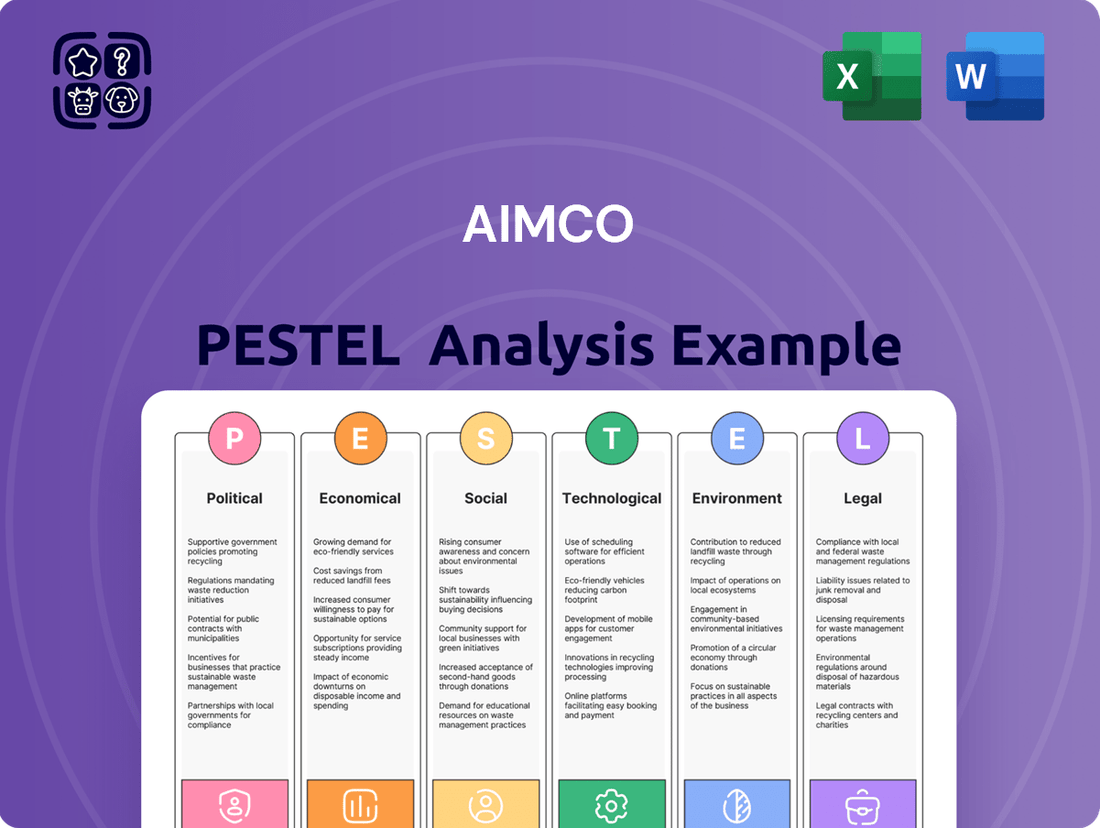

AIMCO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

Gain a critical advantage by understanding the external forces shaping AIMCO's future. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company. Equip yourself with actionable intelligence to refine your strategies and anticipate market shifts. Download the full PESTLE analysis now for unparalleled strategic clarity.

Political factors

Government housing policies, encompassing zoning laws, land development regulations, and affordability initiatives, significantly shape AIMCO's capacity to secure, build, and oversee properties. For instance, in 2024, several states, including California and Oregon, have enacted legislation to streamline the approval process for multifamily housing and reduce restrictive zoning, aiming to boost housing supply.

Shifts in these policies, such as those targeting increased housing availability or the promotion of affordable housing options, present both potential advantages and hurdles for AIMCO. A 2025 report by the National Association of Home Builders indicated that while some areas are easing development rules, others are imposing stricter environmental reviews, creating a mixed regulatory landscape.

The potential for rent control legislation remains a significant political consideration for AIMCO. This could manifest at federal, state, or local levels, directly impacting rental income streams and property valuations. For instance, states like California have implemented statewide rent caps, with the Tenant Protection Act of 2019 limiting annual rent increases to 5% plus inflation for many properties, capping it at 10%.

Changes in tax policies, such as property taxes and corporate income taxes, directly influence AIMCO's financial health. For instance, a rise in property taxes in key operating regions could increase AIMCO's expenses, potentially impacting net operating income. Conversely, new tax incentives for developing affordable housing or implementing energy-efficient upgrades could boost profitability and encourage strategic investments.

