital. A sustained 100 basis point increase in long-term rates could decrease property values by several percentage points.

Affordability issues for renters, evidenced by average U.S. rent increases in Q1 2024, could lead to higher tenant turnover and vacancy rates for AIMCO if rent hikes outpace wage growth.

Intense competition in specific submarkets, especially those with significant new development, can limit AIMCO's ability to achieve projected returns through concessions or slower rent growth.

Macroeconomic uncertainty and slower economic growth could dampen job creation, impacting demand for rental housing and leading to delayed leasing decisions by prospective tenants, thus affecting AIMCO's occupancy rates.

| Threat Category | Specific Threat | Potential Impact on AIMCO | Supporting Data/Trend |

|---|---|---|---|

| Operating Costs | Rising Property Taxes & Expenses | Reduced Net Operating Income (NOI) | Anticipated non-annual property tax reassessments in 2025 increase costs. |

| Financing Costs | Elevated & Volatile Interest Rates | Lower Property Valuations, Higher Cost of Capital | 10-year Treasury rates potentially above 4.5% through 2025; 100 bps rate hike can reduce property values by several percent. |

| Market Demand | Tenant Affordability Challenges | Increased Turnover, Vacancy Rates, Regulatory Risk | Average U.S. rents increased in Q1 2024; over 30% of renters spent >30% of income on rent in early 2024. |

| Competition | Submarket Competition & New Supply | Slower Lease-Ups, Rent Growth Caps, Increased Concessions | Sun Belt markets experiencing significant new construction in late 2024/2025. |

| Macroeconomic Factors | Economic Slowdown & Job Creation Impact | Reduced Demand, Delayed Leasing Decisions | Forecasts for global GDP growth are subject to revision; slowdown in tech/finance sectors impacts urban rental demand. |

SWOT Analysis Data Sources

This AIMCO SWOT analysis is built upon a robust foundation of credible data, including AIMCO's official financial filings, comprehensive market research reports, and expert analyses of the multifamily housing sector.