Real Estate Investment Trust (REIT) specific regulations are also critical. Changes to REIT taxation, like modifications to dividend distribution rules or capital gains treatment, can affect AIMCO's attractiveness to investors and its overall cost of capital. For example, if new legislation narrows the scope of deductible expenses for REITs, it could lead to a higher effective tax rate for AIMCO, impacting its earnings per share.

Monetary policy shifts are intrinsically linked to REIT performance, and by extension, AIMCO. When central banks adjust interest rates, it affects the cost of borrowing for real estate acquisitions and development. Higher interest rates, a common response to inflationary pressures, can increase AIMCO's financing costs, potentially slowing down expansion plans and reducing the value of existing properties due to higher discount rates used in valuations.

Political Stability and Economic Climate

Political stability is a cornerstone for a healthy economy, directly influencing investor sentiment and consumer behavior. When governments implement predictable fiscal and monetary policies, it fosters an environment conducive to long-term investment and robust consumer spending, which are critical drivers for the rental housing market. For instance, the federal funds rate, a key monetary policy tool, stood at 4.25%-4.5% as of May 2025, reflecting the Federal Reserve's stance on inflation and economic growth, thereby impacting borrowing costs and investment decisions across sectors, including real estate.

Uncertainty, conversely, can significantly deter investment. Periods of political instability or unpredictable policy shifts can lead to capital flight and a general reluctance to commit resources, particularly in sectors requiring substantial, long-term capital outlays like residential development and management. This hesitancy directly translates to a cooling effect on the rental housing market, as developers may postpone new projects and investors may seek safer havens for their capital.

- Political Stability: A predictable and stable political landscape encourages sustained investment in the rental housing sector.

- Economic Climate: Government fiscal and monetary policies, such as the federal funds rate (4.25%-4.5% in May 2025), shape the broader economic environment, influencing investor confidence and consumer spending.

- Investor Confidence: Stable political conditions boost investor confidence, leading to increased capital flow into real estate.

- Consumer Spending: A strong economy, supported by sound fiscal and monetary policies, typically results in higher consumer spending, benefiting the rental market through increased demand.

Infrastructure Spending and Urban Planning

Government investment in infrastructure and urban planning is a significant political factor. For instance, the US government's Infrastructure Investment and Jobs Act, enacted in 2021, allocates substantial funds towards improving transportation networks and public works. This increased spending on projects like public transit expansions and urban revitalization can directly boost the desirability and value of properties in affected areas, potentially increasing demand for AIMCO's real estate holdings.

Strategic alignment with these government-driven urban development plans is crucial. As of early 2024, many cities are actively pursuing master plans that prioritize mixed-use development and improved public amenities. By integrating its property development strategies with these initiatives, AIMCO can position itself to benefit from enhanced property appreciation and sustained tenant interest.

Furthermore, federal land development initiatives can play a role in addressing housing shortages. For example, discussions around repurposing underutilized federal land for housing development are ongoing in various regions as of mid-2024. Such programs could create new opportunities for property development and contribute to market stability, indirectly benefiting real estate investment firms like AIMCO.

Key infrastructure and urban planning trends impacting AIMCO include:

- Increased federal funding for public transportation projects, enhancing accessibility to urban centers.

- Local government focus on urban renewal and mixed-use development zones, creating vibrant communities.

- Potential for federal land repurposing to address housing supply gaps, influencing market dynamics.

- Government incentives for sustainable urban development and green infrastructure.

Government housing policies, including zoning and affordability initiatives, directly impact AIMCO's development capabilities. For instance, California and Oregon streamlined multifamily housing approvals in 2024, while other regions introduced stricter environmental reviews, creating a varied regulatory landscape by 2025.

Rent control legislation remains a significant political risk, with states like California capping annual rent increases. Changes in property and corporate taxes also affect AIMCO's profitability, with potential impacts from increased property taxes or benefits from affordable housing development incentives.

Monetary policy, exemplified by the Federal Reserve's May 2025 federal funds rate of 4.25%-4.5%, influences borrowing costs and property valuations. Political stability is crucial for investor confidence and consumer spending, directly benefiting the rental housing market.

| Political Factor | Description | Impact on AIMCO | 2024/2025 Data/Example |

|---|---|---|---|

| Housing Policy | Zoning, development, and affordability regulations. | Affects property acquisition, construction, and operational costs. | CA & OR streamlined approvals in 2024; mixed regulatory environment persists. |

| Rent Control | Legislation limiting rent increases. | Directly impacts revenue and property valuation. | California's Tenant Protection Act limits annual increases. |

| Tax Policy | Property, corporate, and REIT-specific taxes. | Influences profitability, cost of capital, and investment attractiveness. | Changes in REIT taxation can affect earnings per share. |

| Monetary Policy | Interest rate adjustments by central banks. | Impacts borrowing costs, financing, and property valuations. | Fed Funds Rate at 4.25%-4.5% in May 2025 affects financing costs. |

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing AIMCO across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting pest control operations.

Economic factors

Interest rate shifts significantly impact AIMCO's financial operations. Higher rates directly translate to increased borrowing costs for property purchases, ongoing development projects, and the refinancing of existing debt. This can make new ventures less attractive and squeeze profit margins.

Conversely, periods of lower interest rates can be a boon for AIMCO, encouraging more investment and development by making capital cheaper. This dynamic directly influences the feasibility and profitability of the company's real estate ventures.

For instance, the 10-year Treasury rate saw a notable increase, rising by more than 100 basis points from its September 2024 trough. By May 2025, this rate had climbed to approximately 4.47%, illustrating the tightening credit environment AIMCO is navigating.

The interplay of housing supply and demand directly impacts AIMCO's performance in its key U.S. markets. An oversupply situation can depress occupancy and rental income, whereas a shortage fuels rent growth and property value increases.

Apartment construction reached a half-century peak in 2024, with an estimated 600,000 units completed. However, forecasts suggest a significant slowdown, with completions projected to fall to around 450,000 in 2025 and further decrease to approximately 400,000 in 2026, potentially tightening supply in certain areas.

Strong employment rates and consistent wage growth are key drivers for the rental housing market, directly benefiting companies like AIMCO. When more people are employed and earning more, they have higher disposable incomes, leading to increased demand for housing, including rentals. This translates into higher occupancy rates and the ability to command better rental prices for AIMCO.

The U.S. labor market has shown resilience, with 1.7 million jobs added to payrolls through October 2024. This robust job creation supports household incomes and, consequently, consumer spending on essentials like housing.

Inflation and Construction Costs

Inflationary pressures are directly impacting construction costs, which can significantly alter project budgets and profitability for companies like AIMCO. For instance, the Producer Price Index for construction industries saw a notable year-over-year increase leading into 2024, reflecting higher input expenses.

The cost of essential materials, such as lumber and steel, along with escalating labor wages, are key drivers of these increased construction expenses. These factors directly influence the financial viability of undertaking new development or redevelopment projects. For example, in late 2023 and early 2024, many construction material prices experienced double-digit percentage increases compared to the previous year.

Higher overall construction costs, exacerbated by factors like tariffs on imported materials and a tightening credit environment, are creating headwinds for new supply entering the market. This dynamic can lead to project delays or even cancellations, directly affecting AIMCO's expansion plans and potential returns on investment.

- Rising Material Costs: Lumber prices, a key component in residential construction, saw significant volatility in 2023, with some periods showing month-over-month increases exceeding 15%.

- Labor Shortages and Wages: The construction labor market continued to face shortages in 2023 and early 2024, pushing average hourly wages up by approximately 5-7% year-over-year in many regions.

- Tariff Impact: Tariffs on steel and aluminum, implemented in previous years, continued to add an estimated 5-10% to the cost of structural components for many projects in 2023.

- Credit Tightening: Increased interest rates and stricter lending standards in 2023-2024 have made financing for new construction projects more challenging and expensive.

Consumer Confidence and Spending

Consumer confidence plays a crucial role in the rental market's vitality. When people feel secure about their financial futures, they are more likely to spend on housing, including rent. This willingness to spend directly impacts demand for rental properties.

In 2024, a notable trend was renters feeling confident enough in their economic outlook to commit to new apartment leases. This suggests a healthy appetite for rental housing, especially for well-maintained and desirable units.

Several factors contributed to this confidence:

- Job Market Strength: A robust job market with consistent wage growth provides consumers with the financial stability to make housing commitments.

- Inflationary Pressures: While inflation can dampen spending, a perceived easing of inflationary pressures in 2024 likely bolstered consumer confidence regarding discretionary spending, including rent.

- Savings Levels: Post-pandemic savings, though potentially drawn down, still offered a cushion for many consumers, enabling them to navigate rental costs.

This elevated consumer confidence directly fuels demand for rental units, supporting occupancy rates and rental income for property owners.

Interest rate shifts directly influence AIMCO's borrowing costs for property acquisition and development. For instance, the 10-year Treasury rate increased significantly, reaching approximately 4.47% by May 2025, reflecting a tighter credit environment that impacts project feasibility and refinancing expenses.

The supply of new apartments is projected to decrease, with completions expected to fall from around 600,000 units in 2024 to approximately 450,000 in 2025, potentially tightening markets and benefiting AIMCO through increased demand and rental growth.

A strong U.S. labor market, evidenced by 1.7 million jobs added through October 2024, underpins consumer confidence and housing demand. This economic resilience supports higher occupancy rates and rental income for AIMCO.

Rising construction costs, driven by material price increases (some experiencing double-digit year-over-year hikes in early 2024) and labor wages, present challenges. These factors, coupled with credit tightening, can delay or cancel new projects, impacting AIMCO's expansion strategies.

Same Document Delivered

AIMCO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AIMCO PESTLE analysis breaks down the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company. You'll gain valuable insights into the external forces shaping AIMCO's strategic landscape.

Sociological factors

Demographic shifts are profoundly reshaping the rental market. The growing number of millennials, now exceeding 50% of U.S. homebuyers, and Gen Z, comprising 25% of U.S. renters, indicates a strong demand for rental properties from younger generations.

Evolving household structures, such as an increase in single-person households and a return to multi-generational living arrangements, directly impact the types of apartment communities in demand. This diversification in living preferences necessitates varied unit sizes and amenity offerings to cater to different household needs.

Urbanization and suburbanization are reshaping where people live, directly impacting apartment demand across different regions. Understanding these shifts is crucial for AIMCO's investment strategies, especially given its focus on specific U.S. markets.

AIMCO's portfolio is well-positioned, with its stabilized operating assets benefiting from a strong presence in established suburban submarkets. For instance, as of Q1 2024, AIMCO's suburban holdings demonstrated resilience, with occupancy rates averaging 96.5% in key growth corridors, outperforming urban core averages in some instances.

Tenant expectations are shifting, with a growing demand for flexible living and integrated amenities. This means apartment communities need to offer more than just a place to sleep, incorporating features like co-working spaces, modern fitness centers, and communal areas that foster a sense of community. For instance, a 2024 survey indicated that 65% of renters prioritize access to on-site amenities when choosing an apartment, a significant increase from previous years.

AIMCO must proactively adapt its portfolio to align with these evolving lifestyle preferences. This includes not only modernizing existing properties but also considering new developments that cater to desires for hybrid work environments and social connectivity. The company's ability to integrate these sought-after features will be crucial for attracting and retaining residents in the competitive rental market of 2024-2025.

Housing Affordability and Socioeconomic Factors

Housing affordability remains a critical issue, directly affecting rental demand. When incomes don't keep pace with rising housing costs, more people are pushed into the rental market, creating a larger potential tenant base. This trend is particularly noticeable in areas with high living expenses.

Socioeconomic factors, such as the burden of student loan debt, significantly influence housing choices. For instance, data from 2024 indicates that approximately 43% of younger millennials carry an average student loan debt of around $30,000, which often delays their ability to purchase homes, thus expanding the renter demographic.

- Increased Renter Pool: Student loan debt, impacting a substantial portion of younger adults, delays homeownership, leading to a larger pool of renters.

- Income-to-Cost Ratio: The widening gap between average incomes and housing expenses forces more individuals and families to rent, boosting demand.

- Delayed Milestones: Financial pressures like student debt can push back major life decisions, including purchasing a home, contributing to sustained rental market strength.

Work-from-Home and Hybrid Work Models

The shift towards work-from-home and hybrid models has significantly reshaped housing preferences. This trend is driving demand for larger living spaces, rooms suitable for home offices, and properties with robust internet connectivity, directly influencing real estate development strategies.

For instance, in 2024, a significant portion of the workforce continues to operate remotely, with surveys indicating that over 60% of companies offer some form of hybrid work. This sustained preference means developers are increasingly prioritizing amenities that cater to this lifestyle, such as co-working spaces within residential buildings and enhanced broadband infrastructure.

- Increased demand for larger units: Homebuyers are seeking more square footage to accommodate dedicated home offices and general living space.

- Focus on connectivity: Reliable and high-speed internet is now a non-negotiable amenity, impacting property desirability and location choices.

- Amenity evolution: Residential developments are incorporating features like private workspaces, enhanced common areas, and fitness facilities to support remote workers.

- Location shifts: Some individuals are moving further from traditional urban centers to find more affordable housing with more space, provided good remote work infrastructure is available.

Societal values and lifestyle trends significantly influence housing demand and preferences. The emphasis on community and shared experiences is growing, with renters seeking environments that foster social interaction. This is evident in the rising popularity of apartment communities offering communal spaces and organized resident events.

The increasing acceptance of flexible living arrangements, including co-living and short-term rentals, reflects changing societal norms around homeownership and commitment. This trend suggests a need for adaptable housing solutions that cater to transient populations and those prioritizing experiences over traditional property ownership.

AIMCO’s strategic focus on providing quality, amenity-rich living environments aligns with these evolving societal expectations. For instance, a 2024 survey of renters across major U.S. metropolitan areas found that 70% of respondents expressed a preference for communities that facilitate social connections, a key driver for AIMCO’s community-building initiatives.

The perception of renting versus owning is also shifting, with many viewing renting as a viable and attractive long-term housing solution, especially in high-cost urban areas. This perception is bolstered by the increasing quality and amenity offerings in rental properties, making them competitive with homeownership in terms of lifestyle and convenience.

Technological factors

The increasing integration of proptech and smart building technologies is reshaping the real estate landscape, offering significant gains in operational efficiency and tenant satisfaction. These advancements, encompassing everything from smart thermostats to AI-driven maintenance platforms, are becoming essential for competitive advantage.

The global proptech market is experiencing robust growth, with projections indicating it will surpass $100 billion before 2032. This surge reflects the industry's recognition of technology's role in optimizing energy usage, streamlining property management, and enhancing the overall resident experience, directly impacting cost reduction and revenue generation.

AIMCO's adoption of advanced data analytics and predictive modeling is a key technological driver. By leveraging big data, the company can refine pricing strategies, identify promising investment opportunities, and proactively address tenant needs, enhancing overall operational efficiency. For instance, in 2024, the real estate sector saw a significant increase in the use of AI for market forecasting, with companies reporting up to a 15% improvement in rental income prediction accuracy.

The integration of AI assistants offers tangible benefits, providing AIMCO with granular insights into potential rental income streams and anticipated repair expenditures. This foresight allows for more accurate financial planning and resource allocation. A 2025 industry report indicated that AI-driven predictive maintenance in property management can reduce unexpected repair costs by as much as 20% annually.

AIMCO's marketing and leasing strategies are increasingly shaped by digital transformation. The company leverages online leasing platforms and digital marketing to connect with a wider pool of prospective tenants, streamlining the application and lease signing process. This digital shift is crucial as a significant portion of renters now begin their property search online.

The adoption of virtual tours and augmented reality (AR) technologies is enhancing how AIMCO showcases its properties. These tools allow potential residents to explore apartments and amenities remotely, offering a more immersive experience than traditional photos or videos. For instance, a substantial percentage of apartment hunters in 2024 expressed a preference for virtual tours, indicating their growing importance in decision-making.

Construction Technology and Innovation

Advancements in construction technology are significantly reshaping development. Innovations like modular construction and 3D printing offer pathways to more efficient, cost-effective, and sustainable building practices. For instance, the global 3D printing construction market was valued at approximately $1.5 billion in 2023 and is projected to reach over $6 billion by 2030, indicating substantial growth.

While 3D-printed homes are becoming a reality, potential shifts in immigration and deportation policies could impact the construction workforce. A reduced labor pool might drive up labor costs, thereby accelerating the adoption of technological solutions to bridge the gap. In 2024, the construction industry in many developed nations faced labor shortages, with some estimates suggesting a deficit of hundreds of thousands of skilled workers.

- Modular Construction: Prefabricated components built off-site can reduce project timelines by up to 50% and waste by 90%.

- 3D Printing: This technology can reduce material waste by 30-60% and speed up the construction of basic structures.

- Labor Shortages: Projections for 2025 indicate a continued strain on construction labor, potentially increasing reliance on automation and prefabrication.

- Sustainability Focus: New technologies are increasingly emphasizing reduced energy consumption and material usage during both construction and the building's lifecycle.

Cybersecurity and Data Privacy

The escalating digital landscape necessitates stringent cybersecurity protocols and unwavering compliance with data privacy laws to safeguard sensitive tenant and corporate data. A significant data breach in 2024 could result in substantial financial penalties, with regulatory fines for non-compliance with regulations like GDPR or CCPA potentially reaching millions of dollars.

AIMCO, like any real estate entity, faces significant risks from cyber threats. In 2024, the average cost of a data breach for organizations globally was estimated to be around $4.45 million, a figure that underscores the financial imperative for robust security infrastructure.

Key considerations for AIMCO include:

- Enhanced Data Encryption: Implementing advanced encryption for all tenant data, both in transit and at rest, is crucial.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing to identify and address potential weaknesses.

- Employee Training: Providing comprehensive and ongoing cybersecurity awareness training for all staff to mitigate human error.

- Incident Response Planning: Developing and regularly testing a detailed plan to effectively manage and recover from any security incidents.

Technological advancements are fundamentally altering property management and construction. AIMCO's embrace of proptech, including AI and data analytics, is driving operational efficiencies and enhancing tenant experiences, with the proptech market projected to exceed $100 billion by 2032. Furthermore, innovations in modular construction and 3D printing are streamlining building processes, with the 3D printing construction market expected to reach over $6 billion by 2030, offering solutions to persistent labor shortages anticipated in 2025.

| Technology Area | Impact on AIMCO | Market Projection/Data (2024/2025) |

|---|---|---|

| Proptech & Smart Buildings | Improved operational efficiency, enhanced tenant satisfaction, cost reduction | Global proptech market to exceed $100 billion before 2032 |

| AI & Data Analytics | Refined pricing, better investment identification, proactive tenant management | AI in market forecasting improved rental income prediction accuracy by up to 15% (2024) |

| Virtual Tours & AR | Immersive property showcasing, wider tenant reach | Growing preference among apartment hunters (2024) |

| Modular Construction & 3D Printing | Faster, cost-effective, and sustainable building practices | 3D printing construction market projected to reach over $6 billion by 2030 (from ~$1.5B in 2023) |

| Cybersecurity | Protection of sensitive data, compliance with privacy laws | Average cost of a data breach ~$4.45 million globally (2024) |

Legal factors

Zoning and land use laws are critical for AIMCO, dictating where and how it can build or renovate. These regulations control the type, density, and size of developments, directly influencing AIMCO's expansion and redevelopment plans. For instance, restrictive zoning can limit the number of units in a new community or prevent the conversion of existing properties.

States are actively reforming local zoning laws to address housing shortages and encourage development. By mid-2024, several states, like California and Oregon, have enacted legislation to streamline approval processes for certain types of housing, including accessory dwelling units (ADUs) and multi-family housing in traditionally single-family zones. This trend aims to increase housing supply and affordability, potentially creating more opportunities for AIMCO.

AIMCO must strictly adhere to a complex web of local, state, and national building codes, along with environmental and safety regulations for all its construction and renovation endeavors. These mandates are non-negotiable and directly impact project execution.

Recent shifts in building codes, particularly in states like California and New York, are beginning to permit innovative multifamily housing designs, potentially streamlining development and increasing density. For instance, California's SB 9, enacted in 2022, allows for lot splitting and duplex construction on single-family lots, a significant regulatory change. This evolution can influence AIMCO's development costs and project timelines, offering opportunities for more efficient construction if leveraged.

Tenant-landlord laws significantly shape how Aimco operates, influencing everything from lease terms to how they handle evictions. These regulations, which also cover essential habitability standards, directly impact Aimco's day-to-day management and potential legal risks.

Recent federal mandates now require a 30-day notice for evictions related to nonpayment of rent in specific multifamily housing programs. This adds a layer of procedural complexity and can extend the eviction timeline, potentially affecting Aimco's cash flow and occupancy rates.

Fair Housing Laws and Discrimination Regulations

AIMCO must strictly adhere to fair housing laws like the Fair Housing Act to prevent discrimination claims and safeguard its reputation. These regulations are fundamental in prohibiting bias based on protected characteristics throughout all housing transactions and activities.

The political landscape, particularly initiatives like Project 2025, could significantly impact housing regulations. This project aims to roll back recent advancements designed to address racial disparities in home appraisals and potentially repeal the Affirmatively Furthering Fair Housing (AFFH) rule, which could alter compliance requirements.

- Fair Housing Act Compliance: Ensuring all rental and sales practices are free from discrimination based on race, color, religion, sex, familial status, national origin, or disability is paramount.

- Project 2025 Influence: Potential policy shifts could affect how AIMCO approaches fair housing, particularly concerning appraisal equity and affirmative marketing efforts.

- Reputational Risk: Non-compliance or perceived discriminatory practices can lead to significant legal penalties, financial damages, and severe damage to brand image.

Environmental Regulations and Permitting

AIMCO must navigate a complex web of environmental regulations, encompassing land use, waste management, and energy efficiency. These laws mandate specific permits and adherence to rigorous standards for all development projects. For instance, the U.S. Environmental Protection Agency (EPA) oversees numerous regulations that impact construction and property management, with ongoing updates to standards for emissions and water usage.

These environmental mandates are increasingly shaping sustainable building practices within the real estate sector. Developers are prioritizing features like green roofs, solar energy integration, and water conservation systems to comply with evolving legislation and meet tenant demand for eco-friendly spaces. In 2024, the demand for LEED-certified buildings continued to rise, with a significant portion of new commercial construction aiming for such designations.

- Permitting Requirements: AIMCO must secure permits for land development, construction, and ongoing operations, ensuring compliance with local, state, and federal environmental laws.

- Sustainable Building Influence: Regulations are driving the adoption of energy-efficient materials, water-saving fixtures, and waste reduction strategies in new and existing properties.

- Waste Management Standards: Adherence to regulations concerning construction debris disposal and recycling is critical to avoid penalties and promote responsible development.

- Energy Efficiency Mandates: Compliance with energy codes, such as those related to HVAC systems and building envelope performance, impacts operational costs and design choices.

AIMCO must navigate evolving zoning laws, with states like California and Oregon streamlining approvals for multi-family housing and ADUs by mid-2024 to combat shortages. Building codes are also adapting, with California's SB 9 allowing duplex construction on single-family lots, potentially influencing AIMCO's development costs and timelines.

Tenant-landlord regulations, including a federal 30-day notice for evictions related to nonpayment in certain programs, impact AIMCO's cash flow and occupancy. Fair housing laws are critical, and initiatives like Project 2025 could alter compliance requirements concerning appraisal equity and affirmative marketing.

Environmental regulations, such as EPA standards for emissions and water usage, necessitate permits and adherence to rigorous standards. The increasing demand for LEED-certified buildings in 2024 highlights the trend towards sustainable building practices, influencing AIMCO's design choices and operational costs.

| Legal Factor | Impact on AIMCO | 2024/2025 Trend/Data |

|---|---|---|

| Zoning & Land Use | Dictates development locations, density, and size. | States streamlining approvals for multi-family housing. |

| Building Codes | Affects construction methods, costs, and timelines. | California's SB 9 allows duplex construction on single-family lots. |

| Tenant-Landlord Laws | Governs lease terms, evictions, and habitability standards. | Federal 30-day notice for evictions in specific programs. |

| Fair Housing Laws | Prohibits discrimination in all housing transactions. | Project 2025 may impact appraisal equity and affirmative marketing rules. |

| Environmental Regulations | Mandates permits and standards for land use, waste, and energy. | Growing demand for LEED-certified buildings. |

Environmental factors

Climate change is increasingly impacting the real estate sector, with more frequent and intense extreme weather events like floods, hurricanes, and wildfires posing significant physical risks to properties. For AIMCO, this translates to potential increases in insurance premiums, direct property damage, and operational disruptions. The real estate industry is actively adapting to these environmental shifts, recognizing the need for resilient infrastructure and proactive risk management strategies.

AIMCO must increasingly integrate sustainability into its operations, as evidenced by the growing demand for green properties. In 2024, for instance, a significant portion of commercial real estate transactions were influenced by ESG (Environmental, Social, and Governance) factors, with tenants and investors prioritizing eco-friendly buildings. This trend is expected to accelerate, pushing for the adoption of energy-efficient technologies and sustainable materials in new developments and renovations.

Resource scarcity, particularly concerning water and energy, presents a significant environmental factor for AIMCO. Fluctuations in the availability and cost of these essential resources directly influence property operations and development projects, impacting everything from maintenance to new construction. For instance, rising energy prices in 2024 could increase AIMCO's utility expenses across its portfolio.

To address these challenges, AIMCO may need to proactively invest in water conservation systems and explore renewable energy sources. Such investments not only mitigate risks associated with scarcity but also offer opportunities to reduce long-term operational costs. Smart building technologies are crucial in this regard, enabling better optimization of energy consumption and water usage throughout their properties.

Waste Management and Recycling Regulations

AIMCO faces growing scrutiny over waste management and recycling. Stricter regulations, driven by heightened public awareness, necessitate a proactive approach to sustainability across its property portfolio. This includes robust waste reduction strategies, comprehensive recycling programs, and ensuring environmentally sound disposal methods for all generated waste.

The financial implications are significant. For instance, in 2024, the US Environmental Protection Agency (EPA) reported that municipal solid waste generation reached approximately 300 million tons. Companies like AIMCO are investing in advanced waste sorting technologies and infrastructure to comply with evolving mandates and reduce landfill reliance. These investments are crucial for operational efficiency and maintaining brand reputation in an increasingly environmentally conscious market.

- Evolving Regulatory Landscape: Expect continued tightening of waste and recycling mandates, potentially increasing compliance costs for property owners.

- Consumer Demand for Sustainability: Tenants and residents increasingly favor properties with strong environmental credentials, impacting occupancy rates and rental premiums.

- Operational Efficiency Gains: Implementing effective waste reduction and recycling can lead to cost savings through reduced disposal fees and potential revenue from recycled materials.

- Investment in Green Technologies: Companies are allocating capital towards innovative waste management solutions, such as anaerobic digestion and advanced material recovery facilities.

Location-Specific Environmental Risks

Properties situated in regions vulnerable to specific environmental hazards, such as seismic zones or coastal areas experiencing erosion, can incur elevated insurance costs, necessitate more rigorous construction standards, and potentially suffer long-term value depreciation. AIMCO's strategic real estate investments across various U.S. markets demand a thorough evaluation of these localized environmental considerations.

For instance, a 2024 report indicated that coastal properties in Florida, particularly those in flood-prone zones, saw insurance premium increases averaging 15-20% year-over-year, directly impacting operating expenses and property valuations.

- Seismic Risk: Properties in California, a state with significant seismic activity, face higher seismic retrofitting costs and insurance premiums, potentially affecting marketability and investment returns.

- Flood Risk: Coastal or riverine properties are susceptible to increased flood insurance costs and potential damage, as evidenced by rising FEMA flood insurance rates in many U.S. regions.

- Wildfire Risk: In Western states, properties in wildfire-prone areas are experiencing escalating insurance premiums and stricter building codes related to fire resistance.

- Climate Change Impact: Long-term devaluation risk is amplified for properties in areas projected to be significantly impacted by rising sea levels or extreme weather events, influencing future investment decisions.

AIMCO must navigate increasing regulatory pressures and evolving consumer preferences for sustainable properties. The demand for green buildings is a significant driver, with a notable portion of commercial real estate transactions in 2024 influenced by ESG factors. This trend is projected to intensify, pushing for greater adoption of energy-efficient technologies and eco-friendly materials in real estate development and renovation projects.

Resource scarcity, particularly concerning water and energy, directly impacts AIMCO's operational costs and development projects. Rising energy prices in 2024, for example, are likely to increase utility expenses across its portfolio, underscoring the need for investments in water conservation and renewable energy sources to mitigate risks and reduce long-term expenses.

The company also faces growing scrutiny regarding waste management and recycling, with stricter regulations and heightened public awareness necessitating robust waste reduction strategies and comprehensive recycling programs. In 2024, the US EPA reported approximately 300 million tons of municipal solid waste generated, highlighting the importance of advanced waste sorting technologies for compliance and brand reputation.

| Environmental Factor | Impact on AIMCO | 2024/2025 Data/Trend |

|---|---|---|

| Extreme Weather Events | Physical property damage, increased insurance premiums, operational disruptions. | Coastal properties in Florida saw average insurance premium increases of 15-20% year-over-year in 2024. |

| Sustainability Demand | Need for green properties, potential impact on occupancy and rental premiums. | Significant portion of 2024 CRE transactions influenced by ESG factors; trend expected to accelerate. |

| Resource Scarcity (Energy/Water) | Increased operational costs, potential impact on development projects. | Rising energy prices in 2024 increased utility expenses for many real estate portfolios. |

| Waste Management & Recycling | Compliance costs, brand reputation, operational efficiency. | US EPA reported ~300 million tons of municipal solid waste in 2024; investment in advanced sorting technologies is crucial. |

PESTLE Analysis Data Sources

Our AIMCO PESTLE Analysis is meticulously constructed using data from leading international organizations, government statistical agencies, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the market.